Chapter 5 – Managing missed payments and overpayments better

This chapter discusses proposed changes to:

- Working for Families Tax Credits;

- child support; and

- student loans for domestic borrowers.

Summary of proposals in this chapter

- Overpayments and missed payments of Working for Families Tax Credits and student loans would be addressed promptly rather than waiting until a 7 February due date.

- A small balance write-off would apply consistently across the social policies.

- A range of options would be available for most customers to manage an overpayment or missed payment.

- Penalties and/or interest would not apply while overpayments or missed payments are being actively managed.

- Inland Revenue would be able to set a due date and impose penalties and/or interest when the debt is not being managed, there is fraud, or the customer has a history of non-compliance.

Intervening earlier when the risk of debt arises

The proposals in Chapters 3 and 4 to improve accuracy, shorten the period of assessment and change the timing of payments should significantly reduce the risk of debt arising. When debt does arise, the proposals should identify any overpayment or missed payment earlier and taking action at that time should reduce its size. This chapter looks at further proposals to better manage social policy debt.

Debt can arise in three different ways:

- An obligation to pay is missed – such as a liable parent missing the due date for a payment.

- There is an overpayment of an entitlement for Working for Families Tax Credits or to a receiving carer for child support.

- Too little is deducted from income to cover a payment obligation, for example, student loan repayments.

If a customer does not fully repay an overpayment or pay an obligation by a required date, penalties and/or interest may apply. Each of the social policies Inland Revenue administers has different rules around due dates and the application and rate of penalties and/or interest. For Working for Families Tax Credits and student loan customers the due date is usually 7 February, which is at least 10 months after the obligation arose and at a time when there is often pressure to pay other bills. Child support obligations are currently due 20 days after the end of each month, with penalties applying but no interest.

The current approach does not always distinguish between those struggling to do the right thing and those who are deliberately non-compliant. It waits until the debt is due, and uses penalties and/or interest to encourage payment. This works for some customers but for others it can mean the debt grows faster than their ability to repay. If customers are aware, they can contact Inland Revenue to make repayment arrangements, which could mean some penalties are written off or are not imposed, or they can apply for hardship relief. This can result in inconsistent treatment based on customers’ knowledge of the rules.

Inland Revenue has several ways to collect debt and has been moving to intervene earlier to reduce levels of debt. However, the legislation generally takes the approach of first imposing penalties and writing them off later.

The Government proposes to build further on the early intervention approach to help customers get things right from the start. This means intervening earlier when the risk of debt arises for Working for Families Tax Credits and student loans, and to change the approach to child support debt to help make payments manageable.

The proposals build on successes from the 2012 changes to student loan repayments which almost eliminated missed payment debt from salary and wage income for student loan borrowers. Changes to the penalty rules for income tax and Working for Families Tax Credits came into effect from 1 April 2017. This removes the 1% monthly incremental late payment penalty for unpaid debt. Use-of-money interest and initial late payment penalties still apply.

The main proposal in this chapter is for Inland Revenue to have a range of tools to help customers manage any overpayment or missed payment. Most customers want to pay their debt and will actively seek out how to do so. Alternatives would be available for those who are not able to self-manage or not willing to meet their obligations. Hardship provisions will continue to be available to those who qualify.

Ignoring small amounts

When family circumstances change there can be an understandable delay in telling Inland Revenue. This delay could result in an overpayment of Working for Families Tax Credits. If the overpayment is small, it could cost Inland Revenue more in time and resources to collect than the value of the amount. For this reason legislation often has thresholds under which debts are not collected.

In the Better administration of individuals’ income tax discussion document, the Government is consulting on the personal tax thresholds, including the $20 threshold when tax debt need not be paid, and the $200 income threshold for having to file. There are several small balance thresholds across the different social policies – all setting thresholds at different levels. For example, there is a $20 annual small balance write-off for Working for Families Tax Credits, student loans and overseas child support liable parents.[20] For domestic liable parents there is an under $1 small balance write-off. In terms of income being disregarded there is:

- a $1,500 threshold for additional other income for student loans purposes;

- a $500 threshold for changes in taxable income for child support; and

- a $5,000 threshold for other types of family scheme income for Working for Families Tax Credits.

The Government proposes to apply the under $20 annual small balance write-off consistently for all Working for Families Tax Credits, child support and student loan customers. The Government will continue to review the rules for under $1 assessments and rounding of amounts. When the small debt is owed to a receiving carer or liable parent from the receiving carer, the Government would make the payment and write-off the debt.[21] Integrity measures would be put in place to stop customers abusing this provision.

Currently, amounts less than $5 that have been collected but not paid to a receiving carer need not be paid until the cumulative balance exceeds $5.[22] This would be removed to reflect the negligible cost in making refunds electronically, in line with the proposals around personal tax refunds in the Better administration of individuals’ income tax discussion document.

The Government is interested in whether people think separate thresholds should continue to apply when small amounts of income are required to be reported. Or should all income be reported but any resulting payments would only be paid or collected when the amount exceeds a specified threshold? What factors should be considered when setting either income reporting thresholds or payment thresholds? It is expected that customers would be able to report income changes and family circumstance changes more easily through online accounts.

Customers managing the payment themselves

Earlier feedback has indicated it is important that social policy customers have some say and control over how their debt is managed. The Government proposes that most social policy customers with an overpayment or missed payment would be able to select a preferred repayment method and the frequency of repayment such as in full or spread over several weeks. As the missed payments or overpayments would be managed more quickly than under the current system, no penalties or interest would apply while the amount is being self-managed.

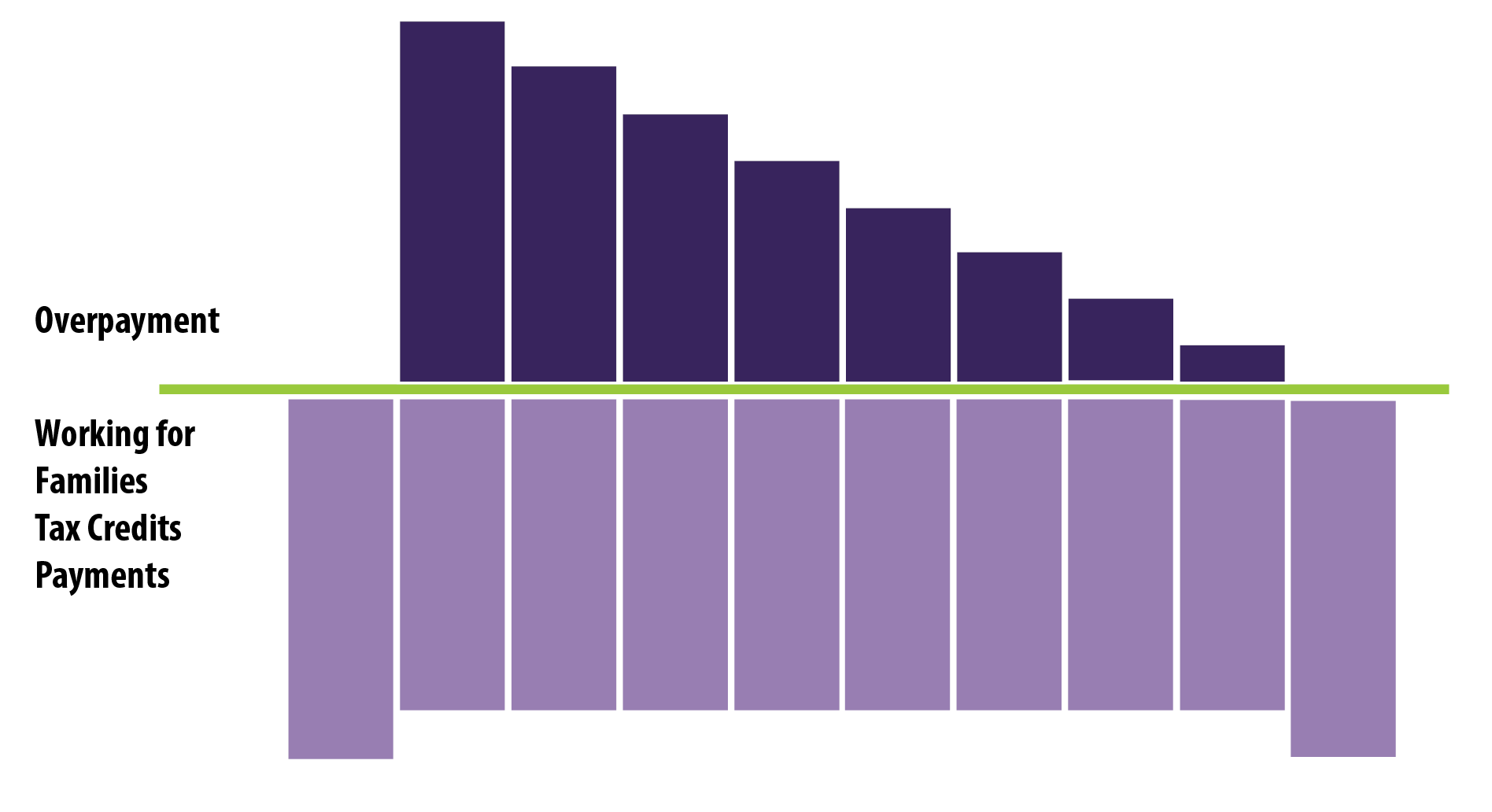

Rather than waiting until 7 February after the tax year, any Working for Families Tax Credits overpayment or missed student loan payment would be identified much earlier, at the end of the shorter period or the tax year, and required to be managed then. The customer would be required to choose a repayment option and if they do not self-manage the repayment, Inland Revenue would choose a repayment method for them.

Recovery through future entitlement payments

One option, whether the debt is managed by the customer or Inland Revenue, is to recover any debt from future entitlement payments. Currently, Inland Revenue pays Working for Families Tax Credits to families who have a Working for Families Tax Credits debt. This option would enable some of the ongoing payments to repay the debt. This option is currently used for child support receiving carers who have an overpayment debt. Again, no penalties and/or interest would apply while this option is in place.

With shorter periods of assessment there might be times when a customer has no current entitlement but expects to have a future entitlement, for example, they will soon be returning to full-time work or a child will be returning to their care. Debt repayment from future entitlements would be an option for some customers, although this would be closely monitored.

Working for Families Tax Credits - recovery through future payments

Recovery through wages and bank accounts

When there is no ongoing entitlement from which to make a repayment, another option for customers and Inland Revenue is to have payments deducted from wages or from bank accounts. This option is currently used for student loans, Working for Families Tax Credits and child support debt, and is also used for child support ongoing obligations.

Most customers have some salary or wage income subject to PAYE deductions, and payroll systems are already required to make various deductions. If the customer has no employment income (including no main benefit payments), deductions can be made direct from the customer’s bank account.

Inland Revenue would discuss with the customer the most appropriate method of payment and set the amount and frequency of the deductions. The objective is to ensure payments are regular and manageable.

Again, no penalties or interest would be charged while this recovery option is in place.

Imposing a due date, penalties and interest

While these options will suit most customers, there will always be a requirement for stricter debt collection actions. Inland Revenue would retain the ability to notify a customer that an amount is due in full. After a given date, penalties and/or interest would be applied to the balance. The date would reflect the compliance history of the customer and the circumstances of the debt.

Existing tools for addressing serious non-compliance would also be retained, such as information matching and the ability to make arrests at the border.

QUESTIONS FOR READERS

5.1 Do you think there should be a consistent threshold or separate thresholds for different social policies to ignore small balance amounts?

5.2 Should there be different thresholds for ignoring small amounts of income for different social policies? Or should all income be reported but payments only paid/collected as a result, if the payment exceeds a specified threshold?

5.3 What factors should be considered when setting either income thresholds or payment thresholds?

5.4 Do you agree that any overpayment or missed payment should be self-managed by the person who owes the amount, if at all possible?

20 In some cases Inland Revenue is able to refrain from assessing small amounts.

21 This currently can happen when a receiving carer owes a liable parent but not the other way around.