Proposed changes to PAYE and GST

- Agency disclosure statement

- Reader’s guide to this RIS

- Status quo and problem definition

- Objectives

- Regulatory analysis

- Conclusion

- Consultation

- Implementation

- Monitoring evaluation and review

- Appendix A - Using digital services to integrate tax requirements into business processes

- 1. PAYE information at the time of the business process

- 2. Facilitating provision of PAYE information through payroll software

- 3. Remit PAYE and related deductions on payday

- 4. PAYE – encouraging the take-up of digital services and targeting support

- 5. PAYE Thresholds

- 6. GST –Introducing a framework for setting an electronic filing threshold for GST returns

- Appendix B - Getting it right from the start

- Appendix C - Making the PAYE rules work better

Agency disclosure statement

This Regulatory Impact Statement (RIS) has been prepared by Inland Revenue. It provides an analysis of options to improve the administration of PAYE and GST.

The options considered are intended to reduce compliance costs for businesses and administrative costs for Government, while improving the administration of PAYE and social policy and ensuring the rules are robust. The options were developed in the context of the wider tax policy framework of a clear and coherent broad-base, low-rate tax system.

It is challenging to accurately forecast some of the costs (including compliance, and administrative costs) for the options due to information not being available or difficulty in estimating likely behavioural changes. Equally, it is difficult to determine the number of taxpayers who may be impacted by the proposals as various factors may influence the decision to adopt a proposal. Instead, indications of the direction and order of magnitude have been provided where appropriate.

None of the policy options restrict market competition, impair property rights, reduce incentives for small businesses to operate, or override fundamental common law principles.

Mike Nutsford

Policy Manager, Policy and Strategy

Inland Revenue

2 June 2016

Reader’s guide to this RIS

This document covers 9 discrete proposals which have been grouped into three themes. To manage this large number of topics we have shifted the detailed analysis of each theme, and the component proposals within that theme, out of the Regulatory Analysis section and into a set of three appendices.

The body of the RIS still contains an overview of the options considered but the detailed analysis of the costs, benefits, impacts and recommendations is contained in the corresponding appendix. Within the overview tables the following symbols are used:

✔✔ Significantly better than the status quo

✔ Better than the status quo

✘ No better than the status quo

✘✘ Worse than the status quo

The consultation section of the RIS provides a summary of our consultation approach with the feedback received on each proposal set out in corresponding appendix.

STATUS QUO AND PROBLEM DEFINITION

Inland Revenue’s transformation programme

1. The Government’s objective for the revenue system is for it to be as fair and efficient as possible in raising the revenue required to meet the Government’s needs. For taxpayers the tax system should be simple to comply with, making it easy to get right and difficult to get wrong. It should serve the needs of all New Zealanders, put customers at the centre and help them from the start, rather than when things go wrong.

2. The shift to digital and greater globalisation has reshaped how businesses and individuals interact and connect, and their expectations of government.

3. Businesses are increasingly using software packages to automate processes and reduce their compliance burden. Businesses have consistently ranked tax as their highest compliance priority, and it often contributes the most to their overall compliance burden. Compliance costs could be reduced by making better use of businesses’ everyday processes and systems to meet tax obligations. Enabling businesses to spend less time on tax and more time on running their business will support Government’s wider goals of building a more competitive economy and delivering better public services.

4. The ways in which individuals work has changed with different types of employment and working arrangements. The New Zealand workforce has become more casualised as permanent employment has become less common, and temporary, casual and contract work has become more prominent. Other trends include part-time and temporary workers increasingly holding multiple jobs, and more self-employment and small businesses. Many of the current tax policies and administrative processes were designed for an era when New Zealand’s workforce was more strongly characterised by salary and wage earners in permanent full-time employment arrangements.

5. To protect the Government’s ability to collect sufficient revenue to keep providing services, it is important that New Zealand’s revenue system keeps pace with change and is as efficient as possible. The fiscal challenges associated with an ageing population and associated demand for high quality healthcare and other services will add impetus to the need for a highly efficient and responsive revenue system. To meet these challenges, Inland Revenue requires a fundamental shift in the way it thinks, designs, and operates.

6. The Government has agreed to change the revenue system through business process and technology change. A digitally-based revenue system, simplified policies, and better use of data and intelligence to better understand customers will simplify how services are delivered and change how customers interact with the revenue system.

7. Having a good overall revenue system means having both good policies and good administration. While the policy framework is fundamentally sound, there is an opportunity to review current policy and legislative settings as levers to help modernise the revenue system and ensure it is responsive to global changes.

8. There is no doubt that Inland Revenue’s computer systems (known as FIRST) need replacement to improve resilience and agility. They have reached the end of their life and are not sustainable in the medium to long term. The FIRST systems are aging, extremely complex, very difficult and costly to maintain, and inflexible. Since FIRST was implemented, a number of income-related social policies have been added to the platform. Implementing social policies within a platform designed for tax administration has added layers of complexity and risk to Inland Revenue’s business processes and technology infrastructure. This in turn limits the department’s ability to respond to government policy priorities.

9. However, Business Transformation is far more than just updating a computer system. It is a long-term programme to modernise New Zealand’s revenue system, and will re-shape the way Inland Revenue works with customers, including improvements to policy and legislative settings and enabling more timely policy changes. A new operating model and new systems will be the catalysts for these changes.

10. PAYE and GST are key components of the New Zealand tax system. This regulatory impact statement outlines options made possible by modernisation of the New Zealand revenue system, for improving the administration of PAYE and GST.

Problems with PAYE and GST and their magnitude

11. PAYE raises 37% of tax revenue. In addition PAYE processes are used for the payment of the ACC earners’ levy, some child support obligations, student loan repayments, employer’s superannuation contribution tax (ESCT), payroll giving and KiwiSaver contributions (of both employers and employees).

12. PAYE income information is used to assess entitlements for tax credits, to determine child support obligations and to determine whether benefit entitlements from the Ministry of Social Development (MSD) and compensation entitlements from the Accident Compensation Corporation (ACC) have been overpaid.

Compliance costs

13. PAYE imposes compliance costs on more than 194,000 New Zealand employers. Because of the absence of economies of scale it is generally accepted that PAYE imposes higher per employee compliance costs on small employers than on larger ones. If this is considered to be unfair thresholds and subsidies are mechanisms which can be used to differentiate obligations or offset costs. On the other hand such subsidies and thresholds impose costs on society in general and taxpayers specifically. From a dynamic perspective they can be seen as encouraging the growth of small business relative to other investments, although in this context it is appropriate to note that employers are not necessarily businesses. Non-profit organisations, individuals, clubs and societies can all have obligations as an employer. The role for thresholds and subsidies is considered further in many of the options canvassed in this regulatory impact statement.

14. For the smallest employers (1 – 5 employees) the most recent compliance cost survey (2013) identified the median hours spend on PAYE as 12 hours a year. The PAYE legislation is prescriptively written. It requires PAYE information to be provided on a monthly basis which prevents employers and the government benefiting from using business software to integrate PAYE obligations into normal business processes, such as paying staff. Estimates made for Inland Revenue’s Business Transformation business case suggest that using modern digital services could reduce PAYE compliance costs on small employers (1-5 employees) by between 15% and 40%.

15. PAYE information is currently required monthly, by the 5th of the following month for the largest employers and by the 20th of the following month for all other employers. Although PAYE information is provided for each employee it is aggregated across the pay periods in the month to provide monthly totals.

Impact on individual employees

16. The aggregated and delayed nature of current PAYE information enables errors to perpetuate across multiple pay periods and limits Inland Revenue’s ability to identify and work with employers to rapidly correct them. In turn this affects individual employees who can have PAYE over or under-withheld or can incur additional student loan deductions or child support or Working for Families’ debt. As an example almost 19,000 student loan borrowers were required to make addition deductions in the year to June 2015 because they were on the wrong tax code.

17. The aggregated and delayed nature of current PAYE information also limits opportunities to improve the future operation of social policy for example by reducing the period over which social policies such as Working for Families are assessed. A shorter assessment period could allow assistance to better match periods of need.

PAYE rules

18. The existing tax treatment of holiday pay paid in advance has a tendency to result in over-withholding of PAYE, which gives rise to fairness concerns.

19. Different types of PAYE income payments and PAYE-related social policy products currently have different rules on what is to be done when there is a legislated rate (or threshold) change during a pay period or if there is rate (or threshold) change between the date the payment is made and the pay period to which the payment relates. This creates complexity and confusion for employers, which adds to compliance costs.

GST

20. GST raised 36% of tax revenue in the year to June 2015. Around 640,000 persons and businesses are registered for GST. The time and costs they incur in complying with their GST obligations and the cost of administering GST could be reduced and efficiency improved if more use was made of electronic services in interaction with Inland Revenue.

OBJECTIVES

21. The Government is committed to making positive changes to reduce the time and costs to employers of meeting their tax obligations, it also seeks more useful and timely PAYE information to improve the administration of social policy and support wider improvements to public services. The criteria against which the options have been assessed are:

a. Fairness and equity: to support fairness in the tax system, options should, to the extent possible, seek to treat similar taxpayers in similar circumstances in a similar way.

b. Efficiency of compliance and administration: the compliance impacts on taxpayers and the administrative costs to Inland Revenue should be minimised as far as possible.

c. Sustainability of tax and income-related social policy system: options should collect the revenue required in a transparent, coherent and timely manner while not leading to tax driven outcomes and should enable more timely policy changes.

d. Basis for improved social policy and other government services: options should support the more effective use of income information in the delivery of social policy and improved information sharing between government agencies to deliver better public services.

22. These criteria are weighted equally. It is acknowledged however that judgements are affected by the weight given to different aspects for example ‘Fairness and equity’ involves consideration of both the employers who may benefit from a subsidy or incentive and of taxpayers who must pay for it.

23. Impacts on employees are considered, from a systems perspective under ‘Sustainability of the tax and income-related social policy system’ and under ‘Basis for improved social policy and other government services’. This later criterion is only used in respect of PAYE information.

24. Fiscal impacts are identified where relevant. There are no social, environmental or cultural impacts from these recommended changes.

REGULATORY ANALYSIS

25. Officials have developed options to address the above issues. These options have been grouped into the following three key themes:

A. Using digital services to integrate tax requirements into business processes

B. Getting it right from the start (additional PAYE information)

C. Making the PAYE rules work better.

26. Each of these themes and the options under them are summarised below. Further detail on the issues and options under each theme is contained in the appendices.

27. Within the overview tables the following symbols are used.

✔✔ Significantly better than the status quo

✔ Better than the status quo

✘ No better than the status quo

✘✘Worse than the status quo

A. Using Digital services to integrate tax requirements into business processes

28. Currently businesses and other employers need to manage their PAYE obligations as separate processes which stand-alone from the management of business as usual. Elsewhere businesses, organisations and individuals are increasingly harnessing the power of software to automate, integrate and facilitate processes.

29. Maintaining the current PAYE processes would deny employers the opportunity to take advantage of modern digital services to reduce compliance costs by integrating PAYE requirements into business processes. Integrating tax requirements into business processes, such as providing PAYE information at the time employees are paid, would also reduce administrative costs and lay the basis for improved service provision to employees from Inland Revenue and wider government.

30. Using digital services to reduce compliance and administrative costs and improve the quality of government services is crucially dependent on the nature and quality of the PAYE-related services offered in payroll software and options are considered to ensure payroll software facilitates the provision of PAYE information at the time of the business process.

31. To maximise available compliance and administrative savings and reflect the fact that PAYE and related deductions belong to employees and then the Crown, PAYE and related deductions should also be remitted on payday. Options for changing when remittance of PAYE and related deductions are due are considered.

32. Options for encouraging and targeting the uptake of digital services are also considered in this section as is the use of thresholds to differentiate obligations between larger and smaller employers.

33. The final proposal in this section examines options for reducing the costs associated with filing GST returns.

Options and Analysis

34. The proposals to address the issues identified are:

- PAYE information at the time of the business process

- Provision of PAYE information through payroll software

- Remit PAYE and related deductions on payday

- PAYE - encouraging the take-up of digital services and targeting assistance

- PAYE thresholds

- GST – Introducing a framework for setting an electronic filing threshold for GST returns

PAYE Information provision at time of business process

35. To improve processes for the provision of PAYE information officials have considered a number of options. These options centre on whether or not employers are required to provide information at the time of the business process, for example providing information about income and deductions on payday[1]. The options are summarised below and are outlined further in appendix A -1.

| Options | Comparison to status quo |

| 1. Retain the status quo – where the legislation requires PAYE information on a monthly basis regardless of the employers pay cycle. | |

| 2. Voluntary provision of PAYE information at time of business process | Fairness and equity ✔ |

| 3. Require PAYE information on payday[2] and other PAYE information[3] no later than payday. For employers below a threshold and not using payroll software the due date would allow for returns to be posted. | Fairness and equity ✘ |

| 4 Require pay period PAYE information on payday[4] and other PAYE information[5] no later than payday above a threshold and at month end for those below the threshold or exempt, the due date for this category would allow time to post a return. | Fairness and equity ✔✔ |

Recommendation

36. Option three, requiring PAYE information on payday from all employers would represent a significant improvement on the status quo and rates highest on the criteria related to the sustainability of the tax and income-related social policy system and the extent to which it creates a foundation for future improvements to social policy. It reflects the proposition that this information is available at this point in time as a result of the employer paying staff and could therefore be provided to Inland Revenue at little additional cost.

37. Officials however recommend option 4. Option 4 would require pay-period PAYE information to be provided on payday above a threshold and at month end from those below the threshold and from those with an exemption because they are unable to access digital services. This option balances the interests of employers with small payrolls who may not derive the benefits associated with the use of payroll software against the wider system benefits that are available from payday filing of PAYE information.

Facilitating provision of PAYE information through software

38. The Commissioner can prescribe the content and format for electronic forms. The options considered below centre on whether or not payroll software should:

- only be able to be used to provide PAYE information on payday[6], even in circumstances where the employer is below a payday filing threshold and could chose to file with a later due date, and

- be required to offer services which employers can chose to use to advise of new and departing employees when they are added to or removed from the payroll.

39. The options are summarised below and are outlined further in appendix A -2.

| Options | Comparison to status quo |

|---|---|

1. Status Quo – leave it to the market to decide whether

|

|

2. Require payroll software to:

|

Fairness and equity ✔ |

Recommendation

40. Officials recommend option 2 which requires payroll software providers to only offer payday filing and to offer a service to notify IR when new employees are added or removed from the payroll. This option best supports the objectives of reduced compliance and administrative costs and provides the best basis for subsequent improvements to social policy.

Remit PAYE and related deductions on payday

41. Officials have considered three options to address opportunities in relation to PAYE remittance and its integration into business processes and the use of digital services. These options focus on whether the timing and process of remitting PAYE should be required to be aligned with:

- the business process of paying employees, and

- the timing and process of providing PAYE information to Inland Revenue.

42. It is noted that those employers who are not required to align PAYE remittance with the process of paying their employees under the below options will be able to remit PAYE on payday on a voluntary basis should they wish to take advantage of integrating all PAYE obligations with their business processes.

43. These options are summarised below and are outlined further in appendix A-3.

| Options | Comparison to status quo |

|---|---|

| 1. Retain the status quo – employers are allowed to hold PAYE and related deductions until they are required to remit them to Inland Revenue either once or twice a month. | |

| 2. Align the remittance of PAYE with the business process of paying staff for all employers. | Fairness and equity: ✘✘ |

| 3. Align the remittance of PAYE with the business process of paying staff for employers above a threshold and payroll intermediaries, and retain delayed PAYE remittance for employers below the threshold. | Fairness and equity: ✘ |

Recommendation

44. Officials recommend option 3 as it balances the benefits of aligning PAYE (and related deductions) remittance with the business process of paying employees and the consideration of the impact payday remittance may have particularly on small businesses and not-for-profit organisations. Officials acknowledge that retaining the status quo while allowing employers who chose to do so, to remit on payday, would avoid the negative impacts that requiring payday remittance could have.

PAYE encouraging the uptake of digital services and targeting support

45. Government has identified a major role for digital technology in making tax simpler and a key focus will be working with the software industry to ensure the deployment of high quality user friendly services. A payroll subsidy currently exists to encourage small businesses to outsource their PAYE obligations. Officials have considered options to encourage digital uptake and target support. The options are summarised below and are outlined further in appendix A-4.

| Options | Comparison to status quo |

|---|---|

| 1. Retain the status quo – leave the payroll subsidy threshold where it is. | |

| 2. Reduce the payroll subsidy threshold to better target the subsidy. | Fairness and equity ✔✔ |

| 3. Repeal the payroll subsidy | Fairness and Equity ✔ |

Recommendation

46. Option 3 addresses the concerns about eliminating distortions and weights fairness to the tax payer higher than option 2.

47. Officials recommend option 2 to reduce the payroll subsidy threshold to better target the subsidy and reduce the potential for it to distort decisions about whether or not to use a listed payroll intermediary (eligible for the subsidy) or to purchase payroll software or other services (ineligible).

PAYE thresholds

48. Because of the absence of economies of scale PAYE obligations impose higher per employee compliance costs on small employers than on larger ones. Although not without costs of their own thresholds are a mechanism through which obligations and entitlements can be differentiated to mitigate the higher compliance costs and to target support.

49. Officials have considered four options for a PAYE threshold to apply to the following obligations and entitlements:

- The obligation to file PAYE information electronically

- The obligation to file PAYE information on payday

- The obligation to remit PAYE and related deductions on payday

- Eligibility for the payroll subsidy

50. These options are summarised below and are outlined further in appendix A-5

| Options | Comparison to status quo |

|---|---|

1. Status quo thresholds which relate to the above obligations and entitlements as follows: $100,000pa of PAYE and ESCT[7] for electronic filing- but no payday filing obligation. $500,000pa of PAYE and ESCT threshold for twice monthly remittance of PAYE and for PAYE information by 5th of following month. $500,000pa of PAYE and ESCT as the threshold for the payroll subsidy. Change to threshold requires legislative amendment. |

|

2. One PAYE threshold for all obligations and entitlements at $100,000pa of PAYE and ESCT. Threshold able to be changed by Order-in-Council following consultation |

Fairness and equity ✔ |

3. One PAYE threshold for all obligations and entitlements at $50,000pa of PAYE and ESCT. Threshold able to be changed by Order-in-Council following consultation |

Fairness and equity ✘ |

4. Status quo: $500,000pa of PAYE and ESCT threshold for frequency of twice monthly remittance. $50,000pa of PAYE and ESCT for electronic filing. All employers to submit PAYE information on payday. No payroll subsidy. Threshold able to be changed by Order-in-Council following consultation. |

Fairness and equity ✘ |

Recommendation

51. The analysis of the options depends on the importance ascribed to the various obligations, particularly the importance of payday information compared to the value put on payday remittance of PAYE.

52. Because it balances the objective of receiving PAYE information earlier against small businesses’ concerns about the cash flow impact of earlier remittance officials recommend option 2 to introduce a single threshold at $100,000 a year of PAYE and ESCT to determine the following obligations and entitlements:

- The obligation to file PAYE information electronically

- The obligation to file PAYE information on payday

- The obligation to remit PAYE and related deductions on payday

- Eligibility for the payroll subsidy

- The threshold able to be changed in future by Order in Council following consultation:

GST – Introducing a framework for setting an electronic filing threshold for GST returns

53. Currently there is no electronic filing threshold for the filing of GST returns. To address uptake of electronic services for GST in the future and its benefits officials have considered two options.

54. These options are summarised below and are outlined further in appendix A-6.

| Options | Comparison to status quo |

|---|---|

| 1. Retain the status quo – All taxpayers can choose to file their GST returns electronically or on paper. | |

| 2. Introduce a framework for the setting of an electronic filing threshold for GST returns. | Fairness and equity: ✘ |

| 3. Introduce a non-electronic filing penalty set at $250 as part of the framework under option 2. | Fairness and equity: ✔ |

Recommendation

55. Officials recommend options 2 and 3 to introduce a framework for setting an electronic filing threshold for the filing of GST returns by Order-in-Council in the future and a non-electronic filing penalty set at $250 as part of this framework.

56. Combined option 2 and 3 recognise the benefits of reduced compliance and administrative costs and reduced transcription errors that can be realised through electronic filing. The option acknowledges the relatively high level of uptake of electronic filing for GST returns under current Inland Revenue services and provides a mechanism to introduce a threshold if electronic filing does not continue to increase.

B. Getting it right from the start

Provision of date of birth information and contact details for all new employees

57. Because new employees are not always set up correctly from the start, or as near as possible to the start of their employment PAYE compliance and administrative costs are higher than they need to be and employees can incur social policy debt and be subject to incorrect PAYE withholding.

58. The recommended requirement that payroll software should offer employers the opportunity to forward new employee details as soon as they are added to the payroll and before they are first paid will contribute to reducing these problems. Current tax processes are however out of step with modern approaches to identity confirmation in not seeking date of birth information and in not taking the opportunity to update contact details at the time employment changes. The options also consider whether employers should be able to pass on information such as contact details already gathered from the employee.

59. Officials have considered two options which are summarised below and set out in more detail in Appendix B-1.

| Options | Comparison to status quo |

|---|---|

| 1. Retain the status quo: No date of birth information and contact details only from those in or eligible for KiwiSaver and no ability for employer to pass on information already gathered from an employee. |

|

| 2. Require date of birth and contact detail information for all new employees and enable employers to pass on information already gathered. | Fairness and equity ✔ |

Recommendation

60. Officials recommend option 2 to require date of birth and contact information for all new employers while allowing employers to pass on information already gathered from an employee for their own purposes.

C. Making the PAYE rules work better

Tax treatment of holiday pay

61. The tax treatment of holiday pay differs depending on whether it is paid as a lump sum (in which case it is treated as an extra pay), or whether it is included in an employee’s regular pay or paid in substitution for an employee’s ordinary salary or wages when annual paid holidays are taken (in which case it is treated as salary or wages).

62. Holiday pay paid in advance as a lump sum is currently taxed as an extra pay. This has a tendency to result in over-withholding of PAYE. Anecdotally, it is common for employees in some industries to work longer hours in the lead up to Christmas, which can exacerbate the over-withholding caused by using the extra pay formula. This, combined with receiving no income during the following weeks when the holiday is taken, may make things difficult for the employee financially.

63. While employees are able to obtain a refund for any over-withheld tax following the end of the tax year, the fact that it can adversely affect employees’ adequacy of income around the period the holiday is taken gives rise to fairness concerns.

64. Officials have considered a number of options, which are summarised below and outlined in more detail in Appendix C-1.

| Options | Comparison to status quo |

|---|---|

| 1. Retain the status quo | |

| 2. Require employers to deduct PAYE from holiday pay paid in advance as if the lump sum payment was paid over the pay periods to which the leave relates | Fairness and equity ✔✔ |

| 3. Retain the ability for employers to tax holiday pay paid in advance as an extra pay, but allow employers the option of deducting PAYE as if the lump sum payment was paid over the pay periods to which the leave relates | Fairness and equity ✔ |

Recommendation

65. Officials recommend option 3, as it strikes the best balance between fairness and compliance cost considerations, and it is the most sustainable option.

Application of legislated rate changes

66. Different types of PAYE income payments and PAYE-related social policy products have different rules on what is to be done when there is a legislated rate (or threshold) change during a pay period or if there is rate (or threshold) change between the date the payment is made and the pay period to which the payment relates. The rates (or thresholds) that apply are sometimes based on the pay date, sometimes pay period end-date or pay period start-date, while sometimes apportionment applies. This creates complexity and confusion for employers when there is a rate (or threshold) change, which adds to compliance costs.

67. Officials have considered a number of options, which are summarised below and outlined in more detail in Appendix C-2.

| Options | Comparison to status quo |

|---|---|

| 1. Retain the status quo | |

| 2. Alignment based on pay date | Fairness and equity ✔ |

| 3. Alignment based on pay period end-date | Fairness and equity ✘✘ |

| 4. Alignment based on pay period start-date | Fairness and equity ✘✘ |

| 5. Alignment based on apportionment | Fairness and equity ✔ |

Recommendation

68. Officials recommend option 2 because it would simplify the transitional process the most for employers when a legislated rate or threshold change occurs (thus resulting in the largest reduction in compliance costs), and it would be the most sustainable option.

CONCLUSION

69. The recommended options under the above themes enable material compliance and administrative cost savings, enable improved service delivery to individuals and lay a foundation for subsequent improvements to social policy and wider government services. They do this while recognising that ‘one size cannot fit all’ and while maintaining New Zealand’s broad base low rate tax framework.

CONSULTATION

70. Several forms of consultation have been undertaken in developing the options outlined in this statement.

71. In June 2014, Inland Revenue, the Treasury and Victoria University hosted a conference entitled Tax administration for the 21st Century. The conference explored options for making tax easier through reducing both compliance and administration costs, while balancing increased voluntary compliance against the core tax policy objectives of raising sufficient revenue and ensuring fairness and efficiency. The main points made by attendees were to give people the ability to self-manage their tax affairs through improved services and more flexible legislative frameworks, the importance of involving businesses and others in the design of the rules and processes, the need to ensure that there is an overall net benefit to society of the changes not just a cost shift from Inland Revenue to businesses, and to ensure the continued maintenance of the current tax system whilst the reforms occur.

72. Following this conference the Government issued Making Tax Simpler – a Government green paper on tax administration which outlined the scope and direction of the review of the tax administration, and sought feedback on the problems taxpayers face with the current system. At the same time the Government released Making Tax Simpler – Better Digital Services a Government discussion document which identified the key role envisaged for digital services in the modernised tax administration system.

73. Feedback on these two documents informed Making Tax Simpler – Better administration of PAYE and GST: a Government discussion document which was released for public consultation in early November 2015. In addition to the discussion document an on-line forum was established and employers and GST registered persons were notified of the consultation and encouraged to provide feedback. Over 1,000 comments were made to the online forum and more than eighty written submissions were received. This public feedback has informed the development of the options presented in this statement.

74. Submissions from representative bodies, large employers and employers already using payroll software noted one-off compliance costs to upgrade software, but were generally supportive of further integration of PAYE processes into payroll software. Submissions from employers not using payroll software and from smaller employers were largely opposed to providing PAYE information at the time of the business process as they did not want to have to adopt software and/or were concerned about the potential for higher compliance costs from more frequent filing.

75. Submissions on the proposed changes for GST supported allowing GST registered persons to file directly from their accounting software, a change that does not require legislative amendment but were generally opposed to the proposal that there be a threshold above which GST registered persons would have to file electronically.

76. Further details on the response to consultation are provided for each measure set out in the appendices.

IMPLEMENTATION

77. The discussion document consulted on three implementation options for the potential obligation to report PAYE information at the time of the business process:

- a voluntary-first approach with the potential for subsequent compulsion after a critical mass had adopted the new way of submitting PAYE information;

- a review approach that would establish a timetable for a review but would not establish new obligations until after the new digital PAYE services were in operation and had been reviewed; or

- a legislated approach where the initial legislation would establish a lead-in period by the end of which employers would be required to provide information at the time of the business process.

78. The majority of submissions on the implementation approach supported the voluntary-first approach with some support for the review approach. Feedback in response to other questions and discussions with some software providers suggests however, that in the absence of a legal requirement for employers to provide PAYE information at the time of the business process, it will be difficult to ensure that software providers update their systems and services.

79. The voluntary-first and review approaches would also postpone the realisation of benefits and potentially delay the timeframe for the introduction of the changes to social policy which depend on disaggregated and more timely PAYE information.

80. Accordingly a legislated approach to implementing a timeframe for the changes to PAYE is proposed. The approach will initially be permissive and allow employers to adopt the new ways of providing PAYE information and remitting PAYE and related deductions, but the legislation will include a timeframe by the end of which employers will be required to provide pay-period PAYE information. Employers at, or above, the threshold will be required to provide the information electronically.

81. Having regard to the timetable for the introduction of Inland Revenue’s new START system, and taking into account feedback from large employers about their requirement for 1 to 3 years to plan, schedule and implement the changes, it is proposed that the recommended options will be included in a bill to be introduced later in 2016 and enacted before Parliament rises for the general election in 2017. The recommended options will apply as set out below:

- 1 April 2018 is the date from which it will be permissible for employers to submit PAYE information and remit PAYE and related deductions on payday.

- 1 April 2018 is the effective date for the proposed changes to the PAYE rules.

- 1 April 2018 is the date at which the eligibility threshold for the payroll subsidy would change.

- 1 April 2019 is the date from which employers with an obligation to do so, will be required to submit pay-period PAYE information on payday.

- 1 April 2019 is also the date from which any employers required to do so would remit PAYE and related deductions on payday.

MONITORING EVALUATION AND REVIEW

82. Inland Revenue will monitor the outcomes pursuant to the Generic Tax Policy Process ("GTTP") to confirm that they match the policy objectives. The GTPP is a multi-stage policy process that has been used to design tax policy in New Zealand since 1995.

83. The final step in the process is the implementation and review stage, which involves post-implementation review of legislation, and the identification of remedial issues. Post-implementation review is expected to occur around 12 months after implementation. Opportunities for external consultation are built into this stage. Any necessary changes identified as a result of the review would be recommended for addition to the Government's tax policy work programme.

84. Also, as part of Inland Revenue’s business transformation programme a benefit management strategy has been developed and endorsed. The programme costs and benefit estimation approach is outlined in Appendix G of the November 2015 Programme Update and Detailed Business Case. The benefit management strategy provides the framework for managing benefits within the programme, and:

- defines benefit components;

- details how programme benefits will be quantified and measured;

- documents how progress will be tracked; and

- describes what governance arrangements will be in place.

85. Inland Revenue has commissioned a regular survey of compliance costs. This survey is being redeveloped in the context of Inland Revenue’s business transformation programme and will survey SMEs, individuals and larger employers with a specific focus on the impact of change.

86. Both internal and external stakeholders will be actively involved in the on-going assessment of timeframes, benefits identification and benefits realisation for each stage of the transformation programme.

APPENDIX A - USING DIGITAL SERVICES TO INTEGRATE TAX REQUIREMENTS INTO BUSINESS PROCESSES

Status Quo and problem definition

There are just over 194,000 employers in New Zealand with PAYE obligations.

- Thirty seven percent of total tax revenue comes from PAYE ($25,760 million)[8]

- PAYE system is also used to collect:

Currently businesses and other organisations employing staff including not for profit organisations, central and local government[14] agencies, clubs, societies and individuals, need to attend to their PAYE obligations on timetables set by the Income Tax Act 2007 and the Tax Administration Act 1994. Filing returns and making payments are separate stand-alone processes.

Employers must deduct PAYE and related deductions from an employee’s salary or wages each payday and provide aggregated information[15] for each employee about income paid and deductions made to Inland Revenue once a month. PAYE information is due on the 5th of following month for the largest employers (those with over $500,000 a year of PAYE and employers superannuation contribution tax (ESCT)) and on the 20th of the following month for all other employers.

Employers must pay (remit) the PAYE and other deductions to Inland Revenue. The largest employers remit twice monthly on the 20th for deductions made between the 1st and the 15th and on the 5th of the following month deductions made between the 16th and month end. All other employers remit their PAYE and other deductions with their PAYE information on the 20th of the following month.

Employers with more than $100,000 a year of PAYE and ESCT must file their PAYE information[16] electronically. Despite this a significant number of Inland Revenue’s PAYE processes and requirements involve paper forms, or electronic forms which cannot be directly populated from a payroll software system but must be manually completed.

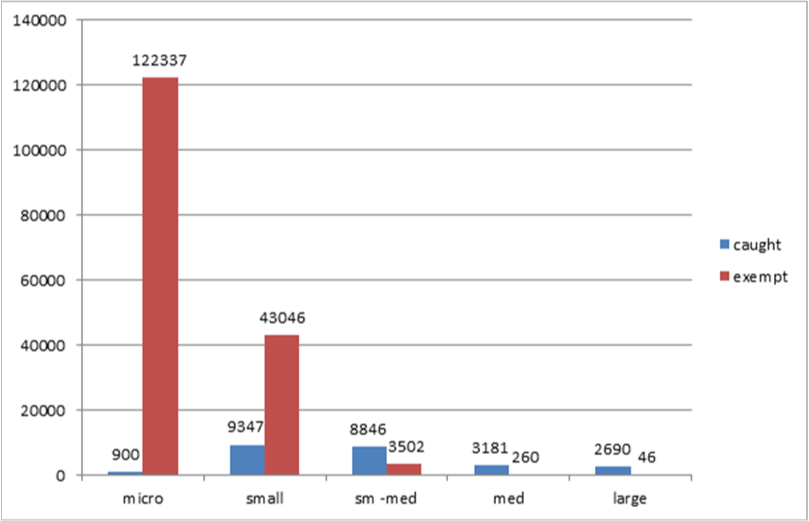

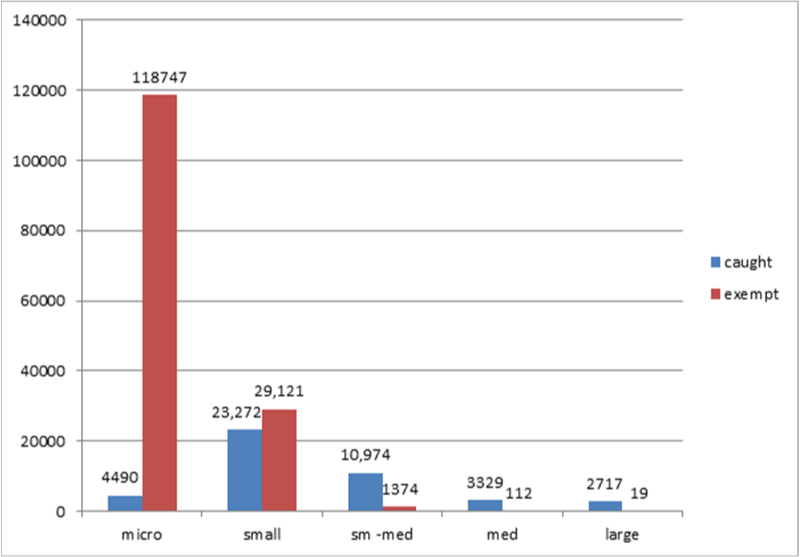

PAYE imposes compliance costs on employers. It is generally accepted that per employee compliance costs are highest for small employers. Inland Revenue’s 2013 survey of small and medium enterprise (SME) compliance costs identified median PAYE including KiwiSaver, compliance costs for micro employers (1-5 staff) of $827 per annum and $1,350 per annum for small employers with between 6 – 19 staff.

If these costs are extrapolated across the all employers in these segments PAYE compliance costs for micro and small employers amount to over $171 million per annum. Data limitations and sample size suggest however that the figures should be regarded as indicative and ranged ± 30% ($120 million to $223 million).

Administrative costs for PAYE are comparatively low at an estimated $0.25 per $100 of PAYE. There is however potential for reduction in administrative costs as a significant number of Inland Revenue staff are currently engaged in error correction and other remedial work.

The status quo also imposes costs on employees. PAYE information about income and deductions is currently aggregated across a month and is not received until the month following. This means that Inland Revenue is unable to ensure that deductions are correctly set up from the start of employment and limits its ability to subsequently intervene if things start to go wrong. As a result employees can end up paying additional student loan deductions or incur child support, or Working for Families’ tax credit, debt.

The aggregated and delayed nature of current PAYE information also limits opportunities to improve the future operation of social policy, for example by reducing the period over which social policies such as Working for Families are assessed. A shorter period of assessment could allow assistance to better meet periods of need. In March 2015 the Government released Making Tax Simpler: A Government green paper on tax administration which set out these ideas. A consultation document on social policy which will set out how these changes might work is scheduled for release in 2017.

In addition, the delayed remittance of PAYE and related deductions denies individuals the timely application of their student loan repayments and KiwiSaver contributions and delays the onward passage of child support payments.

Options

The proposals to address these issues are:

- Require PAYE information to be provided at the time of the business process

- Facilitating the provision of PAYE information through software

- Remitting PAYE at time of the business process

- PAYE – encouraging the take-up of digital services and targeting support

- Use of thresholds to vary obligations

- GST – Introducing a framework for setting an electronic filing threshold for GST returns

1. PAYE information at the time of the business process

Businesses are increasingly using software packages to automate and integrate processes. Digital systems provide the opportunity to eliminate calculation and transcription errors and to seamlessly transmit data from the customer to Inland Revenue at the time of the business process. This could improve accuracy and timeliness, reduce compliance and administrative costs and create opportunities for improved social policy.

New and departing employee information

Under the status quo information is not received about new employees until the month following when they are first paid and processing time with Inland Revenue’s current system means that it is often more than 6 weeks after a new employee is first paid that Inland Revenue may identify a problem with their deductions and get back to the employer.

These delays may require the employer to make adjustments, which incurs compliance costs, and may impose debt or additional payments, such as higher student loan repayments, on the employee. For example in the year ended 2015 more than 18,700 student loan borrowers incurred additional student loan deductions which could have been avoided if they had been on the correct tax code. These additional deductions generally lifted the repayment rate from 12% of salary to 17%.

If employers provided information about new employees when they were first added to the payroll and before they were first paid, it would allow Inland Revenue to respond in near real-time to assist the employer to set the new employee up correctly from the outset.

However in small businesses the process of adding employees to the payroll does not necessarily occur as a discrete process prior to staff being paid. New staff details are added as part of completing the first pay. New staff in large organisations can also be added to the payroll immediately prior to payment and while there might in theory be time for an employer to send information to Inland Revenue and action a near-real time response from Inland Revenue, in reality the payroll staff will often have other priorities.

Pay period information

Integrating the provision of PAYE information relating to income and deductions with the process of paying staff would improve timeliness and by eliminating transcription and reducing calculation errors, should improve the quality of the information.

Integrating PAYE obligations to report income and deductions with the payday process would provide Inland Revenue with pay period information on[17], or close to, payday. At present employers must calculate PAYE income and deductions for each payday but are then required to aggregate it for each employee into monthly totals. Disaggregated (pay period) information provided sooner would enable Inland Revenue to intervene more quickly to improve the accuracy of PAYE withholding, for example by suggesting a special tax code to someone at risk of being overtaxed because their secondary tax code has taken them into a higher tax bracket.

It would also enable Inland Revenue to better monitor the income assessments made by employees for social policy entitlements such as Working for Families and to intervene with more confidence when it appears that customers are at risk of being underpaid or of incurring year-end debt. In the year to June 2014 52,000 families were either over or under paid by more than $500 and while some of this will reflect changes in family arrangements rather than changes in income, the redevelopment of systems to support Working for Families customers requires accurate, timely PAYE information.

Pay period PAYE information provided sooner would provide the opportunity for Inland Revenue to reduce the square up period for Working for Families from a year to a shorter period which could enable assistance to better match periods of need.

Pay-period information provided sooner would also improve the effectiveness of information sharing with Ministry of Social Development and the Accident Compensation Corporation to identify fraud and overpayment. Finally if pay period information on income and deductions was available to other Government agencies in near real-time it could lay a foundation for further service improvements.

Consultation

Feedback from employers on providing PAYE income and deduction information on payday was mixed. Large employers and representative bodies generally support the further integration of PAYE requirements with payroll software, agreeing that after the one off cost of change there should be compliance costs savings. Similarly a number of smaller employers currently using payroll software were supportive of the proposed changes. Most respondents found it hard to estimate the magnitude of the savings although they were usually assessed as relatively modest. Submitters who supported further integration of PAYE with payroll software wanted a simple method for correcting payroll errors.

Other submitters considered that an updated means of filing through Inland Revenue’s website would make electronic and/or payday filing more attractive to small employers.

However many submitters who responded on the on-line forum opposed the change either because they did not use payroll software or because they were concerned that the changes would increase compliance costs because of the requirement for more frequent filing.

Options

Several options to integrate PAYE information with business processes were considered.

A voluntary-first approach would amend the legislation to allow employers to choose to file on payday if it suited them. If a significant number of employers demand the service software providers could be expected to update their payroll systems to offer it and payday filing might subsequently be required from all employers. Feedback from large employers identified however that unless changes are required by legislation their often overseas based software providers may not update their systems. Limited consultation with software providers servicing small employers in the New Zealand market reinforced these concerns.

Requiring all employers to provide pay period information on payday would maximise the benefits available from earlier PAYE information and would lay the best foundation for subsequent improvements to social policy. This option would not require employers to calculate additional information as the PAYE information is required to calculate the pay. The option would however require the information to be provided more often (each payday). Under this option it is proposed that the due date for those above a threshold would be the day after payday and for those below the threshold and not using payroll software, it would be set allowing time for the receipt of posted returns.

The option of requiring pay-period PAYE information to be provided on payday[18] by employers above a threshold, with other employers required to provide the same information but able to choose to do so, on a monthly basis, reflects the fact that employers filing PAYE information on paper could incur additional compliance costs from payday filing. This option would allow larger employers and other users of software to benefit from the proposals to integrate the provision of PAYE information with the process of paying staff while not imposing more frequent filing on small employers.

Bringing the date for monthly filing forward from the 20th to a date after month end which allows for the receipt of posted returns is designed to minimise delay while recognising that it will take time for employers, who chose to continue to file using paper, or who can’t access digital services, to complete their month end processes and mail the information to Inland Revenue.

In all options other than the status quo it is intended that simple payroll errors would be able to be self-corrected in a subsequent period.

Officials’ analysis of the options is set out on the next page. None of the options have fiscal impacts.

| Options | Fairness and equity | Efficiency of compliance and administration | Sustainability of tax and income related social policy system | Basis for improved social and other government services |

|---|---|---|---|---|

1. Retain status quo: the legislation requires PAYE information on a monthly basis regardless of the employers pay cycle. |

The status quo denies opportunity to employers who want to benefit from integration of tax and business processes. |

Overall compliance and administrative costs higher than they would be under other options. |

PAYE information underpins much of the income-related social policy system - the status quo is inflexible and limits policy options. |

PAYE information would still be aggregated and received from employers in the following month. |

2. Voluntary provision of PAYE information at time of business process |

Better than status quo Would enable employers to decide although if payroll software providers do not upgrade the choice is illusory. |

Better than status quo Employers whose software providers have updated their systems could benefit. The administration may have to cater for both approaches over a long period. |

No better than the status quo The system will have to cater for those who chose the status quo as so will remain inflexible. |

No better than status quo Redesign of social policy cannot assume that PAYE information will be available on a pay period and more timely basis. |

3. Require pay period PAYE information to be filed on payday and other PAYE information[19] no later than payday from all employers. For employers below a threshold, not using payroll software, the due date is proposed as a date which allows for the receipt of posted returns. For others the due date is the day after payday.[20] |

No better than status quo The payday filing obligation is imposed on all employers. Those using manual systems could incur increased costs which will raise fairness concerns. |

Better than status quo Compliance costs for many employers should reduce although costs on small employers not filing electronically could increase due to payday filing requirement. Administration costs will decrease. |

Significantly better than status quo All employers providing pay period information and filing on payday will improve the flexibility of the tax and income related social policy system |

Significantly better than status quo Pay period information on payday from all employers would provide significant improvements over the status quo in the management and future improvement of social policy delivery. |

4 Require pay period PAYE information on payday and other PAYE information no later than payday above a threshold and at month end for those below threshold or exempt.[21] The due date for those below the thresholds and not using software would allow for the receipt of posted returns. |

Significantly better than status quo Permits employers to choose options which should reduce compliance costs without imposing pay period filing on small employers. |

Better than status quo Following a one off compliance cost to upgrade software, compliance and administrative costs lower than status quo. |

Better than status quo All employers providing pay period information will improve the flexibility of the system but not as much as option 3. |

Better than the status quo An improvement over the status quo. Does not provide payday information near payday for all employees but is a stepping stone towards that objective. |

Recommendations

Officials recommend option 4 – require the provision of pay period PAYE information on payday and other PAYE information no later than payday above a threshold, and require the same information from those below the threshold and from those unable to access digital services, but allow them to choose whether to provide it on payday or at month end, allowing time for posting a return. This option balances the interests of small employers, with regard to compliance costs, against the wider system benefits available from universal payday filing

The status quo must change if employers who are using payroll software or an updated IR website are to benefit from being able to provide information as part of their business process. The current requirement is that regardless of when an employer pays employees the PAYE information must be provided on a monthly basis.

The option of leaving it to employers to choose whether to provide PAYE information on payday or on the current basis would not ensure that payroll software providers update their packages and services to support payday filing, which would undermine the benefits.

Option 3, requiring PAYE information from all employers at the time of the business process is also a substantial improvement on the status quo. It would maximise the benefits available from earlier PAYE information but may impose additional compliance costs on employers who do not use payroll software.

For a discussion of threshold levels under option 4, number of employers affected and mechanisms to change the threshold see the discussion of thresholds in section A-5 (page 40).

2. Facilitating provision of PAYE information through payroll software

Provision of PAYE information through payroll software would maximise compliance and administrative cost savings and by facilitating payday reporting would maximise the opportunities for improved service provision[22] to employees.

Consultation

The option of requiring employers to use payroll software was however discounted before consultation. This judgment was informed by the sheer number of very small employers and by the significant opposition to the prospect of being required to use software from those who responded to consultation on Making Tax Simpler: Better digital services a Government discussion document which identified the major role proposed for digital technology in making tax simpler. Many of those who responded on the online forum, to the Making Tax Simpler - Better administration of PAYE and GST similarly indicated that they considered that they were ‘just too small’ to justify the cost[23] of payroll software.

PAYE income and deduction information

At present if payroll software is used to populate electronic versions of the PAYE information return (the employer monthly schedule) the software must meet a prescribed format. The material that can be prescribed covers content and format but not due dates[24].

If all employers, or employers above a threshold, are required to provide PAYE information about income and deductions on payday, payroll providers will need to update their software to remain compliant. The approaches to payday filing set out above do however leave grey areas around software being used by employers which are under the electronic filing threshold for whom the due date would allow time to post a return.

In the absence of a specific requirement that payroll software must be used to file income and deduction information on payday, payroll providers may experience pressure from employers under the relevant threshold, to take advantage of the later due date available to small employers. For the reasons set out in the previous section, provision of PAYE information at the time of the business process should provide compliance cost savings to users of payroll software and there will be administrative cost and social policy benefits if all payroll software is used to submit PAYE information about income and deductions on payday.

Provision of employee information at the time they are added to or removed from the payroll

As set out in the previous analysis feedback to consultation identified that it would not always be practicable to require employers to provide information about new employees before they were first paid and about departing employers when they are removed from the payroll. For this reason officials have recommended that the obligation is to provide such information no later than the next return of PAYE income and deduction details. Despite it not being practicable to legislate for, there was considerable support from employers for the option of sending new employee details to Inland Revenue before they are first paid and getting confirmation or otherwise, back in near-real time.

There was also support for the proposal that the employer could use their payroll software to notify Inland Revenue of a departing employee mid pay period enabling Inland Revenue to automatically de-link the employee from the employer. Due to the current delays in the provision and processing of PAYE information de-linking can take months which can result in employers being contacted repeatedly about employees who have ceased employment.

The options considered below include leaving it to the market to decide whether:

- employers can use their payroll software to advise Inland Revenue of new and departing employees at the time they are added to or removed from the payroll;

- employers can source payroll software which allows small employers to take advantage of a later due date for filing PAYE information.

The alternative option would require all payroll software to:

- offer the capability of advising Inland Revenue when employees are added or removed from the payroll;

- only offer payday filing of PAYE income and deduction information (no later filing date option regardless of the size of the employer).

Neither of the options has fiscal implications.

| Options | Fairness and equity | Efficiency of compliance and administration | Sustainability of tax and income related social policy system | Basis for improved social and other government services |

|---|---|---|---|---|

1. Status Quo – leave it to the market to decide whether:

|

Employers below the relevant threshold using payroll software may be able to take advantage of a due date which allows time to post a return. Employers could choose whether to use software which can advise Inland Revenue of new and departing employees at the time of the business process. The constraint would be whether an employer can source the feature they want in the software they use. |

Compliance and administrative costs may be higher/slower to reduce than under option 2. |

Outcome dependent on the choices that software providers and employers make. To the extent that fewer employers report PAYE information at the time of the business process (on payday and when employees are added to and removed from the payroll) the quality of services provided to individuals may be reduced. |

|

2. Require payroll software to:

|

Better than the status quo Employers can have confidence that software offering digital services which integrate with business processes will be available. However employers below the threshold using software who wish to file PAYE information with a later due date are denied the option. All employers using payroll software would be provided with the option of providing details of new and departing employees at the time of the business process. |

Significantly better than the status quo Compliance and administrative costs lower than under the status quo because more employees will be set up correctly from the start or near start of employment. |

Better than the status quo Option 2 will obtain pay period information on payday for more employees which improves the flexibility of the system compared to the status quo. |

Significantly better than the status quo If all employers who use payroll software are filing income and deduction information on payday it will improve the services that can be offered to their employees. |

Recommendations

Officials recommend option 2 – Require payroll software to:

- Only offer payday filing of PAYE income and deduction information.

- Offer services which employers can choose to use to report new and departing employee information at the time employees are added to or removed from the payroll

While the status quo, leaving it to the market, would theoretically maximise the choices available to employers it may require employers to change their processes on more than one occasion and would reduce the likelihood that all new employers choosing payroll software would chose a service or product which should minimise their compliance costs.

In addition the status quo is likely to be more costly to administer, due to slower identification of errors and as a result, would mean less accurate withholding and less effective administration of social policy.

3. Remit PAYE and related deductions on payday

Employers deduct PAYE (and related deductions, such as child support, student loan and KiwiSaver) from their employees’ salary or wages each payday. The employer holds the withheld amount in trust for the Crown until it is passed on to Inland Revenue, once or twice a month, to meet the employee’s tax (and some other) liabilities. Large employers and software intermediaries pass on withheld amounts twice monthly on the 20th of the month and the 5th of the following month. Employers who have below $500,000 of PAYE and ESCT a year remit PAYE once a month on the 20th of the month following the PAYE source payment to the employee.

The delayed remittance results in a separate PAYE payment and reconciliation process for employers which adds to their PAYE compliance costs. However, employers get the benefit of any interest on the withheld amounts until they pass them on to Inland Revenue.[25] Some other amounts that are part of the employer monthly schedule system (for example KiwiSaver employer contributions) are passed on in the delayed remittance process. In addition, the delayed remittance results in employers that are in financial difficulties and default on their PAYE remittance obligations only being able to be identified and provided with support on a delayed timeframe.

Integrating PAYE remittance as well as PAYE information with the employer’s business process of paying their employees would realise a number of benefits. It could reduce compliance costs in particular for employers using payroll software and reduce administrative costs. It would also reflect the fact that the deducted amounts do not belong to the employer, but are passed on to Inland Revenue to meet the employees’ tax (and some other) liabilities. It could also reduce employer defaults.

However, these benefits have to be weighed against the disadvantages of aligning PAYE remittance with the business process of paying employees. In particular employers using manual or paper systems may have increased compliance costs because of an increased frequency in PAYE payments to Inland Revenue. Employers would lose the advantage of reducing interest on borrowings they use to fund their business they would otherwise incur or earning interest on the PAYE deductions they hold for a while before passing them on. In particular small businesses’ cash flow may be adversely impacted. Assessments of the magnitude of this impact range from a one off $2.85 million additional interest cost on employers[26] to $175 million[27].

Payroll intermediaries have been identified as a particular case where there could be adverse impact from a requirement for payday remittance. Legislation currently provides that employees using payroll intermediaries must pass on PAYE and related deductions to the intermediary on payday. This enables the intermediaries to earn interest on those deductions until payment to Inland Revenue is due. Officials have been advised that interest earned in this way is a significant part of payroll intermediaries’ revenue stream (one payroll intermediary advised it is about 40%) and in its absence the over 23,000 employers who use them may experience higher fees.

Consultation

The majority of those who responded to consultation were opposed to requiring employers to align the remittance of PAYE with the business process of paying employees and the process of providing PAYE information provision. The main concern was that they saw it negatively affecting businesses’ cash flow and the ability to offset some of the cost of employers’ PAYE obligations would be lost. Additionally, there were concerns that more frequent payment could increase compliance costs and there would be reduced time for error correction. A few submitters supported aligning the process of paying employees with employers’ PAYE obligations (PAYE remittance and provision of PAYE information) because they expect this to reduce compliance costs and to have the potential to help reduce PAYE payment default.

Options

Officials have considered three options in relation to PAYE remittance:

- Option 1: Retain the status quo with delayed remittance of PAYE once or twice monthly.

- Option 2: Require all employers to remit PAYE and related deductions to Inland Revenue at the time they pay their employees.

- Option 3: Require employers above a threshold and payroll intermediaries to remit PAYE and related deductions at the time they pay their employees and employers below the threshold retain the delayed remittance of PAYE.

Officials’ analysis of the options is set out in the table on the next page.

It is noted that employers who are not required to remit PAYE when they pay their employees under any of the below options will still be able to do so on a voluntary basis should they wish to take advantage of integrating all PAYE obligations with their business processes.

Some employers pay their employees daily. Officials considered whether PAYE deducted on daily payments should be required to be remitted on a payday basis. However, on balance this was discounted. It is considered that a minimum frequency of a week should apply to PAYE remittance. This means that employers who pay their employees daily and may be required to remit PAYE on a payday basis can aggregate the withheld PAYE on daily payments to employees to remit them to Inland Revenue on a weekly basis.

Under options 2 and 3, employees who are responsible for providing their own PAYE information and remitting their own PAYE and related deductions because they receive gross payments from their employer(s) (including IR56 taxpayers) would have to remit their PAYE and related deductions on a monthly basis by the same due date as for the provision of PAYE information.

| Options | Fairness and equity | Efficiency of compliance and administration | Sustainability of tax and income related social policy system | Fiscal |

|---|---|---|---|---|

1. Retain the status quo allowing delayed remittance of PAYE once or twice monthly. |

Depending on the option chosen for the provision of PAYE information, this option may result in additional PAYE remittance due dates separate from the due date for PAYE information for some or all employers, which may increase compliance costs and risk. |

The possibility of timely assistance for employers in risk of defaulting on PAYE (and related deductions) is limited. |

No impact. |

|

2. Require all employers to remit PAYE and related deductions to Inland Revenue at the time they pay their employees. |

Worse than status quo Could impose additional compliance costs specifically on small employers who already incur higher PAYE costs per employee. In particular some small businesses and small not-for profit organisations may experience cash flow difficulties. |

Better than status quo Realises compliance cost reduction if aligned with business and PAYE information provision processes for employers using business software. Increases compliance costs for businesses using manual or paper processes (likely very small businesses). |

Significantly better than status quo Employers that have difficulties with meeting PAYE remittance obligations are identified faster and support can be provided faster. |

No revenue impact. No fiscal impact. Cash-flow benefit for the Crown of $1,040 million in the first year and $55 in the following. |

3. Require employers above a threshold and payroll intermediaries to remit PAYE and related deductions at the time they pay their employees and employers below the threshold to remit PAYE when they provide PAYE information in the following month. |

No better than status quo Takes into consideration cash flow impacts on small employers. The cash flow impact on those above the threshold will depend on the threshold (see threshold section) Small employers which may be adversely affected by the impact on payroll intermediaries are entitled to the payroll subsidy. |

Significantly better than status quo Realises compliance cost reduction if aligned with business and PAYE information provision processes for employers using business software, but allows small businesses who are more likely to use manual or paper processes to remit PAYE once a month. |

Significantly better than status quo Employers that have difficulties with meeting PAYE remittance obligations are identified faster and support can be provided faster. |

No revenue impact. No fiscal impact Cash impact for the Crown depends on the level of the threshold (see section on thresholds) |

Recommendations

Officials recommend option 3 – Require all employers with yearly PAYE and ESCT at or above a threshold to remit PAYE on payday and employers below the threshold to remit PAYE in the following month when they provide PAYE information. This will reduce compliance costs for employers and administrative costs for Inland Revenue while considering cash flow implications for small businesses and other small organisations.

Officials acknowledge however that retaining the status quo while allowing those employers who wish to, to remit PAYE on a payday basis, could avoid some of the negative impacts associated with option 3.

For a discussion of threshold levels and number of employers affected see the section on thresholds in A-5 on page 40.

4. PAYE – encouraging the take-up of digital services and targeting support

Government has identified a major role for digital technology in making tax simpler. The development and delivery of high quality digital services which are user friendly and intuitive will play a key role in encouraging the uptake of digital services and in the realisation of the associated benefits.

Consultation

A significant number of those who responded to consultation suggested that to encourage digital uptake Inland Revenue should make payroll software freely available. Others suggested that some form of subsidy should be provided to offset the cost of switching or updating software and still others commented favourably on the existing payroll subsidy with some suggesting that the value should be increased.

Inland Revenue provided tools

In a world of rapidly changing technology the option of Inland Revenue developing its own basic payroll software and making it freely available has been discounted. Even basic payroll software is complex and does much more than calculate tax and related obligations. To become a provider of payroll software would be a distraction from Inland Revenue’s core focus on tax and social policy. In addition employers who begin by using a basic package often subsequently seek additional services; these employers would be better served by starting with an upgradable product or service.

Instead Inland Revenue will update and modernise the tax and social policy focused calculators on its website and will modernise the electronic services that allow for the filing of PAYE information through its website. These changes do not require legislative change and are not further analysed below.

Subsidy