| Enhancements to tax policy within broad-base, low-rate (BBLR) tax settings |

| Review of the tax framework for employee share schemes |

Reforming the tax treatment of employee share schemes to ensure appropriate and balanced outcomes. |

| Income protection insurance: a review |

The Financial Services Council is seeking a review of the income tax treatment of income protection insurance. There is a lack of clarity about the tax treatment of this form of insurance and inconsistencies across products offering similar benefits. |

| Deductibility of holding costs for revenue account property |

Considering the deductibility of holding costs for property. |

| Abusive tax position penalty |

Examining the application of the abusive tax position penalty in cases of tax avoidance, and whether any changes are needed to the penalty. |

| Demergers (new) |

Considering an exclusion from dividend taxation for corporate demergers. |

| Petroleum mining decommissioning expenditure (new) |

Replacing the existing ability to spread back petroleum mining decommissioning expenditure to earlier tax years with a refundable tax credit in the current year. |

| Review of bank account requirement for offshore persons’ IRD numbers (new) |

The bank account requirement for an offshore person to obtain an IRD number continues to cause issues in practice. In particular, it is an obstacle in a number of cases to people being able to comply with their tax obligations. |

| Trust beneficiaries as settlors (new) |

There are instances when beneficiaries of trusts who leave their beneficiary income in the current accounts with the trust become inadvertent settlors. This is not in accordance with the policy intent. |

| Financial arrangement issues (new) |

There are a variety of financial arrangement taxation issues ranging from remedial to policy enhancements to ensure these rules work as intended. |

| Taxation of non-bank securitisation vehicles (new) |

Extending the current securitisation regime to beyond banks. |

| Impact of case law on the ”voting interest” test for corporate trustees (new) |

Considering the impact of recent case law on the application of the voting interest test in the Income Tax Act 2007 and the Goods and Services Tax Act 1985 to corporate trustees. |

| Repeal adverse events income equalisation deposit regime (new) |

This regime is, in practice, little used, because the main scheme offers more flexibility. However, its existence can cause some confusion. |

| Review of donee status applications |

Dealing with applications by organisations for donee status under schedule 32. |

| Treaty of Waitangi settlements |

Tax implications of Treaty settlements are addressed as required. |

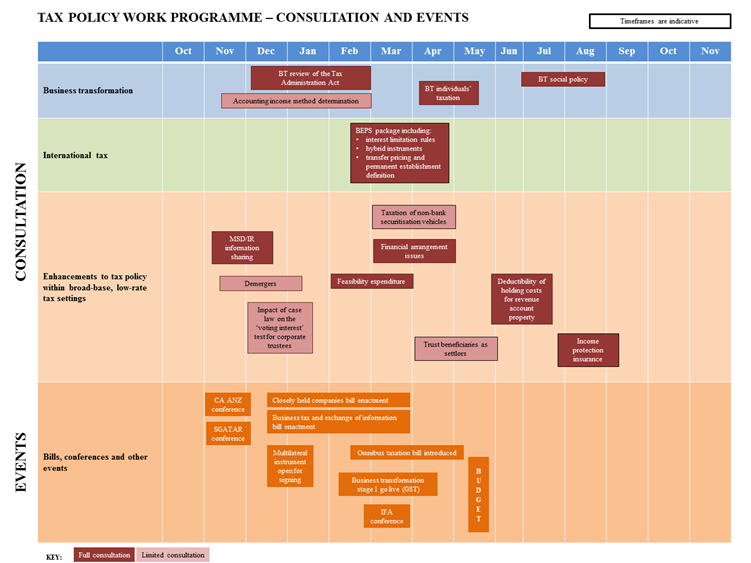

| International tax and base erosion and profit shifting (BEPS) |

| Hybrid instruments and entities |

Consideration of foreign hybrid instruments and entities in the context of BEPS. |

| Double tax agreement (DTA) work programme |

New Zealand is seeking to establish new and updated double tax agreements with a number of countries, including Norway, China, Korea, Slovak Republic, Portugal and Fiji. |

| Automatic exchange of information |

Domestic implementation of a new global standard on the automatic exchange of financial bank account information with treaty partners. |

| Interest limitation rules |

Consideration of New Zealand’s interest limitation rules in light of OECD recommendations. Part of the BEPS Action Plan. |

| Multilateral instrument |

As part of the BEPS work, the OECD has proposed countries sign a multilateral instrument that will simultaneously amend the double tax agreements of participating countries. The amendments to DTAs will address certain aspects of the BEPS project that have a treaty dimension e.g. treaty shopping or permanent establishment avoidance. |

| Foreign trust disclosures |

Policy recommendations arising from the Government Inquiry into foreign trust disclosure requirements. |

| Inbound investment framework |

An officials’ paper outlining New Zealand’s approach to taxing foreign investment income has been prepared. It has been used as the basis for targeted consultation with private sector representatives, and has also been published on the tax policy website to facilitate a wide understanding of the trade-offs the Government faces in responding to BEPS. |

| Business transformation and Better Public Services |

| Business transformation |

| Better administration of GST and PAYE |

Policy options to reduce compliance and administrative costs consistent with longer term business transformation thinking. |

| Review of the Tax Administration Act |

Developing a framework for tax administration with an emphasis on the key roles of the Commissioner, taxpayers and tax agents, as well as the rules around information collection and tax secrecy which underpin their interactions. |

| Individuals’ taxation |

Improving the tax system for individuals, including comprehensive pre-population of income information, collection of information, more efficient debt collection processes and the degree of interaction with the tax system. |

| Business taxation |

Improving the tax system for business, including the calculation of provisional tax, the collection of information and reviewing the penalties and interest rules. Includes researching additional measures that have potential to deliver further benefits to businesses, reduce compliance costs and make the tax system simpler. |

| Investment income information |

Streamlining the collection of information about investment income such as interest, dividends, PIE income and Māori authority distributions. |

| BT social policy |

Improving the social policy system for individuals and families, including alignment of definitions, reviewing assessment periods to improve accuracy and timeliness of payments, more efficient debt collection and prevention processes, and improving outcomes for customers with special or exceptional circumstances. |

| Better Public Services |

| Information sharing agreement between Ministry of Social Development and Inland Revenue |

Information sharing with Ministry of Social Development to assist in determining entitlements to benefits, social assistance and other services. |