Appendix - Taxation of structures multinationals use in New Zealand

Structures used by non-residents to do business in New Zealand

This appendix examines the current tax treatment of four structures that non-residents commonly use to sell goods into the New Zealand market. These are:[18]

- direct sales by a non-resident from offshore;

- in-market sales by a fully-fledged in-market manufacturer or assembler;

- in-market support services for direct sales from offshore; and

- in-market sales through a New Zealand distributor.

This appendix also examines the impact of the OECD’s BEPS measures on these structures and impact of the measures proposed in this discussion document. We note that only structures 3 (in-market support services for direct sales from offshore) and 4 (in-market sales through a New Zealand distributor) give rise to potential BEPS concerns at this time. Consequently only these structures could be affected by the measures set out in this discussion document.

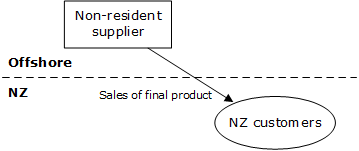

1. Direct sales by a non-resident from offshore (direct sales structure)

This structure involves the non-resident having no presence in New Zealand in relation to its sales – either in its own right or through another entity. Instead, the non-resident simply supplies goods or services to New Zealand customers from overseas. This can be by direct sale to consumers or by sale to retailers, who then on-sell the product to consumers. We set out a diagram of this structure below.

Direct sales from offshore

(Click on the image for a full-size version | SVG source)

No New Zealand income tax is currently payable by the non-resident on its direct sales under domestic law. This is because there is no New Zealand source for income derived by a non-resident from simply selling goods and services into New Zealand.

In addition, the non-resident does not have a PE in New Zealand under the direct sales structure because it has no presence here. So even if the non-resident’s income had a New Zealand source, we would be prevented from taxing it under any applicable DTA. The proposed PE avoidance rule would not change this as it does not apply unless there is a related person carrying on sales activities in the local jurisdiction.

From a policy perspective this outcome is entirely in accordance with the current norms of international taxation which New Zealand – as well as other countries – follow. Accordingly the Government is not proposing any measures to address this structure. However the OECD is continuing to monitor this issue with respect to the digital economy and intends to produce a further report in 2020. The Government may reconsider the tax treatment of this structure then.

We note that, following recent amendments, GST will generally be payable by non-residents who supply services to New Zealanders under this structure. GST is also currently applied on the importation of higher value goods into New Zealand.

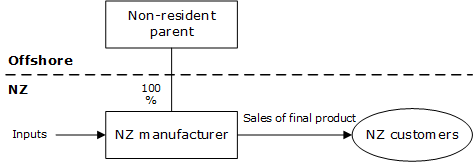

2. In-market sales by a fully-fledged in-market manufacturer or assembler

We set out a diagram of this structure below.

In-market sales by an in-market manufacturer or assembler

(Click on the image for a full-size version | SVG source)

Since everything is happening in-country there are no issues with PE avoidance or transfer pricing. Accordingly this structure does not give rise to any TP or PE avoidance concerns. As a result this structure would not be affected by any of the proposals in this discussion document.

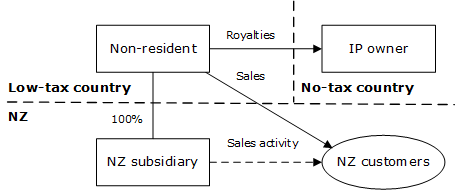

3. Direct sales from offshore with in market sales activities (in-market support structure)

This structure is similar to the direct sale structure discussed in Example 1, except that the non-resident needs to have a sales team in New Zealand to liaise with customers and arrange the sales. Under the problematic variant of this structure, the non-resident would have a PE in New Zealand if it carried out those activities itself, and would be taxable on some of its sales income. To prevent this, the non-resident contracts with a New Zealand subsidiary formed to carry out those activities. We refer to this problematic variant as the “in-market support structure”.

Under the in-market support structure, the New Zealand subsidiary is paid a fee for its services, but this fee generally only exceeds its costs by a small margin. The non-resident also usually pays a significant royalty to another group member (typically in a no tax jurisdiction) for its use of related intellectual property. This ultimately shifts much of the non-resident’s profits from its New Zealand sales into a non-tax paying jurisdiction (generally without any New Zealand non-resident withholding tax being payable). We set out a diagram of this structure below.

In-market support services

(Click on the image for a full-size version | SVG source)

Problems with the current tax treatment of the in-market support structure

The significance of the sales activities carried out in New Zealand should generate an equally significant amount of New Zealand tax under this structure.[19] However there are several problems with the current tax treatment which prevent this from happening. These are as follows:

- The non-resident’s sales income will arguably only have a New Zealand source if the subsidiary is in substance an agent for the non-resident (so that the non-resident can be treated as carrying on business in New Zealand through its subsidiary). Where the subsidiary is just contracting to provide sales related support activities for its non-resident parent, the sales related activities might not be attributable to the non-resident. If this is the case, then the non-resident’s income will not have a New Zealand source. This is despite the fact that the subsidiary is part of the same economic entity as the non-resident and is effectively under its control.

- The royalty paid by the non-resident into the low tax jurisdiction for its New Zealand sales will also arguably not have a New Zealand source. As a result, the royalty will not be subject to New Zealand non-resident withholding tax (NRWT) under our domestic law.

- Similarly, New Zealand will be prevented under any applicable DTA from taxing the non-resident’s New Zealand sales income or applying NRWT to its royalty payments unless the New Zealand subsidiary is effectively a dependant agent of the non-resident. Non-residents who use the problematic variant of this structure typically attempt to arrange their business activities so their non-resident subsidiaries are not treated as dependant agents. This can often be achieved, as this currently only requires the sales contracts to be signed and partially negotiated offshore. (Note this will change for some of our DTAs as a result of the BEPS Action Plan as discussed below.)

As a result of these problems, non-residents using this structure may be able to escape tax on their New Zealand sales income. In addition, the non-resident may be able to pay a royalty to shift its profit from its New Zealand sales out of the non-resident’s jurisdiction (which has a DTA with New Zealand) and into a low tax jurisdiction (which does not have a DTA with New Zealand) without any New Zealand NRWT being payable.

Even if New Zealand cannot tax the non-resident on its sales income, it is possible to increase the amount of income derived by the New Zealand subsidiary. This is because, if the New Zealand subsidiary is carrying out significant sales activity, it can be treated as receiving a higher fee from the non-resident under our transfer pricing rules.

This does not solve the current problems with taxation of the structure however, as the amount of additional income derived by the New Zealand subsidiary under the transfer pricing rules will usually be less than the amount the non-resident would derive if its sales income was taxable in New Zealand. Effectively, any value attributable to local market factors and intangibles, such as goodwill, would often not be taxed in New Zealand in these circumstances as a practical matter (largely due to a lack of visibility over the value added through the entire supply chain).

Effect of OECD’s BEPS measures

The OECD’s BEPS PE measures strengthen the definition of a PE by widening the circumstances in which a non-resident’s local representative will give rise to a deemed PE for the non-resident. In particular, the measures provide that a person will give rise to a PE for a non-resident if the person habitually plays the principal role leading to the conclusion of contracts by the non-resident and the contracts are not materially modified by the non-resident. This measure should generally result in the non-resident having a PE under the In-Market Support Structure.

However the measures will only apply to a DTA if the other country elects to include them. We expect that several of New Zealand’s treaty partners will not elect to include them. Accordingly the BEPS PE measures will not be effective in many cases for New Zealand’s purposes.

A general anti-avoidance provision is also being inserted into DTAs (where the countries sign up to the Multilateral Instrument) as part of the OECD BEPS programme. Called the “principal purpose test”, it provides that a country does not have to grant a treaty benefit if:

- obtaining the benefit was a principal purpose of the relevant arrangement; and

- granting the benefit in the circumstances is not within the object and purpose of the DTA.

The principal purpose test should help us prevent non-residents from using contrived arrangements to gain protection under a DTA from taxation on their NZ sales income. However the principal purpose test may not be very helpful in the absence of the widened PE definition.

Effect of the proposals in this discussion document

The PE avoidance rule in this discussion document would address the above problems with taxing this structure. In particular, the rule would:

- ensure that the New Zealand subsidiary’s sales activity created a PE for the non-resident;

- deem the non-resident to supply its goods or services through the PE;

- ensure the non-resident’s sales income had a New Zealand source; and

- allow New Zealand to apply NRWT to the royalty paid by the non-resident to the related entity resident in the no tax jurisdiction under any applicable DTA.

Therefore the PE avoidance rule would allow New Zealand to tax this structure. However, the amount of tax paid would still be determined under the usual PE profit attribution and transfer pricing rules. Accordingly, New Zealand would not be able to tax all of the non-resident’s New Zealand sales income. This is appropriate however, given that not all of the value was created by the non-resident in New Zealand.

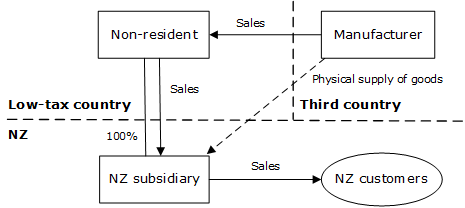

4. In-market sales through a non-resident owned distributor (in-market distributor structure)

Under this structure, the non-resident actually has its own separate distributor in New Zealand. The distributor is a New Zealand resident subsidiary of the non-resident which buys the products from the non-resident and on-sells them to New Zealand customers. Under the problematic variant of this structure, the distribution terms are arranged so that the non-resident can justify charging a high price for its sale of the goods to the New Zealand subsidiary. The non-resident argues that this leaves only a small profit margin for the subsidiary to be taxed on in New Zealand. We refer to this problematic variant as the “in-market distributor structure”.

Under the in-market distributor structure, the non-resident is not usually the manufacturer of the product, but instead operates a “regional procurement hub” in a low tax jurisdiction to centralise procurement, inventory and some distribution activities. The non-resident procurement hub entity typically carries on limited actual activities in relation to its sales to the New Zealand subsidiary. The New Zealand subsidiary manages the risks and is the entrepreneurial entity in reality. We set out a diagram of this structure below.

In-market distributor

(Click on the image for a full-size version | SVG source)

Problems with the current tax treatment of the in-market distributor structure

In this case the non-resident does not itself carry out any activities in New Zealand. Consequently:

- the non-resident’s sales income does not have a source in New Zealand; and

- the non-resident does not have a PE in New Zealand under any applicable DTA.

Therefore it is clear that the non-resident is not subject to income tax on its New Zealand sales income, while the New Zealand subsidiary is fully taxable on its sales income (as a New Zealand resident). The problem with this structure is the low amount of profit attributed to the New Zealand subsidiary compared with the non-resident. Typically the non-resident argues that it legally bears most of the enterprise risk, and so it (the non-resident) should receive most of the profits.

This is a transfer pricing issue rather than an income source or PE issue. New Zealand’s current legislation generally allows for a reasonable amount of profit to be attributed to New Zealand in most cases. However it is still possible for non-residents to shift their profits offshore by entering into legal arrangements that lack commercial reality. For example, arrangements can be entered into on terms that are commercially unrealistic, but which legally shift the risk (and thus the profits) to the non-resident. That is, current legislation favours respect for the legal form of the transaction over its economic substance.

Application of the OECD’s BEPS measures

The OECD has revised its transfer pricing guidelines as part of its BEPS measures. The guidelines have been amended to price transactions between related parties more on the basis of their commercial and economic reality than their legal form (although the legal form is still relevant). The transfer pricing guidelines are also intended to prevent profits from being allocated to a location where no contributions are made to those profits, with the profits instead being allocated to the locations where the business activities are actually conducted. The guidelines also require arrangements to be re-characterised where they are on non-commercial terms.

The new guidelines should address the in-market distributor structure. This is because under that structure, the non-resident typically carries on no or minimal actual activities. The New Zealand subsidiary manages the risks and is the entrepreneurial entity in reality. Accordingly the new transfer pricing guidelines should attribute a significant amount of profit to the New Zealand subsidiary.

New Zealand follows the OCED transfer pricing guidelines to the extent permitted by our domestic legislation. However New Zealand will need to amend its domestic transfer pricing legislation before the revised OECD transfer pricing guidelines can be fully applied. This is because the current New Zealand legislation has a more legal focus, and so does not permit the more substance based approach of the OECD guidelines to be applied in all cases.

Application of the transfer pricing measures set out in this discussion document

The transfer pricing measures set out in this document would allow New Zealand to apply the new OECD transfer pricing guidelines. Accordingly, the transfer pricing measures would allow us to appropriately tax the in-market distributor structure.

The proposed PE avoidance rule would not apply to deem the non-resident to have a PE in respect of its sales to the distributor under this arrangement. This is because the distributor’s sales activities would be in respect of its own sales to customers, not in respect of the non-resident’s sales.

18 These structures are simplified versions of the ones used in practice.

19 Although New Zealand would never be able to tax all of the sales income. This is because much of the sales income will be attributable to activities carried out overseas, such as the manufacture of goods. New Zealand can only tax the portion of the sales income that is attributable to the activities carried out in New Zealand.