Extending the active income exemption to non-portfolio FIFs

(Clauses 7(2), 7(3), 8(2), 13, 14, 15(2), 16, 19(2), 25(3), 26(2), 29, 33, 35(2), 35(8), 35(9), 36 to 40, 42, 43, 69 70(3), 70(4), 72, 73, 97, subclauses 126(4), (9), (18), (20), (25), (27) and (30))

Summary of proposed amendments

In 2009 an active income exemption was introduced for foreign companies that are controlled by New Zealand investors (CFCs). The Bill extends the active income exemption to interests of between 10% and 50% in companies that are not controlled by New Zealanders (non-portfolio FIFs).

Application date

The changes apply to income years beginning on or after 1 July 2011.

Key features

Under the existing rules investors in FIFs are able to calculate their income based on how the income would be calculated if the FIF were a branch of a New Zealand company (the branch equivalent method). The branch equivalent method will be replaced by the attributable FIF income method. Investors will only be able to use the attributable FIF income method in respect of FIFs in which they have a 10% or greater interest. Such investors will generally calculate their FIF income as though the FIF were a CFC using the active income exemption, although two modifications are made to make the CFC rules more accommodating to FIF investors.

Firstly, the active business test is relaxed to enable FIF investors to use consolidated accounting information to apply the test to chains of FIFs (including FIFs that are in different jurisdictions). Secondly, the exemption that applies to payments of interest, rent and royalties from an active CFC to an associated CFC (e.g. 50% common ownership) is modified so that a similar exemption applies when a FIF holding company controls an active FIF. These modifications are explained in the detailed analysis below.

Background

New Zealand’s international tax rules can impose higher tax or compliance costs on offshore operations than those faced by competing businesses operating in the same country. In many cases a New Zealand business which invests into a foreign country needs to not only comply with the tax rules of that country, but also attribute income (and potentially pay further tax in New Zealand) using New Zealand tax concepts. In contrast, many other countries reduce or eliminate the additional tax or compliance burden created by a second layer of tax by exempting offshore income that is earned by active businesses (e.g. manufacturing, services and sales income). This may create an incentive for New Zealand companies undertaking or considering active business ventures outside New Zealand to relocate their headquarters to countries with more favourable tax rules.

In 2009 an active income exemption was introduced for foreign companies that are controlled by New Zealand investors (CFCs). The reform was intended to ensure that New Zealand businesses that expand offshore by operating subsidiaries in foreign countries could compete on an even footing with foreign competitors operating in the same country. This means that a New Zealand-owned manufacturing plant in China would generally face the same tax rate as other manufacturers operating in China.

CFCs are a key vehicle for expanding New Zealand businesses beyond the domestic market. However, firms expand beyond New Zealand through a variety of structures, and New Zealand companies wanting to expand overseas may have good commercial reasons for not operating through a wholly or majority-owned subsidiary. For this reason the proposed Bill will allow investors with interests of between 10% and 50% in foreign companies that are not controlled by New Zealanders to apply the active income exemption to these FIF interests.

Detailed analysis

Attributable FIF income method (section EX 50)

The branch equivalent method is replaced with an attributable FIF income method. Under this method investors in the FIF generally calculate their FIF income as though the FIF were a CFC using the active income exemption. No income is attributed from FIFs that satisfy the active business test, either independently or as part of a consolidated group of FIFs.

Investors that do not satisfy the active business test attribute the portion of attributable income that corresponds with their income interest in the FIF (the investor’s income interest is also worked out by applying the CFC rules).

The attributable FIF income method differs from the CFC rules in two key respects. Firstly, the active business test is relaxed to enable investors to use consolidated accounting information to apply the test to chains of FIFs (including FIFs that are in different jurisdictions). Secondly, the exemption that applies to payments of interest, rent and royalties from an active CFC to an associated CFC (e.g. 50% common ownership) is modified so that a similar exemption applies when a FIF holding company controls an active FIF.

The remainder of this commentary focuses on these differences. A detailed description on how the CFC rules operate can be found in the October/November 2009 Tax Information Bulletin (Part II, Vol. 21, No. 8).

Active business test (sections EX 21D, EX 21E and EX 50)

An “active business test” is used to reduce compliance costs in cases where there is a low risk to the tax base. The test is passed and no income is attributed, if less than 5% of the gross income of the foreign company is passive. If the test is failed, then only the passive income (i.e. highly mobile income such as interest, rent or royalties) is attributed to the shareholder.

Under the CFC rules, New Zealand investors that have more than one majority-owned CFC in a jurisdiction are allowed to use consolidated accounts for all their majority-owned CFCs in that jurisdiction for the purposes of the active business test. The purpose of this measure is to simplify the application of the test when accounting information is available at a consolidated level, such as when a group produces segmental reporting by country.

The Bill proposes a similar consolidation rule for investors in non-portfolio FIFs. This should enable more investors to use the active business test as it can be easier to access consolidated accounting information for an entire group of FIFs than to access information for each separate company.

The requirements for being able to apply the active business test to a group of foreign companies under the attributable FIF income method are more relaxed than those that apply to a group of CFCs:

- The CFC rules require the investor to have a more than 50% income interest in each CFC. Under the attributable FIF income method it is the FIF for which that method is used which must have a more than 50% voting interest in the lower-tier foreign companies. Voting interests include interests that are held directly or indirectly.

- The CFC rules also require all the CFCs to be in the same jurisdiction in order to apply the active business test on a consolidated basis to a group of CFCs. Under the attributable FIF income method the foreign companies can be in different jurisdictions (so long as none of those companies is a CFC).

- Finally, the CFC rules require the investor to remove amounts corresponding to income interests not held by the investor (i.e. minority interests). The attributable FIF income method omits this requirement so amounts belonging to other investors are included in the calculations. This concession is made purely because of concerns about the practical difficulties for a non-controlling shareholder of identifying amounts attributable to other shareholders. The above modifications to the CFC rules occur through new section EX 50(4B).

Requirement to apply FIF calculation methods to lower-tier foreign companies (sections EX 50(6), EX 50(7) and EX 50(7B))

In many cases a New Zealand investor will own shares in a foreign company which itself owns shares in a second foreign company. If the investor chooses to use the attributable FIF income method in respect of the first foreign company, they will generally be required to “look-through” and to apply a FIF calculation method with respect to their indirect interest in the second foreign company. This is achieved by the formula in sections EX 50(6) and (7) and is consistent with the existing practice under the branch equivalent method.

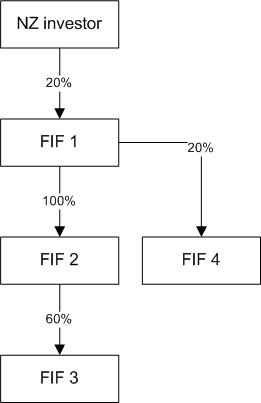

Example

If the NZ investor chooses to use the attributable FIF income method for FIF 1, it would generally have to apply a FIF calculation method to FIF 2 and FIF 4. If the investor then chooses to apply the attributable FIF income method to FIF 2, it would then generally have to apply a FIF calculation method to FIF 3.

If the investor had instead decided to apply a different FIF calculation method (such as the fair dividend rate or cost methods) to FIF 1, then they would not be required to look-through and apply a FIF calculation method to FIFs 2, 3 or 4, as they only have an indirect interest in these FIFs.

The Bill proposes several exceptions to the “look-through” rule in section EX 50(6). The purpose of these exclusions is to enable investors to apply the active business test using consolidated accounting information in situations where they have a direct interest in a FIF that holds shares in other foreign companies. In such cases it may be easier to access consolidated accounting information, than it would be to access separate accounting information for each company.

Consider a New Zealand investor with an interest in a FIF that owns a second foreign company. The investor will have no additional FIF income from the second foreign company if:

- The second foreign company is able to apply and pass the active business test on its own terms, independent from the upper-tier FIF. Note that the New Zealand investor would have to have an indirect interest of 10% or more in the second foreign company for that company to be able to apply the active business test in the first place; or

- The FIF and the second foreign company are able to apply and pass the active business test as part of the same test group. To be part of the same test group the FIF must hold a 50% or greater voting interest in the second foreign company, and the second foreign company must not be a CFC; or

- The FIF is able to apply and pass the accounting-based active business test in section EX 21E even after some relevant amounts from the second foreign company are included in the “added passive” item. The relevant amounts will differ depending on the level of shareholding that the FIF has in the second foreign company. If the FIF holds a joint venture interest in the foreign company the amounts which would be recorded in that FIF’s accounts under New Zealand Equivalent to International Accounting Standard 31 (NZIAS 31) would need to be included. If the FIF holds 20% or more, but less than 50% of the foreign company, then amounts recorded under the equity method in that FIF’s accounts under NZIAS 28 would need to be included. If the FIF holds less than 20% of the foreign company then any dividends and holding gains recorded under NZIAS 39 for that company would need to be included. Note that including such amounts in the “added passive” item is optional, but the look-through rule will continue to apply to indirect FIF interests that do not qualify for one of the above exclusions.

Example

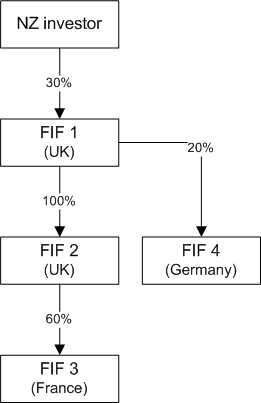

Consider the following group structure.

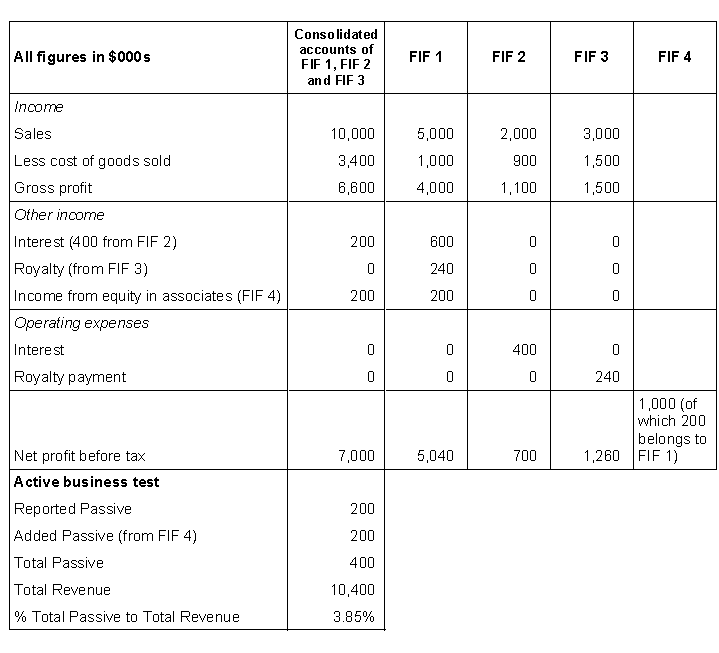

If the New Zealand investor chooses to apply the attributable FIF income method to FIF 1 it can apply the active business test using information from the consolidated accounts of FIF 1. Each line item in these accounts will include amounts from FIF 2 and FIF 3. These amounts will be included in the “reported passive” item for the purposes of the test.

Amounts from FIF 4 will be included as a separate line item (income from equity in associates) in the consolidated accounts of FIF 1. If the investor chooses to add this line item to the “added passive” item for applying the active business test to the test group and that test group still passes the active business test with these amounts included then the investor would not apply a FIF calculation method to FIF 4.

Now assume that FIF 1 receives $400,000 of interest payments from FIF 2, $240,000 of royalty payments from FIF 3 and $100,000 in dividends from FIF 4. FIF 1 earns $5m of sales income and $200,000 in interest from unrelated entities. FIF 2 earns $2m of sales income, FIF 3 earns $3m of sales income and FIF 1 is entitled to 20% of the $1m earned by FIF 4. Because FIF 2 and FIF 3 are controlled by FIF 1 their earnings appear in full in the consolidated accounts. The intra-group royalty and interest payments are disregarded in the consolidated accounts. Income from FIF 4 comprises $200,000 of income from associates under the equity method (the dividend is not recognised in income and instead reduces the carrying value of the investment).

The New Zealand investor chooses to apply the active business test using the consolidated accounts of FIF 1, FIF 2 and FIF 3 and by adding amounts from FIF 4 to the “added passive” item. Reported passive is $200,000 (third-party interest), added passive is $200,000 (from FIF 4) and total revenue is $10.4m, so the percentage of total passive to total revenue is 3.85%. Because this is less than 5% the New Zealand investor does not attribute any income from FIF 1, FIF 2, FIF 3, or FIF 4.

Exemption for intra-group payments (sections EX 50(4B)(a), (b) and (c) and EX 50(4C))

In the event that the active business test is not satisfied for a particular FIF, and the holder of the FIF interest uses the attributed FIF income method to calculate attributed income, the method treats the FIF in many ways as a CFC. However, there are some key differences.

Under the existing CFC rules there is an exemption for interest, rent and royalty payments between commonly-controlled CFCs, so long as both CFCs are in the same jurisdiction and the CFC that makes the payment is a non-attributing active CFC (i.e. passes the active business test).

The Bill modifies the requirement for foreign companies that are not CFCs, so that a similar exemption applies when the recipient foreign company has more than 50% of the voting interests in the foreign company that makes the payment. For payments between CFCs, the requirement that the CFCs be associated companies is unchanged, but some changes have been made to “same jurisdiction” test (see commentary on attributed foreign income – liability to tax). Payments between FIFs will have to pass a similar “same jurisdiction” test in order for the exemption to apply.

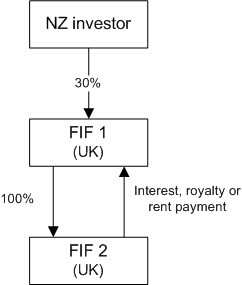

Example

Interest, royalty and rent payments from FIF 2 to FIF 1 would normally be attributable income of FIF 1. However because FIF 1 and FIF 2 are in the same jurisdiction (the UK) and FIF 1 holds more than 50% of the voting interests in FIF 2, the payments would be excluded from the definition of attributable income.

Amendment to definition of passive Telecommunications income

Subsection EX 20B(3)(m)(ii) of the Income Tax Act 2007 deems certain telecommunications services income to be attributable income to the extent to which the equipment is owned by “the CFC or by another CFC that is associated with the CFC”. This subsection is amended so it also covers situations where a CFC (or a FIF using the attributable FIF income method) is associated with a (second) FIF or CFC. In the absence of this change it would be possible to reduce a foreign company’s attributable income by dealing with an associated foreign company that is not a CFC.