Simplifying filing requirements for individuals and record-keeping requirements for businesses

AGENCY DISCLOSURE STATEMENT

This Regulatory Impact Statement has been prepared by Inland Revenue.

The problem that this statement addresses is the increasing number of contacts with taxpayers that Inland Revenue is required to process. Along with an increase in volume, there has been an increase in the complexity of these contacts.

This statement provides an analysis of options to transform the way in which Inland Revenue delivers its services and with a view to reducing contacts. A major focus of the policy project has been to examine ways in which Inland Revenue can administer its responsibilities in a more efficient manner. The proposed approach adopts electronic services as the main method of service delivery and seeks to reduce compliance costs for businesses and individuals.

The increase in contacts has been driven by a number of policy settings, such as the requirement for social policy recipients to file a tax return. Also driving this increase is the current ability for certain taxpayers to access refunds of over-deducted PAYE without having the reciprocal requirement to pay under-deducted PAYE. Although the proposals are intended to reduce these contacts, the extent to which they do this can be established only once they are made operational.

The most significant dependency of the analysis is the ability of Inland Revenue to deliver significant operational change, particularly given its commitment to other major changes such as student loan redesign and the child support review. The design and information technology commitments to these two projects mean that there is limited ability for Inland Revenue to deliver other initiatives in the short to medium term. As a consequence, design and implementation of the proposals would be staggered from July 2011, with full implementation occurring 1 April 2015.

The analysis summarised in this document has been the subject of public consultation via a Government discussion document and associated online forum, Making tax easier, released in June 2010. The proposals have been developed in light of the feedback received, and they strike a balance between the concerns raised in the submissions and the efficiency of tax administration. As the proposals were developed, more focused consultation was carried out with key selected stakeholders and interest groups. This feedback was also reflected in the policy design.

The recommended policy proposals are intended to reduce compliance costs for businesses and individuals. They do not impair private property rights, although one of the proposals may reduce the net amount of refunds. They may also affect the business of the personal tax intermediary market, as one of the proposals will impact on the current business model used by these firms by reducing the net amount of refunds by requiring returns to be squared across four years. The policy proposals recommended do not override fundamental common law principles.

Dr Craig Latham

Group Manager, Policy

Inland Revenue

25 July 2011

STATUS QUO AND PROBLEM DEFINITION

1. The problem that this Statement addresses is that Inland Revenue’s increasing number of contacts with taxpayers and the resulting processing is creating pressure on the administration of the tax system. The increase in contacts is due in part to the expansion of Inland Revenue’s responsibilities into social policy administration through initiatives such as KiwiSaver, student loans, Working for Families tax credits and child support. Businesses and individuals find tax processes time-consuming and uncertain.

2. At a high level, the underlying causes of the problem can be categorised as the following:

- Lack of certainty, due in large part to frequent changes to the tax rules: Although this is generally due to changes in Government policy, and is typically accompanied by public consultation, the frequency of tax changes has led to substantial increases in the number of taxpayers who require assistance from Inland Revenue.

- Meeting the expectations of taxpayers: As the volume of tax returns and queries increases with changes to policy and the expansion of Inland Revenue’s responsibilities, service delivery standards necessarily come under pressure. This expansion has also increased the expectations that taxpayers have of Inland Revenue. Because of the heavy reliance on paper (with around 26 million letters per year being sent to taxpayers), Inland Revenue’s response times have come under pressure.

- System integrity: Inland Revenue’s FIRST computer system has been substantially added to and modified as a result of policy change, which has added to the pressure on the core strengths of New Zealand’s tax system. It is integral to taxpayer trust that tax administration systems do not fail.

3. These problems are exacerbated by:

- Inland Revenue’s systems are designed to be as accurate as possible with minor variations generally netting out over time. For PAYE, deductions are based on current rates, and the annualising of the pay amount for individual pay periods may be out of line with individuals’ annual income tax liabilities on their employment income (ignoring social assistance) in various situations. However, for PAYE, refunds can occur in a number of circumstances such as:

- when individuals enter employment part way through the year,

- have PAYE deducted at the non-declaration rate because they have not yet obtained an IRD number and tax code,

- have deductions made at the incorrect code for whatever reason (including employer error),

- change jobs during a year at different rates of pay,

- have lumpy income (those in part time or casual employment based on hourly pay rates, where the amount may vary considerably from pay period to pay period),

- hold more than one job at a time,

- receive extra pays, and

- do not earn uniform amounts of employment income in each pay period throughout a full tax year, for whatever reason, when personal tax rates change during the year.

- Large numbers of individuals self-select to file an income tax return or receive a personal tax summary (also known as an income statement) in years in which they are due a credit. This has resulted in a significantly increased workload for Inland Revenue as people re-enter the annual filing system. This is in large part due to the ability of taxpayers to choose to file only when they are due a refund and not in years when they have tax to pay.

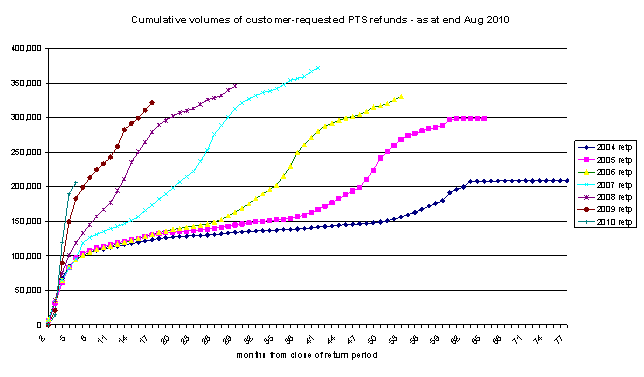

- The graph below shows the increase in customer-requested personal tax summaries. In 2004, it took 60 months (from the close of return period) for the volume of self-selected personal tax summaries to reach 200,000. In 2008, it took only 14 months to reach this level.

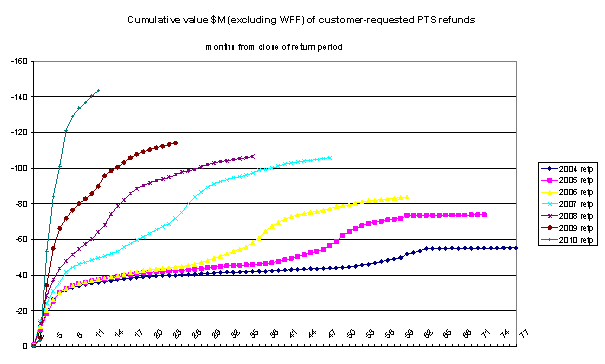

- The ability for some taxpayers to access refunds of over-deducted PAYE, but not pay their under-deducted PAYE, has resulted in a situation where large amounts of revenue are being paid out, without a reciprocal obligation on taxpayers to pay potential shortfalls as evidenced in the graph below.

- The requirement of people who interact with social policy programmes to file a tax return has also contributed to the increase in the volume of contacts. For example, large numbers of Working for Families tax credits recipients are required to file an income tax return because they receive these tax credits. However, all that is needed to assess their entitlement is their income and family details, rather than the amount of tax they have paid.

- Electronic filing needs to be streamlined to remove the barriers that are currently discouraging businesses and individuals from using it. Specifically, some of the barriers that we can address immediately are:

A person who carries on business or derives income in New Zealand must also keep sufficient records in New Zealand. This is a problem for the increasing number of taxpayers who are choosing to use payroll or accounting software that uses offshore data storage. The Commissioner of Inland Revenue’s discretion to exempt this requirement only extends to a “person”, and this means that each individual needs to seek the exercise of discretion. Requiring individual applications for exemption is increasingly impractical given the rise in use of offshore data storage.- When information in a taxpayer’s return has been provided to Inland Revenue electronically, the taxpayer is required to retain a paper copy of the information for seven years. Similarly, other information that is submitted electronically also needs a hard-copy transcript. To ensure consistency with policy objectives in the Electronic Transactions Act 2002, which in essence provides that the existence of readable and reliable electronic copies would satisfy a requirement to retain paper copies, this requirement needs to change.

4. The proposals have also been developed in light of submissions received on a Government discussion document and online forum, Making tax easier, which was released in June 2010.

OBJECTIVES

5. The desired Government outcome is to have a tax administration that delivers value-for-money services and is sufficiently flexible to change and grow. This is in line with the Government’s six economic policy drivers, one of which is a world-class tax system.

6. The options have been assessed against the following objectives:

(1) they reduce tax compliance obligations for individuals and/or businesses,

(2) they facilitate a move to using electronic services as the main form of service delivery by Inland Revenue, and

(3) they are fair and equitable.

7. The move to electronic services is important because it is Inland Revenue’s preferred method of delivery to deal with the increasing number of contacts with taxpayers. These services are in line with the expectations of taxpayers and would increase Inland Revenue’s agility and flexibility. They would also potentially decrease the number of contacts, and make those contacts quicker and easier to deal with and lead to efficiency savings in the future.

REGULATORY IMPACT ANALYSIS

8. Two streams of policy initiatives have been developed to address the policy problems outlined above. These two streams can be broadly broken down into those that relate to individuals and those that relate to businesses.

9. Our preferred options are:

Individuals

- Require taxpayers who self-select to file an annual return (either an IR 3 or PTS) to be squared up across the previous four income tax years (Option 3).

- Remove the requirement for Working for Families tax credit recipients to file an income tax return (Option 5).

- Amalgamate the two major income tax return forms (that is the IR 3 and the PTS) and replace them with one consolidated web-based income tax return form (Option 7).

- Move to the use of electronic services as the primary mode of service delivery, using a phase-in approach (Option 11).

Businesses

- Allow the Commissioner of Inland Revenue to authorise, and also revoke permission for, certain “classes of persons” to keep their records outside of New Zealand (Option 13).

- Remove the requirement for taxpayers who submit electronic returns or information to Inland Revenue to retain paper copies (Option 14).

| Option | Negatives | Positives | Consultation | Net impact | Implementation issues |

|---|---|---|---|---|---|

| INDIVIDUALS | |||||

| Options for reducing the number of taxpayers required to file an income tax return | |||||

| 1. Make PAYE full and final at the point of deduction for employees in stable employment for 11 or more months in the year. | Taxpayers in stable employment for 11 or more months per year and who have PAYE over-deducted, would not be able to get the over-deducted PAYE refunded to them. Many taxpayers may disagree with this (as seen in consultation) mainly due to the potential for error in the PAYE system. If there was an exemption from this rule for major over-deductions, this could be difficult to define and to administer. |

Major administrative efficiencies for Inland Revenue (528,000 people would be taken out of the annual filing system). See the Making tax easier discussion document, paragraph 7.10. Gives certainty to taxpayers, as large numbers would not be required to file. Taxpayers who have been sent tax bills for small amounts of under-deducted PAYE would no longer be required to pay these amounts. Addresses the problem of cherry picking (filing only in the years in which one is due a refund) to an extent. Will increase Crown revenue to a moderate extent, but moreso than Option 3. |

Public consultation took place via the Making tax easier discussion document and online forum. Feedback was generally against this proposal. Submitters felt that it was too arbitrary, and that taxpayers have a right to file a return and get any over-deductions refunded to them. Feedback also argued that there is too much potential for over-deduction in the PAYE system, and as long as this is the case, this option should not be progressed. |

528,000 taxpayers would no longer be able to file a tax return at the end of the income year. Moderate increase in Crown revenue. Efficiency gains to Inland Revenue (due to lowered contacts). |

Potential pressure from taxpayers for refunds could make this difficult to administer in a consistent way. Difficulty in assessing what makes a major over-deduction. Potential for employers to consistently under-deduct PAYE, leading to large-scale under-payment of PAYE and income tax. May push some taxpayers out of the PAYE system and into receiving cash payments which are not subject to withholding tax payments. System updates required. |

| 2. Set a de minimis amount for refunds, below which refunds would not be paid out (e.g. $50). | Very difficult to set an acceptable level, as any amount of refunded PAYE may be valuable to taxpayers, especially those on low incomes. Fairness and equity – any amount of over-deducted PAYE should be refunded to its rightful owner. |

Simple to administer. Recognises the cost and difficulty of processing large volumes of small-value refunds. Counteracts the cost of processing these small refunds. |

This option was suggested by several submitters in response to the consultation on Option 1 (above) in Making tax easier. |

327,000 taxpayers would no longer be able to file (see the Making tax easier discussion document, paragraph 7.6). Results in some Crown savings. |

Some potential for employers to under-deduct PAYE to the extent of the de minimis. Increased contacts, as individuals try to confirm the amount of their return. System updates required. |

| 3. Require taxpayers who self-select to file to be squared up across the previous four years. | Removes the ability for taxpayers to file only in the years that they are due a refund (i.e. cherry pick), but arguably this is a fairer outcome. Does not have the same degree of administrative savings as Option 1 may have. Initially, the amount of refunds being released may increase, as taxpayers would be required to square up in years that they may not have otherwise. |

This option is the best at addressing the problem of cherry picking refunds. Would result in presently unpaid terminal tax being paid or offset against refunds. Requires taxpayers to choose either accuracy of tax paid, or administrative efficiency. Results in Crown revenue savings of $66 million over ten years. |

This option was developed in light of the responses received in the Making tax easier consultation. Retains the ability for taxpayers to file a return if they wish to, something that came across in submissions as being important to taxpayers. |

No taxpayers would be prevented from filing, but those that are not required by law to file, would need to file for the previous four years. Results in some Crown savings (approx. $27 million per year). |

Communicating the change to taxpayers, particularly that the rule would be phased in over several years. Minimising administrative pressure would depend on the uptake of electronic services being successful. Potential operational pressure of ensuring that all taxpayers who self-select also do so for the previous four years. Potential for taxpayers to try to “game” the system by attempting to bring themselves within the requirements to file. System updates required. There may be confusion from a customer perspective about what their final tax position actually is. |

| 4. Retain the status quo, regarding the filing requirements of individuals. | Allows taxpayers flexibility to file only in the years where they are due a refund (cherry pick). Large numbers of taxpayers who do not have to file are doing so anyway, which has resulted in large numbers of taxpayers being brought back into the system unnecessarily. This increase in taxpayers filing causes pressure on the system. |

Taxpayers understand the current system. |

Public consultation via the Making tax easier discussion document and online forum. The feedback received was mostly concerned with the ability for taxpayers to file and get back any potential over-deductions, which is something this option provides. |

No taxpayers would be precluded from filing. Taxpayers would still be able to cherry pick refunds. No revenue savings for the Crown and no efficiency gains to Inland Revenue. |

Large pressures on the system and resources, which have been caused by significant increases in recent years of taxpayers self-selecting to file (taxpayers who are not required to file but choose to anyway). This has largely been facilitated by personal tax summary intermediaries (PTSIs). See graphs on pages 2 and 3. |

| 5. Remove the requirement for Working for Families tax credits recipients to file an income tax return. | This group would not have to pay terminal tax in the years that they are under-deducted; however, they also would not be automatically refunded over-deductions. If the customer wants an overpayment of PAYE refunded, they would now fall into the four-year square up criteria and have to elect into the system. |

Reduces the tax compliance obligations for this group by giving them a choice of whether to file or not. This group would not have to pay terminal tax in the years that they are under-deducted; however, they also would not be automatically refunded any over-deductions. Potential for some revenue savings to the Crown of approximately $10 million per year The exact amount of revenue savings will differ according to whether large numbers in this group continue to file. Gives this group equality with other taxpayers, as they now have the choice to file. |

This option has not been the subject of public consultation. This option takes into account the concerns raised about the other proposals relating to individual filing, such as the importance of being able to file a tax return and be refunded any potential over-deductions. Officials have consulted with NZICA, which supports this proposal, as it reduces tax compliance for this particular group. |

Approximately 260,000 taxpayers would no longer be required to file a tax return. Results in efficiency gains to Inland Revenue, and a reduction in compliance costs for taxpayers. Results in some revenue savings for the Crown (approx. $10 million per year). |

Significant system changes required. Minimising administrative pressure would depend on the uptake of electronic services being successful. There is potential that people within this group of taxpayers may be over-deducted, and if they do not file, they would not be refunded. However, since they are currently required to file, they would be familiar with the process, and many of them may choose to continue to file. Managing people through the change in process. |

| 6. Retain the status quo whereby all Working for Families tax credit recipients are required to file a tax return. | All Working for Families tax credit recipients would be sent tax returns, which would mean that they would be required to pay terminal tax in the years when they have PAYE under-deducted. Filing a tax return is arguably unnecessary for the bulk of these people, as all that is needed to assess their entitlement is their income, not how much PAYE they have paid. |

All Working for Families tax credit recipients would be sent tax returns, which would mean that they would automatically get their refunds in years when they are due them. |

This option has not been the subject of public consultation. |

All Working for Families tax credit recipients would still be required to file. No efficiency gains, compliance cost savings or Crown revenue savings. |

There are approximately 400,000 recipients of Working for Families tax credits. Sending these taxpayers assessments and tax returns adds to the administrative burden on Inland Revenue. |

| 7. Amalgamate the two major income tax return forms (the Personal Tax Summary and the IR3). | Having a short form personal tax summary is useful for people with uncomplicated tax affairs. |

Results in less confusion about which form taxpayers are required to file. Results in less duplication of processes, as both forms require a degree of maintenance. |

This option has not been the subject of public consultation. Officials have consulted with NZICA and some representatives from the PTSI industry. Both support this option as it would reduce confusion about which tax return form to use and reduce the amount of paper they deal with on behalf of their clients. |

This should result in significant efficiency savings for Inland Revenue (approx. $6 million per year once fully implemented) and tax agents, and also potentially taxpayers. Less confusion for taxpayers regarding which form to file. As the form will be primarily web-based, it may not suit all taxpayers. However, a paper version will be available in limited circumstances. |

Would only work in a predominantly electronic environment. Any paper version of an amalgamated tax return would be long and unsuitable for sending out in large volumes. There would need to be a paper version for taxpayers who cannot use the online version, but this would function as a back-up channel only. Significant system changes required. |

| 8. Retain the status quo of two different income tax return forms for individual taxpayers (the Personal Tax Summary and the IR3). | Taxpayers are often unsure of which of the two forms they should fill in, and contact Inland Revenue for guidance, which uses up administrative resources on what should be a simple decision. Having two forms results in duplication, as any updates to personal income tax administration need to be done twice (i.e. for both forms). |

Many taxpayers are familiar with the current process. Having a short form personal tax summary is useful for people with uncomplicated tax affairs. |

Same as above. |

No efficiency gains for Inland Revenue. Taxpayers would continue to use either of the forms. |

The status quo is based on a paper delivery system and so adds considerably to the large volume of letters that Inland Revenue sends out each year. If Inland Revenue moves to an electronic environment, the current forms would need to be substantially redesigned, as they have been developed for paper. |

| 9. Mandate the use of electronic services. | Would not suit some taxpayers, which in turn may affect their ability to comply with their tax obligations. |

Would result in a high uptake of electronic services, which would give Inland Revenue administrative efficiencies. Would allow Inland Revenue to focus resources on the electronic channel. Would allow private-sector providers such as PTSIs to assist taxpayers with their filing obligations. No need for a residual paper channel. |

Public consultation via the Making tax easier discussion document and online forum. There were strong views on either side of this option. - Those who had used Inland Revenue’s current online services and were familiar with them were in support of the option. - Those who had not used these services were not in support. Many pointed out that many taxpayers may not have access to the internet or a computer, particularly older generations. They argued that Inland Revenue should maintain a paper channel for these people. The submissions from private-sector individuals and interest groups such as NZICA were overall in support of electronic services, but had reservations about making the use of them mandatory. |

All individual taxpayers would be required to file online. May result in a decrease in voluntary compliance among those unable or unwilling to file online. Would result in a high degree of administrative efficiency for Inland Revenue. |

This may push some people into simply not complying with their tax obligations if they cannot file online. It may result in high demand on Inland Revenue’s call centre if large numbers of taxpayers need support to use the online services. It could pose issues regarding authenticating taxpayers and ensuring security online, such as keeping taxpayer details secret and secure. |

| 10. Apply a digital border and charge for the submission of paper returns. | Cost may be prohibitive for some taxpayers, leading them to fail to comply with their filing obligations. Difficult for taxpayers who do not have access to computers and therefore have no reasonable alternative to filing paper returns. |

Would result in a high uptake of electronic services, which would give Inland Revenue administrative efficiencies. Would allow Inland Revenue to focus resources on the electronic channel, instead of trying to spread resources across several channels. May open up tax compliance services to the private sector. |

This option has not been the subject of public consultation. |

Taxpayers who file paper returns would need to pay a fee in order to submit their return in this manner. Some private sector businesses may provide this as a service for a fee. It would result in high uptake of electronic services, which in turn would result in efficiency savings for Inland Revenue. May discourage voluntary compliance among taxpayers who cannot file online and are unwilling to pay to submit a paper return. |

This may push some people into not complying with their tax obligations if they find the cost prohibitive and they cannot file online. Inland Revenue would need to be careful to manage the relationship with any private-sector providers to ensure quality and that appropriate safeguards are in place for dealing with taxpayer information. It is unclear how or by whom the data would be validated before being submitted to Inland Revenue. Managing the quality of services provided by the private sector. |

| 11. Move to “e” via a phase-in approach. | May not suit all taxpayers, particularly those who do not have access to computers or are unfamiliar with them. |

Allows time for Inland Revenue and taxpayers to adjust to the change. Allows Inland Revenue time to support taxpayers through the change. |

This option has not been the specific subject of public consultation, but it has been developed in light of the submissions that have been received on Option 8. Officials have consulted with NZICA and some representatives from the PTSI industry. NZICA supports this option, but acknowledge that the services must be fit for purpose. The PTSIs support this option, as it should reduce the amount of paper they deal with on behalf of their clients, which in turn would improve their business processes. |

Would potentially result in large numbers of taxpayers using online services. If high uptake of online services, there would be significant administrative efficiencies for Inland Revenue. May not be preferred by all taxpayers. |

It would need to be managed carefully to ensure that: - There is sufficient uptake and enrolment for Inland Revenue’s e-services. - Appropriate consultation and testing is done so that it is optimised. - It is simple and easy to use. - IR internal systems are able to cope with the increase to an e-environment. - It is robust and secure. Getting most taxpayers using the services would be crucial so that Inland Revenue is not thinly spread across a range of channels. This could be difficult without mandating the use of electronic services. |

| 12. Retain the status quo whereby tax return filing is based on paper processes, with some tax filing services available online. | The heavy reliance on paper is unsuitable in the modern world, it is cumbersome, and it slows Inland Revenue’s ability to deliver policy changes. Difficult for Inland Revenue to try to maintain multiple channels. Resources are spread thinly, as there is no scope to focus on one channel. |

Suitable for taxpayers who do not have access to computers and the internet. |

This option has not been the specific subject of public consultation, but it has been considered, given some of the strong objections that were received as part of the public consultation on the move to electronic services. The submissions that were against mandating the use of electronic services were mostly concerned that there would be no back-up channel available for taxpayers who cannot use e-services. As long as there is provision for these taxpayers, a move to focusing on electronic services is probably acceptable. |

Taxpayers would not be required to file online, but would be encouraged to do so. No significant administrative efficiencies for Inland Revenue. |

Sending out the current levels of paper statements and returns could be very difficult to maintain. Also, given the increasing trend for taxpayers to self-select to file tax returns, this group is likely to get larger. |

| BUSINESSES | |||||

| Options for reducing barriers to electronic filing for businesses | |||||

| 13. Allow the Commissioner of Inland Revenue to authorise, and also revoke permission for, “classes of persons” to keep their records outside New Zealand. | Small risk that storage offshore is not as secure or as accessible as storage within New Zealand. However, this can be mitigated by administrative criteria, e.g. an application for offshore storage is still required by the Commissioner of Inland Revenue, and administrative criteria must be met. |

Administratively more simple than requiring an individual person to make applications (as is currently the case). People who use an approved data storage product and provider would not have any extra obligation than currently exists for business records. |

This issue was raised by the Software Developers Working Group (an industry group that meets with Inland Revenue officials on a regular basis), which is in favour of the proposed solution. |

This would allow software developers the ability to request an exemption from the requirement to store data within New Zealand on behalf of their clients, rather than requiring the individual business to make an application Should result in administrative efficiencies for Inland Revenue and a reduction in compliance costs for businesses. |

Inland Revenue is developing administrative criteria for the extension of the exemption. Overseas territorial issues need to be considered when drafting criteria, especially if the country holding the data does not have a double tax agreement with New Zealand. |

| 14. Remove the requirement for taxpayers to retain hard (paper) copies of electronic returns. | Risk that businesses would not store their electronic returns. However, this risk currently exists with the paper return system. Integrity of person’s electronic return may be questioned. This risk is addressed in the requirements under the Electronic Transactions Act 2002. |

More consistent with the policy intent of the Electronic Transactions Act 2002, which treats electronic copies in a similar way to paper. Reduces compliance costs for businesses. |

This issue was raised by the Software Developers Working Group, which is in favour of the proposed solution. |

This would allow taxpayers to store their records electronically. Should result in administrative efficiencies for Inland Revenue and a reduction in compliance costs for businesses. |

Inland Revenue would need confidence that the information is stored in a system that ensures the completeness of the return, the return is unaltered, and is in line with any record-keeping requirements in the Tax Administration Act 1994. |

CONSULTATION

10. The options have been developed in accordance with the generic tax policy process (GTPP). The initial consultation for these changes took the form of a June 2010 Government discussion document called Making tax easier. The discussion document outlined the potential new direction for Inland Revenue’s delivery of services. It called for submissions from the public and was also accompanied by an online forum.

11. As the range of options were developed, officials engaged in more consultation as appropriate. As the consultation differed according to the particular proposal, a summary of the approach taken and the outcomes of consultation are outlined in the section on regulatory analysis. This format was also chosen in order to clearly show the impact that consultation had on the policy development, and the large extent to which the preferred options have been developed with the feedback in mind.

CONCLUSIONS AND RECOMMENDATIONS

12. For the options relating to individuals, the recommendations are those that best address the concerns detailed in the submissions received. For the options relating to employers, the recommendations are based on those that make the most administrative sense, and there has been consultation on these recommendations with the Software Developers Working Group.

13. Below is a table outlining the preferred options, and the key reasons why they are preferred:

| Option | Key reasons | |

|---|---|---|

| 3 | To require taxpayers who self-select to file to be squared up across the previous four income tax years |

|

| 5 | Remove the requirement for Working for Families tax credit recipients to file an income tax return. |

|

| 7 | Amalgamate the two major income tax return forms and replace them with one, consolidated, web-based form. |

|

| 11 | Move to the use of electronic services as the primary mode of service delivery, using a phase-in approach. |

|

| 13 | Allow the Commissioner of Inland Revenue to authorise, and also revoke permission for, certain “classes of persons” to keep their records outside of New Zealand. |

|

| 14 | Remove the requirement for taxpayers who submit electronic returns or information to Inland Revenue to retain paper copies. |

|

IMPLEMENTATION

14. Implementation issues have been considered in the table under the regulatory impact analysis section of this statement. This is because the issues are many and varied, and are specific to each option.

15. For the implementation of these proposals, Inland Revenue has four major pressures:

- addressing increasing demands for services

- managing tight baseline funding

- working with a computer system that has been substantially added to and modified

- managing any move to a new platform.

16. The key goal is to manage these tensions while meeting Inland Revenue’s current and future obligations. In particular, as a consequence of student loan and child support redesign project pressures, Inland Revenue is reassessing the impact of its capital position and capability requirements.

17. From the 2011/12 financial year, it is proposed Inland Revenue would take a strategic approach over a multi-year period to migrate taxpayers into the updated electronic environment. The initial work would include research to determine the mix of education, customer change management and awareness approaches that Inland Revenue would adopt. We would also work with third parties and customers to identify enhancements to our online services and products.

18. To mitigate the risk to the student loans and child support deliverables, we would propose that the application date for options 3, 5 and 7 be 1 April 2015 (the 2014/2015 income year). However, work would commence immediately on initial design work. As officials gain more understanding of the impacts of the other commitments, we would report back to Ministers on whether this application date can be brought forward.

MONITORING, EVALUATION AND REVIEW

19. In general, the monitoring, evaluation and review of these proposals would take place under the GTPP. The GTPP is a multi-stage policy process that has been used to design tax policy in New Zealand since 1995. The final step in the process is the implementation and review stage, which involves a post-implementation review of legislation, and the identification of remedial issues. Opportunities for external consultation are also built into this stage. In practice, this would mean that these proposals would be reviewed at a time after the policy has had some time to work. Any changes that are needed to give the legislation its intended effect would be added to the tax policy work programme, and proposals would go through the GTPP.