Allowing contractors to elect their own withholding rate

(Clauses 87, 88, 92(2)–(6), 93(1)–(18), 98, 99 and 114)

Summary of proposed amendment

The proposed amendment will allow contractors who are subject to the schedular payment rules to elect their own withholding rate without having to apply to Inland Revenue for a special tax code.

Application date

The proposed amendment will come into force on 1 April 2017.

Key features

The proposed amendment will allow contractors who are subject to the schedular payment rules to elect their own withholding rate without having to apply to Inland Revenue for a special tax code.

Under the proposed amendments there will be some situations when a contractor will not be able to elect their own rate. These include:

- when a contractor has not provided their name and IRD number, a 45% rate of withholding applies;

- when a contractor has not met a liability under an Inland Revenue Act, the Commissioner can prescribe a rate of withholding;

- a minimum rate of withholding applies to contractors. For non-resident contractors and contractors with temporary work visas this minimum rate is 15%, for all other contractors this is 10%;

- if a contractor has changed their rate twice in a 12-month period, they require the consent of the payer to any further changes.

If a contractor has not selected a rate, a “standard rate” applies. This standard rate is the relevant rate listed in schedule 4 of the Income Tax Act.

Background

Currently, when a contractor is subject to the schedular payment rules, a flat rate of withholding applies. This rate will often not accurately match the contractor’s actual income tax liability. Contractors can obtain a special tax code to alter their rate, but the process can be cumbersome, requiring them to apply to Inland Revenue and supply supporting information.

Detailed analysis

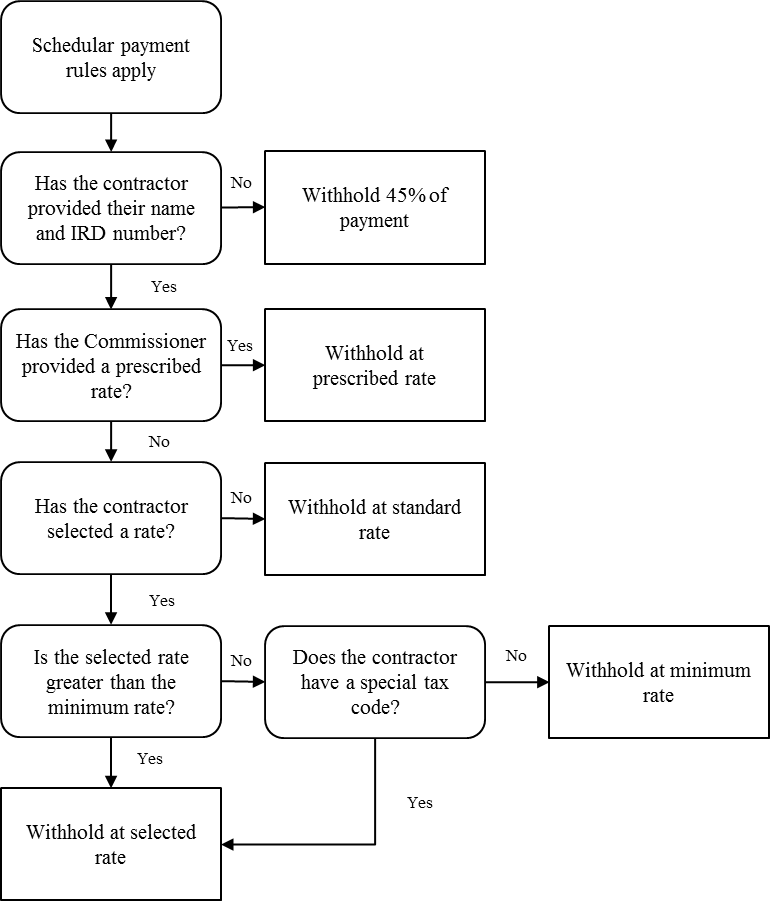

Proposed new section RD 10B of the Income Tax Act 2007 sets new rules for what rates would apply for contractors subject to the schedular payment rules. The flowchart below summarises these rules:

Overview of different rate types

| Description | Rate | |

|---|---|---|

| Elected rate | Chosen by the payee. | 10% – 100% |

| Special rate | Payee can request from Commissioner. | Only necessary if the payee wants a rate lower than 10% (or 15% as above) |

| No notification rate | Where payee does not provide name or IRD number to the payer. | 45% |

| Prescribed rate | Set by Commissioner where the payee has not met a liability under the Inland Revenue Acts. | Cannot exceed 60% |

| Non-resident entertainer rate | This rate must be used by non-resident entertainers. | 20% |

| Standard rate | The rate for the activity or arrangement set out in Schedule 4, which will apply if none of the rates set out above apply. | Vary between 10.5% and 33% depending on the type of activity or arrangement |

Elected rate

Proposed sections RD 10B(3)(a) of the Income Tax Act 2007 and 24LB of the Tax Administration Act 1994 provide that contractors subject to the schedular payment rules may elect the withholding rate that is to apply to payments to them.

To elect a rate of withholding, the contractor must notify the person making the payment of the rate to apply and this notification must be made in a form approved by the Commissioner.

Minimum rate

To address the risk that contractors may attempt to defer or avoid paying their tax by choosing an artificially low withholding rate, proposed section 24LB(2) provides that contractors must elect a rate of withholding that is greater than the minimum rate.

For non-resident contractors and contractors who are holders of temporary entry class visas, the minimum rate is 15%. For all other contractors, the minimum rate is 10%.

Special tax rate

A contractor may have a rate lower than the 10% minimum if they obtain a special tax rate certificate under section 24N of the Tax Administration Act 1994.

Repeatedly changing withholding rates

If a contractor has previously elected a withholding rate twice in a 12-month period to the same payer, they require the consent of the schedular payer to make any further changes in their withholding rate.

Example

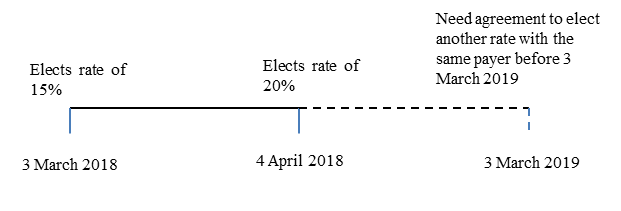

On 3 March 2018 Caroline starts work as a building contractor for Small Builders Ltd. Payments from Small Builders to Caroline are subject to the schedular payment rules and Caroline initially selects a withholding rate of 15%.

On 4 April 2018, Caroline wishes to change her withholding rate and notifies Small Builders that she wishes to have a withholding rate of 20% apply to her. Caroline does not require the consent of Small Builders to this change as she has only elected a withholding rate once within the last 12 months. However, if Caroline wishes to make any further changes to her withholding rate for payments made by Small Builders up till 3 April 2018, she will require the consent of Small Builders.

On 5 August 2018, Caroline starts work for Large Builders Ltd. Caroline can elect a new withholding rate without the consent of Large Builders Ltd. as she has not previously elected a withholding rate with Large Builders.

No notification rate

Proposed section RD 10B(2) provides that when a contractor does not give their name and IRD number to their payer, then payments to them must have tax deducted at a 45% rate.

This replaces the current “no notification” rate for schedular payments in section RD 18 of the Income Tax Act. This is intended to provide a simpler “no notification” rate for schedular payments that is aligned with the rate that applies to employees.

Prescribed rate

Proposed sections RD 10B(4) of the Income Tax Act 2007 and 24LC of the Tax Administration Act 1994 provide that when a contractor has not met a liability under the Inland Revenue Acts the Commissioner has the ability to prescribe a withholding rate.

The proposed process for the prescribed rate is similar to the one for deduction notices under section 157 of the Tax Administration Act 1994, and requires a notice to be provided to the payer or the contractor that a different rate should be applied. If a notice is provided to the payer, the payee must also be provided a notice, unless after making reasonable enquiries the Commissioner does not have a valid address for the contractor.

Under the proposed amendments the Commissioner can require two different types of prescribed rate deductions. These are:

- standard schedular payment deductions under the ordinary PAYE rules (which provide PAYE tax credits for the contractor);

- additional deductions, which are used to meet the contractor’s tax debts or other liabilities.

The additional deductions would generally be required to be recorded on a separate line in the employer monthly schedule and under a different tax code. This is similar to how additional deductions are currently done for student loans. Where additional deductions are paid in this way, the initial late payment penalties charged on the original debt are not applied.

The Commissioner does not intend to use this prescribed rate notice to require additional deductions to meet a contractor’s other tax debts until schedular payments are administered in Inland Revenue’s new computer system.

Example

Ben is a building contractor. He earns $120,000 each year from his building contracts with several major building companies. Ben elects a withholding rate of 10% and $12,000 is withheld from him for the year.

Ben predominantly provides labour services and has minimal deductions. His end of year tax liability is $30,000 and so Ben has a terminal tax bill of $18,000. Ben does not pay his terminal tax bill and so ends up with a tax debt.

The Commissioner prescribes a new rate of withholding to Ben and his payers. This new rate is:

- 25% under the standard schedular payment code (WT). Ben receives PAYE credits for these amounts and these amounts are intended to ensure that Ben does not have an end of year income tax liability and further tax bills; and

- an additional 15% under a new tax code and recorded on a new line in the employer monthly schedule. Amounts withheld under this code are used to pay Ben’s tax debt for the previous year.

Standard rates

If a contractor does not elect a rate of withholding under section 24LB, proposed section RD 10B(3)(b) provides that the standard rate of withholding applies to them.

The standard rate is the relevant rate set out in schedule 4 of the Income Tax Act 2007. For contractors working for labour-hire firms and those under voluntary withholding agreements the proposed standard rate is 20%.

For other contractors the proposed standard rate in schedule 4 is the same as the rate that currently applies to those payments. This means that if a contractor that was previously subject to the schedular payment rules does not elect a different withholding rate when the proposed amendments come into force, their withholding rate remains unchanged.

Non-resident entertainers

The proposed amendments do not apply to non-resident entertainers. Non-resident entertainers will continue to have a flat withholding rate of 20% apply to them. These entertainers can continue to have withholding treated as a final tax and will not have to file returns.