Chapter 1 - Introduction

1.1 One of the principal objectives of the Government’s public sector reforms is for agencies to take a more collaborative, cross-agency approach to delivering better services to New Zealanders. Government agencies are expected to provide the right service to the right person at the right time, by improving the amount and type of information that can be shared between them.

1.2 Inland Revenue has been exchanging targeted information with the Ministry of Social Development since 1994. Those exchanges have delivered significant benefits to the Government and citizens in terms of service improvements and more accurate payments.

1.3 At present, agencies share information under a number of information matching and sharing agreements, which have specific purposes and enable limited information to be shared. This results in multiple requests for the same information under different legislative provisions to determine a customer’s entitlement to benefits and subsidies. These agreements also provide limited ability for collaboration between agencies, and are difficult, expensive, and time-consuming to amend.

1.4 Alternatively, an Approved Information Sharing Agreement (AISA) is a legal framework outlined in Part 9A of the Privacy Act 1993 that allows for a wider purpose for the information shared compared with individual agreements, while also providing robust privacy and appropriate safeguards around how that information may be used.

1.5 Inland Revenue and the Ministry of Social Development are seeking to replace their existing information sharing agreements with an AISA. This will allow a wider purpose for the sharing of information, which will, in turn, enable services to be delivered more seamlessly and in a timelier manner, by allowing the two agencies to perform their respective roles more efficiently.

Purpose of this consultation

1.6 The Government believes the proposals set out in this document will allow the two agencies to provide services more efficiently, while maintaining the protections provided by the Privacy Act 1993 and the Tax Administration Act 1994.

1.7 The Government welcomes feedback on the perceived advantages and disadvantages of these proposals and whether further controls should be put in place.

1.8 These proposals build on the current successful information sharing activity.

Summary of proposals

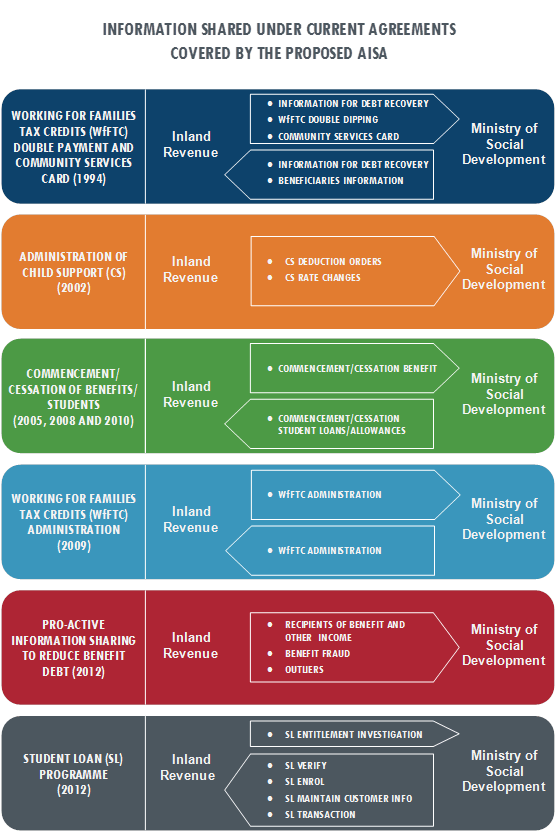

1.9 The Government proposes that the current numerous and diverse information sharing agreements between Inland Revenue and the Ministry of Social Development should be amalgamated into one Approved Information Sharing Agreement. The diagram shows the information shared between the two agencies under those agreements.

1.10 The Government also proposes that the information shared between the two agencies is extended to:

- sharing income and family details to enable the provision of targeted housing assistance to those in need; and

- sharing income details of students and their parents to enable verification of income for the assessment of student allowance entitlements.

How to make a submission

1.11 Submissions are invited on the proposals in this discussion document.

1.12 The closing date for submissions is 16 December 2016.

1.13 Submissions can be made:

- online at the Government Online Engagement Services’ website www.govt.nz/Info-sharing-IR-and-MSD;

- by email to [email protected] with “Information sharing between Inland Revenue and the Ministry of Social Development” in the subject line; or

- by post to:

Information sharing between Inland Revenue and the Ministry of Social Development

C/- Deputy Commissioner, Policy and Strategy

Inland Revenue Department

PO Box 2198

Wellington 6140

1.14 Submissions should include a brief summary of major points and recommendations. They should also indicate whether it would be acceptable for officials from Inland Revenue and the Ministry of Social Development to contact those making the submission to discuss the points raised, if required.

1.15 Submissions may be the subject of a request under the Official Information Act 1982, which may result in their release. The withholding of particular submissions, or parts thereof, on the grounds of privacy, or commercial sensitivity, or for any other reason, will be determined in accordance with that Act. Those making a submission who consider that there is any part of it that should properly be withheld under the Act should clearly indicate this.