Overview

(Clauses 27 to 54)

The bill proposes a new method of paying provisional tax – the accounting income method (AIM).

Background

There are currently three methods for calculating provisional tax: the standard uplift, estimate and GST ratio methods. The proposed AIM is not replacing these methods; it introduces a fourth method. Most businesses meet their income tax liability by paying provisional tax in three instalments throughout the year. Use-of-money interest (UOMI) is charged as if income was earned evenly over an income year, which is not realistic for many taxpayers. Feedback to Inland Revenue has focused on the inflexibility of provisional tax and its lack of integration with the natural rhythms of running a business. The current dates for payment are independent of when income is earned, which does not work well for businesses with fluctuating incomes and tight budgets. New businesses benefit from not having to pay provisional tax in their first year of business but often struggle with making payments in their second year.

This proposed new measure was announced by the Government in Budget 2016 as part of a package focused on tax reform for small businesses. The package is designed to provide certainty and reduce compliance costs.

A growing number of small businesses are using accounting software. The introduction of AIM will offer software providers an incentive to extend the capability of their products to include the consideration of tax-related issues during the year rather than waiting for a year-end review.

Using upgraded software that includes income tax information would enable businesses to consider their tax adjustments throughout the year and seek input from their tax advisor at any time, rather than just at year-end. This would provide businesses with better visibility of their tax liability during the year. New businesses would be able to start paying tax when they start making a profit, educating them about, and supporting them to meet, their tax obligations in their first two years in business. There would be no tax surprise for them in their second year of business.

Proposed approach

Inland Revenue has previously worked with software providers to enable GST returns to be filed from accounting software. This has simplified meeting tax obligations and reduced the amount of time that businesses spend on compliance. AIM is another step in integrating tax into business processes.

Inland Revenue would continue to work with tax agents to ensure that their involvement in the reform of provisional tax, and in particular, the proposed AIM approach, continues. Their involvement in developing any proposed changes would ensure a practical perspective on the design of AIM and its use in business.

It is expected that it will take time for taxpayers to feel confident in using a new proposed provisional tax method. It is expected that the accuracy of payments made will gradually improve as corrections made at year-end are captured in software and flow through to future years, reducing the error rate.

What using AIM will mean for businesses

Under the proposed changes, provisional tax would be integrated into business processes and payment amounts would be based on current year tax-adjusted income. Businesses using AIM would have more certainty they are paying the right amount of tax as it will be paid as income is earned. This would increase businesses’ confidence in their financial position at any particular time.

For those who keep their accounting packages up to date, calculating a business’s provisional tax liability during the year would not require any significant additional work for businesses and their advisors. For those who currently leave most of their tax calculation until year-end, AIM would require more consideration of adjustments during the year; this should, however, be offset by a reduced year-end workload. The calculation of income tax would become integrated into the general operation of business accounts.

An AIM-capable software system must have a way of flagging entries or sending communication to a third party (usually the tax agent). This is not a compulsory review point but rather ensures there is always a way for the tax agent to stay involved in the process. The extent of the relationship between the taxpayer and their tax agent is at their discretion.

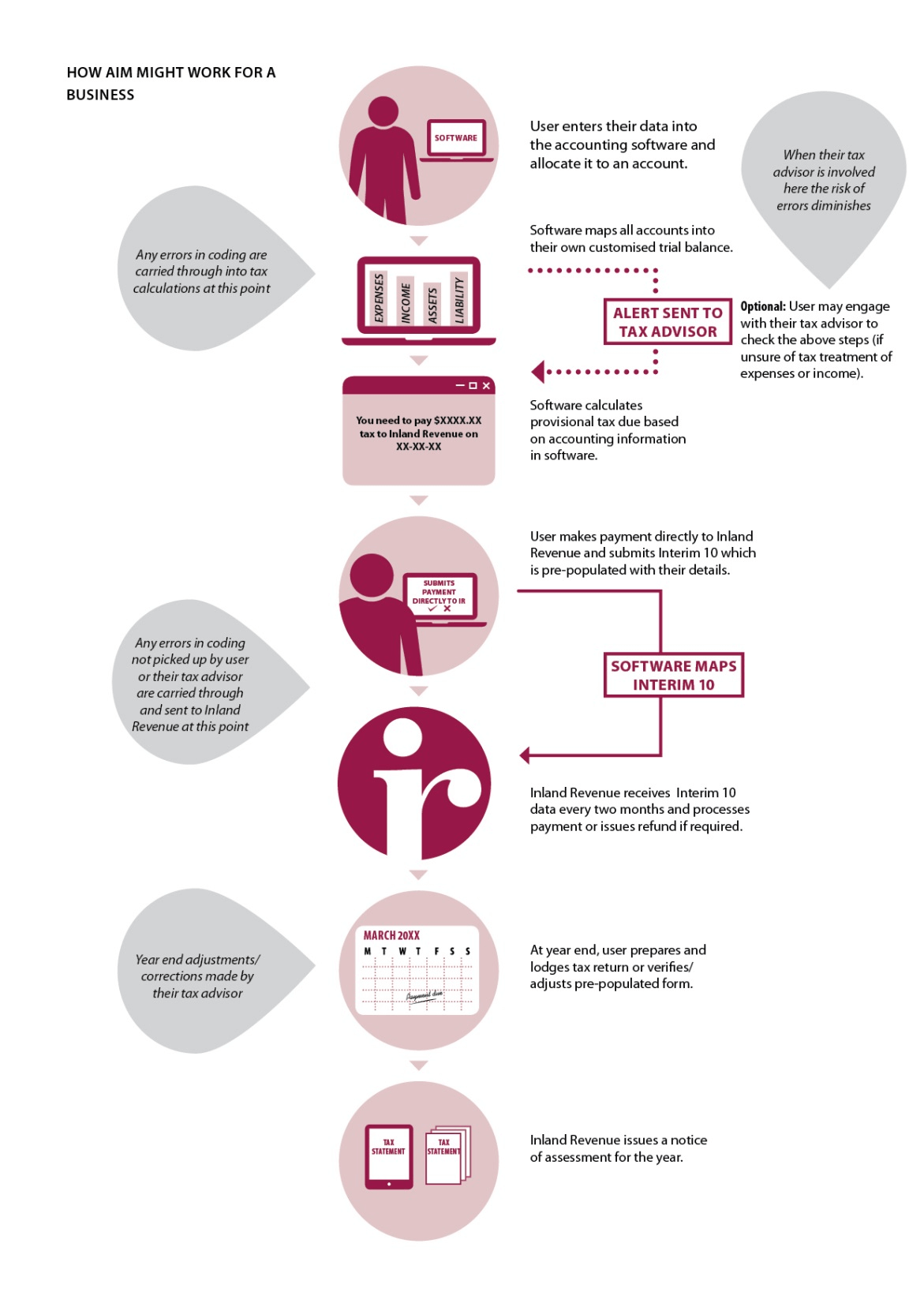

The following graphic shows how the AIM proposal would work for a business.

The following examples illustrate how the proposed AIM would apply.

Example 1

Murphy Cliffe has recently finished a painting apprenticeship and intends to set up his own house painting business. He has no previous business knowledge and his parents suggest he meet with their accountant to get some advice. The accountant suggests Murphy sets up a company, starts using a basic accounting software package and elects into paying provisional tax using the AIM approach to help him budget in his first year of business. Murphy’s company has a March balance date and will pay GST and provisional tax using the AIM approach on a two-monthly basis. Murphy does not make any profit in the first few months due to his set-up costs, but starts to make a profit towards the end of the year. He will pay provisional tax as follows:

| GST & provisional tax payment dates | 28-Jun 2018 | 28-Aug 2018 | 28-Oct 2018 | 15-Jan 2019 | 28-Feb 2019 | 7-May 2019 | Total prov tax | Terminal tax due |

|---|---|---|---|---|---|---|---|---|

| Income earned during current year | Nil | Nil | Nil | 20,000 | 30,000 | 50,000 | 28,000 | |

| Implied tax on taxable income | Nil | Nil | Nil | 5,600 | 8,400 | 14,000 | 328,000 | Nil |

AIM will help Murphy budget for tax correctly in his first year of operation as he pays tax as he earns income. He decides to wait before he buys a new vehicle for his business.

If Murphy had decided against using AIM, he would have paid no provisional tax in his first year of operation and had his business continued into its second year, his tax payment schedule for his first and second year[1] would be as follows:

| GST & provisional tax payment dates | 28-Aug 2018 | 15-Jan 2019 | 7-May 2019 | Total prov tax | Prov tax 1 28-Aug 2019 |

Prov tax 2 15-Jan 2020 |

Prior year terminal tax due April 2020 |

Prov tax 3 7-May 2020 |

|---|---|---|---|---|---|---|---|---|

| First year of business | no provisional tax due in first year of business | |||||||

| Tax due in second year of business | Nil | Nil | Nil | Nil | 9,800 | 9,800 | 28,000 | 9,800 |

Unless Murphy had budgeted carefully he may not have set the right amount aside for his terminal tax due in the second year in one lump sum. He instead bought a new vehicle for his business. In his second year of operation his terminal tax from his first year of $28,000 falls due and he also has to pay his provisional tax payments for his second year of $9,800 each. If Murphy had not set the appropriate amount aside in his first year of business he may struggle to meet this payment schedule and his business could fail.

Example 2

Benson Electrical Ltd is considering the use of AIM in their existing business. They currently use accounting software, pay GST every two months, and have a March balance date. Their accountant talks to them about using AIM due to the unpredictable nature of the contracts they are being awarded. The inability to plan in the past has resulted in exposure to use-of-money interest. They generally have a slow start to the financial year but business picks up in the latter half. Their business is steadily growing and their residual income tax is $180,000 in 2017 and $220,000 in 2018.

They ask their accountant to show them what their provisional tax liability would look like under different methods for the 2019 year and how exposure to use-of-money interest would differ.

In this scenario, their possible use-of-money interest[2] costs range between nil and $6,594.

| Provisional tax payment dates | 28-Jun | 28-Aug | 28-Oct | 15-Jan | 28-Feb | 7-May | Total prov tax | ||

|---|---|---|---|---|---|---|---|---|---|

| Income earned during current year | 108,000 | Nil | 178,000 | 250,000 | 178,000 | 143,000 | |||

| Implied tax on taxable income | 30,240 | Nil | 49,840 | 70,000 | 49,840 | 40,040 | 239,960 | ||

| Provisional tax methods and due dates for payment | 28-Jun | 28-Aug | 28-Oct | 15-Jan | 28-Feb | 7-May | Total prov tax | Terminal tax due | UOMI incurred |

| AIM | 30,240 | 0 | 49,840 | 70,000 | 49,840 | 40,040 | 239,960 | 0 | 0 |

| Uplift 105% | 77,000 | 77,000 | 77,000 | 231,000 | 8,960 | 682 | |||

| Uplift 110% | 66,000 | 66,000 | 66,000 | 198,000 | 41,960 | 3,194 | |||

| Estimate | 40,000 | 60,000 | 90,000 | 190,000 | 49,960 | 6,594 | |||

| Uplift/Estimate switch | 63,000 | 63,000 | 130,000 | 256,000 | -16,040 | 224 |

Proposed approach

To date, Inland Revenue has worked with representatives of the software and accounting industry in developing AIM to test concepts and identify opportunities. Their role was to help officials understand software capabilities and use by small businesses and identify opportunities for reducing businesses’ compliance costs. Statistical and market data was provided by software providers to help Inland Revenue prepare its advice to Government. (Inland Revenue was not provided with access to the data or business systems of individual businesses only summarised and anonymous information was used in the development of this policy.)

Since April 2016, there has been extensive consultation on the technical details of the AIM proposals through written submissions, an online forum and workshops with small business owners, accountants and interested software providers.

In the upcoming year, it is proposed Inland Revenue would continue to work with interested software providers on incorporating AIM into their products.

Inland Revenue will continue to work with members of the accounting profession to provide a practical perspective on the design of AIM and its proposed use in business.

It is proposed that Inland Revenue drafts a technical Determination in relation to the changes proposed in the bill. This reflects the fact that AIM is first and foremost a tax collection method. Its provisional tax natures implies it is not a year-to-date method requiring exact tax liabilities to be calculated on a regular basis, but it does need to ensure reasonably accurate amounts of tax are collected during the year. For this reason, it is proposed that AIM requires a series of adjustments to calculate the amounts of provisional tax due. The proposed Determination would also outline what technical adjustments must be made within the software.

Having these technical matters contained in a Determination that all software providers must adhere to, would ensure commonality of treatment across different software products. A working group comprising representatives from the accounting and software professions, small business representatives and officials would develop these proposed Determinations. This will ensure the adjustments and information requirements are practical, relevant and as simple as possible, and that the software remains intuitive and effective to use. The proposed technical Determination is discussed in more detail later.

[1] Using the standard uplift method of 105% of his prior year residual income tax, which assumes his tax liability grows from $33,000 to $34,650.

[2] Calculation is based on UOMI rates of 8.27% and 1.62%. It also takes into account the new provisional tax rules of no use-of-money interest for residual income tax less than $60,000 (extension of safe harbour rules), first two provisional tax instalments if using uplift and a taxpayer choosing to switch between methods will be subject to use-of-money interest from the first instalment date.