Chapter 4 - GST treatment of alloy gold

4.1 The GST treatment of gold, silver and platinum depends on their purity. Gold, silver and platinum[5] are a “fine metal”, when they are in any form having a fineness of not less than a certain specified percentage (99.5%, 99.9% and 99.0% respectively). A supply of fine metal is generally exempt, but in certain circumstances may be zero-rated. This includes both exported fine metal, and the first supply of new fine metal to a dealer for the purpose of supply as an investment item. In addition, GST is not charged on fine metal when it is imported.

4.2 In contrast, gold, silver or platinum (collectively referred to as “gold") in a form having a lower purity are not a “fine metal”, and will generally be subject to the same GST treatment as other goods. However, one area where different rules will apply is in allowing deductions for secondhand goods. Deductions are not allowed to the extent secondhand goods are manufactured or made of gold.

Reasons for the current treatment of gold

4.3 This treatment dates back to an amendment made through the Goods and Services Tax Amendment Act 1986, after the Goods and Services Tax Act 1985 received Royal assent, but before GST began to be imposed on supplies of goods and services in New Zealand.

4.4 Previously, the Goods and Services Tax Act 1985 did not contain rules providing for any special treatment for supplies of gold. A supply of gold would be taxable under the ordinary rules. However, a number of concerns were raised about this treatment, as a result of fine gold also being used for investment purposes.

4.5 A major concern was that the price of gold in New Zealand would increase when GST came into force on 1 October 1986 by 10% (the rate of GST at the time) over the internationally set price. This would produce a windfall gain for persons holding gold at this time (if not required to register for GST) as they would be able to sell their gold for this increased price (as a registered purchaser would receive an input tax credit for secondhand goods), but not return any GST. The person could take further advantage of this rule by acquiring gold before 1 October, including by importing additional gold, to take advantage of this potential windfall, at the expense of government revenue.

4.6 Other concerns included the mismatch in treatment with paper dealings in gold, which were arguably an exempt financial service, the risk that gold could be treated as “money”, and that taxing gold would create a tax incentive for investment gold to be exported or held offshore.

4.7 As a consequence of these concerns, the supply of fine gold was made exempt, with a special rule zero-rating the first supply of new fine gold used for investment purposes. The effect of these rules was that GST would not be charged on or embedded in fine gold – while exemption normally effectively taxes a supply by denying deductions, zero-rating the first supply addressed the issue of embedded GST. This is because the refiner may recover GST charged when it purchases non-fine gold to be refined, with subsequent supplies of the fine gold being exempt.

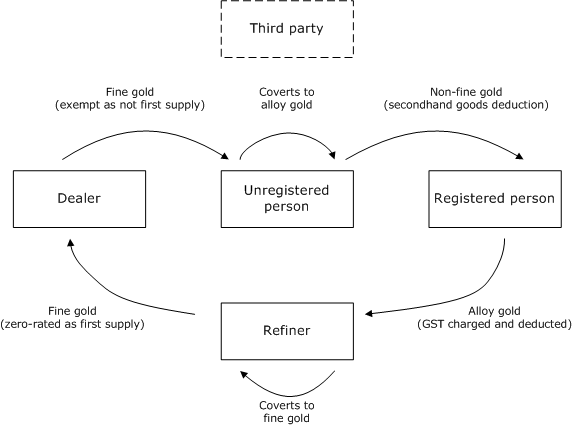

4.8 Concerns remained, however, about allowing deductions for secondhand goods supplied by a non-registered to a registered person such as a refiner. These arose because, for example, an unregistered person could acquire fine gold, and turn it into a non-fine gold alloy. The gold alloy could be supplied to a registered person who would claim an input tax deduction in respect of the purchase. The registered person could then either export it (as a zero-rated supply) to be refined overseas,[6] or potentially sell the gold to a refiner, who would deduct the GST charged. The alloy could then be refined to extract the gold component, as fine gold (and reimported without GST, if applicable), and the cycle could begin again. An example of this is shown below. Completion of this cycle would result in one more deduction than corresponding GST paid. (Note that these concerns reflect the GST rules as they were at the time GST was introduced.)

Example: Carousel fraud involving gold

4.9 This concern was addressed by preventing input tax deductions from being taken for the gold component of secondhand goods. This was achieved by amending the definition of “secondhand goods” to exclude secondhand goods consisting of fine metal, and secondhand goods to the extent they are manufactured or made from gold.

Industry concerns

4.10 Industry representatives have expressed their concern with this treatment, as it does not provide relief for GST embedded in alloy gold, which becomes a cost borne by registered persons in the industry, contrary to the intention underlying GST as a tax on consumption.

4.11 It is argued that the rules in this area are poorly understood, and that practice between businesses varies. In particular, some businesses may be unaware of the special rules for gold, and may be claiming deductions for secondhand goods. This is said to distort competition between businesses which claim a deduction, and those that do not, as businesses taking the deductions bear a relatively lower cost in purchasing these goods, which can allow them to offer a higher price for secondhand gold. Therefore a business taking a deduction could have a significant advantage over its competitors.

4.12 Industry representatives have raised other concerns with the current treatment. The approach of excluding goods from the treatment is said to result in high compliance costs, as the gold component must be determined and valued, so that the deductible portion can be determined. It has been noted that the rules do not recognise the widespread use of gold in a variety of consumer goods, such as in electronics.

4.13 The treatment furthermore produces an incentive for unregistered persons to transact directly with each other, or for a registered person to act as agent of the seller, rather than purchasing the goods themselves.

Policy considerations

4.14 Allowing deductions for secondhand goods recognises GST that is embedded in the price paid for these goods. A GST-registered business that acquires secondhand goods from a consumer will need to return GST when they resupply those goods; however, the goods have already been taxed when they were acquired by the consumer (who could not deduct GST). The effect is that, in the absence of this deduction, the secondhand goods will be taxed twice. Allowing a deduction results in a single layer of tax on these goods, while also taxing the value added by the business.

4.15 As discussed above, the exclusion of gold from the definition of “secondhand goods” reflects the fraud risk stemming from the difference in treatment of fine and non-fine gold, and the ability to convert these metals from a fine form to a non-fine form and back again. Officials understand that the costs involved in carrying out this conversion do not necessarily outweigh the value of the deduction, and the scheme remains theoretically possible. This is because of the relative ease with which gold can be altered from a fine to a non-fine state.

4.16 However, conversion into alloy gold goods that would actually be supplied to consumers (such as jewellery) is a more expensive process. Therefore, the non-fine gold produced by the carousel arrangement would not be in the form of these manufactured goods, but instead be in an unprocessed state. Consumers are not expected to acquire gold in such a form.

4.17 This distinction could allow secondhand goods deductions for alloy gold goods, or goods with an alloy gold component. Secondhand goods could include goods that have been manufactured from alloy gold, such as jewellery or electronic circuitry, but exclude alloy gold that has not undergone a manufacturing process since being produced.

4.18 While there may be real commercial reasons for gold to be in such an unprocessed form – for example, gold filings from the production of jewellery may be collected and melted together before sale to a refiner – officials understand that in these cases, the supplier is likely to be GST-registered. Therefore, GST will be returned and deducted on the supply, and the rules for secondhand goods will not apply.

Suggested solution

4.19 An amendment could be made to allow a deduction in respect of secondhand goods that are manufactured from non-fine gold, silver or platinum. This would exclude non-fine gold, silver and platinum that has not undergone additional manufacturing processes, and therefore still poses a fraud risk. In that case a deduction would still be unavailable.

4.20 This would recognise embedded GST, and reduce compliance costs by removing the need to determine the gold, silver and/or platinum content of those goods.

Timing

4.21 An important question is the timing of any amendment. It has been argued that the rules are unclear. The unavailability of a deduction is in contrast to the normal position for secondhand goods, and is one of a limited number of exceptions to the rule ordinarily permitting a deduction.

4.22 The Commissioner has previously published her view on the treatment of gold, silver and platinum, in Tax Information Bulletin Volume 5, Number 13, “Gold and other fine metal – secondhand goods credit”. That article discusses a hypothetical scenario of a jeweller acquiring jewellery composed of non-fine gold, and only taking a deduction in respect of other metals mixed with gold to make the jewellery. However, it has been claimed that the exception could be interpreted as referring to the industry meaning of “gold”, “silver” and “platinum”, which is the fine metal form. This would exclude the fine metal component of a good that is not composed entirely of fine metal, but allow a deduction for non-fine metal. It has been suggested that a number of businesses may have already claimed deductions on this basis.

4.23 It is likely that in some cases these transactions may not have been economic in the absence of a deduction, and would not have been entered into. The unexpected liability to repay these amounts may have a significant effect on their business. As a deduction is only denied in respect of the gold component, it may also be difficult to determine the extent to which a deduction would have been available in respect of the other components of the good.

4.24 However, it is also important that any amendment be equitable between taxpayers. Officials suggest that any amendment be retrospective by four years before the date of enactment. This would provide certainty to taxpayers by allowing previously claimed deductions, while ensuring compliant taxpayers are not disadvantaged, by being able to claim deductions within the four-year period.

5 Other substances can also be declared to be a fine metal by Order in Council.

6 This requires supply to another registered person, who exports it, due to limitations on zero-rating exported goods where a secondhand goods deduction has been claimed.