Chapter 8 - Child support payment, penalties and debt

This chapter discusses the child support penalty rules, and suggests possible changes that may assist with the prompt payment of child support and increased compliance by paying parents. It also considers the question of how the Government can deal with existing accumulated penalty debt.

It specifically seeks submissions on which of the following ideas should be considered further:

- reducing incremental penalty rates and improving enforcement;

- capping penalties;

- closer alignment with late payment penalties and use-of-money interest used for tax purposes;

- penalty write-off grounds;

- writing-off assessed child support debt; and

- passing on penalties to the receiving parent.

8.1 The child support scheme as a whole needs to be perceived as fair. Paying parents are more likely to pay child support if the way it is calculated is transparent and takes account of the right variables. The options described elsewhere in this discussion document are intended to address many of the concerns about fairness that paying parents have with the current scheme.

8.2 There is currently a very high level of accumulated debt relating to child support penalties, much of which has been in place for a long time. Ways of dealing with this debt need to be considered to ensure that payments are made for the care of the children or to offset the cost to the Government of providing benefits to receiving parents.

8.3 This chapter discusses child support penalties and looks at a range of options for change in this area to stop child support debt being created in the first place or, where it does exist, to reduce it as soon as possible.

8.4 Improved administrative practices, in addition to the proposed automatic deduction of child support payments from salary and wages discussed in chapter 7, would be a significant step towards better addressing concerns of receiving parents and stopping child support debt being created.

8.5 In addition to any legislative measures, both parents need to have ready access to succinct and accurate information on child support and the consequences of non-payment so that ignorance of the law is not a barrier to compliance.

Child support debt

8.6 On balance, the New Zealand child support scheme has been very successful in collecting assessed child support debt. Since the scheme’s introduction in 1992, Inland Revenue has collected 89 percent of all the child support payments assessed by Inland Revenue. This rate compares very favourably internationally.

8.7 Despite the fact that the vast majority of payments are collected, the aggregate child support debt (assessed child support debt plus associated penalties) has continued to accumulate.

8.8 In addition to child support debt owed by parents living in New Zealand, a significant amount of debt is also owed from parents living overseas. Most of this overseas debt is in respect of paying parents living in Australia, but amounts are also due by parents living in other countries. New Zealand currently has a reciprocal agreement with Australia that allows Inland Revenue to pass child support cases to the Australian Child Support Agency for enforcement (and vice versa). Although it is more difficult for Inland Revenue to recover debt from other countries, child support debt collection in such circumstances may improve if the Hague Convention for the International Recovery of Child Support and Other Forms of Family Maintenance (in which New Zealand is a signatory) comes into force.

8.9 As at 30 June 2010, total child support debt stood at $1.944 billion. Over 70 percent of this aggregate debt (or nearly $1.368 billion) now consists of accumulated child support penalties.

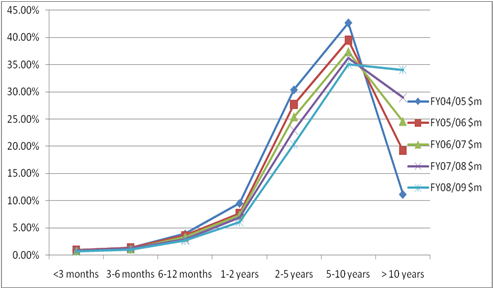

8.10 Table 11 highlights how the age profile of debt has changed over time. Debt that is over 10 years old continues to increase as a proportion of total debt – it now represents approximately 35 percent of all debt.

Table 11

8.11 Penalties play an important role in encouraging parents to meet their child support obligations. They also help to fund the Government’s costs of collecting this debt. If penalties are excessive, however, they can perversely discourage the payment of child support to the detriment of the children concerned. Striking a balance between these conflicting issues is essential.

Current penalties rules

8.12 Currently, paying parents who fail to pay in full and on time incur an initial penalty of 10 percent of the unpaid amount. A further penalty of two percent of the unpaid amount (including the 10 percent penalty) is imposed on a compounding basis for each month that the amount remains outstanding. These penalties are retained by the Government and are not passed on to a receiving parent.

8.13 Since the introduction of the Child Support Scheme, various legislative changes have been made to encourage parents to pay more promptly and reduce debt levels, the most recent being in 2006. This 2006 change allowed Inland Revenue to remit the two percent incremental penalty when an instalment arrangement is entered into and payments under the arrangement are maintained.

8.14 Several concerns have been identified with the current penalty system, including:

- the size and nature of the penalties, in particular the two percent incremental penalty;

- the relatively limited circumstances in which the two percent incremental penalty can be written off;

- the restrictions on writing off assessed debt; and

- whether penalty amounts paid should be passed on to the receiving parent.

Alternative options for imposing penalties

8.15 The cumulative nature of the two percent monthly penalty means that penalty amounts can grow rapidly. These penalties continue to become an increasingly large proportion of the total outstanding child support debt.

8.16 At some point parents who would otherwise be willing to pay off their assessed child support liability may be reluctant to approach Inland Revenue because of the magnitude of the penalty sums involved, particularly if they are not aware they could qualify for some form of penalty remission. In other words, high levels of penalty debt could be acting as a disincentive to re-engage with the child support scheme and start or resume payment of child support liabilities.

8.17 Submissions are therefore sought on whether any of the following options outlined in this chapter should be introduced. The basis for any change should be that it would provide a better incentive for paying parents to comply with their child support obligations and make payment as soon as possible.

Reduce current incremental penalty rate

8.18 One option would be to keep the current structure of the existing penalty system in place, but to reduce the two percent incremental penalty.

8.19 Such a reduction could be introduced after a set period of non-compliance by the paying parent – for example, after non-compliance of one year. To counter perceptions that this could be a reward for non-compliance, it could be introduced at the same time as additional and more focussed enforcement measures, as discussed below. This would ensure that there were more effective sanctions in place for those that continue to avoid payment.

8.20 Reducing the two percent incremental penalty would help to prevent penalty debt from escalating at the current rapid rate. It would slow down the rate at which debt increases, helping to avoid debt from reaching levels where parents feel they are simply not able to be repaid (and which may be viewed as disproportionate to the original debt).

8.21 The effect that such a change may have can be seen from the example of a paying parent who has not paid a child support assessment of $3,227[39] for five years. Under the current rules, the amount owing after five years, including core assessment and penalties (initial and incremental two percent amounts), would be in excess of $11,500. Changing the incremental penalties to 1 percent after one year would have the effect of reducing this outstanding debt to approximately $7,250.

8.22 This could be seen as a fairer outcome that might reduce the disincentive for paying parents to start making their child support repayments. Importantly, this reduction would not make any difference to the receiving parent other than in the sense of improving the possibility of payment.

8.23 However, if such a change were made to penalty rates, the Government would need to ensure that other offsetting enforcement measures were adopted. Additional measures could potentially include:

- The paying parent being subject to a more focussed and specific compliance effort from Inland Revenue (that is, being subject to more intensive case management).

- Further use of the automatic deduction of refunds due to paying parents from other Inland Revenue sources in order to offset any child support debts due (for example, in respect of unconfirmed personal tax summaries).

- The use, in extreme circumstances, of departure prohibition orders whereby paying parents could be restricted from travelling overseas until their child support liabilities are settled. Departure prohibition orders are used with some success in Australia.

- “Naming and shaming” paying parents, while being mindful of privacy concerns and the need to ensure a person is not improperly named.

Capping penalties

8.24 Another suggestion is to cap the amount of penalties that could apply to a parent’s child support debt. This would stop the debt accumulating and reduce the potential reluctance parents might have to contact Inland Revenue.

8.25 On the other hand, once this cap is reached there may be limited further incentive for paying parents to continue to pay their child support liability. If this option were to be considered, the Government would need to ensure that other enforcement measures were also adopted to increase the likelihood of payment (similar to those previously described in this chapter). This could also include an option to increase the initial 10 percent penalty at the same time.

Aligning child support penalties to tax penalties and use-of-money interest

8.26 Another question worth considering is whether to better align child support penalties with the penalty and use-of-money interest rules that apply for tax purposes. Using tax-based late payment penalties and use-of-money interest rates would allow for better alignment with the treatment of tax debts and could provide administrative efficiencies for Inland Revenue.

8.27 A tax-based penalties system is not fully relevant to the child support scheme, however. In addition to late payment penalties and use-of-money interest, tax penalties also contain shortfall penalties. These are determined in relation to benchmark standards of behaviour and care (for example taking an unacceptable tax position or being grossly careless) that are not usually relevant to the non-payment of child support.

8.28 In addition, use-of-money interest applied for tax purposes is not a penalty. Rather, it compensates the Government for receiving the tax revenue in a later period. Under the child support scheme, the Government is collecting child support from one parent on behalf of the other parent, and does not pass penalties on to the receiving parent. This is in contrast to the tax system, where the Government is the direct recipient of the money collected. Applying interest to a debt to which the Government is not directly entitled could be seen to be at odds with the purpose of use-of-money interest.

8.29 That said, some other jurisdictions (for example, Australia) do apply interest to late payments of child support and it would be possible to design a system so that child support penalties were linked to prevailing tax use-of-money interest rates (while also retaining a penal element). For example, the existing initial 10 percent non-payment penalty could be retained, but the incremental two percent monthly penalties could be replaced with a penalty equal to the tax use-of-money interest rate plus an additional penal rate (for example, an additional 1 percent per annum).

Penalties write-off grounds

8.30 As noted previously, the vast majority of existing child support debt relates to penalties. This is in part because payments made by paying parents will always first be set off against assessed child support debt, not penalties.

8.31 Although the primary objective of any changes to the penalty rules should be to progressively recover any existing core debt and establish the regular payment of child support liabilities, writing off penalties should also be considered if this facilitates regular payment or is justifiable on hardship grounds.

8.32 Currently, there is a range of grounds under which penalties can be written off by Inland Revenue. In some cases write-offs are mandatory while others are at the Commissioner’s discretion. Some write-off processes relate only to the 10 percent penalty, some only to the incremental penalties, and others cover both.

8.33 Despite the number of grounds that exist, the ability to write-off child support penalties is generally more restrictive than for the write-off of tax penalties because the Crown is holding the money for use towards the care of the child involved. Nevertheless, there seems to be some scope for improving the ability to write off penalties. In particular, although changes were made in 2006 that enabled the write-off of incremental penalties if an instalment arrangement had been entered into and adhered to for a minimum period of 26 weeks, the rules could be relaxed to allow a greater level of write-off.

8.34 Options that could be considered include:

- relaxing the circumstances in which penalties can be written off when a paying parent agrees and adheres to an instalment arrangement for ongoing compliance;

- allowing Inland Revenue a wider range of options to negotiate the write-off of penalties;

- allowing Inland Revenue to automatically write-off low levels of penalty-only debt below a certain value; and

- introducing a child support penalty debt amnesty whereby penalties are automatically written off if a paying parent pays all their existing assessed child support debt during a set time period.

8.35 Submissions are sought on whether any of these options, described in more detail below, should be considered further. The main basis for any change should be that it would increase the incentives for paying parents to start meeting their child support obligations in full. Where this is not relevant (for example, when only penalty debt remains as all assessed debt has already been recovered) any change should enable the Government to collect the largest amount possible given the circumstances and the need to balance the likelihood of fully recovering the debt with the administrative costs involved.

Relaxing circumstances when penalties can be written off for ongoing compliance

8.36 The current rules stipulate that for any incremental penalties to be written off, an instalment arrangement for the repayment of core assessment debt must be entered into and adhered to for a minimum of 26 weeks. Any failure to meet this agreement, however minor, means that the penalties cannot be written off.

8.37 The strict way in which the current rules operate for writing off incremental penalty debt can be an impediment to its effectiveness, sometimes with serious implications for the goodwill and willingness of paying parents to continue repaying their outstanding (and ongoing) child support debt.

8.38 Applying less stringent conditions in certain circumstances, such as by continuing to allow a penalty-write off when the vast majority of agreed repayments have been made, and there are clearly justifiable circumstances why other payments have not been made, could have merit.

Negotiated write-off of penalties

8.39 Greater ability to negotiate with paying parents on an individual basis, even if some assessed debt remains, would allow Inland Revenue a wider range of options for the write-off of penalty debt. Inland Revenue would be able to balance a range of considerations in attempting to collect the highest amount of assessed child support and penalties over time. For example, it would take into account the integrity of the child support scheme, the promotion of voluntary compliance and the administrative costs involved.

8.40 The objective of any negotiated write-off would be to achieve the maximum possible recovery, taking into account the effect on the paying parent, the efficient use of resources, fairness to other compliant parents and parents who have already paid their penalties in full.

8.41 As currently exists for penalty-only debt (that is, when the assessed debt has been paid), such a write-off could be used if the paying parent would be placed in significant hardship or if it would be a demonstrably inefficient use of Inland Revenue’s resources to collect the debt because the chances of collection are very low.

8.42 To ensure transparency and consistency, such a provision would be supported by published administrative guidelines or criteria.

Allowing Inland Revenue to automatically write-off low levels of penalty-only debt

8.43 Another option could be to allow Inland Revenue to automatically write-off certain low levels of penalty-only debt (when the assessed child support has been paid, and only penalty debt remains).

8.44 The discretion would allow Inland Revenue, once all assessed child support debt had been paid, to automatically write off all penalty-only debt below a certain value. This value would be determined by Inland Revenue, based on set published criteria or guidelines.

Child support penalty debt amnesty

8.45 A child support penalty debt amnesty could be introduced whereby if a paying parent paid all their existing assessed child support debt during a set period all associated penalties would be automatically written off.

8.46 Although an amnesty for existing child support debt would likely achieve a significant recovery of arrears in the short term, any gains would likely be short-lived. This is because an amnesty is not likely to change the long-term behaviour of errant paying parents. A greater concern is that compliant paying parents (and those that have already paid their penalties) would see persistent failure to comply by others being rewarded rather than punished. This could have an adverse effect on the future behaviour of compliant paying parents and create adverse perceptions about the fairness of the child support scheme more generally.

Write-off of assessed child support debt

8.47 Inland Revenue cannot currently write off assessed debt because, in many cases, the debt is owed to the other parent for the care of the child. Receiving parents who are not on a benefit do, however, have the discretion to waive the assessed debt.

8.48 Inland Revenue does not have any discretion to waive assessed debt owed to it when a parent is in receipt of a benefit. The courts can order a debt to be written off but this is costly and time-consuming.

8.49 Arguably, assessed debt relating to beneficiaries should be able to be written off by Inland Revenue on serious hardship grounds. Similar allowance already exists in relation to tax debt – for example, when someone has a serious illness and is unable to work, or is otherwise unable to meet minimum living standards. Submissions are invited on the merits of allowing Inland Revenue to write off assessed debt in these circumstances.

Inland Revenue passing on penalties to the receiving parent

8.50 Some receiving parents consider that penalty payments made by paying parents should be passed on to them so that they are compensated for the loss of funds and not, therefore, disadvantaged by the non-payment of child support.

8.51 Penalties for child support debt could be considered to have three purposes: a monetary sanction for not complying, compensation for the lack of use of funds, and compensation for the additional administration costs incurred in recovering overdue debts.

8.52 Passing on a component that is compensating for the lack of use of funds only to the receiving parent would make the child support scheme more complex to administer. Determining the appropriate rate to be passed on would also need to be regularly reviewed.

8.53 Passing on penalties may also create inconsistencies in treatment between receiving parents, as the approach adopted by Inland Revenue in writing off penalties could affect the amounts actually received. As a result, receiving parents who were in otherwise identical situations could receive different amounts of support.

8.54 The focus should therefore be on encouraging the prompt payment of child support, with the imposition of late payment penalties, and the ability to write off in certain circumstances, being the main method of achieving this.

8.55 For reasons discussed earlier, the Government is not currently in favour of penalties being passed on to receiving parents. Submissions are, however, invited on this issue.

39 This amount represents the average annual assessment for a paying period for one year only. In reality, many paying parents who are in debt are likely to be liable for more than one year.