Chapter 2 - Key elements of potential changes

- The future for business processes - PAYE

- The future for business tax

- Withholding taxes from capital income

- Individuals

- Social policy

- The policy and legislative framework for tax administration

- Next steps

- List of all questions for readers from this chapter

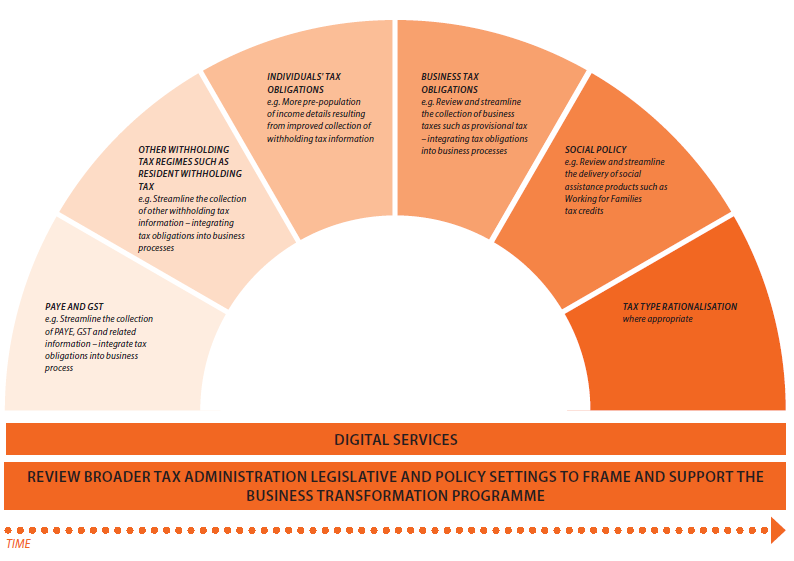

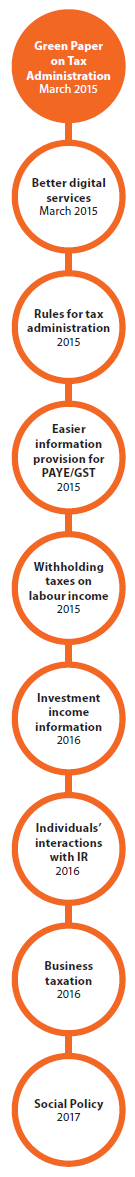

The diagram below shows the key elements of the modernisation programme.

These elements are discussed in greater detail in the appendices attached to this Green paper, but the following provides a brief summary.

THE FUTURE FOR BUSINESS PROCESSES – PAYE

Questions for readers

- The Government’s view is that more effective use of a business’s own systems to provide PAYE, GST and related information to Inland Revenue would provide real benefits to employers – do you agree?

- If not, what would be a better focus for future consideration in relation to PAYE processes?

- Have we considered all likely issues in relation to streamlining the collection of PAYE and related information?

Taxes deducted from salary and wage earners by their employers form a very important part of our tax administration, so streamlining the collection of PAYE, GST and related information, and integrating tax obligations into business processes, is crucial for modernising the tax system.

Pay As You Earn (PAYE) is a system for deducting income tax at source for salary and wages, and all who employ staff use the PAYE system. Every month, employers (or PAYE intermediaries) send PAYE information to Inland Revenue using the Employer Monthly Schedule (EMS).

This process is a crucial part of the administration so the Government wants it to operate as smoothly as possible with minimum compliance costs for employers.

Integrating the collection of this information into normal business processes would be an important first step to reduce the compliance costs for businesses. In doing so, providing PAYE information then becomes part of a wider process rather than an additional step required by the tax system.

Crucially, comprehensive collection of accurate PAYE information is also a pre-requisite to enable Inland Revenue to provide accurate tax information for individuals on an online income statement (see page 32 for more information on this).

In its current form, the EMS has many positive attributes, but it is still largely paper based. Even when electronic filing is used or required, submitting returns is an additional process and not aligned to businesses’ accounting or payroll processes. This results in businesses spending extra time inputting data and increases the risk of errors.

Potential benefits from improving the way the EMS operates for employers, intermediaries and Inland Revenue include:

- avoiding unnecessary duplication by integrating PAYE into existing business systems (for example, the payroll system) rather than a stand-alone system and process;

- allowing business systems to talk directly to Inland Revenue systems, and vice versa;

- easy amendment and correction of tax codes;

- ensuring the information provided is validated immediately; and

- up-front verification of information (i.e. tax codes) to allow the EMS to be better used to collect underpayments of tax.

Focussing on the transfer of data, rather than on the current prescriptive filing of EMS returns, means information can potentially be provided and corrected at any time during a period, rather than just at the end of a prescribed period. This will ensure that what is withheld or paid during the year more accurately reflects the customer’s actual obligation or entitlement. It should also provide additional flexibility for taxpayers.

In order to improve and streamline the collection of PAYE information, the following issues will need to be carefully considered.

In order to improve and streamline the collection of PAYE information, the following issues will need to be carefully considered.

- Should the current EMS form be replaced with automatic digital data transfers?

- How should Inland Revenue ideally obtain additional relevant information?

- When will the information be considered accurate?

- Should some employee information be private and not shared with an employer (for example, should child support information be treated differently as it is a matter between the employee and Inland Revenue)?

- Should the timing of PAYE information and payment of PAYE align to when salaries and wages are paid to employees?

Innovation by software developers and payroll providers will be an important ingredient in ensuring that any PAYE changes are successful. In particular this should help ensure that “normal” business processes are used wherever possible.

Such changes will not just be confined to the provision of PAYE information – the same issues and principles will also apply to other requirements. For example, the ability to use a business’s own systems should equally apply to GST information requirements.

If you would like to read more about streamlining the collection of PAYE and GST go to Appendix 2.

But it is not just about streamlining PAYE processes…

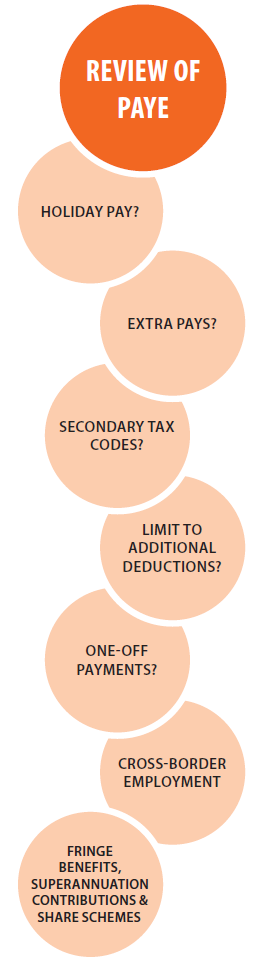

It is also timely to look at the PAYE rules more generally to ensure that they work as efficiently as possible. A review of these rules will focus on removing undue complexity and providing more clarity in their application.

The rules have not been fundamentally reviewed since their introduction in 1957. This review of tax administration provides the opportunity to investigate whether improvements can be made to ensure the rules reflect modern employment practices.

A review of the PAYE rules should focus on removing complexity to ensure employers can apply the rules with the least amount of effort resulting in a reduction in compliance costs.

There are a number of factors influencing the accuracy of the amount of PAYE deducted. These include use of the correct tax code, assistance by Inland Revenue in helping to identify incorrect tax codes and calculation accuracy (for both payroll packages and manual calculations), and other changes in employee information.

A review of the existing PAYE rules will focus on:

- Rationalisation of how employment remuneration is taxed and whether all forms of remuneration can be included under PAYE. For example, can some or all of fringe benefits, employer superannuation contributions and employee share schemes income be incorporated into the PAYE rules?

- Whether one-off payments can be included in the PAYE rules to avoid taxpayers becoming provisional taxpayers.

- How the PAYE rules apply to cross-border employment relationships.

- Wage protection for example, ensuring employees receive a sufficient minimum net payment when exploring whether the PAYE system should be used to recover outstanding liabilities.

- Extra pays, due to the complexity of the current calculation.

- Clarifying the taxation of holiday pay.

- Simplifying the application of secondary tax codes due to better income information being received during the year.

- Opportunities for common definitions of salary and wages to be used for a range of taxes and social policy products, thereby simplifiying the rules and reducing complexity.

If you would like to read more about reviewing the PAYE rules go to Appendix 2.

Questions for readers

- Are we considering all the relevant issues with the application of the current PAYE rules?

- Are there any other concerns facing employers that would improve how the PAYE rules work?

Enhancing withholding taxes to cover ‘employment-like’ income

Withholding taxes like PAYE are widely considered to be the foundation of an effective tax administration. Such a system requires third parties (for example, employers, financial institutions etc.) to withhold an amount of tax from payments of income.

The existing PAYE model works well for the withholding of employment income where the traditional employee-employer relationship exists. For those who earn their income outside of a true employer-employee relationship, such as the self-employed or independent contractors, the picture is less straightforward.

The current rules only require the payer to withhold tax for payments made to contractors who are in a listed set of industries. For contractors involved in those industries not listed, however, withholding does not currently take place.

The current contractor withholding rules were introduced in 1957, at the same time as PAYE. The labour market has changed since 1957. The rules have only ever been extended in an ad hoc way, for example, adding or removing specific industries. A review is needed to develop a more comprehensive and consistent withholding regime to keep up with modern work practices.

Business transformation provides the opportunity to consider whether there are ways to improve and simplify taxpayers’ interactions with Inland Revenue when the traditional employer-employee relationship does not exist. A review would consider whether withholding at source could be used in a wider range of situations, including independent contractors, and possibly for particular industries.

Enhancing the withholding regime also provides for the ability to improve compliance from particular participants in the labour market, for example, from migrant workers.

The main objective is the provision of timely information and tax payments from business which are accurate, comprehensive and error free. Information should also be able to be shared with other government agencies where it is appropriate to do so.

Solutions in this area would ideally reduce compliance and administration costs for businesses and Government as a whole, while at the same time increasing compliance levels from all customers. Ideally there would be other benefits as well, such as reducing the possibility of customers falling into debt. In practice there are likely to be trade-offs. An important consideration is to ensure that any change does not just merely shift the cost of compliance from Inland Revenue to business.

The Government may, where it has concerns with voluntary compliance, look to address the scope of the PAYE and the schedular payment rules.

If you would like to read more about possible changes to the withholding regime go to Appendix 2.

Questions for readers

- What factors should Government be particularly conscious of when considering changes to the withholding tax regime in order to cover more employment-like situations?

THE FUTURE FOR BUSINESS TAX

It is vitally important for the Government to understand what, from a business tax perspective, the fundamental issues are in order to make improvements.

Questions for readers

- What are the key tax administration issues currently facing businesses? Are there any particular areas that present concrete ways of increasing speed and certainty?

- How important is improving the provisional tax rules in reducing compliance costs for business? Are there other more important issues the Government should be focusing on instead, or as well?

- The Government seeks feedback on more effective and simple methods of calculating and paying provisional tax and, in particular, how provisional tax could be better aligned to other business processes.

The tax system needs to focus on speed, accuracy, certainty, predictability and low business risk in business taxation matters.

Businesses have stated that speed and certainty, and issues with provisional tax are important concerns. Businesses want access to the right people at the right time at Inland Revenue to ensure they are doing the right thing. But are there aspects of running a business that present specific issues – such as the impact of taking on more staff?

The tax system should be easy for businesses to comply with, ensuring they spend more time on running their businesses and less time on tax. If it is easy to do the right thing, overall levels of compliance will increase.

As mentioned above, the provisional tax rules are an important consideration for businesses as they are the mechanism by which most businesses pay tax during the year. The following discussion provides some initial high-level ideas to improve the calculation and payment of provisional tax.

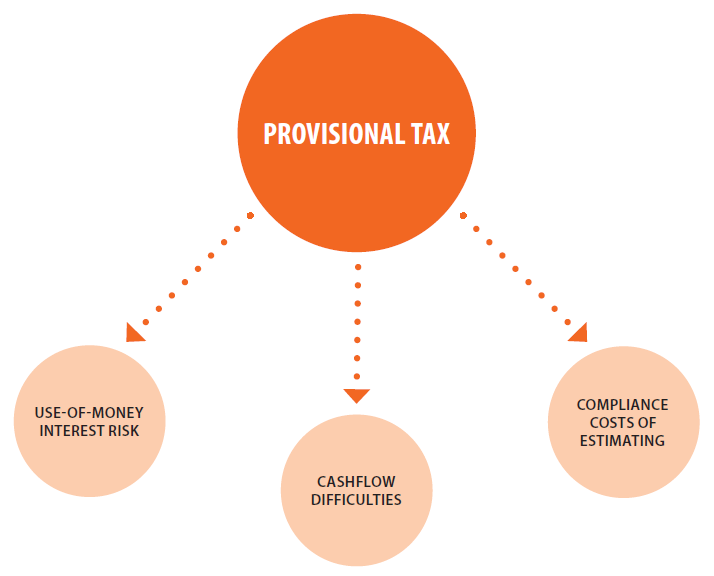

Provisional tax

Businesses are required to pay income tax on their profits. The exact amount of tax that a business is required to pay for each year can only be determined after that year has finished.

The current provisional tax rules, however, are designed to ensure that tax is paid during the year, rather than at the end of the year.

The calculation and payment of provisional and terminal tax currently presents some problems for businesses of various sizes, including:

- use-of-money interest (UOMI) risk for businesses, resulting from the need to estimate annual tax liabilities part-way through a year of assessment for provisional tax purposes;

- the compliance costs associated with estimating liabilities before the year of assessment has ended; and

- the one-off square-up nature of terminal tax can present cash flow difficulties for businesses, in particular, because of the nature of the current rules for new businesses. This also has flow-on effects for Inland Revenue in its enforcement activities.

Any design improvements to the provisional tax rules would need to consider the following:

- the impact on how businesses generate their cashflows;

- the use, as much as possible, of existing business processes and technology;

- encouraging compliance by making it easy to comply and hard not to;

- the reduction of compliance costs;

- the impact of UOMI on underpayments on businesses;

- equity between different taxpayers; and

- maintaining fiscal stability and predictability for the Government.

The calculation and payment of business income tax could be done more “on-account” as income is earned during the year – much like a PAYE system for businesses. One idea is by considering whether accounting profits with a few key adjustments (for example, reversing out capital gains and losses and excluding non-taxable income) could effectively be used as a better proxy for a business’s end-of-year tax obligation. This has the potential to simplify the calculation of provisional tax and create more certainty for taxpayers and reflect cashflow.

Alternatively, a simplified system whereby provisional tax payments are based on another proxy (for example a bespoke percentage of a business’s turnover) could also be investigated.

Any review of the provisional tax rules would also have to consider changes to the standard uplift method of calculating provisional tax, together with the current safe harbour limits and use of money interest rules.

A review of the tax pooling rules should also be undertaken to see if they can be improved and/or made available to more taxpayers.

If you would like to read more about the future for business tax go to Appendix 3.

Small businesses

A particular focus of modernising the tax administration system is to ensure it becomes easier for small businesses to comply with their tax obligations, thereby reducing their compliance costs and improving overall levels of compliance. Many small businesses have difficulty in meeting their tax obligations. Compliance costs are also higher for smaller businesses compared with larger businesses which tend to have better tax understanding, better financial systems and better business processes.

Therefore, it is important that Inland Revenue is more proactive and sophisticated in its approach to providing assistance to these businesses.

Taxes should not be a minefield for small businesses – complying should be easy. It may be that there is assistance that Inland Revenue could provide to specifically help small businesses, including encouraging the use of improved business systems and accounting software that meets specific standards to ensure the first few years of a business’s life-cycle are successful.

Other forms of assistance could involve ensuring that the right support is available at key events that may result in tax obligations, such as taking on new staff for the first time. Ensuring that businesses get it right first time and maintaining that will be a real focus. This is likely to be a more productive use of both business and Inland Revenue staff time than lower-value activities, such as keying in data from paper forms.

Software would have the ability to help users correctly classify transactions to ensure tax obligations are correctly met right from the start. Taxpayers who use the software would benefit from greater certainty as errors and misclassification would be reduced.

A move in this direction could be supported by changes to the penalties regime. The current penalties regime is based on associated shortfalls arising from individual transactions. Where appropriate, the penalties regime could be adjusted to instead focus more on recognising that the taxpayer is attempting to comply. Inland Revenue could provide the support necessary to encourage taxpayers to remedy systems faults which give rise to tax shortfalls. Adopting business systems and accounting software that meets specific standards would be a key component of this.

Small business may also benefit from tax rules being 'simplified'. By ‘simplified’ the Government does not mean introducing tax concessions for small businesses. Tax breaks for a particular group or industry are likely to create distortions by encouraging resources to flow into less productive activities, solely to get the tax break. This is inconsistent with the BBLR framework discussed in chapter 1.

However, it may be possible to make some changes that result in tax simplification for small businesses that reduce compliance costs and make it easy to comply without a substantial fiscal impact.

If you would like to read more about proposed improvements for small businesses go to Appendix 3.

Questions for readers

- Is the proposed direction outlined here the correct focus to provide benefits for small businesses or are there other more important ways of helping small businesses?

- Are there any areas where you think tax for small businesses can be simplified, without creating specific tax breaks?

- A particular focus is to ensure that small businesses achieve higher levels of compliance – what are the most important practical ways of promoting and achieving higher levels of compliance?

Information provision

In a digital world, providing paper tax returns is an out-dated concept.

Taxpayers are often forced to duplicate processes in order to comply with current information requirements. The information required may also be out of sync with the business’s size or risk profile.

From Inland Revenue’s perspective, it may not be receiving from businesses the type of information that would most effectively allow it to carry out its debt recovery, audit and other core functions.

There is also an efficiency cost to taxpayers and Inland Revenue in processing non-digital and/or superfluous information.

New technology provides an opportunity to rationalise current tax returns for businesses. The focus in the future should be on providing relevant and timely information efficiently. This will therefore form the basis of a review of information requirements facing businesses.

If you would like to read more about business income information provisions go to Appendix 3.

Questions for readers

- What are the key considerations that should be taken into account when looking at the provision of business income information?

WITHHOLDING TAXES FROM CAPITAL INCOME

Income earned from savings and investments is likely to grow in the future, as the population ages and more capital is accumulated. It is therefore important to ensure that such sources of income, and associated resident withholding tax (RWT) deducted at source, are accurately and promptly recorded.

Income earned from savings and investments is likely to grow in the future, as the population ages and more capital is accumulated. It is therefore important to ensure that such sources of income, and associated resident withholding tax (RWT) deducted at source, are accurately and promptly recorded.

A review of the current RWT rules should build on improvements arising from more effective and streamlined collection of PAYE information. Any improvements in this area will also help facilitate changes to how Inland Revenue interacts with individuals and businesses.

A particular focus is how to enhance the provision of information about RWT on interest and dividends by integration into existing business processes – similar to the process envisaged for an improved PAYE information-gathering process.

This information should be obtained from those who are able to provide it at the lowest cost and where that information is most likely to be accurate. Although there may be some short-term costs for financial institutions and other businesses in order to provide this information, there are longer term benefits to those businesses and their customers– for example, more accurate and automatic withholding and increasing levels of compliance. There will also be long-term benefits to financial institutions as tax is integrated into business processes.

Collaboration with financial institutions and other businesses deducting RWT will be essential to ensure that any RWT changes are effective in keeping overall compliance costs in this area to a minimum.

In particular, a review needs to look at:

- improving the timeliness of information to Inland Revenue;

- the type of information provided;

- how to best incorporate the requirement to provide information into normal business processes, in order to reduce compliance costs;

- whether changes could remove the need for financial institutions to provide annual tax information to customers if it was already being provided directly to Inland Revenue; and

- whether RWT systems could be used as an efficient method of collecting underpayments of tax.

If you would like to read more about a review of the RWT rules go to Appendix 4.

Questions for readers

- Is there anything else a review of the RWT rules should consider?

INDIVIDUALS

Conceptual view of individuals' income tax in the future

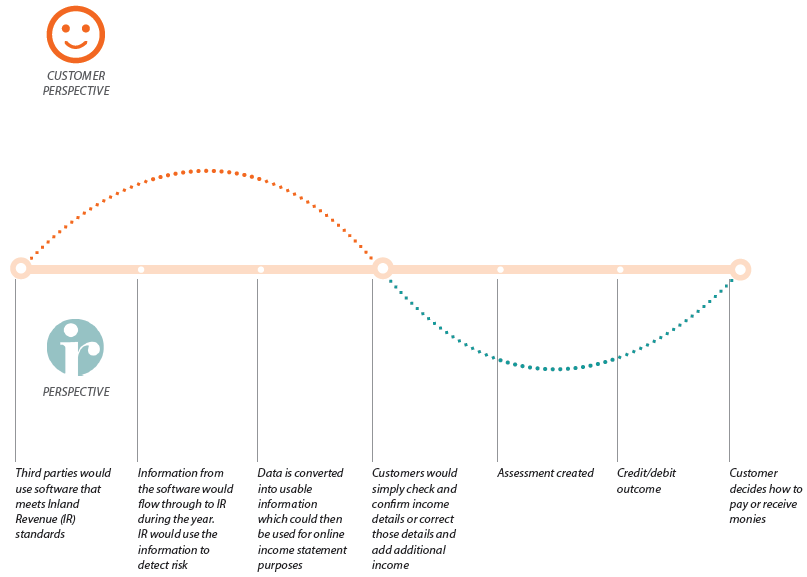

Streamlining PAYE and withholding tax mechanisms will be the building blocks on which an individual’s improved experience of the tax system will be based. More comprehensive and accurate information received from these changes will allow for a fundamental review of how individuals interact with the tax system in the future.

By way of background, a policy decision was made in the 1990s to try and remove the requirement to file income tax returns from as many individuals as possible. However, over time, this approach has created tension in the tax administration system between taxpayers who are not required to file, and those who are or who chose to do so in favourable circumstances (for example, to claim a refund). This creates fairness concerns for those who have to file and have tax to pay.

Significant numbers of individuals are now either required to file returns or are choosing to do so. It is therefore timely to consider whether it is still desirable to keep as many individuals as possible from actively interacting with the tax system.

This is particularly so as new technology now affords the possibility of Inland Revenue receiving accurate income information from employers, (see page 21) allowing Inland Revenue to provide an individual with a secure online tax statement showing those income details. This could include amalgamation of various tax interactions in one place (for example, including donations rebates). The key would be to make customers’ interaction with Inland Revenue as simple as possible.

The only action required for the vast majority of customers would be to check and confirm their details. Where applicable, certain individuals would also need to report other income received – such as overseas income where there was no deduction of tax at source. International initiatives on the exchange of income information may also provide opportunities to provide overseas income details in the individual’s tax statement.

More effective use of technology could allow Inland Revenue to automatically adjust withholding rates to collect any underpayments of tax, making it easier for individuals to meet their tax payment requirements. Refunds could be made quickly and automatically.

This level of simple engagement would help ensure that individuals better understand what their tax obligations are, and how the wider tax system works. Over time, this would help improve voluntary compliance.

If you would like to read more about how individuals could interact with the tax system in the future go to Appendix 5.

Questions for readers

- Do you agree with the idea of interacting with the tax system by online tax statements?

- If not, why not?

- Is there anything else we should consider?

SOCIAL POLICY

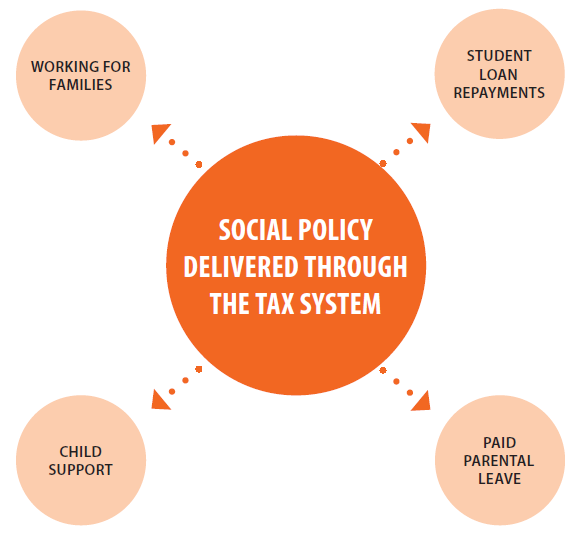

Social policies administered by Inland Revenue (primarily Working for Families and Child Support) generally operate within the tax system on a yearly basis. Some of the potential changes may also affect Paid Parental Leave, Student Loan repayments and KiwiSaver.

Social policies administered by Inland Revenue (primarily Working for Families and Child Support) generally operate within the tax system on a yearly basis. Some of the potential changes may also affect Paid Parental Leave, Student Loan repayments and KiwiSaver.

Some Working for Families and Child Support customers will go into debt, or are already in debt unnecessarily because of out-of-date information held about an individual or family.

For Working for Families, debts or underpayments generally arise because of the annual assessment period, with payments made in advance or concurrently with the entitlement. This type of system requires upfront estimates of entitlement together with an end-of–period square-up.

However, circumstances often change throughout the year, resulting in multiple contacts between Inland Revenue and individuals, or no contact at all (and therefore outdated information). Neither situation is a good result.

The intention is to design processes that work for the customer and are fit for purpose. Processes should ideally match the timeliness of payments to customers’ needs, and ensure payments are received on a real-time basis.

Reviewing the administration of these areas should include consideration of the suitability of the annual cycle and how to make better use of information from other sources.

Any change to the annual cycle would be a fundamental shift in the administration of Child Support and Working for Families. More accurate and timely information, on a more regular basis, is likely to be achieved by advances in technology, ensuring easy and low-cost interactions with the people involved.

Debt prevention would be the main benefit arising from improvements in this area. A system based on the ability to make frequent adjustments because of changing circumstances should mean less chance of going into debt.

If you would like to read more about re-designing processes for administering social policy go to Appendix 6.

Questions for readers

- Do you agree with the proposed direction of re-designing processes for administering social policies in the future?

THE POLICY AND LEGISLATIVE FRAMEWORK FOR TAX ADMINISTRATION

Simplifying the tax administration system requires consideration of key tax administration and legal issues that frame and underpin much of New Zealand’s tax administration system.

Changes to the way that taxpayers interact with Inland Revenue through digital services provide an opportunity to consider fundamental issues contained with the Tax Administration Act 1994.

This section considers some of those changes.

The role of Parliament and the Commissioner of Inland Revenue

Parliament both guides and constrains the role of the Commissioner of Inland Revenue, and the relationship between the Commissioner of Inland Revenue and taxpayers.

The power to levy taxes belongs to Parliament. Legislation is necessary to ensure certainty in the rules and to determine how much prescription versus Commissioner administrative decision-making is desirable.

To a reasonable extent, the role of the Commissioner is clear and adequately expressed in the Tax Administration Act. 'Care and management' is a key component of this and works well as a mechanism to reflect that the Commissioner needs to apply her limited resources effectively and efficiently.

However, there are areas in which the Commissioner’s role should be reviewed, such as how the 'care and management' provisions can be made more effective, and how they apply in non-tax areas.

The role of taxpayers and third parties

Self-assessment is a feature of the current New Zealand tax administration. It reflects the fact that, traditionally, a taxpayer has the information to best determine their own income and tax liability.

Even in a world where assumptions about information collection and calculations are challenged, and online income tax returns are provided and calculated by Inland Revenue, the liability and obligation to pay tax ultimately still belongs to a taxpayer. This is known as 'self-assessment'.

However, it will be important to test this assumption and consider the implications of any changes concerning the roles and obligations of taxpayers. An understanding of taxpayer obligations is core to the compliance and penalties legislation. Any changes to these obligations could have implications for penalties.

A review of these policy and legislative settings needs to be considered in the context of any changes to the self-assessment framework.

Information and secrecy

Inland Revenue holds a lot of information, and has more interactions with New Zealanders than any other agency. Using and analysing information in a timely and more efficient way will become more critical in the future. Consideration of the use, collection and disclosure of information will also be crucial.

Critical to the effective administration of the tax system is the trust that customers have that their information will not be disclosed inappropriately – and this is reflected in the secrecy rules. Equally, Inland Revenue sometimes needs to disclose information to third parties when it is reasonable to do so.

One of the Government’s objectives for the future tax administration is to use information more effectively within Inland Revenue and to facilitate greater co-operation across government. The Government wants agencies to 'to use information as an asset'. In doing so, a number of potential tensions will need to be reconciled to meet these objectives, including:

- the interplay between information sharing and tax secrecy, and any potential impact on the integrity of the tax system;

- the differences (if any) between non-taxpayer-specific information and taxpayer-specific information;

- the treatment of information for social policy purposes;

- intelligence sharing and participation in cross-agency initiatives;

- co-location and joint service provision with other government agencies;

- the implication of greater information collection via accounting software and/or intermediaries; and

- how to manage the collection, storage and use of large external data sets.

Legislative structure of the Tax Administration Act

As an umbrella act the Tax Administration Act should provide a consistent administrative framework across the Inland Revenue Acts. Consideration would need to be given not only to the interplay of the Tax Administration Act with the Income Tax Act and the Goods and Services Tax Act, but also to the level of consistency that is necessary or desirable between the legislation dealing with tax matters and various social policy functions.

Specific tax policy work in this area will necessitate their own changes to the Tax Administration Act. As a result, certain provisions will become obsolete. A starting point for a new Tax Administration Act could be to re-order provisions, including those that can sensibly be carried over from other Inland Revenue Acts.

If you would like to read more about the policy and legislative framework for tax administration go to Appendix 7.

Questions for readers

- Do you agree that the correct areas are being looked at in reviewing the policy and legislative framework for tax administration?

NEXT STEPS

The following sets out a very high-level summary of the scope of the tax policy work discussed in this Green paper, together with indicative dates when subsequent public consultation may occur.

The following sets out a very high-level summary of the scope of the tax policy work discussed in this Green paper, together with indicative dates when subsequent public consultation may occur.

Enabling secure digital services

In tandem with this Green paper a discussion document on Providing better digital services in a tax administration context has been released.

That paper considers whether secure digital services can be delivered using the current policy and legislative framework.

In particular, it identifies legislative and other barriers to moving to digital services, and discusses options to help move people to digital services (including incentives, disincentives and, where appropriate, requiring people to use of digital services).

The policy and legislative framework for tax administration

In the second half of 2015 a discussion document on developing a tax administration framework fit for the 21st century will be released. This will discuss, for example, the respective roles of Parliament, the Commissioner of Inland Revenue and customers.

Employment income

In the second half of 2015, two discussion documents on employment income will be released.

The first will focus on:

- the collection of information for PAYE purposes; and

- modernising the PAYE rules more generally.

The second will focus on:

- enhancing withholding taxes to cover ‘employment-like’ income.

Withholding taxes on capital income

In 2016 a discussion document on streamlining the collection of information relating to other withholding regimes will be released. This document will look at ways of ensuring that sources of income with tax deducted at source (for example, interest and dividends) are accurately and promptly recorded.

Individuals’ taxation

In 2016 a discussion document on improving the tax system for individuals – for example, in relation to the pre-population of tax returns and more efficient payment and debt mechanisms – will be released.

Business taxation

From 2015–2016, a number of discussion documents focussed on improving the tax system for businesses will be released. These will look at streamlining business tax processes, for example, in relation to provisional tax, small businesses, the collection of information, and on penalties and interest.

Social policy

From 2017 onwards, a number of discussion documents on various social policy issues such as encouraging people to update or confirm personal circumstances during the assessment period – will be released.

Other areas of potential focus may include:

- periods of assessment and payment;

- aligning definitions and rules across common social policy elements; and

- debt prevention and collection.

LIST OF ALL QUESTIONS FOR READERS FROM THIS CHAPTER

The future for business processes - PAYE

- The Government’s view is that more effective use of a business’s own systems to provide PAYE, GST and related information to Inland Revenue would provide real benefits to employers – do you agree?

- If not, what would be a better focus for future consideration in relation to PAYE processes?

- Have we considered all likely issues in relation to streamlining the collection of PAYE and related information?

- Are we considering all the relevant issues with the application of the current PAYE rules?

- Are there any other concerns facing employers that would improve how the PAYE rules work?

- What factors should Government be particularly conscious of when considering changes to the withholding tax regime in order to cover more employment-like situations?

The future for business tax

- What are the key tax administration issues currently facing businesses? Are there any particular areas that present concrete ways of increasing speed and certainty?

- How important is improving the provisional tax rules in reducing compliance costs for business? Are there other more important issues the Government should be focusing on instead, or as well?

- The Government seeks feedback on more effective and simple methods of calculating and paying provisional tax and, in particular, how provisional tax could be better aligned to other business processes.

- Is the proposed direction outlined here the correct focus to provide benefits for small businesses or are there other more important ways of helping small businesses?

- Are there any areas where you think tax for small businesses can be simplified, without creating specific tax breaks?

- A particular focus is to ensure that small businesses achieve higher levels of compliance – what are the most important practical ways of promoting and achieving higher levels of compliance?

- What are the key considerations that should be taken into account when looking at the provision of business income information?

Withholding taxes from capital income

- Is there anything else a review of the RWT rules should consider?

Individuals

- Do you agree with the idea of interacting with the tax system by online tax statements?

- If not, why not?

- Is there anything else we should consider?

Social policy

- Do you agree with the proposed direction of re-designing processes for administering social policies in the future?

The policy and legislative framework for tax administration

- Do you agree that the correct areas are being looked at in reviewing the policy and legislative framework for tax administration?