Chapter 2 - Taxation of investment income in the future

- Background

- A simpler future for individuals

- What would need to change?

- Different processes for payers of investment income

- Changes for Inland Revenue as well

- Compliance costs

Background

The proposals in this discussion document are designed to remove or reduce inefficiencies in the current system for investment income payers, recipients and Inland Revenue. These current issues are summarised here.

Tax information is hard to keep track of

Different types of investment income are taxed in different ways. Also, if a taxpayer invests with a number of different investment providers they are likely to receive at least one withholding tax certificate or dividend statement from each of them. It can be difficult for individual taxpayers to keep track of their overall tax position based on the statements and certificates, as well as any other income they earned. This can make it harder for them to know whether they are fully complying with their tax and social policy obligations or receiving the correct level of social policy entitlements.

The proposals in this discussion document would increase the amount of information that Inland Revenue will be able to pre-populate for taxpayers. For large numbers of taxpayers that would mean all of their taxable income information is available in one place. Taxpayers who receive income from a number of other sources that would not be able to be pre-populated, such as foreign sourced income and rental income, would still need to provide information on that income to Inland Revenue.

The provision of information to Inland Revenue by payers and taxpayers is inefficient

The organisations that collect withholding tax from investment income have to provide information to their customers. If their customers file a tax return they also provide the information to Inland Revenue. The inefficiency increases for taxpayers who have to collate investment information from a number of statements and certificates from various different investment providers. It would be more efficient if the information only had to be provided to Inland Revenue once, by the investment providers.

The timing of the provision of information, gaps in the information required and significant numbers of records without IRD numbers, mean that Inland Revenue is currently unable to effectively calculate income positions to use for social policy and to ensure returns are correct. This also makes it difficult for Inland Revenue to check that RWT rates and PIRs elected are available to the taxpayer.

Non-declaration rates

To make sure that investment income is taxed appropriately, people are supposed to provide their IRD numbers. A customer who doesn’t provide an IRD number is taxed at a non-declaration withholding tax rate, which is at least equal to the top withholding tax rate for people who have provided their IRD numbers. The non-declaration rates are intended to encourage people to provide their IRD numbers but do not create an incentive when the non-declaration rate is lower than or equal to the top marginal income tax rate (currently 33%). In fact, some taxpayers may have effective marginal tax rates that are higher than 33% if they receive social policy payments or have to make child support or student loan payments.

The non-declaration rates are inconsistent across the tax system. PAYE on wages and salaries has a 45% non-declaration rate; the RWT non-declaration rate is 33% and the PIE non-declaration rate is 28%. As the RWT non-declaration rate is equal with the top marginal tax rate and the PIE non-declaration rate is equal with the top PIR (but lower than the top two marginal tax rates) they do not provide a real incentive for investors to provide their IRD numbers unless the investors are on low marginal tax rates.

A simpler future for individuals

The Government thinks it would be simpler for taxpayers to comply with their tax obligations if Inland Revenue could show them a list of all of the income it knows they’ve received during a year, and the tax that was withheld from that income. The information could also be useful to taxpayers for non-tax purposes (such as proof of income for borrowing money). This would mean taxpayers with investment income wouldn’t have to collect and collate that information from the withholding certificates they receive from the payers of investment income. Having most or all of their income pre-populated in their tax records would save taxpayers time and reduce the risk of errors.

The Government also thinks it would make things easier for taxpayers if Inland Revenue could assist them to work out which tax rate they should select for their investment income, to make sure that they are not overtaxed during the year, or undertaxed and face a tax bill later. Inland Revenue would be in a better position to do this if it received more information about taxpayers’ income during the year, rather than after the end of a year.

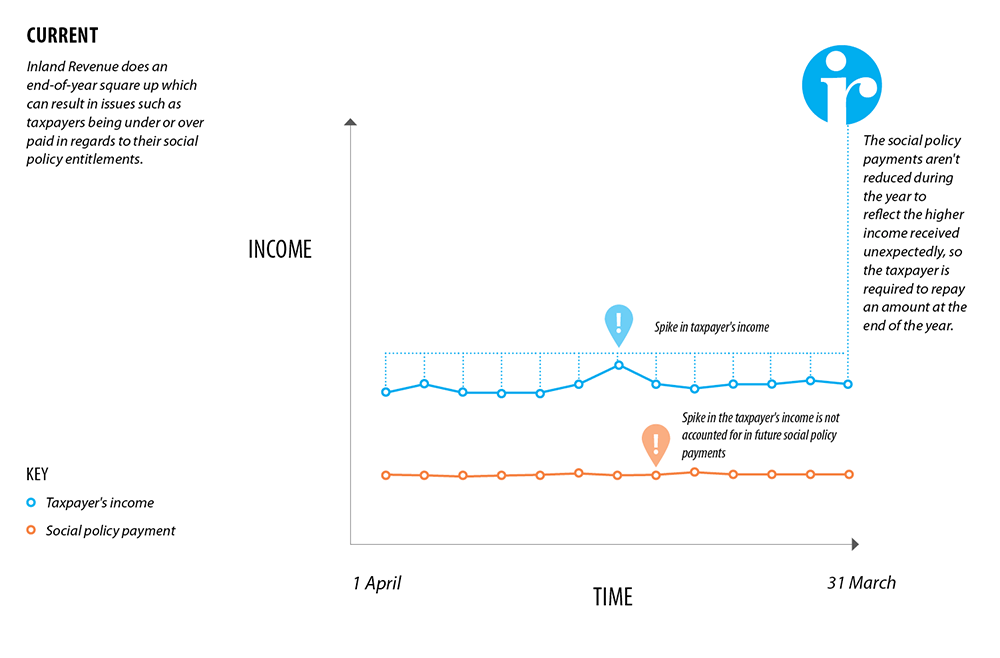

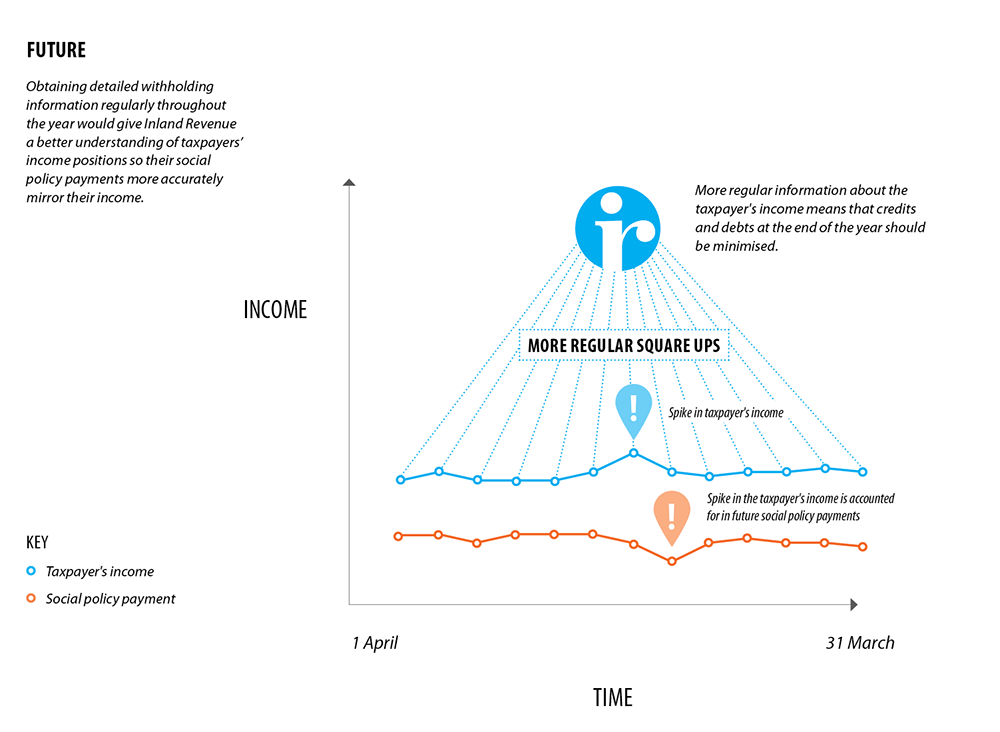

Obtaining detailed withholding information regularly throughout the year would give Inland Revenue a better understanding of taxpayers’ income positions and the time at which the income was earned. This would enable Inland Revenue to more accurately determine the amount of social policy payments a taxpayer is entitled to receive or the amount of child support or student loan a taxpayer is liable to pay during the income year. The ability to make timely adjustments would reduce end-of-year square-up issues such as taxpayers having significant amounts to repay, or having received too little during the year when they needed the assistance.

What would need to change?

To achieve these goals, Inland Revenue would need to receive information from payers of investment income sooner and more often than it currently does. In some cases Inland Revenue would also require more information than it currently receives from payers (although payers already hold this information and they would not need to collect more details from their customers). Inland Revenue would need to receive and process this information efficiently, and match the income information to individual taxpayers’ records.

Different processes for payers of investment income

Depending on the type of investment income that they pay and the type of tax that applies, payers currently have different obligations in terms of the information they are required to provide to Inland Revenue, and how often they provide it.

In the future all payers of investment income would be expected to provide similarly detailed information on the recipients of the income and the amounts of income and tax credits they receive for all tax types and for income that is not subject to withholding tax. This information would typically be provided monthly, or in line with business processes if payments are made less frequently.

The information would be transferred to Inland Revenue through an electronic data transfer process and would go through validation checks so the payer would be advised immediately if the information that they had provided could not be validated. This would enable corrections to be made quickly and save later rework. Payers could alternatively choose to complete an online form if that better suited their technical capability, or if they have a small number of investors.

Payers of investment income and Inland Revenue would be able to communicate via a business-to-business information transfer, allowing the payers to receive electronic notifications of corrections to customer information from Inland Revenue, such as withholding tax rate changes if the customer is using an inappropriate rate.

Payers would need to send more information on jointly held investments to enable Inland Revenue to identify all of the recipients of the investment income.

Inland Revenue would add the information received from payers to the recipients’ tax records. Payers would no longer have to prepare end-of-year tax certificates for customers who had supplied their IRD numbers. However, they would still need to prepare an end-of-year tax certificate for customers who hadn’t supplied their IRD numbers.

Payers of investment income sometimes have customers who are exempt from withholding tax. Inland Revenue would provide payers with details on their customers who hold valid certificates of exemption, so payers can confirm whether they need to withhold tax.

Changes for Inland Revenue as well

Inland Revenue would receive the validated information through online forms or electronic data transfers and this would allow Inland Revenue’s system to match the relevant information with individual taxpayers’ tax accounts without manual intervention. This would enable Inland Revenue to much more accurately assess the tax position of individual taxpayers throughout the year.

Using the up-to-date information, Inland Revenue would monitor taxpayers’ income levels during the year and be able to increase or reduce income-targeted social policy payments such as Working for Families Tax Credits. This would help to ensure that people are receiving the correct level of assistance throughout the year and reduce the risk of an under or overpayment at the end of the year.

Inland Revenue could also potentially advise payers of investment income of corrections to withholding tax rates and other information in time for the payers to make any needed adjustments during the income year. This would help to ensure that taxpayers are on an applicable rate for their circumstances and would reduce adjustments at the end of the tax year.

For recipients who haven’t given the investment income payer their IRD number, Inland Revenue would use information matching tools to associate the income to the recipient taxpayer, if sufficient identifying information is available.

Compliance costs

The proposals in this document are part of a wider change to the tax system and the tax obligations of people and organisations. A fundamental reason to collect information from the payers of investment income is that this is significantly more efficient and reliable than collecting the same information from each of the recipients of the income. The greatest efficiency gains come through collecting information from payers with large numbers of customers.

This discussion document proposes changes that are intended to simplify the tax system for individuals and to make more efficient use of information. By collating all of the information that Inland Revenue holds on a taxpayer’s income in one place, and providing easy access for the taxpayer, Inland Revenue will make it easier for taxpayers to manage their tax affairs. It will take less time and effort for the recipients of investment income to understand their tax position and social policy obligations and entitlements, and filing a tax return will be able to be done more quickly.

The proposed increases in reporting obligations would be expected to give rise to some additional compliance costs for payers of investment income. However, this is mitigated by the fact that the payers would not need to seek more information from customers, but rather to report more of the information they already hold.

The adjustments to the reports that are produced by the payer’s systems should be a one-off cost, although it is possible that reporting additional information more regularly may give rise to some additional ongoing costs. These costs will likely be limited, as payers already have to calculate the tax when they pay the investment income and the more detailed reporting requirements will replace existing summary reporting requirements.

Other changes are likely to reduce compliance costs for payers of investment income, including:

- changes to make the transfer of information more efficient;

- removal of some requirements, such as the need to send end-of-year certificates to all customers; and

- the creation of a database of current certificates of exemption to make it easier for payers to manage their obligations.

If these changes proceed it will be important to ensure that timeframes for reporting changes are realistic, as payers of withholding income would not be able to make the system changes until the requirements have been fully determined (feedback on realistic timeframes is requested later in the document). Some payers of investment income may also need to make changes to multiple computer systems and need to fit the changes in alongside other system change priorities. A number of other regulatory changes will also require system development, including the international Automatic Exchange of Information which is expected to require financial institutions to begin conducting due diligence and meeting reporting requirements on all new accounts from 1 July 2017.