Main policy issues raised in submissions received

Issue: Further research should be conducted before any changes to the child support scheme are made

Submissions

(Matter raised primarily by Auckland Coalition for Safety of Women and Children, Auckland Women’s Centre, Dunedin Community Law Centre, Nicola Gavey, Vivienne Elizabeth, Julia Tolmie, Prue Hyman, the Equal Justice Project, Women’s Studies Association)

There is currently a lack of comprehensive data and research on child support issues, in particular in a New Zealand context. No significant changes should be made to the child support scheme until further research is conducted on the effects of any change.

Comment

In developing the Government’s September 2010 discussion document on child support, Supporting children, officials considered a variety of domestic and international research on child support matters. This included a significant amount of Australian research undertaken as part of similar changes made to the Australian child support formula in 2008.

Recent New Zealand research specifically undertaken to inform the discussion document included:

- Costs of raising children by Iris Claus, Paul Kilford, Geoff Leggett and Xin Wang; and

- What separating parents need when making care arrangements for their children by the Families Commission.

The discussion document provided detailed analysis of both the current scheme and options for updating the scheme. As well as consideration of research undertaken and specific submissions received on the discussion document, a dedicated website was established to ask readers to respond to a series of questions based on the options included in the document. There were 2,272 participants in this online consultation, comprising:

- 834 receiving parents (37 percent);

- 753 paying parents (33 percent); and

- 685 “other” parties (30 percent), including those who both pay and receive child support, other family members, members of representative organisations and advocates involved in child support policy such as lawyers and academics.

Results based on the proposed formula changes were also modelled and summarised in the regulatory impact statement prepared by Inland Revenue on the child support scheme reforms.

Recommendation

That the submissions be declined.

Issue: The proposed changes will have a negative effect on caregivers

Submissions

(Matter raised primarily by Auckland Coalition for Safety of Women and Children, Auckland Women’s Centre, Child Poverty Action Group, Families Commission, Human Rights Commission, Lesley Patterson, Nicola Gavey, Vivienne Elizabeth, Julia Tolmie, Prue Hyman, Women’s Studies Association)

The changes in the bill will disproportionately affect those who will be least able to withstand any reduction in income. There is a concern that caregivers, in particular mothers, will be adversely affected to the detriment of their children.

Comment

The overall objective of the revised child support formula is to achieve an equitable outcome based on up-to-date costs of raising children, both parents’ income and a greater range of care levels. This will encourage more parents to pay their outstanding child support liabilities voluntarily, benefitting the children involved.

There are wide-ranging views about what a fairer and more effective scheme might look like and how to achieve this. It will never be possible to design rules to satisfy all concerned as there are too many conflicting interests and points of view.

However, if a child support formula were being established for the first time, the principles behind the proposed formula would provide a sound basis for calculating child support payments and entitlements. Officials consider that the proposed formula provides the best opportunity for introducing a revised formula that represents a fair reflection of the expenditure for raising children, the parents’ contribution to care and the parents’ capacity to pay. For these reasons the proposed child support formula is considered a significant improvement over the current one and will benefit, in particular, all parents who become part of the child support scheme after the changes are made.

It is recognised that moving from one method of calculating child support to another will, in the short term, have both a positive and negative financial effect for parents already in the scheme, and will have a material financial impact for a minority of parents. It should be noted, however, that as a percentage of parents, those affected adversely are as likely to be paying parents as receiving parents.

Overall, it is estimated that approximately 70,500 parents will be better off under the changes (that is, they will receive more or pay less child support) and approximately 62,500 worse off (that is, they will receive less or pay more).

For the majority of parents whose child support will be affected, the change in child support received and paid is likely to be between plus or minus $66 per month (plus or minus $800 per year).

In addition, for a large percentage of receiving and paying parents (60 percent and 40 percent respectively), the changes to the formula would not result in any change in the amounts received or paid. For approximately 140,000 parents, therefore, there would be no change. This group would consist of some of the most financially vulnerable parents – those who would continue to either receive a sole-parent benefit (and therefore not receive child support payments directly) or continue to pay the minimum contribution because their income level is below the minimum level for child support purposes.

The approach taken during the review was to categorise the parents into paying parents and receiving parents. Being a receiving parent is generally indicative of being the primary caregiver, and this can be the mother, the father, or another person. That said, as the majority (but certainly not all) of receiving parents are female, women are more likely to be adversely affected by this change.

Taking both female paying and female receiving parents into account, it is projected that approximately 26,000 of these parents would receive more or pay less child support and approximately 31,500 of these parents would receive less or pay more child support. The majority (approximately 83,000) would be unaffected – for example, receiving parents who remain on a sole parent benefit would continue to receive full benefit levels.

Taking both male paying and male receiving parents into account, it is projected that approximately 44,250 of these parents would receive more or pay less child support and approximately 30,750 of these parents would receive less or pay more child support. Approximately 56,250 would be unaffected by the proposed formula.

Recommendation

That the submissions be noted.

Issue: Child support payments should be passed on to beneficiaries instead of being retained by the Crown

Submissions

(Matter raised primarily by Auckland Coalition for Safety of Women and Children, Auckland Women’s Centre, Child Poverty Action Group, Families Commission, Office of the Children’s Commissioner, Prue Hyman, Women’s Studies Association, Anne Busse)

The child support system could contribute to decreasing child poverty if the Crown passed on child support payments to sole parents on state-provided benefits. This would be an effective and efficient method of reducing poverty and increasing income support for affected families.

Comment

Currently, New Zealand does have a partial system of passing on child support payments in that a receiving parent receives any child support amount paid over and above the benefit they receive. They are, however, guaranteed as a minimum, the benefit amount.

Most countries that have introduced a full pass-on system have used it to emphasise the welfare of the children when child poverty and/or poor child support payment rates have been of central concern.

Although alleviating child poverty is not a specific policy objective of the proposed measures in the bill, and the Child Support Act more generally, indirectly the measures will assist by encouraging parents to take responsibility for the financial support of their children, by paying their outstanding child support liabilities voluntarily and on time. Child poverty is a wider issue than child support as poverty can also arise when parents live together.

While there is some international evidence to show that a child support pass-on system can improve collection rates and help alleviate child poverty in certain circumstances, its introduction would involve a very significant fiscal cost to the Government. This cost would be reduced only if benefits were wholly or partly offset against child support payments received, similar to that which already occurs.

The Crown entitlement recapture that has occurred in each of the past six years below shows the potential amounts that could be involved for a full child support pass-on system.

| Child support year | Crown recapture ($m) | Proportion collected | 100% estimated ($m) |

|---|---|---|---|

| 2007 | 161.0 | 83.48% | 192.9 |

| 2008 | 152.1 | 80.56% | 188.8 |

| 2009 | 152.2 | 77.57% | 196.2 |

| 2010 | 161.2 | 74.97% | 215.0 |

| 2011 | 159.9 | 72.08% | 221.8 |

| 2012 | 155.5 | 67.01% | 232.1 |

As noted, these amounts would be reduced if the pass-on was in some way restricted, or if associated cost savings arose for the Government from a reduction in other benefits being made at the same time (for example, special needs grants). The amount reduced would depend on the ultimate make-up of any package designed, but the net overall cost would still represent a significant cost to the Government.

Offsetting benefit payments against child support received would create uncertainty, and in some cases hardship, for beneficiaries and their children, as the overall amount they received would be dependent on whether and how promptly the other parent paid his or her child support contribution.

Pass-on is often cited as a way of encouraging parents to pay their child support payments as the payment goes to the other parent or caregiver, rather than to the Crown. A point to note is that pass-on does not necessarily ensure that child support payments are applied for the benefit of the child and this may, as one submission noted, cause additional tensions between some parents.

To the extent that pass-on is used to assist collection, officials note that collection of child support is traditionally high in New Zealand by international standards – with around 89 percent of all core assessment collected over time.

Officials note that if further measures were to be considered to help alleviate child poverty, this should ideally be considered in a wider context than just when parents live apart. This work would likely need to be co-ordinated by the Ministry of Social Development, and consider a number of measures. In that context, it should be noted that the Government is soon to release its White Paper for Vulnerable Children.

Recommendation

That the submissions be declined.

Issue: Guaranteed child support payments (also referred to as the “advanced payment scheme”)

Submissions

(Matter raised primarily by Office of the Children’s Commission, Lesley Patterson, Prue Hyman, Equal Justice Project, Women’s Studies Association)

The Crown should automatically advance child support payments to receiving parents to avoid the instability and delay of payments to parents. The Crown would then recoup any child support payments received.

Comment

The domestic purposes benefit already effectively guarantees payments for basic necessities to a child’s caregiver. Child support received from a paying parent is only passed on to the custodial parent if it is in excess of a domestic purposes benefit received.

When caregivers are not receiving a benefit, child support is only paid to the custodial parent once it is received by Inland Revenue. The child support scheme, both currently and proposed, does not provide any guaranteed payments as its aim is to set out and administer rights and obligations between the parents of a child.

Extending the scheme to provide guaranteed payments would require a judgement call to be made in determining basic needs. This is not the role of the child support scheme. More targeted solutions (for example, special needs grants) assessed by the Ministry of Social Development are likely to be more appropriate in such circumstances.

A guaranteed payment in all cases where child support was not paid would be a significant risk for the Government and, in many cases, involve undue fiscal cost to the Crown – and, ultimately, for taxpayers. It could also have a negative effect on incentives for paying parents to pay on time.

Various measures in the bill, including automatically deducting child support from all salary and wages, should facilitate timely payments to custodial parents.

Recommendation

That the submissions be declined.

Issue: Incorporating the promotion of child well-being as a core objective of the Child Support Act

Submissions

(Matter raised primarily by Auckland Coalition for Safety of Women and Children, Child Poverty Action Group, Dunedin Community Law Centre, Families Commission, Human Rights Commission, Law Society of New Zealand, Office of the Children’s Commissioner, Equal Justice Project, Women’s Studies Association)

Consistent with Article 3 of UNCROC, the bill should require that the Child Support Act’s objects provision be amended to incorporate a child’s best interests.

Comment

There was concern in some submissions that the bill proposed removing section 4(c) of the Child Support Act that affirmed the rights of caregivers of children to receive financial support for those children from their non-custodial parents. Although it is proposed that this objective be removed, it is to be replaced by new section 4(fa) in the bill that proposes the insertion of the following objective that is essentially the same, only using updated terms:

“To affirm the rights of carers who provide significant care of children to receive financial support in respect of those children from a parent or parents of the children.”

It has also been submitted that this should be extended further. For example:

- The Human Rights Commission and Law Commission contend that the objects provision should be amended to require that financial arrangements made to support a child reflect and promote a child’s needs and best interests.

- The Office of the Children’s Commissioner proposes that the objective should be “to affirm the right of children to be maintained by their parents and the promotion of their on-going wellbeing and healthy development following parental separation” and “to require that, in all decisions and actions made under the Act, the welfare and best interests of the child shall be a primary consideration.”

- Including overarching objectives in the Child Support Act that are specifically centred on the welfare and best interests of the child would not fit well within the Child Support Act and the child support scheme more generally. This is because the Child Support Act is fundamentally about the payment and receipt of child support. While an effective child support scheme that collects and distributes financial support efficiently is undoubtedly in a child’s best interest, making this an explicit objective would place the administrator of the Act, Inland Revenue, in the position of having to establish in each child support case, whether the individual measures in the Act, on their own, achieved that objective.

The British example given by the Office of the Children’s Commissioner highlights this point, as the object in that case is limited to “…. the exercise of any discretionary power conferred by this Act …. shall have regard to the welfare of the child likely to be affected by his decision.” While in principle this type of more restricted objective may be desirable, it should be noted that even extending the objectives that far would, implicitly, require Inland Revenue to consider what is in the best interest of the child – an area of judgement that the department may not be best placed to make.

To that end, one option that could be considered would be for Inland Revenue to consult with a body better placed to determine the welfare and needs of children (for example, the Children’s Commissioner) before setting any administrative guidelines relating to the exercise of a discretionary power conferred to it under the Child Support Act.

Recommendation

That the submissions be noted.

It is recommended that when Inland Revenue sets administrative guidelines relating to the exercise of any discretionary power conferred to it under the Child Support Act, it should first consult with the Children’s Commissioner.

Issue: The 28 percent care threshold at which recognition is given in the proposed child support formula is too low

Submissions

(Matter primarily raised by Auckland Coalition for Safety of Women and Children, Auckland Women’s Centre, Child Poverty Action Group, Dunedin Community Law Centre, Francis and Julia Quirke, Prue Hyman, Suzanne Edwards)

The proposed care threshold at which recognition is first given in the proposed child support formula is too low, and does not take into account that the primary financial burden for many costs remains with the principal caregiver.

Comment

In proposing the 28 percent level at which care should be recognised for child support purposes, the following criteria were taken into account:

- the level of regular and shared care that starts to give rise to dual costs;

- how the extra costs are borne by each parent;

- the degree of complexity that the child support scheme should reasonably bear;

- the financial impact of any change, as it affects paying parents, receiving parents, children, and when the child support offsets benefit payments, the Government;

- the degree to which the approach encourages paying parents to comply; and

- the costs involved in implementing the approach.

Various levels of care were considered to provide recognition to those paying parents who provide high levels of care, but who are unable to satisfy the current 40 percent of nights shared-care threshold or “substantially equal” care test.

In addition to the option proposed (to recognise, on a tiered basis, care in excess of 28 percent – on average two nights a week), the following options were also considered:

- care in excess of 14 percent of care (on average one night a week);

- care in excess of one-third of care (to align with Working for Families tax credits); and

- retaining the current 40 percent of care threshold.

Recognition at 14 percent is the threshold adopted in some other jurisdictions (for example, in Australia and Britain). Although this option would provide recognition to more paying parents who care for their children, it may be seen as too generous, particularly if the majority of everyday and other significant one-off costs are still borne by receiving parents. It would also involve a greater fiscal cost as more child support liabilities would be reduced, thereby further reducing the amount received by the Government to offset benefit payments to receiving parents.

Conversely, providing recognition at a higher threshold may mean that parents who incur a significant level of care and its associated costs are not provided with any recognition for the care they provide. There is no one correct level of care, it is instead ultimately a question of judgement based on the criteria noted above.

There is general agreement that the costs associated with shared care of a child are higher than when one parent has sole care. The major cause is the need to duplicate housing and related costs, such as utilities, household furnishings, play and study space, toys and play equipment, and additional transport costs. However there is no specific New Zealand data on the differences in costs, and who bears the costs, between shared care levels at 40 percent and 28 percent.

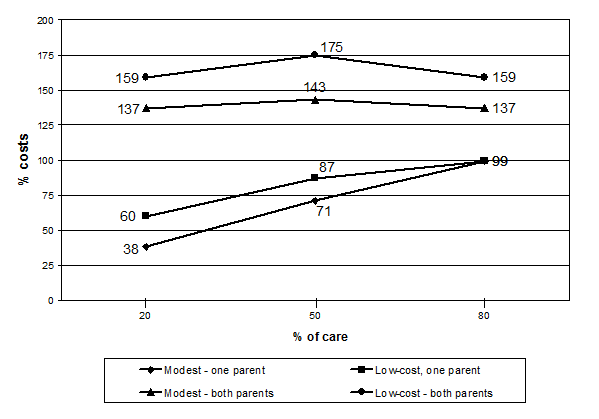

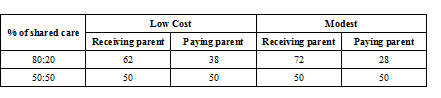

Research by Paul Henman for the Australian Ministerial Taskforce on Child Support has helped to provide some insight into the question of how additional costs are likely to be borne.

The findings (illustrated below) show that sizable additional costs are likely to arise even when a parent has only a 20 percent share of a child’s care, implying that the shared-care threshold should be substantially lower than the 40 percent of nights currently used.

Estimated average shared care costs as proportion of

100 percent care situation in Australia

Percentage of estimated average total costs incurred by each parent

It is worth noting that the recognition provided to a parent in the proposed formula in the bill does depend on the level of care provided (the recognition being tiered), with 28 percent merely being the lowest qualifying care recognised.

Recommendation

That the submissions be declined.

Issue: The child support formula should not apply to equal shared-care situations

Submissions

(Matter primarily raised by Adam Simpson, Mark Richardson, Pam Hulls, Robert Montgomery, Sally Marr, Tim Monck-Mason, Troy Shoebridge)

In cases where the care of a child is shared equally (50% each), the child support formula should not apply.

Comment

The submissions received on this point are based on the premise that as the parents are sharing the care of the child and all the associated costs equally, there should be no need for any financial adjustment to be made between parents.

This approach ignores the possibility of parents having materially different incomes and, therefore, materially different expenditures to support their children. The essential features of the proposed formula are that:

- the deemed expenditure for raising children directly reflects both parents’ income; and

- this expenditure is distributed between parents according to their respective share of that combined income and their level of care of the child.

The aim of the new formula is to replicate, as far as possible, the financial arrangements that would exist if the parents were living together (notwithstanding that separation often causes a decline in parents’ living standards). Failure to do this may ultimately result in an unfair outcome for the parents and a significant drop in living standards for the children.

Recommendation

That the submissions be declined.

Issue: Transitional issues for departures

Submission

(Matter raised by the New Zealand Law Society)

It is unclear whether the bill will apply retrospectively if there is a successful application for a departure from an assessment that extends beyond the implementation date for the new formula. The existing departures should remain in place until the order expires or there is a further application for variation or discharge.

Comment

It is agreed that transitional provisions will be required to deal with existing applications for a departure from an assessment arising from an administrative review that extends beyond the implementation date for the new formula. Although Inland Revenue is currently discouraging departures that go beyond the likely implementation date, some may remain.

As noted in the Law Society’s submission, for some parents the departure may no longer be appropriate when the new formula is in place, while for others the rationale for a departure may still be valid.

It is therefore recommended that the new formula apply from the implementation date, in the first instance, for departures arising from administrative reviews that extend beyond the implementation date. However, it is also recommended that the Commissioner of Inland Revenue should be given the discretion to continue, where appropriate, with existing departures that go beyond the implementation date when the departure is based on issues or elements that are not taken into account in the new formula calculation.

For court-ordered departures that go beyond the implementation date, it is recommended that these orders should continue until the order expires or one of the parties applies for another departure order or applies to vary the order in some other way.

Recommendation

That the submission be partially accepted, with the Commissioner of Inland Revenue given the discretion to continue with existing departures arising from administrative reviews that go beyond the implementation date when the departure is based on issues that are not taken into account under the new formula.

For court-ordered departures that go beyond the implementation date, it is recommended that these orders should continue until the order expires or one of the parties applies for another departure order.

Issue: Privacy and cultural concerns with the automatic deduction of child support from paying parents’ salary and wages

Submissions

(Matter primarily raised by the Legislation Advisory Committee, Mark Richardson, Sally Marr, Troy Shoebridge)

Concerns have been raised about the automatic deduction of child support from paying parents’ salary and wages, which could result in privacy and cultural issues with employers having knowledge of employees’ child support details.

Comment

Although the Office of the Privacy Commissioner had concerns with the automatic deduction of child support from paying parents’ salary and wages, on balance they concluded that the public benefit (including the desire to prevent people from falling into arrears and debt) appeared to justify the privacy impacts on compliant individuals.

Recognising that some employees may rightly have legitimate concerns about employers being informed of their child support affairs, however, it is recommended that the Commissioner of Inland Revenue be given the discretion where there are legitimate privacy, cultural or other concerns, and alternative payment options have been provided, not to automatically deduct child support payments from salary and wages.

Recommendation

That the submissions be partially accepted, with the Commissioner of Inland Revenue given the discretion, where there are legitimate privacy, cultural or other concerns, and alternative payment options have been provided, not to automatically deduct child support payments from salary and wages.

Issue: The proposed child support formula is too complex

Submission

(Matter raised primarily by the New Zealand Law Society)

The proposed child support formula is too complex and should be simplified so that it reflects the intentions of a child support scheme – one that is simple, efficient, equitable and transparent. For example, consideration should be given to reducing the split for the percentages of average weekly earnings used in proposed new schedule 2 in the bill to three groupings.

Comment

Although individual elements of the proposed child support formula could, in theory, be considered in isolation, taking all the elements into account results in a more cohesive and comprehensive change to the formula that incorporates:

- estimated average expenditures for raising children;

- varying levels of care; and

- the income of both parents.

Incorporating just one or two of these options would limit the overall impact and effectiveness of any changes and would, in officials’ view, represent a significantly less comprehensive, equitable and transparent solution. Sacrificing this for greater simplicity is not recommended.

It should also be noted that 69 percent of respondents to the online consultation undertaken thought that all the factors should be used to determine child support payments.

That said, the proposed child support formula is more complex, particularly when a parent has multiple relationships, than the one currently used. However, parents or other affected parties will not be expected to undertake the calculations themselves. Inland Revenue’s systems will undertake all calculations required to determine liabilities and entitlements. For parents and other carers wishing to undertake their own estimations, comprehensive, yet easy-to-use online calculators, will be provided, together with explanations of the principles sitting behind the calculations and worked examples. This will assist transparency, subject to privacy constraints, such as not revealing the income of the other parent.

In these circumstances, reducing the split for the percentages of average weekly earnings used in schedule 2, for example, would not make the changes any simpler.

Further, the approach proposed is, in officials’ view, preferable to starting from the basis of a more simple formula, and moving on to cater for different circumstances at a later date. Adopting this approach would lead to more confusion for parents, as the law (setting out the basis for child support calculations) would change on a regular basis. It would also lead to significant system and administrative concerns for Inland Revenue in implementing an ever-changing child support scheme.

Recommendation

That the submission be declined, but it be noted that parents or other affected parties will not be expected to undertake the child support formula calculations themselves. Inland Revenue’s systems will undertake these calculations to determine all liabilities and entitlements.

Issue: Ability for parents to enter into binding voluntary agreements

Submission

(New Zealand Law Society)

Currently, voluntary agreements made between parents can be displaced by a successful formula assessment application for child support under the Child Support Act. It is submitted that, if the receiving party is not in receipt of a social security benefit for a child, voluntary and independent agreements made between parents should be binding until the parties or the Family Court agree to vary the agreement. If the recipient becomes a beneficiary, then the formula assessment could be made at that time.

Alternatively, consideration should be given to adopting a two-tiered approach which would provide for:

- a binding child support agreement only where each party has received independent legal advice; and

- a child support agreement that is more flexible and which is designed for parties not ready to bind to a long-term commitment.

Comment

Officials support the tenet and substance of this submission and agree that wherever possible, it is better for parents to reach a mutually agreeable outcome without redress to the child support scheme.

There are, however, some potential questions that would need to be carefully considered before this measure could be implemented – for example, what would constitute a binding agreement for child support purposes, where the boundaries between binding and non-binding agreements would lie, and how such a provision would interact with the Care of Children Act 2004 and the Property (Relationships) Act 1976.

Concerns around the ability of one parent to potentially exert undue pressure on another would also need to be dealt with, along with the potential consequences of one party’s situation (for example, their financial position) changing considerably after an agreement has been entered into.

Officials support this submission in principle and consider that it is an issue worth considering further, but that further detailed policy work should be undertaken first. To that end, it is recommended that Inland Revenue discuss this matter with the Ministry of Justice with a view to reporting back to Ministers on next steps.

Recommendation

That the submission be noted and that Inland Revenue discuss this matter with the Ministry of Justice to identify whether further policy work is needed and, if so, report to joint Ministers on next steps.

Issue: “Cost of children” calculations for children under five

Submissions

(Matter primarily raised by Child Poverty Action Group, Maxine Ford, F&J Quirke)

The “cost of children” calculations contained in schedule 2 of the bill do not sufficiently cater for children under the age of five, either in terms of the opportunity cost of foregone earnings associated with looking after young children or, alternatively, the high cost of childcare.

Comment

The table that forms the basis of schedule 2 in the bill endeavours to provide for childcare, and some degree of lost earnings, by applying the higher cost of raising 5 to 12 year olds also to 0 to 4 year olds (given that childcare costs are likely to be highest for very young children).

Given data constraints, estimates of the cost of raising children in New Zealand did not separately calculate the costs of raising children in the 0 to 4 year age group.

However, we note that the Australian studies undertaken for the purposes of designing their child support formula did include a more detailed age breakdown. Research undertaken in 2005 indicated that, for middle income (A$50,000–$60,000) families, the costs associated with raising a child aged 0 to 4 years was, as a percentage of income, between 4 to 8% lower than the cost of raising a child in the 5 to 12 year old group, as follows:

Gross costs of children as a percentage of gross family income

| Number of children | 0-4 age range | 5-12 age range |

| 1 | 10% | 14% |

| 2 | 16% | 22% |

| 3 | 20% | 28% |

| 4+ | 24% | 33% |

These costs do not include childcare costs or opportunity costs, such as forgone earnings while looking after children. Conversely, they do not take into account childcare subsidies.

Given that New Zealand’s study produced broadly consistent results to those of Australia, there is no reason to assume that this lower cost for 0 to 4 year olds would not also exist in New Zealand.

The Australian approach taken was to combine the two age bands and apply the percentages of the older group, which are higher, effectively providing some recognition of the costs of childcare that can be faced by the parent who has major care of a child under five and wishes to undertake paid work, and the opportunity costs that custodial parents face when children are very young.

This approach has also been followed in the proposed New Zealand changes, in the child expenditure table contained in schedule 2 in the bill. Providing recognition beyond this level for indirect costs such as opportunity costs is a debatable issue given the purpose of the child support scheme is to focus on the direct cost of the child.

Recommendation

That the submissions be declined.