Mixed-use assets

14 August 2013

A special report from

Policy and Strategy, Inland Revenue

Mixed-use assets

Sections CC 1, CW 8B, CX 17, DB 5, DB 7, DB 8, subpart DG, DZ 21 and YA 1

These rules establish a new basis for apportioning deductible expenditure relating to certain assets which are used both privately and to earn income (mixed-use assets). The changes, which follow the original Budget 2011 announcement and subsequent consultation, are aimed at making the rules fairer.

Background

For most assets, it is straightforward to determine whether expenditure is deductible. If the asset is only used to derive income or used in business, related expenditure will be deductible.[1] If the asset is only used privately (such as a private house or a car) then no deduction is available for related expenditure.[2] Because mixed-use assets combine both private and income earning use in a single asset, difficult questions arise about the appropriate portion of expenditure that will be deductible.

The easiest way to explain this is to divide expenditure into “daily amounts”. If a bach is used by its owners for 40 days in a year, and rented out for 25 days in that year, it is clear that:

- 40 days’ worth of expenditure is not deductible

- 25 days’ worth of expenditure is deductible.

What is not clear is what happens to the expenditure which relates to the 300 days of the year when the asset is not used at all.

Under the previous rules, the 300 days when the asset is “available for income-earning use”, also gave rise to deductions. This means the owner would claim deductions for expenditure relating to 325 days, or 89% (325/365) of total expenditure.

This was not considered an equitable outcome, given that the asset was used both for income earning and private purposes, and indeed, the principal purpose of acquisition may well have been private.

This special report provides early information for interested parties and precedes the coverage of the legislation that will be provided in a forthcoming Tax Information Bulletin.

Key features

These amendments apply to real property used for short-term accommodation and to boats and aircraft that cost more than $50,000 – collectively called mixed-use assets. They establish an apportionment method to determine the deductibility of expenditure associated with them. The proportion of expenditure that is now deductible is calculated by dividing the number of days in which the asset was actually used to earn income by the total number of days the asset was actually used (for both purposes). In the illustration above, this would mean the owner would now be able to claim 38.5% of expenditure (25 days of income earning / 65 days of total use). This is the key rule in these amendments.

A number of other changes have also been made to support the apportionment method:

- rules to allow asset owners to treat the asset as outside the tax system (no tax on income but no deductions allowed). Owners can opt out of the tax system if the asset has earned gross income of less than $4,000, or where ring-fenced losses (as described below) are generated;

- rules which apply where income-earning use of these assets is low (2% or less of asset value) and tax losses are generated. These tax losses cannot be offset against other income, but must be carried forward to future income years. This deals with the difficulty of knowing whether a loss arising from a mixed-use asset is a genuine loss (that should be allowed) or a loss which arises because the apportionment formula has failed to exclude all of the private benefit (which should be denied). This is described as “deduction quarantining”, but is conceptually the same as loss ring-fencing;

- rules to deal with interest expenditure for mixed-use assets that are held in company structures. These rules ensure that fair treatment is delivered to assets in these structures compared with individual ownership, so they do not create a situation where people can avoid apportionment of interest expenditure by moving the asset into a company structure.

The rules apply to mixed-use assets owned by all forms of entities except companies that are not close companies.

Application date

The new rules apply to mixed-use assets which are accommodation from the beginning of the 2013–14 income year. Mixed-use assets which are boats and aircraft are subject to the rules from the 2014–15 income year.

Detailed analysis

The key amendment is new subpart DG. It is structured as follows:

- Section DG 1 – High-level description of what subpart DG does;

- Section DG 2 – Sets up the relations with the rest of the Income Tax Act, and establishes some general rules about the asset by asset basis, group companies and ascertaining voting and market value interests;

- Section DG 3 – Details which assets are subject to the rules;

- Section DG 4 – Describes what is private use;

- Section DG 5 – Defines interest for the purposes of the subpart and points to later sections that apportion it;

- Section DG 6 – Extends the associated persons rule to make a person and company associated if the person has a 5% interest in the company, or the shareholding gives them a right to use the asset;

- Section DG 7 – Allows certain income-earning expenditure to be fully deductible;

- Sections DG 8 and DG 9 – Set out the key apportionment rule;

- Sections DG 10 to DG 14 – Set out the interest apportionment rules when the mixed-use asset is owned by a company;

- Sections DG 15 to DG 19 – Detail the quarantining or loss ring-fencing rules;

- Section DG 20 – Sets out the treatment when the mixed-use asset’s income cannot be directly ascertained;

- Section DG 21 – Sets out when an owner can treat the asset as outside the tax system (no tax on income, but no deduction allowed); and

- Section DG 22 – Deals with assets held for part of the year.

- Other new sections or amendments are:

- New section CW 8B to provide that certain income from mixed-use assets that would otherwise be gross income is exempt income (and section CC 1 is consequentially modified);

- Section CX 17, which deals with fringe benefits provided to shareholders, is amended;

- The interest deductibility sections in subpart DB are amended and subpart DG overrides them as appropriate;

- Section DZ 21 is added to allow for the depreciation roll-over when a mixed-use asset that was owned by a company is transferred to the shareholders; and

- The definitions in section YA 1 are amended.

Assets subject to the rules

Section DG 3

Section DG 3 sets out which assets will be subject to the mixed-use asset rules in an income year. There are three key criteria:

- Use

- Type of asset

- Ownership of asset.

Use

Section DG 3(1) defines “asset” (referred to as mixed-use assets). The criteria for a mixed-use asset requires the asset to be used to earn income, and also to be used privately. The important concept of private use is discussed in the next section. Additionally, the asset is required to be unused for at least 62 days in the income year or, where the asset is typically only used on working days, unused for 62 working days.

Type of asset

The new rules only apply to assets which are:

- Land (including improvements to land). The rules will typically apply to holiday homes, but city apartments and such like may also fall inside the rules. In particular the rule applies to the provision of short-term accommodation (long term-accommodation is specifically excluded).

- Ships, boats and other water craft.

- Aircraft.

There are two important points to note about these last two categories of mixed-use asset.

The mixed-use asset rules only apply to boats and aircraft which have a cost to the person of $50,000 or more, or if they were not acquired at market value, their market value on acquisition was $50,000 or more. The market value rule covers situations where assets are acquired from related parties at less than market value. Where the asset is acquired by a partnership (including a look-through company) it is the cost to the partnership that is relevant, not to the partners.

The concepts of “ships, boats or craft” and “aircraft” are not defined. They are intended to have a broad ordinary meaning.

In the case of all three categories of assets, for the purposes of these rules, the asset will include any assets which are related to it. So, in the context of a holiday home, items such as the furniture and appliances will be subject to the rules, and in the context of a yacht, items such as the dinghy and the lifejackets will be included.

Entities subject to the rules

The rules apply to any person claiming deductions in relation to the asset, not just the person who owns it. For example, a person who leases an aircraft, and then uses it personally and rents it out, will be subject to the rules.

The rules apply to deductions claimed in all entities other than companies which are not close companies (i.e., the rules do not apply to assets held by companies known as widely held).

Exclusions

Some assets which meet the above criteria are still excluded from the rules. An asset is excluded if:

- The private use is minor and the asset is primarily used in a business which is not a rental or charter business. If the asset is owned by a company, private use creates an obligation to pay FBT or income tax. This excludes circumstances such as a helicopter which is generally used on a farm but is used for say 3% of its operating time for private purposes. “Minor” is undefined for these purposes and bears its ordinary meaning.

- It is a residential property which has long-term rental as its only income-earning use. This deals with situations such as when a person’s home which is occupied by them for the first part of the year, remains empty for a period of three months while they work in another part of the country, and then rented out by them as an ordinary residential rental when they decide to remain in that other part of the country long-term.

- A similar rule also applies for boats and aircraft which are initially used by the owner and then undergo a change of use, and are rented out after that change of use (the rule also applies to assets which are initially rented out and then used exclusively by the owner following the change of use). An example would be a boat which is used as a private asset for the first part of the year, and then rented out during the second part of the year following the owner’s acquisition of a new boat for private use.

Concept of private use

Section DG 4

The concept of private use is important to establish whether an asset is a mixed-use asset, because one of the criteria for an asset to be a mixed-use asset is that it is used both to earn income and privately.

There are three categories of private use.

The first is use of the asset by a natural person (an individual) who is either the person who owns, leases, licenses, or otherwise has the asset. This will cover the simplest situation where the asset is owned by a natural person, and that person uses their own asset.

The second is the use of the asset by a natural person who is associated with the person who owns, leases, licenses or otherwise has the asset. The legislation as enacted extends the associated person test by including people who have a voting interest of 5% or more, and those whose share in the company gives them a right to use the asset.

Two common situations which this rule will cover are:

- The asset is owned by a natural person, and is used by that person’s close relative (see section YB 4).

- The asset is owned by a company (or trust or partnership), and used by a natural person who is associated with that company, a trust or partnership (see section YB 3).

Use by a person who falls into one of the above categories will constitute private use even if the person uses the asset along with others – such as when the owner stays in the bach along with some of her friends, even if the friends pay market rental.

Use by a person who falls into one of the above categories will also constitute private use regardless of any amount paid for the use. However, any amount which is paid will be treated as exempt income (see sections DG 4(6) and CW 8B) which means that it will not be taxable. The use will not be considered income-earning use for the purposes of the apportionment formula, which means that it does not increase the level of deductibility.

The third category is where the asset is used by a person who is not associated with the owner, but who pays less than 80% of the market value of that use. Market value is specifically defined in section DG 3(5) for these purposes using the concepts of open market, ordinary terms and arm’s length. It is intended to capture situations such as when an asset is made available to a friend or a person otherwise connected with the owner for a price which is clearly lower than that ordinarily charged to renters with no connection with the owner. It is not intended to capture situations when an asset is rented by an unrelated person at a lower price for reasons such as:

- the asset is being rented in an “off-peak” or “quiet” period;

- the asset is being rented for a longer period than it is usually rented for; and

- the asset is being rented at a reduced price to establish profile or a market share.

If the rate the asset is rented for would have been offered to any other person who wanted it for that period or during that time, that will be a market rate.

As with payment for the use of an asset by an associate, any amount received which is less than 80% of market value is not required to be returned as income for tax purposes, and use for which less than 80% of market value is paid does not constitute income-earning use for the purposes of the apportionment formula.

Private use exemptions

There are three exemptions which exclude certain use from the definition of “private use”.

The first covers situations when the owner uses the asset to earn income in the ordinary course of their business. For example, a person who owns a boat will not be treated as using the boat privately when he or she takes out skippered fishing charters, if that is in the ordinary course of the business.

The second exemption covers situations when the owner uses the asset to carry out repairs caused by someone who rented the asset. For example, a bach might be rented to people who damage it. The owner might then need to stay in the bach to repair that damage because the owner lives some way away, and it will take more than one day to repair the damage. The use by the owner to repair the bach will not constitute private use.

The third exemption covers situations when the owner uses the asset to relocate it at the beginning or end of a period of hire, the relocation is necessary to enable the hire, and the income derived by the owner directly or indirectly includes an amount for the relocation.

Example

Mary owns a launch. During the course of an income year, she takes her family out on the launch, she lets her brother use the launch (paying the market rate of $200 per day) and she lets her friend use the launch (paying fuel costs only at the rate of $50 per day).

All these uses are instances of private use. The $200 per day which Mary receives from her brother and the $50 per day that Mary receives from her friend are exempt income so not subject to tax.

When Mary rents out the launch to non-associates at market rates, takes the launch to another port for rental to non-associates at $250 per day and then back again to the home port, or takes the launch to a boatyard for repair after damage was caused by a non-associate during a rental period, none of these instances is private use.

Expenditure which is deductible in full

Section DG 7

The primary objective of the new rules is to set in place an apportionment mechanism so that the deductibility of expenditure is determined by the ratio of income-earning use to total use. However, the new rules recognise that there are some items of expenditure that ought to be deductible in full, even though the underlying asset has some private use. The new rules allow expenditure to be deducted in full where:

- it relates solely to the use of the asset for deriving income, and either is expenditure from which the person who owns or otherwise has the asset would not reasonably expect to receive a personal benefit (or, when a company owns or otherwise has the asset, no associate of the company would receive a personal benefit); or

- the expenditure must be incurred to meet a regulatory requirement to use the asset to earn income.

The simplest example would be advertising expenditure – it solely relates to the income-earning use of the asset, and delivers no personal benefit to anyone.

An exception to this rule is expenditure on repairs and maintenance. The rules provide that repairs and maintenance cannot generally be treated as falling within this provision, which means that they will always be subject to apportionment. There is one carve-out from this exception. Where costs are incurred to repair explicit damage caused when an asset is used to earn income, that repair cost will be deductible in full.

For example, a bach is rented out and the renters leave the barbecue on overnight, causing heat damage to a nearby wall. The costs of repairing that damage will be deductible in full.

Example

John operates a charter boat which he also uses privately. He incurs expenses, including costs in meeting Maritime New Zealand survey requirements, advertising costs, and general maintenance costs. The advertising costs are fully deductible because they deliver no personal benefit. The survey costs are fully deductible if they are incurred only for charter purposes. The general maintenance costs are not deductible under this provision because they deliver a personal benefit as well as an income-earning benefit. A portion of these maintenance costs may be allowed as a deduction under the apportionment rules.

Expenditure subject to apportionment

Sections DG 8 and DG 9

The apportionment rules are the core of the new rules for mixed-use assets.

The apportionment rule is used to determine the deductibility of expenditure (and depreciation loss) which relates to the asset and is not expenditure which is fully deductible under the provision referred to above, or expenditure which relates purely to the private use of the asset. This expenditure will typically include rates, insurance, general repairs and maintenance.

The expenditure will include interest expenditure incurred by owners on debt which relates to the mixed-use asset (debt that has been identified through a tracing rule). However, special rules apply to interest incurred by companies other than qualifying companies as, in the absence of these rules, the interest would generally be fully deductible.

The proportion of the expenditure which will be deductible is calculated by multiplying the expenditure by the following formula:

income-earning days

income-earning days + counted days

Income-earning days are those days when the asset is used to earn income, other than exempt income (such as when the asset is rented to associates or for less than 80% of the market value). This includes days when the asset is used in a wider business and therefore the income is derived indirectly.

Income-earning days also include days when the asset is used by the owner to repair damage caused by a renter, where the asset is relocated to facilitate a rental and the cost of that relocation is included in the rental, and where the asset is unavailable for use because it had been reserved by someone but they did not use it. Days for which the use of the asset triggers a fringe benefit tax liability also count as income-earning days.

Counted days are those days when the asset is in use, but the use is not an income-earning day. Counted days will therefore include days when the asset is used privately, and when the asset is used to earn exempt income – by being rented to associates or for less than market value.

Units other than days can be used if they achieve a more appropriate apportionment. For example, nights would probably be a better unit of measurement for accommodation, and flying hours for aircraft.

Depreciation itself is usually apportioned by the mixed-use assets rules, but gain or loss on sale is dealt with by the relevant rules in subpart EE. Further, when depreciation is apportioned on the basis of floor area or similar, that basis is not overridden by the mixed-use assets apportionment rules.

Example

Jim rents out his aeroplane at market value for 100 hours in an income year, and uses it for his personal enjoyment for 50 hours. Jim incurs expenditure of $10,000 for general repairs and maintenance of the plane. He may deduct two-thirds of the expenditure. His deduction is calculated as follows:

$10,000 × (100/(100 + 50)) = $6,666.67

Example

Mary owns a launch. During the course of an income year, she takes her family out on the launch for 20 days, she lets her brother use the launch (paying the market rate of $200 per day) for 5 days and she lets her friend use the launch (paying fuel costs only at the rate of $50 per day) for 1 day.

Mary rents out the launch to non-associates at market rates for 30 days, and spends two days taking the launch to another port for one of these rentals and then back again to the home port afterwards.

She spends one day taking the launch to a boatyard for repair after damage was caused by one of those renters.

Mary’s income-earning use is:

- 30 days’ rental to non-associates

- 2 days’ relocation use

- 1 days’ repair use

for a total of 33 income-earning days.

Mary’s counted days are:

- 20 days’ family use

- 5 days’ use by her brother

- 1 days’ use by her friend

for a total of 26 counted days.

Mary’s apportionment calculation is therefore:

33 income-earning days

33 income-earning days + 26 counted days

= 33

59

= 56%

So Mary can deduct 56% of her mixed-use asset expenditure.

Expenditure quarantining rules

Sections DG 15, DG 19 and DG 20

Background

The fundamental problem that the mixed-use asset rules address is the difficult boundary between expenditure incurred to earn income, which should be deductible against income, and expenditure incurred for private purposes, which should not be. The apportionment method set out above is the key mechanism by which this is done.

However, a tax loss can still arise, notwithstanding the apportionment rule. This is more likely to occur when income-earning use is low, as in the following example:

Income earning use – 15 days at $200 = $3,000 gross income

Private use – 30 days

Expenditure subject to apportionment – $20,000

Deductible expenditure – 15/45 x $20,000 = $6,667

Net loss – $3,667.

A loss in a single year is unexceptional, and many conventional businesses will suffer occasional losses, perhaps as a result of one-off external events. Examples of these kinds of events which might affect a holiday home would be a poor ski season which reduced the demand for ski-field accommodation, or perhaps flood damage to a property which meant it could not be rented out.

However, a loss which recurs from year to year indicates that the apportionment formula has failed to correctly distinguish between expenditure incurred to earn income, and expenditure incurred for private purposes. This is because income would be expected to generally exceed the expenditure incurred to earn that income – with occasional exceptions, such the examples noted above.

For these reasons, the new rules include a deduction quarantining, or loss ring-fencing rule. Under this rule, a person who is in an occasional loss position will not be able to offset their loss against other income in the current year, but will be able to use it against their future profits from the mixed-use asset. However, a person who is in perpetual loss because the apportionment rule has failed to properly capture all private expenditure will never have future profits to offset the loss against, and the rule amounts to a permanent loss denial.

Detailed rules

The deduction quarantining rules only apply where the income which a person earns from their mixed-used asset is less than 2% of the value of the asset. If the asset is land-based, the 2% is measured against its value for local rating purposes, but if the asset has been acquired from a non-associated person since that rating value was set, it will be measured against the price it was acquired for. Exempt income (which is income earned from associates or which is less than 80% of market value) does not count towards the 2% test.

For other assets, the 2% is measured against the asset’s value for tax depreciation purposes.[3]

Where the deduction quarantining rules apply and the person’s expenditure after apportionment exceeds their income, the amount of the expenditure which exceeds the income is not deductible in that income year.

Example

David has a city apartment with a rateable value of $300,000. He rents out the apartment and also uses it privately. He receives a market rate rental of $4,000 from non-associates, and $6,000 from associates. David’s total allowable expenditure, following the application of the apportionment rules is $15,000. Since David’s income from non-associates is less than 2% of the apartment’s rateable value, the excess expenditure of $11,000 is denied as a deduction.

The quarantined expenditure can be offset against profits in subsequent income years.

Example

In the following income year, David derives $10,000 from renting his city apartment at market rates to non-associates. David's total allowable expenditure following the application of the apportionment rules is $8,000. As calculated above he also has expenditure of $11,000 quarantined from the previous income year. David is able to deduct $2,000 of that quarantined expenditure to bring his profit down to zero. The remaining $9,000 continues to be quarantined and may be allowed as a deduction for a later income year.

There are a number of restrictions around the use of the quarantined deductions in later years:

- The profit must arise from the use of the same asset

- The profit must arise when that asset is used as a mixed-use asset.

There is one exception to the “same asset” rule – if the asset for which the loss arose is damaged, destroyed, or lost and is no longer held by the person, and the replacement asset is identical or substantially the same as the original mixed-use asset, the loss from the first asset can be offset against subsequent profits from the second asset.

Example

Graeme has a $5,000 quarantined deduction arising from renting out his family bach. Unfortunately it burns down. The insurance company pays out the replacement cost of the bach, which is $350,000. Graeme has a new bach built on the same site at a cost of $350,000. The new bach is of a similar size to the old bach, but has a different layout which allows an extra bedroom and is made of different materials than the old bach, which was built in the 1960s.

Despite the new layout, the extra bedroom, and the use of different materials, the new bach is substantially identical to the old bach, and Graeme can offset the $5,000 quarantined deduction against future profits from renting out the new bach.

There are some situations when it is impractical to apply the deduction quarantining rules. These situations arise when it is too hard to measure whether the income earned from the asset is equal to 2% or more of its value. This can arise when the income-earning use of the mixed-use asset is in a wider business, rather than it being rented out.

However, a small amount of use as part of a business will not exclude the deduction quarantining rule from applying, if the asset is also rented out. So, where the rental use of the mixed-use asset is at least 80% of the income-earning use of the asset, then the deduction quarantining rules will still apply, with the 2% being assessed against the rental income.

Example

Paul uses a helicopter on his farm to check stock for 50 hours in an income year, rents it out for 50 hours, and also uses it privately. While the income from the rental is clear, the income Paul derives in relation to the use of the helicopter in farming operations is not. Paul derives farming income from selling sheep, and it is not possible to attribute any of that income directly to his use of the helicopter in the farming operations. While the helicopter is also rented out, and that income can be clearly identified, the use of the helicopter to earn rental income is only 50% of the total income-earning use of the helicopter. This is less than the 80% threshold. Any loss attributable to the helicopter is therefore not quarantined.

“Opting out” rules

Section DG 21

The new rules entitle some holders of mixed-use assets to treat the asset as being outside the tax system. “Opting out” has the following consequences:

- Income from the asset is not subject to tax

- No deductions can be claimed for expenditure which relates to the asset.

There are two circumstances in which a person can opt out:

- The gross income from the mixed-use asset (not including income from associated persons or income which is less than 80% of market value) is less than $4,000; or

- The person would otherwise have quarantined deductions.

- The decision to opt out is made in each year, and can change from year to year. There are no specific reporting requirements, but as with all other aspects of taxation, the person will need to maintain sufficient records to be able to provide evidence that they were entitled to opt out.

Example

The only income Mike has from the rental of his bach is $3,000 from a person who is not an associated person. Mike can opt out of the rules in this subpart, which would mean that he would not be liable to tax on the amount, but would also not be entitled to claim any deductions in relation to the bach.

A company which holds a mixed-use asset cannot use these opt-out provisions.

MODIFICATIONS TO GENERAL RULES WHEN ASSETS ARE HELD IN COMPANIES

Additional rules concerning interest deductibility are required when the mixed-use asset is held in a company, and when shareholders incur interest in relation to their investments in companies. This is because of:

- The rule that most companies can deduct all interest expenditure

- The rule that shareholders in companies can deduct interest they incur on debt to buy shares.

Without additional rules to apportion interest expenditure it could be more tax advantageous to hold mixed-use assets in corporate structures. Ideally the tax system should not influence a person’s decision to hold assets in a particular structure.

The following information sets out variations to the core rules described above which apply when mixed-use assets are held by close companies.

Treatment of interest when an asset is held in a corporate structure

Sections DG 10, DG 11, DG 12, DG 13 and DG 14

This group of provisions sets out specific rules to address the deductibility of interest when the mixed-use asset is held by a company. As well as applying to the company which holds the asset, these rules potentially also apply to shareholders of the company which has the asset (both corporate and individual) and other companies in the same group as the company which has the asset.

The apportionment calculation discussed above remains at the core of the interest rules for companies. The purpose of the rules discussed here is to identify the interest expenditure to which that apportionment calculation ought to apply. The apportionment ratio calculated above applies to all relevant company and shareholder interests.

Interest deduction for the company which has the mixed-use asset

Section DG 11

This rule applies only to the company that directly holds the mixed-use asset and determines the amount of interest expenditure that is required to be apportioned. In order to do this the company which holds the mixed-use asset needs to determine two amounts:

- The value of the mixed-use asset (“asset value”). For land, this is the most recent rating value, or the acquisition cost of the land if more recent and the land was acquired from a non-associated person. For assets other than land, the relevant value is the tax value for depreciation purposes.

- The value of the company’s debt (“debt value”), which is the average of its debt at the beginning of the year and the end of the year. All of the company’s interest-bearing debt is relevant, not just debt which has some connection with the mixed-use asset.

The asset value is then compared with the debt value.

If the asset value is equal to or more than the debt value, all of the company’s interest is subject to apportionment. The amount of asset value that exceeds the debt value (also known as the net asset balance) will need to be considered further under the provisions which consider group companies and shareholders.

Example

Holiday Home Ltd holds a holiday home which is subject to the mixed-use asset rules and which has a rateable value of $200,000. The company has debt of $40,000, with associated interest expenditure of $4,000. Since the debt value is less than the asset value, all of the $4,000 interest expenditure must be apportioned using the same apportionment formula that applies to the other expenditure relating to the holiday home.

If the asset value is less than the debt value, then apportionment will only apply to a part of the company’s interest expenditure. That part is calculated using the following equation:

interest expenditure X asset value

debt value

Example

Boat Ltd has a charter boat which has a depreciated tax value of $60,000. The company has debt of $100,000, with associated interest expenditure of $10,000. Since the debt value is more than the asset value, the company must calculate how much of its interest expenditure is subject to apportionment. The amount of interest expenditure subject to apportionment is $10,000 × ($60,000/$100,000) = $6,000. Therefore, $6,000 of interest expenditure must be apportioned using the same apportionment formula that applies to the other expenditure relating to the charter boat.

Interest deductions for group companies

Sections DG 10 and DG 12

The rules only need to be considered when the asset value exceeds the debt value in the company which has the mixed-use assets under the provisions discussed above.

The rules apply to companies which are in the same group of companies as the company which has the mixed-use asset. The normal tax concept of a group company is used to determine how these rules apply, with two important exceptions:

- a group of companies is treated as a wholly owned group of companies;

- a company which would not ordinarily be part of a wholly owned group of companies, but is treated as part of a wholly owned group of companies under the provision above, is not included in the wholly owned group of companies if no private use of the asset has been made by any shareholder of that company (or a person associated with that any shareholder) where the shareholder does not also have interest in the company that owns the mixed-use asset.

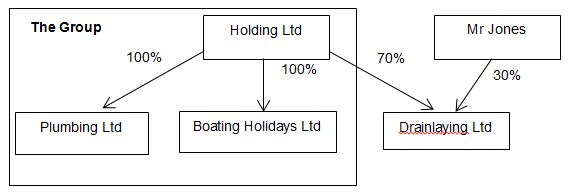

Example

Holding Ltd owns 100% of Boating Holidays Ltd, which owns a boat which is a mixed-use asset, and 100% of Plumbing Ltd. Holding Ltd also owns 70% of Drainlaying Ltd, with the other 30% of Drainlaying Ltd being held by a Mr Jones. Plumbing Ltd is part of the group for the purposes of apportionment of interest. Mr Jones does not use the boat, so Drainlaying Ltd is not part of the group for the purposes of apportionment of interest.

The Group

Once the relevant group of companies has been identified, the net asset balance from the company which owns the asset (the excess of the value of the asset over debt in that company) is attributed out to group members one at a time.

The rules apportion group company interest expenditure in the same way as the company who holds the asset, however, group companies compare their debt value to the net asset balance (instead of the asset value). For example, if the net asset balance is equal to or more than the debt value, all of the group company’s interest must be apportioned under the standard apportionment formula. The excess of the net asset balance over debt in that company is the new net asset balance, in which case another group company (if there are any other group companies) then uses the new net asset balance (unless it is nil). This net asset balance is reset every time a company calculation is done by reducing its value by the amount of the particular company’s debt value.

If the debt value exceeds the net asset balance the relevant portion of the group company’s debt will be subject to apportionment and no further group or shareholder interest apportionment calculations will have to be performed.

The legislation does not prescribe the order in which that attribution takes place – that is a decision to be made by the group.

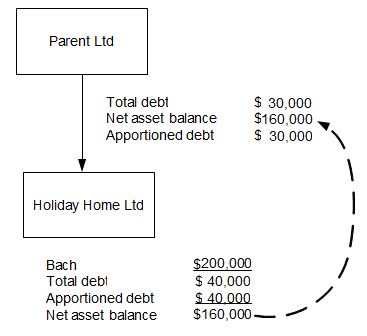

Example

Holiday Home Ltd has a net asset balance of $160,000 ($200,000 less $40,000) and is wholly owned by Parent Ltd. Parent has debt of $30,000, with associated interest expenditure of $3,000. Since Parent's debt value is less than the net asset balance, all of Parent's interest expenditure must be apportioned.

Note that “apportioned debt” is debt in which related interest expenditure must be apportioned.

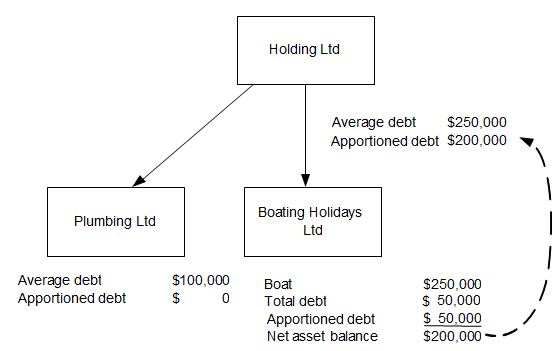

Example

Boating Holidays Ltd’s boat has a tax depreciation value of $250,000 and the company has debt of $50,000. Boating Holidays Ltd therefore has a net asset balance of $200,000 to be attributed out to group members.

Plumbing Ltd has average debt of $100,000 and Parent Ltd has average debt of $250,000. The group tax accountant decides to apply apportionment to Parent Ltd’s debt. The interest in Parent Ltd which is subject to apportionment is:

$200,000

$250,000 x interest expenditure

None of Plumbing Ltd’s debt is subject to apportionment.

Interest deductions for corporate shareholders

Sections DG 10 and DG 13

This section applies when a net asset balance (excess of asset value over debt value) remains after identification of debt in the company which owns the asset, and any group companies under the provisions described above. It applies to identify debt in corporate shareholders for the purposes of applying apportionment to their interest deductions. Again, the same process is followed to identify interest expenditure that is required to be apportioned by comparing the shareholders debt value and the remaining net asset balance. However, the net asset balance applied to shareholders is calculated by reference to their voting interest (calculated as if they were the ultimate shareholder) in the company in which they hold shares (or if this is a group company, the net asset value left after all the group company calculations have been done).

The provision contains an ordering rule. Debt is identified in the following order:

- companies which are shareholders in the company which has the mixed-use asset or in a company which is in the same group as the company which has the mixed-use asset, and which have a voting interest in the company which has the asset; then

- companies which have a voting interest in one of the companies referred to in the previous paragraph.

The provisions do not apply to a company:

- which has a direct or indirect interest of less than 50% in the company which has the mixed-use asset; and

- of which no associated person who does not otherwise have a voting interest in the company that owns the mixed-use asset has had private use of the asset.

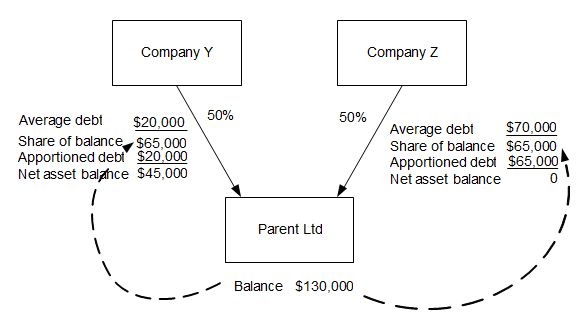

Example

In an earlier example, Holiday Home Ltd had a net asset balance of $160,000 which it passed on to Parent Ltd. Parent Ltd apportioned interest on debt of $30,000, leaving a net asset balance of $130,000. Parent Ltd has two equal corporate shareholders, Company Y, which has debt of $20,000 with associated interest expenditure of $2,000, and Company Z, which has debt of $70,000 with associated interest expenditure of $7,000. Each company’s share of the net asset balance is $65,000 ($130,000 × 50%). Since Company Y's debt value is less than its share of the net asset balance, all of its interest expenditure must be apportioned. Company Z's debt value is greater than its share of the net asset balance, so the interest it must apportion is calculated as $7,000 × ($65,000/$70,000) = $6,500.

Interest deductions for non-corporate shareholders

Sections DG 10 and DG 14

These provisions apply when a net asset balance remains after the identification of debt in the company which owns the asset, any group companies, and any corporate shareholders. They apply to debt held by non-corporate shareholders, and trustees who are companies.

Non-corporate, interest on debt which is subject to apportionment is only debt which was incurred to acquire the shares in a company which:

- has the asset;

- is a shareholder in the company which has the asset;

- has a voting interest in the company which has the asset;

- is a shareholder in a company which is in the same group as the company which has the asset, and has a voting interest in it.

However, the rules will not apply when the person has a direct or indirect interest of less than 50% in the company, and did not have any private use of the asset.

The person’s share of the net asset balance is calculated by reference to their voting interest in the company in which they own shares, which in turn must have a direct or indirect interest in the mixed-use asset owning company.

Example

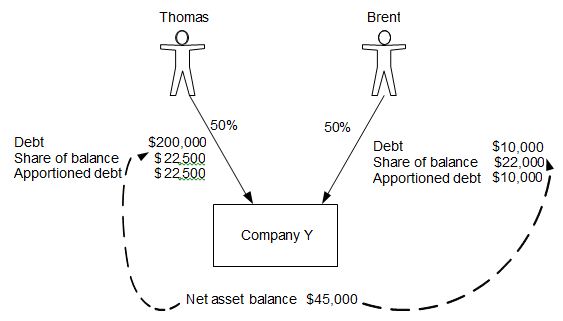

In an earlier example, Company Y’s share of Parent Ltd’s asset balance was $65,000 and it had debt of $20,000. Company Y therefore has an asset balance of $45,000 to be distributed amongst its shareholders. Company Y has two shareholders: Thomas, who has borrowed $200,000 to acquire a 50% interest in the company, and Brent, who has borrowed $10,000 to buy his 50% interest. Each has a share of the remaining net asset balance of $22,500. The formula is ($65,000 − $20,000) × 50% = $22,500. Since Thomas's debt value is greater than his share of the net asset balance, Thomas must apportion 11.25% of his total interest expenditure. The formula is 22,500/200,000. Since Brent's debt value of $10,000 is less than his share of the net asset balance of $22,500, all Brent's interest expenditure must be apportioned. Obviously apportionment stops at the level at which the shareholder is not a company.

Deduction quarantining rules when an asset is held in a corporate structure

Sections DG 15 – DG 19

Additional rules are provided to deal with deduction quarantining when the mixed-use asset is held in a company. Interest deductions identified in a group company or shareholder under the provisions discussed above may be subject to quarantining.

The rules need to be considered when the gross income from the asset is less than 2% of its value as discussed above. For reasons set out below, whether income exceeds apportioned expenditure in the company holding the asset is not relevant.

The first step is to calculate the difference between the income earned from the asset and the apportioned expenditure in the company which has the asset. If expenses in that company exceed its income – that is, it is itself in loss and subject to deduction quarantining – then the apportioned interest expenditure identified in all group companies and shareholders will also be subject to quarantining.

If the income in the company which has the asset exceeds its expenses – that is, it is in “profit”, described in the legislation as “outstanding profit balance” – then to the extent possible, that profit will be notionally allocated to those group companies and shareholders which had apportioned interest, in amounts equal to their apportioned interest amounts (and in the same order in which those various persons had debt apportioned). To the extent an apportioned interest amount can be matched with “profit”, then it will be deductible against other income in the company (or if none, available to be carried forward as an ordinary, unrestricted loss). There is no obligation to offset the interest amount against income from the company which holds the mixed-use asset.

However, once all of the “profit” has been exhausted and none remains to be allocated against an interest amount, then that interest amount will be quarantined and not able to be deducted in the current year.

Quarantined amounts will be carried forward to future years, and will be deductible where they can be notionally matched with an amount of “profit” from future years from the company which has the mixed-use asset.

Example

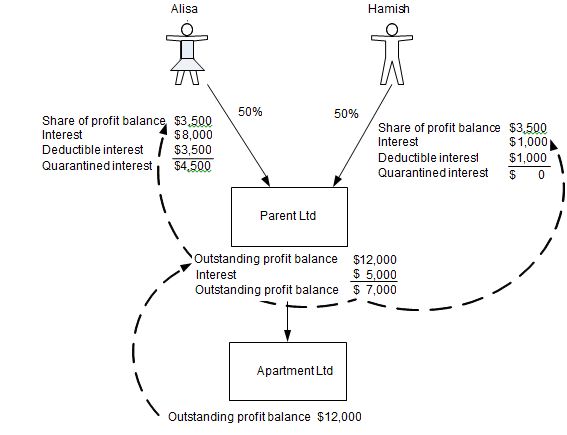

Apartment Ltd owns an apartment to which the rules in this subpart apply and the income derived from the asset in the current year is less than 2% of the cost of the apartment. The company has calculated an outstanding profit balance of $12,000 as a result of deducting its apportioned expenses from its income from the apartment. Apartment Ltd is 100% owned by Parent Ltd, which has interest expenditure, after apportionment, of $5,000. Parent Ltd has 2 equal shareholders, Alisa who has apportioned interest expenditure of $8,000, and Hamish who has apportioned interest expenditure of $1,000. Parent Ltd is the first entity subject to the deduction quarantining rules. Its apportioned interest expenditure of $5,000 is less than the outstanding profit balance of $12,000, so it is not required to quarantine any of its interest expenditure. However, the outstanding profit balance is reduced to $7,000 ($12,000 – $5,000). Because Alisa and Hamish are equal shareholders their share of the $7,000 outstanding profit balance is $3,500 each ($7,500 x 50%). Alisa can therefore deduct $3,500 of her $8,000 apportioned expenditure, but must quarantine the remaining $4,500 ($8,000 – $3,500). Hamish has the same entitlement to deduct $3,500 of his apportioned expenditure but only has $1,000 of apportioned expenditure anyway, so is able to deduct all of it. The $2,500 remaining after Hamish has done that is not used.

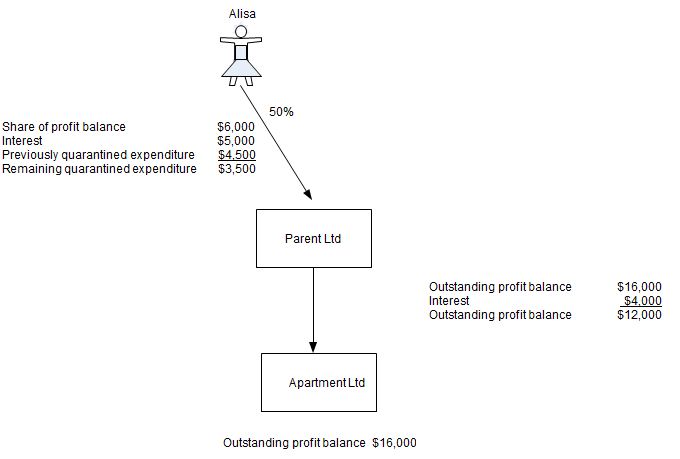

For example, in the following income year, Apartment Ltd has calculated an outstanding profit balance of $16,000 after deducting apportioned expenditure from the income from the apartment. In that same year, Parent Ltd has apportioned interest expenditure of $4,000 and Alisa has apportioned interest expenditure of $5,000. Therefore, Parent Ltd can claim all of its apportioned interest expenditure and an outstanding profit balance of $12,000 remains ($16,000–$4,000). Alisa’s share of the outstanding profit balance is $6,000 ($12,000 × 50%) and therefore she can claim her current year apportioned interest expenditure of $5,000, and can claim $1,000 of her previously quarantined expenditure. Alisa’s remaining $3,500 of quarantined expenditure remains quarantined.

Transitional rule to allow companies to transfer assets to shareholders

Section DZ 21

The purpose of this rule is to facilitate the restructuring of arrangements under which mixed-use assets are held in companies. This rule allows the mixed-use asset to be transferred out to shareholders without triggering any depreciation recovery.

A company can choose to apply this rule when:

- on 31 March 2013 it has a mixed-use asset

- it transfers the asset to its shareholders (or to the shareholders of its shareholders) in proportion to their shareholding.

The transfer must be made before the end of the company’s 2013–14 income year.

The transfer of the asset is treated as if it were a disposal and acquisition of the asset for an amount equal to the adjusted tax value of the asset on the date of the transfer. This means that no depreciation recovery will be triggered by the transfer. The policy intention was that the shareholder would step into the shoes of the company and so be liable for any depreciation recovery on eventual disposal of the asset as if they had claimed all of the depreciation which the company had claimed.

If the asset is transferred to a shareholder for less than market value, a dividend may arise.

Example

BoatCo Ltd has a boat on 31 March 2013 which meets the various requirements set out in subpart DG. All the shares in BoatCo Ltd are owned by Michelle. The boat has a market value of $75,000, and an adjusted tax value of $55,000. BoatCo Ltd transfers the boat to Michelle without payment (which is treated as a dividend of $75,000). For depreciation purposes, BoatCo Ltd is treated as disposing of the boat for $55,000, and Michelle is treated as acquiring it for $55,000. After the amendment Michelle will be treated as acquiring the boat for $75,000 gross, and having accumulated depreciation of $20,000 as at the date of acquisition.

SUNDRY TECHNICAL RULES

Summary of key provisions for assets owned by partnerships and look-through companies

Boats and aircraft are only subject to the rules if they cost more than $50,000. For the purposes of this test, if an asset is held by a partnership or a look-through company (LTC), the value of all the interests of the partners in the partnership or the shareholders of the LTC are aggregated (see section DG 3(5)).

Summary of key provisions for assets owned by qualifying companies

The general rule for companies that states that interest on all debt is deductible, regardless of the use of that debt, does not apply to qualifying companies. Qualifying companies are instead required to identify the use of their debt to determine whether interest on it is deductible or not – a tracing rule. The mixed-use asset rules recognise this approach by excluding qualifying companies from the interest apportionment rules which apply to companies, and instead apply apportionment only to interest on debt which relates to the mixed-use asset (see section DG 5(2)).

However, as with ordinary companies, it may also be necessary to consider debt incurred at a group company or shareholder level. A qualifying company is therefore required to calculate a net asset balance in the same way as an ordinary company, and the same rules for attributing that to group companies and shareholders also apply.

Relationship between the mixed-use assets rule and other provisions

Section DG 2

The mixed-use asset rules override various provisions in subpart DG which deal with the deductibility of interest and financing expenditure. This override is necessary because the mixed-use asset rules limit deductions for interest and financing expenditure that would otherwise be able to be claimed.

The rules in subpart DD which limit deductions for entertainment expenditure do not apply to expenditure incurred in relation to the private use of an asset under the mixed-use asset rules.

Where the use of an asset is private use under the mixed-use asset rules, no liability to fringe benefit tax will arise. The choice which is normally available to treat a benefit provided to a shareholder/employee as either a fringe benefit or a dividend is specifically disabled, and the use is required to be treated as a dividend.

The use of an asset by a shareholder may constitute both private use under the mixed-use asset rules and a deemed dividend (if, for example, less than market value is paid for the use of the asset). This is consistent with the position under ordinary law – which is well-understood for cash dividends – that no deduction is available for the amount outlaid to pay a dividend. In a dividend context, the mixed-use asset rules are merely the mechanism by which the cost of providing the non-cash dividend is calculated.

Where an asset is acquired or disposed of during the income year

Section DG 22

Various rules are provided to deal with assets being acquired or disposed of during the course of the income year. These rules:

- pro-rate the 62-day test used to determine whether an asset is a mixed-use asset;

- set appropriate days to measure the debt value of companies;

- pro-rate interest expenditure which companies are required to apportion; and

- pro-rate the 2% threshold to determine whether losses are subject to ring-fencing.

NOTE: Some examples used in the legislation do not always reflect the correct amounts. These will be corrected in the next available tax bill.

1 Section DA1, General Permission, Income Tax Act 2007.

2 Section DA2, General Limitation, Income Tax Act 2007.

3 Consideration is being given to amending the legislation to set a hurdle rate which is higher than 2% for boats and aircraft from 1 April 2014, which is when these assets become subject to these rules.