Appendix 1 – Background on how payments are currently determined

This appendix sets out some background material on how Working for Families Tax Credits are determined, and how child support is assessed. This may help when considering the options in Chapter 3.

Working for Families Tax Credits

Current annual estimates approach hard for customers to get right and easy to get wrong

Currently, a family has an annual Working for Families Tax Credits entitlement based on whether they receive a main benefit, the number of children they care for and weekly hours of work. The amount a family receives is dependent on their annual family income. Income under $36,350 a year is ignored. For every dollar of income over this amount, a family’s entitlement reduces by 22.5 cents until it is fully abated.[30] They are entitled to be paid after the end of the tax year once their income and circumstances for the year have been confirmed, with payment made as a lump sum. This can mean a family caring for a child on 1 April 2017 would receive a lump sum payment around July 2018.

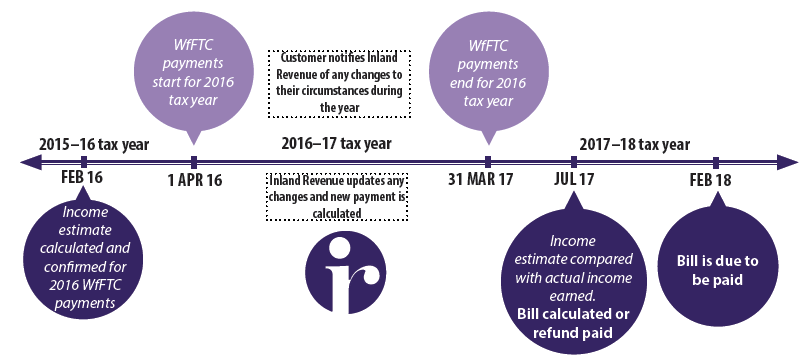

Most families require more timely support and opt to receive weekly or fortnightly instalment payments during the year, based on an estimate of their annual income and circumstances. The payments are the annual entitlement divided into 52 weekly or 26 fortnightly payments. They do not reflect how income is earned through the year.

The estimate is made in February before the start of the next tax year (1 April). Customers can update their details during the year, re-estimate their annual income and have instalment payments adjusted based on changes in family details or changes in their annual income estimate. The estimate is also rounded up and instalment payments rounded down to reflect they are instalments rather than final payments, and to reduce the risk of overpayment. In some cases, Working for Families Tax Credits payments could be stopped if a re-estimate determines the family has already received their full annual entitlement.

After the income tax return and family details for the tax year are confirmed, around July, the annual entitlement based on actual past income is compared to the total instalment payments. Any remaining entitlement is paid out in a lump sum. Any overpayment is repayable. The process repeats itself each tax year.

Customers receiving a main benefit during the year are treated differently

The annual assessment approach means that some families may not be entitled to any assistance because, over the year, their income is too high. For example, if a family estimates their income in February and they have a low income period at the start of the year, they would get paid during the year based on their estimate. Part way through the year if the family income increases they will have a debt at the end of the year when their annual income is confirmed. This can occur even if they were unemployed for parts of the year.

How income estimates work

To address this issue, the current legislation "turns off" the annual assessment when a customer is receiving a main benefit and instead shifts to a monthly assessment period for the time they are on the main benefit. This allows Work and Income to pay the maximum amount of family tax credit to customers on main benefits even if they would otherwise not qualify because their annual income is too high. Income earned before or after being on a main benefit is ignored. This ensures that families have full financial support in periods of unemployment. However, these rules do not apply to families who may have a similarly low income in a month but are not receiving a main benefit. For customers not on a main benefit, the annual assessment approach is applied.

Child support

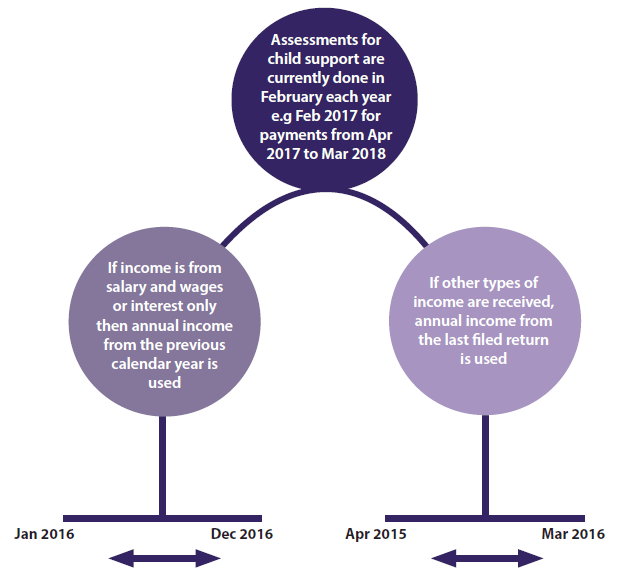

The child support system already uses past period income information to determine child support obligations. Assessments for child support are currently done in February each year for the year starting 1 April. If income is earned only from salary and wages or interest payments, the salary and wages from the previous calendar year (January to December) are used as the annual income figure in the assessment.[31] If other types of income are received, the last filed tax return income is used – that is, income from two years ago. The income figure is adjusted by inflation to reflect that it is not current, but there is no square-up at the end of the year against the income actually earned in that year.

Using past income information means the assessment is certain but not always a good indicator of a liable parent’s current ability to meet the payment (or the receiving carer’s need for support). If a parent has a significant drop in income, they can estimate their income for the remainder of the current year, with a square-up after the end of the child support year to determine how accurate the estimate was compared to actual income. This can lead to overpayments or underpayments.

In determining income for child support, parents are entitled to a living allowance and can claim a dependent child allowance. If the income is below these allowances, a liable parent would pay the minimum child support amount.[32] If income is above these allowances, child support payments are a result of the formula assessment that looks at relative income and care levels and child expenditure.

How income is used for child support now

The child support system uses past period income information to determine child support obligations

30 These are the current abatement settings. From 1 April 2018, the annual income threshold will be $35,000 and the rate at which payments reduce for every dollar over that amount will be 25 cents in the dollar. Family tax credit rates will also increase for children aged under 16 years.

31 Any interest income received is ignored for this group.

32 There are some exceptions for specific circumstances such as when a liable parent is in prison with no income.