Chapter 1 - Overview

An efficient tax administration system is important for New Zealand and is critical to our country’s economic and social wellbeing.

Why?

Inland Revenue collects taxes and distributes money on behalf of the Government.

- Taxes pay for essential public services such as schools, hospitals, roads, social welfare and much more.

- There are millions of interactions with the tax system every day. People pay tax through their wages, salaries and interest payments; businesses collect and pay GST and other taxes.

- Important government services, such as Working for Families, student loans, child support and KiwiSaver are delivered by the tax administration system.

- Running the tax system is expensive; for the government in running it, and for individuals and businesses complying with it. Everyone shares these costs, whether directly or indirectly.

A BETTER TAX ADMINISTRATION SYSTEM

The Government wants to make it simpler and faster for New Zealanders to pay the taxes and receive the entitlements they should. It is proposing changes that will create opportunities for individuals and businesses to spend less time on taxes and compliance, and more time on living their lives and growing their businesses.

Technology is a key consideration for this Government. The tax administration system could improve services and reduce compliance costs for customers and administrative costs for Inland Revenue.

For this to happen:

- Inland Revenue needs to offer a wider range of secure digital services.

- It needs to work with others who deal with tax, such as banks and business software developers, so tax interactions are built into customers’ regular transactions, rather than having to manage tax separately at specific times of the year.

THIS IS HOW THE FUTURE COULD LOOK:

|

|

|

|---|---|---|

| MIKE: Individual | ZACK: Small business | MARY: Medium/Large business BEN: Individual |

Mike is 66 and retired, but still helps out at his former employer occasionally. He has reinvested his KiwiSaver funds in a range of New Zealand listed shares and bonds, and term deposits. What if Mike’s interest and dividends were already included in his online tax return? He could simply check everything was correct, and confirm and complete his return at the click of a button. |

Zack wants to establish an adventure tourism business. What if Zack could buy a “business in a box” accounting software package that would automatically register his new business with government, including Inland Revenue, for income tax, GST, and as an employer? |

Mary runs a medical supplies company with 140 staff. Ben works for the company on a casual basis when they need an extra hand. He is repaying his student loan and is entitled to Working for Families tax credits. What if Mary’s payroll software automatically sent Ben’s information to and from Inland Revenue as part of each weekly pay cycle, with his student loan repayments and Working for Families entitlement being automatically calculated and updated? Mary’s job would be much easier and Ben would no longer have money owing or a refund due at the end of each year. |

SUMMARY OF PROPOSALS

Many people and businesses are already using digital services to manage their taxes, and are enjoying the convenience, speed and simplicity. As Inland Revenue builds more and better digital services – sometimes in conjunction with third parties – more people and businesses will be able to enjoy the benefits that digital services provide.

People and businesses who do not have access to digital technology, or the skills or knowledge to use it, might be able to use digital services if some help was provided.

Non-digital services would continue to be provided for those who still cannot use digital services.

Some people and businesses might be able to use digital services, but need encouragement. When the majority of individuals and businesses in similar circumstances are using digital services, having a few who do not use digital services can create problems. These could include: the costs in keeping a non-digital service available for a small number of users, or denying others, such as a business’s customers or employees the benefits of an improved tax administration system. This paper seeks views on how we might move these individuals and businesses to digital services.

These proposals will need changes to the law, and system changes at Inland Revenue. Inland Revenue will be communicating the changes to New Zealanders well before the introduction of any changes.

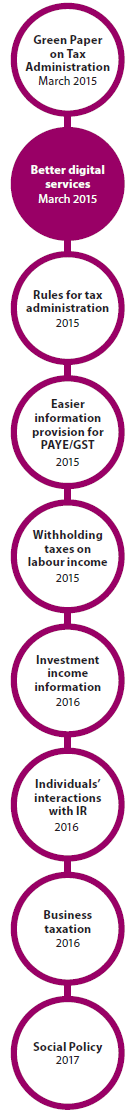

CONSULTATION TIMETABLE

| Green Paper on Tax Administration | March 2015 |

| Better digital services | March 2015 |

| Rules for tax administration | 2015 |

| Easier information provision for PAYE/GST | 2015 |

| Withholding taxes on labour income | 2015 |

| Investment income information | 2016 |

| Individuals’ interactions with IR | 2016 |

| Business taxation | 2016 |

| Social Policy | 2017 |

MAKE A SUBMISSION

You are invited to make a submission on the ideas raised in this discussion document. You can make a submission:

- Online at: makingtaxsimpler.ird.govt.nz

- By email to: [email protected]z, please put “Making Tax Simpler” in the subject line.

- By post, with submissions addressed to:

Making Tax Simpler

C/- Deputy Commissioner, Policy and Strategy

Inland Revenue Department

PO Box 2198

Wellington 6140

The closing date for submissions is 15 May 2015.

Submissions may be the subject of a request under the Official Information Act 1982, which may result in their release. The withholding of particular submissions, or parts thereof, on the grounds of privacy, or commercial sensitivity, or for any other reason, will be determined in accordance with that Act. Those making a submission who consider that there is any part of it that should properly be withheld under the Act should clearly indicate this.

WIDER CONTEXT

Changes to the way tax is administered are planned over a number of years. You can find out more about the bigger picture, and have your say on a range of other topics in the future, by visiting makingtaxsimpler.ird.govt.nz