Chapter 1 – Overview

- Introduction

- A Government programme of administrative improvement

- Summary of proposals

- Invitation to comment

- How to make a submission

Introduction

Inland Revenue is modernising its tax and social policy administration, which will reshape the way it works with customers, and improve policy and legislative settings. The Government’s objective is for the revenue system to be as fair and efficient as possible. For Inland Revenue customers, the revenue system should be simple to comply with, making obligations and entitlements easy to get right and difficult to get wrong.

This discussion document explores some proposals for improving the way social policy entitlements and obligations are administered by Inland Revenue. These entitlement and obligation payments are:

- Working for Families Tax Credits;

- child support;

- student loan repayments; and

- KiwiSaver.

The focus here is not on changing the fundamental policy settings. Rather, this document focuses on improving the way those social policies are administered by Inland Revenue, taking advantage of the opportunity offered by the modernisation of Inland Revenue’s systems.

Improving the administration of social policy payments will mean more customers will receive the right amount at the right time. It will bring Inland Revenue closer to giving customers confidence that payments they receive are full and correct and will not have to be repaid, therefore reducing the possibility of debt to Inland Revenue. Payments will be able to reflect and quickly respond to changes in customers’ income.

This can be achieved through basing payments on recent actual income over shorter periods than the current annual assessment, and making more frequent and manageable payments during the year. Customers will find it easier and simpler to provide Inland Revenue with the information required to apply for, receive or make their payments, or to update their family circumstances.

Key definitions will be aligned and there will be greater flexibility for Inland Revenue to address unusual circumstances.

The changes proposed in this document, and covered in previous consultation documents, build on better information and administrative improvements to the way customers interact with Inland Revenue as a result of the modernisation of the revenue system. The changes will enable and encourage customers to manage their obligations and entitlements with speed and certainty using modern technology.

A Government programme of administrative improvement

Building on the 2015 Green Paper

A good social policy system can be thought of as having good policy supported by good administration. The starting point for the 2015 Government Green Paper on tax administration (the Green Paper) is that New Zealand has a good tax and social policy system. The opportunity before Government is to make it even better.

The Green Paper reflected on how the social policies administered by Inland Revenue had been incrementally changed over many years. Those policies were grafted into an existing tax administration system – a system which was primarily designed to support tax policy.

The Green Paper outlined some early high-level thoughts on how to improve Inland Revenue’s administration of social policies, by designing policies and processes that would be customer-focused and "fit for purpose". Focusing on the customer is a key feature of the changes being made to Inland Revenue – making it easier for customers to get their obligations and entitlements right from the start, difficult to get wrong and making it easier to correct any errors or update any changes in circumstances.

Social policy payments should be calculated on a more responsive basis, provide more certainty for individuals and families, and result in less debt. There would be a shift towards using existing information to help customers get the right payment at the right time.

Information sharing and Better Public Services

The proposals are part of a wider public sector programme of change. Inland Revenue is also involved in information sharing and cross-agency work to improve public services, such as SmartStart.[1]

Information sharing has the potential to improve the information used to administer social policies in Inland Revenue and the administration of social policies by other Government agencies. Some of these proposals are covered in the Proposals for modernising the Tax Administration Act discussion document, and also in the consultation on the Approved Information Sharing Agreement between Inland Revenue and the Ministry of Social Development.

Inland Revenue works with other agencies to deliver social policy. In particular, it works with the Ministry of Social Development on the delivery of Working for Families Tax Credits to beneficiaries and applications for child support, and with StudyLink on the transfer of student loans. These arrangements are expected to continue.

The social policy proposals follow on from previous consultation documents

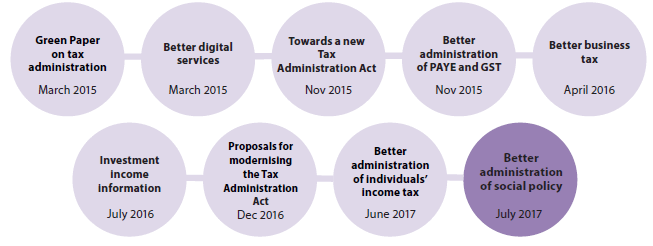

This document is the ninth in the Making Tax Simpler series, which began in March 2015. The Green Paper proposed that changes would be considered and introduced in sequential stages. The social policy proposals take into account earlier changes to digital technology, GST, PAYE, investment income, business tax and individuals’ end-of-year tax obligations.

Ultimately, the Making Tax Simpler proposals seek to make it easier for customers to get their payments and entitlements right from the start. Although each previous consultation document focused on a particular area, those proposals will impact on the administration of social policy as well.

The Better digital services discussion document identified the major role of digital technology in making tax and social policy simpler for New Zealanders.

The PAYE system collects information and payments from employees’ salary and wages for tax and social policy purposes, such as student loan deductions and child support payments. The Better administration of PAYE and GST discussion document explored possible changes to simplify the KiwiSaver enrolment process and how integrating the provision of PAYE information into the payroll process would reduce compliance and administrative costs. It proposed providing more frequent employment information, which could improve several processes, including calculating social policy payments. These proposals are included in a Bill currently before Parliament.[2] These changes will contribute to the proposals outlined in this document to shorten the period of assessment for social policies.

The consultation time line for the Making Tax Simpler series

The Better business tax officials’ issues paper discussed alternatives to current provisional tax methods. Subsequent legislative amendments include the new Accounting Income Method (AIM), which uses provisional information provided by businesses more frequently, resulting in provisional tax payments that better reflect the income patterns of businesses. AIM will be available from 1 April 2018. Information provided under AIM could also be used for improving the accuracy of social policy payments. The amendments also removed the 1% incremental late payment penalty on Working for Families Tax Credit debt.

The Investment income information discussion document explored providing more investment income information (in some cases more frequently) and also looked at how the quality of the information provided could be improved. These proposals are also included in a Bill currently before Parliament. Again, this information means the Government can consider shorter periods of assessment for social policies.

The discussion documents Towards a new Tax Administration Act and Proposals for modernising the Tax Administration Act examined some of the core concepts in the Tax Administration Act, focusing on the roles of the Commissioner, taxpayers, intermediaries and information. This included discussion and proposals about the collection of information, and better use of information sharing, including in the social policy context.

The Better administration of individuals’ income tax discussion document set out proposals for Inland Revenue to monitor information it receives to help individuals to get their taxes right during the year, including updating information for customer accounts. It also considered proposals to better use existing and new information to make it easier for customers to interact, to update their tax codes promptly and address issues with secondary tax. A similar approach would also be used for social policy information.

The proposals in this discussion document provide the opportunity to:

- ensure customers receive their correct entitlements or fully meet their obligations by making the rules and processes easier to understand;

- provide greater certainty around payments;

- make payments more accurate and improve the access to and timing of payments; and

- improve agility while maintaining the coherence and integrity of the system.

A core principle underpinning these proposals is that people should not be entitled to any less government support than they are currently entitled to receive.

Summary of proposals

The Government is interested in your feedback on the proposals in this discussion document as summarised on the following pages.

Chapter 3: Making payments certain, accurate and timely

- Assessments would continue to be based on current family circumstances, such as residence, employment or benefit status, and care of children.

- If the customer’s income is already known to Inland Revenue during the year (observable income), Working for Families Tax Credits or child support amounts would be based on recent actual income information provided throughout the year.

- If a customer’s income is not known to Inland Revenue during the year or not confirmed during the year (non-observable income), Working for Families Tax Credits or child support amounts would be based on estimates of income or recent income information from previous years.

Working for Families Tax Credits

There are three options:

- With observable income – look at recent income over a fixed period and current family circumstances to determine the entitlement for the current period.

- With observable income – use income information as it is reported to Inland Revenue to calculate an annualised figure and adjust ongoing payments accordingly, with a reassessment whenever new income information is reported.

- With non-observable income – use information provided through the year to better estimate income and make instalment payments, with an end-of-year square-up to confirm actual income.

These options would be supported by an end-of-year check to ensure that families had not missed out on any of their annual entitlement owing to changing income.

Child support

There are four options:

- Retain the past income annual assessment but shift the start of the child support year so that it is after income tax obligations are completed. This would mean more recent annual income can be used to determine payments.

- With observable income – look at recent income over a shorter fixed period and current family circumstances to determine the entitlement for the current period.

- With observable income – use income information as it is provided to Inland Revenue to calculate an annualised figure and adjust ongoing payments accordingly, with a reassessment whenever new information is reported.

- With non-observable income – use information provided through the year to estimate income and make instalment payments, with an end-of-year square-up to confirm actual income.

Chapter 4: Better payment options

- Child support liable parents who have employment income would have compulsory deductions from salary and wages or schedular payments.

- Child support liable parents who do not have compulsory deductions would have to pay more frequently and earlier than currently.

- Child support obligations could be met through payments made directly to third parties that are of direct benefit to the child, subject to conditions.

- Child support payments could be available for receiving carers as soon as they are received (or deemed to be received) by Inland Revenue.

- Receiving carers would have options for how frequently they receive payments, including at the same time as they receive Working for Families Tax Credits.

- Student loan borrowers with adjusted net income such as schedular, casual agricultural or election-day income would be required to use the SL tax code to make student loan repayments.

- Student loan borrowers with other forms of adjusted net income would be required to make more regular payments throughout the year.

Chapter 5: Managing missed payments and overpayments better

- Overpayments and missed payments of Working for Families Tax Credits and student loans would be addressed promptly rather than waiting until a 7 February due date.

- A small balance write-off would apply consistently across the social policies.

- A range of options would be available for most customers to manage an overpayment or missed payment.

- Penalties and/or interest would not apply while overpayments or missed payments are being actively managed.

- Inland Revenue would be able to set a due date and impose penalties and/or interest when the debt is not being managed, there is fraud or the customer has a history of non-compliance.

Chapter 6: Aligning and updating key definitions

- Align the wording of key definitions when they relate to the same concept across different social policies.

- Align the rules for shared care of a dependent child at a minimum of 35 percent of ongoing care with reference to any care orders, and a default measure of number of nights in care for the period of the shared arrangement or what is most appropriate in the circumstances.

- Align the maximum age of a child to be at the end of the calendar year they turn 18.

- Change the definition of "financially independent" to refer to a set dollar amount rather than 30 hours of work a week, and ensure the benefit reference is to being on a benefit or receiving a full-rate student allowance.

- Align the minimum age of a financially independent child to 16 years.

- Align the residence definition, with a person no longer resident once they are out of the country for more than 183 days, unless specific exemptions apply.

- Require a dependent child to meet the "physically present in New Zealand" test to qualify for Working for Families Tax Credits, or meet one of the exemptions that deem a person to be New Zealand based.

- More closely align the definition of income used for child support to the definition used for Working for Families Tax Credits so that:

- tax losses from past years are ignored; and

- more types of income are included in the definition.

- Other minor changes to align the definitions of income across Working for Families Tax Credits and student loans, when appropriate.

Chapter 7: Customers with unusual circumstances

- Introduce general principle-based discretions for the different social policies administered by Inland Revenue.

- Develop guidance for Inland Revenue staff on when to apply discretions.

Appendix 1 sets out some background information on how assessments are determined for Working for Families Tax Credits and child support.

Appendix 2 shows a comparison of the different definitions of income.

Invitation to comment

You are invited to make a submission on whether the proposed changes in this discussion document would improve the administration of social policy for customers and what impact you think they would have. Questions in Chapters 3 to 6 offer specific points for you to consider and comment on.

Following consideration of the submissions, the Government will refine the proposals and consider what changes to proceed with. It will also consider when it would be best to implement any changes. These proposals require amendments to legislation. At this stage the Government intends to introduce an amending bill in 2018. There will be further opportunity to comment on the legislative changes as part of the Parliamentary process.

How to make a submission

You can make a submission:

- online at: www.makingtaxsimpler.ird.govt.nz

- by email to: [email protected], with "Better administration of social policy" in the subject line

- by post to:

"Better administration of social policy"

c/- Deputy Commissioner Policy and Strategy

Inland Revenue

PO Box 2198

Wellington 6140

The online webpage includes options to complete a survey or post comments. The closing date for submissions is 15 September 2017.

It would be helpful if longer submissions could include a brief summary of the main points and recommendations.

Official Information Act 1982

Submissions may be the subject of a request under the Official Information Act 1982, which may result in their release. Parts of submissions may also be summarised or quoted in official documents, which may also be subject to a request for public release. It is anticipated that a summary of submissions would be made public on the Making Tax Simpler website.

The withholding of particular submissions, or parts thereof, on the grounds of privacy, or commercial sensitivity, or for any other reason, will be determined in accordance with that Act. Authors making submissions who consider that there is any part of the submission that should be properly withheld under the Act should clearly indicate this.

1 SmartStart is a website that provides step-by-step information and support to help parents access the right information and services for them and their baby. See more information at https://smartstart.services.govt.nz

2 Taxation (Annual Rates for 2017–18, Employment and Investment Income, and Remedial Matters) Bill.