Chapter 3 – Making payments certain, accurate and timely

- Summary of proposals in this chapter

- Determining entitlements and obligations

- Opportunity for a new approach to how income is assessed

- No change to annual assessment for student loan repayments

This chapter discusses proposed changes to:

- Working for Families Tax Credits; and

- child support.

Summary of proposals in this chapter

- Assessments would continue to be based on current family circumstances, such as residence, employment or benefit status, and care of children.

- If a customer’s income is already known to Inland Revenue during the year (observable income), Working for Families Tax Credits or child support amounts would be based on recent actual income information provided throughout the year.

- If a customer’s income is not known to Inland Revenue during the year or not confirmed during the year (non-observable income), Working for Families Tax Credits or child support amounts would be based on estimates of income or past income information from previous years.

Working for Families Tax Credits

There are three options:

- With observable income – look at recent income over a fixed period and current family circumstances to determine the entitlement for the current period.

- With observable income – use income information as it is reported to Inland Revenue to calculate an annualised figure and adjust ongoing payments accordingly, with a reassessment whenever new income information is reported.

- With non-observable income – use information provided through the year to better estimate income and make instalment payments, with an end-of-year square-up to confirm actual income.

Child support

There are four options:

- Retain the past income annual assessment but shift the start of the child support year so that it is after income tax obligations are completed. This would mean more recent annual income can be used to determine payments.

- With observable income – look at recent income over a shorter fixed period and current family circumstances to determine the entitlement for the current period.

- With observable income – use income information as it is provided to Inland Revenue to calculate an annualised figure and adjust ongoing payments accordingly, with a reassessment whenever new information is reported.

- With non-observable income – use information provided through the year to estimate income and make instalment payments, with an end-of -year square-up to confirm actual income.

Determining entitlements and obligations

Generally, two elements are used to determine entitlements and obligations for income-targeted social policies. First, does the person or their family meet the entry criteria for the social policy? Second, how much income do they have? The first determines if they qualify for that social policy, while the second determines the amount of the obligation or entitlement.

The Government proposes several options for improving how Working for Families Tax Credits are administered. Each has an emphasis on different objectives of timeliness, accuracy and consistency. The Government is interested in which of these options customers most prefer and why.

Family or individual circumstances

Whether a person or their family meets the entry criteria for a social policy depends on their circumstances. For example, the family tax credit depends on the recipient having children in their care, and the in-work tax credit also requires that a single person works 20 hours or more a week and does not receive a main benefit.[4]

Payments are expected to continue to reflect current family or individual circumstances, such as whether the person is currently caring for a child or residing in New Zealand. This is important to ensure policy objectives are met. The onus will continue to be on the customer to keep Inland Revenue informed of any changes in their family or individual circumstances that affect their entitlements or obligations.

Amount of income

Most social policies administered by Inland Revenue use an annual income assessment – often using the same annual period as income tax (1 April to 31 March). This is modified in various ways to create weekly, fortnightly, monthly or annual payments but these are still based on an annual income assessment. This reflects that for tax purposes income is determined on an annual basis and social policy payments are administered within the tax system.

For Working for Families Tax Credits, customers look forward and estimate their annual family income for the tax year. Instalment payments are then based on those estimates. Alternatively, the family can wait until the end of the tax year, report income actually earned in that tax year and receive a lump sum payment.

Child support takes the approach of using past annual income information, from either the previous calendar year or two tax years back. However, if the customer has a significant drop in income, they can estimate their income for the remainder of the current child support year.[5] A square-up at the end of the year determines how close the estimate was to actual income. The square-up only applies to the part of the year the estimate was for.

Student loan domestic borrowers with wages or salary automatically repay their loans through deductions from their employment income, with repayments reflecting the length of their pay period. Borrowers with adjusted net income[6] make repayments at the end of the year and sometimes in the following year based on adjusted net income received in the past year.

Opportunity for a new approach to how income is assessed

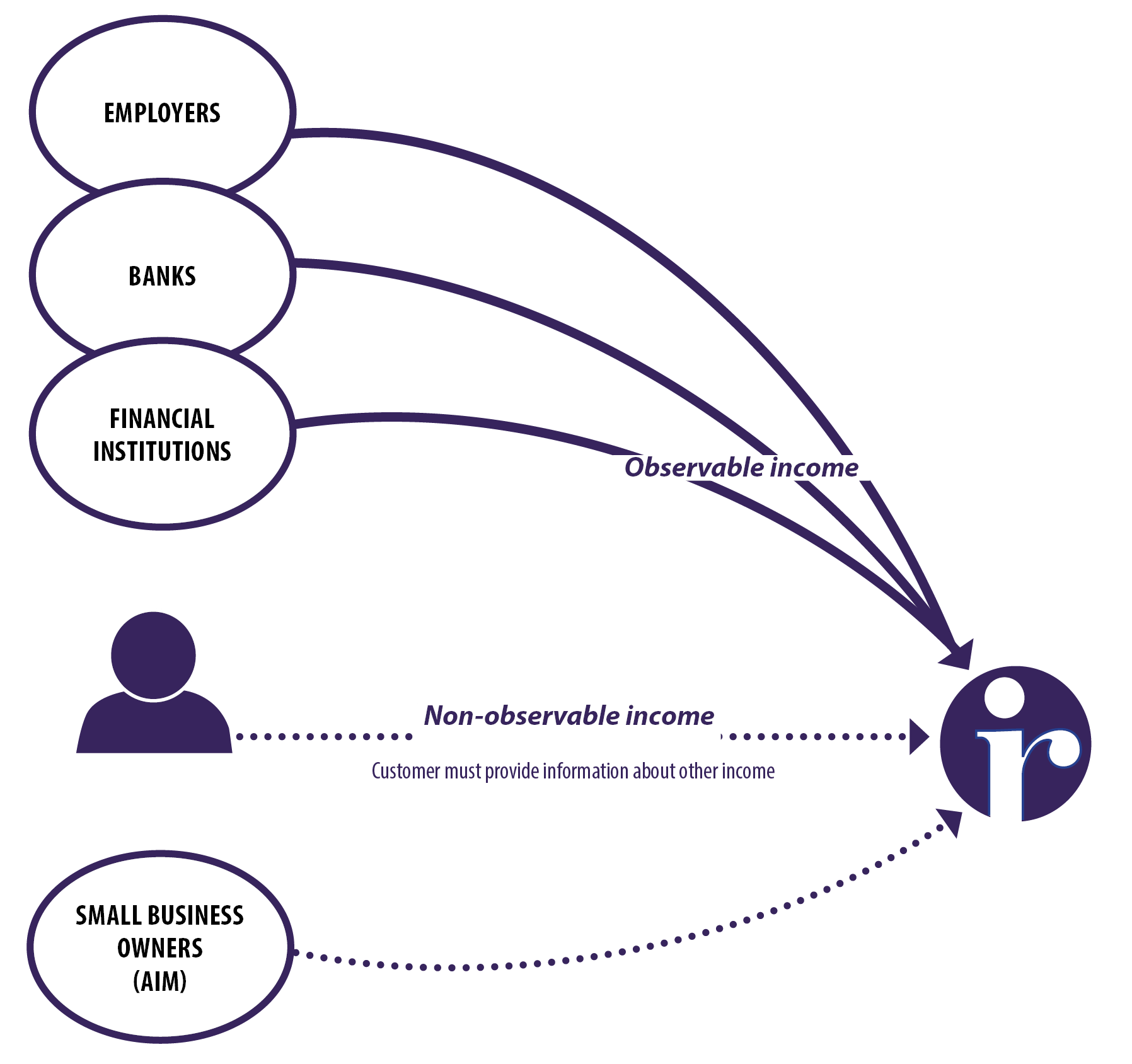

Observable income = income information that is provided to Inland Revenue by a third party such as an employer during the year and includes child support payments made through Inland Revenue.

Non-observable income = income information that is not reported from a third party during the year and is provided directly by the customer.

Observable vs non-observable income

From 1 April 2019, Inland Revenue expects to receive employment income information shortly after each payday. From 1 April 2020, financial institutions will provide information on interest earned and dividends paid every month. This means that Inland Revenue will know, and be able to observe, most of the income of most social policy customers from these sources as it is paid during the year.

If the customer’s income is observable during the year, the Government proposes that Inland Revenue would be able to assess Working for Families Tax Credits or child support amounts based on recent actual income information provided throughout the year, as it does now for student loan repayments.

If the income is not observable (for example, overseas income or distributions of trust income), another approach is required. In some cases Inland Revenue and the customer will only know at the end of the year what their income is – for this group an annual assessment will have to remain. In other cases new information might allow for better estimates and payments during the year. The new Accounting Income Method (AIM) for calculating and paying provisional tax will give Inland Revenue a clearer picture of the income being earned by some small business owners during the tax year.

Having different assessments based on whether the income information is observable or non-observable is similar to proposals in the Better administration of individuals’ income tax discussion document. That document proposes that income tax filing obligations be based on whether income has been reported during the year. The Better administration of individuals’ income tax discussion document also discusses how Working for Families Tax Credits customers with only reportable types of income would no longer need to file end-of- year tax returns solely because they are social policy customers, as Inland Revenue would already hold all the required income information.

Working for Families Tax Credits

The proposals would apply to the family tax credit, the in-work tax credit and the parental tax credit but would not apply to the minimum family tax credit as it is calculated as a top-up payment rather than an abated credit.

The estimates approach means payments are almost always wrong

A summary of how Working for Families Tax Credits are currently determined is set out in Appendix 1.

Families that get paid Working for Families Tax Credits during the year are required to estimate their income for the year ahead and have a "square-up" of the estimate with their actual income at the end of the year. The result is often that families end up being overpaid and at risk of penalties and interest, or underpaid and not receiving the full support when it is needed. Some families prefer to avoid the risk of debt by seeking a lump sum payment only at the end of the year.

For the 2015 tax year, as at the beginning of June 2016, there were nearly 300,000 families who had a square-up.

| Paid during the year by Inland Revenue | Total families (number) | Total families (%) |

|---|---|---|

| Exactly correct[7] | 1,850 | 0.5% |

| Underpayment | 152,382 | 41.7% |

| Overpayment | 87,646 | 24.0% |

| Lump sum paid after the end of year | 58,023 | 15.9% |

| No square-up[8] | 65,307 | 17.9% |

| Total | 365,208 | 100.0% |

When a customer has been overpaid Working for Families Tax Credits, they have until 7 February to repay the amount. If the amount is not repaid it becomes debt and is subject to the interest and penalty rules.

Of the families that were overpaid for the 2015 tax year:

- 46.1 percent fully repaid the overpayment before the due date;

- 53.9 percent did not repay the overpayment before the due date; and of these:

- 18.8 percent have now fully repaid the overpayment and any interest and penalties; and

- 35.1 percent remain in debt.

For a majority of those who are overpaid or underpaid during the year the difference between their annual entitlement and instalments is within 20 percent of their entitlement, so the estimate is relatively close, but for a third of customers the difference is greater than 20 percent.[9]

The annual period of assessment can also lead to inconsistencies. Customers who are on a main benefit are assessed monthly, whereas families who have similarly low incomes in a month, but are not receiving a main benefit, are assessed on an annual basis.

Improving the estimation of annual income

The extensive changes being made to modernise Inland Revenue’s systems mean administrative improvements would be made to the current estimation of annual income (both observable and non-observable).

Customers will be encouraged to regularly update their circumstances, and non-observable income estimates, and Inland Revenue will use information it receives during the year to pro-actively encourage this. Some customers may be required to re-estimate their income quarterly – such as seasonal workers or part-year workers.

However, administrative improvements, supported by legislative changes,[10] will not address all issues with the annual assessment approach, in particular when an increase in income later in the year means earlier payments of Working for Families Tax Credits have to be repaid. Nor will it fully address the problems with over and underpayments that arise from using an estimate of income and the uncertainty this causes.

It is proposed that the option of a lump sum payment after the end of the year would still be available.

Using more recent income information and a fixed shorter assessment period

By using observable income information received during the year, the Government proposes an option that looks at recent past income information and uses this to calculate Working for Families Tax Credits. The entitlement would be based on a period shorter than a year. The length of the shorter period of time is a question the Government is interested in hearing views on and is discussed later in this chapter. The examples use four weeks or a month, but it could also be quarterly periods or a number of weeks to match pay periods.

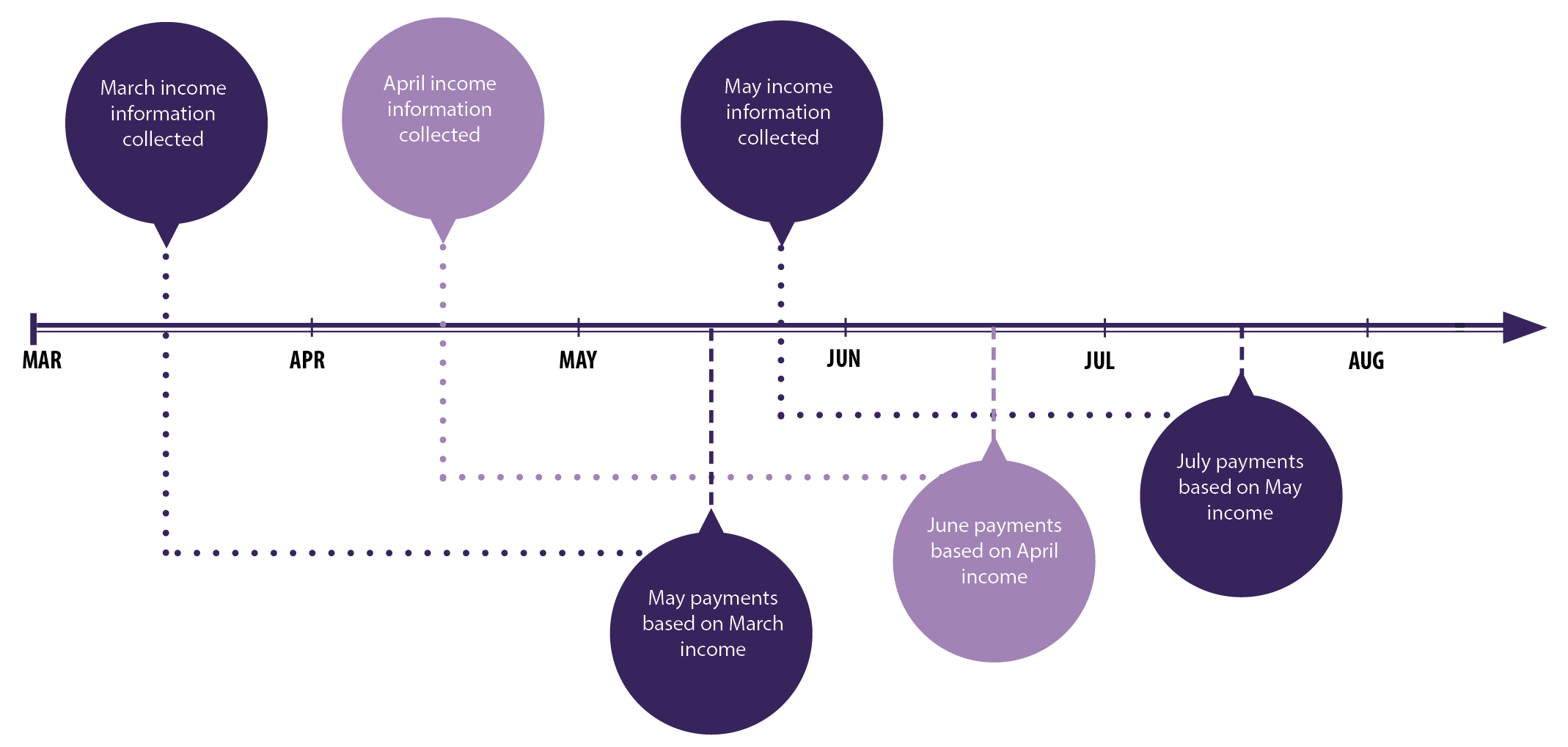

Under this option, at the end of each period the income details for that period would be checked and used to calculate tax credits to be paid in the next period. As it takes time for Inland Revenue to process it, the payment period will always lag slightly behind the income period.

For example, the May entitlement could be based on income information received for March. This information would be received by Inland Revenue in April and used to calculate May entitlements.

This option reduces much of the inaccuracy that currently occurs from trying to estimate income. There would be no requirement for customers to update annual income estimates during the year or undergo a square-up calculation at the end of the year. There would be no under or overpayments as a result of income changes as actual income is being used. Working for Families Tax Credits debt would be greatly reduced as a result. Families would know that whatever they receive they keep, as long as their family circumstances are correct.

Delay between income change and flow through to entitlement

MURRAY

MURRAY

AND AMY

Murray and Amy have a four-year-old daughter Kate. Amy stays at home and looks after Kate while Murray works. Under the current annual system they estimate their family income will be $60,500 for the year. Their Working for Families payments are $60 each week ($3,120 over the year).

The nature of Murray’s job means there are periods of high earnings and times when there is limited work available so it is difficult for them to estimate exactly.

At the end of the year their income is confirmed as $62,578 and their actual annual entitlement is calculated as $2,690.70. This means they have been overpaid by nearly $430. If they are unable to repay this by the due date they will be charged penalties and interest.

Under the shorter periods of assessment proposal, their Working for Families Tax Credits would be based on actual income received in a previous period, removing the need to estimate.

| 4 week periods | Employment income | Shorter periods | Annual period based on $60,500 estimate |

|---|---|---|---|

| 1 | $5,249 | $109.03 | $240 |

| 2 | $5,937 | $0.00 | $240 |

| 3 | $5,565 | $37.93 | $240 |

| 4 | $5,080 | $147.06 | $240 |

| 5 | $5,369 | $82.03 | $240 |

| 6 | $7,446 | $0.00 | $240 |

| 7 | $4,711 | $230.08 | $240 |

| 8 | $1,000 | $660.92 | $240 |

| 9 | $1,655 | $660.92 | $240 |

| 10 | $3,836 | $426.96 | $240 |

| 11 | $5,443 | $65.38 | $240 |

| 12 | $5,577 | $35.23 | $240 |

| 13 | $5,710 | $5.31 | $240 |

| Total | $62,578 | $2,460.87 | $3,120 |

| Entitlement based on actual income | $2,460.87 | $2,690.70 | |

| Overpayment to be repaid | $0 | $429.30 |

Note: Numbers are based on current Working for Families Tax Credits settings. These will change on 1 April 2018.

Under this approach, payments of Working for Families Tax Credits would automatically adjust during the year as income varies rather than staying mostly constant. This could impact on a family's ability to budget and plan ahead. Customers would be notified of each period’s entitlement, and online calculators would help customers see the impact an income change has on payments.

Depending on how their income fluctuates during the year, a family would receive different amounts of entitlement at different times compared to the current annual assessment basis. The payments would more closely match variations in income, with more paid after low periods of income and less paid after high periods of income. There are two exceptions. First, if a family’s income remains under the abatement threshold,[11] a change in income between periods would have no effect – they would continue to receive the maximum payment. Second, if a family’s income remains above the point of full abatement, they would continue to receive no payment.

The impact is mainly for those who earn over the abatement threshold and below the point of full abatement – that is, they are entitled to an abated payment. Payments would more closely match their income in recent periods and there would not be the risk of over or underpayments. However, total payments over time would also potentially change due to the shorter assessment period.

For some families the entitlements they receive over 12 monthly periods or 13 four-weekly periods, compared to the current annual system, could be different – they could receive more or receive less. The difference would depend on a number of factors, including:

- the length of the period of assessment (a shorter period of assessment would create greater differences); and

- the amount of income they receive in a period compared to the abatement threshold and the point at which payments are fully abated.

If a family has income that is below the abatement threshold for some periods and income that is above the abatement threshold in other periods, they would receive less in 12 months compared to the current annual system. This is most likely to affect families whose income is near $36,350 (that is, the abatement threshold). It is proposed that these families would receive a catch-up payment to make sure they received their full annual entitlement based on their end-of-year income.

A family with income in some periods above the full abatement threshold and some periods below would receive more than under the current annual system.

A further example of the potential impact of this proposal is shown on the following pages.

JACK AND

JACK AND

ANN

Jack and Ann have a nine-year-old son Lynn. The family estimate at the start of the year that they will earn $51,500. The nature of Jack’s job means the family’s income fluctuates, and they try their best to update their income estimate. After a period of high earnings they increase their estimate in September to $57,500. In February after a period of low earnings they change their estimate again to $56,000. Under the shorter periods of assessment proposal, Jack and Ann would not need to tell us about these income changes.

At the end of the year they confirm their income is $55,959 and their actual annual entitlement is calculated at $4,179.98. This means even though they tried their best to estimate their income correctly they have been underpaid by $205.98.

Under the shorter periods of assessment proposal, Jack and Ann’s Working for Families Tax Credits would automatically adjust as Jack’s income changes. This better reflects the family’s income and need at the time.

They no longer need to update their income during the year if it changes, and no longer need an end of year square-up.

While Jack and Ann would receive more under shorter periods than they would under the annual period, this additional amount would not need to be repaid.

| 4 week periods | Employment income | Shorter periods | Annual period based on estimates |

|---|---|---|---|

| 1 | $3,231 | $563.08 | $396 |

| 2 | $3,923 | $407.38 | $396 |

| 3 | $3,969 | $397.03 | $396 |

| 4 | $6,492 | $0.00 | $396 |

| 5 | $6,492 | $0.00 | $396 |

| 6 | $4,615 | $251.68 | $227 |

| 7 | $4,577 | $260.23 | $227 |

| 8 | $4,538 | $269.01 | $227 |

| 9 | $4,654 | $242.91 | $227 |

| 10 | $4,692 | $234.36 | $227 |

| 11 | $3,615 | $476.68 | $227 |

| 12 | $2,546 | $660.92 | $316 |

| 13 | $2,615 | $660.62 | $316 |

| Total | $55,959 | $4,424.22 | $3,974 |

| Entitlement based on actual income | $4,424.22 | $4,179.98 | |

| End-of-year payment | $0 | $205.98 |

Note: Numbers are based on current Working for Families Tax Credits settings. These will change on 1 April 2018.

Using past income to determine payments in a later period means a delay between income received and payments adjusting. Two scenarios are worth considering:

- If a family’s income increases, their Working for Families Tax Credits would not decrease until the following payment period. There would be a period in-between in which the family would be earning a higher income without a reduction in tax credits.

- If a family’s income decreases, their Working for Families Tax Credits would not increase until the following payment period. There would be a period in-between in which the family would be earning a lower family income without any increase in tax credits.

A problem with having a longer period of assessment (such as a quarter of the year), is that the delay between the time that income decreases and the time that Working for Families Tax Credits increase could raise cashflow issues for some families. A benefit of the proposal to have a shorter period of assessment is that this problem is much less of an issue. However, if having a longer period of assessment is ultimately preferred, consideration could be given to mitigating these cashflow issues by providing an option which would allow some payments to be brought foward as an advance.

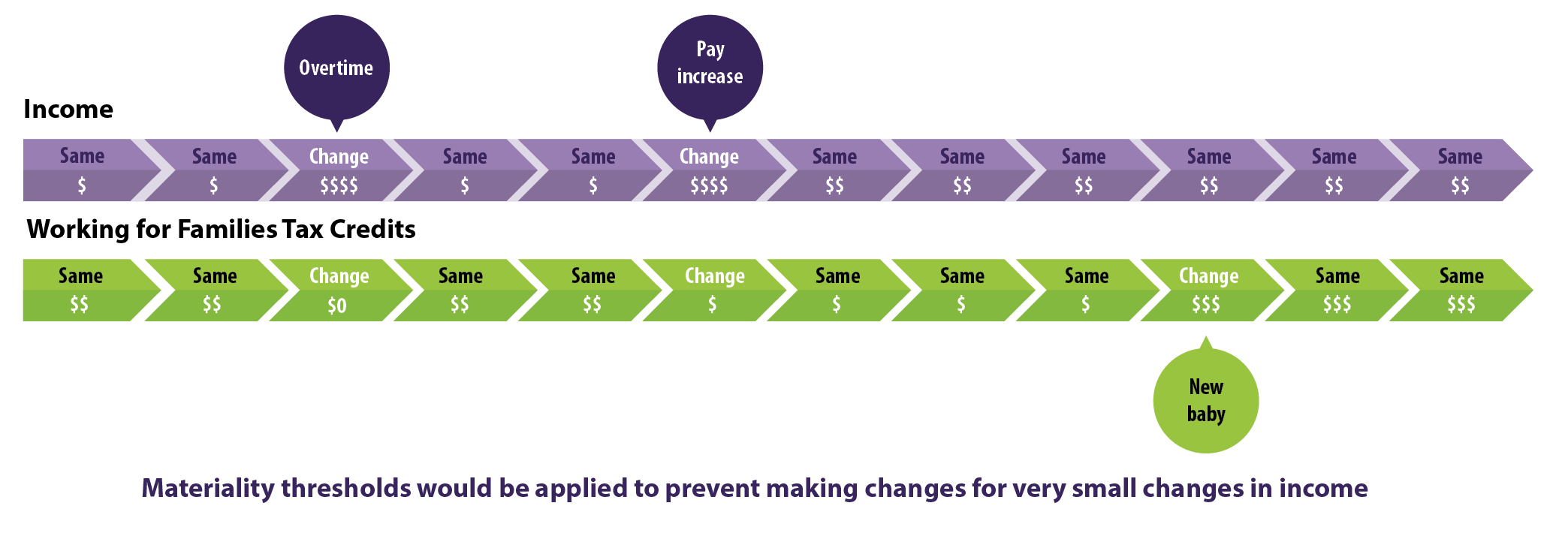

Using recent income information with continuous reassessments as information is received

Another option for families with observable income would be to base assessments on the customer’s most recent income information. As income changes during the year, the family’s entitlement would adjust in response.

JOANNE

Example of continuous reassessment

Joanne works 30 hours a week for $1,200 per fortnight. She gets $69.54 a fortnight in child support payments. Inland Revenue receives her income information shortly after each payday and, along with her child support received, calculates an equivalent annual family income of $33,094. Joanne is paid the maximum Working for Families payment of $328 a fortnight.

During a busy period at work Joanne agrees to work the next four Saturday shifts. As a result her next two fortnightly pays are $1,520. Inland Revenue receives this information and calculates an annual figure of $39,628. Her child support received hasn’t changed (an annual amount of $1,808), making her equivalent annual family income $41,436. This changes how much Working for Families Tax Credits she will receive in the next two fortnightly pays – the payment will drop to $276 a fortnight.

When Joanne returns to normal shifts her pay goes back to $1,200 a fortnight. Inland Revenue receives this information and recalculates the equivalent annual income ($33,094). Fortnightly payments of Working for Families Tax Credits go back to $328.

The income information would be used to calculate a daily entitlement amount that would continue to be paid (weekly or fortnightly) until Inland Revenue receives the next income information and calculates an updated amount. Customers would be notified of the change in payment.

The advantage of this proposal is that income changes would be taken into account as soon as the information is reported to Inland Revenue.

How frequently payments change would depend on how often income information changes.

For some customers with regular income, or no changes in family circumstances, there may be only a few changes during the year. Also, if income remains below the abatement threshold, a change in income would not change the level of entitlement.

For others there may be several changes every month, reflecting a high degree of change in their income or family circumstances.

Not every change would trigger a reassessment. There would be thresholds applied to prevent changes to payments for very small changes in income.

As with the earlier option, the shift from an annual assessment to continuous reassessments would mean customers receive different amounts at different times.

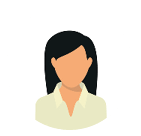

When income is not observable

The options are more constrained when Inland Revenue is not receiving income information from a third party during the year. In this situation the Government proposes that either the current annual estimate would remain in place with improvements, or customers could provide additional income information throughout the year and have payments based on shorter periods.

There would continue to be an end-of-year square-up to check actual income for the year against information provided during the year.

Using declarations of non-observable income information to make assessments

When a customer has business income, they may be providing provisional information through the Accounting Income Method (AIM). This could be used by Inland Revenue to recalculate Working for Families Tax Credits entitlements for the next AIM period. The entitlements would be reassessed each time new information is provided through AIM.

Customers not using Accounting Income Method (AIM) could provide information on their business income for the previous two months, for example. This information would be used to recalculate their Working for Families Tax Credits entitlements for the next two months. Inland Revenue would reassess the entitlements each time new information is submitted.

Child support

As with the proposals for Working for Families Tax Credits, the Government has considered several options to improve the administration of child support.

It is proposed that an annual income assessment would be retained. In some cases Inland Revenue does not have the necessary information for some parents to use other options (for example, those parents living overseas).

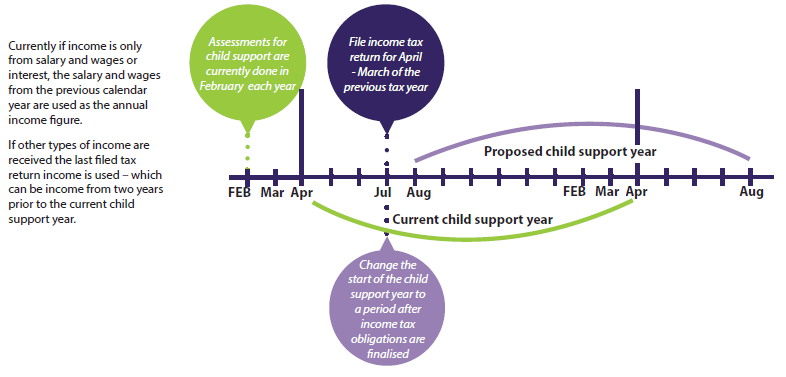

Changing the child support year to use more timely income information

One option to improve the timeliness of income information for child support assessments, whether observable or non-observable, is to change the start of the child support year to a period after income tax obligations are finalised – for example, July. Child support assessments could then be made using income confirmed from the previous tax year (rather than the last calendar year or two years ago). All the customer’s income, including interest income, would be used in the assessment as set out in Chapter 6.

This could improve the timeliness of the income information used but would not address the issues arising when income changes during the year or the difficulties with estimating current year income. To get full advantage of using confirmed income information shortly after the end of the tax year, the extension of time rules for filing through a tax agent would also need to be considered.

Using observable income information with fixed shorter assessment periods

Another option is to keep using recent actual income information but to shorten the period to something more recent, such as the previous month. This is similar to the option to use shorter periods for Working for Families Tax Credits assessments. The income information used would be more current and more likely to reflect the liable parent’s ability to pay and the level of support required by the receiving carer. For example, the May child support assessment could be based on the income information received in March.

Because child support requires the income of both parents to determine who is the liable parent and the amount of child support to be paid, both parents would ideally need to have the same period of assessment for their income.

Using past observable income information with continuous reassessments

Another option is to use past income information to determine the assessment but to reassess payments when either parent has a change in income. Reassessments would be made only when new income information (or changes in family circumstances) is reported, for example, from employers.

A materiality threshold would be required to ignore very small changes in income. In the earlier Working for Families Tax Credits example, Joanne’s change in fortnightly pay would mean about 40 cents difference in fortnightly child support payments.

For changes that are over the materiality threshold, Inland Revenue would make the adjustments and notify customers of payment changes. Some customers could end up with many reassessments during the year as their or the other parent’s income changes.

If a customer has business income and is providing provisional information about their income through AIM, Inland Revenue could use it to reassess child support obligations for the next AIM period. Those who are not using AIM could provide regular information about their business income for the previous one or two months, which Inland Revenue could use to reassess their entitlements for the next period. At the end of the year the actual annual income would be compared to the provisional information and any adjustments would be made.

If the customer is the liable parent and they provide information showing no income for a period, the minimum child support obligation would apply. At the end of the child support year, the actual income for the year would be compared to the provisional information reported during the year, and over or underpayments determined. This is broadly similar to the current estimations process but utilises better information about the way the parent earns income during the year. While the payments may be more timely under this option, they are less certain than the current system.

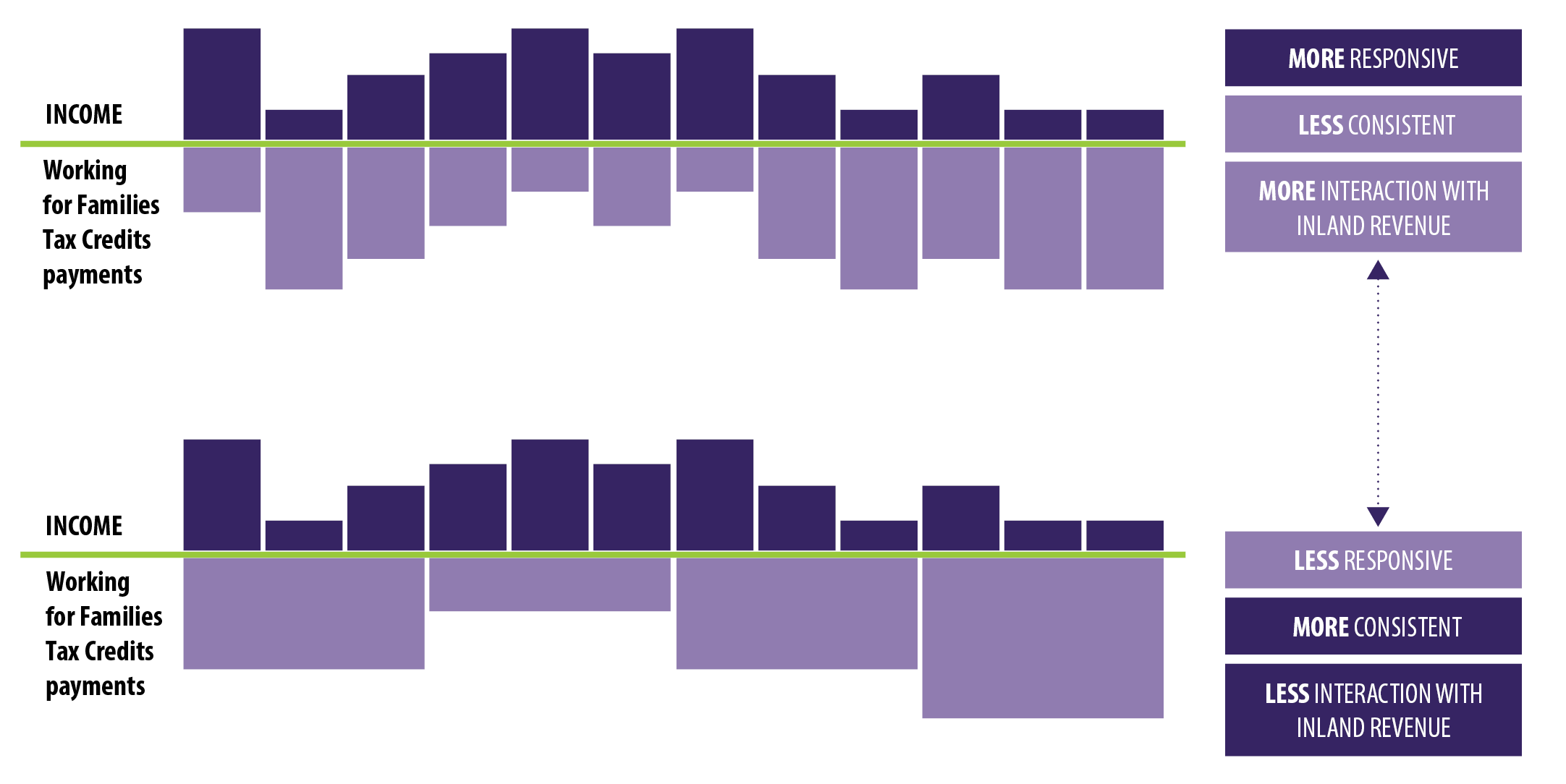

Balancing timeliness and consistency in setting the period of assessment

One of the key features of the options outlined for both Working for Families Tax Credits and child support is the use of shorter periods of assessment such as monthly or daily (continuous). There is no perfect length of assessment period that suits everyone. Different groups of customers will have their own preferences and reasons for wanting payments measured over different periods of time. This comes down to trade-offs between different objectives, mostly the timeliness of payments (how quickly payments can change to reflect changes in income) and consistency (how long payments stay the same).

| A longer period of assessment means: | A shorter period of assessment means: |

|---|---|

| variability in income is less relevant, as highs and lows in weekly income are offset against each other | variability in income is more relevant, as high and low income periods matter more to the level of payment |

| payments are less volatile, more consistent and reliable, making it easier to budget | there is more volatility in payments, so customers may not know what they will be paid, or be required to pay, in the future |

| payments are less responsive to changes in income, so it will take a while for payments to change after income changes | payments would respond faster to changes in income, so they more closely reflect current income, needs and ability to pay |

| customers who would be declaring their non-observable income for the period would have fewer interactions with Inland Revenue | customers with non-observable income would have to provide information to Inland Revenue more often |

In comparison, most main benefit payments are based on weekly income assessments, although some benefits are assessed on annual income. Paid parental leave is based on an average of weekly income over the previous 26 or 52 weeks (depending on how long the person has worked). For families whose only income is a main benefit, their Working for Families Tax Credits entitlement is assessed monthly rather than annually for the months they receive the benefit. This is explained further in Appendix 1. In the United Kingdom, the universal credit payment is based on monthly income assessments (as monthly pay periods are common).

Consideration will be given to payday cycles. Months or quarters will have different numbers of payday cycles, especially in leap years. This can create extra variability in income solely due to the number of weeks in each month or quarter. There would be less variability in income information and assessments if the period was four or eight weeks, for example.

The Government is interested in whether customers prefer shorter or longer periods of assessment and why.

No change to annual assessment for student loan repayments

For domestic borrowers with salary and wages, the current system of payday deductions would continue to apply. Repayments are deducted from wages and paid to Inland Revenue alongside PAYE. The amount of the deduction is calculated based on the income earned in that pay period.

There are no repayment changes if you are an overseas-based borrower and have no New Zealand employment income.

The remaining concern is how domestic borrowers with other sources of income (known as "adjusted net income") such as investment income and business income, can make loan payments during the year as their income is earned, rather than waiting until the end of the year.

It is proposed that the annual assessment for domestic borrowers with adjusted net income will be retained. However, the Government proposes to collect payments during the year as income is earned, to avoid the requirement for a large end-of-year lump sum payment. Chapter 4 discusses how the amount and frequency of these payments will be determined.

QUESTIONS FOR READERS

3.1 Which is the least important to you of these three objectives?

- Certainty – what you get paid is correct.

- Timeliness – payments adjust quickly to changes in your income.

- Consistency – payments are constant over time and don’t change from month to month.

3.2 Which is the most important to you of these three objectives?

- Certainty – what you get paid is correct.

- Timeliness – payments adjust quickly to changes in your income.

- Consistency – payments are constant over time and don’t change from month to month.

3.3 Do you like the approach where you don’t have to tell Inland Revenue about changes in employment income or interest and dividends, with Inland Revenue adjusting payments automatically as information is received from employers, banks or companies?

3.4 For Working for Families Tax Credits, do you see value in moving away from estimating annual income with an end-of-year square-up and towards using recent actual income information?

3.5 How important is it that payments react quickly to a change in income, compared to remaining mostly constant?

3.6 How quickly should payments change in response to income changes? What is the appropriate period to consider past income information? For example, daily, each pay period, four-weekly, monthly, quarterly, annually? Why do you prefer that period of time?

3.7 If you have non-observable income, do you see benefit in an option that uses more information declared during the year to set interim payments? What would be the best period of assessment given there would be compliance costs from providing more frequent information?

3.8 For child support do you see value in moving to shorter, more recent periods of past income information?

3.9 What factors should the Government take into account when setting the period?

4 Main benefits include Jobseeker Support, Sole Parent Support and Supported Living Payment.

5 The child support year is the same as a tax year – 1 April to 31 March.

6 "Adjusted net income" is a defined term in the student loan legislation and covers a wide range of sources of income. It generally means income other than wages or salary.

7 Exactly correct in this context means the total Working for Families Tax Credits paid during the year were within $1 of the annual entitlement.

8 The vast majority of those with no square-up were beneficiaries paid by the Ministry of Social Development and are assumed to be paid correctly. The rest have not yet filed for the 2015 tax year.

9 See page 47 of the 2016 Annual Report for Inland Revenue.

10 For example, schedule 31 of the Income Tax Act 2007, which automatically adjusts customers’ income estimates upwards, would be removed.

11 The annual abatement threshold as at 1 April 2017 is $36,350. An equivalent monthly abatement threshold would be around $3,030.