GST zero-rating of emissions units transactions - proposed amendments

The provisions of the Goods and Services Tax Act 1985 which zero-rate certain transactions in emissions units were amended by the Taxation (Annual Rates, Trans-Tasman Savings Portability, KiwiSaver and Remedial Matters) Act 2010. An error in those amendments appears to have the effect of zero-rating supplies made in exchange for supplies of emissions units beyond the original intention of certain supplies made to or by government.

The Minister of Revenue has advised that he intends to correct this error in a Supplementary Order Paper to the Taxation (GST and Remedial Matters) Bill 2010 to be proposed at the Committee of the Whole House stage. The correcting legislation will have a commencement date of 1 July 2010, the date the error arose.

The policy intention of the legislation (and its form prior to the recent amendment) was that a very limited range of other supplies made in exchange for emissions units were also zero-rated, essentially for compliance reasons. These other supplies were circumstances where the other party was the government, and the supply was the supply by a person to the government of:

- the capture of carbon in a growing forest, under the post-1989 forestry or Permanent Forest Sink Initiative rules; or

- services where the government transfers emissions units to a person as a grant or subsidy. This supply of services is deemed by a provision of the GST Act, and is likely to arise, for example, in circumstances where the government transfers emissions units to a trade-exposed exporter.

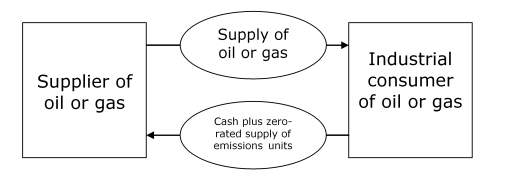

The impact of this error is illustrated by the following example.

In the example, an industrial consumer used to purchase $100 (plus GST) of oil from a supplier. After the introduction of the ETS, the supplier now charges an emission unit plus $100 plus GST rather than increasing the cash price of the oil to take into account its liability under the ETS. The oil supplier is directly passing on its ETS liability. The GST payable by the oil supplier (and claimable by the industrial consumer) on the supply of oil is intended to be on the total value of the supply being $100 plus the value of the emissions unit.

The error has inadvertently extended the zero-rating of the reciprocal transaction to taxpayer to taxpayer transactions where a supply of emissions units is part or all of the consideration for an underlying supply. In the above example, if the legislative error was not corrected, the proportion of the supply of oil or gas that is equal to the value of the emissions units would be zero-rated.

Proposed amendment to the Goods and Services Tax Act 1985

Commencement date 1 July 2010.

1. Section 11(1)(o) to be replaced by the following:

“(o) the goods are supplied to or by the Crown as consideration for a supply-

(i) for which there is no payment of a price; and

(ii) that is chargeable at the rate of 0% under section 11A(1)(s) or (t).”

2. Section 11A(1)(u) to be replaced by the following:

“(u) the supply of the services is to or by the Crown as consideration for a supply-

(i) for which there is no payment of a price; and

(ii) that is chargeable at the rate of 0% under paragraph (s) or (t); or”

Any comments on this proposal should be sent to [email protected]