Extending withholding to labour-hire firm contractors

(Clauses 93 (19) and 100(2))

Summary of proposed amendment

The proposed amendment extends the schedular payment rules to contractors that work for labour-hire firms.

Application date

The proposed amendment will come into force on 1 April 2017.

Key features

The proposed amendment adds payments by labour-hire firms to their contractors to the list of payments that are subject to the schedular payment rules.

As a result, labour-hire firms will be required to withhold from all payments made to their contractors. They will be required to withhold at the relevant rate as described under the proposed amendments outlined in “Allowing contractors to elect their own withholding rate”.

Labour-hire firms will have an obligation to deduct withholding tax when they make payments to companies used by contractors. Labour-hire firm contractors will not be eligible to receive certificates of exemption from withholding.

A labour-hire firm is defined as “an entity which has as one of its main activities the business of arranging for a person to perform work or services directly for clients of the entity.”

Background

The current withholding rules are out of date and do not cover changing employment practices and modern industries. Over the last two decades there has been a large growth in the labour-hire firm industry. However, the withholding rules do not adequately address contractors working for this industry.

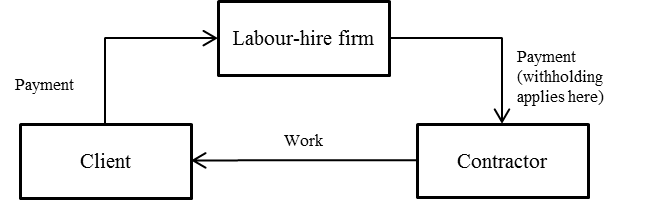

Labour-hire firms provide workers to perform services to clients. The labour-hire firm can engage these workers either as employees or contractors. The current withholding rules do not generally apply to contractors engaged by labour-hire firms. This means these contractors are required to manage their own tax obligations and have to deal with provisional tax. It also means that these contractors have opportunities for non-compliance (whether deliberate or accidental).

In addition, using a company structure has become increasingly popular with contractors. Payments to companies are generally not subject to withholding tax under the schedular payment rules.

Detailed analysis

The amendments propose to insert Part J to Schedule 4 of the Income Tax Act, which adds payments made by labour-hire firms to contractors under a “labour-hire arrangement” to the schedular payment rules.

Under proposed Part J, payments are covered by the schedular payment rules when:

- The payment is made under a labour-hire arrangement (as defined).

- One of the main activities of the entity making the payment is providing labour-hire arrangements (that is, the labour-hire arrangement is not incidental to the main business of the entity).

1. The payment is made under a labour-hire arrangement

A labour-hire arrangement is an arrangement which in whole or part involves the performance of work or services by a person directly for the client of the entity, or directly for a client of another entity. The entity receives payment from the client and pays the worker themselves.

Directly for a client of another entity

A labour-hire arrangement also includes situations when there are chains of labour-hire firms involved. This can happen if a labour-hire firm arranges for another labour-hire firm to provide workers for their client.

2. One of the main activities of the entity making the payment is providing labour-hire arrangements (that is, the labour-hire arrangement is not incidental to the main business of the entity)

The proposed amendment only applies when one of the main activities of the entity making the payment is providing labour-hire services. This means that withholding under the amendment only applies if the entity is carrying on a labour-hire business. It is not necessary for the labour-hire activities to be the sole business, or even the main business of the payer. However, a merely incidental business is not sufficient to require withholding.

The proposed amendment is similar to Australia’s Pay As You Go withholding rules.

Example 1: Labour-hire

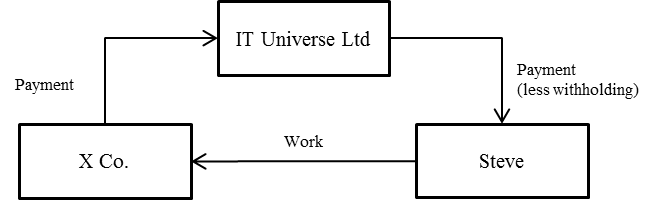

IT Universe Ltd provides contractors to other businesses to help with their IT projects. X Co. asks IT Universe Ltd for IT contractors to help with an upgrade of their systems. IT Universe Ltd provides one of their contractors (Steve, a New Zealand resident) to assist X Co.

IT Universe Ltd is arranging for a worker (Steve) to provide work directly for their client (X Co.). As a result, they are in a labour-hire arrangement with Steve and X Co. and this arrangement is part of their labour-hire business. IT Universe Ltd is required to withhold tax from any payments to Steve. The rate will be the applicable rate as set out in the earlier section Allowing contractors to elect their own withholding rate. If he does not specify a rate then the standard rate for labour-hire firm contractors of 20% will apply.

Example 2: Solicitor and barrister

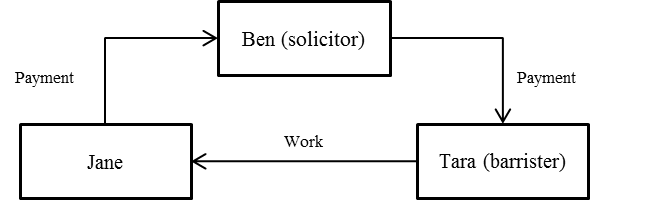

Ben is Jane’s solicitor. Jane is engaged in litigation and requires a barrister to represent her in court. For this purpose, Ben instructs Tara and pays Tara on Jane’s behalf.

Ben is arranging for a contractor (Tara) to provide work directly for their client (Jane). However, Ben is not required to withhold from these payments because arranging for people to work for his clients is not one of his main activities. The payment is incidental to his business of providing legal services.

Example 3: Chain of labour-hire firms

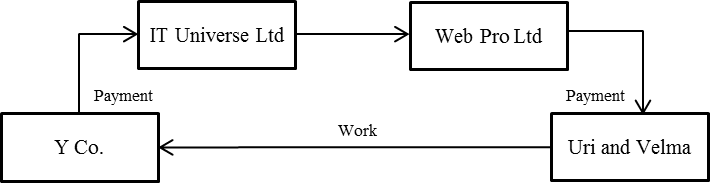

Y Co. asks IT Universe Ltd for web designers to help them build a new website. IT Universe agrees to provide a number of web designers to Y Co. but is unable to find enough suitable people.

IT Universe Ltd goes to Web Pro Ltd (another labour-hire firm) and arranges for some of Web Pro’s contractors (Uri and Velma) to perform work for Y Co.

Web Pro Ltd. is arranging for contractors (Uri and Velma) to perform work directly for the client (Y Co.) of another entity (IT Universe Ltd.). As a result, they are in a labour-hire arrangement and this arrangement is part of their labour-hire business. Web Pro is therefore required to withhold from any payments it makes to Uri or Velma.

Example 4: Subcontractors

Paul is a builder and contracts to build a house for Susan. He subcontracts another contractor, Bruce to do the plumbing work for the house. Paul is not required to withhold from payments to Bruce because he is not arranging for workers to perform work directly for clients, nor is providing labour-hire arrangements one of his main activities.

Company exception

The amendments provide that the general exception to the schedular payment rules for companies will not apply to payments under labour-hire arrangements.

That means labour-hire firms will be required to withhold from payments in the circumstances outlined above regardless of the type of legal entity the payments are made to.

A company that finds it is being over-withheld as a result of this, can apply for a special tax code to reduce their withholding rate below the minimum rate. This can include applying for a withholding rate of 0%.

Example 5: Chain of labour-hire firms continued

As in the earlier example, IT Universe Ltd. has agreed to provide web designers for Y Co. IT Universe arranges for Web Pro Ltd to provide workers for Y Co.

IT Universe is arranging workers to provide work directly to clients. As a result, they are in a labour-hire arrangement and this labour-hire arrangement is part of their labour-hire business. As a result IT Universe Ltd is required to withhold from any payment made to Web Pro.

Web Pro may apply for a special tax code to reduce their rate of withholding (including applying for a rate of 0%).

Certificates of exemption

Under the proposed amendments, contractors working for labour-hire firms cannot obtain certificates of exemption to exempt themselves from the schedular payment rules. These contractors may still apply for a special tax rate if withholding is inappropriate, which includes being able to apply for a 0% rate.

This means that all contractors working for labour-hire firms must have payments to them recorded on the Employer Monthly Schedule even if a 0% rate of withholding applies to them.