RIA - GST on assets sold by non-profit bodies

| Date | 3 May 2018 |

|---|---|

| Type | Regulatory impact assessment |

| Title | GST on assets sold by non-profit bodies |

| Description | Regulatory impact assessment on proposals for GST on assets sold by non-profit bodies. |

| Downloads | PDF - From Word (103 KB) |

| Contents |

COVERSHEET: GST ON ASSETS SOLD BY NON-PROFIT BODIES

| Advising agencies | Inland Revenue |

|---|---|

| Decision sought | Agreement in principle to policy proposal |

| Proposing Ministers | Minister of Revenue |

SUMMARY: PROBLEM AND PROPOSED APPROACH

Problem Definition

What problem or opportunity does this proposal seek to address? Why is Government intervention required?

Inland Revenue has recently looked at what constitutes a non-profit body’s “taxable activity” and provided an interpretation that differs from the understanding previously held by many. This recent interpretation means a non-profit body can still claim input tax deductions on the purchase of goods and services but does not need to return output tax on the sale of these assets or equivalent event (such as an insurance pay-out or deregistration from GST) if these assets are not part of the non-profit body’s “taxable activity”. This interpretation has increased non-profit bodies’ advantage relative to other GST-registered persons and, in doing so created a significant but unquantifiable fiscal risk.

Proposed Approach

How will Government intervention work to bring about the desired change? How is this the best option?

Non-profit bodies would be required to return GST on an asset’s sale or equivalent event if input tax deductions have been claimed for that asset. This is consistent with the previous understanding of a non-profit body’s “taxable activity” held by many and would not affect the broader concessionary GST treatment of non-profit bodies. Furthermore, this option would mitigate the revenue risk arising from the recent interpretation of a non-profit body’s “taxable activity”.

SECTION B: SUMMARY IMPACTS: BENEFITS AND COSTS

Who are the main expected beneficiaries and what is the nature of the expected benefit?

The main expected beneficiary will be the Crown as the proposed option will prevent a significant but unquantifiable revenue risk by closing a gap in the GST base.

Non-profit bodies will benefit from the proposed option as it will provide them with certainty as to the GST treatment of the sale of their assets (or equivalent event). Furthermore, the proposed option will provide guidance to non-profit bodies on whether or not they should elect to register for GST if they are below the GST registration threshold.

Where do the costs fall?

Non-profit bodies who had taken a view that GST was not payable on the sale of some assets they had claimed input tax credits for will suffer a GST cost under the proposed option. However, non-profit bodies would have suffered this GST cost under the previous understanding by many of a non-profit body’s “taxable activity”.

What are the likely risks and unintended impacts, how significant are they and how will they be minimised or mitigated?

It is possible that some non-profit bodies will have an unexpected GST cost arising from the proposed option. Transitional rules would be put in place to mitigate the impact of these costs.

Identify any significant incompatibility with the Government’s ‘Expectations for the design of regulatory systems’.

There are no areas of significant incompatibility with the Government’s ‘Expectations for the design of regulatory systems’.

SECTION C: EVIDENCE CERTAINTY AND QUALITY ASSURANCE

Agency rating of evidence certainty?

Inland Revenue is confident of the evidence base for the existence of the problem. However, Inland Revenue does not have the data available to quantify the magnitude of the potential revenue risk.

Quantifying the magnitude of the revenue risk would require data on the value of assets held by non-profit bodies which are not part of their taxable activity, and the likelihood of these assets being disposed of or an equivalent event arising.

To be completed by quality assurers:

Quality Assurance Reviewing Agency:

Inland Revenue and the Treasury.

Quality Assurance Assessment:

The quality assurance reviewers at Inland Revenue and the Treasury have reviewed the impact statement GST on assets sold by non-profit bodies and consider that the information and analysis summarised in it meets the quality assurance criteria of the Regulatory Impact Assessment Framework.

Reviewer Comments and Recommendations:

We consider that given the nature of the problem that the impact statement addresses it would not be appropriate to undertake consultation with potential affected parties prior to the in-principle decision being made by Cabinet. In addition, we are comfortable that the restricted options analysis in this statement is appropriate in order to respond swiftly to address the problem.

Impact Statement: GST on assets sold by non-profit bodies

SECTION 1: GENERAL INFORMATION

Purpose

Inland Revenue is solely responsible for the analysis and advice set out in this Regulatory Impact Statement, except as otherwise explicitly indicated. This analysis and advice has been produced for the purpose of informing in principle policy decisions to be taken by Cabinet.

Key Limitations or Constraints on Analysis

Consultation and testing

No consultation has been undertaken with external stakeholders yet. Consulting with external stakeholders would have worsened the revenue risk by bringing their attention to the problem and allowing them to exploit it. However, consultation is planned with stakeholders on the design of the proposed option.

Range of options considered

Only options targeted at addressing the specific issue identified have been considered. Other options which would alter the broader concessionary GST treatment of non-profit bodies have not been considered at this time. The analysis required to examine options that impact the broader concessionary GST treatment of non-profit bodies would not be able to be undertaken quickly enough in order to address the current revenue risk in a timely manner.

Responsible Manager (signature and date):

Chris Gillion

Policy Manager

Policy and Strategy

Inland Revenue

3 May 2018

SECTION 2: PROBLEM DEFINITION AND OBJECTIVES

2.1 What is the context within which action is proposed?

GST treatment of non-profit bodies

Non-profit bodies may register for GST even if only a small proportion of their activities would be subject to GST. If they do register they are entitled to claim back GST on virtually all goods and services they acquire even if a large proportion of their activity is something other than making taxable supplies (such as receiving and paying out donations). In this respect the GST treatment of non-profit bodies is concessionary relative to other registered persons.

New interpretation of a non-profit body’s “taxable activity”

Inland Revenue’s Office of the Chief Tax Counsel (OCTC) has recently reviewed what constitutes a non-profit body’s “taxable activity”. OCTC concluded that the taxable activity of a non-profit body comprises the activity that is directed to the making of supplies for a consideration and extends to activities that have a sufficient nexus to this activity. However, the taxable activity of a non-profit body does not include activities they undertake which do not have a sufficient connection to the activity of making supplies for a consideration. Crown Law has also examined this issue and agreed with OCTC’s interpretation.

The outcome of this new interpretation is an even more concessionary tax treatment for non-profit bodies than was already the case and a potentially significant revenue loss that cannot be accurately estimated. Non-profit bodies will still be able to claim back GST on all expenses except those related to an exempt supply. However, they would only have to return output tax on supplies that form part of their taxable activity. The sale of an asset that does not form part of a non-profit body’s taxable activity would not be subject to GST even though the non-profit body could have claimed GST refunds in relation to that asset.

An example of this is a charity that owns two buildings – one a headquarters dedicated to fundraising (not a taxable activity) and one an emergency accommodation facility which charges a below market fee for its services (a taxable activity). The charity can claim an input tax deduction for capital and ongoing costs relating to both buildings because it can claim GST on anything that is not related to an exempt supply. Under the new interpretation it could be argued that the charity would not be required to pay output tax on a sale of the fundraising headquarters because the sale would not have been made in the course or furtherance of the taxable activity of providing emergency accommodation.

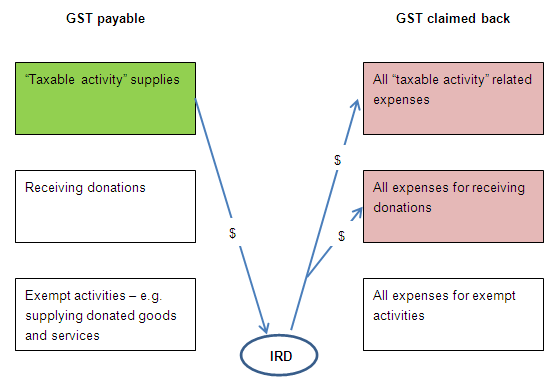

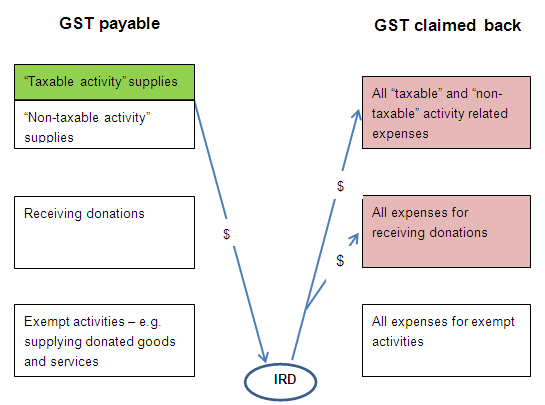

The diagrams on the following page illustrate the GST position for a non-profit body under the previous understanding of “taxable activity” held by many (old interpretation), and the new interpretation of “taxable activity”. The green box on the left hand column shows the GST payable by the non-profit body and the red boxes on the right show the GST that can be claimed back by the non-profit body. The non-coloured boxes show where GST is either not payable or not able to be claimed back. We note that the only difference between the first and second diagrams is that the GST payable is reduced because some supplies that were previously considered part of a non-profit body’s taxable activity are now not taxable supplies under the new interpretation.

GST position under "old" interpretation

GST position under "new" interpretation

2.2 What regulatory system, or systems, are already in place?

The regulatory system already in place is the revenue raising and collection regulatory system, specifically the Goods and Services Tax Act 1985.

2.3 What is the policy problem or opportunity?

Under the GST policy framework GST should be as neutral as possible among different taxpayers. As such, non-profit bodies should not receive concessionary treatment relative to other GST-registered persons. However, successive Governments have chosen to provide non-profit bodies with a concessionary GST treatment.

The recent interpretation of a non-profit body’s “taxable activity” provides an even more concessionary treatment of non-profit bodies than may have been originally thought to exist. This further reduces the neutrality between the GST treatment of non-profit bodies and other registered persons. As such, the Government needs to consider whether it wants to allow this even more concessionary treatment or to restrict the concessionary treatment to what may have previously been regarded as the extent of the concessionary treatment of non-profit bodies.

The recent interpretation of a non-profit body’s “taxable activity” has also created a potentially significant but unquantifiable revenue risk for the Crown. The revenue loss will arise when a non-profit body sells an asset that was assumed to have given rise to a GST liability prior to the recent interpretation but now does not. It can be expected that the pool of readily sellable non-profit bodies’ assets would be limited. On the other hand, there is a potential tax base risk related to the ability for GST-registered purchasers to claim second-hand goods deductions if the goods were not subject to GST. A revenue loss could also arise if a non-profit body deregisters for GST purposes. Further revenue losses could arise with insurance pay-outs if the asset in question would previously have been assumed to be part of the non-profit body’s taxable activity.

GST previously returned by non-profit bodies on an asset’s sale or equivalent event may also need to be refunded under the new interpretation of a non-profit body’s “taxable activity”. Inland Revenue is aware of one non-profit body that will be receiving a large GST refund because of the new interpretation of “taxable activity”. The concern is that once this refund has been received, other non-profit bodies will also apply for significant GST refunds.

The magnitude of the revenue risk arising from the recent interpretation of a non-profit body’s “taxable activity” cannot be accurately estimated. However, based on data from the Department of Internal Affairs (DIA), the value of current and non-current assets held by DIA-registered charities (including large organisations such as universities) is around $55 billion. This suggests that the revenue risk arising from the new interpretation is potentially very high.

2.4 Are there any constraints on the scope for decision making?

The need for a quick response to this issue means the broader concessionary GST treatment of non-profit bodies has not been reviewed. The concessionary GST treatment of non-profit bodies may still be reviewed at a later stage.

2.5 What do stakeholders think?

Stakeholders have not yet been consulted on the problem or the proposed solution. Consultation would have made stakeholders aware of the problem and increased the risk of non-profit bodies applying for GST refunds based on the new interpretation of their “taxable activity”.

Consultation with the non-profit bodies sector will take place following an announcement by the Minister of Revenue of the Government’s plan to require non-profit bodies to return GST on an asset’s sale or equivalent event if they have claimed input tax deductions for that asset. Consultation will involve a consultation paper being released, followed by a four week period for stakeholders to make submissions.

SECTION 3: OPTIONS IDENTIFICATION

3.1 What options are available to address the problem?

Option one: Do nothing (status quo)

Under this option, the neutrality between the GST treatment of non-profit bodies and other registered persons would be further reduced. Furthermore, the revenue risks identified above will eventuate when non-profit bodies become aware of the new interpretation of a non-profit body’s “taxable activity”.

Option two: Non-profit bodies would be required to return GST on an asset’s sale or equivalent event if they have claimed input tax deductions for that asset (proposed option)

Under this option the Goods and Services Tax Act 1985 would be amended to require non-profit bodies to return GST on an asset’s disposal or equivalent event if they have claimed input tax deductions for that asset.

For example, a healthcare non-profit body is devoted to monitoring the health of children under the age of 5 in the local community. The non-profit body is partly funded by the local health board which provides the non-profit body with the necessary medical staff. The non-profit body obtains the necessary medical equipment and overhead expenses out of its own fund-raising activities. The non-profit body also leases out child car seats and baby equipment to the public for a fee.

The non-profit body has claimed input tax credits for all the GST it has incurred in acquiring the equipment needed for both the health monitoring service and the hiring activity, and for rent and other overheads relating to both activities.

The non-profit body decides that the hiring activity is detracting from its main activity of providing health checks and therefore decides to sell off the car seats and baby equipment to the highest bidders. It also discovers that there is now better medical equipment available for rent, the cost of which could be met by selling off the existing medical equipment to other health providers.

Under this option the non-profit will be required to pay GST on the proceeds of sale of the car seats, baby equipment and medical equipment. Under the status quo it may have been argued that the sale of the medical equipment was not subject to GST as it was not sufficiently connected with the activity of hiring out car seats and baby equipment for a fee.

Goods and services acquired before 1986

There would be no specific rule for goods and services acquired before 1986. Input tax deductions will not have been claimed for the capital cost of acquiring the goods and services but, if input tax deductions for expenses attributable to such goods and services had been claimed, the goods and services will be treated as if they had been brought into the GST base and therefore output tax would apply. Other GST-registered entities with pre-1986 assets are generally required to pay output tax on sale of the assets or equivalent event so the proposed approach simply aligns the GST treatment for non-profit bodies with the general GST treatment.

Transitional rules

It is possible that some non-profit bodies may have had a genuine expectation that, despite having claimed input tax credits, there would be no output tax liability on sale or equivalent event of an asset. This would be where they had already taken a view of what constitutes a non-profit body’s “taxable activity” consistent with Inland Revenue’s recent interpretation. In that case it would seem fair to allow these non-profit bodies to pay back any GST already claimed and remove the relevant goods and services from the GST base so as to put the non-profit bodies in the same position as if that GST had never been claimed.

Under this option these non-profit bodies could, for a limited time, either notify Inland Revenue or apply to Inland Revenue to pay back any input tax claimed on goods and services affected by the changed interpretation since the date they were registered for GST, rather than pay output tax on the sale of the particular assets or an equivalent event. The main instances in which this is likely to be a better outcome for a non-profit body is with land or any other asset that appreciates rather than depreciates in value.

Application date

This option would apply retrospectively to the sale of a non-profit body’s assets (or equivalent event) from the date the Minister of Revenue makes an announcement signalling the Government’s intention to implement this option. This would minimise the potential revenue loss arising from the new interpretation of a non-profit body’s “taxable activity”. The option would also use a savings provision to preserve the tax positions of non-profit bodies taken before the date of this announcement.

Following this announcement, a consultation paper would be released and stakeholders would have four weeks to make submissions. Consultation will be focussed on receiving submissions on the detailed design of the option, particularly the transitional rules.

3.2 What criteria, in addition to monetary costs and benefits, have been used to assess the likely impacts of the options under consideration?

The main objective of this project is to prevent the revenue risk arising from non-profit bodies receiving an even more concessionary treatment than may have been originally thought to exist. The following criteria will be used to assess options against this objective.

- Neutrality – the option should promote neutral tax treatments of non-profit bodies and other persons.

- Certainty – the option should provide certainty to non-profit bodies as to what assets would be subject to GST upon the asset’s sale or equivalent event.

- Compliance costs – the option should minimise compliance costs for non-profit bodies.

- Administration costs – implementation and administration costs for Government departments should be minimised.

3.3 What other options have been ruled out of scope, or not considered, and why?

Removing the broader concessionary GST treatment of non-profit bodies is an option to address the issue that has not been considered. Reviewing the broader concessionary GST treatment provided to non-profit bodies would take time to fully analyse the impacts of making any changes. Furthermore, reviewing the broader concessionary GST treatment would require extensive consultation. However, the issues identified above require a quick response in order to minimise the revenue risk.

SECTION 4: IMPACT ANALYSIS

Marginal impact: How does each of the options identified at section 3.1 compare with the counterfactual, under each of the criteria set out in section 3.2?

| No action | Preferred option | |

|---|---|---|

| Neutrality | 0 | + (Reduces the concessionary treatment of non-profit bodies compared to other GST-registered persons) |

| Certainty | 0 | + (Increased certainty for non-profit bodies) |

| Compliance costs | 0 | - (Increased compliance costs associated with transitional rules) |

| Administration costs | 0 | 0 (No significant change in administration costs for Inland Revenue) |

| Overall assessment | 0 | ++ |

Key:

++ much better than doing nothing/the status quo

+ better than doing nothing/the status quo

0 about the same as doing nothing/the status quo

- worse than doing nothing/the status quo

- - much worse than doing nothing/the status quo

SECTION 5: CONCLUSIONS

5.1 What option, or combination of options, is likely best to address the problem, meet the policy objectives and deliver the highest net benefits?

The preferred option is option one which requires non-profit bodies to return GST on an asset’s sale or equivalent event if they have claimed input tax deductions for that asset. This is the preferred option because it increases the neutrality of the GST treatment of non-profit bodies and other registered persons compared to the status quo. This option reduces the concessionary treatment of non-profit bodies that exists under the status quo, whilst still maintaining the previous commonly held view of the GST concessions available to non-profit bodies.

Importantly, this option also prevents the significant revenue risk that exists under the status quo.

This option also increases certainty as non-profit bodies will know that they are required to return GST on an asset’s sale or equivalent event if they have claimed input tax deductions for that asset. Under the status quo, a non-profit body would instead have to determine whether any particular asset formed part of their taxable activity to determine if they have to return GST for that asset’s sale. This certainty will also help non-profit bodies below the GST-registration threshold to determine whether they should elect to register for GST or not.

It is acknowledged that the transitional rules would increase compliance costs for non-profit bodies that wish to use these rules. However, these rules are necessary to minimise the impact of an unexpected GST liability that may arise for non-profit bodies under the proposed option. Furthermore, this increase in compliance costs would only occur for non-profit bodies that choose to use the transitional rules.

5.2 Summary table of costs and benefits of the preferred approach

| Affected parties (identify) | Comment: nature of cost or benefit (eg ongoing, one-off), evidence and assumption (eg compliance rates), risks | Impact $m present value, for monetised impacts; high, medium or low for non-monetised impacts |

Evidence certainty (High, medium or low) |

| Additional costs of proposed approach, compared to taking no action | |||

| Regulated parties (non-profit bodies) | Increase in output tax of an unquantifiable but significant amount. Increased compliance costs for non-profit bodies that want to use the transitional rules. |

High unquantifiable monetary cost. Low |

High |

| Regulators (Inland Revenue) | None | None | High |

| Wider government | None | None | High |

| Other parties | None | None | High |

| Total Monetised Cost | High but unquantifiable | High | |

| Non-monetised costs | Low | High | |

| Expected benefits of proposed approach, compared to taking no action | |||

| Regulated parties (non-profit bodies) | Increased certainty | Low | High |

| Regulators (Inland Revenue) | None | None | High |

| Wider government | Significant but unquantifiable monetary benefit due to closing gap in GST base. | High unquantifiable monetary benefit. | High |

| Other parties | Increased neutrality between the GST treatment of non-profit bodies and other registered persons. | Low | High |

| Total Monetised Benefit | High but unquantifiable | High | |

| Non-monetised benefits | Low | High | |

5.3 What other impacts is this approach likely to have?

We do not anticipate that the proposed approach would have any other impacts.

5.4 Is the preferred option compatible with the Government’s ‘Expectations for the design of regulatory systems’?

The preferred option is compatible with the Government’s “Expectations for the design of regulatory systems”.

SECTION 6: IMPLEMENTATION AND OPERATION

6.1 How will the new arrangements work in practice?

The proposal will require amendment to the Goods and Services Tax Act 1985. These amendments will be drafted following the proposed consultation and will be added to the next omnibus tax bill as a supplementary order paper.

The proposed option will apply retrospectively from the date of the Minister of Revenue’s announcement of the changes. Between the date of the Minister’s announcement and the changes receiving the Royal assent, the status quo will apply. However, where taxpayers seek to obtain refunds during this transitional period, which must be repaid once the changes receive the Royal assent, the Commissioner may determine resources should not be applied to such reassessments consistent with her wider care and management obligations. Inland Revenue will manage the situation with taxpayers to minimise the occurrence of taxpayers receiving refunds that they will then need to pay back to Inland Revenue once the changes receive the Royal assent.

Inland Revenue will be responsible for administering the changes once they are introduced.

6.2 What are the implementation risks?

The main implementation risk concerns how to manage the period between the date of the Minister of Revenue’s announcement and the date of the Royal assent. It is expected that few non-profit bodies would apply for refunds they are entitled to under the status quo as they would know they would be required to pay any refund they receive back once the changes receive the Royal assent. Inland Revenue will also work with non-profit bodies and their tax agents to manage this transitional period.

The proposed consultation following the Minister of Revenue’s announcement will also help to address any other implementation risks that may be raised by stakeholders.

SECTION 7: MONITORING, EVALUATION AND REVIEW

7.1 How will the impact of the new arrangements be monitored?

Inland Revenue will monitor the outcomes pursuant to the Generic Tax Policy Process ("GTTP") to confirm that they match the policy objectives. The GTPP is a multi-stage policy process that has been used to design tax policy in New Zealand since 1995.

We do not expect extensive monitoring to be necessary as the proposed option is merely confirming what was until recently an understanding of the law held by many.

7.2 When and how will the new arrangements be reviewed?

Post-implementation review is expected to occur around 12 months after implementation.

If the post-implementation review identifies any need for remedial action it would be recommended for addition to the Government's tax policy work programme and could potentially be included in future taxation bills.