Chapter 2 – Background

2.1 The GST treatment of non-profit bodies (NPBs) differs from that of other entities in two areas:

- The supply of donated goods and services by an NPB, for example the sale by a charity shop of donated clothing, is exempt. This means that no GST is paid on the sale of these goods and services, and no input tax deductions are available for GST costs incurred in making those sales.

- Except for exempt supplies (such as the sale of donated goods), input tax deductions can be claimed by NPBs for all GST incurred for any activity that is not an exempt activity of an NPB. The receipt and payment of donations is outside the scope of GST rather than specifically exempt. Under current legislation, NPBs can therefore claim input tax deductions (often in the form of refunds) for the GST costs involved in fundraising and distributing funds or providing services. As a result, of the 19,000 NPBs registered for GST purposes, 7,000 are registered despite the fact that their annual turnover does not exceed the $60,000 compulsory registration threshold.

2.2 The exemption for donated goods and services by an NPB is clearly legislated for and will not be affected by the proposals in this issues paper. Rather, the issues paper concentrates on the lack of specific guidance in the legislation on the output tax (the GST charged) liabilities of an NPB where goods and services that are not specifically exempt are supplied by an NPB. The question of whether GST is payable in these cases is dependent on whether the goods and services in question are supplied in the course or furtherance of the NPB’s “taxable activity”, that is any regular activity that involves making supplies for consideration.

2.3 The GST treatment of NPBs’ outputs has been uncertain since the introduction of GST, so it has likely been assumed by many that the liabilities would be the same as for any GST-registered person apart from the exemption for donated goods and services. In other words, some may have assumed in line with the general expectation under the GST system, that GST is payable on any supply for which input tax deductions have been claimed. This was because it may have been thought that, once an entity registers, all its activities (other than its expressly exempt activities) form part of the entity’s taxable activity.

What is a “taxable activity”?

2.4 What might constitute an NPB’s taxable activity has recently been more closely considered by Inland Revenue. It is suggested that the taxable activity may not include activities undertaken by the NPB that do not have a sufficient connection with the activity of making supplies for a consideration. So when there are two activities, one of which involves making supplies for consideration and the other of which involves making supplies for no consideration, the question is whether the two activities have a sufficient connection with each other to be treated as one taxable activity or as two activities, one taxable and one not. It may also be possible to have situations where there is more than one taxable activity and other activities that are not taxable.

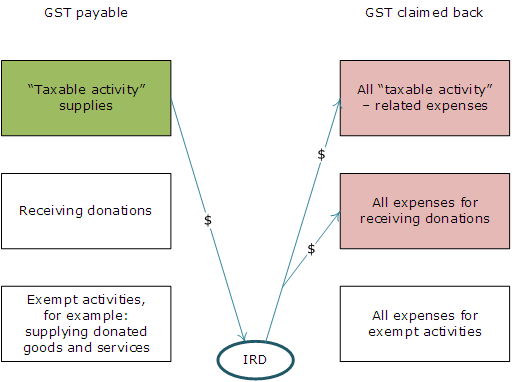

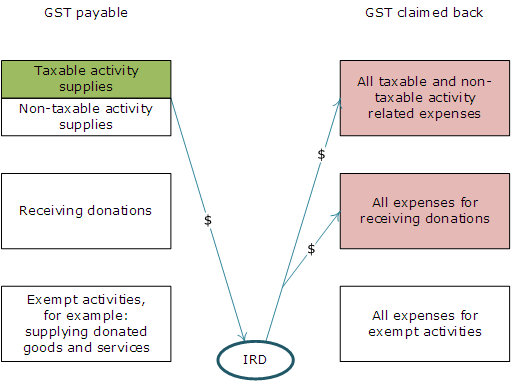

2.5 Figures 1 and 2 illustrate the GST position for an NPB under the earlier alternative interpretation (“old interpretation”) and the “new interpretation’ of “taxable activity”. The green box on the left hand column shows the GST payable by the NPB and the red boxes on the right show the GST that can be claimed back by the NPB. The non-coloured boxes show where GST is either not payable or not able to be claimed back.

2.6 Note that the only difference between figures 1 and 2 is that the GST payable is reduced because some supplies that were previously considered part of an NPB’s taxable activity are now non-taxable supplies. While they are not exempt supplies under the GST Act, they are still excluded from the “taxable activity” definition as they do not have a sufficient connection with an activity from which money (or other consideration) is derived. Importantly, while described differently, the new interpretation does not change the level of input tax deductions that can be claimed by NPBs.

Example 1: Asset not part of the taxable activity

A charity for the homeless owns two buildings – one a headquarters dedicated to fundraising and one an emergency accommodation facility which charges a fee based on the facility’s costs for its services. The funds raised assist towards researching issues about homelessness and finding local and national solutions.

The charity has claimed input tax deductions for capital, maintenance and overhead costs relating to both buildings. Following Inland Revenue’s recent interpretation, it could be argued that the charity would not be required to pay output tax on a sale of the fundraising headquarters because the sale would not have been made in the course or furtherance of the taxable activity of providing emergency accommodation. This situation arises because:

- Unlike other GST payers, NPBs are entitled to input tax deductions for all GST incurred unless it relates to making exempt supplies – so deductions can be claimed for fundraising activities.

- The fundraising activity does not on balance have a sufficient connection with the activity of providing accommodation to the homeless for a fee.

This example is illustrated in figures 1 and 2.