Chapter 3 - GST treatment of directors' fees

3.1 The GST Act provides that a person engaged as a director is not carrying on a taxable activity. This rule is designed to keep directors out of the GST net, unless their activities as a director are performed as part of a broader taxable activity, in which case their directorship will form part of that activity.

3.2 Inland Revenue has issued a Public Ruling on the tax treatment of payments to directors (BR Pub 05/13). The Ruling largely achieves an outcome that reflects the policy intent of the provisions: directors that are not carrying on a taxable activity are not generally required to charge GST for their services.

3.3 When GST is charged, the paying company will generally be entitled to an input deduction, so GST is not an economic burden on business.

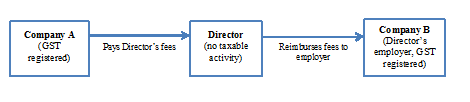

3.4 However, there is one circumstance when the correct GST outcome, from a policy perspective, is not achieved. This arises when an employee is engaged by a third-party company who is not their employer and the employee is required to account to the employer for the directors’ fees received. The diagram below illustrates the arrangement.

3.5 In the above scenario, the directors’ fees paid to the employee are not subject to GST, because section 6(3)(b) precludes them from having a taxable activity. However, when the employee passes these fees on to the employer (Company B), Company B is, under the Ruling, required to account for output tax on the supply of “permitting the employee to be a director”.

3.6 This result means that Company A will not receive an input deduction for the fees paid, because they are paid to a non-registered person who will not be able to provide a tax invoice. Company B will, however, have to account for output tax on the amount reimbursed by the employee. This lack of input deduction on an amount that ultimately generates output tax liability means that either Company A, Company B or both companies will bear GST as a cost.

3.7 The Ruling is also applied in comparable circumstances when an employee has been engaged as a member of a local authority or statutory board under section 6(3)(c). The situation with members of local authorities or statutory boards is slightly complicated by the fact that there is no proviso to section 6(3)(c) – meaning these members can never be registered. Our suggested solution below seeks to address the application of both sections.

Suggested solution

3.8 To avoid altering established contractual relationships or forcing directors to register for GST when they otherwise would not be required to do so, the simplest solution would be to treat Company B as making a supply to Company A (permitting their employee to be a director/member) to the extent that Company B is either paid directly by Company A or reimbursed by the employee. This supply would be treated as having been made for all relevant 6(3)(c) supplies and when a director was prohibited from registering under section 6(3)(b).

3.9 This would allow Company B to issue a tax invoice for the fees (or the relevant portion of the fees), and the related input tax deductions could be claimed by Company A. This suggestion could be workable because it is unlikely that Companies A and B will be unaware of their respective involvement. The practicalities, such as invoicing, could therefore be arranged at the time of the appointment. The suggestion could achieve a neutral outcome without imposing the compliance and administration costs of requiring the director to register for GST.

3.10 The rule should also logically extend to situations when Company B is a registered partnership or trust and the employee is a partner/trustee released to act as a director (or member of a local authority or statutory board). This would provide greater consistency in the GST treatment, irrespective of the commercial structure used.

3.11 It is important to note that the solution suggested would be aimed solely at ensuring GST neutrality in the transaction. It is not intended to alter the contractual relationships and, as such, would not affect the income tax treatment of any of the parties or the withholding obligations of the party making the payment.