Rationalising other FIF calculation methods

(Clauses 8(2), 15(2), 25(1), 25(2), 26(1), 26(3) to (7), 27, 28, 30, 33, 35(1), 35(3), 35(4), 35(5), 35(6), 36(7), 35(8), 35(10), 36 to 40, 42, 62, subclauses 126(2), (6)and (7), and clause 131)

Summary of proposed amendments

Investors who are unable to use the active income exemption (due to having a less than 10% shareholding or insufficient access to information) will use the rules that were developed for portfolio FIFs.

To achieve this, the fair dividend rate and cost methods will be available to most FIF interests and not just those that are a less than 10% interest. Investors will only be able to choose to use the comparative value method if they are a natural person or a trustee of a family trust. In addition, the accounting profits and branch equivalent methods will be repealed.

Investors with non-ordinary shares (i.e. shares that are economically equivalent to debt) will apply the comparative value method in cases where an end of year market value is available and the deemed rate of return method in cases where it is not.

Application date

The changes apply to income years beginning on or after 1 July 2011.

Key features

Under the existing FIF rules sections EX 46 and EX 62 limit an investor’s choice of calculation method and their ability to change from a method they are currently using.

The Bill reforms these rules so that the fair dividend rate and cost methods will be available to most FIF interests and not just those that are a less than 10% interest. Investors will only be able to choose to use the comparative value method if they are a natural person or a trustee of a family trust.

Non-portfolio investors will generally be able to change to the fair dividend rate or cost method in respect of their first income year beginning on or after 1 July 2011.

Background

In 2007 some new methods were introduced for calculating income from less than 10% shareholdings in foreign companies (portfolio FIFs). As a consequence, such investors calculate income based on an assumed 5% rate of return (fair dividend rate method), although natural persons and trustees of family trusts can choose to be taxed on the actual returns of all of their foreign portfolio investments (although any losses are reduced to zero).

These new methods were limited to FIF interests of less than 10%. In cases where the investor cannot use the active income exemption, it makes sense to tax foreign investments consistently.

Accordingly, it is proposed that all investors who are unable to use the active income exemption for FIFs (due to having a less than 10% shareholding or insufficient access to information) will use the rules that were introduced in 2007 for portfolio FIFs.

Detailed analysis

Fair dividend rate and cost methods

The fair dividend rate and cost methods will no longer be limited to FIF interests of less than 10%. The Bill aims to achieve this by removing subsection EX 46(7)(a) and subsection EX 46(9)(a).

If a person does not choose a calculation method (and is not required to use a certain method), they are deemed to have chosen to use the fair dividend rate method, or the cost method if it is not practical to use the fair dividend rate method. This is achieved by changes to the default calculation methods in section EX 48.

Proposed repeal of accounting profits method

The Bill proposes that the accounting profits method be repealed with application from an investor’s first income year beginning on or after 1 July 2011. Persons who used the accounting profits method in the year preceding the repeal of this method would be able to change to any other method (see new subsection EX 62(2)(a)), subject to the limits on the choice of method in section EX 46.

Comparative value method

Investors will only be able to choose the comparative value method if:

a) the interest is a non-ordinary share under subsection EX 46(10); or

b) if they are a natural person or a trustee of a family trust and do not use the fair dividend rate or cost method for any of their other interests.

This simply reflects the existing limitations on choosing the comparative value method under the portfolio FIF rules. The Bill aims to achieve this by removing subsection EX 46(6)(c) (which prevented the above limitations from applying to FIF interests of 10% or more).

Where a person chooses to use the comparative value method for one FIF interest they will not be able to use the fair dividend rate method or cost method for their other FIF interests. This result is achieved by existing section EX 46(8)(b).

Note that an investor would be required to use the comparative value method if they have a “non-ordinary share” (share that is equivalent to debt) as defined in section EX 46(10) and it is practical to get an end of year market value for that share. Subsection EX 46(6)(d) already achieves this.

Investors will only be able to get a loss for an entire portfolio under the comparative value method if they have a non-ordinary share. Other losses for an entire portfolio using the CV method will be treated as zero income. The removal of subsection EX 51(7)(a) achieves this result.

Deemed rate of return method

Under the proposed rules investors will only use the deemed rate of return method when they have a non-ordinary share and it is not practical to get an end of year market value for that share. This is achieved through the repeal of section EX 46(4) and amendments to section EX 46(5). Now that non-portfolio investors can use the fair dividend rate and cost methods (which apply tax to an assumed 5% return), it is no longer necessary to allow taxpayers to choose to use the deemed rate of return method as this applies tax at a higher than 5% return.

Limits on choice of calculation method (section EX 46)

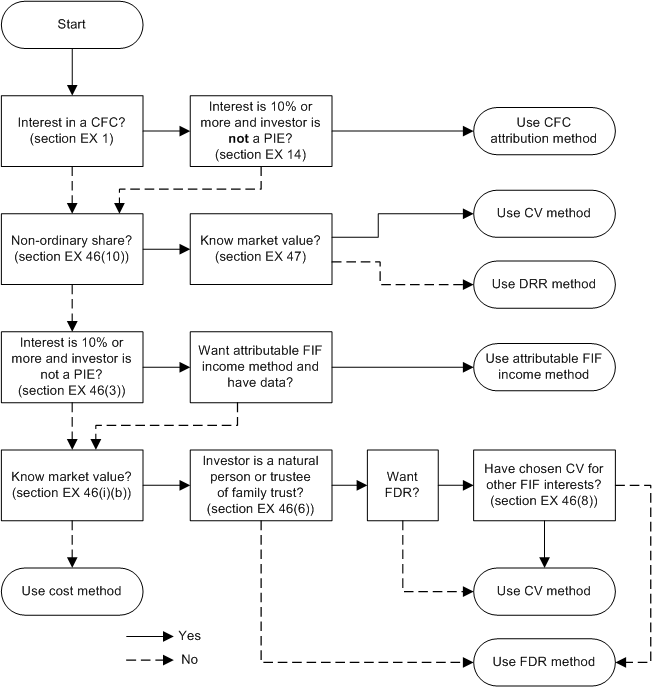

The following diagram summarises the main limitations that would apply to an investor’s choice of calculation method under the proposed amendments. Note the diagram does not include the rules in section EX 62 which limit an investor’s ability to change from a method that they are currently using to a different method. Changes to section EX 62 are described below.

Limits on changes of method (section EX 62)

In general, once investors start to use a calculation method for a FIF interest they are required to continue using the same calculation method. Section EX 62 supports this approach by providing a set of rules that limit an investor’s ability to change from a FIF calculation method that they are currently using to a different FIF calculation method. The Bill proposes several changes to this section to reflect the changes to the available calculation methods. The limits on the choice of method under section EX 46 also apply when changing a method.

A proposed amendment to section EX 62(2)(a) would allow investors who used the accounting profits method in the year preceding the repeal of this method to change to any other method (see new subsection EX 62(2)(a)).

A proposed amendment to section EX 62(2)(c) would allow investors to switch from the comparative value method when it is impossible to find out the end of year market value of the interest or if they are prevented from using it because they are not a natural person or a trustee of a family trust or using it in respect of a non-ordinary share (i.e. section EX 46(6) prevents them from using it).

A new provision is proposed after section EX 62(9) that would allow investors to change to the fair dividend rate method (and by implication also the cost method) from the accounting profits method, the branch equivalent method or deemed rate of return method in respect of their first income year beginning on or after 1 July 2011. This reflects the fact that the accounting profits and branch equivalent methods have been repealed and the deemed rate of return method will only be used in the case of non-ordinary shares where it is not practical to get an end of year market value for the share.

A proposed amendment to section EX 62(6) would allow investors to change from the branch equivalent method to the attributable FIF income method. It would also allow investors to change to or from the attributable FIF income method on one occasion (not counting the initial change from branch equivalent method to attributable FIF income method). An investor will only be able to change to or from the attributable FIF income method a second time if there has been a change in circumstances that significantly changes their ability to obtain enough information to use the attributable FIF income method and if altering their income tax liability is not the principal purpose or effect of the change (section EX 62(7)). This is consistent with the existing restriction on changing to or from the branch equivalent method.