Chapter 3 - Detailed proposals

- Information IRD would need

- Dividend information

- Information for interest subject to RWT and NRWT and PIE income

- Information for exempt interest and interest subject to approved issuer levy

- Provision of IRD numbers

- Joint ownership of investments

- Joint bank accounts, other jointly owned interest-bearing investments and jointly owned PIE Investments

- Joint ownership of other investments

- Māori authority distribution information

- Date of birth information

- Who should provide the information

- End-of-year tax certificates

- Private peer-to-peer lending

- Timing, frequency and methods

- Timing

- Frequency of receipt of information

- Method of reporting

- PIEs

- Māori authorities

- Companies paying dividends

- Error correction

- Methods for providing the information

- Making it easier to get information to Inland Revenue

- Miscellaneous matters

- Certificates of exemption

- Closely held company dividends and interest

- Question for readers

Information IRD would need

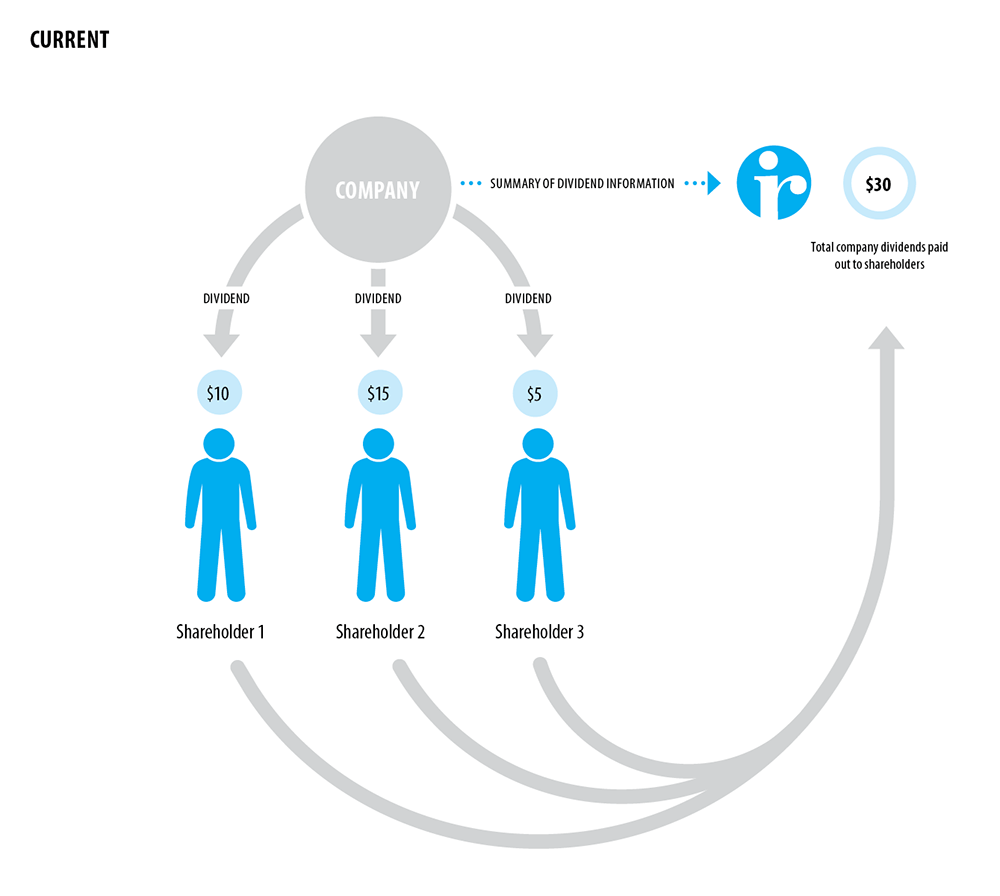

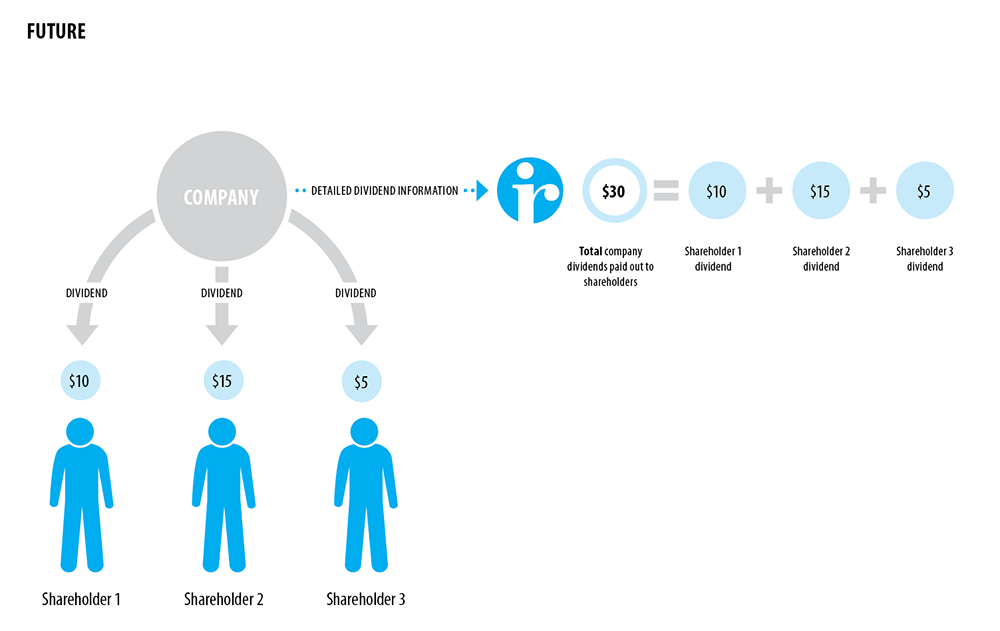

Dividend information

Companies provide detailed information to their shareholders (shareholder dividend statements) for each dividend that they pay but they only provide summary information to Inland Revenue on the total dividends paid, unless additional information is specifically requested. This means Inland Revenue is unable to associate dividend income with each shareholder.

In the future companies would need to provide detailed information to Inland Revenue after paying each dividend, so the dividend information can be pre-populated on the shareholders’ tax records.

The information that companies would need to provide would include identifying information such as the name, address and IRD number (if held) of the shareholder, as well as the amount of the dividend, any imputation credits attached and any withholding tax deducted. This is information that the company already holds in order to pay the dividends and send out the shareholder dividend statements. No changes are proposed for dividends paid to non-residents.

Information for interest subject to RWT and NRWT and PIE income

The detailed information that is currently provided to Inland Revenue after the end of the tax year regarding interest subject to RWT or NRWT and PIE income will still be required going forward (although it is likely to be required more regularly as discussed in the Timing, frequency and method section on page 30). This includes details such as the name, IRD number (if held), address, interest paid and RWT, NRWT, or PIE tax deducted from the interest or PIE income for each recipient.

Information for exempt interest and interest subject to approved issuer levy

Inland Revenue receives no detailed information about interest that is exempt from withholding tax or that is subject to the approved issuer levy (AIL). Having this information would allow Inland Revenue to allocate the income to people’s tax records, if they have an IRD number, and to check that the recipients were entitled to have AIL deducted or claim exemptions from withholding tax.

Under this proposal the payers of exempt interest and interest subject to AIL (potentially limited to domestically issued debt) would provide detailed reporting like the reporting required for RWT, NRWT on interest and PIE tax. For example, payers will provide details such as the name, IRD number (if held), address, interest paid and AIL paid on the interest (if any) for each recipient.

If the interest is paid to a New Zealand resident nominee company or an agent, the first payer would show the payment to the nominee or agent in their reporting, and the nominee or agent would provide detailed reporting for the payments that they in turn make.

Where the interest subject to AIL is paid in respect of debt issued domestically (e.g. New Zealand bank deposits and bonds issued in New Zealand) we would expect the interest payers to hold the details of the investors in order to manage the payment of interest (whether themselves or through a New Zealand registry).

Inland Revenue understands that where debt instruments (typically wholesale) are issued to offshore investors through offshore paying agents the New Zealand interest payer may not hold detailed information on the investors (they simply pay the interest to the offshore paying agent who pays the investors). Inland Revenue also understand that the offshore paying agents may be constrained in their ability to provide this information by privacy laws in their own jurisdiction. The Government is interested in feedback on whether this understanding is accurate and would welcome suggestions if there are ways that this information could be obtained.

The Government is also interested in feedback from issuers of offshore debt instruments on the practical likelihood of New Zealand resident investors (other than collective investment vehicles) investing in these products.

Provision of IRD numbers

Associating income information with the right taxpayers is vital for pre-populating the income information into taxpayers’ Inland Revenue records. Successful pre-population will make it simpler for taxpayers to complete tax returns if they need to or choose to. If people do not provide their IRD number to the organisation that pays them investment income, it is difficult for Inland Revenue to associate the income with a particular taxpayer and to gain an accurate understanding of their tax position. This limits Inland Revenue’s ability to give the taxpayer the details they need to complete a tax return, and to calculate any social policy entitlements or obligations. It may also make it difficult for the taxpayer to calculate the prescribed investor rate (PIR) available to them in a future year.

As the top (and default) withholding tax rate for RWT is 33%, there is no incentive for investors who are already on the top tax rate to provide their IRD number to the organisations that they invest with as their investment income will be taxed at the right rate regardless. Similarly there is no real incentive for taxpayers to provide their IRD number to their PIE when they are on the 30% or 33% marginal tax rate, as their PIE income would likely be taxed at the 28% default PIR.

The Government proposes making the non-declaration rates for RWT on interest and PIE income 45%. This gives an incentive for investors to provide their IRD numbers and aligns the non-declaration rates for these taxes with the non-declaration rate for PAYE.[7] It would be important for investors to be adequately informed of this change, if it was made, to allow reasonable time for them to provide their IRD number and not be subject to the higher tax rate.

The RWT non-declaration rate on dividends and taxable Māori authority distributions would remain at 33%. Company dividends have a flat tax rate of 33%, so requiring additional rates would cause significant compliance costs to change systems as they have not been set up to collect tax at different rates. Many Māori authorities also have significant administrative and system constraints and would be likely to have difficulty complying with more complicated requirements.

If the PIE income non-declaration rate was increased to 45% this could be seen as unduly harsh as PIE tax is usually a final tax. Under the current PIE rules the recipient could not get a refund of the tax even if they filed a tax return. This could be alleviated by making PIE income that has been taxed at the non-declaration rate part of the recipient’s taxable income. They could then include it in their tax return and get a tax credit for the 45% PIE tax deducted. Alternatively, the tax deducted at the non-declaration rate could be left as a final tax as this would provide the strongest incentive for people to provide their IRD number to their PIE manager.

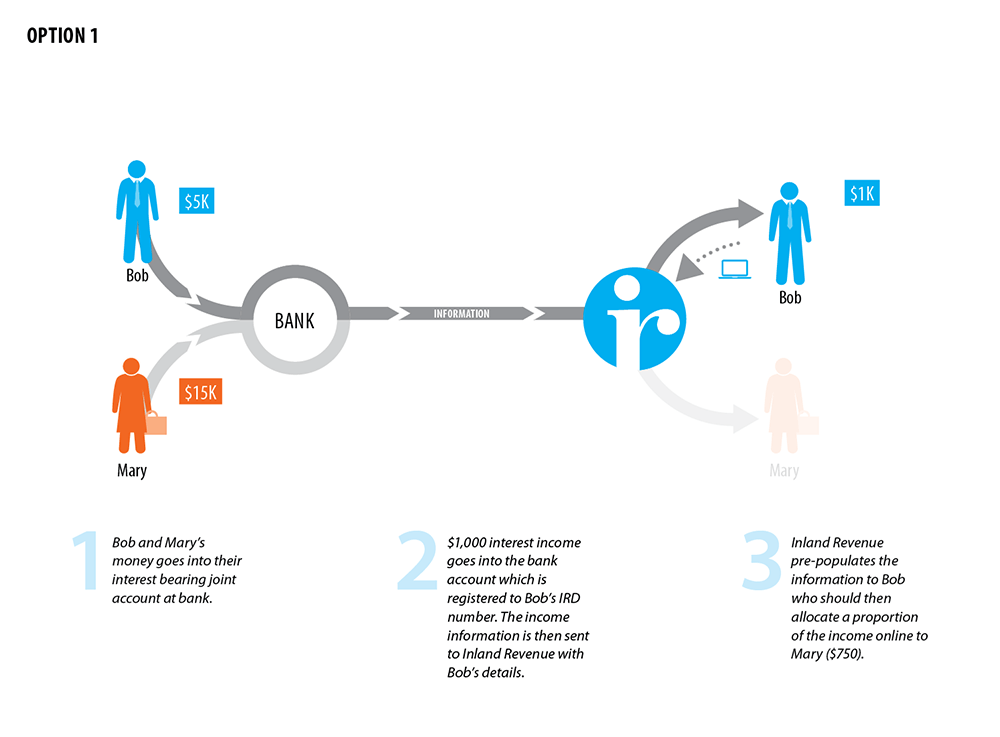

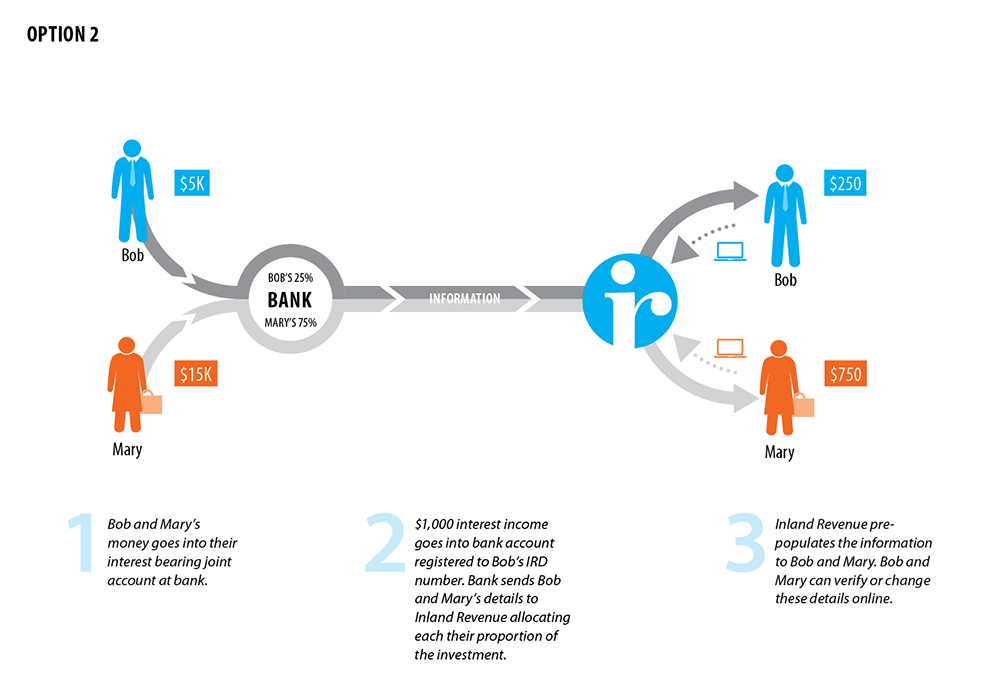

Joint ownership of investments

A proportion of the income from jointly owned investments is taxable to each of the owners based on their proportion of ownership of the investment. It is important to accurately allocate the income to each owner to ensure that their tax and social policy obligations and entitlements are correctly calculated.

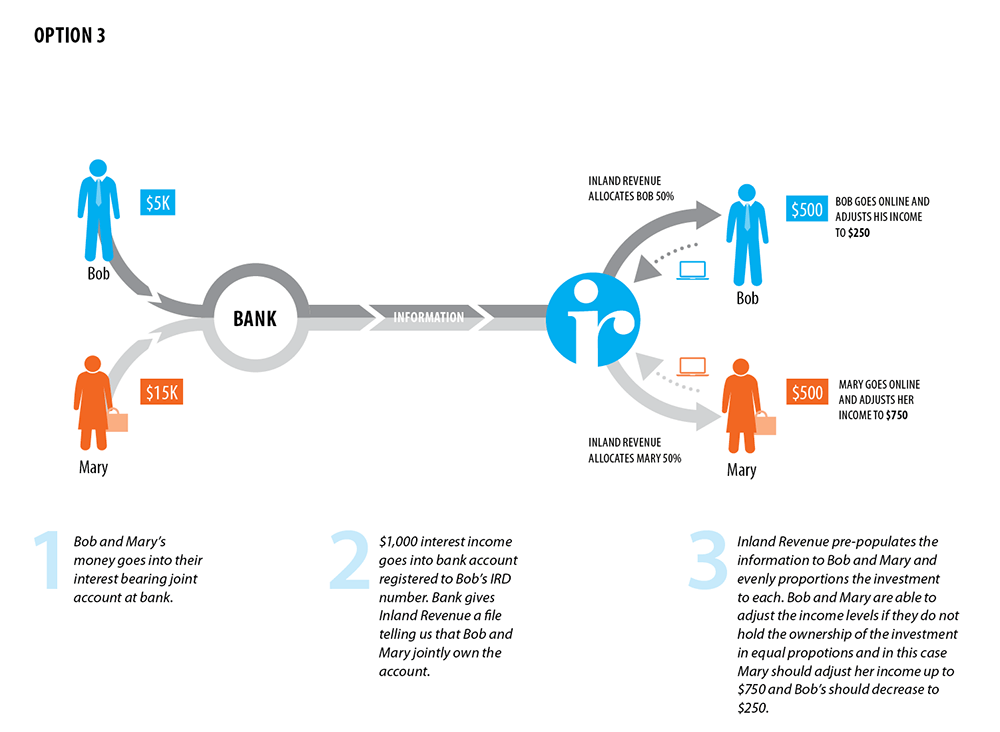

Joint bank accounts, other jointly owned interest-bearing investments and jointly owned PIE Investments

Currently Inland Revenue receives only one IRD number for each jointly owned investment when interest and PIE income is reported, and has to rely on the owners correctly allocating the interest income in their tax returns (shown in the diagram on the next page as Option 1). The current method of reporting jointly owned investment income is not considered to be sustainable going forwards. To have some basis for allocating interest and PIE income to each owner for pre-population, Inland Revenue will need some identification details such as IRD number, name and address for each owner.

Jointly owned investments are currently treated as a single record in withholding tax returns (Option 1), which is consistent with the way they are treated by the PIEs’ and interest payers’ systems. In order to include all of the owners’ details it might be necessary for the investment income payer to split the income and the tax withheld among the owners and then treat each portion as an individual record in the withholding tax returns (shown in the diagram as Option 2). The Government is aware that this could cause system difficulties for investment providers and also that the investment providers may not hold information on the proportions of the investment owned by each of the joint owners.

As the joint owners may not own the investment in equal proportions there would need to be a way for owners to correct the income attributed to them if the investment provider cannot provide the ownership proportions to Inland Revenue. This would also need to be able to be cross-checked against the proportion attributed to other owners to ensure that all of the income is being returned. It may be possible for the owners to inform Inland Revenue directly if changes to the proportions allocated to the various owners are required.

Alternatively, the jointly owned investment could remain as a single record and the investment provider could provide a supplementary return setting out the details for each joint owner (shown in the diagram on the previous page as Option 3). This would need to be linked to the record in the main withholding tax return by some form of unique identifier so Inland Revenue could split the income and the tax credits. The income could be split on a pro-rata basis unless the investment provider had details of the ownership proportions for the investment that could also be provided with the return.

Joint ownership of other investments

If shares are held jointly, the shareholder dividend information will need to include details for each joint owner to the extent that these are held by the company. The ownership of the shares and the entitlement to the dividend income will be treated as being held in even proportions.

Membership of a Māori Authority is held individually rather than jointly and as such the discussion of joint ownership is limited to PIE income, interest bearing investments and shares.

Māori authority distribution information

Māori authorities provide detailed information to their members (distribution statements) for each taxable distribution, but they only provide Inland Revenue with summary information on the total distributions, unless additional information is specifically requested. This makes it impractical for Inland Revenue to associate distribution income with each member unless they file a tax return and declare the distribution income.

Taxable Māori authority distributions are taxable income to the member that receives them. The member’s tax liability on their taxable Māori authority distributions may be covered by the attachment of Māori authority credits to the distribution, or the deduction of RWT. Inland Revenue proposes to include taxable Māori authority distributions and any attached Māori authority credits or RWT credits in the pre-population process.

Māori authorities are not currently required to provide detailed distribution information to Inland Revenue. In order to pre-populate the information on taxable Māori authority distributions, Inland Revenue will need detailed information from the Māori authority on the amount of the distribution, the recipient, the amount of the Māori authority credits and the amount of any RWT credits.

The information that would be required would be the same as the information that Māori authorities are currently required to send out to their members when they make the distributions, and would include recipient details such as name, address and IRD number, as well as the amount of the distribution and any credits attached. It is similar to the type of information provided by banks in relation to interest that they pay to their customers.

Date of birth information

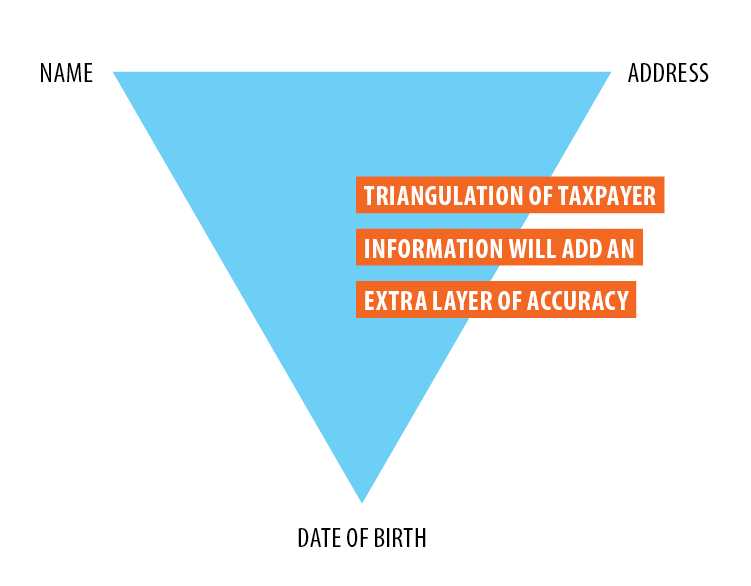

The Government proposes that date of birth information should be provided if it is held by investment income payers. Privacy concerns have been raised by submitters who responded to the Government’s Green Paper; however, having date of birth information would significantly increase Inland Revenue’s confidence in confirming the identity of the recipient of the income and ensuring that the income is allocated to the correct IRD number. There is also a proposal to collect date of birth information for PAYE purposes in the Making Tax Simpler – Better Administration of PAYE and GST discussion document.

Some people use multiple spellings or versions of their name and it is not uncommon for two or more people to have the same name. People can also give incorrect IRD numbers in error. Where people have not provided their IRD number or have given an incorrect IRD number, providing the date of birth will improve Inland Revenue’s ability to match income to a taxpayer. Inland Revenue currently receives name and address information but adding date of birth information adds another layer of accuracy to the matching process and can make it possible to identify people even if they have had a change of name or address.

Example

Jenny and her mother have the same name and live at the same address. Jenny hasn’t given her interest payer her IRD number, but her mother has supplied hers. There is a risk that Jenny’s investment income could be matched with her mother’s Inland Revenue records. If they both had their date of birth recorded with their investment providers, Inland Revenue could be sure to allocate their income to the right accounts.

Who should provide the information?

The key driver of efficiency in withholding tax systems is large payers of investment income deducting tax from many recipients and paying that to Inland Revenue. This also drives compliance as there is third party reporting of the recipients’ income. Given these benefits, it is logical for these responsibilities to remain with the payers of investment income. There may, however, be the opportunity to remove some other obligations from the payers.

End-of-year tax certificates

Tax certificates – usually printed – are provided to taxpayers by each organisation that they invest with. Taxpayers with multiple investments can end up with dozens of different tax certificates (such as year-end interest certificates, shareholder dividend statements and Māori authority distribution statements) that they need to keep track of in order to understand their tax position. In recognition of this difficulty, some share registries offer their customers a summary of all of the certificates that the share registry has provided to the customer. The recipients then include the collated investment information in their tax return. This seems more difficult than it needs to be, particularly as some of the information has already been provided to Inland Revenue by the payers.

If the income details can be pre-populated cumulatively through the year, taxpayers would be able to get a summary of their end-of-year position by logging onto the Inland Revenue website. This would make it easier for taxpayers that need, or want, to complete a tax return. Once this is working effectively it could be appropriate to remove the obligation for interest payers to provide end-of-year tax certificates to customers who have supplied their IRD numbers, as all their information would be in their Inland Revenue record. This could be a significant saving in time, effort and cost for interest payers. They would still need to provide end-of-year certificates to customers who had not supplied an IRD number, as Inland Revenue may not be able to match the income to the right person. In addition, if the non-declaration rate was increased to 45%, the end-of-year certificate would be a reminder to these people that they are being taxed more heavily because they haven’t supplied their IRD number to their investment provider.

Private peer-to-peer lending

The current withholding system typically requires payers to provide the information to Inland Revenue. This is most efficient for larger organisations who are paying interest and dividends to many customers, but is not as suitable for private peer-to-peer lending. This is not, however, a problem for peer-to-peer lending arranged through a commercial peer-to-peer lending platform as the commercial lending platforms undertake the withholding obligations and provide the required information to Inland Revenue.

Interest on private loans (for example, loans between family members) is taxable to the recipient but is unlikely to be subject to withholding tax (if the interest is less than $5,000 per annum it is unlikely to be subject to RWT). The lenders receiving interest from private loans may be unaware that they should be declaring it as income, and there is no third party reporting to help ensure that this type of income is declared. We do not propose extending withholding tax to include this type of lending if it is not included already. Instead, we propose adding a specific question to the tax return asking people whether they have received any interest income that has not had withholding tax deducted from it (this could have a note explaining that this includes private loans).

The use of a specific question would aim to ensure that people knew that they had to declare this income and to encourage people to correctly declare their interest income without causing a major increase in compliance costs.

Timing, frequency and methods

Timing

The timeframes for filing withholding tax returns and making payments will remain the same, with the exception of March end-of-year returns. It is proposed that the detailed March returns would be filed by 20 April for RWT, NRWT and AIL and 30 April for PIE tax to enable pre-population of the investment income into taxpayers’ records. This will be necessary to give taxpayers access to complete records so they can use the information in their tax return and to support rate choices and social policy income calculations.

Frequency of receipt of information

Organisations paying investment income only supply customer-specific withholding information to Inland Revenue after the end of the tax year (and only for some types of income and some tax types). This information is received after Inland Revenue has prepared personal tax summaries and summaries of earnings (these currently only show employment, benefit and some pension income, for people to transfer to their IR3 tax return). The withholding tax information is not matched up with PAYE information, so Inland Revenue cannot intervene if withholding tax rates are not in line with a taxpayer’s marginal tax rate until well after the end of the tax year. This means that a taxpayer may have been overtaxed during the year and need a refund, or undertaxed and have more tax to pay. Inland Revenue is also unable to make adjustments during the year (based on the income for the year to date) to people’s social policy entitlements and obligations.

For Inland Revenue to use information during the year to pre-populate taxpayers’ records, check tax rates, adjust social policy entitlements and obligations, and make better informed compliance management choices, it needs to receive taxpayer-specific withholding information more regularly.

The Government proposes that taxpayer-specific withholding information should be provided monthly (or for the month of with the business process if the income is paid less frequently than monthly with the returns being due in the following month). This would include information on interest, dividends, royalties and Māori authority distributions subject to RWT, NRWT and AIL, and exempt interest and dividend income. The specific information required would be similar to the end-of-year information currently provided for RWT, NRWT and PIE with some enhancements, as discussed in the “Information IRD would need” section from page 20.

Method of reporting

The detailed income could be reported for each period or cumulatively to date. Reporting period by period would mean that after validation an amount would be added (or subtracted if there had been a correction) to the pre-populated amount in the recipient’s tax records. Alternatively, year-to-date reporting would enable the pre-populated information to be replaced as the new figures are transferred to Inland Revenue. Only one option will be made available to avoid confusion and unnecessary complication.

PIEs

Under the PIE tax rules investors have to select their PIR based on their income in the previous two years. Given the difficulties that taxpayers face in working out their income, there is a reasonable chance that taxpayers will be basing their choice of PIR on incorrect calculations of income. Taxpayers could also fail to complete a tax return when they are required to if they forget to update their PIR as their income level increases (or if they don’t realise that their income has reached an income threshold that requires them to select a higher PIR). If PIE information was provided more regularly Inland Revenue could help taxpayers to fix incorrect rate choices.

The majority of PIEs are exit PIEs, which means they only pay tax on income at the end of the income year (unless an investor exits the PIE). This means that while PIE providers regularly calculate income and accrue tax some may not carry out a full and final tax calculation process until the end of the tax year. It could impose an additional compliance burden to require these full and final processes to be carried out during the year, and this may not be justified in cases where taxpayers do not need to include the PIE income for social policy calculations.

It may be appropriate to only require monthly investor detail and income reporting for PIE income that is not locked in, as only this PIE income is included in the income calculations for social policy. PIE income that is “locked in”, such as income from KiwiSaver funds and complying superannuation funds with withdrawal restrictions, is not included in income calculations for social policy purposes, so such income may not need to be reported as frequently.

An alternative option for locked in PIE funds might be to provide reporting on investors’ details and their current PIRs at some points during the year to allow Inland Revenue to check that the rates are available to the investors. This could perhaps be done quarterly or six-monthly. This reporting could also include the current level of PIE income and therefore the expected PIE tax on that income at the end of the year, to help to inform Government forecasting.

Māori authorities

As Māori authorities typically make distributions once or twice a year, the information requirement would be connected to the time of payment rather than requiring monthly returns.

Companies paying dividends

As companies typically pay dividends once or twice a year (and sometimes don’t pay a dividend) the information requirement would also be connected to the time of payment with a return for the month in which the payment was made being required (this return would be due on the 20th of the following month) rather than requiring monthly returns.

Error correction

If detailed information is required more often, it is inevitable that there will be some errors in it. While Inland Revenue would expect withholding tax payers to use due care in their reporting, there does need to be a mechanism for error correction.

Minor errors should be allowed to be corrected in subsequent periods as long as the amounts are not significant. A minor error in programming a withholding tax system of a large interest payer could result in errors in the withholding from payments to tens of thousands of recipients. Even though the error for each recipient of the interest income might be very small, the cumulative error could easily be thousands of dollars without being significant compared to the total withholding tax being paid by the interest payer. If possible these types of errors should be corrected in subsequent filings to avoid recalculations for all of the recipients and refilings for the periods in error.

There would need to be some restriction on the size of the errors that could be self-corrected in subsequent periods. This could be set as a threshold for the size of the error. Setting a simple dollar value threshold would either be too low to correct relatively minor errors for large payers (as discussed above a very small error across a large number of customers quickly adds up) or would be far too high in relation to smaller payers (as a suitable threshold for large payers would be likely to exceed the annual total of withholding tax remitted by smaller payers). The Government therefore proposes that the relative size of the error compared to the amount of withholding tax being paid should be taken into account in setting the threshold.

It would also be inefficient to only have a percentage based threshold as a small payer might make a $50 error that equated to 20% of their total payment of $250. This could be far higher than a percentage based threshold but be too small to justify requiring the payer to resubmit the period that the error related to. For these reasons we propose that it would make sense to have a simple dollar value threshold for self-correction as well as a percentage threshold based on the amount of withholding tax the payer remits to Inland Revenue. As long as the error was lower than the higher of the two thresholds the payer would be entitled to self-correct in a subsequent period.

Methods for providing the information

Making it easier to get information to Inland Revenue

Currently a number of the withholding tax returns are paper-based (with no option for electronic filing) and the detailed information that accompanies the end-of-year reconciliation can be sent electronically or on paper.

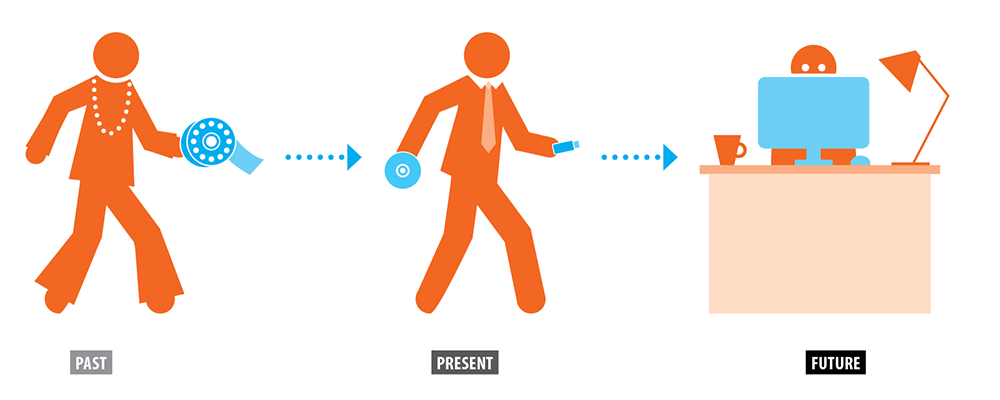

There are difficulties with the current methods for transferring electronic information to Inland Revenue as there is a 20 megabyte size limit for files attached to emails. This means that larger payers of withholding tax cannot email their information to Inland Revenue. The only way to provide electronic information is to store it on a CD or a USB stick and deliver that to Inland Revenue. The information is then processed and validated, which can take some time.

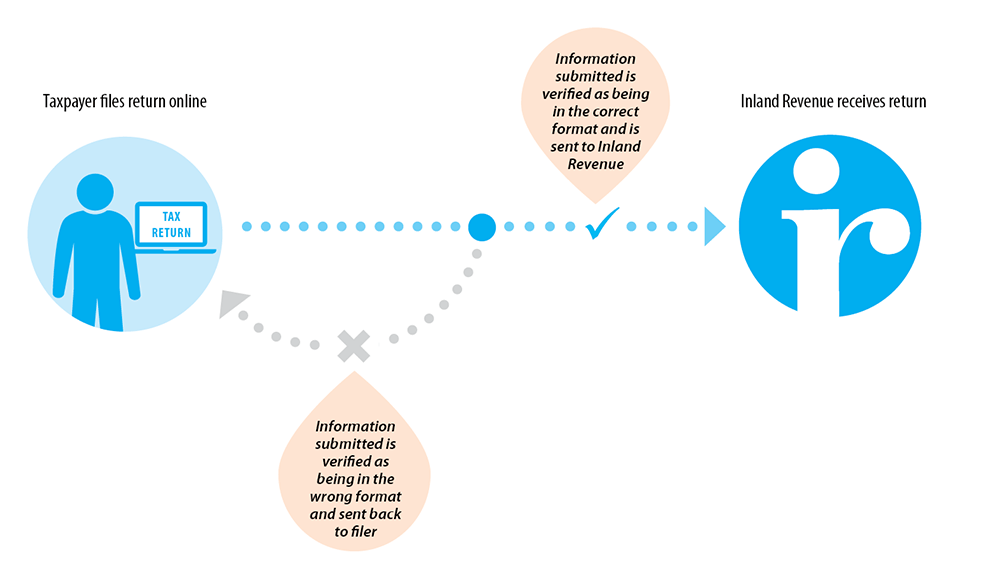

Inland Revenue’s new technology platform will include changes to the way that withholding information can be provided. This will make it easier for payers to file their returns electronically with Inland Revenue. A key change for RWT, NRWT and AIL will be a gateway to upload information (similar to that already used by PIEs to file returns). Returns filed will go through an automatic validation process (as shown in the diagram on the next page), which means that any errors that would prevent Inland Revenue from using the information would be communicated back to the filer immediately. These changes would allow larger files to be transmitted to Inland Revenue electronically.

In addition to the electronic gateway, there will be an option of an online form for payers who choose not to use the electronic gateway. The online form would be able to be populated with the required information. This option may be particularly useful for smaller withholding taxpayers as it would enable them to provide the information electronically without having to make their information fit the electronic gateway requirements.

The pre-population of tax records is best supported by the provision of information electronically rather than by paper. However, we recognise that different types and sizes of investment income payers will have different levels of ability to file information electronically. In particular we acknowledge that some payers of investment income will not be ready to file electronically at this stage.

There are several approaches we could take in relation to the filing options available to different payers of investment income. For example, we could:

- Continue to provide all investment income payers the option of filing by paper, subject to a review after a given period of time, or until a given future date;

- Require larger investment income payers to file electronically, for example those with more than a certain number of recipients to whom they pay investment income; or

- Require almost all investment income payers to file electronically, with some exceptions, for example for those who do not have access to digital services.

The second approach would require a threshold to be set. Setting an appropriate threshold would involve balancing the Government’s desire for earlier investment income information in a digital format and smaller payers’ concerns about the feasibility of accessing digital services. The Government welcomes feedback on these options.

Miscellaneous matters

Certificates of exemption

When customers claim tax exempt status, the organisations paying interest and dividends have to manually check certificates of exemption from withholding tax and have no easy way of checking the status of these certificates. They may also have to ascertain whether the customer can appropriately claim to be exempt under non-tax legislation, in which case they may not even need a certificate of exemption. These challenges make it difficult for paying organisations to test whether all of the exemptions claimed by their customers are valid.

Certificates of exemption issued and cancelled are currently published in the New Zealand Gazette each quarter. Inland Revenue proposes to create an electronic database of certificates of exemption that are currently valid. This would allow withholding tax payers to check whether a customer’s claim for an exemption is correct, and could remove the need for customers to supply a copy of their certificate to their investment provider.

The database would be kept up to date for any new issues or cancellations and would offer a real-time source of information for withholding tax payers. It would also enable payers to review their customer files to confirm that all customers who are currently being treated as exempt actually are.

Some people and organisations are also able to claim exemptions under Acts other than the Income Tax Act 2007 and the Tax Administration Act 1994. These exempt people and organisations would not be included in the exemption certificate database unless they chose to get an exemption certificate.

A database could reduce both the risk of people incorrectly claiming RWT exempt status and the compliance costs of investment providers if people with exemptions under other Acts were required to hold a certificate of exemption. They would therefore be included on the database of exempt people and organisations. The disadvantage would be a one-off administrative requirement for those people who were exempt under other Acts to get an RWT certificate of exemption when they may not otherwise have chosen to do so.

Closely held company dividends and interest

The Closely held company taxation issues issues paper (September 2015) discussed issues relating to the application of RWT to dividends and interest payments made by closely held companies (these are companies where five or fewer shareholders control more than 50% of the direct voting interests in the company). The paper referred some of these issues for consideration in the wider context of work being undertaken to streamline business tax processes. These issues are still under consideration and are not included in this discussion document.

Question for readers

- Would companies have difficulties providing detailed dividend information to Inland Revenue so it can pre-populate shareholders’ tax records? If so, why and how could this be made easier?

- If detailed reporting was required for interest that is subject to AIL to determine the recipients eligibility to be subject to AIL how frequently should that information be provided?

- If providing detailed reporting on interest that is exempt from withholding tax would be difficult please explain why and how this could be made easier.

- If you issue debt instruments offshore do you hold information on the investors and if not are you reasonably able to obtain it? Contextual information supporting your answers and your views on the likelihood of New Zealand investors investing directly in these products would be greatly appreciated.

- Are there any practical problems with providing detailed reporting?

- Should a higher non-declaration rate be put in place for RWT on interest and/or PIE income? If not, please explain why.

- Would there be administrative difficulties in applying an additional tax rate for non-declared taxpayers? If so, please explain the nature of the problem.

- If a higher non-declaration rate is put in place for PIE income should the PIE income taxed at the non-declaration rate be treated as taxable income of the recipient to allow them to claim the tax credits in their tax return?

- Are there better ways to deal with the allocation of joint interest income to the owners?

- For interest payers and PIEs, how should joint interest information be provided to Inland Revenue?

- How should the interest or PIE income be attributed to each joint owner?

- If you think that it would be difficult for Māori authorities to provide detailed distribution information to Inland Revenue, please explain why and how this could be made easier.

- Should investment income payers provide Inland Revenue with date of birth information for their customers? If not, please explain why.

- Should the Government remove the requirement for interest payers to provide end-of-year tax certificates for customers that have provided their IRD numbers?

- How can disclosure of this type of interest income be encouraged?

- Do you agree that adding a question to the tax return could be useful to encourage disclosure of this type of income?

- If taxpayer-specific information is to be provided more frequently, would it make a significant difference to compliance costs to provide the information monthly rather than quarterly or would the difference be marginal as system changes would be needed either way?

- For organisations affected by the proposed increased reporting requirements, what would be a realistic timeframe for making changes to systems?

- Would it be preferable for payers of withholding income to provide the information for each individual period or for the year to date?

- If you are a manager of a PIE fund (or funds), would your systems be capable of providing monthly income calculations (and investor details) or would the alternative reporting option be necessary for locked in PIEs?

- What other alternatives should be considered for reporting investor details and PIRs and income reporting for locked in PIEs?

- Do you agree that there should be a simple dollar threshold and a percentage based threshold for error correction?

- How should thresholds setting a limit on the size of the errors allowed to be self-corrected be calculated and what levels are reasonable?

- What specific technical constraints or limitations should be considered when designing the electronic gateway?

- If some investment income payers were to be required to file information electronically based on the number of recipients that they pay investment income to, what number of recipients should result in an investment income payer being required to file electronically?

- Does the concept of having a database of the currently valid certificates of exemption have merit? If not please explain why.

- Should people and organisations who are exempt under other Acts need to apply for a certificate of exemption in order to be treated as exempt from RWT?

[7] The “Better Business Tax” issues paper issued in April 2016 also proposes a 45% non-declaration rate for contractors.