Thin capitalisation rules

Overview

The thin capitalisation rules form part of New Zealand’s international tax rules and are designed to protect our tax base. The rules place limits on how much debt a non-resident can put into their New Zealand investments. This is important as the use of debt is one method that non-residents can use to move profits out of New Zealand to significantly lower the amount of New Zealand tax they would otherwise pay.

The thin capitalisation rules have generally been operating effectively. However, Inland Revenue’s investigators, through their normal audit work, have come across some situations where strengthening the rules would be beneficial.

There are two key concerns with the existing rules. They currently only apply when a single non-resident controls a New Zealand investment. However, investors can often act together in a way that mimics control by a single investor. The rules can also be ineffective when the debt of a worldwide group of companies comes from shareholders rather than third parties.

To respond to these issues, the bill proposes expanding the thin capitalisation rules so they apply when a group of non-residents appear to be acting as a group and own 50 percent or more of a New Zealand investment. The bill also proposes ignoring shareholder debt when taxpayers are calculating their allowable level of New Zealand debt under the rules.

Amendments to three other aspects of the rules are intended to address other areas where the rules appear to be deficient.

These changes were signalled in an issues paper, Review of the thin capitalisation rules. The original proposals have been modified, based on feedback received. For example, the definition of shareholders “acting together” in the bill is more certain than that originally proposed, and there is now a limited extension to what is known as the “on-lending concession” for trusts.

The proposed changes will apply from the beginning of the 2015–16 income year.

PROPOSED CHANGES TO THE THIN CAPITALISATION RULES

(Clauses 87 to 98, 123(30) and 123(32))

Summary of proposed amendments

The bill proposes changes to five aspects of the thin capitalisation rules. The most significant change of these extends the rules so they will apply when non-residents who appear to be acting together own 50 percent or more of a company. Non-residents will be treated as acting together if they hold debt in a company in proportion to their equity, have entered into an arrangement setting out how to fund the company, or act on the instructions of another person (such as a private equity manager). The bill will also extend the rules so they apply to all trusts that have been majority settled by non-residents, as well as all companies controlled by the trustees of such trusts.

The bill will change what is known as the “110 percent worldwide debt test”. This test, in essence, compares the amount of debt in a company’s worldwide operations to the debt in the company’s New Zealand operations. The proposed change will mean debt that originates from shareholders will be excluded when calculating the debt level of a company’s worldwide operations.

Increases in asset values following internal company reorganisations will be ignored, unless the increase in asset value would be allowed under generally accepted accounting principles in the absence of the reorganisation, or if the reorganisation is part of the purchase of the company by a third party.

The bill will also make a technical change to ensure that, in the outbound thin capitalisation rules, individuals and trustees must generally exclude their indirect interests in offshore companies if the interest is held through a company they are associated with.

Key features

- Sections FE 2, FE 4, FE 26 and FE 31D extend the inbound thin capitalisation rules to cases in which non-residents act together when investing in New Zealand (they currently apply only when a single non-resident controls the investment).

- Section FE 18 excludes, from the worldwide group debt measure used in the inbound rules, debt linked to shareholders of group entities or to persons associated with shareholders.

- Sections FE 2, FE 3 and FE 26 extend the inbound rules to apply to all resident trustees if 50 percent or more of settlements made on the trust were made by a non-resident, non-residents acting together or other entities subject to the thin capitalisation rules.

- Section FE 13 extends the on-lending concession so that it applies to all financial arrangements held by a trust provided certain criteria are met.

- Section FE 16 ignores increases in asset values that are the result of transactions between associated persons, unless the increase would be allowed by accounting standards in the absence of a transaction.

- Section FE 16, in relation to the outbound thin capitalisation rules, forces consolidation of interests held by individuals or trustees with interests held by companies in which they have a significant interest.

Application date

The amendments will apply from the 2015–16 income year.

Background

An officials’ issues paper, Review of the thin capitalisation rules,[1] released in January 2013 proposed six changes to the thin capitalisation rules.

The issues paper proposed the following changes:

- that the thin capitalisation rules would apply if a group of non-residents who were “acting together” own 50 percent or more of a company;

- a change to what is known as the “110% worldwide debt test” to exclude debt that originates from shareholders when calculating the debt level of a company’s worldwide operations;

- extending the rules so they apply to all types of trust that have been majority-settled by a non-resident, or a group of non-residents “acting together”;

- excluding capitalised interest from a company’s asset base;

- requiring individuals and trustees to consolidate a trust’s interests with companies they own when determining their New Zealand group;

- ignoring increases in asset values that are the result of an internal sale of assets.

Fifteen submissions were received on the issues paper. Most submitters agreed with the need to reform the thin capitalisation rules but raised several technical concerns, such as the proposed method of defining non-residents “acting together”.

Officials subsequently released a second paper, Thin capitalisation review: technical issues,[2] to address the technical concerns raised by submitters.

Based on feedback in both rounds of consultation, several changes were made to the original proposals. For example, the definition of shareholders “acting together” in the bill is more certain than that originally proposed, and there is now a limited extension to what is known as the “on-lending concession” for trusts.

Detailed analysis

Companies controlled by shareholders acting together

The thin capitalisation rules are designed to apply to companies controlled by shareholders who have the ability to substitute equity with debt. This is clearly the case when a company is controlled by a single non-resident – the controlling non-resident has little constraint on how it can fund the company, and so is free to invest through debt rather than equity. However, this ability to substitute equity with debt is also available to non-residents who are acting together. They are able to coordinate their activities and act in much the same way as a single non-resident yet the current rules do not apply.

The bill proposes to extend the rules so they apply also to companies controlled by a group of shareholders who are acting together. Section FE 2 of the Income Tax Act 2007 will be amended so the thin capitalisation rules apply to a company where a non-resident owning body holds 50 percent or more of a company’s ownership interests, or has control of a company by any other means.

Consequentially, section FE 1 will also be amended to reflect the broader application of the rules.

Non-resident owning body

Proposed amendments to section FE 4 define a non-resident owning body.

To be a non-resident owning body, two or more non-residents will have the following characteristics:

- have, directly or indirectly,[3] debt in the company in proportion to their equity;

- have an agreement that sets out how the company should be funded if the company is not widely held (a term defined in section YA 1);

- exercise their rights under their ownership interests in a way recommended by a person or persons (such as a private equity manager), or similarly a person or persons act on the members’ behalf to exercise their rights.

Member interests will only need to be approximately in proportion. This rule is intended to prevent taxpayers from structuring investment arrangements to avoid exact proportionality.

An agreement that sets out how an entity should be funded in the event of a specified event (such as insolvency) will not constitute an agreement that sets out how the company should be funded.

Example

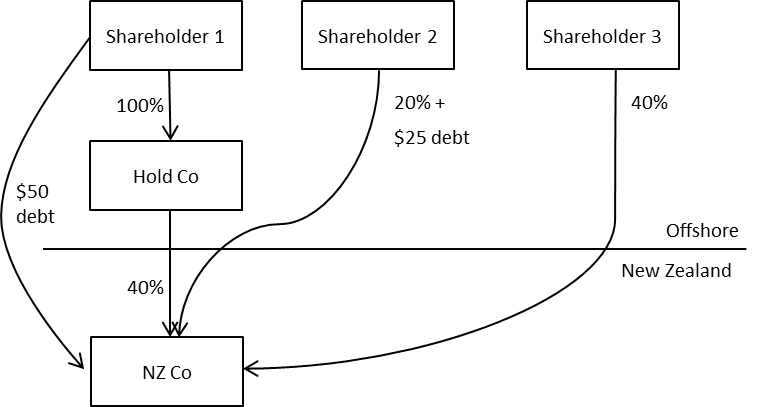

Resident company NZ Co has three non-resident shareholders: Hold Co, Shareholder 2 and Shareholder 3. Shareholder 1 owns 100 percent of the shares in Hold Co, and is therefore an indirect owner of NZ Co.

Shareholder 1 and Shareholder 2 have also lent money to NZ Co ($50 and $25, respectively).

Shareholder 1 (together with its associate Hold Co) and Shareholder 2 will be members of a non-resident owning body. Shareholder 1 has 40 percent of the shares in NZ Co and has lent it $50 (a ratio of 0.8:1). Shareholder 2 has 20 percent of the shares in NZ Co and has lent it $25 (also a ratio of 0.8:1).

The thin capitalisation rules will therefore apply to NZ Co as 60 percent of its shares are held by a non-resident owning body.

The ownership interests of a non-resident owning body will be determined as if the members of the body are associates. This means that, as per section FE 41, the ownership interests of the owning body will be calculated by aggregating the ownership interests of the body’s members, except to the extent the aggregation would result in double-counting.

Example

Resident company A Co has five non-resident shareholders who have an agreement that specifies how company A should be funded: Mr W (married to Mrs W), Mrs W, Mr X, Mr Y and Mr Z. Each holds 20 percent of the issued shares.

Mr W’s ownership interest in A is 40 percent (as his interests are aggregated with Mrs W under section FE 41). Mrs W’s ownership interest is similarly 40 percent. The other shareholders (who are not associated with each other or Mr and Mrs W) have an ownership of 20 percent each.

The ownership interests are added together, but with 40 percent removed to correct for double-counting of Mr and Mrs W’s interests.

The non-resident owning body made up of Mr W, Mrs W, Mr X, Mr Y and Mr Z therefore has 100 percent of the ownership interests in A Co.

New Zealand groups

Under the proposed new rules, the New Zealand group of a company controlled by a non-resident owning group will be determined much in the same way as companies controlled by a single non-resident.

Proposed new section FE 26(2)(bb) will generally provide that a New Zealand company is a New Zealand parent company if a non-resident owning body has direct ownership interests of 50 percent or more in the company.

A similar amendment is proposed for section FE 26(3)(d), which will generally define a parent of an excess debt entity as the company where the non-resident owning body directly holds 50 percent or more of its ownership interests.

There are two exceptions to these rules. The first is when a non-resident owning body has members that have operations in New Zealand (for example, if some of the members of the group operate through a branch in New Zealand). In this case, the non-resident owning body will be the New Zealand parent as provided by subsection (2)(bc) or (4C), as appropriate.

The second exception is if some members of a non-resident owning body invest into New Zealand through holding companies. The grouping rules will not be able to identify a New Zealand parent for the top-level operating company in New Zealand (Z Co in the example below). Accordingly, section FE 26(6) will deem the top-level operating company as the New Zealand parent. A company controlled by the top-level operating company will identify the operating company as its parent under section FE 26(3). Each holding company will also have a New Zealand group that is just the company.

Example

Non-residents X Co, Y Co and Z Co (who are not associated persons) each own 33 percent of resident company A Co and have proportionate debt and equity. They therefore will form a non-resident owning body.

A Co has three resident subsidiaries.

The New Zealand parent for A Co can only be determined under section FE 26(2)(bb), under which A Co will be treated as the New Zealand parent (the non-resident owning body has direct interests of 100 percent in A Co). Similarly, A Co’s subsidiaries will only be able to determine their New Zealand parent (A Co) under section FE 26(3)(d)(ii).

A Co’s New Zealand group will comprise A Co and its three subsidiaries.

As A Co’s group could only be determined under sections FE 26(2)(bb) and (3)(d)(ii), section FE 31D applies to deem the worldwide group of A Co to be its New Zealand group.

Example

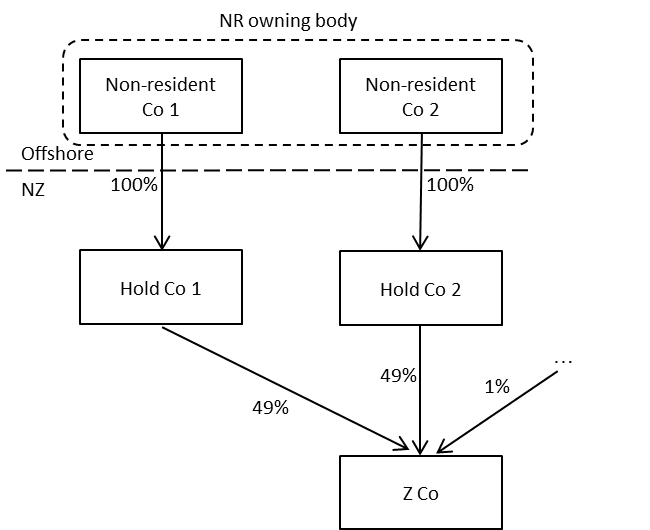

Non-resident Co 1 owns 100 percent of Hold Co 1 and Non-resident Co 2 owns 100 percent of Hold Co 2. Hold Co 1 and Hold Co 2 are therefore subject to the thin capitalisation rules under section FE 2(1)(c).

The non-residents meet the criteria for being a non-resident owning body. Z Co is therefore also subject to the thin capitalisation rules under section FE 2(1)(bb).

Hold Co 1’s New Zealand group is Hold Co 1 (as Hold Co does not hold 50 percent or more of Z Co’s ownership interests it does not include it in its group under section FE 26). Hold Co 2’s New Zealand group is similarly just Hold Co 2.

Z Co’s New Zealand group cannot be determined under section FE 26 other than under subsection (6). Z Co is therefore deemed to be its New Zealand parent. As Z Co has no subsidiaries, its New Zealand group comprises only itself.

New grouping rules only apply if existing rules do not

These new grouping rules will only apply if the thin capitalisation rules as they currently stand do not apply – that is, to a company not controlled directly or indirectly by a single non-resident. This means the New Zealand parent of a company controlled by a single non-resident will be unaffected by the proposed changes, even if the company is also controlled by a non-resident owning body. Its New Zealand group will, by extension, also be unaffected.

Example

Non-resident companies Z, X and Y own 50, 25 and 25 percent, respectively, of New Zealand-resident company A Co. Z, X and Y have an agreement that sets out how A Co should be funded. Z, X and Y therefore form a non-resident owning body.

A Co has three resident subsidiaries. Z also owns 100% of an Australian company.

Under the current thin capitalisation rules, the New Zealand group of A Co comprises A Co and its three New Zealand subsidiaries. The worldwide group is the New Zealand group, Z and the Australian company.

There will be no change to the New Zealand or worldwide group of A Co as a single non-resident (Z) owns 50 percent of its shares – even though a non-resident owning body also holds 50 percent or more of A Co’s shares.

Worldwide groups

Proposed new section FE 31D will provide that the worldwide group of a company controlled by a non-resident owning body is just its New Zealand group, unless a single non-resident also controls the company.

Rules to ensure matching New Zealand groups

Under the thin capitalisation rules it is important that New Zealand groups of different entities are the same. That is, if Company A includes Company B in its New Zealand group, then Company B should include Company A in its group. It is also important that an entity cannot be included in multiple groups. This is to prevent the double-counting of the entity’s debt and assets.

Proposed section FE 3(d) and (f) excludes a company from a group of a trust (or from the group of a controlling body) if the company does not include the trust (or body) in its own group. This rule would apply, for example, when a trust owns a subsidiary company. Without the rule a trust could include a company in its group but the company may not include the trust in its group.

A separate rule is proposed in section FE 14(3B) to ensure that an entity cannot include its debt and assets in more than one New Zealand and worldwide group. This might occur, for example, if a member of a controlling group controls some companies in its own right.

An ordering rule will apply in some cases when an entity is determining what group it should include its debt and assets in: if the entity is a company that is controlled indirectly or directly by a single non-resident then it must include its debt and assets in the New Zealand group of the single non-resident. If this is not the case then there will be no rule for determining what group the debt and assets should be included in.

Worldwide group debt test

Whether there is any interest denial under the thin capitalisation rules depends on the result of two tests. One of these tests is known as the “worldwide group debt test” and is designed to ensure the amount of debt in a New Zealand company is proportionate to the amount of genuine external debt of the ultimate non-resident parent of that New Zealand company.

In some circumstances, however, the debt of the ultimate parent company may also include debt from the parent’s shareholders or other owners of the group. In such cases the debt level of the worldwide group does not reflect the level of genuine external debt. The worldwide group debt test therefore does not operate as intended.

To address this, proposed new section FE 18(3B) will provide that, when an excess debt entity (other than an outbound excess debt entity[4]) is calculating its worldwide group debt percentage, it must exclude debt that is linked to an owner of the worldwide group.

An “owner” will be a person who has an ownership interest in a member of the group or is a settlor of a trust that is a member of the group.

A financial arrangement will be treated as linked to an owner of the group if the owner, or an associate of the owner (excluding associates who are members of the group):

- is a party to the financial arrangement (for example, by a loan directly from the owner);

- has guaranteed or otherwise provided security for the financial agreement (for example, where an owner has used some of its assets as security for the loan);

- has provided funds or will provide funds, directly or indirectly, to another person who is providing funds under the financial arrangement (such as a back-to-back loan).

Carve-out for minor shareholders’ debt

Proposed new section FE 18(3B) will also include a carve-out to the above rule for minor shareholders. An owner’s financial arrangement will not be excluded from the worldwide group debt test if:

- the owner has a 10 percent or less ownership interest in the group; and

- the financial arrangements held by the owner are traded on a public exchange.

Example

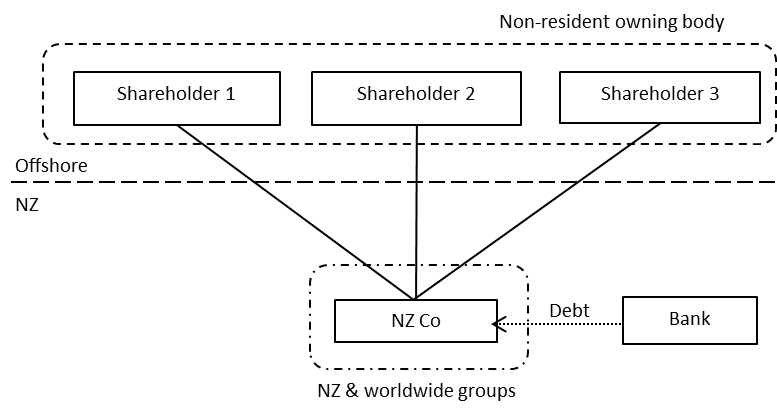

Three shareholders collectively own New Zealand company NZ Co. As NZ Co is controlled by a non-resident owning body, its worldwide group is the same as its New Zealand group.

The three non-resident shareholders will be treated as “owners” of NZ Co as they each have an ownership interest in NZ Co and are outside of its worldwide group. Any debt they extend to NZ Co will not be treated as debt in NZ Co’s worldwide group debt test.

Bank, however, will not be treated as an “owner” of NZ Co as it has no ownership interest in NZ Co and is not associated with any of the shareholders. A loan from Bank will therefore be included as debt in NZ Co’s worldwide group debt test.

Effect of shareholders lending to NZ Co

The three shareholders decide to lend a total of $500,000 to NZ Co. NZ Co has $800,000 of assets.

The debt-to-asset ratio of NZ Co’s New Zealand group is $500,000/$800,000 = 62.5 percent.

The debt-to-asset ratio of NZ Co’s worldwide group is $0/$800,000 = 0 percent

(as the debt from the owners is excluded).

The debt-to-asset ratio of NZ Co’s New Zealand group exceeds both the 60 percent safe harbour and worldwide group debt test. NZ Co will therefore have income under section CH 9 to cancel out some of its interest deductions.

Effect of Bank lending to NZ Co

Instead of borrowing from its shareholders, NZ Co borrows the $500,000 from Bank. Again, NZ Co has $800,000 of assets.

The debt-to-asset ratio of NZ Co’s New Zealand group is $500,000/$800,000 = 62.5 percent.

The debt-to-asset ratio of NZ Co’s worldwide group is $500,000/$800,000 = 62.5 percent.

While the debt-to-asset ratio of NZ Co’s New Zealand group exceeds the 60 percent safe harbour, it does not exceed the worldwide group debt test. NZ Co will not have any income under section CH 9.

Extending the thin capitalisation rules to more trusts

Proposed amendments to section FE 2(1)(d) will extend the thin capitalisation rules to all types of trusts for tax purposes (complying trusts, non-complying trusts and foreign trusts). The proposed new rules will mean a trust is subject to the thin capitalisation rules if the majority of settlements on it come from non-residents, or from persons who are subject to the thin capitalisation rules.

A trust will be subject to the rules if 50 percent or more of the settlements are made by:

- a non-resident or an associated person;[5]

- an entity subject to the inbound thin capitalisation rules (that is, an entity to which section FE 2(a) to (cc) and (db) applies); or

- a group of non-residents or entities subject to the thin capitalisation rules that act together as a group.

As with companies, the thin capitalisation rules will apply to trusts settled by entities acting together as a group (a controlling group). This concept of “acting together as a group” will be left undefined. This is because the proposed rules for determining when a group of shareholders are acting as a group (thereby forming a non-resident owning body) cannot be used for trusts. For example, it is not sensible to refer to settlements made in proportion to debt extended to a trust because rights to income from a trust generally do not depend on the amount a person has settled on it.

As with companies, the ownership interests of a controlling group will also be aggregated as if the members were associates.

Proposed new section FE 2(1)(db) will also provide that a trust is subject to the thin capitalisation rules if a person subject to the thin capitalisation rules has the power to appoint or remove a trustee. This is designed as an anti-circumvention measure. It will mean trusts are subject to the rules if they have been settled by a New Zealand resident and then effective control of the trust is transferred to a non-resident by giving the non-resident power to appoint or remove the trustee.

There will be a carve-out from this rule if a person has the power to add or remove a trustee for the purpose of protecting a security interest. This type of security interest is commonly held by banks that have lent to a trust.

Proposed sections FE 2(1)(d) and (db) provide that settlements made by the trustee and powers of removal or appointment of the trustee must be ignored when applying the sections. This is to prevent circularity if two trusts make settlements on each other or each have the ability to appoint the other’s trustee.

To illustrate, say settlements on Trust A are made by a non-resident and Trust B. Settlements made on Trust B are made by Trust A. It is only possible to determine whether Trust B is subject to the thin capitalisation rules if the settlement it has made on Trust A is ignored. Ignoring the settlement means the sole settlor of Trust A is a non-resident; Trust B is therefore subject to the thin capitalisation rules as it has been settled by a trust that is itself subject to the rules. Once Trust B’s status is determined, it is then possible to determine that Trust A should also be subject to the rules as it has also been settled by entities that are subject to the rules (a non-resident and Trust B).

Companies controlled by trusts

Proposed new section FE 2(1)(cc) ensures the thin capitalisation rules apply to any resident company that is controlled by a trust that is already subject to the thin capitalisation rules (to which the amended section FE 2(1)(d) or (db) will apply), or controlled by such trusts and other persons acting together as a group.

This proposed amendment is a consequence of extending the thin capitalisation rules to more trusts. If a trust will be subject to the thin capitalisation rules, companies controlled by that trust should also be subject to the rules.

Grouping rules for trusts and companies controlled by trusts

Proposed amendments to section FE 3 will define the New Zealand group of a trust as the trust and all companies controlled by the trust. Whether a trust controls a company will be determined under section FE 27, based on its choice of control threshold under that section.

Similarly, the New Zealand group of a company that is controlled by a trust will be the trust and all other companies controlled by the trust. This will be provided by proposed new section FE 26(4C), which will define the New Zealand parent of a company controlled by a trust (or controlling group) to be the trust (or the group). The other members of the New Zealand group will then be determined under section FE 28.

As with companies controlled by non-resident owning bodies, the worldwide group of a trust, a controlling group and a company controlled by a trust (or controlling group) is the same as its New Zealand group.

Extension of on-lending concession for trusts

Currently, section FE 13 provides what is commonly referred to as the “on-lending concession”. It removes financial arrangements that provide funds to a person from the ambit of the thin capitalisation rules.

Proposed amendments to section FE 13 will mean that, for a trust that holds only financial arrangements and does not control any companies, the on-lending concession will apply regardless of whether the arrangement provides funds.

This amendment is designed for securitisation vehicles that hold only financial arrangements, which will become subject to the rules because of the changes relating to trusts described above. This carve-out is proposed on the basis that the on-lending concession would apply to most of the trust’s debt in any event.

Exclusion of asset uplift

Proposed new sections FE 16(1D) and (1E) will provide that increases in a company’s New Zealand group assets that arise from sale or other transfer of assets between a member of the group and a person associated with the group must be ignored. This may or may not be another member of the group. However, the increase in value will be allowed if:

- generally accepted accounting practice would allow the increase in asset values in the absence of the transfer; or

- the transfer is part of a restructure following the purchase of the group by a person not associated with the group.

This is to ensure that increases in asset values that are not recognised under generally accepted accounting practice in the consolidated worldwide accounts of a company cannot nevertheless be recognised in the asset values of the company’s New Zealand group.

Example

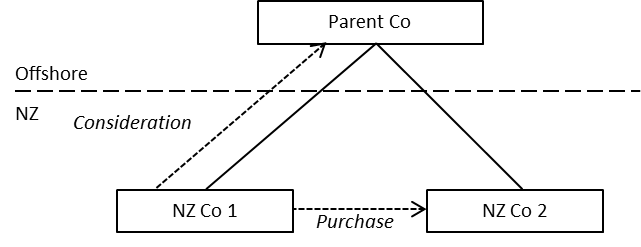

Parent Co owns two New Zealand subsidiaries, NZ Co 1 and NZ Co 2.

NZ Co 1 purchases the shares in NZ Co 2 from Parent Co. NZ Co 1 will not be able to include any increase in asset values resulting from this purchase for thin capitalisation purposes unless that increase would have been allowed under generally accepted accounting practice in the absence of the purchase.

Excluding individuals’ and trustees’ interest in a CFC

Proposed new section FE 16(1BA) largely rewrites existing section FE 16(1B) but with a new provision. Individuals or trustees will be required to exclude certain interests in a CFC or FIF they hold indirectly through an associate that is outside of their New Zealand group if the associate is outside of their group by virtue of being an excess debt outbound company or included in the group of such a company.

This provision is necessary as section FE 3(2)(a) excludes from the New Zealand group of an individual or trustee who is an outbound investor, all companies that are excess debt outbound companies or included in the group of such a company. Despite this provision, the person or trustee’s indirect interests in the CFC or FIF should be still be excluded from their group assets.

1 The paper can be found at http://taxpolicy.ird.govt.nz/publications/2013-ip-thin-capitalisation/overview.

2 The paper can be found at http://taxpolicy.ird.govt.nz/publications/2013-ip-thin-capitalisation-technical-issues/overview.

3 Legally, debt cannot be held indirectly. Accordingly, proposed section FE 4(1)(a)(ii) will provide how to determine if debt is held indirectly in proportion to equity.

4 This change applies to the “inbound” thin capitalisation rules, which apply to non-resident investments in New Zealand. The “outbound” thin capitalisation rules, which apply to New Zealand investment abroad, are not affected.

5 Here, an associate will not include a relative that has not made any settlements on the trust. This is to prevent the rules from applying to a trust settled by a New Zealand resident merely because the resident has a non-resident relation.