Chpater 2 - Background

2.1 This chapter describes New Zealand’s current rules for taxing foreign superannuation. It also outlines the reasons why a review of these rules is appropriate.

New Zealand residents’ interests in foreign superannuation

2.2 Immigrants to New Zealand and returning New Zealanders often hold investments in foreign superannuation schemes which were acquired while they lived and worked outside New Zealand. The range of retirement savings is extensive and varies from country to country. However, in very general terms, retirement savings can include interests in:

- Defined contribution schemes. These are generally where an individual and/or their employer contribute to a superannuation scheme. The amount eventually distributed to the individual represents those contributions plus investment earnings.

- Defined benefit schemes. Under these schemes, the amount that is eventually distributed to the individual is pre-determined. An individual may or may not contribute directly to the scheme. If the individual does contribute to the scheme, the amount received does not generally depend on the amount of their contributions.

2.3 In some cases – such as if the foreign government has made contributions to the individual’s investment, or given a tax deduction for contributions that the individual has made to their investment – the individual may not be permitted to access their savings until retirement age. These are called “locked-in” schemes.

2.4 Distributions of retirement savings from a superannuation scheme or another intermediary can take various forms. Generally, these will be as either a periodic pension, a lump sum, or a combination of both. In some cases, a lump sum payment is (or must be) transferred to another superannuation scheme or used to purchase an annuity.

2.5 An individual may also have an entitlement to receive a pension from a foreign Government or a similar statutory body.

2.6 The scope of this review is limited to New Zealand tax-residents who hold interests in defined contribution or defined benefit foreign superannuation schemes. Pensions and lump sums received from a foreign Government would not be covered by the new rules unless the payments arose as a result of services provided by the individual to that government. Furthermore, while New Zealand-residents may also have other overseas investments that they intend to use as retirement savings (for example, shares, bank deposits and real estate), this reform will not change the taxation of those investments.

Current taxation of foreign superannuation

2.7 Most countries will tax interests in domestic superannuation schemes at one or more of the following levels:

- the contribution to the pension scheme;

- investment earnings of the pension scheme; and/or

- the pension benefit or payment to the recipient.

2.8 For instance, when a New Zealand-resident has contributed to a New Zealand superannuation scheme (that is, there is no international dimension), New Zealand taxes the retirement savings on a “TTE” basis. This refers to taxing the contributions to the superannuation scheme, taxing the investment earnings of the scheme and exempting the pension benefit or distribution.

2.9 The TTE approach is consistent with the way that other New Zealand-based savings are taxed. For example, an individual who deposits income derived from their employment in a financial institution will have had their employment income taxed, and will be taxed on any interest income that they earn. When they withdraw an amount from their bank account, the withdrawal is not taxed.

2.10 By comparison, a New Zealand-resident with foreign retirement savings has always been taxed under different rules, which may not follow the TTE approach.

2.11 Before 1993, New Zealand taxed pensions or lump sum payments when they were received. In 1993, the foreign investment fund (FIF) rules were introduced for all foreign investments, apart from investments in controlled foreign subsidiaries. The primary purpose of these rules was generally to tax interests in foreign investments, including foreign superannuation schemes, on an accrual basis rather than on receipt. This approach to taxation is generally desirable because it ensures that investments in foreign assets are not favourably taxed relative to investments in New Zealand assets.

2.12 As a starting point, the FIF rules applied to interests in foreign superannuation schemes.

Tax treatment of foreign superannuation schemes under the FIF rules

2.13 Under the current FIF rules, interests in foreign superannuation schemes are generally taxed using either the fair dividend rate (FDR) method, the cost method, or the comparative value (CV) method.

2.14 The FDR and cost methods tax a deemed 5% return, based either on the market value or the cost of the investment.[1] The CV method taxes the increase or decrease in the value of the investment by taking the difference in value at the start and end of the year.

2.15 When an interest in a foreign scheme is a FIF, any actual returns (that is, a pension or lump sum) are exempt from tax.

Carve-outs from the FIF rules that apply to foreign superannuation

2.16 Some interests in foreign superannuation schemes can be “carved out” of the FIF rules, meaning they are instead subject to the general taxation rules. The following exemptions from the FIF rules were enacted in response to various concerns. These concerns are, in particular:

- Foreign superannuation schemes are often locked-in. This means that the funds generally cannot be withdrawn or otherwise assigned until a specified retirement age. Imposing accrual FIF taxation may create cashflow hardships as the individual’s tax liability would have to be met out of other income.

- Investments in foreign superannuation schemes are usually not tax motivated. Instead, they arise because a New Zealand-resident previously lived and worked offshore and established an interest in a foreign superannuation scheme during that period.

- Accrual FIF taxation is out of step with how most other countries tax superannuation, which normally occurs on distribution. This creates problems in coordinating the timing of tax payments and foreign tax credits with the treatment in other jurisdictions.

2.17 Locked-in schemes: The main carve-out from the FIF rules that applies specifically to foreign superannuation is for locked-in schemes. This carve-out addresses the major concern that the FIF rules would create cashflow problems for people with such interests.

2.18 New migrants’ four year relief: When the carve-out for locked-in schemes did not apply, a carve-out was previously available to new residents to give them time to adjust to the FIF rules. This meant that a new migrant was not required to comply with the FIF rules for the first four years in which they were resident. The interest became subject to the FIF rules after the end of the four-year period. This carve-out was replaced in 2006 by an exemption for transitional residents.

2.19 Australian superannuation schemes: Interests in some Australian superannuation schemes have also been carved out from the FIF rules. In Australia, it is generally compulsory to make contributions to a superannuation scheme. This carve-out was introduced to address concerns that the FIF rules were difficult to comply with.

2.20 $50,000 minimum threshold: The FIF rules do not apply if an individual’s total FIF interests (that is, their interests in the foreign superannuation scheme and any other foreign interests covered by the FIF rules) are less than $50,000. This carve-out was introduced to reduce compliance costs for people with minimal foreign investments.

2.21 Transitional residents’ exemption: The transitional resident rules were introduced in 2006. An individual will generally be a transitional resident if they are a new migrant or have been away from New Zealand for more than 10 years, and do not claim Working for Families tax credits. Transitional residents do not need to account for foreign interests under the FIF rules during approximately the first four years in which they are resident in New Zealand. Further, they do not need to pay tax on most foreign income that they earn in that period. This provides a window in which they are able to transfer their foreign retirement savings to New Zealand tax-free.

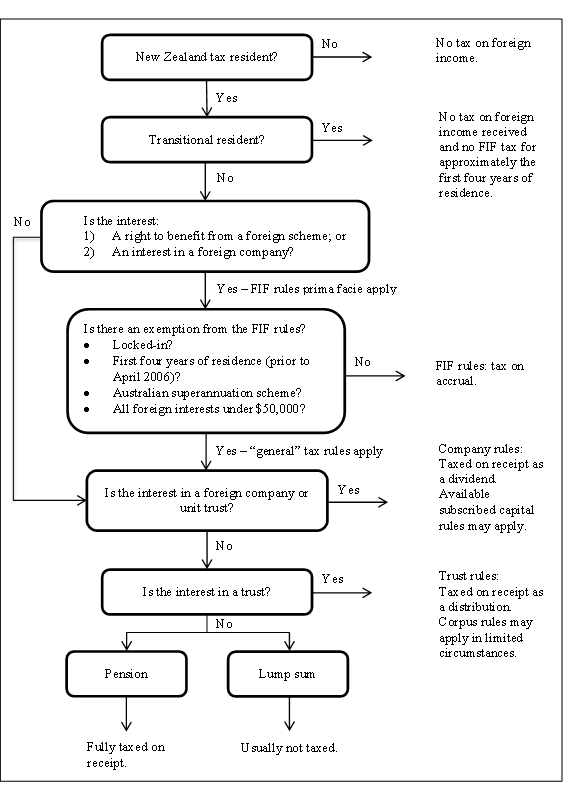

Taxation of foreign superannuation interests if the FIF rules do not apply

2.22 When an interest in a foreign superannuation scheme is carved out from the FIF rules, it is subject to general tax rules – that is, tax on receipt.

2.23 In the case of pension payments, this is a straightforward matter of returning the amount of the pension received and being liable to taxation at an individual’s marginal tax rate.

2.24 In the case of lump sum payments, the tax treatment is more complex and the tax consequences may not be consistent across different people. In some cases, the entire amount of the lump sum payment would be taxable, some cases would involve partial taxation and in other cases the entire amount would be exempt.

2.25 While a transfer to a New Zealand superannuation scheme may not intuitively be considered a receipt of funds, it should be noted that potential taxation also applies when the individual has transferred the lump sum directly to another superannuation scheme. For tax purposes, a transfer is deemed to be a disposal of the individual’s interest in the original superannuation scheme and a purchase of rights in the new superannuation scheme. A transfer to another scheme is therefore a taxable event akin to a withdrawal that is subsequently reinvested.

2.26 The disparity in tax treatment arises because the question of whether the pension or lump sum payment constitutes taxable income depends on which of the “general” tax rules apply. This involves an investigation into the underlying legal structure of the vehicle or arrangement in which the savings are held. For example, if the scheme is structured as a company then the amount received will generally be a dividend and therefore taxable at the individual’s marginal tax rate. To the extent that rules deeming the dividend to be capital (the “available subscribed capital rules”) apply, the amount will not be taxable.

2.27 Moreover, determining the amount to be taxed requires people to not only understand the underlying corporate nature of the scheme, but in some cases to have access to sufficient information about their total capital contributions to the scheme in order to calculate the non-taxable component of the distribution.

Interests in foreign life insurance schemes

2.28 Investments in life insurance schemes often have a savings element. In general, tax on foreign life insurance schemes is returned under the CV method. Officials are not aware of concerns regarding the current taxation of foreign life insurance.

Current taxation of foreign superannuation

Why review the rules for taxing foreign superannuation?

2.29 Officials are concerned that the current rules for taxing foreign superannuation are complex, inconsistent, and lacking in overall cohesion.

2.30 A key problem is that two different sets of rules (either the FIF rules or the “general” tax rules) potentially apply to an individual’s foreign superannuation interest. This creates a number of difficulties.

2.31 As noted previously, various exemptions from the FIF rules for foreign superannuation were introduced for a number of policy reasons. People with foreign superannuation must determine whether they are exempt from the FIF rules or not, which can be very difficult.

2.32 Applying the FIF rules to foreign superannuation can be problematic. The FIF rules can be complex for people to understand and comply with. The rules apply regardless of whether an individual has received any distributions from the scheme, potentially creating cashflow problems. It can be technically difficult to apply the FIF rules to certain superannuation schemes (such as defined benefit schemes), for which the valuation of the investment for FIF purposes can be uncertain. In addition, accrual taxation is inconsistent with how most other countries tax superannuation, which normally occurs on distribution. This mismatch can create problems in coordinating the timing of tax payments and foreign tax credits with the treatment in other jurisdictions.

2.33 An individual’s overall tax liability can vary significantly based on whether the FIF rules apply or, alternatively, whether the final distribution is taxable under the “general” tax rules. The FIF rules may tax a deemed return on the investment. In contrast, if the final distribution is instead taxable, the entire amount (less capital, when this is allowed) is typically taxable at an individual’s marginal tax rate. The extent to which the amount is taxed will generally depend on the underlying legal structure of the scheme.

2.34 The taxation of lump sum receipts from foreign superannuation interests under the “general” tax rules presents particular difficulties. As mentioned, depending on the legal structure of the scheme and the information available, all of the lump sum could be taxable at an individual’s marginal rate. On the other hand, an individual may have partial or no taxation on the amount of the distribution.[2] Applying these rules imposes high compliance and administrative costs and does not seem to result in fair outcomes across people in similar circumstances.

2.35 To some extent these concerns, particularly the tax treatment of lump sums, have become more pressing over time. In the past, it was either too difficult, too expensive or indeed prohibited under the scheme rules or other countries’ laws to transfer superannuation to New Zealand. Accordingly, at the time the exemptions from the FIF rules were originally introduced, little consideration was paid to the tax treatment of lump sum payments or transfers.

2.36 Contrary to earlier expectations, there have been significant numbers of lump sum transfers made from foreign superannuation schemes since the exemptions from the FIF rules were introduced. Such transfers were most recently facilitated by the United Kingdom rules for interests in superannuation schemes held by non-residents. In many cases, this effectively meant that the FIF rules applied because, by definition, the schemes are not locked-in.

2.37 As a result, people to whom the FIF rules apply are broadly taxed on the return from the scheme for the years in which they are New Zealand-resident. However, these people have an annual obligation to return income under the FIF rules until such time as a transfer is actually made, which can be problematic from a compliance perspective.

1The FDR method generally applies when a market value for the interest is available. The cost method may be used when a market value for the interest is not available.

2In most cases, partial or no taxation can occur only when the interest is in a scheme which is treated as a company or unit trust for New Zealand tax purposes.