Chapter 4 - Self-management and integrity

- Self-management framework

- Modernising the withholding rules

- Electing own withholding rate

- Labour-hire firms

- Voluntary withholding

Withholding at source systems are widely considered to be the foundation of an effective tax system. Such systems impose an obligation on an independent third party (for example, an employer or financial institution) to withhold an amount of tax from a payment of income. Withholding at source systems:

- Remove taxpayers from provisional tax obligations or at least reduce them to a level where safe harbour from use of money interest may apply;

- Are a more cost-effective way for both taxpayers and the revenue agency to interact;

- Provide a timely flow of income to the government;

- Reduce the likelihood of non-payment that might otherwise arise where the taxpayer reports the income but is unable to pay some or all of the tax assessed; and

- Can significantly reduce the ability for taxpayers to understate their income.

New Zealand has a number of domestic withholding taxes, most notably PAYE and RWT. The “schedular payments” rules are another example of withholding, however they have significant issues.

They are neither comprehensive in scope nor simple to apply, and require a flat rate withholding tax to be deducted from certain classes of payments which are not salary or wages but are largely payments for services (rather than goods).

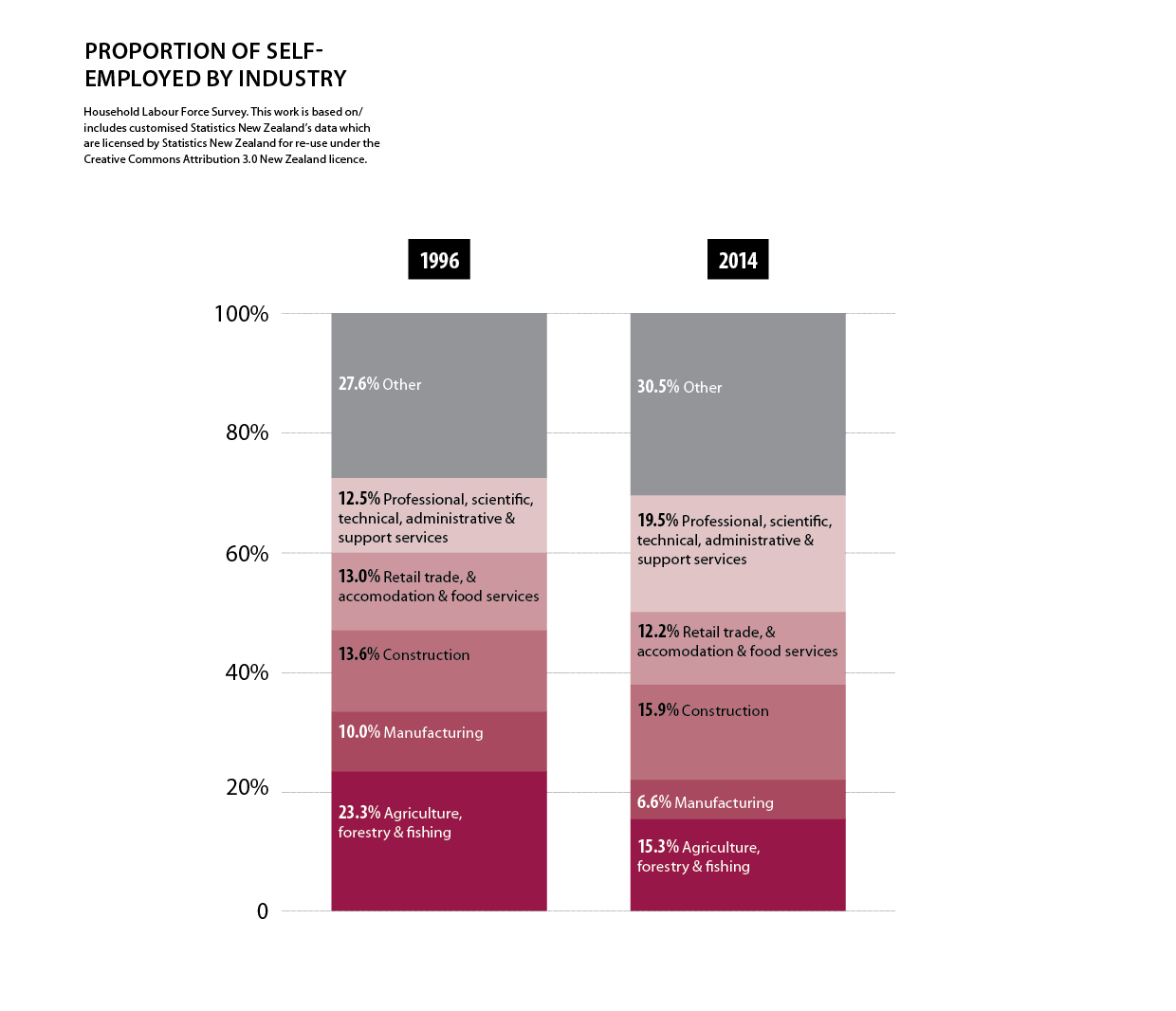

Although the withholding tax rules for schedular payments have not changed for many years, the labour market has undergone significant shifts. While the proportion of people who are self-employed (with no employees) has not changed much over the last 20 years, the industries they work in have changed. There has been a decrease in those working in industries such as agriculture and manufacturing, and an increase in the construction, professional, scientific, technical and administrative and support services, as shown in the diagram below. This means more self-employed people are working in industries not covered by the withholding tax rules.

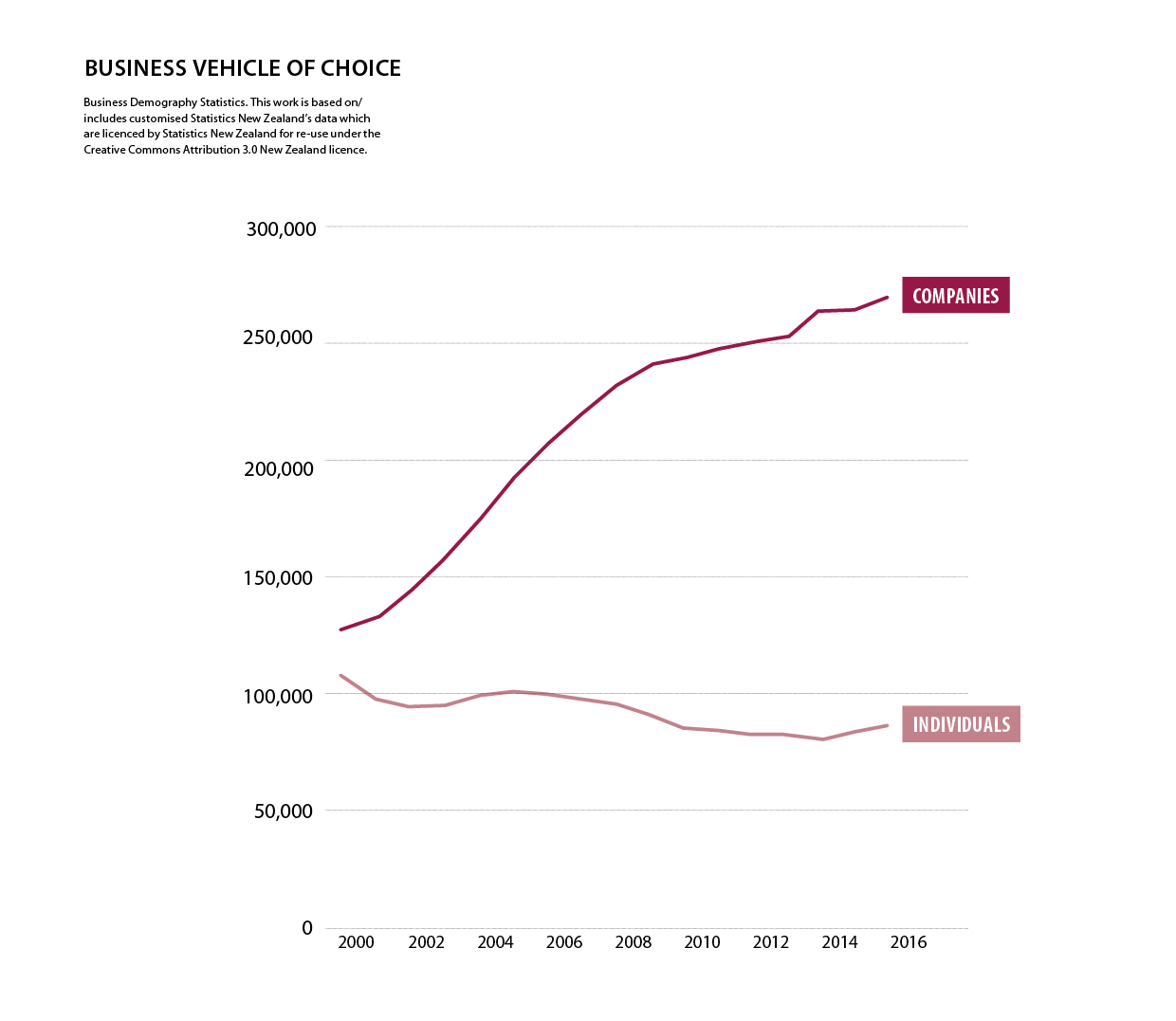

In addition, using a company structure has become increasingly popular with contractors as shown in the diagram on page 40. Payments to companies are generally not subject to withholding tax under the schedular payments rules.[10]

As the current rules are both out-of-date and narrow in application there may be opportunities for SMEs to supress income and operate totally or partially in the hidden economy. Such businesses will have a competitive advantage over those who are compliant with their tax obligations. This tax advantage may also impact on small business hiring decisions.

Example 16: Sandra is a Management Consultant. She was a salaried employee until 2009 when she started working as an independent contractor and worked for several large organisations from 2009-2010.

Inland Revenue commenced an audit of Sandra which revealed that she had only declared a small proportion of her contracting income and that she was charging GST but not filing GST returns. Sandra now has a tax debt of $360,000.

Many workers are moving from being employees to being self-employed and operating through a company structure. This means that payments to them are made without PAYE or withholding tax applying. This can create issues for those individuals who are not used to dealing with their tax obligations directly and have previously relied on their employer to deal with those obligations. In addition, the current rules are not designed to make it easy for people to self-manage their affairs.

Example 17: Candytasters Limited employs five people to test new types of confectionary. Willy, the owner of Candytasters, tells his employees he wants them all to become contractors and work through company structures. The five employees do this.

Candytasters Limited no longer has to deal with PAYE and other deductions on behalf of the individual tasters. The tax obligations have shifted to people who may never have had to look after their own tax obligations other than as an employee.

Enforcement of the employee-contractor boundary is also an inefficient mechanism to bring contractors into the withholding rules. Audit activity in this area can be expensive, as it is generally determined on an individual contractor basis, rather than for groups of taxpayers.

Example 18: Codeit Limited is a large New Zealand company that designs software. It has a workforce of programmers who are all contractors. Within this group there are 15 contractors who exhibit the characteristics of being employees. To challenge this Inland Revenue needs to work through each employee and apply the tests to determine their employment status for tax purposes.

Self-management framework

Both individuals and businesses live and operate in often complex environments. Meeting various tax obligations can also be complex. Historically the tax system has not allowed a high degree of flexibility to enable people to address these complexities and manage their obligations in a way that works for them.

The goal of the future is to design a system where people are empowered to self-manage. This involves providing more flexibility for businesses and minimising the degree of complexity in managing their tax affairs so that it is easy for businesses to get their tax affairs right. At the same time the system should make it hard for people to get their tax affairs wrong and Inland Revenue should have the ability to quickly identify areas of concern and take action to ensure things get back on track.

Modernising the withholding rules

The schedular payment withholding rules need modernising to ensure that they keep pace with modern society, make it easy for people to comply and self-manage their obligations, and to minimise costs to the system. The Government has announced a first step towards modernising the rules, providing increased flexibility and addressing an area where compliance issues have arisen.

The measures announced are:

- Pay as you go for contractors – electing own withholding rate;

- Pay as you go for contractors – labour-hire firms; and

- Voluntary withholding agreements.

The initial measures provide a foundation for future reform. A wider review of the rules is necessary to address the issues outlined at the start of this chapter more comprehensively, and is likely to be included in a later discussion document on improving the tax system for businesses.

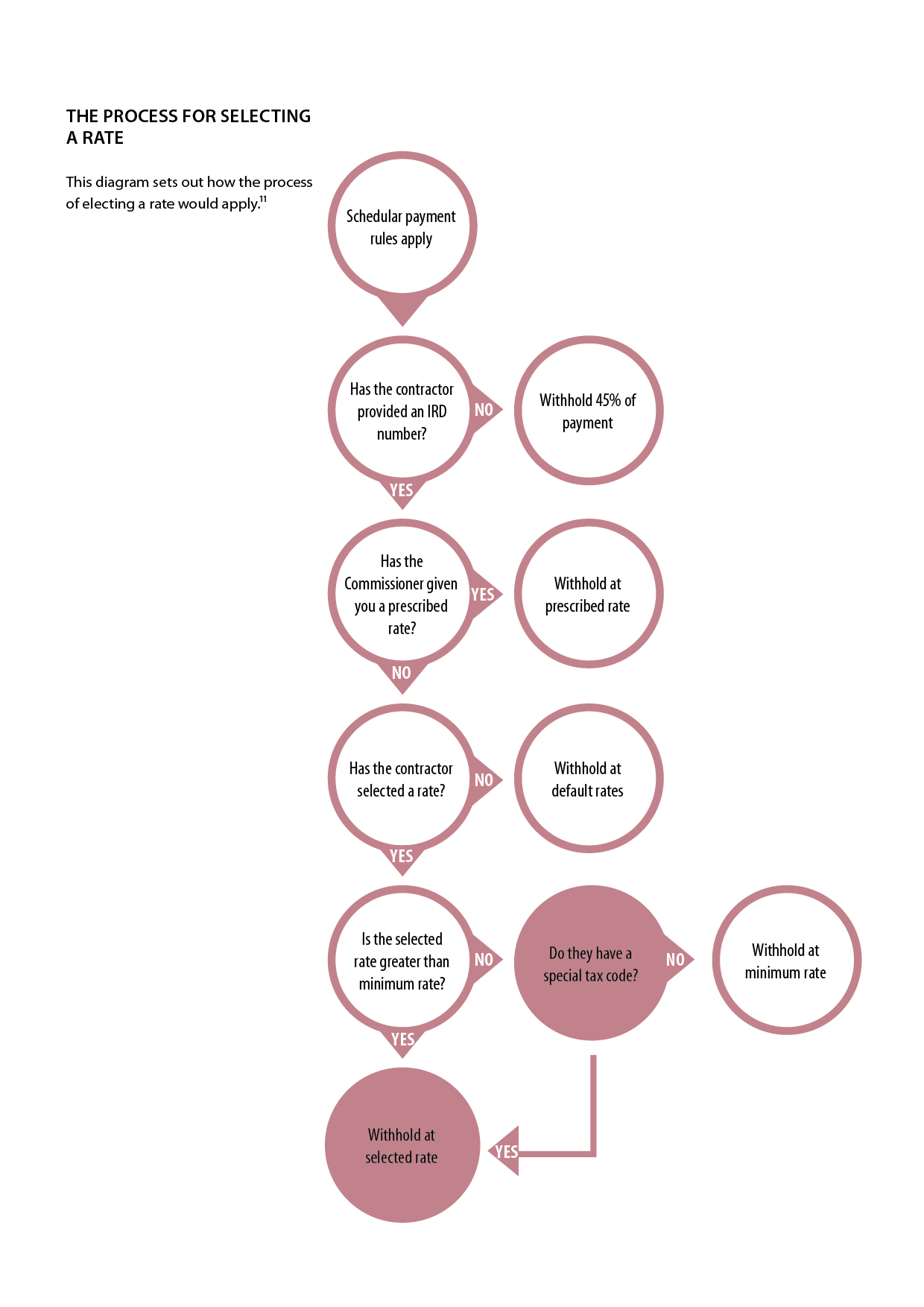

Electing own withholding rate

Electing your own withholding rate aims to assist contractors to better match their tax payments to their income. The current rules specify flat rates of withholding. This will often not accurately match the contractor’s actual income tax liability. Contractors can obtain a special tax code to alter their rate, however the process can be cumbersome, requiring them to apply to Inland Revenue and provide supporting information.

The Government has announced it intends to amend the rules, to allow contractors to select their own withholding rate, without needing to make an application to Inland Revenue. This will mean an application for a special tax code will no longer be needed to alter the rate applied to a schedular payment.

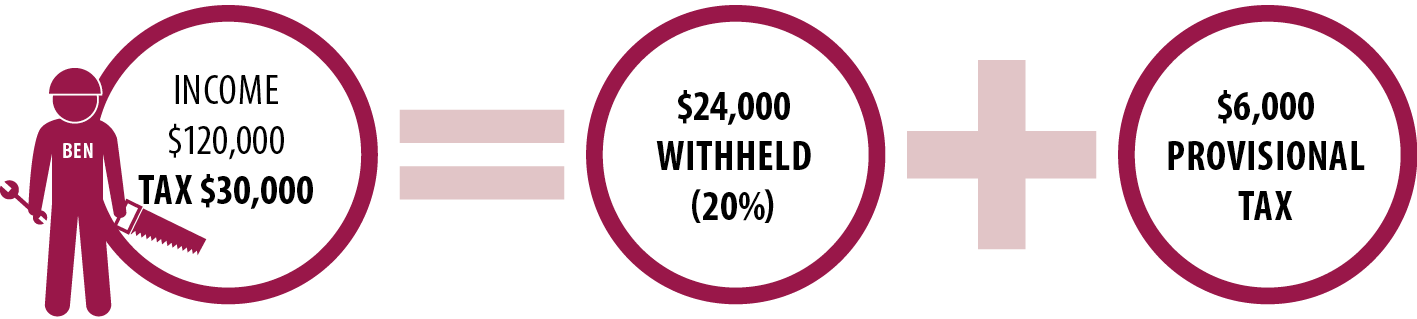

Example 19: Ben is a building contractor. Ben earns $120,000 each year from his building contracts with several major building companies. The payments to Ben are subject to the current withholding rules and the building companies deduct 20% withholding tax from payments they make to Ben.

Ben predominantly provides labour services and has minimal deductions. At year end he has an additional $6,000 of income tax to pay over and above what has been withheld. This also means Ben will have to pay provisional tax the following year.

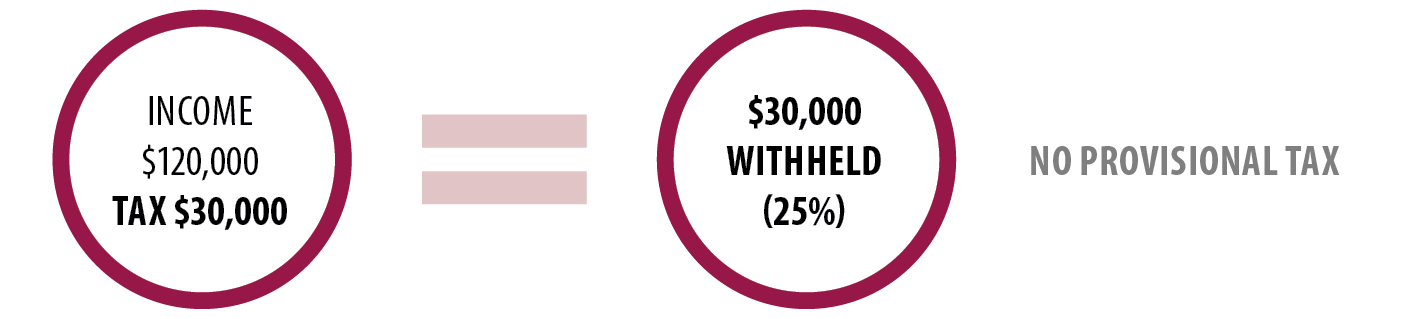

Under the new rules Ben can elect a higher withholding rate of 25% (without needing to apply for a special tax code). Ben’s withholding now matches his final tax liability, he no longer has to pay provisional tax and his end of year tax bill is minimal.

Prescribed rates of withholding

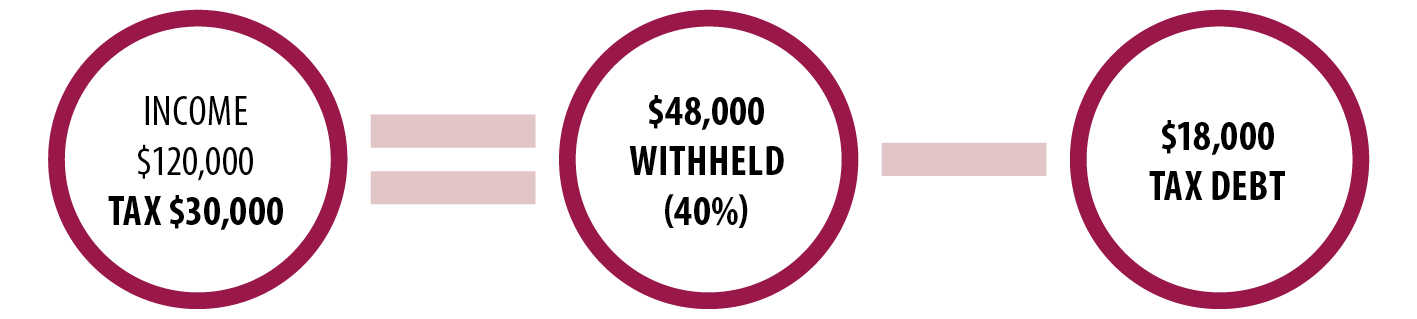

In some cases a contractor will be unable to select their own rate as they will be subject to withholding at a rate prescribed by the Commissioner. It is intended that, in some circumstances, the Commissioner will be able to give notice to a payer that they are required to withhold at a higher rate than that selected by the contractor. This would occur where the contractor is non-compliant with their tax obligations. Prescribing a higher rate will assist the contractor to become compliant and repay any outstanding debt.

The Commissioner prescribed rate would be similar to the existing power in section 157 of the Tax Administration Act 1994, which enables the Commissioner to require deductions by notice. However, the ability to prescribe rates would be more flexible and practical than the existing provision. Section 157 deductions must be a flat amount and are required to be paid separately to the employer monthly schedule. This process would vary the deduction rate applied to the payment to the contactor, and be reported and paid through the employer monthly schedule and employer deductions processes.

Minimum rates

Allowing contractors to elect their own withholding rate creates a fiscal risk. This risk arises because contractors may use the proposal to attempt to defer or avoid paying their tax through choosing artificially low withholding rates. This also creates additional administration costs for Inland Revenue in collection of unpaid tax debt.

To address this fiscal risk and ensure the integrity of the withholding system, a minimum rate of withholding will be imposed on contractors.

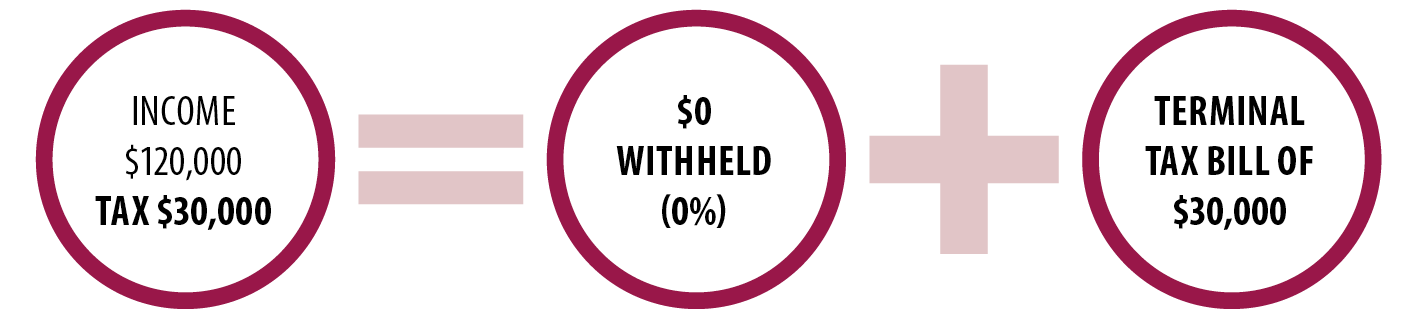

Example 19B (if no minimum rate): After previously electing a 25% rate in 2017, Ben the builder now decides to pick a rate of 0% for the 2018 year. His income and expenses remain the same and therefore his withholding does not match his final income tax liability. Ben now has a terminal tax bill of $30,000 which he will need to pay in 2019.

In 2019 Ben has a terminal tax bill of $30,000 (for income earned in 2018). As a result, he is also now required to pay provisional tax from 2019 onwards (which, if accurate, will mean he has no further terminal tax payments to make).

If Ben does not pay his terminal and provisional tax, the Commissioner may increase his withholding rate to 50% to ensure his obligations are met.

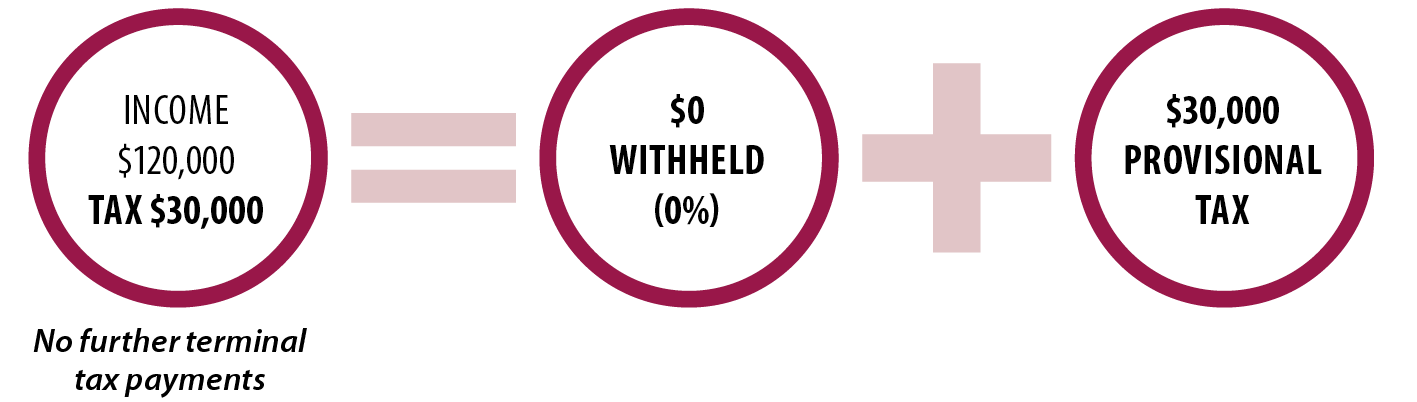

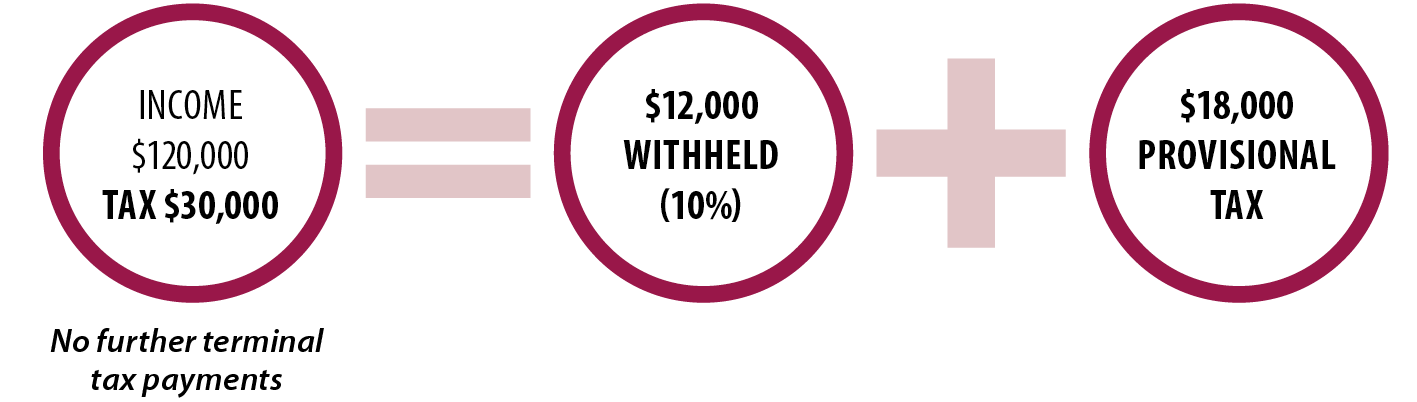

A minimum rate addresses these risks as it decreases the ability for contractors to defer or avoid paying their tax. For example, with a minimum rate of 10%, Ben in the previous example would only be able to defer paying $18,000 of tax rather than $30,000.

Example 19C (if minimum rate of 10%): After previously electing a 25% rate in 2017, Ben the builder now decides to pick a lower rate of 10% for the 2018 year. His income and expenses remain the same and therefore his withholding does not match his final income tax liability. Ben now has a terminal tax bill of $18,000 which he will need to pay in 2019.

In 2019 Ben has a terminal tax bill of $18,000 (for income earned in 2018). As a result, he is also now required to pay provisional tax from 2019 onwards (which, if accurate, will mean he has no further terminal tax payments to make).

If Ben does not pay his terminal and provisional tax, the Commissioner may increase his withholding rate to 40% to ensure his obligations are met.

However, a minimum rate does have some disadvantages. It is a departure from the self-management framework and may prevent contractors from picking the means of paying tax that works for them. For example, if a contractor would find paying tax easier through provisional tax rather than through withholding, then a minimum rate removes this choice.

In addition, a contractor whose “correct” withholding rate is below the minimum must apply for a special tax code to get the correct rate. This imposes a compliance cost on these contractors.

These costs and benefits are finely balanced. The Government favours a minimum rate of 10% for resident contractors because it is concerned about the fiscal risks, but welcomes submissions on this issue.

Non-resident minimum rate

The Government also favours having a higher minimum rate of 15% for non-resident contractors. This higher minimum rate is favoured because if a non-resident avoids paying their tax it can be difficult for Inland Revenue to collect the unpaid tax if the contractor has returned overseas.

In addition to non-resident contractors, it may be appropriate to have a higher minimum rate for contractors who are on temporary work visas as they are likely to return overseas and pose a fiscal risk.

However, determining whether a higher minimum rate should apply could be difficult for employers. Officials seek submissions as to whether the greater avoidance risk justifies having a different minimum rate for non-resident contractors and contractors with temporary work visas.

Default and non-declaration rates

When a contractor does not specify a rate, a default rate will apply. For contractors working through labour-hire firms (see page 49) the default rate proposed is 20%. This rate would ensure that the majority of labour-hire contractors that do not select a rate have no end of year tax bill and do not have to pay provisional tax.

For contractors not operating through labour-hire firms, the proposed default rate is the same rate that currently applies under Schedule 4 of the Income Tax Act 2007. This helps reduce transitional costs as businesses currently withholding will not need to change the rates for all their contractors.

Under the current schedular payments rules, a contractor subject to withholding is required to provide their name, IRD number and tax code. The IRD number is necessary to ensure that the income information and tax withheld is matched to the contractor, and the contractor is not able to avoid their obligations.

Currently, if a contractor does not provide this information, payments to them must have tax deducted at 15% above the rate that applies under Schedule 4. This non-declaration rate will be replaced with a similar rule to the no notification rule for PAYE whereby there will be a flat rate for non-declaration of 45%.

Non-resident entertainers

Non-resident entertainers currently have a flat withholding rate of 20%. These entertainers can choose to treat this withholding as a final tax and if they do so they are not required to file an end of year income tax return. This treatment helps reduce compliance costs for non-resident entertainers.

Officials propose that non-resident entertainers continue to have a flat rate of withholding of 20% and are not able to elect their own withholding rate. This will mean that these entertainers can continue to have withholding treated as a final tax and will not have to file returns.

Consent of withholder

There may be a concern that the proposal to require the consent of the withholder could increase overall compliance costs. The cost of changing a withholding rate for a withholder could be greater than the benefit to the contractor of having tax correctly withheld.

This problem arises because when a contractor makes a decision to change their withholding rate, there can be a cost to the withholder which the contractor does not personally bear. As a result, a contractor may decide to change their rate in circumstances when it provides them with marginal benefit but imposes relatively larger costs on the withholder.

To resolve this issue, stakeholders proposed that contractors should only be able to change their withholding rate if the withholder consents to the change.

Officials view

Officials consider that if the proposal to allow contractors to elect their own withholding rate required the consent of the withholder it would create the inverse issue. Withholders would be able to refuse to change contractors rates without bearing the impact that refusing to change rates would have on the contractor. This would mean overall compliance costs would be greater when the benefit to the contractor of changing the rate is greater than the cost to the withholder of changing it.

Officials consider that in the majority of situations the decision to change withholding rates will decrease overall compliance costs. As a result, officials generally prefer allowing contractors to decide their withholding rate without requiring the consent of the withholder.

However, when a contractor repeatedly changes their withholding rates this assumption does not hold. Instead it is likely that repeatedly changing rates will impose excessive compliance costs on withholders for little benefit. As a result, officials propose that the consent of the withholder will be required to change a contractor’s withholding rate if the contractor has previously changed their withholding rate twice in the income year.

Labour-hire firms

As set out earlier, the withholding rules are out-of-date and do not cover changing employment practices and modern industries. Over the last two decades there has been a large growth in the labour-hire firm industry. However, the withholding rules do not adequately address contractors working for this industry.

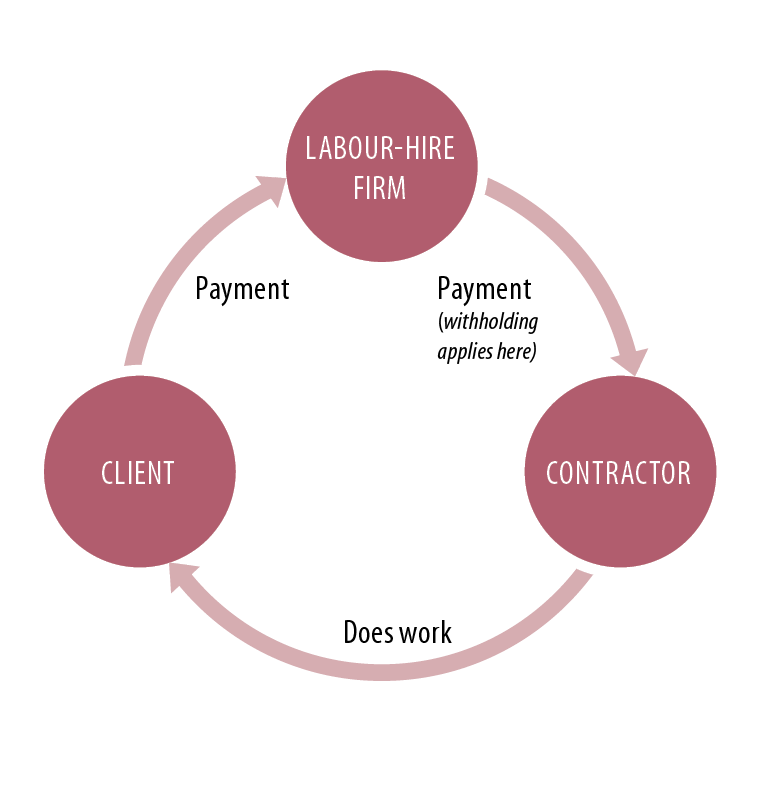

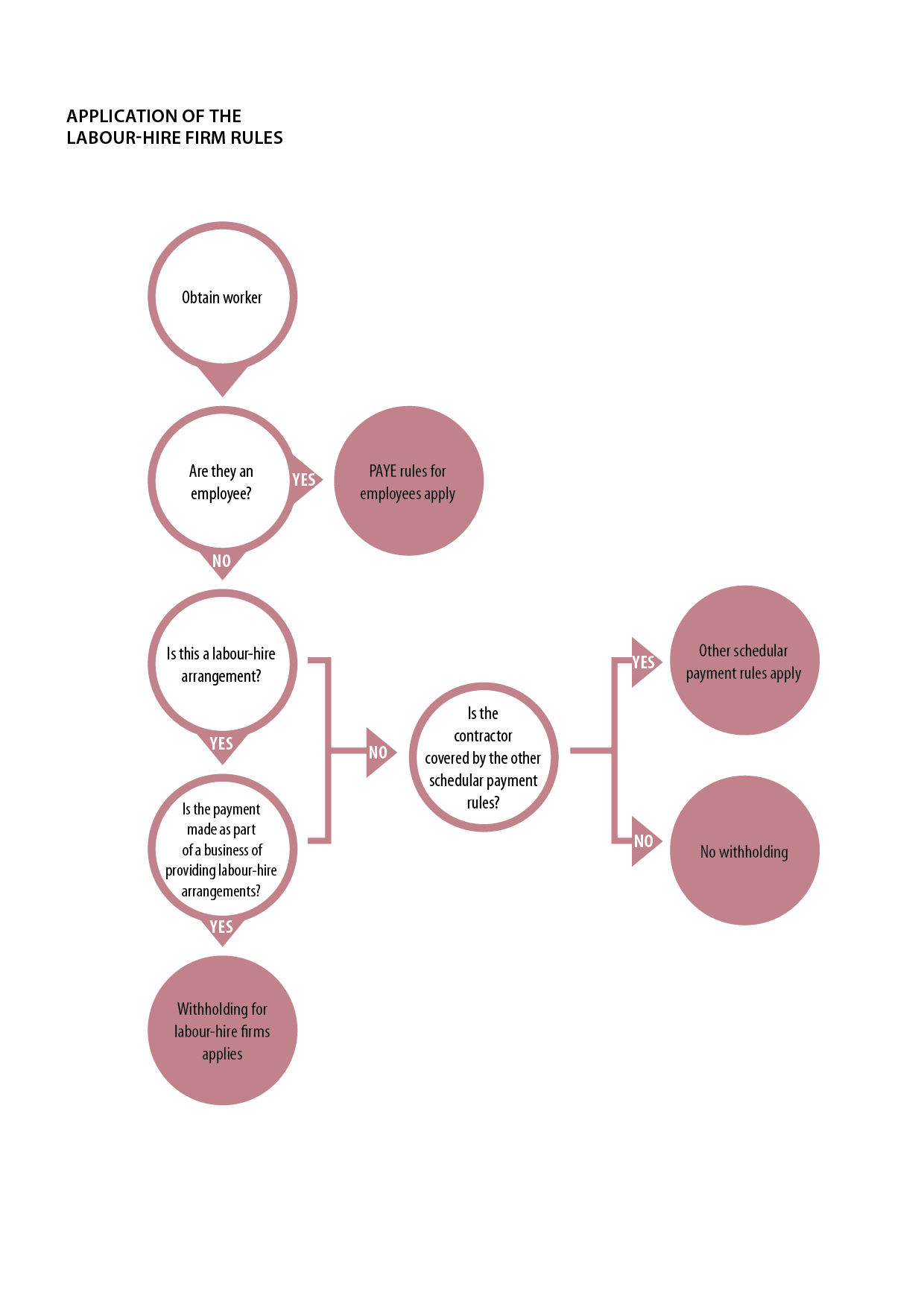

Labour-hire firms provide workers to perform services to clients. The labour-hire firm engages these workers either as employees or as contractors. While contractors and employees do similar work, the withholding rules that apply to them are quite different.

For employees engaged by labour-hire firms, the current PAYE rules mean that withholding applies to payments made to them so they generally have low compliance costs as a result.

However, current withholding rules do not generally apply to contractors engaged by labour-hire firms. This means these contractors are required to manage their own tax obligations and have to deal with provisional tax.

It also means that these contractors have opportunities for non-compliance (whether deliberate or accidental).

The following examples are based on Inland Revenue audits of labour-hire firm contractors.

IT contractor

Amy is an IT consultant who operates through a company. An audit of her revealed that she had over $100,000 of undeclared income from 2010-2013.

The audit also revealed that Amy was claiming Working for Families over this period and received $16,000 of family assistance payments she wasn't entitled to.

Management accountant

Ben is a management accountant. From 2009-2014 he worked as an independent contractor but did not file tax returns.

After being audited it was discovered he had significant undeclared income, and he did not have money to pay for it.

During 2009-2010 Ben was also receiving the unemployment benefit.

Child support evasion

Carl is an IT contractor. From 2013-2014 he worked as an independent contractor. An audit revealed Carl had undeclared income of over $300,000 over this period.

Carl originally had his child support liability assessed at $70 per month. Carl should have been paying in excess of $2,000 per month instead.

To address these issues the Government has announced that the withholding rules will be extended to specifically cover all contractors operating through labour-hire firms. This means that the labour-hire firm will be required to withhold from any payment it makes to its contractors. Extending the withholding rules in this way provides an initial measure to address one set of contractors where there are demonstrated issues.

The proposed approach is consistent with that in Australia, where labour-hire withholding rules have applied since 2000. In Australia, approximately 54,000 labour-hire contractors are subject to withholding and over $400m in tax is withheld annually.[12]

When withholding will apply

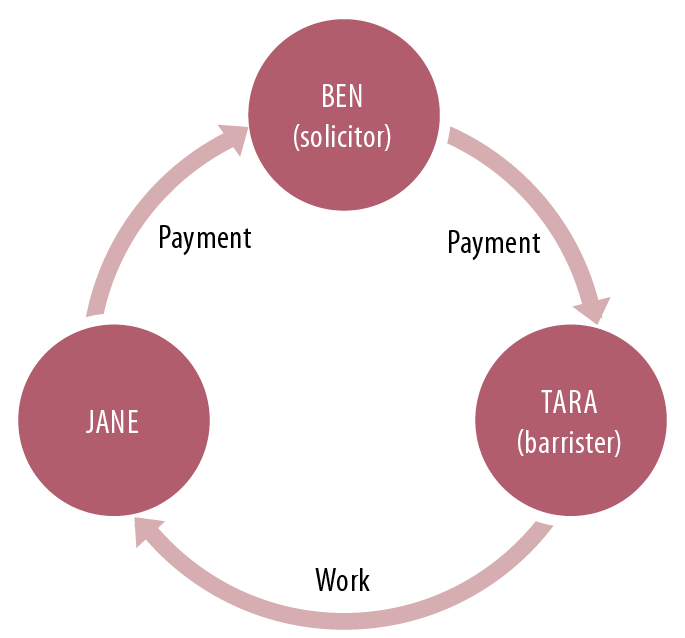

A labour-hire arrangement is one where a firm arranges for workers to do work for clients. The labour-hire firm receives payment from the client and pays the worker themselves.

It is proposed that withholding will apply where:

- There is a labour-hire arrangement (as set out in the diagram above);

- The payer is in the business of providing labour-hire services; and

- The payment is made for that business (that is, the labour-hire arrangement is not incidental to another business).

Consistent with the rules set out on pages 42-48, labour-hire contractors will be able to elect their own withholding rates.

Withholding will apply to a labour-hire contractor regardless of the form in which the contractor structures their business. This removes the ability for the contractor to avoid withholding by structuring as a company.

Contractors subject to the labour-hire rules must have their income reported to Inland Revenue via the employer monthly schedule. This means that a labour-hire contractor would not generally be able to get a certificate of exemption to remove themselves from the rules and the requirement to have their income reported to Inland Revenue.[13]

In circumstances where withholding is inappropriate, or where the minimum withholding rate is too high, the contractor will be able to obtain a special tax code to reduce their withholding rate. These contractors would still have their income reported to Inland Revenue via the employer monthly schedule.

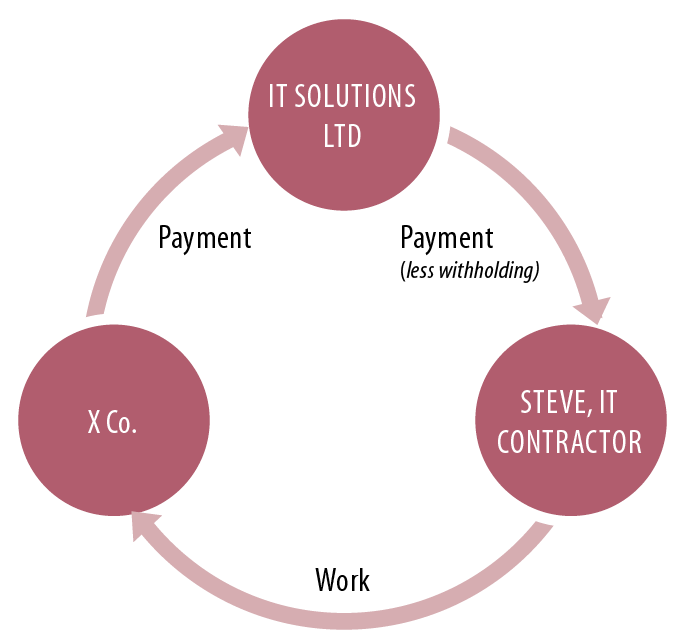

Example 20: IT Solution Ltd provides staff to assist other businesses with their IT projects. X Co. asks IT Solutions Ltd for IT workers to assist with an upgrade of their systems. IT Solutions Ltd provides one of their contractors (Steve, a New Zealand resident) to assist X Co.

IT Solutions Ltd are in a labour-hire arrangement with Steve and X Co. and this arrangement is part of their labour-hire business. As a result, IT Solutions Ltd will be required to withhold tax from any payments to Steve. Steve can specify the rate of withholding, but it must be at least 10%.

Example 21: Ben is Jane’s solicitor. Jane is engaged in litigation and requires a barrister to represent her in court. For this purpose, Ben instructs Tara and pays Tara on Jane’s behalf.

The payment from Ben to Tara is part of a labour-hire arrangement. However, Ben is not required to withhold from these payments because he is not in the business of providing labour-hire arrangements. The payment is incidental to his business of providing legal services.

Voluntary withholding

Contractors not covered by the schedular payment withholding rules are not currently able to have tax withheld on a payday basis. The Government has announced new rules to allow contractors to opt in to voluntary withholding agreements. This will allow those contractors who are not covered by any other withholding provision to opt in and obtain greater flexibility to manage their tax obligations.

A voluntary withholding agreement will require mutual agreement – that is the payer must also agree to withhold. This means that compliance costs will be minimised, as those payers who do not have the systems in place to easily withhold do not have to agree to withhold. However, the requirement for mutual agreement does mean that some contractors who want a voluntary withholding agreement may not be able to obtain one, as the payer does not agree.

9 Based on customised Statistics New Zealand data from the Household Labour Force Survey 1996-2014.

10 Companies in the agricultural, horticultural and viticulture industries and non-resident contractor companies are subject to withholding under the schedular payments rules.

11 This diagram does not apply to non-resident entertainers.

12 Figures taken from data for the 2012/2013 year. See https://data.gov.au/dataset/taxation-statistics-2012-13/resource/233cbf28-6fda-4e53-bbe9-3a37a65fb742.

13 Except where there is a specific rule allowing for non-residents to obtain a certificate of exemption due to the effect of a double tax agreement.