Chapter 6 - Disregarded hybrid payments

- Requirements for rule to apply

- Dual inclusion income

- Carry-forward of denied deductions

- Application of CFC regimes

- Implementation issues

- Application to New Zealand

6.1 This chapter considers Recommendation 3 of the Final Report; the disregarded hybrid payments rule. The rule applies when a deductible cross-border payment has been disregarded by the payee country due to that country’s treatment of the payer. This generally results in a D/NI outcome. This outcome can be counteracted by the disregarded hybrid payments rule through a denial of deduction in the payer country (the primary response), or an inclusion of income in the payee country (the secondary response or defensive measure).

6.2 The disregarded hybrid payments rule only applies if the parties to the hybrid mismatch are in the same control group or are party to a structured arrangement (both defined in Chapter 12).

6.3 Figure 2.3 in Chapter 2 of this document is an example of a disregarded hybrid payment structure.

Requirements for rule to apply

6.4 A disregarded payment is one that is deductible in a country where the payer is a taxpayer (the payer country) and is not recognised as a payment in any country in which the payee is a taxpayer (the payee country).

6.5 A hybrid payer is an entity that is treated by the payee country in a manner that results in a payment by the entity being disregarded.

6.6 An example of a hybrid payer entity in New Zealand is an unlimited liability company wholly owned by a US parent. The company is fiscally opaque in New Zealand but treated as a foreign branch of the US parent in the US. Accordingly when it makes a payment to its parent, there is a deduction in New Zealand but no inclusion in the US.

6.7 The question of whether an entity is a hybrid payer will not turn on a preordained list of entities and no characteristics in and of themselves would qualify an entity as a hybrid payer. Moreover, an entity that is considered to be a hybrid payer in one scenario may not be a hybrid payer under a different scenario. See for instance, Example 3.2 of the Final Report, reproduced below as Figure 6.1.

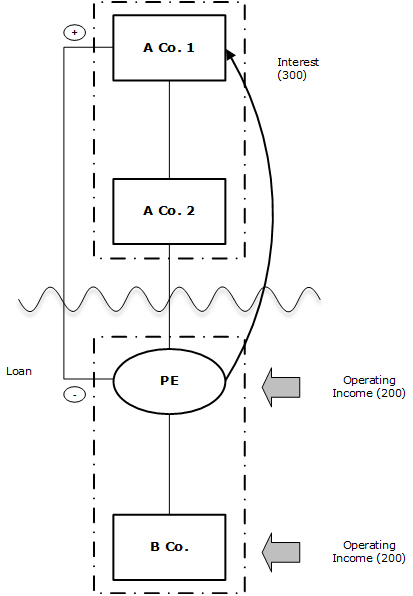

Figure 6.1: Disregarded hybrid payment using consolidation regime and tax grouping[51]

6.8 In this case, the election by A Co 1 and A Co 2 to consolidate for tax purposes results in a disregarded payment and the classification of A Co 2 as a hybrid payer. It is the fact of consolidation rather than the particular characteristics of A Co 2 that mean that the company is a hybrid payer.

6.9 It is possible for a disregarded payment to arise as a result of a deemed payment between a branch and another part of the same legal entity. In some countries, if funds or an asset, attributable to a foreign entity’s operations in a foreign country is provided to a domestic branch of the same legal entity, the domestic branch is entitled to a deduction for a notional payment for the provision of the funds or asset. If the foreign country does not recognise this payment, there is a disregarded payment.

Dual inclusion income

6.10 The disregarded hybrid payment rule will not apply to the extent that the payer’s deduction is offset against income that is dual inclusion income.

6.11 Dual inclusion income is ordinary taxable income in the payer country and in the payee country. Dual inclusion income is also relevant to the deductible hybrid payments rule and to the double deduction and dual resident payer rules which are discussed in Chapters 8 and 9 respectively.

6.12 The exclusion from the rule for disregarded payments offset by the payer against dual inclusion income recognises that a taxpayer’s circumstances may create a tax advantage through a disregarded payment in the payer country which is neutralised by taxation in the payee country. The advantage is neutralised because the payee country taxes the dual inclusion income with no deduction for the disregarded payment.

6.13 Differences in the way that each country treats income in terms of timing or valuation will not prevent the classification of an item of income as dual inclusion income. This is demonstrated in Example 6.1 of the Final Report. In that example, different timing rules apply in the payer and parent countries to the calculation of dual inclusion income, which means that different amounts are affected by the hybrid rule depending on whether the primary or defensive rule applies. The payer country’s calculation of the dual inclusion income is used to make the primary response whereas the payee country’s calculation would be used to make the defensive response.

6.14 The Final Report recommends that items that are taxed as income in one country and are subject to a type of double taxation relief in the other country can nonetheless be classified as dual inclusion income.[52] Dual inclusion income includes an equity return that is:

- taxable in the payee country (whether or not with an underlying foreign tax credit); and

- granted a tax credit or exemption in the payer country, which is designed to avoid economic taxation.

6.15 An example of dual inclusion income that is subject to double taxation relief in one country is Example 6.3 of the Final Report. In that example, a dividend received by a hybrid payer is allowed an intra-group tax exemption in the payer country but is subject to tax in the payee country due to the dividend recipient (hybrid payer) being treated as fiscally transparent in the payee country.

6.16 A further example of dual inclusion income is if B Sub 1 in Figure 2.3/6.1 pays an exempt or fully imputed dividend to B Co, provided that dividend is subject to tax in Country A.

6.17 Broadly speaking, the effect of allowing a D/NI payment to be deducted against dual inclusion income but then applying Recommendation 3 as to any excess is that to the extent of the D/NI payment, any net loss incurred by or through the hybrid entity:

- is unable to be used to offset any other income in the payer country (primary rule); or

- is unable to be used to offset any other income in the payee country.

The qualification to that statement is that it is only entirely true if all of the income derived by or through the payer entity is dual inclusion income. If some of it is not dual inclusion income, the amount of the D/NI payment that may not be deducted will be increased by that amount.

Example

Take the example in Figure 2.3/6.1. Suppose that the interest payment to A Co is $300, and that in addition, B Co has $50 of income and B Sub 1 has $100 of net income. The $50 income earned by B Co would prima facie be taxable also to A Co, and is therefore dual inclusion income. The $100 earned by B Sub 1 would not be taxable to A Co and therefore would not be dual inclusion income.

Accordingly, under the primary rule, Country B would deny B Co a deduction for $250 of the interest. B Co would have no net income or loss, and B Sub 1 would have $100 income. A Co would have $50 income.

Under the defensive rule, Country A would tax A Co on $250 of interest. The result of the defensive rule would be a loss in Country B of $150 (after offset of $100 of B Co’s $250 loss against B Sub 1’s income), and income for A Co in Country A of $300 (the $50 of income earned by B Co plus $250 under the Recommendation 3 defensive rule).

Carry-forward of denied deductions

6.18 Any deduction denied under the disregarded hybrid payments primary rule may be carried forward to a future year to be offset against excess dual inclusion income (that is, dual inclusion income against which a hybrid deduction has not already been taken).

6.19 Carry-forward would be subject to the existing continuity of ownership rule that applies to the carry-forward of losses.

Example

Take the example above. Suppose the only event in year 2 is that B Sub 1 pays a dividend to B Co of $100, which is exempt to B Co in Country B but taxable to A Co in Country A. The dividend is dual inclusion income. If the primary rule applied in year 1, in year 2 $100 of the $250 portion of the interest deduction disallowed in year 1 under the primary rule would be deductible to B Co in year 2, giving it a net loss of $100 in Country B, which it is free to use in accordance with Country B tax rules (for example, it can be grouped with the income of another group member).

However, if the defensive rule applied in year 1, the Final Report does not provide for reversal of the $250 income recognised by A Co.

Submission point 6A

Submissions are sought on whether there are any issues with using the rules for the carrying forward of tax losses as a basis for the treatment of carrying forward disallowed deductions.

Application of CFC regimes

6.20 The Final Report states (paragraph 127) that an item of income can be dual inclusion income if it is the ordinary income of a company subject to tax in one country and is attributed income for the shareholder of the company in another country under a CFC regime. The Final Report recommends that for a taxpayer to claim an item of income to be dual inclusion income, they must demonstrate to the relevant tax authority that the effect of the CFC regime is that the item of income is subjected to full rates of tax in two countries.

Implementation issues

6.21 To calculate its dual inclusion income, a taxpayer must detect all instances where two countries will consider the same item to be included as income. This task could involve substantial compliance costs where a taxpayer has many cross-border payments and where payments are recognised in different ways by the countries. The Final Report suggests that countries should aim to introduce implementation solutions that maintain the policy intent of the rules while reducing the compliance costs that taxpayers may encounter in assessing their dual inclusion income.[53]

6.22 Taxpayers generally prepare accounts of income and expenditure in the countries they operate in. This information could be used as an initial basis for identifying dual inclusion income. A document containing this information with identified dual inclusion income items should be maintained by the taxpayer to support the claiming of a deduction for a D/NI payment (and, if the payer country does not apply the primary rule, non-inclusion of such a payment under the secondary rule).

6.23 The Final Report proposes[54] that, to apply the disregarded hybrid payments rule primary response, the total claimed deductions for disregarded payments would be limited to the extent of the total identified dual inclusion income of the taxpayer. The defensive response would be achieved by requiring payee country entities to recognise income to the extent that deductions claimed in the payer country exceed dual inclusion income.

6.24 Another implementation solution suggested by the Final Report (Example 3.2, reproduced in Figure 6.1) is in relation to a consolidated group that crosses two countries (for example, where a member has a branch in another jurisdiction, or where a member is a resident of another jurisdiction). The Final Report proposes that in applying the primary response the payer country could prevent a hybrid payer from using a loss of the payer country consolidated group to the extent that deductions have been claimed in the payer country for payments that were disregarded under the law of the payee country. For the defensive response, the payee country would require a resident entity to include as income the hybrid payer’s deductible payments that are disregarded in the payee country to the extent that they result in a net loss (taking into account dual inclusion income) in the payer country. The Final Report further suggests that specific measures would be needed to ensure that the parties involved in a transaction cannot circumvent these rules by allocating non-dual inclusion income to the hybrid payer in order to offset its losses.

Submission point 6B

Submissions are sought on the practicalities of assessing a taxpayer’s dual inclusion income, the feasibility of the implementation options described above, as well as any other implementation solutions for the successful operation of dual inclusion income rules in New Zealand.

Application to New Zealand

Carry-forward/reversal of defensive rule income

6.25 The Final Report does not propose a carry-forward rule for the application of the defensive rule. This creates a potential for over-taxation in a scenario where the defensive rule is applied to include extra income in the payee country and excess dual inclusion income arises in a later year.

6.26 A solution to this problem may be to provide for a “reversal” rule whereby the application of the defensive rule in the payee country could be reversed (through an allowable deemed deduction) in a later year where there is excess dual inclusion income.

6.27 Alternatively, the defensive rule could be limited so that income is only included to the extent that the disregarded payment deduction is offset against non-dual inclusion income in the payer jurisdiction. In the event that there is no non-dual inclusion income that the payment can be offset against, the income inclusion could be suspended until non-dual inclusion income is present. Unlike the reversal approach, this option would require the payee country tax authority and payee jurisdiction taxpayers to be aware of the level of non-dual inclusion income being earned in the payer country.

Submission point 6C

Submissions are sought on whether it is appropriate to depart from the OECD’s recommendations in this regard, and which approach would be best to take.

Dual inclusion income

6.28 As with Recommendation 1, it is proposed that CFC income is not able to be included as dual inclusion income. This will avoid drafting a large amount of very detailed and targeted legislation, aimed at situations that are unlikely to arise, and that in all likelihood will not deal appropriately with the peculiarities of such situations when they do arise.

Submission point 6D

Submissions are sought on whether it is appropriate to depart from the OECD’s recommendations in relation to CFC income as dual inclusion income.

51 OECD 2015 Final Report, Example 3.2, at p293.