Chapter 2 - Financial services

2.1 Supplies of financial services in New Zealand are generally exempt from GST, which means that GST is not charged on the value of the supply, and the supplier cannot claim input tax deductions in relation to that supply.

2.2 The policy rationale for this treatment is that the nature of financial services makes them difficult to integrate with the GST system, where liability for tax arises on a transaction-by-transaction basis throughout the production and distribution chain. This is because it is difficult to measure the amount paid for a financial service, as the financial services provider may be compensated through a margin or spread rather than an explicit fee. Due to the difficulty in taxing the value of services supplied by a financial service provider, the next best option is to effectively tax the supply by denying input tax deductions.

2.3 Since 1 January 2005, supplies of financial services to GST-registered persons whose taxable supplies equal or exceed 75 percent of their total supplies may be zero-rated when the financial services provider elects to do so. Allowing financial service providers to recover input tax in relation to their supplies to registered taxable businesses was intended to reduce the potential for tax cascades caused by the exempt treatment of financial services, where tax must either be absorbed or passed on by the business sector.

Costs associated with capital raising

2.4 A longstanding issue associated with the exempt treatment of financial services occurs when businesses that primarily provide taxable goods and services incur costs to raise capital, such as through the issuing of bonds or shares. Examples of the costs that can be incurred in this way include NZX listing fees, legal fees and costs associated with preparing a product disclosure statement. The GST incurred in relation to these costs will be unrecoverable because the provision of equity and debt securities is considered to be a supply of financial services.

2.5 It is arguable that the GST costs incurred in raising capital should be attributed to the business’s broader taxable activity, rather than being viewed in isolation as relating to an exempt supply of financial services. This is because the purpose of capital raising by a regular taxable business is usually to further their taxable activity, and not to add value as a supplier of financial services.

2.6 This leads to the question of whether the deductibility of input tax in relation to a supply of financial services for capital or debt raising activities should be considered on a transaction-by-transaction basis, or whether the economic substance of the transaction in the context of a business’s taxable activity should determine its deductibility.

2.7 GST generally applies on a transaction-by-transaction basis – whether or not the supplier can deduct any cost incurred will ultimately depend on the GST treatment of the particular supply that the costs relate to, not the taxpayer’s broader activity. Allowing deductions for exempt supplies on the basis that the business is primarily taxable would depart from this legislative framework.

2.8 From a policy perspective, exemption makes sense when a financial service provider is in the business of supplying financial services that might otherwise be difficult to tax because of the ease by which margins and fees may be substituted. The financial service provider is adding value to the services it provides, and since it is difficult to tax the value added, one option would be to deny deductions where the services are received by unregistered customers. However, it may not be appropriate to deny deductions when a regular taxable business supplies financial services to raise funds for furthering its taxable activity, particularly when the business is not seeking to add value to the supply of financial services.

2.9 Given that GST is a tax on consumers and not businesses, denying deductions in relation to raising capital in some contexts may be contrary to this principle. Denial of deductions may cause tax cascades in which a taxable business absorbs the GST cost or passes the cost on to its customers. A business that generally makes taxable supplies can also experience higher compliance costs when making exempt supplies to raise capital, as it will be necessary to apportion purchases between these activities when claiming input tax deductions.

2.10 On balance we consider that when a business raises capital to further its taxable activity, it is appropriate to disregard the exempt treatment arising from the capital raising and instead treat these costs as relating to the business’s broader taxable activity.

How tax cascades arise

2.11 The following examples illustrate two ways in which a tax cascade can arise when a business is not entitled to deduct GST costs associated with raising capital. In the first example, the GST is passed on to others in the supply chain. In the second example, the GST cannot be passed on but is absorbed by the company. In practice, a combination of the two may occur.

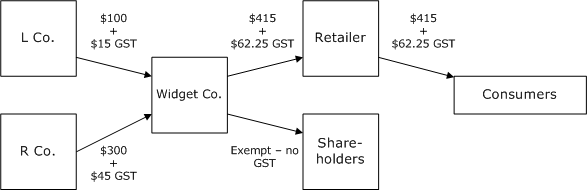

Example: GST is passed on to others in the supply chain

In this example, Widget Co. pays $115 (including $15 GST) for services supplied by L Co. (in relation to issuing shares) and $345 (including $45 GST) for goods provided by R Co. (for use in manufacturing widgets). Widget Co bears a total cost of $415, as it deducts $45 GST, being the GST charged on the supplies used to make taxable supplies (widget sales).

Widget Co. is not able to deduct the $15 GST charged on the supply by L Co., as it was incurred to make an exempt supply – the issue of shares. Widget Co. passes this GST cost on to the retailer. The retailer pays Widget Co. $477.25 and deducts GST, bearing a total cost of $415, as it deducts the GST charged.

The retailer passes these costs on to the final consumers, in a taxable supply of $477.25 ($415 plus $62.25 GST). Consumers are unable to deduct this GST.

The total GST paid in this supply chain is $77.25. This is made up of $60 charged on the $400 of goods and services that were supplied to consumers, the $15 Widget Co. was unable to deduct, and $2.25 in GST charged when the embedded GST was recovered through a taxable supply.

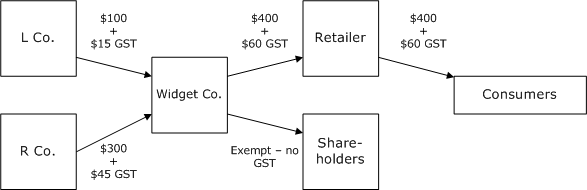

Example: GST cannot be passed on but is absorbed by the company

In this example, Widget Co. is unable to pass the GST cost along the supply chain, and instead it bears this cost. The GST is effectively being paid by Widget Co. through reduced profits, rather than being shifted onto the price of the goods and services that are supplied to final consumers.

The total GST paid in this supply chain is $75. This is made up of $60 charged on the $400 of goods and services that were supplied to consumers, and the $15 Widget Co. was unable to deduct.

When should an input tax deduction be available for capital-raising activities?

2.12 The ability to claim input tax deductions for the cost of raising capital should, however, only be available to the extent that the taxpayer makes taxable supplies of goods and services. Allowing a deduction for capital raising costs incurred for a taxpayer to further their exempt supplies would be contrary to the policy objective of the exemption, which is to effectively tax these supplies by denying deductions.

2.13 Consequently, for registered businesses that incur GST costs in raising capital, the exempt treatment of the supply should be disregarded, with the costs incurred being deductible to the extent that the taxpayer makes taxable supplies as a proportion of their total supplies.

2.14 Apportioning input tax deductions according to the extent to which a taxpayer makes taxable supplies is a pragmatic way to provide certainty on the extent to which capital raising costs are deductible. It is proposed that businesses would not be able to attribute the cost of raising capital to a particular activity. As money is fungible between activities, it may otherwise be difficult to determine the extent to which capital is being raised to finance the taxpayer’s taxable, as opposed to exempt, activities. The proposed solution would instead result in the taxpayer apportioning their capital-raising costs in the same manner as other costs that relate to their business as a whole, as they are not attributable to a particular part of the business.

2.15 Limiting input tax deductions to the extent that the capital raising costs are incurred to further the making of taxable supplies, and not exempt supplies, follows the approaches adopted in other jurisdictions.[2]

2.16 We recognise that, in some cases, the direct attribution of costs may be more appropriate – such as if costs relate solely to the taxable part of a business – and would welcome submissions on this point.

Example

C Co. is a property developer, which makes 80 percent taxable supplies and 20 percent exempt supplies. It issues a bond to raise capital in order to finance the purchase of land. In issuing the bond, it spends $10,000 on legal fees.

The suggested approach would treat these costs as being attributable to C Co.’s broader taxable activity, rather than to an exempt financial supply. This means that C Co. would be able to deduct 80 percent of the GST costs incurred.

Should the approach suggested apply to financial service providers?

2.17 The business-to-business financial services rules allow financial service providers to recover input tax in relation to their supplies of financial services to other registered businesses that predominantly make taxable supplies. Taxpayers that principally provide financial services are able to enter into an agreement with the Commissioner on a fair and reasonable method to apportion their costs between their taxable and exempt activities.

2.18 The costs incurred by financial service providers in issuing shares, bonds and debentures would generally be apportioned according to the extent to which the financial service provider makes taxable supplies. This is consistent with the principle that would apply to regular taxable businesses under the suggested approach.

2.19 It is questionable whether the proposal therefore needs to extend to registered persons that principally make financial supplies. In particular, as financial service providers issue securities as an integral part of their business in intermediating between borrowers and lenders, it may be difficult to draw a distinction between capital raising costs that relate to their broader activities, and other circumstances.

2.20 Submissions are sought however on whether any concerns arise for financial service providers in relation to the deductibility of GST costs incurred in raising capital, and if so, how these concerns may be addressed.

Which supplies of financial services should be included?

2.21 As we have outlined, a registered person must have a taxable activity to deduct costs incurred in capital raising. This means the registered person must carry out the activity continuously or regularly, and supply or intend to supply goods and services for consideration.

2.22 Section 3(1) defines “financial services” as including:

(c) The issue, allotment, drawing, acceptance, endorsement, or transfer of ownership of a debt security;

(d) The issue, allotment, or transfer of ownership of an equity security or a participatory security.

2.23 The key financial services that a business may supply when raising capital are the “issue” or “allotment” of a security. The issue of a security involves the delivery of a document or an act that establishes the title of the holder of a security. The allotment of a security occurs when the person offering a security (the issuer) accepts a subscriber’s offer to purchase the security, which is generally when the contract for the issue of the security is formed.

2.24 For example, this would mean that when issuing a debt or equity security, a business would be able to recover the GST on expenses such as legal and advisory fees, the costs of preparing a product disclosure statement or other documents, valuation fees, printing and advertising.

2.25 This approach would not affect the current treatment of financial services supplied to a non-resident who is outside New Zealand at the time the services are performed, as they will continue to be zero-rated.

Example

D Co., a manufacturing company, plans to issue shares to raise capital for expansion of its operations. In issuing the shares, D Co. incurs expenses such as legal and accounting fees, advertising and printing.

Under the suggested approach, the exempt treatment of the issue of equity security would be disregarded, and the costs would be attributed to D Co.’s broader taxable activity. If when disregarding the issue of shares, D Co. only makes taxable supplies, it can deduct all of the GST costs incurred in issuing the shares.

Suggested solution

2.26 An amendment could be made to disregard the exempt treatment of the issue or allotment of an equity or debt security by a registered person when considering whether the costs relating to this activity are deductible. Instead, these costs would be considered to relate to the registered person’s broader taxable activity, with the costs being deductible to the extent that the registered person makes taxable supplies as a proportion of their total supplies by value.

2.27 Officials consider that it may be appropriate to exclude taxpayers that principally make supplies of financial services from this rule, as they are able to apportion capital-raising costs under the current legislation.

2.28 The amendment would apply from 1 April 2017.

2 The leading European case on the issue is Kretztechnik AG v Finanzamt Linz (Case C-465/03). The case established the principle in Europe that businesses are entitled to recover input tax incurred on the costs of issuing shares to the extent that they make taxable supplies.