Chapter 1 - Overview

The Government has recently announced a package of proposals to simplify business tax, and intends to introduce legislation in August.

Inland Revenue is now seeking feedback to assist with advising the Government on the implementation of this package. This issues paper discusses the technical detail of the proposals and seeks feedback on some design decisions.

Background

All businesses benefit from an environment which gives them confidence to invest and grow. Through the Business Growth Agenda, the Government is working to create a competitive and productive economic environment which supports both export and domestically focused businesses. One way Government can help businesses is by reducing their compliance costs, saving them time and providing more opportunities to run and grow their businesses.

Inland Revenue’s Business Transformation programme is part of the Government’s investment in a productive environment for businesses. A well-functioning, modern revenue system should make it easy for businesses to get things right and difficult to get wrong, and reduce compliance costs.

Research shows that tax compliance costs are relatively high for small businesses. It is important to consistently ask whether these costs are excessive. In particular, for small businesses, there is the question of whether ‘close enough is good enough’ and whether there are ways of reducing compliance costs without providing tax concessions. Of course it is important, where possible, to reduce compliance costs for all businesses.

Business in New Zealand

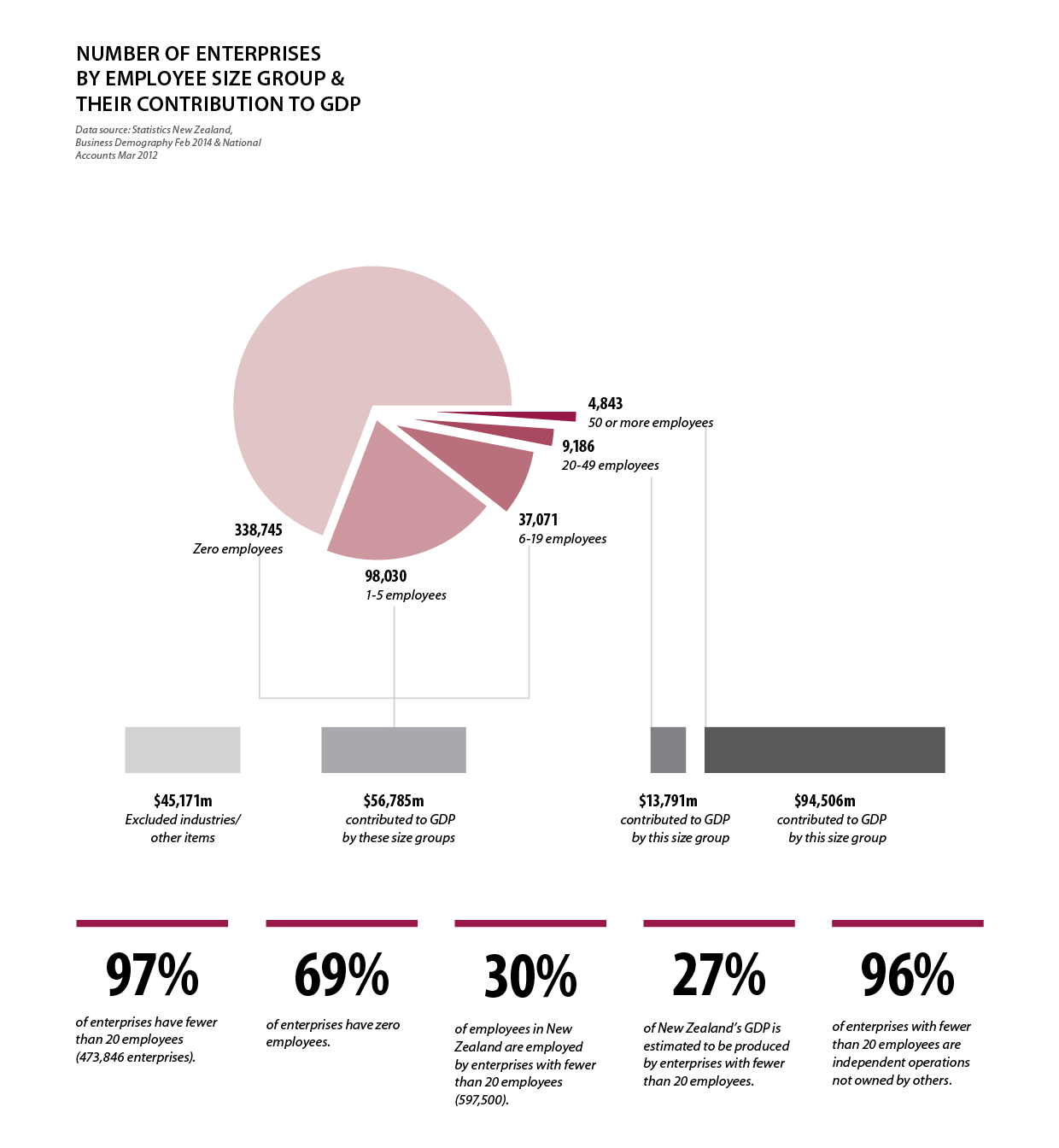

Approximately 97% of enterprises in New Zealand are small businesses. Small businesses, like all businesses, make a significant contribution to the New Zealand labour market. Around 597,000 people, comprising around 30% of the workforce, are employed in small businesses. These figures do not include the self-employed, which number more than 391,000.

Both small businesses and the self-employed are spread across the full range of industries.

Small businesses play a critical role in the New Zealand economy. They often provide a means of entry into business for new entrepreneurial talent and a career for those who value economic independence. Small businesses often act as specialist suppliers of parts and services to large companies. They contribute to variety and consumer choice by serving niche, rather than mass, markets. Small businesses also provide an important source of innovation and invention, something that all economies require.

A particular challenge for small businesses is the relative level of compliance costs they face. The Government has been considering measures to reduce compliance costs for all businesses, recognising that these are a particular concern for small businesses.

Making Tax Simpler

In a March 2015 public consultation document, Making tax simpler: a government green paper on tax administration (the Green paper), the Government sought feedback on the overall direction of the modernisation of the revenue system. A substantial amount of feedback was received about business tax, particularly about issues faced by small businesses.

Recognising the importance of small businesses to the economy, and taking into account the feedback received, the Government has announced a package of tax proposals to help businesses. The package reflects several key themes:

- Changes to provisional tax to increase certainty;

- More timely payment of provisional tax for some taxpayers;

- Self-management and integrity;

- Making the system fairer;

- Improving the operation of markets through greater tax transparency; and

- Making the system simpler.

The Government intends to introduce legislation in August to implement this package. Inland Revenue is now seeking feedback to assist with advising the Government on its implementation. This issues paper discusses the technical details of the proposals and seeks feedback on some design decisions.

With the exception of the proposals in Chapter 3, the measures all have a proposed implementation date of 1 April 2017. The new methods for paying provisional tax set out in Chapter 3 have a proposed implementation date of 1 April 2018.

Summary of announcements

Changes to provisional tax to increase certainty

- Increase the current safe harbour threshold from use of money interest from $50,000 to $60,000 of residual income tax and extend the safe harbour to non-individual taxpayers; and

- Remove use of money interest for the first two provisional tax instalments for all taxpayers who use the standard uplift option, as long as the payments required under that option are made.

More timely payment of provisional tax for some taxpayers

- Introduction of another option for calculating provisional tax, the accounting income method, which allows some taxpayers to pay tax as they earn their income; and

- Allow a company to pay tax as agent for shareholder-employees in respect of their shareholder-employee salary with a view to reducing the impact of provisional tax on them.

Self-management and integrity

- Allowing contractors to elect their own withholding tax rate to more accurately reflect the tax payable on income earned and reduce the impact of provisional tax;

- Extending withholding tax to cover contractors working for labour-hire firms to better reflect the working arrangements with those firms; and

- Introducing voluntary withholding agreements where contractors and principals can agree to withholding tax as income is earned to reduce the impact of provisional tax on contractors.

Making the system fairer

- Removal of the incremental late payment penalty for new debt for goods and services tax, income tax and working for families tax credits.

Improving the operation of markets through greater tax transparency

- Allow the credit reporting of significant tax debts to credit reporting agencies, to provide greater transparency for other businesses; and

- Information sharing with the Registrar of Companies to assist with compliance with company laws to protect other businesses.

Making the system simpler

- Various measures designed to make tax easier to comply with and reduce compliance costs:

- Allow small companies providing motor vehicles to shareholder-employees to make private use adjustments instead of paying fringe benefit tax;

- Increase the threshold for taxpayers to correct errors in returns from $500 to $1,000;

- Simplify the calculation of deductions for dual use vehicles and premises;

- Removal of the requirement to renew resident withholding tax exemption certificates annually;

- Increasing the threshold for annual fringe benefit tax returns from $500,000 to $1m of PAYE/ESCT; and

- Modifying the 63 day rule on employee remuneration to reduce costs of complying with that rule.

How to make a submission

You are invited to make a submission on the points raised in this issues paper by emailing [email protected] with “Better Business Tax” in the subject line.

Alternatively, submissions can also be sent to:

Better Business Tax

C/- Deputy Commissioner, Policy and Strategy

Inland Revenue Department

PO Box 2198

Wellington 6140

The closing date for submissions is 30 May 2016.

Submissions should include a brief summary of major points and recommendations. They should also indicate whether the authors are happy to be contacted by officials to discuss the points raised, if required.

Submissions relating to the Accounting Income Method in chapter 3 can also be made online at aim.makingtaxsimpler.ird.govt.nz.

Submissions may be the subject of a request under the Official Information Act 1982, which may result in their release. The withholding of particular submissions on the grounds of privacy, or for any other reason, will be determined in accordance with that Act. You should make it clear if you consider any part your submission should be withheld under the Official Information Act.