Chapter 8 - Registration and return filing

8.1 This chapter considers the registration system and filing periods that offshore suppliers would use if they are required to register for New Zealand GST. There are three different registration options that could be adopted:

- the domestic registration system;

- a “pay only” registration system; or

- a regional “one-stop-shop” registration system.

8.2 This chapter does not recommend any specific option but the option chosen will be made clear in advance of the implementation date of any new rules.

Domestic registration system

8.3 New Zealand’s current registration system applies to domestic businesses and some non-resident businesses. In order to register, businesses will need to obtain a New Zealand IRD number and then either fill out a registration application form or register online through a system called myIR. Once registered, the business is required to file GST returns every month, two months, or six months depending upon the business’s turnover.[21] Returns can be either filed manually or online through myIR. In addition to accounting for GST on taxable supplies, domestic businesses can also claim back any GST they incur on costs if those costs relate to the making of taxable supplies.

8.4 One option for registering offshore suppliers is simply to use the existing registration system. Since New Zealand’s GST system is broad-based with few exemptions, it is relatively simple and easy to comply with and this is reflected in the simplicity of the return itself. Offshore suppliers would be able to return GST on their supplies of services to New Zealand-resident customers and also claim back any New Zealand GST they may incur in the making of taxable supplies.

8.5 Using the existing registration system would also keep administrative costs to a minimum since administrative processes have already been developed. However, ideally, if input tax deductions were being claimed, any system that adopted existing systems may need to include elements of the existing registration system for non-residents introduced in 2014. These rules reflect the unique revenue risk associated with allowing non-residents to claim input deductions, and include measures such as allowing the Commissioner of Inland Revenue longer to process any refund claims.

8.6 One disadvantage to using the domestic registration system is the fact that the domestic system is not tailored to the specific needs of offshore suppliers. The majority of offshore suppliers are unlikely to incur any New Zealand expenses and therefore will not need to claim back any GST. Consequently, much of the current GST return that is focused on GST claims may not be relevant for those suppliers that are in a pay-only position.

8.7 This system could, however, be implemented relatively quickly and could potentially be used in the first instance until a more tailored system was developed.

“Pay only” registration system

8.8 “Pay-only” registration systems are tailored for offshore suppliers that have no GST/VAT to claim and make payments only. The main benefit of a pay-only system is that the system can be very simple. Since these offshore suppliers are not claiming any GST they are relatively low-risk from a revenue perspective. The usual checks and balances focussed on ensuring that input tax deductions/refund claims are correct can be relaxed. The processes and information requirements around registering for GST could also be simplified.

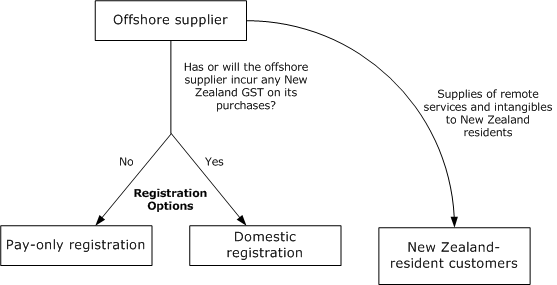

8.9 It is likely that the majority of offshore suppliers would only need to register under a pay-only system as they will not normally incur any New Zealand GST on their purchases. However, some offshore suppliers will incur New Zealand GST (for example, a non-resident may visit New Zealand to conduct market research and may incur GST in the process) and so should have the opportunity to register under the domestic system and claim the GST back. Therefore, the system would need to accommodate two potential types of registration, as shown in the diagram below:

8.10 Some countries have adopted pay-only registration systems, most notably Norway. Australia has suggested that it may seek to develop a similar system. The OECD draft guidelines recommend that, as far as possible, countries develop simplified registration systems for offshore suppliers, such as a pay-only registration system.

Regional registration system

8.11 The European Union operates a “one-stop-shop” for suppliers that supply to multiple European Member States. Under the one-stop-shop suppliers are able to register in a single Member State. This is an alternative to registering in every Member State to which they make supplies.

8.12 All VAT collected by the offshore supplier is returned to that single Member State, which is responsible for redistributing the VAT revenue to the Member States where the consumption took place. The Member State is, in part, responsible for auditing offshore suppliers that register with that State.

8.13 The intention of developing such a system was to lower the compliance costs imposed on offshore suppliers and to enhance voluntary compliance with the system as a whole. Registering and filing a single return with one Member State is considered to be easier than registering and filing in multiple Member States.

8.14 New Zealand is not part of a common market, but, similar benefits could be achieved through a comparable “one-stop-shop”. For example, if an offshore supplier supplied services or intangibles to both Australia and New Zealand, a “one-stop-shop” registration system would allow the supplier to register and file returns in a single country, instead of both countries.

8.15 There are however some drawbacks to this approach. Countries would need to agree to develop “one-stop-shops” and rely on another country to be responsible for collecting and distributing the GST. It would also be preferable that similar rules be adopted in each country that signs up to such a scheme. Countries can individually be expected to have very different tax bases and tax rates. However, administrative rules like registration thresholds and filing periods may need to be consistent for the system to operate easily in practice and ensure compliance costs imposed on offshore suppliers are kept to a minimum.

Taxable periods

8.16 It will be necessary to establish the GST filing frequency of registered non-residents. At present, the default taxable period for a registered person is two months. Larger businesses, with an annual turnover of $24 million or more, are required to file monthly, whereas smaller businesses can elect to file on a six-monthly basis. For non-residents, there are effectively two options:

• mandating a taxable period that will apply to all registrations; or

• allowing the normal rules to apply, so filing frequency will depend on the size of the business concerned.

8.17 On balance, it is proposed for now that there be a set period for non-resident registrations and that period should be two-monthly. In reaching this view it is important to note that, if the preferred registration option uses existing Inland Revenue systems, any mandated taxable period must be a period that is already specified in legislation: monthly, two-monthly or six-monthly.

8.18 A set period would provide certainty for affected businesses. It would also make any tailored pay-only registration system easier to design and to use, because the same rules would apply to everyone required to use it.

8.19 By contrast, applying the standard rules would require registered persons to work out which filing period applied to them. Rules would need to clarify, for the purposes of the one and six-monthly options, what supplies were counted towards the relevant thresholds. In that case it could be assumed that, whenever possible, a non-resident would apply for a six-monthly period to maximise any timing advantages. This would affect revenue collection and increase administration costs because applications would have to be manually processed in order to determine whether the requirements for six-monthly filing were met in each case.

Questions

Of the three options discussed, which registration system do you prefer?

What compliance costs would be imposed on offshore suppliers if they were required to register under the domestic registration system?

Do you consider there would be significant benefits in developing a “pay-only” registration system?

Do you consider there would be significant benefits in pursuing a regional “one-stop-shop” registration system?

Do you prefer a fixed filing time for offshore suppliers or variable filing times that depend upon the offshore supplier’s turnover?

[21] A person must file returns monthly if taxable supplies in a 12- month period are more, or likely to be more than $24,000,000. If turnover is less than $500,000 in a 12-month period a person is able to file every six months.