Cabinet paper: Making Tax Simpler – Proposals for modernising the Tax Administration Act

| Document type | Cabinet paper |

|---|---|

| Title | Making Tax Simpler – Proposals for modernising the Tax Administration Act |

| Description | Considered by the Cabinet Economic Development Committee (DEV) on 21 March 2018 and confirmed by Cabinet on 23 March 2018 |

| Downloads | Cabinet paper (PDF 133 KB; DOCX 119 KB; 22 pages) |

| Contents | |

| Related documents (published separately) |

|

In Confidence

Office of the Minister of Revenue

Chair, Cabinet Economic Development Committee

Making Tax Simpler – Proposals for Modernising the Tax Administration Act

Proposal

1 This paper seeks the agreement of the Cabinet Economic Development Committee to a number of reforms to the Tax Administration Act 1994 following the public consultation on the Government discussion document Making Tax Simpler: Proposals for modernising the Tax Administration Act. The proposals are part of the modernisation the revenue system through the business process and technology changes being implemented by Inland Revenue’s Business Transformation programme.

2 These proposals would be included in the next omnibus taxation bill, likely to be introduced in May 2018.

Executive Summary

3 The discussion document Making Tax Simpler: Proposals for modernising the Tax Administration Act was released on 8 December 2016. This document sits within the series of Making Tax Simpler discussion documents covering policy proposals associated with Inland Revenue’s Business Transformation.

4 The proposals in the discussion document were divided into four key areas:

4.1 collection, use and disclosure of information;

4.2 helping taxpayers get it right from the start;

4.3 the role of tax intermediaries; and

4.4 the role of the Commissioner and the design of the new Tax Administration Act.

5 Submitters generally supported the proposals with some caveats. Several submitters, including Chartered Accountants Australia and New Zealand, indicated they wished to discuss their submissions with my officials. The proposals in this paper are informed by those further discussions and by the submissions.

Collection, disclosure and use of information

6 I propose modernising the rules regarding the confidentiality of Inland Revenue’s information to make them clearer, more cohesive and better aligned with the underlying rationale of protecting taxpayer information. I also propose two changes to the way Inland Revenue shares information, specifically:

6.1 providing more flexibility for Inland Revenue to share information within a regulatory framework, building on existing legislative provisions; and

6.2 a provision allowing Inland Revenue to enter into agreements to share information with other agencies without the need for regulation where customer consent for sharing is obtained.

7 Inland Revenue has adequate powers to collect information and no substantial change is proposed. However, I do propose two minor changes:

7.1 The introduction of a regulation-making power to govern the repeat collection of large third-party datasets. This will provide a more efficient and transparent process for this type of collection, as distinct from the ad hoc collection of such information using existing powers.

7.2 I also propose clarifying explicitly in the legislation that information collected for one Inland Revenue purpose can be used for the department’s other functions.

Getting it right from the start

8 I propose changes to the binding rulings regime as one way of helping taxpayers to get their tax returns right from the start. This is aimed at providing more certainty to reduce compliance and administrative costs for a greater number of business taxpayers. Currently, rulings are generally available only to large taxpayers due to their cost, and there are issues which cannot be ruled on. Therefore, I propose two changes to expand access to binding rulings:

8.1 creating a simplified process for small and medium-sized taxpayers to obtain a binding ruling at a reduced cost compared with the current process; and

8.2 extending the scope of the rulings regime so that rulings can be provided on a broader range of issues.

9 I also propose to better align the error-correction process with taxpayers’ processes by increasing the current $1,000 threshold for taxpayers to include an error in a subsequent return (rather than having to reopen the original assessment) if it is less than both $10,000 and 2% of the taxpayer’s taxable income or output tax liability. Inland Revenue estimates the change in revenue from increasing the threshold will be broadly neutral.

The role of tax intermediaries

10 I propose changes that will clarify Inland Revenue’s ability to provide more services to tax preparers who are not tax agents (such as intermediaries who prepare PAYE and GST returns for other taxpayers) while safeguarding the integrity of the tax system. An example of such a service is being able to order a report on a clients’ filing performance online.

11 I also propose providing the Commissioner of Inland Revenue with a discretion to refuse to recognise someone acting on behalf of another for a fee as a nominated person. This would occur if they have been removed from the list of tax agents for tax integrity reasons, or if allowing them to act for others would otherwise adversely impact on the integrity of the tax system.

The Commissioner’s care and management role

12 I propose a more flexible approach to dealing with situations when the legislation does not align with the intended policy (that is, there is a legislative anomaly). Specifically, I propose a combination of allowing the Commissioner to seek to have the issue resolved via an Order in Council and extending the Commissioner’s care and management power to allow exemptions to be issued to reduce taxpayers’ compliance costs in dealing with legislative anomalies.

13 Extending the Commissioner’s care and management power could be achieved by either:

13.1 A determination: A determination could be used when there were no fiscal implications and the matter was not sensitive, but it was important to provide certainty for taxpayers. I propose that any determinations made under the power should be deemed to be legislative instruments to provide Parliamentary scrutiny of the exercise of the power.

13.2 An administrative action of the Commissioner: The anomaly could be dealt with by an administrative action when it was of a very minor remedial nature (such as an insignificant cross-referencing error).

14 The power of exemption will be subject to limitations and safeguards including consistency with the existing policy and the principles in the care and management provision, being optional for taxpayers to apply, and expiring within three years.

Background

15 The Government discussion document Making Tax Simpler: Proposals for modernising the Tax Administration Act was released on 8 December 2016. This document sits within the series of Making Tax Simpler discussion documents covering policy proposals associated with Inland Revenue’s Business Transformation. It followed a November 2015 document Making Tax Simpler: Towards a new Tax Administration Act, which set out the proposed future framework for the tax administration. These proposals focused on five key dimensions of tax administration, being the roles of the Commissioner, taxpayers and tax agents, and the rules for information collection and tax secrecy that underpin their interactions.

16 During the development of Towards a new Tax Administration Act it became clear that the issues were wide-ranging and complex, and would require more detailed discussion. Therefore, the objective of Proposals for modernising the Tax Administration Act was to firm up the proposals in Towards a new Tax Administration Act, after considering the submissions received.

17 During the consultation, 15 written submissions were received and 19 comments were made on the online forum. Key submission themes included:

17.1 general support for limiting the coverage of the secrecy rule, provided that the issue of commercially sensitive information is appropriately addressed;

17.2 support for the proposed cross-government information-sharing framework, so long as other agencies cannot obtain information they are otherwise not entitled to;

17.3 support for a greater focus on assisting taxpayers to get it “right from the start”;

17.4 general support for amending the statutory definition of “tax agent” to include a wider range of intermediaries; and

17.5 support for an increased care and management discretion, with some differing views on how and when this should be used.

18 Several submitters indicated they wished to discuss their submissions further with officials. My officials held four workshops with representatives of Chartered Accountants Australia and New Zealand, the New Zealand Law Society, and the Corporate Taxpayers Group, to work through the submissions and aspects of the proposals in more detail. A representative from the Crown Law Office attended the workshop that considered the proposal to extend the Commissioner’s care and management power.

Comment

19 My proposals for modernising the Tax Administration Act are set out in four sections: collection, use and disclosure of information; getting it right from the start; the role of tax intermediaries; and the Commissioner’s care and management role. A table summarising the current law, the proposals outlined in the discussion document and the final policy proposals following consultation can be found in appendix one.

Collection, use and disclosure of information

20 The confidentiality of taxpayer information is a key component of the integrity of the tax system and remains the norm among international revenue agencies. Information flows are crucial to the efficient and effective administration of the tax system. Confidentiality rules are seen as facilitating this in three ways:

20.1 encouraging people to provide information with the confidence it will be used and protected appropriately;

20.2 acting as a balance for the broad information collection powers of Inland Revenue; and

20.3 acting to protect taxpayer privacy.

Narrowing the confidentiality rule

21 The current “tax secrecy” rule is extremely broad, and covers all matters relating to the legislation administered by Inland Revenue. As it is so broad, the current rule covers much more than the taxpayer-focused rationale for the rule necessitates. The existing rule can lead to tensions between confidentiality and the Official Information Act’s principle of open access to government information. The current rule can also give rise to tensions between confidentiality and wider government objectives that can be achieved through increased information sharing.

22 I propose that the tax secrecy rule is narrowed so that, instead of being about all matters relating to the Revenue Acts, it focuses on protecting information about taxpayers. The specific obligation on Inland Revenue staff to keep this narrower set of information confidential would remain. Narrowing the rule would enable more general and non-identifying information to be shared or released, while maintaining a rule of taxpayer confidentiality.

23 A key issue raised in submissions was the need to ensure that commercially sensitive information is adequately protected. Therefore, the focus of the proposed rule is not only on information that identifies a taxpayer, but also information that could identify a taxpayer, and information about a taxpayer’s affairs that may not identify them but for example, is commercially sensitive. Rules should remain in place to ensure that sensitive non-taxpayer information about Inland Revenue processes continues to be protected.

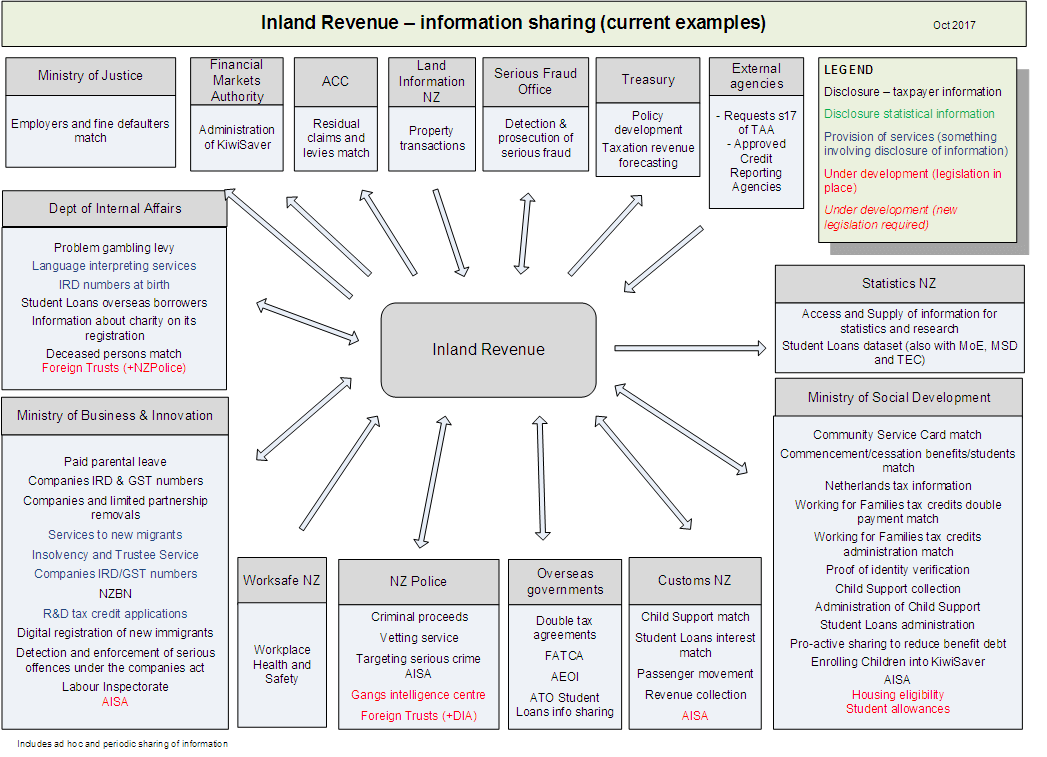

24 Narrowing the tax secrecy rule would not mean that taxpayer-specific information would never be disclosed; rather, as is the case now, an exception to the general rule of confidentiality would be required. Inland Revenue already shares a significant amount of information with other agencies (as outlined in appendix two); however, the various statutory exceptions to confidentiality are cumbersome, and lack cohesion and clear, unifying principles. A new legislative framework is proposed, to gather the exceptions into a clearer, more cohesive set and provide for cross-government information-sharing in a more flexible and adaptive way. I propose the new framework also include an express exception, equivalent to that contained in the Privacy Act 1993, permitting information to be disclosed where there is a risk of serious harm to public health or the safety of one or more individuals.

Disclosure – cross-agency information sharing

25 I propose that Inland Revenue’s cross-government sharing rules are built on an existing exception in the Tax Administration Act 1994, allowing information-sharing that meets certain criteria to be authorised by Order in Council. The existing exception, in section 81BA, was the subject of a recent review by the Commissioner. That review found there were benefits accruing from the use of the provision. It recommended final decisions on the future of section 81BA be made as part of the wider review of confidentiality and information sharing contained in Proposals for modernising the Tax Administration Act. In developing these proposals, I have considered the findings of the review, alongside submissions on Proposals for modernising the Tax Administration Act.

26 Inland Revenue will continue to use the Privacy Act “Approved Information Sharing Agreement” (AISA) rules. However, the new framework will deal with situations not suited to the AISA rules primarily because they involve sharing non-personal (including business) information, rather than personal information.

27 The aim of expanding the regulatory model of more flexible information sharing is to improve the efficiency and effectiveness of government, leveraging the information and systems improvements provided by Business Transformation, while not compromising the ability of Inland Revenue to perform its core functions. Another aim is to ensure information sharing is safe, proportionate, and affects the confidentiality of information no more than is considered necessary to achieve the purpose of the sharing. Information sharing will, in line with the AISA rules, be permitted for the provision of public services, including where these public services involve delivery by non-government organisations. I therefore propose an Order in Council permitting sharing of Inland Revenue information for the provision of public services when:

27.1 the provision of the information improves the ability of the government to efficiently and effectively deliver services or enforce laws;

27.2 the information is more easily or more efficiently obtained from or verified by Inland Revenue than from other sources;

27.3 the amount and type of information provided is proportionate given the purpose for which it is being shared;

27.4 the information will be subject to adequate protection by the receiving agency or agencies; and

27.5 the provision of the information does not unduly inhibit the provision of information to Inland Revenue in the future.

28 I anticipate that over time many of the existing cross-agency information sharing arrangements will move within the more flexible regulatory model. However, the existing provisions authorising these arrangements will need to be retained within the new legislative framework until such time as new arrangements are put in place. I propose, however, that it is appropriate to retain a specific legislative provision for Statistics New Zealand and not move this sharing into a regulatory model. This recognises the long-established sharing, significant volume of data provided, and the statutory independence of both the Government Statistician and the Commissioner of Inland Revenue.

Cross-agency sharing with consent

29 I propose permitting Inland Revenue to share information for public service provision (without the need for the agencies to seek an Order in Council) when the customer concerned has consented. An agreement between the agencies would still be required, to ensure appropriate protections are in place for the information, including ensuring customer consent is obtained and recorded. In some cases, agreements might be relatively simple, for example the passing on of basic contact information. When more sensitive or complex information is being shared, the agreements would contain more detail. I also propose clarifying how the confidentiality rule applies to agencies receiving Inland Revenue information.

Information collection

30 Inland Revenue deals with large numbers of documents, forms, letters and tax returns that contain information about matters such as taxpayers’ circumstances, income or assets. Outside of the tax return process, Inland Revenue can require a person to provide any information considered “necessary or relevant” to Inland Revenue’s functions. The information collection powers work well and no significant change is proposed. However, two proposed changes in Proposals for modernising the Tax Administration Act dealt with the regular collection of large datasets and the re-use of information within Inland Revenue.

Repeat collection of large datasets

31 The availability and usability of large datasets has greatly improved with the aid of technology. To administer the tax system efficiently, Inland Revenue needs to continue to be able to collect one-off taxpayer-specific and bulk data, and obtain some third-party information on a repeating basis. The current rules are adequate for one-off or ad hoc collection of such information, but potentially less so for the regular, repeating collection of information. I therefore recommend a new empowering provision, enabling regulations governing the regular collection of datasets. The existing “necessary or relevant” standard would continue to apply, but the proposal would bring a greater degree of transparency to this type of collection.

32 The Office of the Privacy Commissioner has expressed some concern regarding ensuring appropriate protections are in place for personal information when undertaking this form of collection. I propose that a requirement to consult with the Privacy Commissioner be included in the new empowering provision. My officials are continuing to work with the Office of the Privacy Commissioner on the development of this consultation process. I also propose that the provision include requirement for a review after five years of operation.

Use of information for multiple revenue purposes

33 I also propose clarifying the use of information that Inland Revenue collects for a particular function or purpose. In many cases, interactions with a taxpayer may relate to a particular product, for example personal income tax or Working for Families tax credits. However, the information is often also relevant for other purposes, such as the taxpayer’s student loan or child support account. I recommend a provision to make it clear that information gathered for one of Inland Revenue’s functions can also be used for any other Inland Revenue function.

Getting it right from the start

34 The objective of modernising the tax administration system is to make tax compliance simpler. In the context of the tax assessment process, this means helping taxpayers to “get it right from the start” in line with the tax administration principles suggested by the OECD. The goal of modernising the tax assessment process is to obtain first time accuracy to reduce the need to make subsequent amendments. This should increase certainty for taxpayers, and reduce the resources that taxpayers and the Commissioner need to commit to the process.

Advice

35 The main reason for Inland Revenue to provide advice is to achieve greater levels of voluntary compliance by enhancing taxpayers’ understanding of the rules. As tax intermediaries and advisors also play—and will continue to play—a significant role in providing advice to taxpayers, Inland Revenue’s role is to support and maintain the integrity of this advice.

36 Ideally, the advice provided should give the right level of certainty at the best time, both proactively and reactively, without necessarily being fixed on a particular form of advice. It is recognised, however, that Inland Revenue will never have sufficient resources to advise all taxpayers about the tax implications of every transaction or income source.

37 Inland Revenue has been in the process of designing its future organisational structure, which will be crucial in determining how it will balance its resources towards providing more advice. The current proposals are part of the move to improve the advice Inland Revenue provides.

38 A central means for Inland Revenue to provide advice is the binding rulings regime. A binding ruling provides certainty on core tax, penalties and interest. A ruling is binding on the Commissioner but not on the taxpayer. I propose introducing a simplified binding rulings regime and extending the scope of the rulings regime.

Introducing a simplified binding rulings regime

39 Because of the cost involved, rulings are generally only really available to large taxpayers. The goal of introducing simplified binding rulings is to make rulings more accessible for small and medium-sized entities. A further aim is to reduce the number of small and medium-sized enterprises that end up in the disputes process. I consider that the rulings process is likely to be most appropriate for such entities when they are undertaking a significant arrangement or transaction. The process would be simplified by removing some of the current legislative and operational requirements for obtaining a binding ruling. Further details are:

39.1 Limits will be placed on the amount of tax at issue, to reduce the potential fiscal risk of the Commissioner being unable to change her view once a transaction is ruled on, and on the size of the entity that can use the simplified process (which will be needed when the amount of tax at issue is unclear or unknown). The limits will enable Inland Revenue to provide a ruling more quickly under the process, thereby reducing the possible advisor costs (as well as the fee) for the taxpayer and the administrative costs for Inland Revenue.

39.2 Binding rulings incur an application fee ($280 plus GST) and an hourly rate fee ($140 plus GST) and the discussion document proposed reducing these for SMEs. Inland Revenue already advises an applicant what the expected cost of a ruling will be and this practice is expected to continue with simplified rulings. I propose that the fees for simplified rulings are also dealt with by regulations, which include a Commissioner’s discretion to set the fee level instead of setting the fee or fees in the regulations themselves. The specific fee/s can therefore be determined at a later date.

Extending the scope of the rulings regime

40 In order to extend the range of issues that the Commissioner can provide certainty to taxpayers on, and to clarify certain aspects of the regime, I propose:

40.1 Removing the prohibition on ruling on a taxpayer’s purpose under certain provisions, such as whether a taxpayer has a taxable purpose of selling a property when they acquire it.

40.2 Relaxing the requirement that a ruling can only be issued on an “arrangement”, to allow the Commissioner to give certainty on some specific quasi-factual matters such as whether a person is resident in New Zealand.

40.3 Allowing the Commissioner to rule on a financial arrangement matter for which she can currently only issue a determination.

40.4 Clarifying the difference between an assumption and a condition and when a ruling ceases to apply because a condition or assumption is breached.

Amending assessments

41 Although the focus of the modernised tax administration is on getting it right from the start, there will still inevitably be situations when the taxpayer or the Commissioner will seek to amend or correct an assessment. The current process for amendment is complicated and does not align with taxpayers’ accounting processes for dealing with minor errors. Having to adopt a different process for tax purposes for minor errors, as compared to the accounting treatment, imposes compliance costs.

42 The key difference between processes is whether the taxpayer is required to amend the original assessment or is allowed to include the amendment in a subsequent return. In general amendments must be made to the original assessment, subject to an exception for minor errors (currently less than $1000). There are several reasons why the tax system generally requires taxpayers to make amendments to the original assessment, including:

42.1 The tax collected by the government includes the time value of money as well as core tax payments.

42.2 It is fairer for taxpayers who get their assessments right from the start.

42.3 It provides Inland Revenue with valuable information about errors that are being made by taxpayers.

43 However, the reasons for requiring amendments to be made to the original assessment are not so relevant when the error is minor. In those cases, the compliance costs can outweigh the benefits to the tax system of requiring taxpayers to amend the original assessment.

44 The process for amending original assessments will be substantially simplified under Inland Revenue’s new computer system (START). This will reduce the compliance costs for taxpayers fixing errors. I consider that further compliance savings could be achieved by better aligning the process for fixing minor errors with taxpayers’ processes.

45 I propose:

45.1 Replacing the current criteria that determine whether the error can be included in a subsequent return (i.e. a clear mistake, simple oversight, or mistaken understanding) with a simple monetary threshold, and taking into account the monetary significance to the taxpayer.

45.2 Taxpayers therefore having the option to include an error in a subsequent return if the amount of the error is equal to or less than both $10,000 and 2% of the taxpayer’s taxable income or output tax liability.

The role of tax intermediaries

46 I propose that the group of tax intermediaries with access to Inland Revenue’s advanced services should be expanded beyond tax agents. I also propose that the Commissioner should be able to refuse to recognise a taxpayer’s nominee when doing so would create a risk to the integrity of the tax system.

Expanding the intermediaries that can get Inland Revenue’s advanced services

47 Inland Revenue currently provides advanced services to tax agents, such as being able to request a report on their clients’ filing performance. The statutory definition of a “tax agent” is used for determining who can access these services. This means that other tax service providers (such as those who only file GST returns and employer monthly schedules for their clients) cannot access these services. The discussion document recognised that these providers can still look after their clients’ tax affairs as nominated persons, but without the additional services.

48 Restricting additional services to persons who are listed as tax agents is not required by law, but is an administrative decision by the Commissioner of Inland Revenue. The Commissioner can offer these services as widely or narrowly as she considers appropriate. However, revoking access to these services, once granted can be difficult.

49 I propose to introduce a new provision to deal with intermediaries who do not meet the definition of a tax agent.

50 This new provision would define the group of persons who, despite not being tax agents, are eligible to receive Inland Revenue’s extended service offerings for tax preparers under Business Transformation. The new provision would allow the Commissioner to deregister these persons if she had reasonable tax integrity concerns about them. Any discretion to deregister a registered tax preparer or intermediary would mirror the Commissioner’s existing power to remove a person from the list of tax agents, where allowing that person to continue as a listed tax agent would adversely affect the integrity of the tax system.

51 The proposals are not aimed at subjecting the new group of intermediaries to more stringent regulation than that faced by tax agents. The proposals are intended to ensure that, if a person would not be allowed to be listed as a tax agent for tax integrity reasons, the Commissioner can choose to refuse to allow the person access to Inland Revenue’s services for tax preparers. The Commissioner would also be able to refuse to allow them to act for other taxpayers under the nominated person regime in appropriately limited circumstances.

52 Currently, only those who meet the definition of “tax agent” are given an extension of time for their clients to file returns. No change is proposed to the extension of filing time. I consider that it would be more appropriate to review the extension of filing time when Business Transformation has progressed further.

Discretion for the Commissioner to refuse to recognise nominated persons

53 Inland Revenue’s view is that a person who is nominated by a taxpayer to act on their behalf is the agent of the taxpayer under common law. Therefore, in the absence of an empowering or permissive legislative provision granting the Commissioner some discretion to refuse to recognise a nominated person if she has reasonable tax integrity concerns about giving the person access, it is up to the taxpayer whether the nominee should act (or continue to act) on their behalf. However, there are concerns about the risk of persons who have been removed from the list of tax agents (due to tax integrity concerns) coming back into the system as nominated persons.

54 To strengthen the Commissioner’s existing power to remove a person from the list of tax agents for adversely affecting the integrity of the tax system, I propose that the discretion should be limited to situations where the person is acting on behalf of a taxpayer for a fee or otherwise acting in a professional capacity. Therefore, situations where a person is acting for a family member, for example, would not be covered by the discretion.

Commissioner’s care and management role

55 One of the key goals of the Business Transformation is to make the tax administration system more resilient and flexible. The Commissioner’s care and management responsibility has been interpreted as limited to providing her with administrative flexibility regarding allocating her resources to fulfil her statutory duties. Care and management does not provide flexibility regarding legislative anomalies, being instances when the policy intent is not properly reflected in the legislation.

56 A key aspect of the care and management of the tax system is applying and explaining the law to taxpayers. Generally, tax law can be interpreted in a way that is consistent with the policy intent. Sometimes when tax law cannot be interpreted consistently with the policy intent, this can tie up Commissioner and taxpayer resources in cases and outcomes that are inconsistent with both parties’ practices and outcomes. This situation is also inconsistent with the objective of helping taxpayers to get it right from the start.

57 The Legislation Design and Advisory Committee queried whether the proposed power was needed because legislative anomalies might be able to be resolved by adopting a purposive interpretation of the relevant provision. Towards a new Tax Administration Act noted that generally adopting a purposive approach to interpreting the relevant provision will result in an interpretation consistent with the policy intent. However, there will be occasional cases when this is not possible because, for example, the wording of the legislation is unambiguous. As such, the proposed power would be used as a last resort when the relevant provision cannot be interpreted purposively in a way that is consistent with the policy intent.

58 Towards a new Tax Administration Act suggested a clarification to the care and management provision to deal with some of these situations, based on specific criteria and safeguards. The proposed criteria included minor or transitory anomalies, cases when the legislation did not adequately deal with a particularly complex issue, when a long-standing practice had been overturned, and cases of unfairness at the margins. Most submitters expressed tentative support for this approach, but preferred a principle-based approach to the scope of the power to reduce uncertainty around the scope of the criteria. As a result, I propose that the Commissioner’s enhanced discretion should be limited to situations where the interpretation of the legislation (using ordinary interpretation principles) is inconsistent with the policy intent as determined from the legislative context as a whole. The Commissioner’s enhanced discretion would apply where, for example:

58.1 the relevant legislation does not adequately deal with a particularly complex situation because a statutory rule is difficult to formulate; and

58.2 a long-standing practice has been accepted by the Commissioner and taxpayers, which subsequently turns out to be inconsistent with the legislation (interpreted purposively), and is regarded as appropriate from a policy perspective.

59 The exercise of the discretion would be guided by the principles in the current care and management provisions. This would mean that, in the first instance, the exercise would have regard to the importance of promoting voluntary compliance, and the compliance costs that would otherwise be incurred by taxpayers.

60 Examples of when the discretion could be used include: when a drafting error means that the provision is inconsistent with the intended policy; and when a gap in legislation is discovered that means there is uncertainty as to whether the legislation is consistent with the policy intent. In these situations, the discretion would provide a temporary bridge to allow taxpayers to adopt an approach that is consistent with the intended policy. This would avoid the Commissioner and taxpayers having to commit resources to the unintended outcomes.

61 The Commissioner’s discretion would not be able to be used to modify the application of a tax law for a particular taxpayer, but rather limited to groups or classes of taxpayers. This will ensure that the discretion is used to remedy objectively determined legislative anomalies, and will prevent it from being used in an arbitrary way.

62 Towards a new Tax Administration Act suggested that the exercise of the discretion should be similar to the way the Commissioner publishes a technical position. Submitters, and the Legislation Design and Advisory Committee, supported having a range of options by which the discretion could be exercised (a “tool box approach”). This approach is similar to the suite of powers available to the Financial Markets Authority under the Financial Markets Authority Act 2011 and Financial Markets Conduct Act 2013.

63 I, therefore, recommend allowing the discretion to be exercised by way of:

63.1 A determination: A determination could be used when there are no fiscal implications and the matter is not sensitive, but it is important to provide certainty for taxpayers. I recommend that any determinations made under the power should be deemed to be legislative instruments to provide parliamentary scrutiny of the exercise of the power.

63.2 An administrative action of the Commissioner: The anomaly could be dealt with by an administrative action when it is of a very minor remedial nature (such as an insignificant cross-referencing error). Exercising the power by way of administrative action would involve the Commissioner publishing an acknowledgement of the legislative anomaly, and a proposal to recommend an amendment to the Government to remedy the anomaly. The recommended amendment would include the details of the proposal and the proposed application date. This would not provide assurance about the enactment of the proposed amendment. However, taxpayers would have a high level of confidence that the amendments would be enacted as proposed, given the remedial nature of the issue.

64 I also propose allowing the Commissioner to seek an Order in Council in similar circumstances where the issue is sensitive or has fiscal implications. The safeguards outlined below for exercise of the Commissioner’s discretion would apply with necessary modifications to the Order in Council process.

Discretion optional for taxpayers

65 The exercise of the discretion would bind the Commissioner. I considered requiring the discretion to be applied only where it is taxpayer-favourable. However, I consider that a better approach is to make the application of the discretion optional for taxpayers, as taxpayers are in the best position to determine whether the discretion is favourable to them, which may depend on compliance costs as much as any potential foregone revenue. Taxpayers could continue to apply the black-letter provision if they chose.

66 This approach aligns with the concept of self-assessment and with the fact that the discretion would not override the primary legislation. Submitters supported this approach. I consider that it may be that the discrepancies arising from allowing taxpayers to adopt different approaches would make it inappropriate to exercise the discretion in some circumstances. An example of such a situation might be if a supplier of goods or services could, if the discretion were exercised, choose not to return GST but the recipient could choose to claim an input tax deduction.

Other safeguards

67 Given the risk of real or perceived deviations from the rule of law, I propose specific safeguards:

67.1 The exercise of the discretion would be time-limited and could not exceed three years. After this time, if the issue is ongoing, an amendment to the primary legislation would be required.

67.2 The discretion would not be able to override a court decision, and the power would not be able to be used when a matter is before the courts, including the Taxation Review Authority.

67.3 Consultation would be required before the exercise of the discretion, and any exercise of the discretion would be required to be published.

Application of care and management to non-tax functions

68 Towards a new Tax Administration Act suggested clarifying that the care and management provision applies as appropriate to the Commissioner’s non-tax functions (that is, her social policy obligations). I propose progressing this work in line with the work currently being undertaken on modernising the administration of social policy.

Restructuring the Tax Administration Act

69 Proposals for modernising the Tax Administration Act also proposed restructuring the Tax Administration Act around core provisions, using more regulations, and moving to a hierarchical approach to drafting. I propose incorporating those changes as new legislation is drafted as Business Transformation is progressively rolled out, rather than by seeking to enact a new Tax Administration Act in the immediate future.

Application dates

70 The proposals relating to information are not linked to a tax year and therefore I propose they apply from date of legislative assent. Transitional rules will be required to carry over existing information sharing until such time as new agreements are entered into. The proposals to amend the error correction threshold and to extend services to other tax preparers could be linked with the income year following the assent of the legislation. On that basis, if the proposals are included in the next omnibus taxation bill, the application date for those proposals would likely be 1 April 2019.

Consultation

71 The discussion document Proposals for modernising the Tax Administration Act resulted in 15 written submissions, many of which contained significant detail. Agreement is sought to the public release of an anonymised version of these submissions at the time the bill is introduced or the proposals are announced.

72 Following public submissions my officials have undertaken a number of workshops with key submitters, involving representatives from Chartered Accountants Australia and New Zealand, the New Zealand Law Society, and the Corporate Taxpayers Group. Submitters have generally been supportive of the proposals. The workshops provided an opportunity to consult on the proposals in greater detail with the private sector. A representative of the Crown Law Office attended the workshop considering the proposal to extend the Commissioner’s care and management role. Consultation has also been undertaken with the Legislation Design and Advisory Committee over the proposal to extend the Commissioner’s care and management role.

73 My officials have consulted with the Ministry of Business, Innovation and Employment, the Department of Internal Affairs, the Ministry of Education, the Accident Compensation Corporation, Statistics New Zealand, the New Zealand Customs Service, the Ministry of Social Development, the Crown Law Office, the Ministry of Justice, the Office of the Ombudsman, the Office of the Privacy Commissioner, The Treasury, and New Zealand Police on the content of this Cabinet paper and during the development of the discussion document and proposals. The Department of the Prime Minister and Cabinet were informed.

74 The Crown Law Office was concerned about whether the proposed extension to the Commissioner’s care and management power is consistent with the rule of law, but noted that those concerns are, to a limited extent, addressed by the specific safeguards. The Crown Law Office considers that it would be preferable if the power could be exercised only by Order in Council. Submitters and the Legislation Design and Advisory Committee supported having a range of options by which the discretion could be exercised. The Legislative Design and Advisory Committee considers that rule-of-law concerns can be avoided if the power is designed properly, with a clear threshold, decision-making criteria and purpose for the exercise of the power.

75 The Legislation Design and Advisory Committee noted that the threshold for when the extended care and management power could be used was critical, and that the drafting of the threshold would need to be sufficiently clear and precise to ensure decision making is consistent over time and that the proposed procedural safeguards are not relied on as de facto limitations on the scope of the power. They noted that the equivalent Australian provision would be a good starting point, and that it could be combined with the care and management provisions’ focus on promoting voluntary compliance and reducing the compliance costs for taxpayers. This has been included in the proposal.

76 Statistics New Zealand raised concerns prior to the release of the discussion document regarding how the proposed new information-sharing framework would apply to the tax information it receives. It was agreed at that time that there may be a need for information sharing with Statistics New Zealand to be governed by a different mechanism than the regulatory model proposed in Proposals for modernising the Tax Act. I consider that it is appropriate to retain a specific legislative provision for Statistics New Zealand. This would recognise the long-established sharing, significant volume of data provided, and the statutory independence of both the Government Statistician and the Commissioner of Inland Revenue.

77 The Privacy Commissioner considers that the proposal to enable the regular collection of external datasets (recommendation 6) would allow Inland Revenue to accumulate and share large amounts of personal information to other agencies. While Inland Revenue’s information collection powers have historically been balanced by strong tax secrecy provisions, since 2011 two enabling provisions overriding tax secrecy (section 81A and section 81BA of the Act) have allowed for on-sharing of information. The combination of expanded provisions to increase the collection of information and greater sharing could result in significant privacy issues. For example, under the proposal Inland Revenue could collect bulk online trading sale and purchase data and share this information with a range of other government agencies, providing a de facto means of obtaining information that they would otherwise have no authority to access.

78 The Privacy Commissioner recommends that external datasets collected by Inland Revenue under recommendation 6 should be tagged and only disclosed under the section 81A or 81BA mechanisms where it is explicitly provided for in the Order in Council. The Privacy Commissioner welcomes the proposed requirement that Inland Revenue must consult with him on the formulation of privacy protections prior to any regulation being made under the proposed new provision.

79 In response, Inland Revenue notes that the collection of large datasets is not new – the power to collect large datasets already exists. Rather the proposal focuses on improved transparency and efficiency in those cases where the information is to be sought on a regular, rather than ad hoc, basis. A key criterion for the proposed updated information sharing provision is that agencies are only able to access information necessary to carry out their functions, thus mitigating the concern the Privacy Commissioner has raised. Inland Revenue considers that it is most appropriate to consider these issues in developing regulations for sharing information, rather than at the point of collection. It is very unlikely that an external dataset would ever meet the criteria for sharing with another agency. There may be cases where, for example, income data of a person is created or amended as a result of data obtained in this way, and on occasion that income data might be shared with another agency, where that agency is entitled to access that data, for example to determine access to entitlements.

Financial Implications

80 There is no net fiscal effect from this package of proposals. One of the proposals in this paper has a minor fiscal implication. The fiscal cost of the proposal to alter the threshold for amending assessments will be limited to the use-of-money interest that would be charged or paid if the error had been included in the original assessment versus including it in a subsequent return (when no interest will be charged or paid). It is not possible to isolate interest charged or paid on such errors, but only on reassessments more generally. After taking into account the impairment of interest, the overall net interest on reassessments under consideration is an increase of less than $0.5 million. I estimate that the change in revenue from increasing the threshold will be broadly neutral.

Human Rights

81 There are no human rights implications as a result of the proposals in this paper.

Legislative Implications

82 I propose to include the changes outlined in this paper in the next tax omnibus bill, likely to be introduced in May 2018.

Regulatory Impact Analysis

83 Cabinet’s Impact Analysis Requirements apply to these proposals and a Regulatory Impact Assessment is required. This has been prepared by Inland Revenue and is attached as appendix three.

84 The Quality Assurance reviewer at Inland Revenue has reviewed the following Regulatory Impact Assessments and considers that the information and analysis summarised in them meets the quality assurance criteria of the Regulatory Impact Analysis framework:

84.1 Making Tax Simpler: Proposals for modernising the Tax Administration Act – information collection, use and disclosure;

84.2 Making Tax Simper: Proposals for modernising the Tax Administration Act – rulings, amendments and tax intermediaries; and

84.3 Making Tax Simpler: Proposals for modernising the Tax Administration Act – flexibility for dealing with legislative anomalies.

Publicity

85 I propose to announce these measures and release an anonymised version of the summary of submissions when the bill is introduced. I also propose to proactively release the Cabinet papers relating to this matter at that time.

Recommendations

86 I recommend that the Cabinet Economic Development Committee:

Collection, use and disclosure of information

1 Agree to narrow the coverage of the confidentiality rule to information that relates to the affairs of, or would identify, a taxpayer while retaining a discretion for the Commissioner to withhold certain non-taxpayer specific information in order to protect revenue collection.

2 Agree to a new legislative framework for the exceptions to the confidentiality rule, to gather the current exceptions into a clearer, more cohesive set. This framework would include an express exception, equivalent to that contained in the Privacy Act 1993, permitting information to be disclosed where there is a risk of serious harm to public health or the safety of one or more individuals.

3 Agree to introduce a more flexible, cohesive, and transparent regulatory framework governing the sharing of Inland Revenue information for the provision of public services.

4 Note that existing specific information sharing arrangements will need to be provided for in the legislation until such time as new regulatory arrangements are put in place, however, that it is considered appropriate to retain a specific legislative provision for Statistics New Zealand and not move this sharing into a regulatory model.

5 Agree to allow Inland Revenue information to be shared for the delivery of public services where the taxpayer has consented without the need for regulations.

6 Agree to include a new provision in the Tax Administration Act 1994 that empowers the making of regulations governing the repeat or regular collection of external datasets. Consultation, including with the Privacy Commissioner, will be required before a regulation is made.

7 Agree to clarify that information collected for one particular function of Inland Revenue can be used for any other function by Inland Revenue.

Getting it right from the start

8 Agree to introduce a simplified taxpayer rulings regime, with a reduced cost, for small and medium-sized taxpayers.

9 Agree to expand the scope of the rulings regime so that the Commissioner can rule on a broader range of issues (as detailed at paragraph [40]).

10 Agree to increase the threshold for taxpayers to include an error in a subsequent return (currently $1,000) if it is less than both $10,000 and 2% of the taxpayer’s taxable income (or GST liability).

The role of tax intermediaries

11 Agree to clarify the persons who, despite not being tax agents, are eligible to receive Inland Revenue’s extended service offerings for tax preparers, subject to a person being able to be deregistered if necessary to preserve the integrity of the tax system.

12 Agree to introduce a discretion for the Commissioner to refuse to recognise a person who is acting for other taxpayers as a nominated person (rather than as an agent), where:

12.1 allowing the person to continue to act for other taxpayers would adversely affect the integrity of the tax system; and

12.2 the person is acting for a fee or otherwise in a professional capacity.

The Commissioner’s care and management role

13 Agree to enable new processes to allow exemptions to be issued to address legislative anomalies. The exemption power would be subject to safeguards including consistency with the existing policy and the principles in the care and management provision, being optional for taxpayers to apply, and expiring within three years. Depending on its nature, the legislative anomaly will be able to be addressed either by way of an Order in Council, a determination, or an administrative power of the Commissioner.

Fiscal implications

14 Note that all additional revenue and reduced expenditure that accrues under these proposals forms part of the Inland Revenue Business Transformation programme business case benefit and has already been accounted for by the Government.

15 Note that any additional administrative costs arising as a result of the proposed changes will be accommodated within the Business Transformation programme funding allocated to Inland Revenue.

Legislation

16 Agree that the proposed amendments be included in a tax bill scheduled for introduction in May 2018.

17 Delegate to the Minister of Revenue authority to make minor amendments of a technical nature to the measures recommended in this paper without further reference to Cabinet.

18 Invite the Minister of Revenue to instruct Inland Revenue to draft legislation to give effect to the proposals contained in this paper.

19 Agree to Inland Revenue carrying out targeted consultation on elements of the drafting with key stakeholders.

20 Delegate to the Minister of Revenue authority to defer aspects of the proposals to the second omnibus taxation bill of 2018 if this becomes appropriate.

Publicity

21 Invite the Minister of Revenue to release a media statement to announce these measures when the bill is introduced.

22 Agree to the public release of an anonymised summary of submissions and the Cabinet papers related to this matter at the time the bill is introduced.

Authorised for lodgement

Hon Stuart Nash

Minister of Revenue

Appendix 1

| Current law | Proposal in Discussion Document | Final policy proposal |

|---|---|---|

| Confidentiality Inland Revenue staff must maintain the secrecy “of all matters” relating to the Inland Revenue Acts. |

Narrow the coverage of the confidentiality rule to information that would identify a taxpayer. | Narrow the coverage of the confidentiality rule to information that relates to the affairs of, or would identify a taxpayer. |

| As above, Inland Revenue staff must maintain the secrecy “of all matters” relating to the Inland Revenue Acts. | Retain an ability for the Commissioner to withhold certain non-taxpayer-specific information in order to protect revenue collection. | Retain a discretion for the Commissioner to withhold certain non-taxpayer specific information in order to protect revenue collection. |

| Current secrecy rule has a large number of ad hoc legislative exceptions that could be seen to lack cohesion, transparency and clear unifying principles. | Clearly set out the broad categories of exceptions to the new taxpayer confidentiality rule. | Same as the proposal in the discussion document. |

| Cross agency sharing Cross agency sharing is mostly governed by ad hoc legislative amendments. Some use of Privacy Act AISA rules and section 81BA of the Tax Administration Act, both of which allow information sharing via regulations. |

Provide a legislative framework for sharing Inland Revenue’s information with other agencies for the provision of public services that:

|

ntroduce a more flexible, cohesive, and transparent regulatory framework governing the sharing of Inland Revenue information for the provision of public services. |

| Consented sharing Taxpayer consent does not enable information release – tax secrecy is an obligation on Inland Revenue and not something the taxpayer can waive (unlike privacy). |

Allow information to be shared for public services without need for regulations where the taxpayer concerned has consented. | Allow Inland Revenue’s information to be shared for the delivery of public services where the taxpayer has consented without need for regulations. |

| Inland Revenue officers are obliged to keep information confidential (and face penalty for knowing disclosure). | Retain the obligation on Inland Revenue officers to keep information confidential. | Retain the obligation on Inland Revenue staff to keep information confidential (applied to the proposed narrower set of information). |

| Generally confidentiality obligations follow the information, however this has become unclear in some cases due to the extensive addition of ad hoc exceptions to the tax secrecy rule. | Clarify how the confidentiality rule applies to people who receive Inland Revenue’s information. | Same as the proposal in the discussion document. |

| As above, generally confidentiality obligations (and penalties for breach) follow the information but over time the legislation has become unclear in some cases. | Clarify the penalty for improper disclosure. | Same as the proposal in the discussion document. |

| Collecting information Inland Revenue can request any information that is considered “necessary and relevant” on an ad hoc basis. The rule is not well suited to repeat collection of the same data. |

Include a new provision in the Tax Administration Act that empowers the making of regulations governing external datasets and provides transparency regarding such collection. | Same as the proposal in the discussion document. |

| Legislation does not clearly state that information gathered for one function of Inland Revenue may be used for other functions of Inland Revenue. | Clarify that information collected for one particular function can be used for any other function of Inland Revenue. | Same as the proposal in the discussion document. |

| Advice: cost of ruling The key way that a taxpayer can currently get binding certainty on a tax position is to get a binding ruling. However, the fees charged for rulings are a significant barrier to smaller businesses and individuals getting a ruling. |

Reduce the fees significantly for obtaining a binding ruling, at least for small and medium-sized enterprises. The reduction would be achieved either by having a low application fee for all rulings or a graduated schedule of application fees depending on the size or type of entity. | Introduce a simplified taxpayer rulings regime, with a reduced cost, for small and medium-sized taxpayers. The simplified process will remove some of the current legislative and operational requirements for obtaining a binding ruling, and will have a reduced fee. The simplified process will reduce the possible advisor costs for the taxpayer, in addition to the reduced fee. |

| Advice: scope of rulings regime The current rulings regime is limited to providing certainty in respect of certain specified tax issues. |

Expand the scope of the rulings regime, and clarify certain aspects of the regime. | Same as the proposal in the discussion document. |

| Advice: Post-assessment rulings Currently, a ruling application generally cannot be made following an assessment. This means that following an assessment, a taxpayer generally can only get certainty about a tax issue by proceeding through the formal disputes process. |

Allow a taxpayer to apply for a post-assessment binding ruling. The proposal was aimed at reducing the time for a taxpayer to know the Commissioner’s opinion when there was a discrete legal issue in dispute. | Delay post-assessment rulings until further work has been completed on tying it in with the ongoing consideration of Inland Revenue’s organisational design, the wider advice framework and other elements of the assessment and dispute processes. |

| Amending assessments Currently, if a taxpayer finds an error once a return has been filed, they must go back and reopen the relevant assessment and make the change in the original assessment. There is a limited ability to include an error in a subsequent return if it satisfies the requirement to be a clear mistake or simple oversight, and the error is less than $1,000. |

Align the process for fixing a minor error more closely to the accounting process adopted by taxpayers (to some extent). Specifically, remove the requirement to prove that the error was a clear mistake or simple oversight, and increase the threshold to equal or less than both $10,000 and 2% of their taxable income or output tax for the relevant period. | Same as the proposal in the discussion document. |

| Role of tax intermediaries Currently, only a tax agent that files 10 or more income tax returns is able to access Inland Revenue’s extended service offerings. This restriction is not required by law, but is an administrative decision by the Commissioner to better ensure the integrity of the tax system |

|

|

| Care and management The Commissioner currently has some limited administrative flexibility as to how she allocates her resources. However, she does not have an ability to administratively remedy situations when the interpretation of a provision does not align with its policy intent (a legislative anomaly). This ties up Commissioner and taxpayer resources in outcomes that are inconsistent with both parties’ practices and expectations. |

Extend the care and management provision to allow the Commissioner some greater administrative flexibility to deal with legislative anomalies. The proposed extension was limited by certain specified criteria, and was subject to certain safeguards. The proposed criteria included minor or transitory anomalies, cases when the legislation did not adequately deal with a particularly complex issue, when a long-standing practice had been overturned, and cases of unfairness at the margins. The extended power would not necessarily be legally binding. | Extend the Commissioner’s care and management power to allow exemptions to be issued to address legislative anomalies. The exemption power would be subject to safeguards including consistency with the existing policy and the principles in the care and management provision, being optional for taxpayers to apply, and expiring within three years. Depending on its nature, the anomaly will be able to be remedied either by way of an Order in Council, a determination, or an administrative power of the Commissioner. |