Chapter 6 - Structuring around the rules

6.1 There are two main structuring opportunities that we have considered creating specific rules to deal with. These concern interest allocation and the interposing of entities.

Interest allocation

6.2 We have considered whether specific interest allocation rules are required, as without them investors may be able to structure around the loss ring-fencing rules. For example, this could be done by reorganising funding so that business assets other than rental properties are debt-funded, and rental properties are equity-funded to the greatest extent possible.

6.3 However, interest allocation rules would add substantial complexity and compliance costs. Because money is fungible, it is very difficult to attempt to match borrowings to particular investments (tracing). Stacking rules (for example, allocating debt firstly to ring-fenced investments) may be seen as unfair. And pro rata interest allocation between assets that are subject to the ring-fencing rules and those that are not would require regular valuation of assets.

6.4 If interest on any loan that was secured by a residential property was included in the rules, this would create issues for many people who use their rental properties to secure loans for their businesses. This would impact on small and medium business’ access to capital. In addition, many arrangements could be even more difficult to apply interest allocation rules to, as revolving credit facilities are often used to fund both a rental property and a business.

6.5 We do not propose specific interest allocation rules because of the considerable complexity and compliance costs they would add, which would be particularly onerous on smaller taxpayers.

Interposed entities

6.6 Under the suggested changes, there would be special rules to ensure that a trust, company, partnership, or look-through company cannot be used to get around the ring-fencing rules. These ownership structures are referred to here as entities for simplicity.

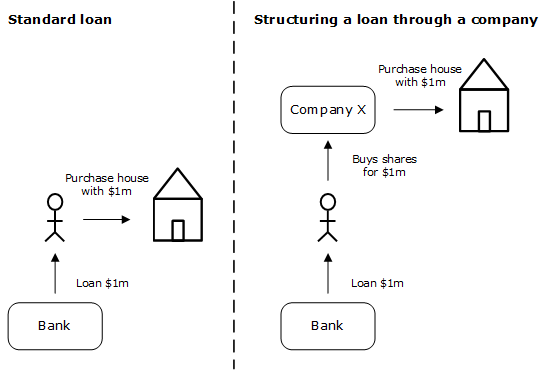

6.7 Otherwise a simple way to get around the ring-fencing rules would be for a taxpayer to interpose an entity to hold a residential rental property, and borrow money to invest in or acquire an interest in the entity. For example, a taxpayer could borrow money to buy shares in a company, which uses those funds to buy a residential investment property. Because the money is borrowed to buy shares, the individual taxpayer would be able to claim deductions for the interest on the borrowings, and offset those amounts against other income sources.

6.8 However, if the taxpayer had used the borrowed money to purchase the property directly themselves, the interest expense would be attributable to the residential rental investment, not shares, so would be taken into account in determining whether the person’s residential rental activity was profit or loss-making. And if the rental activity was loss-making, losses would be ring-fenced under the proposal rules.

6.9 This simple mechanism is illustrated in figure 1.

Figure 1

[Source for image: SVG] |

|

|

|

6.10 A specific rule to deal with the interposing of entities would ensure that this simple mechanism cannot be used to get around the loss ring-fencing rules, undermining their credibility.

6.11 A suggested approach to dealing with interposed entities is to specifically define when such entities would be “residential property land-rich”. It is proposed that this would be the case where over 50 percent of the entity’s assets are residential properties within the scope of the ring-fencing rules, and/or shares or interests in other residential property land-rich entities. The rules could then treat dividends, interest, or distributions from the entity as being “rental property income”, and treat interest on borrowings to acquire an interest in the entity (for example, shares, securities, a partnership interest, or an interest in the trust estate), as “rental property loan interest”. The rules could then ensure that the interest deduction is only allocated to the income year in question to the extent it did not exceed the distributions from the entity (deemed rental property income), any other residential rental income, and residential land sale income (as discussed in chapter 5). Any excess of interest over distributions, rental income, and land sale income would be carried forward and treated as “rental property loan interest” for the next income year. This would mean that losses from rental properties would not reduce the tax on other sources of income.

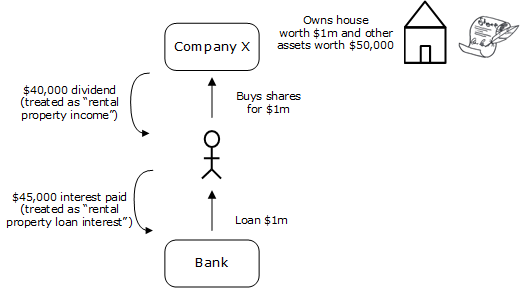

6.12 This suggested approach is illustrated in figure 2.

Figure 2

[Source for image: SVG]

- More than 50 percent of Company X’s assets are residential property, so Company X is “residential property land-rich”.

- Because Company X is “residential property land-rich”:

- the $40,000 dividend the person receives is treated as “rental property income”; and

- the $45,000 interest on the loan to buy shares in the Company X is treated as “rental property loan interest”.

- The $45,000 deduction for “rental property loan interest” is more than the “rental property income” of $40,000, so only $40,000 of the deduction is allocated to this income year.

- The remaining $5,000 deduction is carried forward and treated as “rental property loan interest” for the next income year.

6.13 We are interested in feedback on this suggested approach to preventing the simple interposition of an entity to get around the ring-fencing rules.