GST on cross-border supplies of insurance

(Clauses 48(3), 48(4), 49(1), 55(1), 55(2) and 57(2))

Summary of proposed amendments

Consistent with the new rules for other supplies of remote services, the amendments will extend the special rules for general insurance to cross-border supplies of insurance services provided to New Zealand-resident consumers.

Key features

Insurance services are an example of “remote services”, as there is no requirement for the recipient to be present when the services are performed.

As with other supplies of remote services under the amendments, the proposed new rules will:

- apply GST to insurance services supplied by offshore insurers to New Zealand-resident consumers (proposed section 8(3)(c)); and

- exclude insurance services supplied by offshore insurers to New Zealand GST-registered businesses from GST, unless the insurer and the recipient agree that these supplies will be zero-rated (existing section 8(4) and proposed section 11A(1)(x)).

The proposed amendments will ensure that when an offshore insurer and a GST-registered recipient agree that supplies of insurance services will be zero-rated, the insurer will not be entitled to a deduction for insurance payments on payments to that GST-registered recipient (proposed section 20(3)(d)(vii)), and the GST-registered recipient of the payment will not be required to return output tax under section 5(13) (proposed section 5(13)(d)).

The reverse-charge provisions in section 8(4B) and proposed section 20(3JC) will apply when a GST-registered business purchases insurance services that relate partly to private or exempt use.

The option to provide a tax invoice when GST is inadvertently charged on a supply for consideration of NZ$1,000 or less will not be available for insurance premiums charged to GST-registered businesses (proposed section 24(5C)).

Background

The GST Act contains special rules for general insurance that apply GST on a net cashflow basis, where a GST-registered insurer is required to return GST on insurance premiums received and claim a deduction for insurance payments. A GST-registered business is able to deduct input tax on the premiums it is charged and is required to return GST on insurance payments received.

These rules do not apply to the provision of life insurance, which is treated as exempt supplies of financial services under the GST Act.

Insurance services are an example of a remote service, as there is no necessary connection between the physical location of the insured party and the location where the insurance service is performed. Insurance services are performed and consumed over the period of the contract of insurance.

In the OECD’s guidelines, insurance services are listed as an example of a remote service that, when supplied to a consumer, should be taxed in the consumer’s usual residence.

Detailed analysis

The proposed rules that apply to cross-border supplies of insurance services provided by non-resident suppliers will differ depending upon whether the services are supplied to resident consumers or GST-registered businesses.

Supplies of general insurance services to New Zealand-resident consumers

Under the proposed amendments, a non-resident provider of insurance will be required to return GST on premiums charged to New Zealand-resident consumers (if its supplies to New Zealand residents exceed the registration threshold), as the supply of the contract of insurance will be taxable under proposed section 8(3)(c).

If registered, a non-resident insurer would also be able to claim a deduction when making an insurance payment under a contract with a New Zealand-resident consumer (through existing section 20(3)(d)), or on New Zealand GST costs incurred in paying for replacement goods or repair services.

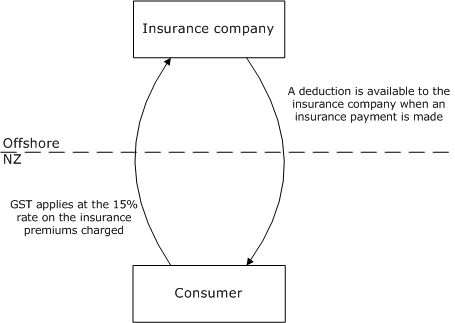

The diagram below shows how the rules will apply to cross-border supplies of insurance to New Zealand residents who are not GST-registered businesses.

Cross-border supplies of general insurance services to New Zealand-resident non GST-registered consumers

Supplies of general insurance services to New Zealand GST-registered businesses

Unless the insurer and the GST-registered recipient agree that the supply will be zero-rated under proposed section 11A(1)(x), cross-border supplies of insurance services to a GST-registered businesses will continue to be excluded from GST under the proposed amendments.

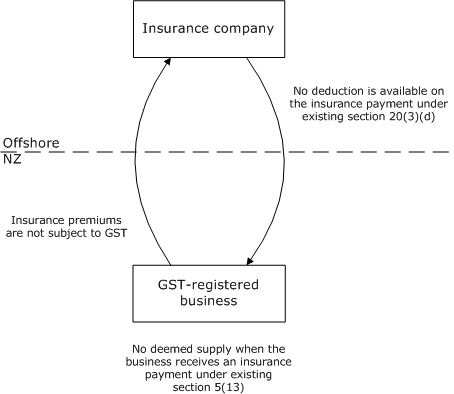

Consequently, a non-resident insurer will not return GST on premiums charged to GST-registered business customers, and will not be entitled to a deduction under section 20(3)(d). A GST-registered recipient of an insurance payment will not be required to return output tax on the payment under existing section 5(13). This means that the current arrangements for GST on supplies of insurance services by a non-resident insurer to a GST-registered business will not change, unless the parties agree that the contract of insurance is a zero-rated supply. The diagram below shows how the proposed rules will apply.

Cross-border supplies of insurance services to New Zealand GST-registered businesses (when the supply is not zero-rated)

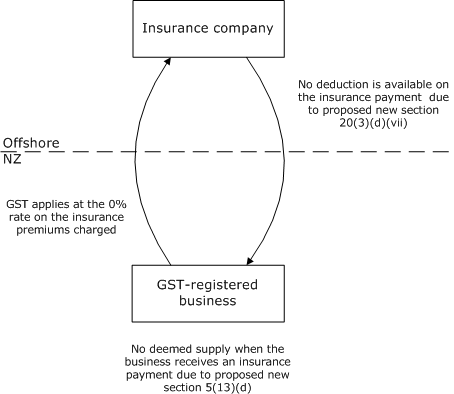

If the non-resident insurer and GST-registered business customer have agreed that the supply of a contract of insurance will be zero-rated, GST will apply at 0% on the insurance premiums. This will allow the insurance company to claim back GST costs incurred in New Zealand in making these supplies, which could include costs incurred in repairing or replacing goods. This should mean that non-resident insurers, in the same way as resident insurers, are indifferent, from a GST perspective, about whether they make a payment to the insured GST-registered business, or replace or repair damaged goods.

However, amendments will ensure that an insurer is not entitled to claim a deduction for insurance payments under these contracts (proposed section 20(3)(d)(vii)), and that a GST-registered recipient of an insurance payment is not required to pay output tax under section 5(13) (proposed section 5(13)(d)). This treatment is equivalent to that in situations when the supply is treated as being made outside of New Zealand and the insurer and GST-registered business have not agreed that the supply will be zero-rated, with the exception of the non-resident insurer’s ability to claim back related New Zealand GST costs. The diagram below shows how these rules will apply.

Cross-border supplies of zero-rated insurance services to New Zealand GST-registered businesses

No option to provide a tax invoice

The option to provide a tax invoice when GST is inadvertently charged on a supply for consideration of NZ$1,000 or less will not apply to supplies under a contract of insurance. Allowing this option would require changes to ensure that GST applies correctly on a cashflow basis, which would lead to significant complexity in the operation of the rules. Due to the nature of insurance services, an insurance company is likely to have access to the information to determine whether their client is a GST-registered business.