Lease inducement and lease surrender payments

14 August 2013

A special report from

Policy and Strategy, Inland Revenue

Lease inducement and lease surrender payment measures in the Taxation (Livestock Valuation, Assets Expenditure, and Remedial Matters) Act 2013

This special report provides early information on the land-related lease inducement and lease surrender payment amendments to the Income Tax Act 2007, contained in legislation introduced in the Taxation (Livestock Valuation, Assets Expenditure, and Remedial Matters) Bill and enacted on 17 July 2013.

This special report precedes coverage of the new legislation that will be published in a Tax Information Bulletin later this year.

Land-related lease inducement and lease surrender payments

Sections CC 1B, CC 1C, DB 20B, DB 20C, EA 3, EI 4B and YA 1 of the Income Tax Act 2007

The tax treatment of land-related lease inducement and lease surrender payments has been reformed for income tax purposes. Lease inducement and lease surrender payments are treated as taxable income to the recipient and deductible to the payer under the Income Tax Act 2007. The reforms are intended to make the tax treatment of lease-related payments fairer and more efficient for businesses, by removing a tax advantage that under the previous rules had the effect of distorting business decisions on leases.

Background

The New Zealand tax system generally maintains the capital-revenue boundary: capital receipts are generally not taxed, whereas revenue receipts are taxed. The boundary, however, became problematic in the context of certain land-related lease payments.

Following the recent economic downturn, arrangements involving lease inducement payments became a popular option for landlords to attract tenants without needing to reduce the rental amounts payable. Lease inducement payments are unconditional lump sum cash payments generally made by landlords to induce tenants to enter into a commercial lease.

In the absence of specific provisions in the Income Tax Act 2007, lease inducement payments, for income tax purposes, were characterised differently for a payer and a recipient. They were generally non-taxable to a recipient (tenant) and generally deductible to a payer (a commercial landlord who is in the business of leasing). The capital nature of a lease inducement payment was confirmed by the Privy Council in Wattie.[1]

Under the previous rules, the tax treatment of lease inducement payments in a commercial context posed a risk to the tax base. It created an opportunity for taxpayers to substitute tax deductible rent payments with non-taxable cash lease inducement payments. Also, compared with other forms of lease inducements such as a rent-free holiday or a contribution towards fit-out costs, these payments provided a tax advantage which distorted business decisions on leases. To address the revenue risk, an officials’ issues paper, The taxation of lease inducement payments, was released in July 2012, containing a proposal to tax lease inducement payments.

In response to concerns raised in submissions, the Government decided to extend the scope of the reform by including another type of lease payment – lease surrender payments. Lease surrender payments that are generally made by tenants to landlords to surrender existing lease arrangements were treated differently to lease inducement payments for income tax purposes. They were typically taxable to the recipient (commercial landlord) and non-deductible to the payer (tenant). The latter treatment was confirmed by the Court of Appeal in McKenzies.[2] Lease surrender payments were regarded as “black hole” expenditure to the commercial tenant – that is non-deductible business expenditure.

Lease surrender payments can also be made by landlords to tenants to surrender existing lease arrangements and, in this case, the payments were typically non-taxable to the recipient (tenant) and deductible to the payer (commercial landlord).

The lease inducement and lease surrender payment reforms were the first stage of the two-stage reform process for reforming the taxation of land-related lease payments. The second stage of the reform reviewed the overall tax treatment of land-related lease payments, such as lease transfer payments. An officials’ issues paper, The taxation of land-related lease payments, was released in April 2013.

Key features

The changes fall into two groups. The first group includes amendments relating to the tax treatment of lease inducement payments, namely the charging provision (new section CC 1B), the deduction provision (new section DB 20B), and the timing provision (new section EI 4B). The second group includes amendments relating to the tax treatment of lease surrender payments, namely the charging provision (new section CC 1C) and the deduction provision (new section DB 20C).

Under the amendments relating to lease inducement payments:

- If a person (the payee) derives an amount as consideration for the agreement by the payee to the grant, renewal, extension, or transfer of a right (the land right) that is a leasehold estate or a licence to use land, the amount is taxable to the payee (new section CC 1B).

- A related deduction provision is provided (new section DB 20B).

- A new timing rule allocates the income and deductions from section CC 1B and DB 20B evenly over the period of the land right. An exception applies when the person ceases to hold the relevant land right, or the estate in land from which the land right is granted, during an income year. For income, the remaining amount to be spread under the general timing rule is allocated to that income year. For deductions, the remaining amount to be spread is allocated to that income year if the land right, and the estate in land from which the land right is granted, are not held by the person or an associated person (new section EI 4B).

Under the amendments relating to lease surrender payments:

- If a person (the payee) derives an amount as consideration for the agreement by the payee to the surrender or termination of a land right (the land right) that is a leasehold estate or licence to use land, the amount is taxable to the payee (new section CC 1C).

- A related deduction provision is provided (new section DB 20C).

- There is no specific timing rule for lease surrender payments. The general principles and provisions of the Income Tax Act 2007 apply to determine the timing of income and deductions for lease surrender payments. Generally, income and deductions arising from lease surrender payments are allocated to the income year in which an amount is derived or incurred.

Application dates

The amendments relating to lease inducement payments (new sections CC 1B, DB 20B and EI 4B) apply to an amount that is derived or incurred on or after 1 April 2013 in relation to a lease or licence entered, renewed, extended, or transferred, on or after that date. A lease includes an agreement to a lease.[3]

The amendments relating to lease inducement payments do not apply to an amount that is derived or incurred on or after 1 April 2013 in relation to a lease or licence entered, renewed, extended or transferred, before 1 April 2013.

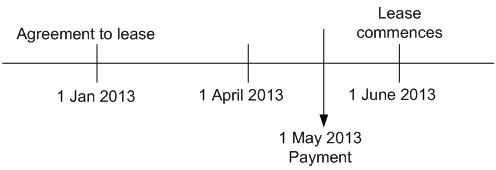

Example

A landlord and a tenant entered into a binding lease agreement on 1 January 2013. The landlord is liable to pay the tenant $100,000 on 1 May 2013 for the agreement to a lease. The lease commences on 1 June 2013.

The amendments relating to lease inducement payments do not apply to the $100,000 payment derived by the tenant. The lease is entered into before 1 April 2013 even though the payment is derived after the 1 April date. The tax treatment of the $100,000 lease inducement payment is determined under the general principles and provisions in the Income Tax Act 2007.

The amendments relating to lease surrender payments (new sections CC 1C and DB 20C) apply to an amount that is derived or incurred on or after 1 April 2013.

Detailed analysis

Tax treatment of lease inducement payments

Income

New section CC 1B provides that if a person (the payee) derives an amount as consideration for the agreement by the payee to the grant, renewal, extension or transfer of a land right, the amount is taxable to the payee. The land right must be a right that is a leasehold estate or a licence to use land.

The term “leasehold estate” is defined broadly in section YA 1 to include any estate, however created, other than a freehold estate.[4] The charging provision, therefore, does not apply to payments from a freehold estate in land, such as the proceeds from the sale of land.

The charging provision applies broadly because it only focuses on the person who receives the payment – the payee. The payer is not relevant. If a person receives a lease inducement payment on behalf of another person, the existing nominee rules in section YB 21 apply to treat the amount as derived by that other person.

Example

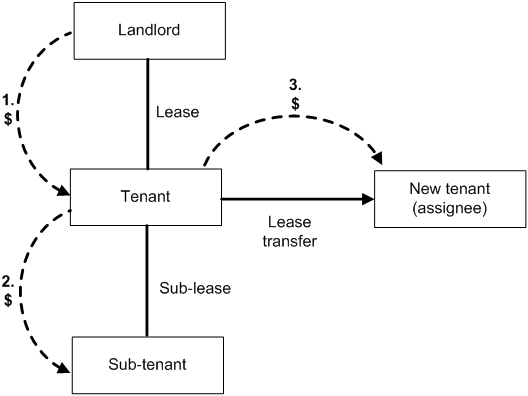

Examples of payments that are taxable under section CC 1B include:

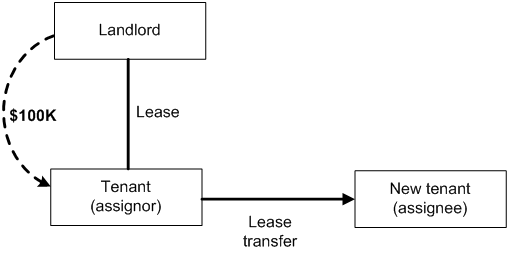

- a payment from a landlord (lessor) to a tenant (lessee);

- a payment from a tenant (sub-lessor) to a sub-tenant (sub-lessee); or

- a payment from a tenant (assignor) to a new tenant (assignee).

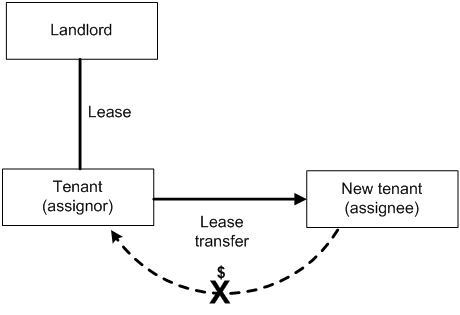

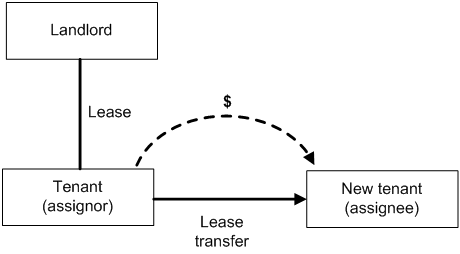

The charging provision does not apply to an amount derived by the payee as the holder of a land right and as consideration for the transfer of the land right to the person paying the amount (section CC 1B(2)).

Example

A lease transfer payment received by an assignor from an assignee for the assignment of an existing lease is not taxable under section CC 1B.

The reference to “amount” in section CC 1B uses the definition of “amount” in section YA 1, which includes any amount in money’s worth. The charging provision therefore includes consideration other than cash.

Note that some land-related lease payments can be subject to more than one income-charging provision in the Income Tax Act 2007. For example, lease premiums are taxable under sections CC 1 and CC 1B and contributions for fit-out costs are taxable under sections CC 1B and CG 8. However, the tax treatment of amounts that are already subject to sections CC 1 and CG 8, which relate to income from land or capital contributions respectively, do not change. The amount is included in income only once (section BD 3(6)) and the new timing rule for lease inducement payments in section EI 4B does not apply to an amount that is income under section CC 1 and CG 8 (section EI 4B(2)).

Exception for a tenant or a licensee of residential premises

An exception for a tenant or a licensee of residential premises applies. The amount is not considered income if the payee is a natural person (individual) and derives the amount as a tenant or licensee of residential premises whose expenditure on the residential premises does not meet the requirements of the general permission.

This exclusion is intended to provide a consistent tax treatment of income and deductions for a tenant or a licensee of residential premises. An individual tenant or a licensee of residential premises is not allowed a deduction for payments of rent because they do not meet the general permission in section DA 1 and the private limitation in section DA 2(2). On the other hand, an accommodation provider, who is not a natural person, is subject to section CC 1B because they would typically be allowed a deduction for payments of rent under the general permission.

If there is a concurrent use of the land right for residential and business purposes, the amount is apportioned accordingly. The amount relating to business purposes is taxable under section CC 1B to the extent that a tenant or a licensee whose expenditure on the premises is allowed a deduction under the general permission in section DA 1.

Deductions

New section DB 20B provides that lease inducement payments are deductible to a person (the payer) if the following conditions are met:

- a person (the payer) incurs an amount of expenditure as consideration for the agreement by another person (the payee) to the grant, renewal, extension or transfer of a right (the land right) that is a leasehold estate or a licence to use land;

- the payer is the person who owns the land right or the estate in land from which the land right is granted; and

- the payee is the person who is obtaining the land right.

The deduction provision allows deductions for other forms of lease inducements, in particular, contributions for fit-out costs. A consequence of this is that the timing rule for deductions in new section EI 4B (discussed below) applies to these payments.

New section DB 20B overrides the capital limitation in section DA 2(1). The general permission in section DA 1 must still be satisfied and the other general limitations in section DA 2 still apply.

Timing of income and deductions

New section EI 4B is a timing provision for lease inducement payments. The timing provision applies to the amount of income under section CC 1B or deductions under section DB 20B that is derived or incurred in relation to –

- a right (the land right) that is a leasehold estate or a licence to use land; and

- a period (spreading period).

The “spreading period” means a period that:

- begins with the commencement, or a renewal or extension, of the land right; and

- ends before the earliest following date on which the land right may be terminated, or may expire, if not extended or renewed.

In other words, the spreading period is an initial fixed period set either at the grant, renewal or extension of the land right. The rationale for this approach is to avoid complexities around adjusting the spreading period (and relevant income and deduction allocations) when the initial fixed period is later modified, renewed or extended. If there is a payment for a renewal or extension of the land right, the payment is spread over the fixed renewal or extension period because that period is regarded as a separate spreading period.

Example 1

A landlord and a tenant enter into a 5-year lease, which includes two 5-year renewal rights. The lease commences on 1 April 2013. On the same day, the tenant receives a lease inducement payment from the landlord.

The spreading period of the lease inducement payment, which is subject to sections CC 1B and DB 20B, is from 1 April 2013 (being the commencement date of the lease) to 31 March 2018 (being the earliest following date on which the lease expires).

Example 2

Following on from the above example, in March 2018, the tenant decides to renew the lease for another 5 years (from 1 April 2018 to 31 March 2023). In January 2022, there is an oversupply of leases in the market. The tenant wants to move to other premises for a lower rent. Knowing this, the landlord makes a lease inducement payment to the tenant for the renewal of the lease for another 5 years (from 1 April 2023 to 31 March 2028). The tenant renews the lease for another 5 years.

The spreading period of the second lease inducement payment is from 1 April 2023 (being the commencement date of the second renewal period) to 31 March 2028 (being the earliest following date on which the lease expires). Although the payment was made in January 2022, the tenant derives the payment in relation to the second renewal period of the lease.

Section EI 4B(3)(a) allocates income and deductions for lease inducement payments. The amount of income and deductions is allocated proportionately to the number of months in an income year over the spreading period.

Given that lease inducement payments are generally made at the commencement of a land right, the amount is allocated evenly over the spreading period. Even when the amount is derived or incurred before the commencement of the land right, the amount is allocated in relation to the spreading period, not when the amount is incurred or derived.

Example

On 1 April 2013, a tenant receives $100,000 from a landlord as consideration for the agreement to enter into a 10-year lease that commences on the same day. The tenant and the landlord both have a 31 March balance date.

The tenant

Under section CC 1B, $100,000 is taxable to the tenant. Under section EI 4B, the income is spread evenly over the 10-year period from the 2013–14 to the 2022–23 income years inclusive (i.e. $10,000 income is allocated to the tenant in each income year).

The landlord

Under section DB 20B, $100,000 is deductible for the landlord. Under section EI 4B, the deductions are spread evenly over the 10-year period from the 2013–14 to the 2022–23 income years inclusive (i.e. a deduction of $10,000 is allocated to the landlord in each income year).

The allocation of income and deductions for lease inducement payments is affected by when the income or expenditure is derived or incurred in relation to the spreading period. For example, if the amount is derived or incurred half-way through the spreading period, the amount is spread evenly over the remaining spreading period. If the amount is derived or incurred at or after the end of the spreading period, the amount is allocated to the income year in which it is incurred or derived.

If the spreading period is more than 50 years, the amount is allocated evenly over the first 50 income years (section EI 4B(3)(a)(iii)).

Note that, under the timing provision, an amount of expenditure incurred by an assignor to induce an assignee to receive an assignment of a lease is allocated to the income year in which the amount is incurred. By assigning the lease, the assignor has no remaining period over which to spread the expenditure. On the other hand, the assignee spreads the amount of income evenly over the remaining period of the lease.

Example

On 1 April 2014, a tenant enters into a 10-year lease. However, after three years, the tenant finds that their business is not doing well and finds the lease burdensome.

The tenant becomes aware that A Ltd is looking for premises. The tenant is keen for A Ltd to take the lease. On 1 October 2017, the tenant pays $30,000 to A Ltd to transfer the lease from that date.

The timing of income and deductions for the tenant and A Ltd under section EI 4B is illustrated in the table below. The tenant and A Ltd have a 31 March balance date.

| Income year | The tenant (assignor) | A Ltd (assignee) | ||

|---|---|---|---|---|

| Deduction | Income | Deduction | Income | |

| 2014–15 | – | – | – | – |

| 2015–16 | – | – | – | – |

| 2016–17 | – | – | – | – |

| 2017–18 | $30,000 | – | – | $2,308 |

| 2018–19 | – | – | – | $4,615 |

| 2019–20 | – | – | – | $4,615 |

| 2020–21 | – | – | – | $4,615 |

| 2021–22 | – | – | – | $4,615 |

| 2022–23 | – | – | – | $4,615 |

| 2023–24 | – | – | – | $4,615 |

The timing provision does not apply to an amount that is treated as income under section CC 1 or CG 8, which relate to income from land or capital contributions respectively. Income under section CC 1 is taxable when derived unless the timing rule in section EI 7 applies. Income under section CG 8 is spread evenly over 10 years unless the payee chooses to reduce the cost base of the depreciable property under section DB 64.

The following example explains how the timing provision would apply to a contribution towards the cost of a fit-out.

Example

On 1 April 2013, a tenant receives a lease inducement payment of $100,000 from its landlord to enter into a 12-year lease. The terms and conditions of the agreement require that the tenant must use the payment for a fit-out of their lease premises.

The tenant spends a total of $300,000 on its fit-out in the 2013–14 income year. The tenant and the landlord both have a 31 March balance date.

The tenant

The tenant can either choose to return $100,000 as income over the next 10 years, starting from the 2013–14 income year, or reduce the cost base of the fit-out by $100,000. Under the latter option, the tenant is only able to claim depreciation on the remaining $200,000 of expenditure incurred on the fit-out.

The landlord

The landlord is allowed a deduction of $100,000 under section DB 20B, which is allocated under section EI 4B over the 12-year period from the 2013–14 to the 2024–25 income years inclusive (i.e. a deduction of $8,333 is allocated to the landlord in each income year).

Disposal of the land right part-way through the spreading period

An exception applies to the new timing rule if the person ceases to hold the relevant land right or the estate in land from which the land right is granted. Generally, a “wash-up” calculation of income and deductions is allowed if a person ceases to hold the land right or the estate in land from which the land right is granted, part-way through the spreading period (section EI 4B(4) and (5)).

For income, if there is a remaining amount to be allocated under the main spreading provision in section EI 4B(3), the amount of income is allocated to an income year (the balance year) ending before the end of the spreading period, if –

- at the beginning of the balance year, the person holds the land right or the estate in land from which the land right is granted; and

- in the balance year, the person ceases to hold the land right or the estate in land from which the land right is granted (section EI 4B(4)).

Example

On 1 April 2013, a landlord pays a tenant $100,000 as an inducement to enter into a 10-year lease. On 1 June 2016, the tenant transfers the lease to a new tenant. Both the landlord and the tenant have a balance date of 31 March.

The $100,000 payment is taxable to the tenant under section CC 1B and deductible to the landlord under section DB 20B.

The timing of income for the tenant under section EI 4B(4) is illustrated in the table below:

| Income year | Tenant | |

|---|---|---|

| Deduction | Income | |

| 2013–14 | – | $10,000 |

| 2014–15 | – | $10,000 |

| 2015–16 | – | $10,000 |

| 2016–17 | – | $70,000 |

| 2017–18 | – | – |

| 2018–19 | – | – |

| 2019–20 | – | – |

| 2020–21 | – | – |

| 2021–22 | – | – |

| 2022–23 | – | – |

The landlord continues to allocate the $100,000 deduction under the main spreading provision in section EI 4B(3).

For deductions, if there is a remaining amount to be allocated under the main spreading provision in section EI 4B(3), the amount of deductions is allocated to an income year (the balance year) ending before the end of the spreading period if –

- at the beginning of the balance year, either or both the land right and the estate in land from which the land right is granted are held by the person or an associated person; and

- at the end of the balance year, neither of the land right and the estate in land from which the land right is granted are held by the person or an associated person (section EI 4B(5)).

Note that if the land right or the estate in land from which the land right is granted is transferred to an associated person, no “wash-up” calculation for deductions is allowed. The remaining amount of deductions continues to be allocated over the spreading period under section EI 4B(3). This is intended as an anti-avoidance measure to prevent the timing of deductions being accelerated by transferring the land right or the estate in land from which the land right is granted to an associated person.

The definition of “land provision” in section YA 1 has been amended so that the definition of “associated person” applying in section EI 4B is the one applicable to land provisions.

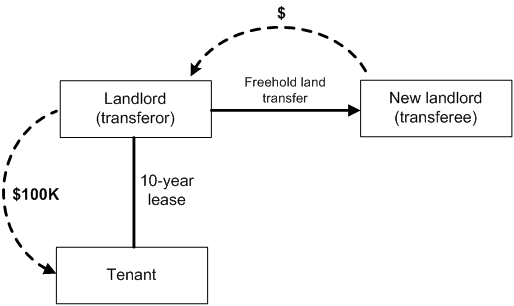

Example

On 1 April 2013, a landlord pays a tenant $100,000 as an inducement to enter a 10-year lease. On 6 June 2016, the landlord sells the freehold land to an unassociated third party. Both the landlord and the tenant have a balance date of 31 March.

The $100,000 payment is taxable to the tenant under section CC 1B and deductible to the landlord under section DB 20B.

The timing of deductions for the landlord under section EI 4B(5) is illustrated in the table below:

| Income year | Tenant | |

|---|---|---|

| Deduction | Income | |

| 2013–14 | $10,000 | – |

| 2014–15 | $10,000 | – |

| 2015–16 | $10,000 | – |

| 2016–17 | $70,000 | – |

| 2017–18 | – | – |

| 2018–19 | – | – |

| 2019–20 | – | – |

| 2020–21 | – | – |

| 2021–22 | – | – |

| 2022–23 | – | – |

If the landlord had transferred the land to their spouse, the landlord would continue to allocate $10,000 of deductions to each income year until the 2022–23 income year.

The tenant continues to allocate the $100,000 amount of income under the main spreading provision in section EI 4B(3).

To prevent overlap, section EA 3, which relates to the timing of prepayments, has been amended to exclude any amounts subject to this timing provision.

Tax treatment of lease surrender payments

Income

New section CC 1C provides that if a person (the payee) derives an amount as a consideration for their agreement to the surrender or termination of a right (the land right) that is a leasehold estate or licence to use land, the amount is taxable to the payee.

The payee must be one of the following:

- the person who owns the estate in land from which the land right is granted; or

- the person who owns the land right.

In most cases, lease surrender payments are made by a tenant to a landlord to surrender an existing lease. However, the charging provision also applies if the payment is made by the landlord to the tenant for them to surrender an existing lease.

Example

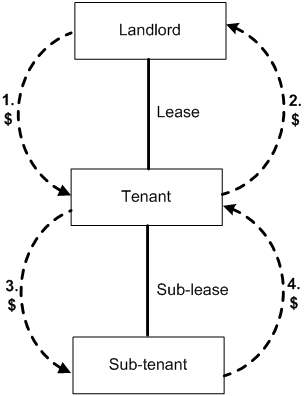

Examples of payments that are taxable under section CC 1C include:

- A payment from a landlord (lessor) to a tenant (lessee);

- A payment from a tenant (lessee) to a landlord (lessor);

- A payment from a tenant (sub-lessor) to a sub-tenant (sub-lessee); or

- A payment from a sub-tenant (sub-lessee) to a tenant (sub-lessor).

If a person receives a lease surrender payment on behalf of another person, the existing nominee rules in section YB 21 apply to treat the amount as derived by that other person.

The term “leasehold estate” is defined broadly in section YA 1 to include any estate, however created, other than a freehold estate.[5] The charging provision, therefore, does not apply to an amount derived in relation to a freehold estate in land, such as the proceeds from the sale of land.

The reference to “amount” in section CC 1B uses the definition of “amount” in section YA 1, which includes any amount in money’s worth. The charging provision therefore includes consideration that is other than cash.

Exception for a tenant or a licensee of residential premises

An exception for a tenant or a licensee of residential premises applies. The amount is not income if the payee is a natural person (an individual) and derives the amount as a tenant or licensee of residential premises whose expenditure on the residential premises does not meet the requirements of the general permission.

This exclusion is intended to provide a consistent tax treatment of income and deductions for a tenant or a licensee of residential premises. An individual tenant or a licensee of residential premises is not allowed a deduction for payments of rent because they do not meet the general permission in section DA 1 and the private limitation in section DA 2(2). On the other hand, an accommodation provider, that is not a natural person (i.e. they are a company), is subject to section CC 1C because they would typically be allowed a deduction for payments of rent under the general permission.

If there is a concurrent use of the land right for residential and business purposes, the amount is apportioned accordingly. The amount relating to a business purpose is taxable under section CC 1C to the extent that a tenant or a licensee whose expenditure on the premises is allowed a deduction under the general permission in section DA 1.

Deductions

New section DB 20C provides that lease surrender payments are deductible to a person (the payer) if the following conditions are met:

- the payer incurs an amount of expenditure as consideration for the agreement by another person (the payee) to the surrender of a leasehold estate or the termination of a licence to use land;

- the payer is a person who owns the land right or a person who owns the estate in land from which the land right is granted; and

- the payee is a person who owns the estate in land from which the land right is granted, or a person who owns the land right.

Section DB 20C overrides the capital limitation in section DA 2(1). The general permission in section DA 1 must still be satisfied and the other general limitations in section DA 2 still apply.

Timing of income and deductions

No specific timing provision is provided for lease surrender payments. The timing of an amount derived or incurred under sections CC 1C and DB 20C is, therefore, determined under the general provisions of the Income Tax Act 2007.

Generally, income and deductions for lease surrender payments are allocated to the income year in which the amount is derived or incurred. This is considered appropriate for lease surrender payments as there would normally be no remaining period of the land right over which the amount can be spread at the time the lease surrender payment is derived or incurred.

1 Commissioner of Inland Revenue v Wattie [1999] 1 NZLR 529.

2 Commissioner of Inland Revenue v McKenzies New Zealand Limited [1988] 2 NZLR 736.

3 The definition of “lease” in section YA 1 of the Income Tax Act 2007 is defined as a disposition that creates a leasehold estate. The definition of “leasehold estate” includes any estate, however created, other than a freehold estate. The definition of “estate” includes both a legal or equitable estate as well as a right to the possession of the land.

4 For income tax purposes, an interest in land has the same meaning as an estate in land.

5 For income tax purposes, an interest in land has the same meaning as an estate in land.