Chapter 3 - More accurate and timely payment of provisional tax

- The accounting income method (AIM)

- Use of cloud based software

- Eligibility criteria for AIM

- Calculation methods

- Making provisional tax payments more frequently

- Seasonal and volatile businesses

- Software program development

- Submission of information to Inland Revenue

- Taxpayers not using software

- Potential issues with the use of AIM

- Refunds

- Use of money interest and penalties

- Suitability of AIM for different types of taxpayers

- Questions for readers

- Paying tax as agent for shareholder-employees

- Use of this method

- Proposed mechanism

- Rate of tax paid on behalf of shareholder-employees

- Other types of income, and other types of taxpayer

- Suitability of paying tax as agent to different types of taxpayers

- Potential use of this measure to provide greater balance date flexibility

- Questions for readers

A key principle underlying the tax system is that generally taxpayers should pay tax as their income is earned. Pay as you earn (PAYE), resident withholding tax (RWT) and withholding taxes are examples of this principle. Provisional tax aims to ensure those who do not have tax deducted at source also pay tax as income is earned, although it starts with the presumption that income is earned evenly over the year.

This presumption does not work well for businesses with seasonal or volatile incomes, as demonstrated in the extreme example of Mustang Limited (see Example 1 in Chapter 2). The Government has therefore announced two new methods for paying provisional tax that seek to better deal with seasonality and volatility by allowing income tax to be paid on a more ‘pay as you go’ basis:

- An ‘Accounting Income Method’; and

- Paying provisional tax on behalf of related parties.

These two proposals also simplify the taxation of the total income of closely related parties by removing some parties from provisional tax and allowing more freedom around balance dates.

The Accounting Income Method (AIM)

More information and detailed questions relating to AIM can also be found online at aim.makingtaxsimpler.ird.govt.nz.

Use of cloud based software

Indications are that greater numbers of small and medium enterprises (SMEs) are ensuring that they have up-to-date accounting information to enable them to make sound business decisions based on their trading history and current position. This is particularly evident in the increasing take-up of digital business systems, including accounting software systems. Integration between accounting software and Inland Revenue’s systems and processes has been requested by taxpayers.

SMEs use tools, like their accounting software, often in conjunction with a professional advisor, to track how their business is performing at various times during the year. The timing of these interactions are often driven by outside events such as preparing GST returns. This same information might, therefore, also be used to make provisional tax payments on an actual results basis.

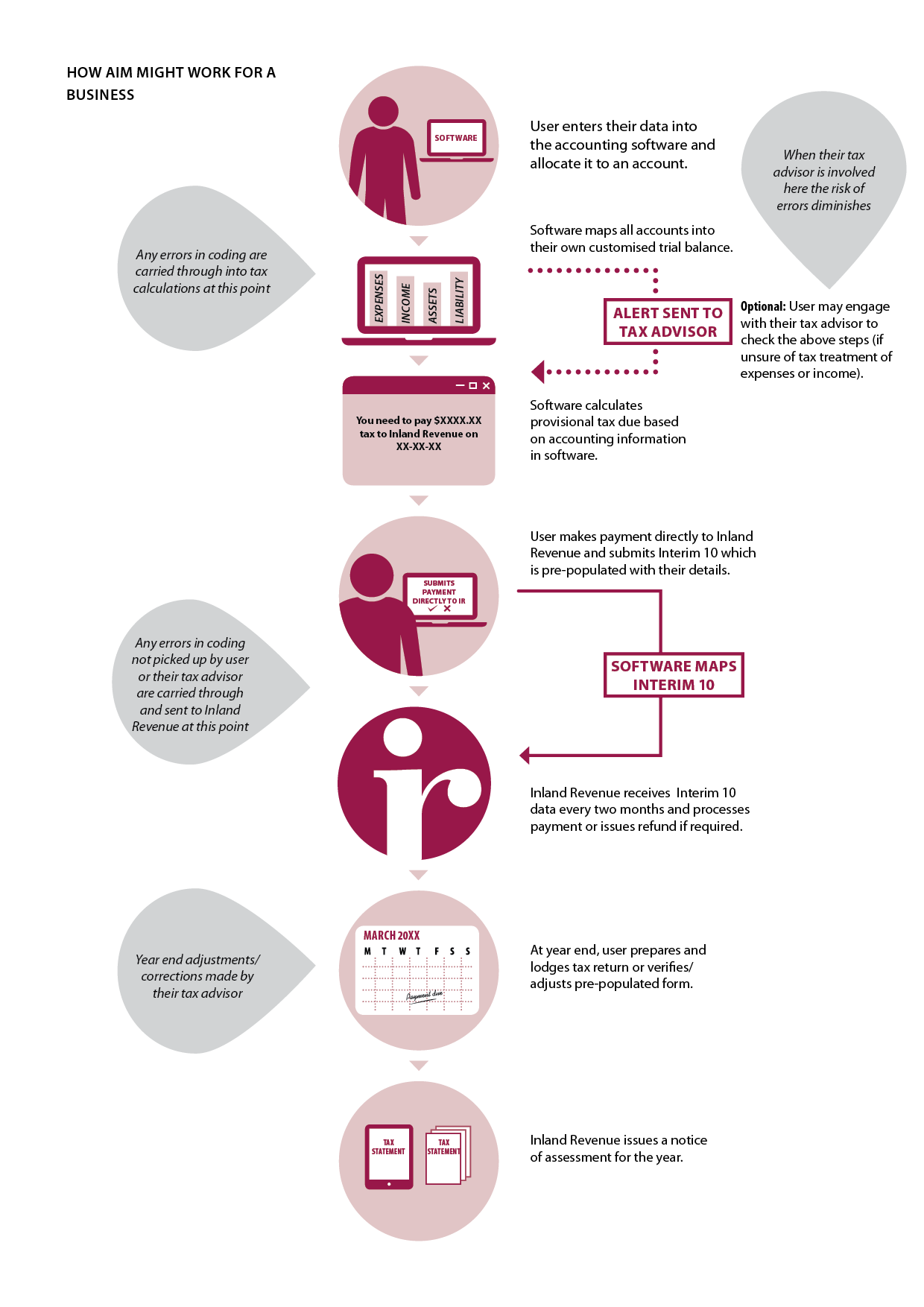

The AIM measure announced by the Government proposes that, accounting information prepared by a taxpayer for a period, be used as a basis for calculating the tax liability of the business for that period. The resulting amount would be payable by the taxpayer as a provisional tax instalment.

AIM payments will be generated by the accounting software and authorised by the user, whether a business or its advisors. The user will confirm the amount to pay and then activate the payment for both GST and provisional tax. The calculation and payment of provisional tax will become part of running the business instead of an extra process.

For accounting income to be the basis for provisional tax calculations, accounting information would need to be regularly updated, including clarification of the tax treatment of some transactions. Some users are already operating on this real-time basis, whereas others may need to update their records more regularly.

Eligibility criteria for AIM

The AIM method will be available to all provisional taxpayers with a turnover of $5 million or less.

AIM is most likely to suit the SME market rather than larger corporate taxpayers because of the size and nature of tax adjustments required to accounting profits in the large corporate market.

While the Government has restricted the use of AIM to SMEs, officials are interested in submissions from larger taxpayers on whether they would consider using this method and whether they would be willing to make the required tax adjustments throughout the year by, for example, completing monthly tax calculations.

Calculation methods

An interim tax calculation is needed to calculate provisional tax payments under AIM. This would be done through accounting software by either using the information prepared for GST returns and making some adjustments for non-GST items such as wages and salaries, interest and tax depreciation; or using a “tax” profit and loss statement for the period as the basis for a provisional tax instalment.

Example 11: Road Runner Industries Limited (Road Runner) manufactures the Coyote rod - an integral part in electric cars. It files GST on a two monthly cycle and this is its first GST return for the year. Since it prepares this information for GST purposes anyway it decides to pay provisional tax using AIM. Road Runner prepares a taxable income figure from its accounting system for the two month period based on the transactions included in its GST return and makes adjustments for capital asset purchases, wages and salaries paid (excluding shareholder salaries), interest and tax depreciation as follows:

| GST taxable supplies (excl. GST) | $200,000 |

| GST expenditure (excl. GST) | $100,000 |

| Net of GST “income” | $100,000 |

| Add back: | |

| Assets purchased during the period | $50,000 (excl. GST) |

| Deduct: | |

| Wages and salaries (excl. s/h salaries) | $30,000 |

| Interest for period | $10,000 |

| Tax depreciation on assets[6] | $25,000 |

| Net “taxable” profit | $85,000 |

| Tax on net profit (28%) | $24,000 |

Alternatively, if Road Runner is not registered for GST or its accounting system can create a profit and loss schedule based on actual results adjusted for tax depreciation and interest, it could use those figures to calculate the “taxable income” for the period as follows:

| Gross sales | $200,000 |

| Less: | |

| Rent | $30,000 |

| Wages and salaries (excl. s/h salaries) | $30,000 |

| Interest | $10,000 |

| Tax depreciation on assets[6] | $25,000 |

| Other expenses | $20,000 |

| Net profit before tax | $85,000 |

| Tax on net profit (28%) | $24,000 |

Under either calculation method Road Runner pays tax of $24,000 for the period to Inland Revenue as a provisional tax instalment.

Making provisional tax payments more frequently

For those using AIM, provisional tax payments will be made monthly for businesses registered for monthly GST returns. Payments will be made two monthly for businesses on a two-monthly or six-monthly GST filing option, and for those not registered for GST.

The Government expects more regular payments of provisional tax will enable a better fit between when income is earned and tax paid, while assisting with financial planning and budgeting. Small businesses are generally very aware of their tax liability and it is often a source of stress for them. Consultation indicates that being able to pay tax on a more regular basis will reduce this stress.

Seasonal and volatile businesses

AIM is intended to help businesses with seasonal or volatile incomes as it allows them to pay tax as income is earned rather than in equal instalments spread across the year.

Example 12: Consider a ski field, Rubicon Limited (Rubicon) which earns all its income over the winter period. Rubicon has a 30 September balance date and decides to use AIM for calculating provisional tax to better reflect the seasonality of its income. There would be no payments during the start of the year, with payments only at the end of the year.

| DATE | 30 NOV | 31 JAN | 31 MAR | 31 MAY | 31 JUL | 30 SEP | TOTAL |

|---|---|---|---|---|---|---|---|

| Net income (loss) | (1,000) | (1,500) | (500) | (2,500) | (2,000) | 10,000 | 2,500 |

| Cumulative income (loss) | (1,000) | (2,500) | (3,000) | (5,500) | (7,500) | 2,500 | — |

| Tax payment (refund) | — | — | — | — | — | 705 | 705 |

Software program development

Currently software programs do not calculate provisional or income tax, or generate income tax payments to Inland Revenue. Officials understand that software companies want to offer this to the market place. Inland Revenue will work with software providers to develop an acceptable calculation method that gives both Inland Revenue and taxpayers confidence in the calculation of their tax liability.

Inland Revenue will develop the basic specifications it requires from a software program before this service can be offered to the market place.

The specifications might include the following:

- Meets minimum prescribed accounting requirements;

- Can file electronically to Inland Revenue;

- Can accurately map a trial balance to the prescribed IR10[7] style form;

- Can calculate profit figures on a regular basis;

- Has the ability to calculate a tax liability (including tax adjustments); and

- Supports the relationship between the tax advisor and client through shared communication, alerts and dual access.

The calculation of provisional tax payments will not be an additional workload for taxpayers. There is additional work to input and code data on a more regular basis. The software will pull relevant accounts into the tax calculation, so taxpayers will need to code their income and expenses to the right accounts (i.e. profit and loss or balance sheet accounts).

The software will use up-to-date figures where they are available, and a mix of prior year figures and current year estimates where this is not the case. For example, home office expenses are traditionally steady so software will use last year’s amount and apportion it over the current year until any corrections are made at year end.

As the amounts paid are on a cumulative basis, any corrections to prior provisional tax periods can be reflected by the software in the current payment. Therefore a tax advisor can make adjustments retrospectively and the software will reflect this for the current period and remember this treatment for next time (for example, if a percentage of an expense relates to private non-deductible use, then the software will apportion and remember this for the future).

Ultimately, under a self-assessment model, the taxpayer is always responsible for calculating and assessing their tax liability. Software is a tool to assist a taxpayer, however, self-assessment will continue to require them to turn their mind to the liability calculated by the software.

Submissions are invited on the ability of software providers to build this capability. Officials also seek submissions on what specifications software developers consider appropriate to ensure Inland Revenue and small businesses can have confidence in the provisional tax payments.

Submission of information to Inland Revenue

Taxpayers using AIM will be required to submit information with their provisional tax payments to enable the calculation to be verified. The option being considered is a subset of the information in the IR10 (an “interim 10”), provided electronically. This would include information that supports the calculation of provisional tax (for example, cost of goods sold) but not information that can wait until end of the year (for example, rates). It may include GST related information so that the two payments can be cross-referenced.

Software packages will automatically map this information and forward it to Inland Revenue at the time of the provisional tax payment. Inland Revenue will not access the raw data held within the software itself. More regular provision of information during the year may also provide opportunities to simplify the end of year tax return process in the future.

Submissions are invited on what level of financial information should be submitted, and whether there is interest in exploring options to further reduce the end of year tax return process.

Taxpayers not using software

Although the use of software is increasing, there will be taxpayers who prefer to use their own software or not to use software at all, for example, a spreadsheet or manual cashbook.

As actual trading results are used to calculate the provisional tax payment it would be necessary to have minimum accounting requirements for taxpayers opting to use AIM manually. A standard of reasonable care would be expected to be taken when calculating provisional tax. At a minimum to use AIM officials anticipate that a taxpayer should maintain a double entry accounting system.

Officials are interested in whether AIM should be available to those using a manual system and, if so, what minimum accounting requirements should be expected. Officials are also seeking views on what level of accuracy would be considered acceptable for tax adjustments, and whether a spreadsheet or manual cashbook would be suitable (as long as there is some reconciliation between the business bank account and the accounting records).

Potential issues with the use of AIM

Loading income in latter part of year

To protect the tax base and the integrity of the tax system in general, consideration must be given to the possibility of taxpayers manipulating the timing of tax payments. GST returns create a natural audit trail, however, there is a risk that a taxpayer could seek to load income into the latter part of the income year even though the income may actually be earned earlier.

It is possible there could be slippage from one payment period for income and/or expenses. Where these correct themselves within two periods it is likely this would be considered reasonable.

Inland Revenue expects a taxpayer to take reasonable care in entering and coding their income and expenses to calculate their AIM payments. If a taxpayer is found to have deliberately manipulated the timing of their income and tax payments, they would no longer be eligible to use AIM. Instead, they would be placed into the estimate method where penalties and use of money interest apply.

Shareholder-employee payments

There is the risk that accounting income could be manipulated through shareholder-employee payments. The calculation of AIM payments will be based on accounting income before shareholder salaries are paid, and deductions for such payments can only be taken if the salary is paid within the period that the tax payment relates to. Overpayments of tax that relate to shareholder salary accruals can then be transferred to meet the shareholders’ tax liability at the end of the year.

Use of Tax Pooling

Provisional tax pooling was introduced to manage taxpayers’ uncertainty around provisional tax payments and their exposure to use of money interest. Consistent with this objective, pooling is not currently available for payments of tax types where a taxpayer has certainty of their liability at the time of payment (for example, GST). As the payments made under AIM are calculated on actual accounting income, taxpayers will have certainty about their payments. Therefore it is not appropriate to allow pooling for provisional tax payments based on AIM.

Fluctuations between income and loss

Although AIM does provide an actual results-based pay as you go system for businesses, unlike salary and wage payments, business income can fluctuate. If income is always positive, the cumulative tax position will always be positive, however, where income fluctuates between profit and loss for particular periods, issues may arise with using AIM. This is most likely to be an issue where profits are earned at the beginning of an income year and losses are incurred at the end. In some situations this issue could be resolved by a change in balance date.

Example 13: Atlanta Limited (Atlanta) is a commercial breeder of falcons. It sells these falcons to farmers to help eliminate rabbits on farms. Due to the breeding cycle of a falcon Atlanta sells all its falcons in the month of June. Atlanta has a 31 March balance date and decides to use AIM to calculate provisional tax to attempt to better reflect the seasonality of its income. Atlanta has the following calculation of income for each two month period:

| DATE | 31 MAY | 31 JULY | 30 SEP | 30 NOV | 31 JAN | 31 MAR | TOTAL |

|---|---|---|---|---|---|---|---|

| Net income (loss) | (2,000) | 10,000 | (1,000) | (1,500) | (500) | (2,500) | 2,500 |

| Cumulative income (loss) | (2,000) | 8,000 | 7,000 | 5,500 | 5,000 | 2,500 | – |

| Tax payment (refund) | 0 | 2,240 | (280) | (420) | (140) | (700) | 700 |

Using AIM, Atlanta would significantly overpay its annual tax liability in the second period and gradually receive that back as refunds over the remaining periods. However, if Atlanta were to adopt a June balance date, to fit with the natural cycle of falcon breeding, AIM might better fit its business.

Overpayments of tax may also occur where a taxpayer’s income profile fluctuates between profit and loss multiple times throughout an income year, albeit over a shorter period than in the example of Atlanta above.

Example 14: The Pitt Company Limited (Pitt) manufactures steel components of wind turbines. As their income fluctuates throughout the income year they want to adopt AIM to more closely match their tax payments to their income earning cycle. Pitt has a 31 March balance date.

Pitt has the following income profile for a year:

| DATE | 31 MAY | 31 JULY | 30 SEP | 30 NOV | 31 JAN | 31 MAR | TOTAL |

|---|---|---|---|---|---|---|---|

| Net income (loss) | 150,000 | (50,000) | 300,000 | (60,000) | 250,000 | 100,000 | 690,000 |

| Cumulative income (loss) | 150,000 | 100,000 | 400,000 | 340,000 | 590,000 | 690,000 | — |

| Tax payment (refund) | 42,000 | (14,000) | 84,000 | (16,800) | 70,000 | 28,000 | 193,200 |

Although not as prominent as the Atlanta example above, Pitt does end up overpaying tax in two of the six two-monthly instalments because of the way the income of the company fluctuates throughout the year, however, these “overpaid” amounts are required to be repaid later in the same year.

This method would still provide a better outcome for Pitt than the current provisional tax rules, which would see them pay three even instalments of $64,400 each in August, January and May.

Refunds

Using AIM when a business fluctuates between profit and loss throughout a year may require Inland Revenue to refund amounts of overpaid tax in some periods, much the same as is currently the case for GST. A taxpayer would be given the option of not having that amount refunded. Where a taxpayer would need to pay these amounts back to Inland Revenue in the following period (i.e. have a profit in the next period), they might choose not to take the short-term refund.

If a taxpayer did wish to receive a refund, the process would be similar to the current GST refund process. This would be an automated process. The ability to have overpaid tax refunded is a significant advantage over the current system.

Officials are interested in submitters’ views on this mechanism and whether they would use it. Would submitters consider options to refund and/or transfer excess provisional tax paid to GST, and are there other approaches that would deal with these situations.

Use of money interest and penalties

If a business, using AIM to calculate and pay provisional tax, does not pay its full annual liability during the year, it will not be subject to use of money interest unless it has failed to pay the full instalments calculated under AIM. It is expected that taxpayers who use AIM will either no longer have terminal tax liabilities (as their tax payments will be made in near real-time, and based on actual results), or have very small variations to their tax liability for the year. Continuing to have the last tax instalment after balance date should allow any shortfall to be identified and paid by the final instalment.

However, if a taxpayer pays less than the amount prescribed by the software for any instalment, use of money interest will apply from the relevant payment dates. Late payments of tax may also attract late payment penalties.

Inland Revenue expects reasonable care to be taken in calculating AIM payments. If Inland Revenue considers that reasonable care hasn’t been taken, then the taxpayer could be liable for penalties of 20% of the resulting tax shortfall.

A taxpayer will be removed from AIM when they do not provide the information required in the interim 10. The consequence of this will be that a taxpayer will be placed back into an estimate method, with the usual use of money interest and penalties applying.

Suitability of AIM for different types of taxpayers

The list below outlines the types of taxpayers best suited to AIM, along with some groups of taxpayers to whom it may not be well suited.

AIM may suit:

- Taxpayers who update their cloud based software accounting systems to manage their business throughout the year.

- Taxpayers whose income does not fluctuate significantly.

- Taxpayers with income concentrated in the latter part of the income year.

- Taxpayers with an annual steady accumulating income (that is, the business continues to make profit month to month, rather than fluctuating between profit and loss).

AIM may not suit:

- Taxpayers who do not have robust accounting processes (using software, spreadsheets or manual accounting records).

- Taxpayers with seasonal income concentrated in the beginning of an income year.

- Taxpayers with large amounts of overseas income resulting in large end of year income adjustments.

- Taxpayers with complex tax adjustments that require year end calculations.

Questions for readers

Officials invite submissions on the AIM proposal, in particular:

- How often records are updated in accounting software;

- Whether larger taxpayers would be interested in using AIM;

- With regard to tax calculations, what level of accuracy taxpayers can expect from software such as in the treatment of tax adjustments;

- What software specifications are appropriate to ensure Inland Revenue and small businesses can have confidence in the provisional tax payment calculations;

- What level of financial information should be submitted in the interim 10;

- Whether there is interest in further exploring options to reduce the end of year tax return process;

- Whether AIM should be available to businesses using manual systems and, if so, what minimum accounting requirements should be required;

- Whether submitters see any issues with how use of money interest might apply to AIM;

- Whether submitters would use the options to refund and transfer excess provisional tax paid to GST payments; and

- Any other technical issues that submitters wish to raise.

Paying tax as agent for shareholder-employees

The second measure the Government has announced to provide for more accurate and timely payment of provisional tax, is to allow a company which does not use AIM to make tax payments on behalf of shareholder-employees. This will potentially enable these shareholder-employees to be removed from provisional tax. In some instances an entity making payment to a taxpayer has a close relationship with that taxpayer. In these cases it may be possible to have the entity pay tax on behalf of the associated parties to minimise compliance costs.

An example of a close relationship providing a low cost tax payment system is a trustee and a beneficiary. Currently, a trustee can pay provisional tax on the total income of the trust (that is, both trustee and beneficiary income). At the end of the year the provisional tax paid by the trustee can be allocated, along with beneficiary income, to the beneficiaries of the trust as part of the trust’s tax return process. If the tax paid is sufficient, the beneficiaries have no provisional tax liability for that income. Without this process, beneficiaries, with no other non-source deducted income, could end up within the provisional tax rules.

The Government has announced that this mechanism will be extended to cover companies. Under this approach shareholder-employees in a company could be removed from the provisional tax rules for their salaries from the company. Tax credits would be received by the shareholder-employees to meet their tax liability.

Tax payments made on behalf of the shareholder-employees would be paid on the company’s provisional tax dates, not any provisional tax dates the shareholder-employees might have had.

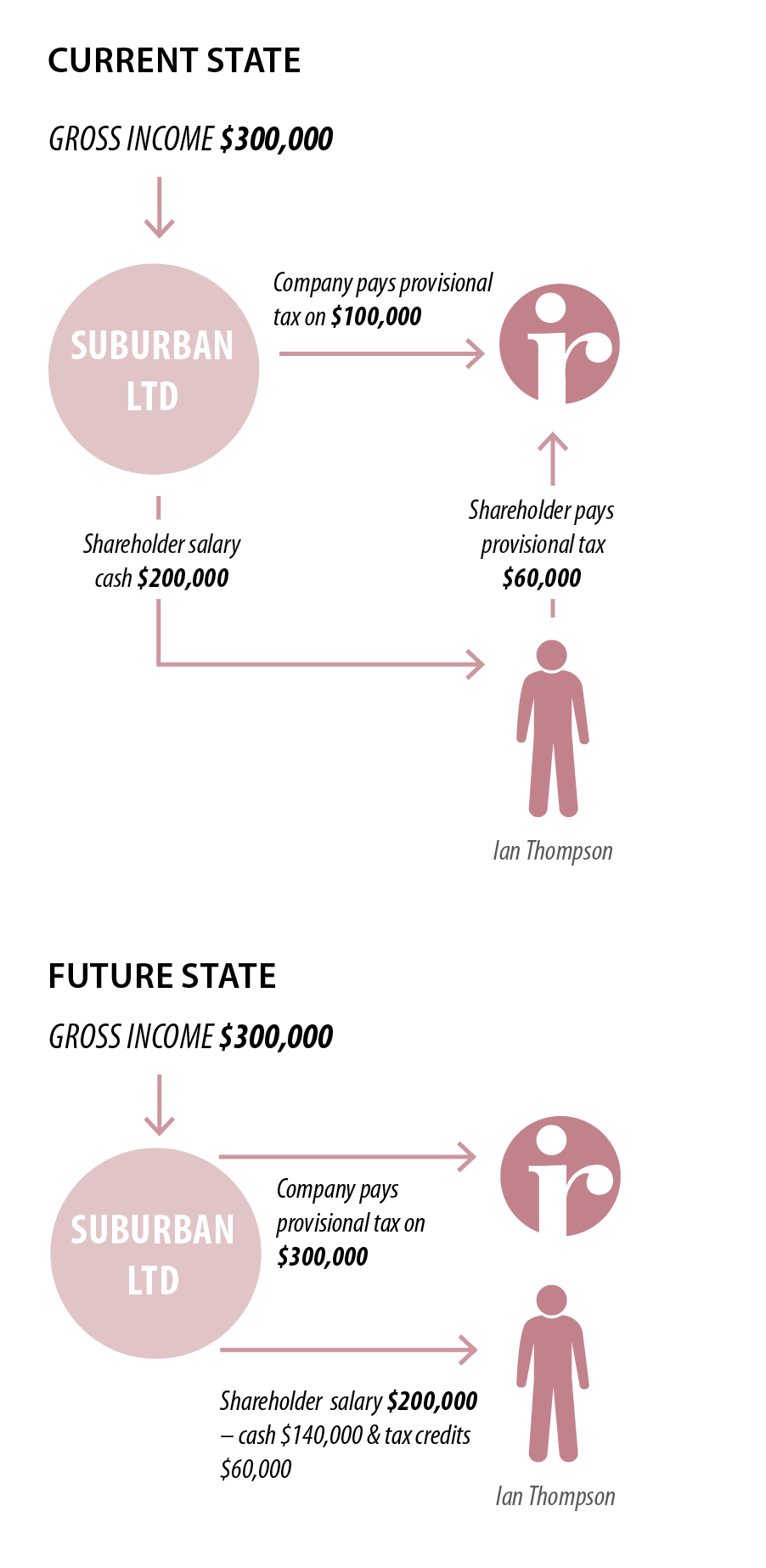

The diagram below shows the current and future state for a company electing to pay tax as agent for its shareholder-employees.

Example 15: Suburban Ltd (Suburban) is a consulting business which has one shareholder-employee, Ian Thompson. At the beginning of the 2018-19 year they both elected that Suburban would pay tax on Ian’s behalf.

Suburban has gross income of $300,000 and no expenses during 2018-19. During the course of the year, Ian took $140,000 in cash out of the company by way of drawings debited to a current account, and Suburban made provisional tax payments of $90,000.

At the end of the year:

- Suburban pays Ian a salary of $200,000 by crediting the current account for $200,000, $140,000 cash and $60,000 of its provisional tax payments to Ian as a tax credit. The $60,000 tax credit meets Ian’s tax liability on the $200,000 income, and he has no further liability.

- After payment of Ian’s salary of $200,000, Suburban’s net income for the year is $100,000. It has $30,000 remaining in its provisional tax account after the transfer to Ian. That amount of $30,000 meets its tax liability on its net income[8].

This measure is intended to reduce business compliance costs by removing shareholder-employees from provisional tax. However, tax calculations, similar to provisional tax calculations made now, will still be required to be made to enable companies to pay the right amount of tax on behalf of their shareholder-employees.

Use of this method

Paying tax on behalf of shareholder-employees in relation to their salaries will be optional. It would also only be practical when the same person deals with tax for the entity and the owners – although this is a decision for those involved to make.

As with the standard method safe harbour [see pages 17 to 20], rules will be required to prevent entities from switching in and out of this option in alternate years to avoid the on-going obligations of provisional tax.

Proposed mechanism

A company and its shareholder-employees would be required to elect to have the company paying tax as agent by the company’s first provisional tax payment date. The following rules would then apply:

- During the course of the year, the company would be expected to add to its own provisional tax payments, amounts equal to any provisional tax the shareholder-employees would have had in relation to their salaries, if they had not elected into paying tax as agent.

- At the end of the income year the various tax returns will be prepared for the company and its shareholder-employees. At this stage the company will be able to look at the total provisional tax paid, and allocate these amounts between the company’s tax liability and the shareholder-employees. This allocation may differ from the initial calculation.

- From a shareholder-employee’s point of view, amounts allocated to them will be treated as a tax credit (just like a tax credit for PAYE or RWT). The ordinary rules will then apply – if that tax credit (along with any other tax credits and amounts paid) are less than the shareholder-employee’s total tax liability, the shareholder-employee will have a terminal tax liability and potentially an interest liability. If the total amount of tax credits and other payments exceeds the shareholder-employee’s total tax liability, then a refund will be available.

Rate of tax paid on behalf of shareholder-employees

Where the company uses the uplift basis, no rate calculation is required – the company’s obligation is simply to pay uplift amounts on shareholder-employees’ salaries as well as on its own income. However, where the company uses the estimation method, the company will need to reflect the shareholder-employee’s tax rate in the amount it pays on the shareholder-employee’s behalf, not the company rate. For shareholder-employees for whom their salary is their primary income it will be their average tax rate; for shareholder-employees for whom it is a smaller part of their income, it may be their marginal rate. This is the same calculation which is made now for shareholders who pay provisional tax using the estimation method.

Other types of income, and other types of taxpayer

The main source of income paid without source deduction to related parties is the payment of salaries to shareholder-employees at irregular intervals, where the PAYE rules do not apply. This proposal is initially intended to be available for these transactions.

However, a progressive extension to other forms of income subject to tax at source could be considered if this proposal is popular with taxpayers. One possibility would be to allow companies to use it where they make other payments where no tax is deducted at source to related parties. The payment of rent is a prime example. This would allow a further group to be removed from provisional tax.

A second possibility would be to allow it to be used in place of resident withholding tax (RWT) for those companies liable to pay it on interest and dividends paid to related parties. This would simplify compliance by removing the need for a company to comply with RWT requirements.

This proposal could also be made available to partnerships. Payment of partnership profits from a partnership out to its partners is not subject to deduction of tax at source. Under current rules each partner is likely to be subject to provisional tax on their share of partnership income. A partnership could pay tax for each of its partners so they would no longer be subject to provisional tax.

Suitability of paying tax as agent to different types of taxpayers

The list below outlines the types of taxpayers to whom paying provisional tax on behalf of related parties may be best suited.

May be suited to:

- Taxpayers where a single person prepares returns for both the company and its shareholder-employees.

May not be suited to:

- Companies with a large number of shareholder-employees who have different people preparing their tax returns.

- Companies where the shareholder-employees have significant other non-source deducted income and are subject to provisional tax anyway.

Potential use of this measure to provide greater balance date flexibility

While most businesses have a balance date of 31 March, Inland Revenue can allow businesses to have a different balance date. A high threshold applies to allowing companies to have early balance dates because it can be used as a tax deferral mechanism. Where income is initially derived in a company with an early balance date and then paid out to its standard balance date shareholder-employees by way of salary, tax will be paid on the shareholder-employees’ later provisional and terminal tax dates.

The high threshold for allowing early balance dates can disadvantage companies that would benefit from one, and accountants whose workload is unevenly spread.

Allowing a company to pay tax on behalf of its shareholder-employees could be used to enable a greater proportion of companies to have early balance dates without fiscal risk. A company that wished to have an early balance date would be required to pay tax on behalf of its shareholder-employees on its own provisional tax dates, so ensuring that the early balance date was being used for genuine business reasons and not as a tax deferral mechanism.

Officials invite submissions on whether this proposal should be used to enable greater availability of early balance dates. It would be helpful if these submissions discussed how important balance date flexibility is.

Questions for readers

Officials invite submissions on the paying tax as agent proposal, in particular:

- Whether submitters who are involved in companies that pay salaries to shareholder-employees would use this measure;

- Whether it would be useful to extend this measure to other income paid by companies to related parties, such as rents, and interest and dividends (in place of RWT);

- Whether this measure could be usefully extended to partners in partnerships;

- Whether increased availability of early balance dates to businesses which used this measure would be valuable; and

- Any other comments or concerns on the implementation of this measure.

6 For this example it is assumed that Road Runner uses the Commissioner’s economic rates of depreciation for accounting and tax purposes. For businesses that have separate accounting and tax depreciation rates an adjustment would be required to substitute accounting with tax depreciation. We understand it is reasonably common for SMEs to use tax depreciation rates for accounting purposes.

7 The Financial statements summary (IR10) form is designed to collect information for statistical purposes and to assist in the administration of the tax system. It isn't designed to replace financial records. The form is a general summary of information relating to the customer's business and operations that is filed with a company tax return.

8 Numbers rounded up for simplicity – in fact Suburban has more tax than it needs to meet its liability, and would be entitled to a refund.