Mixed-use assets

Agency Disclosure Statement

This Regulatory Impact Statement (RIS) has been prepared by Inland Revenue.

It provides an analysis of options to ensure that the level of tax deductions that owners of mixed-use assets are able to claim is appropriate.

Extensive public consultation was undertaken during the development of the wider mixed-use assets proposals. An officials’ issues paper Mixed-use Assets was publicly released for consultation in August 2011. After receiving submissions, a revised proposal was developed, which officials then further discussed with key submitters and other stakeholders. Further minor modifications to the proposal were then made.

We also worked closely with the Treasury in preparing this statement, which agrees with our analysis.

The recommended policy proposal may initially impose minor and additional compliance costs on affected individuals and business. However, this proposal has a minimum income threshold to reduce compliance and administration costs in appropriate circumstances.

The recommended proposal may also reduce investment in mixed-use assets, as the amount of tax deductions available to owners will reduce. However, from consultation, this is expected to be only a moderate effect.

We have not identified any other significant gaps, assumptions, dependencies, constraints, caveats or uncertainties. The recommended proposal in this statement does not impose additional costs on businesses, impair private property rights, restrict market competition, or reduce the incentives on businesses to innovate and invest or override fundamental common law principles.

Dr Craig Latham

Group Manager, Policy

Inland Revenue

1 March 2012

STATUS QUO AND PROBLEM DEFINITION

1. This RIS provides an analysis of options to ensure that the level of tax deductions that owners of mixed-use assets are able to claim is appropriate.

2. A mixed-use asset is an asset that is used for both private and income-earning purposes. Typical examples of these assets are holiday homes, aircraft and boats. When assets are used partly for private purposes and partly to derive assessable income, it is necessary to determine what proportion of expenses and depreciation can be deducted in deriving that assessable income. However, there are no specific statutory rules governing the tax deductibility of expenditure for mixed-use assets. Instead, the approach to deductions is extrapolated from two general statutory tax provisions that set out the fundamental requirements for expenditure to be deductible or not deductible. These two provisions are in the Income Tax Act 2007:

a) The general permission - section DA 1(1)

A person is allowed a deduction for an amount of expenditure or loss (including an amount of depreciation) to the extent to which the expenditure or loss is incurred in deriving their income or incurred in the course of carrying on a business.b) The private limitation - section DA 2(2)

A person is denied a deduction to the extent to which the expenditure is of a private or domestic nature.

3. These statutory provisions can be difficult to apply to mixed-use assets, which have both income-earning and private use. It is difficult to determine what expenditure is attributable to the income-earning use or to carrying on a business (deductible expenditure), as opposed to the private use of the asset (non-deductible expenditure). Particular concerns arise where general expenditure is incurred, such as repairs and maintenance, and where expenditure relates to periods when the asset is not being used for either income-earning or private purposes.

Holiday home example

A holiday home is used by the owners for five weeks of the year and rented out for five weeks of the year. The owner incurred expenditure which relates to:

a) the rental use of the holiday home;

b) the private use of the holiday home; and

c) the 42 weeks of the year where the holiday home was not in use.

It is clear that the owner may claim deductions for expenditure which solely relates to the five weeks of the year that the holiday home was rented since the deductions relate specifically to deriving income (section DA 1(1)). It is equally clear that deductions cannot be claimed for expenditure which relates solely to the five weeks of the year when the holiday home was used by the owner since the private limitation prevents deductions for periods of private use (section DA 2(2)). However, there is a question as to what extent the owner should be able to claim deductions which relate to the 42 weeks of the year the holiday home was empty. A similar question arises for expenditure that is not directly related to any time period.

4. In a 2009 tax information bulletin, “Holiday houses — income tax treatment” (TIB, Vol 21, No 3, May 2009), Inland Revenue stated that as long as the asset is available for income-earning use, and the owner makes reasonable attempts to attract tenants, the owner can claim deductions for depreciation and other expenses for all periods of the year except when the asset is actually being used for private purposes.[1] Allowing owners to claim expenses on this basis is generous considering that:

- the amount of actual private use may exceed the amount of actual income earning use;

- the asset is also available for private use during the unused times; or

- the main reason the person acquired and maintains the asset may be for their private enjoyment.

5. The above approach to deductions may result in tax losses, which can then be used to offset assessable income from other sources. The use of such tax losses leads to a more general perception of unfairness in the tax system.

6. Similar uncertainty exists with the amount of input tax deductions that a GST-registered owner of a mixed-use asset is entitled to. The GST rules may allow a deduction for the cost of a mixed-use asset if it has some taxable use.[2] Under GST legislation, a person is entitled to a deduction for input tax “to the extent to which the goods or services are used for, or are available for use in, making taxable supplies”. The legislation does not clarify the treatment of expenditure in relation to an asset that is “available for use” for both taxable and non-taxable supplies (such as an empty holiday home). There is a risk that owners of mixed-use assets are claiming input tax deductions for all expenditure related to unused time on the basis that the asset is “available for use in making taxable supplies”. As with income tax, this outcome may not reflect the actual taxable use of the asset over time.

OBJECTIVES

7. The main objective is to more closely align the amount of tax deductions that owners of mixed-use assets are able to claim with their use of the asset (whether income-earning or private use). For example, this would mean that owners who have greater private use than income-earning use would be prevented from claiming the majority of their expenses.

8. A second objective is that the new rules should create greater certainty as to the amount of deductions that owners of mixed-use assets are able to claim. Accordingly, the new rules should be clear and simple to minimise the compliance burden for owners of mixed-use assets.

9. A third objective is that the new rules should be perceived as fair by both the owners of the assets and the public more generally. This will assist in maintaining the integrity of the tax system.

REGULATORY IMPACT ANALYSIS

10. Two options have been identified that could address the problem:

Option one: Categorisation approach (not recommended)

This option involves legislating specific tests that categorise mixed-use asset owners into up to three groups based on the underlying use of the asset. Thresholds based on days of private use and income-earning use categorise the owners into the different groups. The rules would then prescribe the amount of deductions that owners in each group can claim. Different outcomes would be possible, ranging from all expenditure being deductible (other than purely private expenditure), through to deductibility only for expenditure that directly relates to the asset’s actual income earning use.

Option two: Apportionment approach (recommended)

This option involves legislating specific rules that require mixed-use asset owners to apportion deductions based on their actual income-earning and private use of the asset, subject to two qualifications:

a) owners who derive income from the asset below $1,000, would be able to choose to treat the income as exempt (and not claim any deductions); and

b) where income from the asset is below 2% of the cost of the asset (or its rateable value if land-based assets), owners would still be required to apportion their deductions but, if a loss results, that loss would only be able to be carried forward and offset against future profits from that asset.

11. A further option would be to leave the legislation unchanged, but for Inland Revenue to provide guidance to owners of mixed-use assets on deductions they can claim. The guidance would outline whether the owners can claim deductions for non-use periods. This option was dismissed early in the policy process as it was thought that guidance would not give sufficient certainty. Guidance gives general advice only and taxpayers are free to argue that it does not apply to them.

12. In developing option two, a range of alternatives were considered for asset owners who earn low levels of income from their assets. Compulsorily exempting income from assets (and so denying deductions), or applying a less generous apportionment calculation were both considered. They were rejected on the grounds that they produced dramatic cliff effects for those close to the thresholds. They also resulted in unfair outcomes for those whose income-earning use was low in a particular year for reasons beyond their control.

Income tax

13. Set out below is further detail of the options, and the main advantages and disadvantages from an income tax perspective.

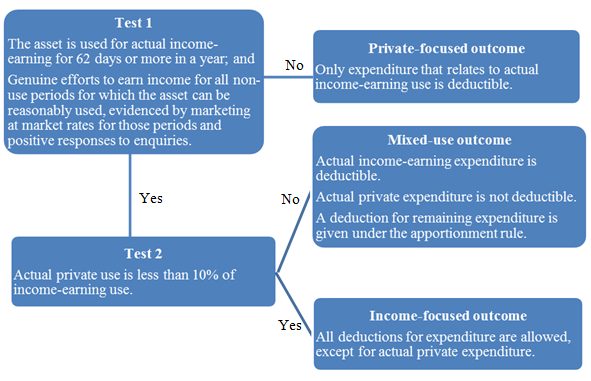

Option one

14. Option one was presented in an officials’ issues paper, Mixed-use Assets, released in August 2011. The issues paper outlined two variations of option one. The first variation suggested two categories of mixed-use asset owners – a private-focused category and an income-focused category. The second variation suggested three categories of mixed-use asset owners – the private-focused category, the genuine mixed-use category, and the income-focused category. The suggested three outcome approach is graphically represented below:

Issues paper – Suggested Three Outcome Approach

15. The proposal would apply to assets that are:

- used privately and to earn income;

- rented out on a short-term basis;

- not in use for at least two months in a year; and

- land of any value and other assets (such as aircraft and boats) with a cost of $50,000 or more.

16. However, the suggested rules would not apply to:

- motor vehicles subject to the existing motor log book rules; and

- part of a family home that is used for earning income (for example, renting out a room to boarders or using a part of the home as a business office).

17. To ensure consistent treatment across different entities, the issues paper suggested that the rules be applied to assets held by partnerships, trusts, close companies, closely-held companies, qualifying companies and look-through companies. Special rules would need to apply to companies, particularly in the area of interest deductibility and imputation issues that arise with companies.

18. The primary advantage of option one is that, after year-end, there is certainty about the deductions that mixed-use asset owners are able to claim. Owners need simply to apply the tests to determine which group they fall into and the amount of deductions they can claim.

19. Both variations of option one suggested a 62 day income-earning threshold and a 10-15% private use threshold. To qualify for higher amounts of tax deductions, owners would need to exceed the income-earning threshold and be under the private use threshold. The disadvantage of such thresholds is the distortionary behavioural effect that they create –owners receive dramatically different outcomes on either side of the threshold and may modify their behaviour accordingly. For example, an owner may decide not to use their holiday home and instead pay for a hotel near the holiday home in order to stay below a private use threshold, or make disproportionate efforts to achieve an additional night of rental to exceed an income-earning threshold.

20. Submissions provided evidence that owners may not be able to achieve the 62 day income-earning threshold despite having a genuine intention to earning significant income from the asset and, as a consequence, be denied deductions. For example, a poor ski season could restrict the rental of a ski chalet. This could mean that it does not meet the income-earning threshold, resulting in the denial of deduction, despite the owner having a strong rental focus.

21. Further difficulties arise in setting the threshold. A single threshold is simple, but discriminates between assets that can be easily rented (such as a city centre apartment which is available throughout the year) and those assets with a specific “season” (such as a ski chalet which is generally rentable only during the ski season). Different thresholds, which seek to apply to different types of assets, may introduce significant complexity.

Option two

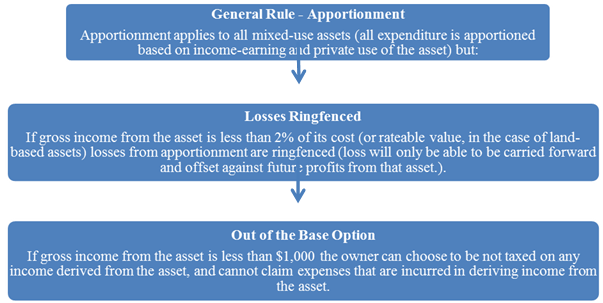

22. The second option was developed in response to submissions received from the Mixed-use Assets issues paper. This option would apply to the same assets and entities as option one (see paragraphs 15-17). The structure of the second option is as follows:

Apportionment Approach

23. This option is simpler than option one as the majority of owners would be required to apportion their deductions instead of the range of potential outcomes under option one. It also delivers fairer results because deductions are apportioned to better reflect the owner’s actual use of the asset.

24. A disadvantage of this apportionment approach is that (for simplicity) it values the benefit that the owner receives from owning the asset by reference only to their actual private use of the asset. It also impliedly values private use at the same rate at which a third party would pay for it. No attempt is made to value other benefits that the owner receives from the asset, such as the ready availability for private use when not rented. This allows owners to claim higher amounts of deductions (and potentially more tax losses) than would be available if more accurate measures of private value were used. However, more accurate measures of private value are extremely subjective and difficult to apply.

25. There are three issues with a pure apportionment approach where owners with minimal amounts of income-earning can apportion their deductions:

a) There would be incentives for owners to modify behaviour or distort asset use in order to achieve higher levels of deductions. This is because a forgone or additional night of private use would produce significant tax effects when days of actual private use and income earning use is low.

b) Requiring owners who have minimal amounts of asset income (and therefore a low potential tax liability) to keep sufficient records and apportion expenditure under the proposed rules would create disproportionate compliance costs.

c) Owners who earn small amounts of income from their asset are likely to hold the asset primarily for their private enjoyment, and have weaker grounds for claiming deductions for periods for which the asset is not used.

26. Consequently, two variations to the standard apportionment method described above are recommended for owners who derive small amounts of income from their mixed-use asset. The two variations are as follows:

a) Where the owner derives less than $1,000 of gross annual income from their mixed-use asset, they would be able to treat that income as exempt. They would not be required to return the income and would not be entitled to claim any deductions. This is designed to address the compliance cost issue.

b) Where the owner derives gross annual income from the mixed-use asset that is less than 2% of the asset’s cost (or the rateable value of land and improvements, for a land-based asset), the apportionment rules continue to apply. However, if a loss arises, that loss is ring-fenced and can only be offset against future profits from that asset. This is designed to stop those with very low levels of income ending up in a loss situation which may not be economically justified.

27. A small number of submitters stated that the options proposed in the issues paper would detrimentally affect the New Zealand holiday “bach culture” and/or the charter boat/aircraft industry. The market for mixed-use assets may be affected by the proposals. However, it is difficult to measure the scale or direction of these effects. Any effect that the changes may have on the market is likely to arise because the market for mixed-use assets is distorted because inflated tax deductions are available. The proposed changes should reduce these distortions.

28. Any approach that reduces tax distortions in this area is likely to moderately reduce investment in mixed-use assets, as people who previously invested in these assets primarily because of the tax deductions are less likely to do so in the future. In addition, those owners who were motivated to make their assets available for rent because of the high level of tax deductions available, may decide that at a lower level of tax deduction it is not worth renting at all. In contrast, both options also create incentives to rent out these types of assets more, as owners who achieve high levels of rental will receive greater amounts of tax deductions.

GST

29. The same two options have been considered for GST purposes. In this context, the advantages and disadvantages largely reflect those set out in paragraphs 13-28 above. The result of the apportionment calculation could also be used to calculate the relevant proportion of GST input tax deductions that a registered person is able to claim.

30. A key difference for GST is that the $1,000 and 2% variations (as recommended for income tax purposes) are not practically possible. A number of GST-registered owners of mixed-use assets would be registered voluntarily, on the basis that their taxable supplies are less than the $60,000 compulsory registration threshold. Because they are charging GST on their supplies, denying them all input tax deductions if a set threshold is not met would be inconsistent with the approach applied to voluntary registration in relation to other industries or activities. Instead, it is proposed that full apportionment of input tax be required, in line with the general GST apportionment rules introduced in 2011.

31. Another difference between income tax and GST is that, because of the shorter tax accounting periods for GST, it is possible to look back only over part of a year. An alternative approach of requiring the owner to use the result of the income tax calculation for subsequent GST periods may produce arbitrary results, particularly if the person has a good year followed by a bad year or vice versa.

32. Instead it is proposed that, for GST purposes, the owner of mixed-use assets would estimate the relative taxable and non-taxable use in their GST returns and then perform an annual square up calculation at the end of the year. This is designed to ensure that the level of input deductions claimed is consistent with income tax deductions. This calculation would be subject to existing de minimis rules so that, if the person’s estimate in the intermediate returns was close to the result produced by the calculation, no minor readjustment would be necessary. Registered persons would also have, under existing rules, the option of deferring all input deductions until the end of the year to ensure their accuracy.

CONSULTATION

33. As noted, an officials’ issues paper Mixed-use Assets was released for consultation in August 2011, outlining two variations of option one. A total of 98 submissions were received. The majority of submitters (around 67%) recognised that the problem needs to be addressed. A few submitters (around 3%) thought that new rules were not required. The remaining submitters did not indicate either way. Only four submissions commented directly on the GST proposals.

34. The submissions received were from a mix of:

- individuals, companies and trusts that own mixed-use assets (around 80%),

- dedicated businesses that advertise and/or manage the income earning element of mixed-use assets for their owners, and

- accounting and law firms.

35. Submitters raised a number of concerns with option one. The greatest concerns focused on the income-earning and private use thresholds. Submitters argued that the thresholds were too difficult to meet and were not aligned with commercial reality. Submitters were also concerned that time spent conducting repairs and maintenance was not taken into account and would be classified as private use. This would push many owners over the private use threshold.

36. Approximately 10% of submissions considered the potential compliance costs of the suggested rules. A range of responses were given. Around half of the respondents on this issue stated that officials should not be discouraged by complexity if more complex rules would give fair and accurate results. The other half thought that the suggested rules were too complex and, if implemented, would lead to owners attempting to avoid them through non-compliance or by ceasing to rent out their assets. It is not clear whether the rules outlined in the issues paper would impose a significant compliance burden on owners, who are already required to accurately calculate their liability under existing law. It is likely that the proposals may initially impose further compliance costs on individuals and businesses. However, these costs are likely to reduce in time as the new rules are better understood.

37. The second option was developed in response to submissions received. Many respondents thought that apportioning expenses based on the underlying use of the asset was a more appropriate solution to the problem. Consequently, option two allows the majority of owners to apportion their deductions, except for a minority who will be able to treat the income received from the asset as exempt. This approach is simpler than option one as it eliminates the need for owners to achieve certain levels of income-earning use or remain under certain levels of private use in order to gain higher deductions. Further, concerns regarding time spent conducting repairs and maintenance are less of an issue given that there are no longer private use thresholds.

38. The key submitters and stakeholders, including accounting and law firms, charter boat firms, holiday home rental firms, and aviation sector bodies were consulted about an earlier version of option two in December 2011 and January 2012. In this earlier version, apportionment was available to the majority of asset holders, with some limitations for those with low levels of income-earning use. The majority of those consulted generally supported this proposal.

39. A number of minor technical issues were raised during consultation, which officials are still working through. These will be reflected in the final legislation.

40. Inland Revenue has worked closely with the Treasury, which agrees with the analysis and recommended option.

CONCLUSIONS AND RECOMMENDATIONS

41. The recommendation is to implement option two, which would:

- Create statutory rules that require mixed-use asset owners to apportion their tax deductions based on their actual income-earning and private use of the asset. The variation to this would be owners who derive small amounts of income from the asset. Those with gross income from the asset of $1,000 or less would be able to treat that income as exempt. Those with gross income from the asset of less than 2% of its cost (or rateable value if land-based assets) will be required to apportion their deductions but if a loss results, that loss will only be able to be carried forward and offset against future profits from that asset.

- Extend the apportionment formula for income tax deductions, so that it also applies to input tax deductions for GST purposes. However, for GST, it is recommended there be no variations for owners who derive small amounts of income from the asset.

42. Option two apportions tax deductions of owners in an equitable manner, as their deductions reflect the amount of private and income-earning use of their assets. Simplicity is not compromised, as the majority of owners would be required to apply only a single method of calculating deductions (as opposed to option one where owners may face differing outcomes year-to-year depending upon their use of the asset). Option two also deals with compliance cost concerns by allowing those with gross revenue of less than $1,000 to treat the income as exempt. It also deals with losses arising at the lower end of the market by restricting loss offset for those whose gross revenue is less than 2% of cost or rateable value.

43. Option one was rejected due to the disadvantages associated with the thresholds (namely, the distortionary behavioural effect they create). Further, as indicated by submissions, owners of mixed-use assets would find it difficult to achieve the 62 day income-earning threshold, despite having an income-earning focus. This would mean that they would be denied a substantial portion of their deductions.

IMPLEMENTATION

44. The new rules will be administered by Inland Revenue through existing channels.

45. Compliance costs can be minimised by releasing clear guidance on the operation of the new rules via existing Inland Revenue channels. Inland Revenue could also make online tools available. The rental industry has also indicated that they would publicise the new rules.

46. Consistent with existing tax rules, individual taxpayers would be required to comply with the existing individual tax return (IR3 return), GST return and information obligations. Generally, individual taxpayers would be required to declare income or a loss from their mixed-use asset in their IR3 return.

47. Mixed-use asset owners who derive a small amount of income from their asset would not be required to file an IR3 return, but would continue to have to meet any GST filing obligations.

MONITORING, EVALUATION AND REVIEW

48. Inland Revenue would monitor the outcomes pursuant to the Generic Tax Policy Process (“GTTP”) to confirm that they match the policy objective.

49. The GTPP is a multi-stage policy process that has been used to design tax policy in New Zealand since 1995. The final step in the process is the implementation and review stage, which involves post-implementation review of legislation, and the identification of remedial issues. Opportunities for external consultation are also built into this stage. In practice, any changes identified as necessary would be considered for addition to the Tax Policy Work Programme, and any such proposals would go through the GTPP. No additional review is proposed.

1 Depreciation is no longer generally available for buildings. Depreciation, however, is still available for other assets, such as boats, planes, furniture, appliances etc.