Tax minimum equity rules for foreign-owned banks

AGENCY DISCOLOSURE STATEMENT

This Regulatory Impact Statement has been prepared by Inland Revenue.

It provides an analysis of options for updating the tax minimum equity rules for foreign-owned banks, to reflect changes in the commercial and regulatory banking environment, and ensure that the appropriate amount of tax is paid in New Zealand.

The existing rules envisage regular review, taking into account changes in regulatory and market practice to ensure an appropriate allocation of equity and debt to New Zealand. Therefore, our analysis has been confined to a review of whether (because of changes in the regulatory and commercial environment) the tax minimum equity ratio for foreign-owned banks should be raised from its current percentage, rather than an overarching review of the use of a tax minimum equity ratio.

The analysis and consultation undertaken as part of our review has been subject to time constraints in order to meet Budget 2011 deadlines.

In keeping with the established process in this area, consultation has been undertaken with the New Zealand Bankers’ Association, and with some other individual banks. A key concern raised during consultation was that any increase in the minimum equity percentage should be made on a principled basis, and not merely to raise revenue. If this is not the case, it would imply that the percentage could be increased any time that the Government needed money. This perception would have ramifications for the financing structures that banks would use over the longer term and, therefore, on the cost of capital. The consultation undertaken has informed both the setting of the appropriate ratio and the transitional approach.

We carried out our review in conjunction with the Treasury, and the Treasury supports our conclusions and recommendations. We also consulted the Reserve Bank of New Zealand throughout our review process. Their independent analysis of our modelling supports the conclusions we reach.

Any increase in the tax minimum equity ratio for foreign-owned banks would be likely to impose additional tax costs on foreign-owned banks. However, we believe that the increased tax costs are justified, as our analysis shows that the amount of tax currently being paid in New Zealand by foreign-owned banks does not fairly reflect the economic reality of their banking business in New Zealand. Moreover, these increased tax costs in New Zealand would be substantially offset by reduced tax costs overseas.

There are also likely to be transitional costs for banks in restructuring their balance sheets (for example, by converting existing tax debt into tax equity) to meet the proposed requirements. However, ongoing compliance costs are minimised, as banks already have systems in place for monitoring their tax equity position under the current rules.

Any increase in the tax minimum equity ratio for foreign-owned banks may reduce the incentives for those banks to invest in New Zealand. However, our analysis shows that our recommended option would not materially influence these incentives.

None of the policy options would impair private property rights, restrict market competition, or override fundamental common law principles.

Dr Craig Latham

Group Manager, Policy

Inland Revenue

28 March 2011

STATUS QUO AND PROBLEM DEFINITION

1. The problem addressed in this Regulatory Impact Statement (RIS) is the setting of the appropriate tax minimum equity ratio for foreign-owned banks. The setting of this ratio is important for ensuring that foreign-owned banks pay an appropriate amount of tax in New Zealand.

2. Currently, foreign-owned banks operating in New Zealand are subject to a special form of thin capitalisation rule. This rule was introduced in 2005 and requires the New Zealand banking group to hold equity equal to at least 4% of its New Zealand risk-weighted exposures (RWEs). The rule prevents banks from using structures that allow excessive interest deductions against the New Zealand tax base.

3. New Zealand incorporated banks are also subject to prudential regulatory requirements, which prescribe the minimum levels of capital they must hold, to protect against insolvency in the event of bad loans or other unexpected losses. This capital is split into “tiers”, with Tier 1 capital consisting of the capital that is closest in nature to ordinary share capital. The minimum Tier 1 capital ratio is currently also 4% of RWEs. Tax equity and Tier 1 capital are generally defined in the same way, with similar instruments (such as common equity) being included in both. However, there are a number of important technical differences, which must be borne in mind when comparing the tax and regulatory amounts of equity.

4. The prudential requirements are based on the “Basel” frameworks, which are applied in many countries. The Basel Committee on Banking Supervision has recently recommended an increase in the minimum Tier 1 capital ratio to 6%, as part of a number of changes proposed under the Basel III framework. The Reserve Bank of New Zealand (RBNZ) will be consulting with the banks regarding the implementation of Basel III in New Zealand. The New Zealand Bankers’ Association (NZBA) expects an increase from 4% to 6% to occur, and that this will happen sometime between January 2013 and January 2015.

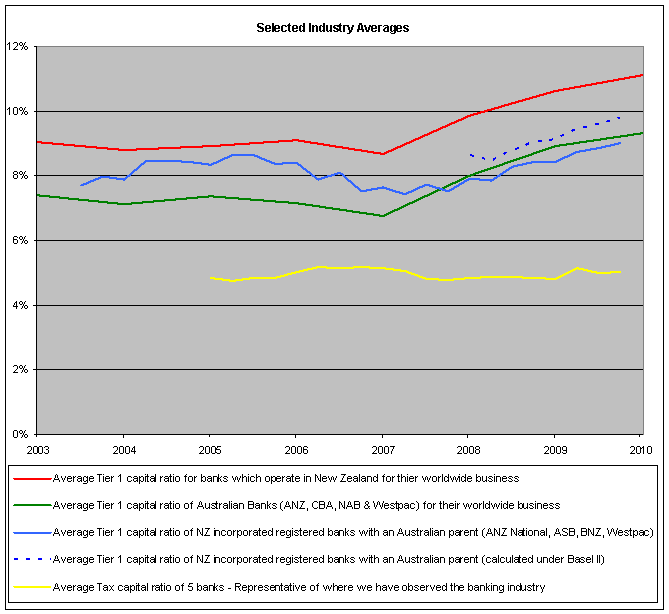

5. As illustrated in the following graph, in recent times (post-financial crisis of 2008), the banks operating in New Zealand have been maintaining higher Tier 1 capital levels than they were pre-financial crisis.

6. This increase is partly explained by the anticipation of higher prudential regulatory ratios, but officials understand that there has also been a fundamental reassessment by markets of the amount of capital that financial institutions must hold.

7. However, as also illustrated on the above graph, the average tax equity ratio has remained close to the prescribed minimum of 4% of RWEs. The primary reason why the average tax equity ratio has remained relatively stable, while average Tier 1 capital ratios have been increasing, is the use of holding company structures in New Zealand. Holding company structures are ignored for New Zealand regulatory purposes but are included for tax purposes. This allows the operating bank (the prudentially regulated entity) to be equity funded by the holding company, while the holding company is partially funded by debt. This enables the holding company to take interest deductions on a portion of the “capital” and thereby pay less tax in New Zealand.

OBJECTIVES

8. The desired Government outcomes are to ensure that:

- the amount of tax paid in New Zealand by foreign-owned banks reflects the economic reality of their banking business in New Zealand, and

- there is continued stability in the banking sector in New Zealand.

REGULATORY IMPACT ANALYSIS

9. The existing rules envisaged regular review, taking into account changes in regulatory and market practice to ensure an appropriate allocation of equity and debt to New Zealand. Therefore, the options considered do not involve an overarching review of the use of a tax minimum equity ratio to prevent excessive interest deductions against the New Zealand tax base. Instead, the review focuses on whether, because of changes in the regulatory and commercial environment, the tax minimum equity ratio for banks should be raised from its current level of 4% and, if so, to what level. Consequently, the options considered in this RIS are different tax minimum equity percentages and transitional approaches.

New threshold options

10. The following table outlines a range of tax minimum equity percentages that could be chosen. For each of these thresholds, the table shows the additional capital that would be required in aggregate by foreign-owned banks, the aggregate reduction in interest deduction, and the estimated increased tax revenue per annum resulting from the increased equity. All of these figures assume that the banks would hold a 0.5 percentage point buffer over the threshold.

| New Threshold | Actual % Equity Held | Additional Capital Required ($ million) | Reduction in Interest Deduction ($ million) | Increased Tax per annum ($ million |

|---|---|---|---|---|

| 4.5% | 5.0% | 34 | 2 | 0 |

| 5.0% | 5.5% | 556 | 28 | 8 |

| 5.5% | 6.0% | 1,391 | 70 | 19 |

| 6.0% | 6.5% | 2,225 | 111 | 31 |

| 6.5% | 7.0% | 3,060 | 153 | 43 |

| 7.0% | 7.5% | 3,894 | 195 | 55 |

| 8.0% | 8.5% | 5,781 | 289 | 81 |

11. In setting the percentage in 2005, worldwide Tier 1 capital ratios were taken as a starting point. At the time, worldwide Tier 1 ratios were, on average, 7% to 8% for the main banks. This was then discounted to take account of surplus capital held by the parent banks, non-bank business equity, and the use of hybrid instruments (equity-like debt instruments). This took the rate to less than 6%.

12. However, other factors were also taken into account, which further lowered the appropriate percentage. These factors included the potential for disruption to the banking industry if further capital was required to support the New Zealand business, robustness over the business cycle and across different banks in different commercial situations, and the fit with the broader trans-Tasman relationship and the economic and revenue impacts.

13. It was also felt that the use of an external statutory benchmark would avoid the perception of arbitrariness that could attach to a percentage that had no such linkage. As such, it reduced the potential uncertainty for the banks as to the future tax consequences of their long-term financing decisions.

14. In the end, it was decided that on balance a ratio of 4% was appropriate, the same as the regulatory minimum.

15. The considerations taken into account in setting the percentage in 2005 remain relevant today. For comparisons with the tax minimum equity ratio, the relevant regulatory equity concept is Tier 1 capital held by the consolidated Australian banks. Tier 1 capital levels currently average over 8.5%, and have been growing over the last 24 months. Tier 1 capital levels for the New Zealand incorporated banks average over 9%. However, some instruments that would not be included in equity for tax purposes are included in the regulatory capital, so these figures are not directly comparable to the tax minimum equity percentage. To the extent to which such instruments give rise to tax deductions, they are already excluded from equity for purposes of the minimum equity calculation in New Zealand. Accordingly, the above figures would need to be adjusted downward for comparative purposes. Overall, the increase in capital has raised capital ratios by 1 to 1½ percentage points from 2005 levels.

16. The regulatory requirements are likely to change in the near future, following a process of consultation between the RBNZ and the banking industry. As noted above, the NZBA expects that the minimum Tier 1 capital ratio will be increased from its current level of 4% to 6%, an increase of 2 percentage points. This increase has been anticipated and banks are already preparing for it, holding more than the current regulatory minimum even though the financial crisis has eased.

17. Based on these increases, applying the policy parameters underlying the 2005 decisions would imply an increase in the minimum equity percentage of between 1 and 2 percentage points. Given the advantages of basing the tax percentage on the regulatory percentage, our preferred option is an increase in the tax minimum equity percentage to 6%.

18. Setting the tax minimum equity percentage for foreign-owned banks above the regulatory minimum has been considered, but is not recommended by officials, particularly because of the increased likelihood that banks’ regulatory capital would be insufficient to meet the tax requirement at these higher levels. As well as potentially creating practical problems for banks in obtaining additional tax capital, a higher tax minimum equity percentage may have an appearance of arbitrariness. This could suggest to foreign-owned banks that the percentage may again be increased at any time in the future as a revenue raising measure, which could be destabilising to the banking industry in New Zealand.

19. The wider economic impact of increasing the tax minimum equity percentage must also be considered. We have carried out modelling of the effect of increasing the tax minimum equity ratio on banks’ cost of capital or the cost of borrowing in New Zealand. Our modelling shows that a rise in the threshold to 6% would have only a minimal impact, requiring a rise in lending interest rates of less than 2 basis points in order to maintain shareholder returns. The primary reason that the impact on lending costs in New Zealand would not be significant is because the increased tax in New Zealand would be substantially offset by reduced tax in Australia.

Transitional options

20. As Ministers wished to announce any increase in the tax minimum equity percentage as part of their Budget 2011 package, options considered included application from either:

- 1 July 2011

- 1 April 2012, or

- at the same time as the anticipated changes under Basel III.

21. Regarding transitional approaches, officials considered both a one-off rise and a staggered rise to the chosen new threshold. A staggered approach would involve increasing the tax minimum equity percentage incrementally over a specified timeframe until it reached the desired level. A myriad of permutations would be possible due to the number of variables involved (including the desired eventual new threshold, and the length of time over which the staggering would occur). Staggering would mean that the aggregate additional capital required by foreign-owned banks would increase incrementally.

22. The following table provides an example of the use of a staggered rise to a new threshold. It illustrates the effects of a staggered rise of the tax minimum equity threshold from 4% to 6% from 1 July 2011 to 31 March 2013. The threshold is increased in six-monthly increments of 0.5 percentage points over the period. For each quarter, the table shows the aggregate additional capital required, the reduction in interest deduction, and the estimated increase in tax. The increased tax is then aggregated for fiscal years.

| Quarter Ended | New Threshold | Actual % Equity Held | Additional Capital Required ($ million) | Reduction in Interest Deduction ($ million) | Increased Tax ($ million) | Annual Tax Increase Year ended 30 June ($ million) | |

|---|---|---|---|---|---|---|---|

| 30-Sep-2011 | 4.5% | 5.0% | 34 | 0 | 0 | 30-Jun-2012 | 4 |

| 31-Dec-2011 | 4.5% | 5.0% | 34 | 0 | 0 | ||

| 31-Mar-2012 | 5.0% | 5.5% | 556 | 7 | 2 | ||

| 30-Jun-2012 | 5.0% | 5.5% | 556 | 7 | 2 | ||

| 30-Sep-2012 | 5.5% | 6.0% | 1,391 | 17 | 5 | 30-Jun-2013 | 25 |

| 31-Dec-2012 | 5.5% | 6.0% | 1,391 | 17 | 5 | ||

| 31-Mar-2013 | 6.0% | 6.5% | 2,225 | 28 | 8 | ||

| All subsequent quarters | 6.0% | 6.5% | 2,225 | 28 | 8 | ||

| All subsequent years | 31 | ||||||

23. As mentioned above, there are myriad permutations of using a staggered approach to raising the tax minimum equity percentage. The above table is but one example. However, it allows for some general observations to be made. Use of the staggered approach means that the annual increase in tax paid rises gradually over the transitional period. Therefore, the longer the transitional period, the longer before the annual estimated increase in Crown revenue reaches its maximum.

24. The use of a staggered approach makes more sense the nearer in time the application date of the new tax minimum equity requirements is. The further away in time the application date is, the more sense it makes to just have a one-off increase in the tax minimum equity percentage, as banks would have more time to convert debt into equity.

25. When considering what the application date should be, officials were mindful that the banks would need sufficient time to make the necessary adjustments to their balance sheets. This may involve the conversion of existing tax debt into tax capital. For some banks, this debt is long-term third party debt.

26. When officials decided on a threshold of 6% as their preferred option, the decision as to the implementation approach became easier. The higher the new threshold, the more time banks would need to make the necessary adjustments, which would influence our choice of preferred implementation approach. A later application date and/or use of a staggered approach would be more appropriate the greater the rise in the threshold. At the relatively small rise to 6%, particularly with a later application date, we considered that staggering was unnecessary.

27. For a new threshold of 6%, our preferred option would be an application date of 1 April 2012 without staggering. This approach (which would give banks until 30 June 2012 to bring in any additional capital required) would allow banks a reasonable amount of time to make the required adjustments, and would also allow for the legislation to go through the full Parliamentary process, including the Select Committee stage.

28. This approach would be expected to raise approximately $8 million of additional tax revenue in the 2011/12 fiscal year and $31 million in each subsequent fiscal year, as per the following table:

| $ millions increase / (decrease) | |||||

|---|---|---|---|---|---|

| Vote Revenue Minister of Revenue | 2010/11 | 2011/12 | 2012/13 | 2013/14 | 2014/15 |

| Crown Revenue and Receipts: Tax Revenue | - | 8.000 | 31.000 | 31.000 | 31.000 |

29. For a new threshold of 6%, we also considered an application date of 1 July 2011 without staggering. This approach would be expected to raise approximately $31 million of additional tax revenue in the 2011/12 fiscal year, and the same in each subsequent fiscal year, as per the following table:

| $ millions increase / (decrease) | |||||

|---|---|---|---|---|---|

| Vote Revenue Minister of Revenue | 2010/11 | 2011/12 | 2012/13 | 2013/14 | 2014/15 |

| Crown Revenue and Receipts: Tax Revenue | - | 31.000 | 31.000 | 31.000 | 31.000 |

30. Although this approach would raise more revenue in the 2011/12 fiscal year, officials do not recommend this approach, because of the short notice it would give the banks, and the potential problems some banks may face in quickly making the necessary adjustments to their balance sheets. Also counting against this approach is the fact that it would not allow for the legislation to go through the full Parliamentary process.

31. We also considered an application date coinciding with the expected implementation of Basel III in New Zealand. Such an approach would mean that it would take longer before tax revenue increased. We do not recommend this approach, as we consider that the tax minimum equity rules have a different purpose to the regulatory rules and, therefore, an explicit linkage in application date is not appropriate. Officials’ view is that the tax minimum equity ratio is already too low at present, given the level of Tier 1 capital currently being held by banks.

CONSULTATION

Banking industry consultation

32. In late October 2010, officials wrote to the affected banks, advising them that the Government intended to explore some issues with the minimum equity rules for banks—in particular, whether the current 4% threshold for minimum equity was still the appropriate percentage. We indicated in our letter that we wanted to get their input into any possible changes, and that we would be in contact with them to see if they wanted to meet to discuss the issues.

33. In November 2010, Inland Revenue and Treasury officials released an issues paper on banking minimum equity, for the purposes of consultation between the banking industry and tax policy officials.

34. In early December 2010, officials again wrote to affected banks. Officials set out, in more detail, the issues with the existing bank minimum equity rules, and asked the banks for their feedback on the following questions:

- Do you agree that the gap between actual capital and tax capital was widened?

- Do you consider a 20% discount to take account of surplus capital, hybrids and other non-banking business to be a useful rule of thumb?

- What would you consider the impact of increasing the minimum equity ratio to the range of 7% to 8% would be in terms of capital and tax paid at the New Zealand entity and banking group level? Would there be any other impacts?

- If the rules were to be changed, what would your expectations be regarding transitional arrangements?

- Are there any other issues which you believe should be taken into account?

35. Further correspondence was exchanged and meetings were held between officials and the NZBA, and some other individual banks, between late November 2010 and late February 2011.

36. As a result of this consultation, the NZBA raised a number of issues, including the impact on the cost of capital and the perceived stability of the New Zealand taxing environment as banks make long-term financial commitments to New Zealand.

37. The NZBA’s key concern was that any increase in the minimum equity percentage should be made on a principled basis, and not merely to raise revenue. If this is not the case, it would imply that the percentage could be increased any time that the Government needed money. This perception would have ramifications for the financing structures that banks would use over the longer term and, therefore, on the cost of capital. Accordingly, the NZBA suggested that the tax minimum equity requirement be linked explicitly with the minimum regulatory requirement.

38. The banks have also expressed concerns about the level at which the tax minimum equity percentage is set. The strong message is that any increase above 6% would be problematic for banks.

39. Another key concern expressed by banks was about the timing of the changes to the tax minimum equity requirements. They emphasised that it will take time for banks to put extra tax capital into their New Zealand balance sheets. This is because it may involve converting some of their existing tax debt (which for some banks is long-term third party debt) into tax capital. Banks have also suggested that the tax changes should coincide with the changes under Basel III.

40. Feedback received through consultation has helped officials in arriving at their preferred option. Officials’ preferred option is for the change not to apply until the quarter beginning 1 April 2012, which would give banks until 30 June 2012 to bring in any additional capital required.

Intra-governmental consultation

41. Inland Revenue officials have carried out their review of the tax minimum equity ratio for foreign-owned banks in New Zealand in conjunction with Treasury officials. The Treasury concurs with our conclusions and recommendations.

42. Officials have maintained close consultation with the RBNZ throughout the review process.

43. RBNZ officials have emphasised their position that the regulatory regime in New Zealand is not designed to provide protection for the New Zealand tax base.

44. RBNZ officials were also consulted about the potential impact on the banking sector of raising the tax minimum equity percentage. RBNZ officials concur with Inland Revenue modelling, which shows that an increase in the percentage to 6% is likely to have only a minimal impact on banks’ cost of capital or the cost of borrowing in New Zealand.

CONCLUSIONS AND RECOMMENDATIONS

45. Officials recommend increasing the tax minimum equity percentage for foreign-owned banks from 4% to 6% from 1 April 2012.

46. Officials do not recommend raising the tax minimum equity percentage any more than the increase in the regulatory minimum, particularly because of the increased likelihood that banks’ regulatory capital would be insufficient to meet the tax requirement at these higher levels.

47. This option allows banks sufficient time to organise the extra capital required, which was a major concern raised by banks during consultation.

IMPLEMENTATION

48. The proposed option, which requires legislative change, would be included in the August 2011 Bill. This would allow the legislation to go through the whole Parliamentary process, including the Select Committee stage. The change would apply for the quarter beginning 1 April 2012, which would give banks until 30 June 2012 to bring in any additional capital required.

49. We expect any additional administrative costs to be minimal, as the proposal involves only a change to the existing tax minimum equity percentage for a small group of taxpayers. Monitoring of the level of tax paid and banks’ compliance with the rules already occurs.

50. Banks are expected to incur initial compliance costs in restructuring their balance sheets (for example, by converting existing tax debt into tax equity) to meet the proposed requirements.

51. Ongoing compliance costs are minimised, as banks already have systems in place for monitoring their tax equity position under the current rules.

MONITORING, EVALUATION AND REVIEW

52. In general, Inland Revenue’s monitoring, evaluation and review of new legislation takes place under the Generic Tax Policy Process (GTPP). The GTPP is a multi-stage tax policy process that has been used to design tax policy in New Zealand since 1995. The final stage in the GTPP is the implementation and review stage, which involves post-implementation review of the legislation, and the identification of any remedial issues. Opportunities for external consultation are also built into this stage. In practice, any changes identified as necessary for the new legislation to have its intended effect would generally be added to the Tax Policy Work Programme, and proposals would go through the GTPP.

53. We would continue to monitor the tax equity ratio maintained by banks and the amount of tax paid in New Zealand. If it became apparent that the amount of tax being paid in New Zealand by foreign-owned banks no longer fairly reflected the economic reality of their banking business in New Zealand, we may revisit the tax minimum equity rules for foreign-owned banks, and any proposals for change would again go through the GTPP.