Chapter 4 - At the end of the tax year

- Current rules

- Two options for end-of-year filing obligations

- The improved status quo

- The alternative approach

- How the "alternative approach" would be different to the "improved status quo"

- What will Inland Revenue do under the alternative approach

- The specific thresholds

...the Government wants it to be simpler for taxpayers to work out what, if anything, they need to do to pay and receive the right amounts.

Some individuals are required to provide information by filing income tax returns so Inland Revenue can ensure that they are paying the right amount of tax on the income they have earned. If an individual files an income tax return that results in a refund or tax to pay, an obligation is created for payment of this amount. However, individuals who are not required to file returns do not have their tax position squared up, so there is no payment obligation.

As discussed in the Green Paper, the Government wants it to be simpler for taxpayers to work out what, if anything, they need to do to pay and receive the right amounts. This involves the Government reviewing which individuals should be required to provide information to Inland Revenue and those who should not. Similarly, it needs to be quicker and require less effort for individuals to do what they need to do.

Current rules

Only some individuals are required to report income to Inland Revenue at the end of the tax year. The rules were changed in the 1990s as part of a package of reforms intended to reduce compliance costs and simplify tax administration by reducing the number of people required to file returns.

Section 33 of the Tax Administration Act imposes a general obligation on all individuals to file annually for the purposes of disclosing their taxable income. That section then excludes from its scope anyone who meets the requirements of section 33AA(1), or is issued an income statement or is required to be issued an income statement.

Individuals are responsible for determining whether they are required to file a return, or request a personal tax summary (or correct one that Inland Revenue has issued to them), or whether they do not need to take any action to finalise their tax position. They are required to do this by considering their income position and deciding whether they meet the requirements of section 33AA based on:

- their tax residency status;

- whether they have any tax credits or losses;

- the amounts of income they have derived from particular sources; and

- the amounts of certain types of income from which tax has been withheld at an incorrect rate.

When the changes to the filing rules were made in the late 1990s, it was expected that only 400,000 people would need to receive a personal tax summary each year. Filing to claim refunds and for social policy reasons, however, means that in the 2015 tax year approximately 1,100,000 people submitted a personal tax summary and an additional 1,100,000 filed an IR3 tax return form.

These rules are quite complex and can be difficult for individuals to understand. In order to know if any income has been taxed at an incorrect rate, and whether it is necessary to file a return as a result, an individual must consider all of their income sources and the tax rates that were applied to them. Some individuals are unaware that they need to provide any information to Inland Revenue.

Section 33AA(1) of the Tax Administration Act sets a monetary threshold which relates to when an individual must file a return. A person is not required to file a return if they (in addition to satisfying a number of other criteria) derive $200 or less of certain types of income from which tax has not been withheld or not withheld correctly. These types of income include employment income, interest and dividends. This $200 of income will translate to different amounts of tax depending on a person’s marginal tax rate.

This means a person who is required to file an income tax return must square up any over-or under- payments, whereas a person who is not required to file a return is not. A central tenet of New Zealand’s tax system is that everyone should pay their fair share of tax. People who earn the same amount of taxable income should pay the same amount of tax, regardless of how they earn that income.

An example of the equity concerns this can raise occurs in years in which there is an extra pay-day. For example, some tax years can have 53 weekly or 27 fortnightly pay-days. When this happens, not enough tax is deducted because typical PAYE withholding calculations are based on standard years of 52 weekly or 26 fortnightly pay-days.[13] People who are required to file returns will typically end up with an unexpected tax liability, whereas those who are not required to file returns will not have to pay this extra amount.

If a person is not required to file a return (“a non-filer”), it does not necessarily mean they do not file. A lot of “non-filers” are due refunds and they may still choose to file if they wish to claim these refunds. In addition, the revenue system now supports a range of social policy entitlements and obligations[14] that require individuals to provide information to Inland Revenue, such as information about family circumstances, and confirm their income through a tax return.

When the changes to the filing rules were made in the late 1990s, it was expected that only 400,000 people would need to receive a personal tax summary each year. Filing to claim refunds and for social policy reasons, however, means that in the 2015 tax year approximately 1,100,000 people submitted a personal tax summary and an additional 1,100,000 filed an IR3 tax return form.[15]

Two options for end-of-year filing obligations

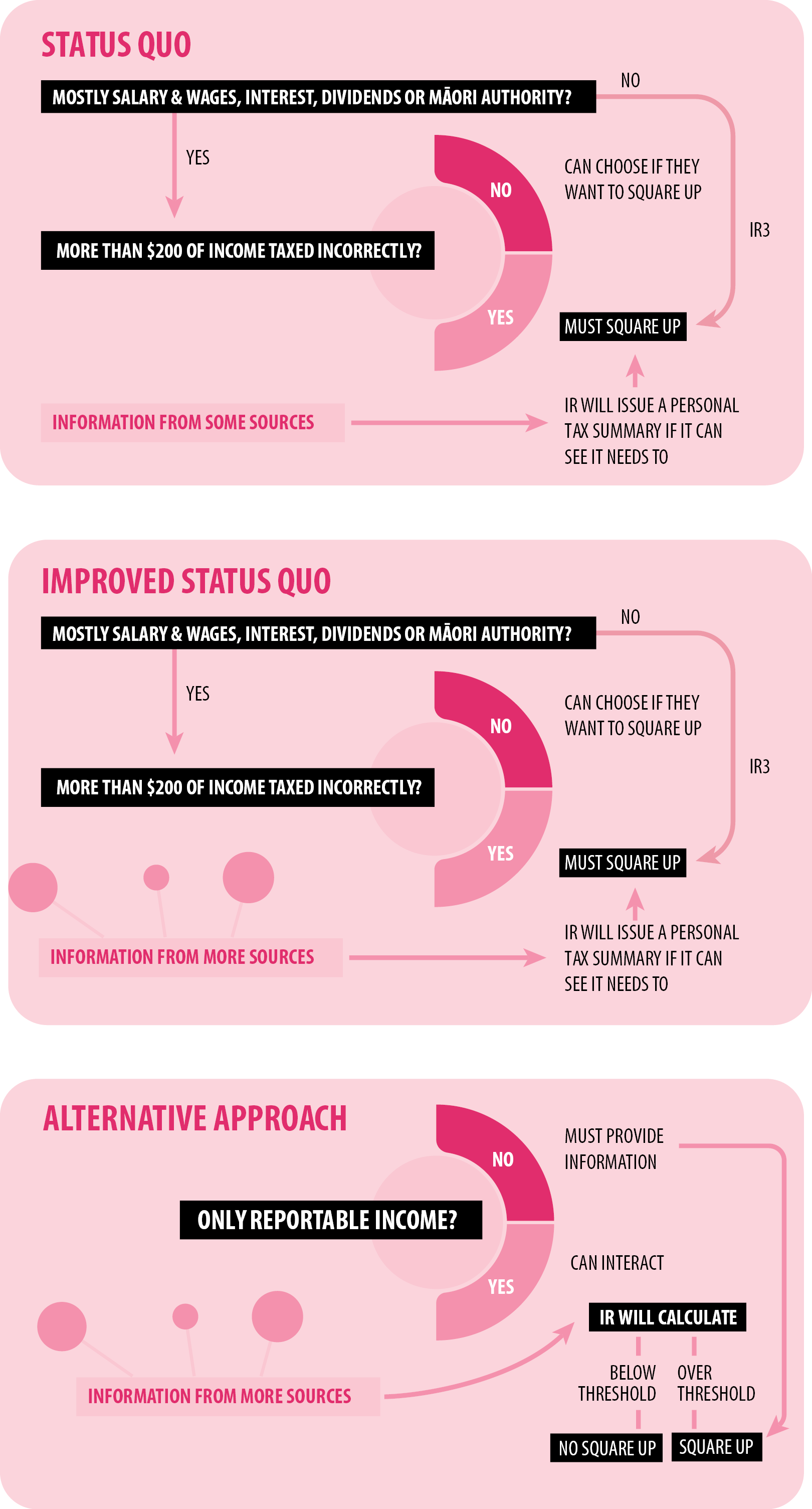

The discussion document sets out two options for which individuals should have to provide information to Inland Revenue at the end of a tax year. The “improved status quo” simply builds on earlier legislative changes in the Making Tax Simpler series, namely improved PAYE and investment income information. Under the improved status quo, Inland Revenue would issue more personal tax summaries to individuals for them to confirm or complete.

The “alternative approach” further simplifies the rules about filing annual tax returns. Individuals whose only income came through withholding tax systems would not have to provide any information to Inland Revenue. Inland Revenue would calculate the difference between the tax that was paid during the year and the individual’s tax liability. If the individual does not interact by a set time, Inland Revenue would issue refunds or request payments of amounts over thresholds.

Under the improved status quo, Inland Revenue would issue personal tax summaries when appropriate, requiring the individuals who received them to square up their tax position. If a personal tax summary is not issued, individuals will still need to determine whether they need to request a personal tax summary.

The alternative approach would separate the requirement to provide information to Inland Revenue from the question of whether an individual’s tax position should be squared up.

The improved status quo

As a result of the proposed changes to the reporting of investment income information in the Taxation (Annual Rates for 2017–18, Employment and Investment Income, and Remedial Matters) Bill, Inland Revenue will be able to more accurately determine who should be issued a personal tax summary. By receiving information about interest, New Zealand-sourced dividends and Maori authority distributions during the year, Inland Revenue will be able to determine if tax was withheld at a rate that would require the individual to complete a personal tax summary. Under the improved status quo, Inland Revenue would issue personal tax summaries when appropriate, requiring the individuals who received them to square up their tax position. If a personal tax summary is not issued, individuals will still need to determine whether they need to request a personal tax summary.

The alternative approach

As noted earlier, when individuals file an income tax return, the consequence is that if the return results in a refund or tax to pay, an obligation is created for payment of this amount (subject to rules around very small balances). Under the current law individuals who are not required to file returns do not have their tax position squared up. The alternative approach would separate the requirement to provide information to Inland Revenue from the question of whether an individual’s tax position should be squared up.

Ultimately, the purpose of requiring individuals to interact with Inland Revenue is to ensure the right amount of tax – or close to the right amount – is paid at the right time. To reduce compliance costs, individuals should need to interact only when it is necessary for that purpose. Under the alternative approach, individuals would only be required to provide information to Inland Revenue if that is necessary to ensure that the right amount of tax is paid.

Under the alternative approach individuals would only be required to provide information to Inland Revenue if that is necessary to ensure that the right amount of tax is paid.

Individuals who earn only income that is reported to Inland Revenue by a third party during the year (or shortly after the end of the year) have no additional information to provide Inland Revenue.

…they would not be required to provide income information to Inland Revenue.

Individuals who earn only income that is reported to Inland Revenue by a third party during the year (or shortly after the end of the year) have no additional income information to provide Inland Revenue. Their interaction is unnecessary to determine the “correctness” of their tax. Inland Revenue holds enough information to calculate if the tax that has been remitted during the year matches the person’s tax liability. Under this approach, they would not be required to provide income information to Inland Revenue. Requiring these people to file would impose costs on them but would not increase the accuracy of their final tax position. The Government considers that these extra compliance costs would outweigh any benefits and has decided that not all individuals should be required to provide income information to Inland Revenue.

“Reportable income”

“Reportable income” is intended to cover all the sources of income in respect of which Inland Revenue receives third party reporting during the year, or very shortly after the end of the year.

Employment income is already reported to Inland Revenue during the year. The Taxation (Annual Rates for 2017–18, Employment and Investment Income, and Remedial Matters) Bill includes a proposal that this information should be reported to Inland Revenue on a pay-period basis.

The Taxation (Annual Rates for 2017–18, Employment and Investment Income, and Remedial Matters) Bill includes a proposal to change the due date to 15 May for payers of interest income to provide yearly information to Inland Revenue. This would allow Inland Revenue to include this information on an individual’s account by the time the individual might be required to file a personal tax summary and become "reportable income". Further changes in that bill would add dividend income and Maori authority income to the list of reportable income sources. From the time these changes take effect, these would all be included in the definition of “reportable income”.

From 1 April 2017, employers will be required to report the taxable value of employee share scheme income through the employer monthly schedule.[16] This will also be included in the definition of “reportable income”.

Other forms of income are reported by third parties to Inland Revenue, for example, income arising from partnership and look-through company interests, and trust income. These are examples of income information that is not provided in time to be included in a tax return. These types of income are not included in the definition of “reportable income”. Inland Revenue will use the information when it is received to ensure that individuals have met their tax obligations.

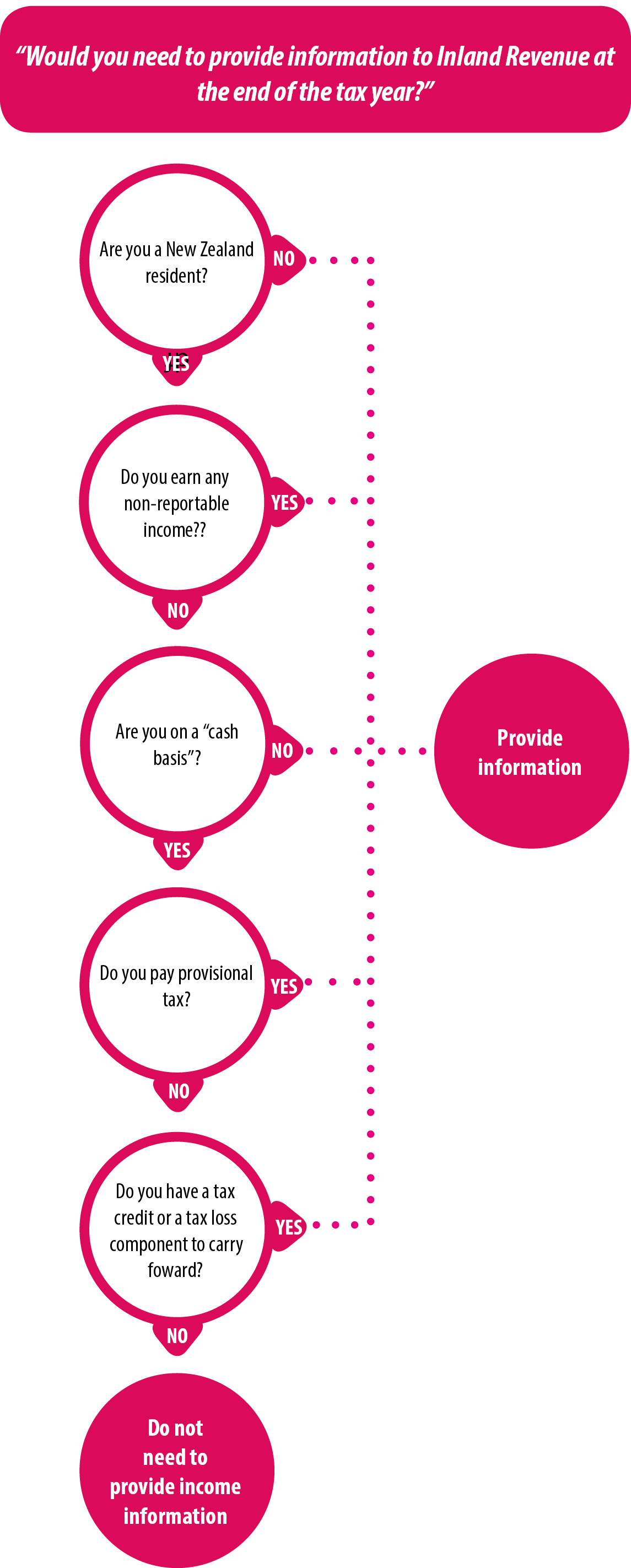

The individual would be responsible for considering whether:

- they have received non-reportable income; and

- they are not a New Zealand tax resident;[17] and

- they have any tax credits they wish to carry forward, a tax loss balance or a tax loss component; and

- they are not a “cash basis” person for the purposes of the financial arrangements rules; and

- they pay provisional tax.

If the individual meets any of these conditions they will be required to provide information to Inland Revenue.

Since 2015 financial institutions have been required to send information about some of their clients to Inland Revenue under the Foreign Account Tax Compliance Act (FATCA) requirements. Following the adoption of the Common Reporting Standard as part of the Automatic Exchange of Financial Account Information in Tax Matters (AEOI), Inland Revenue will receive information about overseas investment income of New Zealand tax residents. Again, this information is not received in time to be included in a tax return process, and so is not included in the definition of “reportable income”.

The individual would be responsible for considering whether:

- they have received non-reportable income; and

- they are not a New Zealand tax resident;¹7 and

- they have any tax credits they wish to carry forward, a tax loss balance or a tax loss component; and

- they are not a “cash basis” person for the purposes of the financial arrangements rules; and

- they pay provisional tax.

If the individual meets any of these conditions they will be required to provide information to Inland Revenue.

Analysis of an individual’s account and history may indicate that it is likely that a particular individual has earned non-reportable sources of income. In this case, Inland Revenue will prompt that individual to include information about the income.

How the "alternative approach" would be different to the "improved status quo"

New Zealand’s tax system operates using a model of self-assessment. This means it is the responsibility of each person to determine the amount of tax payable in relation to their income. That responsibility would remain.

Individuals are currently required to consider the correctness of the withholding on their income. Under this proposal they would no longer be required to do so. Inland Revenue would determine whether there was a difference between the amount of tax remitted through withholding tax, and an individual’s tax liability on this income. It would follow up if any action should be taken.

Currently, if an individual or their spouse is receiving Working for Families tax credits they are sent a personal tax summary or are required to file a tax return at the end of the year. This is to confirm their income for the year to enable a square-up of their entitlement. If a person has to make child support payments, they are required to complete a personal tax summary if they earn more than $200 of interest, dividends or taxable Maori authority distributions. For individuals who only earn reportable income there would be no need to provide income information as Inland Revenue would hold information on all of their income already.

In 2015, 3,334,000 people

- earned income with PAYE deducted (including benefits and New Zealand Superannuation), or

- declared earning interest or dividends, *

and did not appear to receive any:

- shareholder employee salary;

- overseas income;

- trust income;

- other income;

- partnership income;

- business income; or

- rental income.

These people would not need to provide information to Inland Revenue if the alternative approach is adopted.

*This is only about income that is declared, not about income that is earned.

The Government proposes that individuals in this situation would no longer be required to file tax returns solely because they receive Working for Families tax credits or child support or have a student loan. They will still be required to confirm their family circumstances information and non-taxable income information, although it is expected this would be separate to the income tax return.

While people who use special tax codes are currently required to file a personal tax summary or IR3 return, this would not be necessary under the alternative approach. Inland Revenue would know which individuals were issued special tax codes, and if that special tax code was being applied to their income. The individual would not need to notify Inland Revenue that they had used a special tax code.

Individuals who use a special tax code currently have to reapply for a new one each year. Under the alternative approach, this would no longer be necessary. If a special tax code continued to be used after it was no longer providing the correct outcome for an individual, this would be picked up by Inland Revenue monitoring the individual’s income and withholding rates during the year. Inland Revenue would contact the individual about changing the code.

Individuals who earn salary or wages from employment as either an election day worker, or a casual agricultural employee currently have to file income tax returns if they earn more than $200 of that type of income. This would not be necessary under the alternative approach.

The flowchart on page 29 sets out which individuals would have to provide information to Inland Revenue. Individuals are unlikely to need to work their way through the flowchart, as they will generally know whether they are required to provide information or not.

The advantages of this proposal, compared with the improved status quo are that it would:

- be easier for individuals to understand;

- offer a better balance between compliance costs and accuracy;

- take advantage of the increased information available to Inland Revenue from third parties;

- require fewer individuals to provide information to Inland Revenue; and

- remove the inequity whereby people who are not currently required to file do not have their tax positions squared up.

Will individuals be in the same position every year?

Whether someone is required to provide information to Inland Revenue at the end of a tax year will depend on their personal circumstances in that year.

WHAT INLAND REVENUE WILL DO

- Inland Revenue will consider the individual's situation

- Inland Revenue will calculate if there is a refund or tax to pay

- The assessment will crystallise

- Inland Revenue will complete the process.

Some individuals will find that they never have to provide information to Inland Revenue. If, for example, someone receives only reportable income such as a salary and some interest they would not need to provide any information to Inland Revenue.

Conversely, some individuals will find that they have to provide information to Inland Revenue in most years, or every year. This will be the case if they earn non-reportable income or want to claim a deduction for tax purposes. These individuals are already required to file income tax returns under the current law.

Other individuals will find that whether they are required to provide information will vary between years. If, for example, a person had always worked for an employer who deducted PAYE from their wages, but then started earning non-reportable income, they would need to start providing information to Inland Revenue. If, in a later year, they stopped earning that extra income and reverted to earning only reportable income, they would no longer be required to provide information to Inland Revenue.

If other sources of income are added to the list of those required to be reported to Inland Revenue by third parties during the year, or shortly after the end of the year, individuals will not need to provide information to Inland Revenue about that source of income.

What will Inland Revenue do under the alternative approach

Inland Revenue will remind individuals generally about their obligations every year, such as through advertising and awareness campaigns.

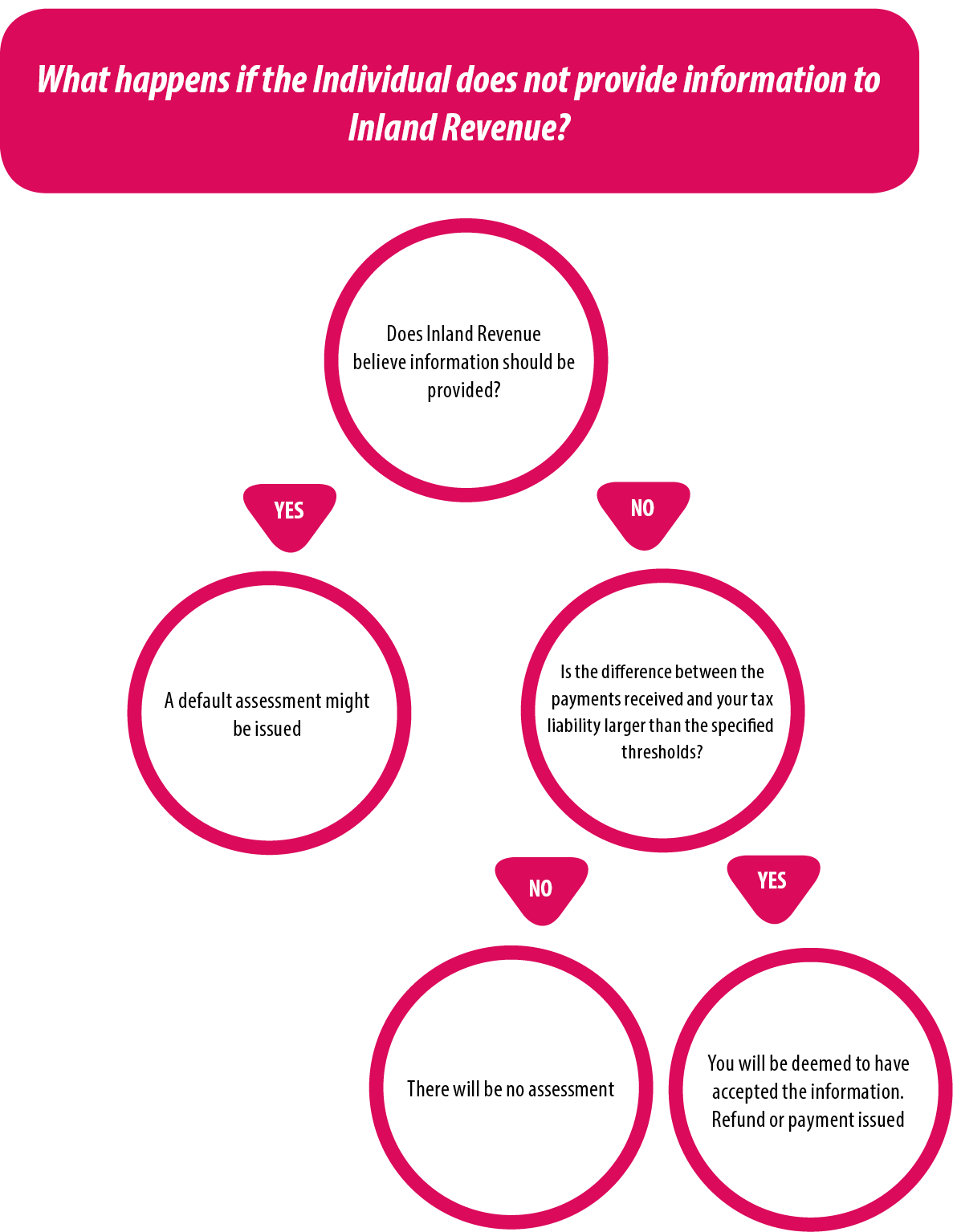

The Government proposes that Inland Revenue will take different approaches to individuals depending on what information it holds about them. The flow chart on page 35 sets these out.

Inland Revenue will consider the individual’s situation

Inland Revenue will consider what it knows about an individual, their income sources, their tax history and their circumstances.

If Inland Revenue has no reason to believe that the individual needs to provide information, it will move to the calculate stage. Individuals who only earn reportable income will know that they do not need to provide information to Inland Revenue, and that Inland Revenue will let them know if there happens to be a refund or amount of tax to pay.

If Inland Revenue needs more information from the individual it will not move to the calculate stage. Inland Revenue may have reason to believe that the individual has received non-reportable income (for example, the individual has earned rental income in a previous year), or has to provide information because of one of the other requirements on page 28, or Inland Revenue may have questions about some information it holds, and needs the individual to clarify.

If Inland Revenue considers that the individual will need to provide more information, it will remind them of their obligation to provide the information, to confirm that they earned no income, or only earned reportable income. If this is not provided by their filing date, non-filing penalties could be applied, and a default assessment may be issued. A default assessment is an estimation of tax liability made by Inland Revenue that remains in place until the individual files a return. This could be made based on the amount of income previously returned by the taxpayer.

If an individual ceases to earn income from a non-reportable source, they should advise Inland Revenue that they no longer earn that income. If an individual begins to earn non-reportable income but Inland Revenue is not aware of this and deems the individual to have accepted the position shown on their statement if they do not interact, it is still the individual’s responsibility to ensure that the correct amount of tax is paid.

Inland Revenue will calculate if there is a refund or tax to pay

As discussed in chapter 2, certain types of income are subject to a withholding tax system, which means the payer of income withholds tax from the income the individual has earned, and pays this money to Inland Revenue.

Although withholding systems are generally accurate, there can sometimes be a difference between the individual’s ultimate tax liability and the amount of tax that was remitted to Inland Revenue.

Individuals are currently required, for each source of income, to calculate the amount of tax that should have been paid and compare this to what was paid. Under the alternative approach Inland Revenue would compare the tax credits and payments it has received with the person’s income tax liability for that year, and calculate the difference (if any). This difference calculation will be displayed on myIR for the individual to see.

All relevant income information that Inland Revenue holds about an individual will be used in this calculation. If Inland Revenue has only linked income to one individual, but the income actually belongs to more than one individual, it would be included in its entirety in that one individual’s account, and therefore their calculation. An example of when this could happen would be a joint investment if the payer does not hold details about all of the owners of the investment. The individuals would be able to tell Inland Revenue that the income should be shared between all the joint owners.

If this calculation shows no difference, or only a small difference, nothing will happen.

The thresholds defining small differences are discussed later in this chapter.

The assessment will crystallise

The information will be shown on myIR, and individuals can log on and confirm the information if they wish. If Inland Revenue has calculated an amount above the threshold, the individual will have a prescribed period to respond. If they do not respond, Inland Revenue will consider that they have accepted the information as shown. It will become their assessment at this time. The reason for leaving a prescribed period before Inland Revenue deems the individual to have accepted the information is to allow for the individual to make any necessary changes, for example, to add any non-reportable income or claim a tax deductible expense.

If the difference is less than the threshold, the amount of tax withheld and paid to Inland Revenue will be treated as the individual’s liability, as happens now for non-filing taxpayers.

Inland Revenue will complete the process

If Inland Revenue has moved through all three previous steps it will act to complete the process. It will do this by:

- issuing a refund;

- requesting payment; or

- carrying foward a loss balance.

As at 1 December 2016, 94.5% of refunds that Inland Revenue paid were made electronically.

The specific thresholds

Inland Revenue can refrain from collecting small amounts of tax owed or issuing small refunds. This reflects the disproportionate costs small amounts can impose on Inland Revenue and individuals. This should continue. Where the amount of tax to pay or refund is less than the "specified threshold", the amount of tax withheld and remitted to Inland Revenue will be treated as the taxpayer's liability, as happens now for non-filing taxpayers.

Feedback is sought on the thresholds. Depending on the levels, there is a trade-off between accuracy, fairness, revenue, compliance and administration costs.

The two existing thresholds are:

- $20 for tax owed; and

- $5 for refunds.

The threshold for refunds

Individuals will still be able to claim a refund below the threshold if they wish. This means individuals have to expend effort to obtain the smallest of refunds, whereas they automatically receive larger refunds. This seems counter-intuitive.

Historically, there has been a small refund threshold to take into account the administrative cost of issuing a refund (usually the cost of posting a cheque), and the costs individuals incur to bank the cheque. As at 1 December 2016, 94.5% of refunds that Inland Revenue paid were made electronically. The very high percentage of refunds paid through digital channels brings into question the need to retain a small refund threshold, or perhaps to only retain one for payments requested by cheque.

The cost to Inland Revenue of issuing a refund digitally, regardless of the size, is negligible, so all refunds could be crystallised and paid. Some individuals might find it odd to receive a refund of a few cents or dollars, but there would be no compliance cost to them if it was received digitally. Most banks charge a nominal fee for depositing cheques, so this option would work best for digital refunds. A small threshold could be retained for cheques.

For the 2015 tax year there were 778,000 people with refunds who did not file or request a personal tax summary.[18] If the alternative approach had applied in that year, with the current refund threshold of $5, Inland Revenue would have issued refunds to an additional 456,000 people. The following table sets out the numbers of people potentially affected at other monetary levels.

| Filed an IR3 | Filed a PTS | Did not file | |

|---|---|---|---|

| $0 | 346,000 | 909,000 | 778,000 |

| $5 | 332,000 | 810,000 | 456,000 |

The threshold for tax to pay

Having a threshold under which small amounts of tax are not payable is a trade-off between accuracy, fairness, revenue, and compliance and administration costs. Individuals will incur a compliance cost in paying small amounts. The Government is interested in the factors submitters think should be taken into account when setting a threshold for amounts of tax to pay.

Under the alternative approach, amounts of tax to pay that are smaller than the specified threshold would not be crystallised, unless the individual chose to pay the amount. It is unlikely that individuals will choose to pay amounts that they are not required to, so the level of the specified threshold for amounts of tax to pay will, in effect, determine the number of individuals who have their tax position "squared up".

As noted earlier, under the current law, an individual is not required to interact with Inland Revenue if they (in addition to satisfying a number of other criteria) derive $200 or less of certain types of income from which tax has not been withheld, or withhheld correctly. Depending on an individual’s marginal tax rate, this $200 of income could equate to up to $66 of tax.

For the 2015 tax year, 617,000 people with tax to pay did not file or request a personal tax summary.[19] If the alternative approach had applied in that year, with the current threshold of $20, Inland Revenue would have required 179,000 of these people to pay, but the 36,000 people who filed a personal tax summary with tax to pay under $20 would not have had to file. If the specified threshold for debts was $66, Inland Revenue would have required 136,000 of these people to pay, but the 58,000 people who filed a PTS with an amount of tax to pay less than $66 would not have had to file.

| Filed an IR3 | Filed a PTS | Did not file | |

|---|---|---|---|

| $20 | 433,000 | 114,000 | 179,000 |

| $66 | 423,000 | 92,000 | 136,000 |

MAURA

Maura is retired. She receives New Zealand Superannuation, and interest income from money she has in a bank. She uses the correct withholding rate for her interest.

Under the current rules, Maura is not required to request a personal tax summary. She can complete one if she would like to.

Under the improved status quo, Maura would not be required to request a personal tax summary. She could complete one if she would like to.

Under the alternative approach, Maura would not have to provide any income information to Inland Revenue.

Inland Revenue would consider what is known about Maura. It would have no reason to believe that Maura needs to provide any information to Inland Revenue.

Inland Revenue would calculate the total amount of PAYE and RWT received during the year from Maura’s superannuation and interest income and compare this to Maura’s income tax liability for the year based on these two sources of income. There would be no difference.

Maura’s assessment would not crystallise (i.e. nothing would happen).

SARAH

Sarah has two jobs and uses a special tax code.

Under the current rules, Sarah is required to complete a personal tax summary because she used a special tax code.

Under the improved status quo, Sarah would be required to complete a personal tax summary because she used a special tax code.

Under the alternative approach, Sarah would not have to provide any income information to Inland Revenue.

Inland Revenue would consider what is known about Sarah. It would have no reason to believe that Sarah needs to provide any information to Inland Revenue.

Inland Revenue would calculate the total amount of PAYE it received during the year from Sarah’s two jobs and compare this to Sarah’s income tax liability for the year based on these two sources of income. Because Sarah used the special tax code, there would be no difference.

Her assessment would not crystallise (i.e. nothing would happen).

NICO

Nico is an employee earning only wage income, from which his employer deducts PAYE every fortnight.

Last year, Nico only ended up working for nine months of the year before quitting his job to travel. His annual salary was $60,000 and he was paid monthly. Because the PAYE calculations assume a person will work for the entire year, each pay period is annualised and taxed at the rate that would apply if they had worked the entire year.

Each month Nico earned $5,000. Nico’s employer withheld tax at a rate that would apply to an annual income of $60,000. This totalled $8,265 tax on the income Nico earned until the end of December. Because his total income for the year was only $45,000 rather than $60,000 his final tax liability is only $6,895. Nico is due a refund of $1,370.

Under the current rules, Nico is not required to file a personal tax summary. He will need to complete one if he would like to claim his $1,370 refund.

Under the improved status quo, Nico would not be required to file a personal tax summary. He would need to request one if he would like to claim his $1,370 refund.

Under the alternative approach, Nico would not have to provide any income information to Inland Revenue.

Inland Revenue would consider what is known about Nico. It would have no reason to believe that he needs to provide any information to Inland Revenue.

Inland Revenue would calculate the total amount of PAYE it received from Nico’s employer was more than his tax liability.

Nico’s assessment would crystallise and Inland Revenue would complete the process by issuing Nico a refund of $1,370.

LIAM

Liam is an employee earning wage income. His employer deducts PAYE every week when Liam is paid. Liam also gets dividends from a utility company each year on which the company pays tax on behalf of Liam.

Liam’s employer reports Liam’s wage income to Inland Revenue. The utility company provides information about the dividends they pay to Liam and the related tax.

Last year Liam earned $46,000 wage income from which his employer withheld $7,070 of tax (for income up to $14000 at 10.5% and for the income over $14000 at 17.5%).

Liam also received dividends of $1,500 from a utility company which include $495 tax ($420 paid by the company at the corporate tax rate of 28% and $75 of RWT withheld by the company so that the total tax equates to the top tax rate of 33%).

Because Liam’s marginal tax rate is only 17.5%, he is entitled to a refund of $232.50 of the tax that was paid on his dividends.

Under the current rules, Liam is not required to file a personal tax summary. He will need to complete one if he would like to claim his $232.50 refund.

Under the improved status quo, Liam would not be required to file a personal tax summary.

Inland Revenue would observe that Liam was due a refund because of the additional tax paid on his dividends. It would issue him a personal tax summary.

Under the alternative approach, Liam would not have to provide any income information to Inland Revenue.

Inland Revenue would consider what it knows about Liam. It would have no reason to believe that Liam needs to provide any information to Inland Revenue.

Inland Revenue would calculate the total amount of PAYE and tax received during the year from Liam's wages and the dividends and compare this with Liam's income tax liability for the year based on these two sources of income. Inland Revenue would calculate the total amount of tax it received was more than Liam's tax liability.

Liam's assessment would crystallise and Inland Revenue would complete the process by issuing Liam a refund of $232.50.

SAM

Sam is an employee earning salary income from which his employer deducts PAYE every week when he pays Sam.

Last year Sam’s annual salary was $78,000. Each week Sam earned $1,500 from which Sam’s employer withheld $320 PAYE (excluding ACC earners’ levy) each pay-day. Because of the day on which his salary is paid, last tax year Sam received 53 weekly salary pays in the tax year (a standard tax year has 52 pay-days).

Because the PAYE system and PAYE tables are based on 52 weekly pay days occurring in a tax year, Sam has a tax shortfall of $175. (He received $79,500 salary income in the tax year, but his weekly PAYE was based on $78,000).

Under the current rules, Sam is not required to complete a personal tax summary.

Under the improved status quo, Sam would not be required to complete a personal tax summary.

Under the alternative approach, Sam would not be required to provide any income information to Inland Revenue.

Inland Revenue would consider what it knows about Sam. It would have no reason to believe that he needs to provide any information to Inland Revenue.

Inland Revenue would calculate the total amount of PAYE it received during the year from Sam’s job and compare this to his income tax liability for the year based on that sources of income. Inland Revenue would calculate the total amount of tax it received was less than Sam’s tax liability.

Sam’s assessment would crystallise and Inland Revenue would complete the process by requesting a payment of $175 from Sam.

LEXIE

Lexie has been self-employed for five years. She buys run-down vintage cars, restores them and then sells them online.

After receiving a large inheritance payment a few years ago she invested some money overseas and now earns a substantial amount of overseas interest income.

In addition to owning her own home, Lexie owns two apartments that she rents out.

None of Lexie’s income is reported to Inland Revenue by a third party during the year.

Under the current rules, Lexie is required to file an income tax return.

Under the improved status quo, Lexie would be required to file an income tax return.

Under the alternative approach, Lexie would be required to provide information because she earned non-reportable income.

Inland Revenue would consider what is known about Lexie. Since Lexie has been declaring self-employed income, overseas income and rental income in previous years, Inland Revenue would consider that Lexie is likely to have non-reportable income this year too.

Inland Revenue would issue a request for Lexie to provide the necessary information.

If Lexie does not do that, Inland Revenue would issue a default assessment for Lexie.

QUESTIONS FOR READERS

4.1 Which do you prefer, the “improved status quo” or the “alternative approach”? Why?

4.2 Do you agree with the proposal that people who earn only “reportable income” should not have to provide information about it to Inland Revenue?

4.3 Can you think of any other types of income that would fit the definition of “reportable income”? If so, what are these?

4.4 Do you agree with the proposal about which people should still have to provide information to Inland Revenue?

4.5 Do you agree that a person should not be required to provide income information simply because they receive Working for Families tax credits or child support or have a student loan?

4.6 Can you think of other people who are required to file returns now that should not have to under the “alternative approach”? If so, who are these people, and why do you think they should not have to?

4.7 If an amount is smaller than the threshold, do you agree that an assessment should not crystallise?

4.8 Do you agree with the proposal about deemed acceptance, default assessment, and not creating an assessment?

4.9 Should there be a threshold for small refunds, or should all refunds, no matter how small, be automatically paid out?

4.10 Should there be a threshold for small refunds if they are paid by cheque?

4.11 Should there be a threshold for small amounts owed, or should all amounts to pay, no matter how small, be payable? If so, what should this level be?

4.12 What factors should be taken into account in setting a threshold for small amounts of tax owed?

13 The amount of extra tax to be paid will depend on the individual’s salary, and how frequently they are paid. In a year when they are paid 53 times, rather than 52, the extra tax will be $0 if their marginal tax rate is in the lowest tax band, $19 if in the second tax band, $134 if in the third, and $175 if in the top band. In a year in which they are paid 27 times rather than 26, the extra tax will be $0 if their marginal tax rate is in the lowest tax band, $38 if in the second tax band, $268 if in the third, and $350 if in the top band.

14 In various forms, Inland Revenue has been involved in Working for Families tax credits since 1986/1987, Child Support since 1991/1992, and the Student Loan scheme since 1991/1992.

15 An IR3 must be filed if an individual earns income which has not been taxed during the year.

16 Employers may withhold PAYE from the employee share scheme income.

17 Alternatively, whether they are a non-resident deriving no income with a source in New Zealand other than non-resident passive income referred to in section RF 2(3) of the Income Tax Act 2007.

18 In the 2015 tax year 3,246,000 individuals were reported as receiving PAYE income. If those people submitted an IR3 or a personal tax summary the following data includes the other income they declared, but if they did not file, then the data is based only on their employment income. 1,851,000 of these people filed a return, while 1,395,000 did not. People who filed returns but were not reported as earning any PAYE income are not included in the following data. Accordingly, the data in the tables will not show the exact number of people who would be affected by the alternative approach at any specified threshold level. For example, a person who did not file might have had interest withheld at a rate that would mean they would also be due a refund or have an amount of tax to pay, but will not show up in this data.