Chapter 5 - Policy design

5.1 It is suggested that three criteria will determine the eligibility of applicants for a cashed-out loss. Applicants will need to meet the following criteria:

- Company (and also group, if the company is part of a group) R&D expenditure on wages and salaries must be at least 20 percent of total group expenditure on wages and salaries.

- The company (and also group, if the company is part of a group) must be in a tax-loss position for the applicable income year.

- The applicant must be a company resident[8] in New Zealand. The company also cannot be a look-through company, listed company, qualifying company or special corporate entity.

R&D wage intensity

5.2 It is proposed that a ratio of expenditure on wages and salaries for R&D to total expenditure on wages and salaries (R&D wage intensity) will be used as one of the eligibility criteria for the cash-out. Under this proposal, companies (and also groups, if the company is part of a group) that spend at least 20 percent of their total wage and salaries expenditure on R&D (as defined in the section below) would be eligible for the cash out, provided they also meet the company and tax loss criteria discussed below.

5.3 Evidence from the Research and Development Business Survey[9] indicates that loss-making R&D-intensive businesses tend to spend a greater proportion of their wage and salary costs on R&D than other businesses, particularly smaller and young businesses.

5.4 One explanation for this is that during the initial loss-making phase of the innovation life cycle, businesses invest a greater proportion of their labour costs in R&D for the initial creation of intellectual property. However, the composition of wage and salary expenditure changes as activities shift towards production and sales, leading to a gradual fall in the proportion of R&D staff (compared with non R&D staff) employed as the business matures. This is supported by evidence from the Research and Development Business Survey, which shows that both older and larger firms have significantly lower ratios of R&D expenditure to total expenditure on salaries and wages.

5.5 Setting a R&D wage intensity threshold (of at least 20 percent) will help to ensure the policy is highly targeted towards assisting R&D-intensive start-up companies.

5.6 Any expenditure on wages and salaries related to “excluded activities” (listed later in this section) will also not be eligible to be included in the calculation of R&D expenditure on wages and salaries.

Contracted R&D

5.7 Under the suggested changes, a business which contracts another entity to undertake R&D services on its behalf will be able to count the outsourced R&D expenditure on wages and salaries towards its calculation of R&D wage intensity, subject to the same excluded activities listed later in the section. In practice, the contracted supplier of R&D will need to provide an invoice to the purchaser which details both the overall R&D wage and salary costs subject to PAYE for the contracted work, and the cost of any other qualifying R&D.

Shareholder salaries

5.8 Using expenditure on salaries and wages will enhance the integrity of the policy. While Inland Revenue can monitor a taxpayer’s total expenditure on salaries and wages through the PAYE system, there is no equivalent source of information for other types of expenditure. Consequently, it is proposed that shareholder salaries be excluded from the R&D wage intensity threshold calculation if they are not subject to PAYE. Basing the eligibility criteria on salary and wage expenditure should help to reduce potential abuse of the policy. It is expected that this approach will also ease the compliance and administrative costs of the proposal, given it is based on existing information.

5.9 However, it is recognised that companies incur other expenditure in undertaking R&D beyond that on salary and wages. A proposal to allow some or all of this additional R&D expenditure (based on a multiplier of a firm’s R&D wage and salary expenditure) is discussed later in this chapter.

Tax-loss position

5.10 To be eligible to have a tax loss cashed out, a taxpayer must be in a net tax loss position. Eligibility for the cashed-out loss will be restricted to losses incurred in the current income year. For example, taxpayers completing a return for the 2015−16 income year will only be able to access a cashed-out loss for a tax loss incurred in the 2015−16 income year. There will be no ability to cash out tax losses from previous income years. Allowing this would create a significant risk to the tax base as losses could be “mined” from companies with existing losses but no sources of current income.

Company and grouping restriction

Company eligibility

5.11 Only certain companies will be able to access the cashed-out loss; look-through companies, listed companies, qualifying companies and special corporate entities will be excluded. No other business structures − for example, partnerships or trusts, will be eligible for a cashed-out loss. A corporate partner in a partnership carrying out R&D can be eligible for a cashed out loss, and will be able to include the R&D activities of the partnership as they flow through to the corporate partner. Furthermore, to be eligible a company must be resident in New Zealand and not treated as non-resident under a double tax agreement. These features will enhance the targeting of the proposed policy and reduce its complexity.

5.12 Current tax loss rules can create a cashflow bias for companies in a tax loss position. However, some entity structures already have their own flow-through treatment of tax losses, including look-through companies and limited partnerships. These business structures may therefore not be similarly subject to the issues faced by a company without a flow-through tax-loss treatment as they could have other income to offset their losses against.

5.13 Another issue faced by small R&D start-ups are the particular capital constraints noted in Chapter 3. These are less of an issue for listed companies, as their listing on a stock exchange should give them greater access to capital.

5.14 Restricting cashed-out losses to companies also ensures that tax losses will only be cashed out at the company tax rate, which is currently 28%. This reduces a potentially complex aspect of the proposal, namely that different types of taxpayers are often taxed at different rates. Partnerships would be particularly difficult because their flow-through tax treatment, combined with individual differences in the allocation of tax losses between each partnership’s respective partners, would make attempting to cash out losses at the marginal rate of each partner complex and impractical.

5.15 It is also standard practice in similar tax jurisdictions to restrict R&D incentives to companies only. Both the new above-the-line R&D tax credit in the United Kingdom and the R&D tax incentive in Australia restrict eligibility to companies only.

Grouping rules

5.16 We consider that, in determining whether a company meets the criteria for this proposed policy (for example, being in a loss position and having a high R&D wage intensity) the company should be considered together with other companies (and entities) that share similar ownership. Without such a rule, the targeting of this proposal to small, R&D intensive start-up companies could fail.

5.17 In particular, we are concerned with two specific situations:

- when an ineligible entity incorporates a subsidiary that might be eligible; and

- when a group of shareholders of an ineligible company incorporates a sister company that might be eligible.

5.18 An example of this first situation would be a large firm with a low R&D intensity. It could incorporate a new company and direct that company to carry out its R&D functions. Without a rule to prevent it, that new company would be eligible to have its tax losses refunded, even though the two companies considered as a whole would not be.

5.19 An example of the second situation would be a group of shareholders who own a company that has largely finished some R&D and is now starting to promote a product for sale. These promotion activities will mean the company is likely to fall below the required R&D wage intensity of 20 percent as they take on non-R&D staff. However, if the shareholders incorporate a new sister company to solely carry out promotion, the original company will continue to have a high R&D wage intensity. It would therefore be eligible for the tax loss refund on its R&D spending. Again, this is inappropriate: the two companies considered as a whole would not be eligible.

5.20 The intention is that these grouping rules, as far as practicable, should not impact on genuine small R&D companies. These companies are likely to have a simple corporate structure so we believe this should be achieved. Nevertheless, we would be interested to hear from submitters about:

- whether, in practice, a small R&D firm is generally a standalone entity or forms part of a larger corporate group; and

- the typical shareholding arrangements of a start-up R&D firm: how many shareholders are there, what percentage of the company do they own, and how does this change over the company’s life?

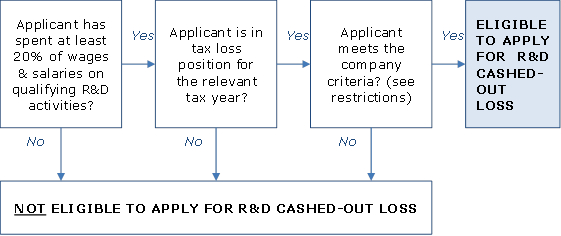

Summary flowchart

5.21 The diagram below summarises the various criteria determining whether an applicant would be eligible for the cash-out proposal.

Company size

5.22 Restricting eligibility to companies below a certain size has been considered, but is not being proposed in this paper. For example, one method of doing this would be to limit eligibility to companies whose turnover is below a certain amount. This approach is not favoured as current eligibility rules should be sufficient to target the policy to small R&D-intensive start-up companies, and this would be another measure of eligibility that Inland Revenue would have to monitor.

Submission points

- Do the eligibility criteria effectively target R&D-intensive start-up companies? Are there any additional eligibility criteria that should be included?

- Are there likely to be difficulties arising in using these criteria? Are there possible unintended consequences? Is the 20 percent R&D wage intensity threshold appropriate?

- Do you anticipate any problems with the proposed arrangements for dealing with contracted R&D; either for purchasers or suppliers of R&D?

- Does the section on grouping rules accurately describe the risks in relation to grouping? Have any situations been omitted?

Definition of R&D

Proposed definition

5.23 It is proposed that existing definitions of research and development are used as they are described in the New Zealand equivalent to International Accounting Standard 38 (NZIAS 38), and consequently the Income Tax Act 2007. These are:

- Research is original and planned investigation is undertaken with the prospect of gaining new scientific or technical knowledge and understanding.

- Development is the application of research findings or other knowledge to plan or design for the production of new or substantially improved materials, devices, products, processes, systems or services before the start of commercial production or use.

5.24 Experiences from the previous R&D tax credit in New Zealand showed that a new definition created significant compliance and administration costs. While it is important that a narrow definition of R&D is used to ensure that the policy is targeted, in practice this is very difficult. Using the existing definition is simpler for taxpayers already familiar with it for accounting purposes. However, to ensure the policy stays targeted, the level of qualifying R&D expenditure will be limited, based on expenditure on salaries and wages and a multiplier, as outlined in the next section.

Excluded activities

5.25 Certain activities (noted below) did not qualify directly as part of the R&D definition for the tax credit. Expenditure on these activities was excluded because they took place in a post-development phase, related to routine work, and/or there was an indeterminate relationship between the activity and economic growth.

5.26 Expenditure on such activities will also not be included for the purposes of calculating the qualifying R&D expenditure for a cashed-out loss or for calculating expenditure on wages and salaries on R&D activities for the proposal presented in this paper. The reasons for the exclusion are generally consistent with its wider policy intent, as many of the activities noted below take place later in the R&D process when the R&D company is less likely to be capital and cashflow-constrained.

5.27 The excluded activities for the now repealed R&D tax credit were:

- prospecting for, exploring for or drilling for minerals, petroleum, natural gas or geothermal energy;

- research in social sciences, arts or humanities;

- market research, market testing, market development, or sales promotion including consumer surveys;

- quality control or routine testing of materials, products, devices, processes or services;

- making cosmetic or stylistic changes to materials, products, devices, processes or services;

- routine collection of information;

- commercial, legal and administrative aspects of patenting, licensing or other activities;

- activities involved in complying with statutory requirements or standards;

- management studies or efficiency surveys;

- the reproduction of a commercial product or process by a physical examination of an existing system or from plans, blueprints, detailed specifications or publicly available information; and

- pre-production activities such as a demonstration of commercial viability, tooling-up and trial runs.

5.28 In addition, it is proposed the following activities are also excluded in the suggested changes:

- clinical trials; and

- the late stages of software development (for example coding).

Excluded expenditure

5.29 Some expenses that a taxpayer incurs should also not be included for the purposes of:

- determining R&D wage intensity (which is used to determine whether a firm is eligible for the cash-out); and

- determining total qualifying R&D expenditure (which is used in calculating the amount of tax losses a firm can cash-out).

5.30 Expenses are excluded on the basis that their inclusion could create an economic distortion, inequity between taxpayers in a similar position, or alternatively endanger the integrity of the proposed policy. Expenditure items that we propose excluding are:

- Interest expenses related to R&D. Including interest expenses will encourage debt financing over equity financing.

- Purchases of existing R&D assets. This R&D has already been created and would allow taxpayers to artificially inflate their R&D expenditure by buying and selling existing R&D assets.

- R&D undertaken offshore. Allowing this expenditure would be undesirable because of potential re-characterisation risks.

- Lease payments. These can include an implicit interest payment; allowing this as R&D expenditure but excluding interest expenses is likely to bias leasing over the purchase of capital items with debt.

5.31 We also propose to exclude any expenditure funded by government grants, or research funding, for R&D. This is to ensure that companies are not able to benefit twice by obtaining an additional cash out for research funded by government grants.

5.32 Outsourced R&D will be eligible for the purchaser (but not the provider) subject to the same set of eligibility criteria applying to the purchase as described earlier in the paper.

Submission points

- Recognising that too loose a set of criteria could leave significant scope for abuse and undermine the integrity and durability of the proposal, is the definition of R&D, when combined with the other criteria, sufficiently robust?

- Are there other definitions of R&D used by companies that could be used for the suggested changes?

- Would excluding government grants cause specific distortions? If so, what would be the nature and magnitude of these distortions?

Determining the amount of tax losses to be cashed out

5.33 Companies that are eligible for the proposal will be able to cash out all or part of their tax losses in the relevant tax year. As with the eligibility criteria, we suggest linking the overall amount that can be cashed out to the company’s salary and wage expenditure on R&D.

5.34 Specifically, we suggest that companies that qualify for the proposal should be able to cash out up to 1.5 times their R&D salary and wage expenditure, provided this amount does not exceed the company’s total tax losses, or its total qualifying R&D expenditure in the relevant tax year. The rationale for linking the amount of the cash-out to a company’s R&D wage and salary expenditure is consistent with the R&D wage intensity criteria discussed earlier. The multiplier of 1.5 which is applied to R&D salary and wage expenditure is intended to help companies cash out losses that are incurred as a result of other R&D expenditure that is not related to salary and wages (such as capital expenditure and overheads).

5.35 In practice, this means companies that qualify for the proposal will be able to cash out the lesser of:

- 1.5 times their eligible R&D salary and wage expenditure in the relevant year;

- total tax losses in the relevant year;

- total qualifying R&D expenditure in the relevant year; and

- the overall cap on eligible losses for the relevant year (see next section).

5.36 This is illustrated by the examples below.

Examples of determining the size of available R&D cash-outs

This box contains some numerical examples to illustrate how the size of the R&D cash-out is calculated.

| Total tax loss | R&D-related salary/wage expenditure | Total qualifying R&D expenditure | Total amount of losses available to cash out | |

|---|---|---|---|---|

| Company A | $200 | $100 | $180 | $150 |

| Company B | $200 | $100 | $140 | $140 |

| Company C | $50 | $100 | $180 | $50 |

Company A – The company has spent $100 on R&D wage and salary expenditure so, given the 1.5 multiplier, a total of $150 could potentially be eligible for cashing out. As this amount is less than the company’s total qualifying R&D expenditure (and also its total tax loss) the full $150 is available to be cashed out.

Company B – Total qualifying R&D expenditure ($140) is less than 1.5 times the company’s R&D wage and salary expenditure. Therefore the amount of losses available to cash out is limited to $140.

Company C – The company’s total tax loss ($50) is less than 1.5 times the company’s R&D wage and salary expenditure and also the company’s total qualifying R&D expenditure. The size of the available cash out is therefore limited to $50.

5.37 Companies would still be eligible to carry forward any losses in excess of the amount cashed out to future years. This means remaining losses would be accorded the same treatment as losses under the current rules.

Overall cap on eligible losses

5.38 We suggest an incremental increase in the amount of losses to be cashed out over time, with the initial overall cap on eligible losses to be set at $500,000 (equivalent to a cashed-out loss of $140,000[10]), and rising over time to a cap of $2 million (equivalent to a cashed out loss of $560,000).

5.39 Increasing the cap on eligible losses incrementally reduces its fiscal risk, especially in the early years of the new rules when there will be uncertainty over the response of R&D producers to the changes. Gradually increasing the cap will also help ensure that the benefits of the cashed-out loss will not be reduced by an increase in demand for R&D inputs that will result in an increase in the cost of doing R&D rather than an increase in R&D.

8 Residents for this policy will not include resident companies that are treated as non-resident under a double tax agreement.