Over-crediting of imputation credits in excess of foreign investment fund income

Agency Disclosure Statement

This Regulatory Impact Statement has been prepared by Inland Revenue.

The problem addressed is a mismatch arising under the tax rules where imputation credits are calculated on the basis of the dividend paid but income tax arises only on the foreign investment fund (FIF) income. This may lead to a resident having excess imputation credits, which they can use to reduce tax on other income, such as salary and wages. Being able to use the imputation credits to offset other income is contrary to the policy behind the imputation rules of alleviating double taxation of New Zealand company profits.

The proposed solution will mean that taxpayers will not be able to use excess imputation credits received from interests in Australian companies to offset their tax liability against other income, e.g. salary and wages (only Australian and New Zealand companies are able to attach imputation credits to dividends paid to New Zealand residents).

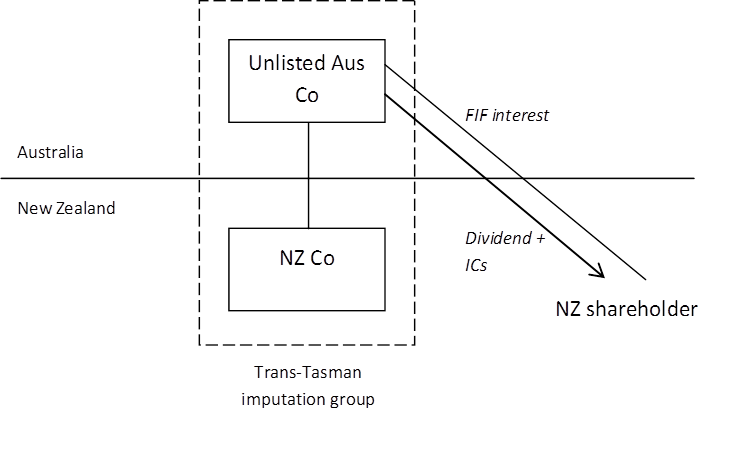

The class of taxpayers likely to be affected is limited - namely New Zealanders with investments in unlisted Australian companies which use the trans-Tasman imputation rules or are part of a trans-Tasman imputation group.

No consultation has been undertaken on the proposal. Officials did not wish to draw attention to a gap in the rules which could be taken advantage of, leading to revenue leakage.

There are no other significant constraints, caveats and uncertainties concerning the regulatory analysis undertaken, other than as set out above. The recommended approaches to the various issues raised do not impose additional costs on businesses, impair private property rights, restrict market competition, reduce the incentives on businesses to innovate and invest, or override fundamental common law principles.

Joanna Clifford

Programme Manager, Policy

Inland Revenue

12 March 2013

STATUS QUO AND PROBLEM DEFINITION

1. The problem addressed by this RIS is a mismatch arising under the tax rules where imputation credits are calculated on the basis of the dividend paid but income tax arises only on the foreign investment fund (FIF) income. This mismatch means that a resident may have excess imputation credits, which they can use to reduce tax on other income, such as salary and wage income.

2. Under the trans-Tasman imputation rules, an Australian company can maintain an imputation credit account. Any New Zealand tax paid by that company, or by another company in a wholly-owned group comprising Australian and New Zealand companies, will generate imputation credits. These credits can be attached to dividends paid from the Australian company to New Zealand shareholders.

3. The amount of imputation credits that a New Zealand resident receives is calculated on the value of the actual dividend. However, if the Australian company is unlisted, the New Zealand resident will likely be taxed on their shareholding under the FIF rules, which disregard the actual dividend and deem an amount of taxable (FIF) income. If the dividend is of greater value than the amount of FIF income, there may be an over-crediting of imputation credits. That is, the New Zealand shareholder receives imputation credits in excess of the tax liability resulting from their investment in the Australian company. These credits can be used to reduce tax on other income.

4. This is illustrated in the diagram below:

5. The amendment is primarily for base maintenance (i.e. to prevent revenue leakage) so is unlikely to have any implications for fiscal forecasts. It is considered unlikely that many taxpayers will have taken advantage of the loophole in the current rules.

6. If the status quo was retained, excess imputation credits would continue to be used to offset the New Zealand tax liability arising on other income, such as salary and wages. This is contrary to the policy that imputation credits should only alleviate double taxation of company profits.

7. The root cause of the problem is that there is an unintended mismatch between the FIF rules and the trans-Tasman imputation rules, which means New Zealand shareholders may receive excess imputation credits that can offset tax on other income, such as salary and wages.

OBJECTIVES

8. The objectives are to:

a) address a risk to the tax base; and

b) ensure that the legislation aligns more closely with the policy, namely that a person with a FIF interest should only be able to use imputation credits against their tax liability to the extent that there is potential double taxation of an amount and cannot use excess credits to reduce tax on other income.

REGULATORY IMPACT ANALYSIS

9. There are two options that may deal with the problem and achieve the objectives:

a) a change so that the amount of imputation credits - which are attached to a dividend received from an Australian company - that a resident can use to offset their New Zealand tax is calculated on the basis of the resident's FIF income from that company, where the dividend exceeds the amount of FIF income; or

b) a change so that an Australian company can attach imputation credits to a dividend paid to a New Zealand resident shareholder calculated on the basis of the shareholder’s FIF income, whether or not the dividend exceeds the amount of FIF income.

Option one (preferred option):

10. This option involves preventing a FIF interest holder from using imputation credits in excess of the tax liability on their taxable FIF income. Accordingly, this option would achieve the policy objective of preventing a FIF interest holder from using excess imputation credits against tax on other income, e.g. salary and wages.

11. The amendment is largely for base maintenance and is not expected to have any revenue implications.

12. The impacts of this option are summarised in the table below.

Option two:

13. This option involves a change so that an Australian company can attach imputation credits to a dividend paid to a New Zealand resident shareholder calculated on the basis of the shareholder’s FIF income, whether or not the dividend exceeds the amount of FIF income.

14. This option is not favoured, as it is broader than is strictly necessary for addressing the problem identified and may therefore have unintended consequences. This is because this option would involve fundamentally changing the existing basis on which companies impute dividends paid to shareholders and could involve significant compliance costs. In particular, an Australian company would need to know details of their shareholders’ FIF income to calculate the amount of imputation credits they could attach.

15. The impacts of this option are summarised in the table below.

| Option | Meets Objective? | Impacts | Net Impact | |||

| Fiscal/economic impact | Administrative/ compliance costs | Risks | ||||

| One | Yes | Tax system | Fiscal risk removed by preventing NZ shareholders in Australian companies from having excess imputation credits. | No administrative costs. | None | Improves status quo by removing fiscal risk and not imposing unnecessary compliance costs. |

| Taxpayers | May affect closely-held company situation (i.e. may alter distributions from unlisted Australian companies to NZ shareholders). | Slightly more than status quo, but less than option two. | ||||

| Two | Yes | Tax system | Fiscal risk removed by preventing NZ shareholders in Australian companies from having excess imputation credits. | Likely to have administrative costs because involves fundamental changes to imputation rules. | Wider than necessary | Improves status quo by removing fiscal risk but imposes higher compliance and administrative costs. |

| Taxpayers | May affect closely-held company situation (i.e. may alter distributions from unlisted Australian companies to NZ shareholders). | Higher compliance costs than option one and status quo. | Unintended consequences because of complexity of redesigning imputation rules. | |||

Social, environment or cultural impacts of both options

16. There are no social, environment or cultural impacts to the options. The groups affected by the amendments proposed are taxpayers that have attributing FIF interests in unlisted Australian companies which elect to use the trans-Tasman imputation rules.

Net impact of both options

17. The net impact of both options is to remove a significant fiscal risk to the tax base, without causing a negative economic impact for taxpayers.

CONSULTATION

18. No public consultation has been undertaken due to the nature of the issue (being base maintenance). The Generic Tax Policy Process recognises that there are some situations where prior consultation may not be appropriate because it may draw attention to gaps in the tax legislation, which could be exploited and cause significant potential revenue leakage.

19. The Treasury and Inland Revenue were the only agencies involved in developing the proposals and carrying out the analysis.

CONCLUSIONS AND RECOMMENDATIONS

20. Option one is the preferred option because it is an effective and simple solution. It prevents a significant fiscal risk and achieves the objective of ensuring that imputation credits are used to eliminate double taxation of company profits in line with the policy intent of the imputation regime and preventing any excess imputation credits from being used to reduce the New Zealand tax liability arising on other income, such as salary and wages.

21. Option two is not favoured because, while it also achieves the objective, it is likely to involve significant changes to the existing imputation rules and is broader than necessary to eliminate the mischief identified. In addition, it could involve significant compliance costs on companies. In particular, an Australian company would need to know details of their shareholders’ FIF income to calculate the amount of imputation credits they could attach.

IMPLEMENTATION

22. The amendment will be implemented through a tax bill this year. The amendment would apply for tax years beginning 1 April 2014.

23. There should be no significant implementation issues with the amendment. Inland Revenue will communicate the change in rules through existing channels, including updating its guides.

MONITORING, EVALUATION AND REVIEW

24. There are no specific plans to monitor, evaluate and review the changes under the Income Tax Act 2007 following the changes, given that this is an isolated base maintenance issue.

25. If any detailed concerns are raised, officials will determine whether there are substantive grounds for review under the Generic Tax Policy Process (GTPP).

26. In general, Inland Revenue monitoring, evaluation and review of new legislation takes place under the Generic Tax Policy Process (“GTPP”). The GTPP is a multi-stage tax policy process that has been used to design tax policy in New Zealand since 1995. The final stage in the GTPP is the implementation and review stage, which involves post-implementation review of the legislation, and the identification of any remedial issues. Opportunities for external consultation are also built into this stage. In practice, any changes identified as necessary for the new legislation to have its intended effect would generally be added to the Tax Policy Work Programme, and proposals would go through the GTPP.