Hon Dr Michael Cullen

Minister of Revenue

MEDIA STATEMENT

Imputation credit loophole to be closed

The government is closing a loophole to prevent Australasian groups of companies abusing the New Zealand tax rules on dividends and imputation credits, Revenue Minister Michael Cullen announced today.

Legislation to be tabled in Parliament this week will amend income tax law to prevent companies from allocating imputation credits to dividends paid to New Zealand investors if the payment of the dividends results in tax deductions in Australia.

"The trans-Tasman imputation rules, which came into effect two years ago, were the result of a joint Australia-New Zealand reform to reduce the double taxation of certain trans-Tasman investments," Dr Cullen said.

"They make New Zealand imputation credits available to Australian companies for their New Zealand investors and, correspondingly, Australian franking credits available to New Zealand companies for their Australian investors.

"Some companies appear to be taking advantage of an unforeseen loophole in the rules, however. They are setting up schemes whereby imputation credits are directed away from foreign shareholders, who generally cannot use the imputation credits, and streamed towards a special group of New Zealand investors, who can. At the same time, the payment is deductible as interest in Australia.

"That is a form of imputation credit streaming and is unacceptable. The government is therefore acting to prevent this activity, which ultimately results in a loss to the New Zealand tax base.

"Once enacted, the changes will apply to shares issued from today. The new rules will apply to dividends paid after 1 April 2006 from shares already issued within the same group of companies. Other existing non-group company issues (the public issues) will be allowed to run through to their maturity," Dr Cullen said.

The changes will be introduced by means of a Supplementary Order Paper to the taxation bill currently before Parliament.

Attached: technical annex providing a detailed analysis of the changes.

Contact: Patricia Herbert, press secretary, 04 471 9412 or 021 270 9013

[email protected]

Technical inquiries to Helen McDonald [tax advisor, Dr Cullen’s office] 471-9728

Imputation credit loophole to be closed – technical annex

BACKGROUND

Two years ago New Zealand and Australia each enacted tax legislation called "trans-Tasman imputation" (TTI). The changes allow New Zealand imputation credits to flow through an Australian group of companies and then back to New Zealand shareholders and vice versa.

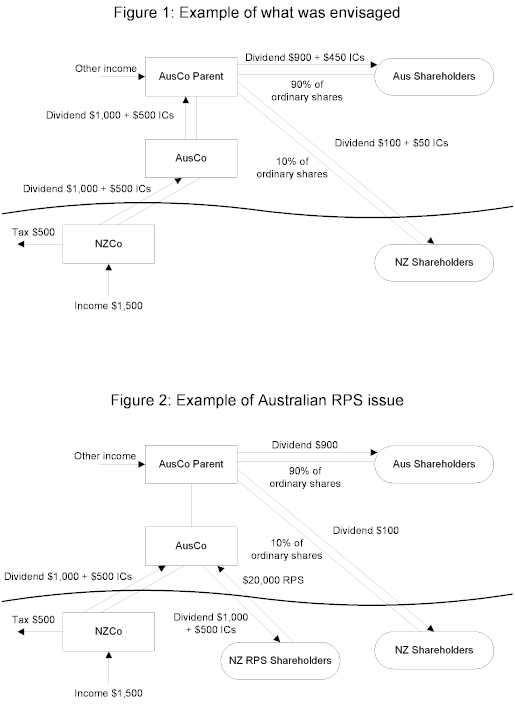

A simplified example of how it was envisaged that TTI would be used is shown as Figure 1. The Australian listed public company franks its ordinary dividends with Australian credits, but as well it attaches New Zealand imputation credits which benefit its New Zealand shareholders.

ISSUES OF REDEEMABLE PREFERENCE SHARES BY AUSTRALIAN COMPANIES

A few Australasian groups of companies have issued redeemable preference shares (RPS) into the New Zealand retail market by way of prospectus. These issues offer a relatively low cash coupon, enhanced by the addition of imputation credits. Thus a New Zealand investor who pays tax at 33% gets, say, a 5% cash coupon, with 2.5% attached imputation credits giving a tax-paid return of 5% (7.5% gross for non-corporate taxpayers).

There seems to be no direct connection between the proceeds of the issue of the RPSs and investment in the New Zealand tax base.

The New Zealand aspects of this are illustrated in Figure 2.

IMPUTATION CREDIT STREAMING

The imputation credits of an Australasian group of companies are valuable only to New Zealand shareholders who can benefit from them. In these cases the credits should, in theory, be distributed to all the shareholders of the parent company. However, typically, an Australian-based listed group of companies would have fewer than 10%, and probably fewer than 5%, of its ordinary shareholders resident in New Zealand. Thus the New Zealand shareholders will not be influential in determining the Australasian group's dividend and imputation credit policies.

The Australasian group can derive much more benefit from the credits, however, by using them to enhance the return on an RPS-type share issued by an Australian group company into the New Zealand market. This is because the Australian group company can then pay lower cash coupons and use the imputation credits to enhance the New Zealand RPS investors' return.

In essence, the Australian group's imputation credits are streamed back to the New Zealand RPS shareholders, who can benefit from them, rather than being directed to the holders of the ordinary shares in the group, who generally will not be able to use them (because they are not New Zealand resident).

From a policy perspective this sort of streaming of credits is inappropriate. The credits belong to the holders of the ordinary shares in the Australian group, not to the holders of the RPS. In these examples there is no real connection between the use of the RPS issue proceeds and the imputation credits that are attached to the dividends.

The "dividend" on the RPS shares is deductible to the Australian issuer company, as Australian tax law regards such instruments as debt instruments.

RESPONSE

Section ME 6 of the Income Tax Act 2004 will be amended so that issuers of shares will not be allowed to attach imputation credits to their dividends when the dividend results in an Australian tax deductible item.

The amendment will provide that a company cannot attach imputation credits to a dividend from a share that is a "debt interest" under the Australian Income Tax Assessment Act 1997. Consequential amendments will be made to the benchmark dividend definition and the benchmark dividend rules.

This solution addresses the concern about the lack of connection between the income that results from the issue of the shares and the New Zealand imputation credits.

It also addresses any potential intra-group TTI issues.

APPLICATION DATES

Once enacted, the amendment will apply from announcement to all such shares issued on or after the date of announcement.

The proposed law change will apply to dividends from existing shares from 1 April 2006 except when the holder and the issuer are not part of the same group of companies. Where the holder and the issuer are not part of the same group of companies these issues will be allowed to run through to their maturity.