Chapter 9 - Releasing information for tax administration purposes

9.1 Inland Revenue is required to keep secret all information it collects under the tax laws. There are two main exceptions to this requirement:

- information can be disclosed when it is necessary to do so for tax administration purposes; and

- information can be shared with other government agencies for non-tax purposes under specific statutory exceptions.

9.2 This chapter discusses whether the tax secrecy provisions provide sufficient flexibility for Inland Revenue to administer the tax system in an optimal way. It proposes a new framework that will help to provide a more effective tax system while providing appropriate restrictions over the use of tax information.

Inland Revenue’s secrecy obligations

9.3 The effective administration of the New Zealand tax system relies heavily on taxpayers voluntarily complying with that system. In order to be willing to comply with the tax system, it is crucial that taxpayers have trust in Inland Revenue. To retain taxpayers’ trust in Inland Revenue, it is important that taxpayers’ information is not disclosed inappropriately.

9.4 At the same time, Inland Revenue must be able to disclose information to taxpayers and third parties, when it is reasonable to do so, in order to operate the tax system efficiently.

9.5 An appropriate balance, therefore, needs to be struck in situations where these principles are inconsistent with each other. Currently, section 81 of the Tax Administration Act governs how these principles are reconciled. This section strictly prohibits disclosure of any information relating to tax legislation except when reasonably necessary to carry into effect Inland Revenue Acts, or when a specific exception applies. Some specific exceptions relate to tax administration purposes and other specific exceptions relate to disclosure for non-tax purposes. Before disclosing individuals’ personal information, Inland Revenue must also consider the principles contained in the Privacy Act.

9.6 The strictness of the current secrecy rules can be seen as promoting the principle that taxpayers’ information is not disclosed inappropriately. However, the rules provide insufficient flexibility to administer the tax system in an optimal way.

9.7 When a conservative interpretation is taken, Inland Revenue can be prevented from making disclosure to administer the tax legislation – even when the disclosure provides benefits (such as efficiency or promotion of taxpayer compliance) that outweigh any costs.

9.8 There is a range of potential initiatives involving disclosure of information related to administering the tax system which have benefits (such as efficiency or taxpayer compliance), but which may not be necessary to administer the tax system.

9.9 When the benefits of disclosure for a particular initiative are sufficiently high, legislative uncertainty has been resolved in the past by adding a specific exception to the legislation clarifying that disclosure is permitted. An example of this is a specific provision introduced in 2007 to ensure that Inland Revenue can inform a taxpayer whether the person who is preparing the taxpayer’s return of income is listed as a tax agent.

9.10 The Government proposes changes to the tax secrecy rules that would allow Inland Revenue to administer the tax system more efficiently.

Proposed legislative change to the tax secrecy rules

9.11 To provide administrative flexibility, while still reflecting the importance of protecting information held by Inland Revenue, the following changes to the secrecy provisions in the tax rules are proposed.

Lower threshold for release of information for tax administration purposes

9.12 As noted above, Inland Revenue is currently permitted to disclose information only when it is reasonably necessary to administer the tax laws. However, this provides insufficient flexibility for Inland Revenue to administer the tax system in an optimal way. The Government proposes this threshold be replaced with a requirement that the disclosure is for a purpose that is related to the administration of the tax system (and Inland Revenue’s related functions such as administration of KiwiSaver and child support). It would be clarified that “administering the tax laws” for these purposes would include measures aimed at protecting the integrity of the tax system or promoting taxpayer compliance.

9.13 Under this proposal, Inland Revenue could disclose information in a greater range of circumstances. Any lowering of the threshold is likely to result in concerns that taxpayer information may be released inappropriately. To mitigate this concern, the Government considers that Inland Revenue should be required to explicitly consider the integrity of the tax system and the importance of promoting compliance, especially voluntary compliance, by all taxpayers before releasing information to another agency.

Explicit consideration of sections 6 and 6A before release of information

9.14 Sections 6 and 6A of the Tax Administration Act are the fundamental guiding principles that are the basis for Inland Revenue’s administration of the tax system.

9.15 Section 6 requires that Inland Revenue officers must protect “the integrity of the tax system”. “The integrity of the tax system” includes, but is not limited to:

- taxpayer perceptions of that integrity;

- the rights of taxpayers to have their liability determined fairly, impartially and according to law;

- the rights of taxpayers to have their individual affairs kept confidential and treated with no greater or lesser favour than the tax affairs of other taxpayers;

- the responsibilities of taxpayers to comply with the law;

- the responsibilities of those administering the law to maintain the confidentiality of the affairs of taxpayers; and

- the responsibilities of those administering the law to do so fairly, impartially, and according to law.

9.16 Under section 6A, Inland Revenue is charged with the care and management of taxes. In exercising this discretion, Inland Revenue must consider the importance of promoting voluntary compliance.

9.17 The Government considers that the proposed rules should require Inland Revenue to explicitly consider how a proposed disclosure will impact on the following key principles reflected in sections 6 and 6A:

- integrity of the tax system;

- promotion of voluntary compliance; and

- administrative efficiency.

9.18 The Government considers that the Inland Revenue should also consider the sensitivity of the information to the taxpayer. This would ensure that taxpayer-specific information that is more sensitive (such as information about child support payments) receives higher protection. If Inland Revenue is the only agency that holds the information, it is likely to be more sensitive.

9.19 The requirement would ensure that Inland Revenue could not make a disclosure, and is not compelled to make a disclosure, unless upon consideration of the factors outlined above, the benefits of the disclosure outweigh the disadvantages.

9.20 Higher benefits to the integrity of the tax system, the promotion of voluntary compliance, or administrative efficiency would have to be demonstrated before there was any disclosure of taxpayer information of a more sensitive nature.

9.21 As noted above, Inland Revenue also considers the principles contained in the Privacy Act 1993 before disclosing individuals’ personal information. This would not change under this proposal.

Information that does not identify a taxpayer

9.22 Currently, Ministerial authorisation is required before information that does not relate to an identifiable taxpayer can be disclosed for non-tax purposes. Because this imposes compliance costs for researchers studying the tax system, this rule sometimes hinders research that would assist in designing a better tax administration. The Government proposes that this requirement be removed. This means that information about Inland Revenue’s processes or aggregate data about taxpayers could be released without Ministerial authorisation, as long as this was consistent with protecting the integrity of the tax system and promotion of taxpayer compliance.

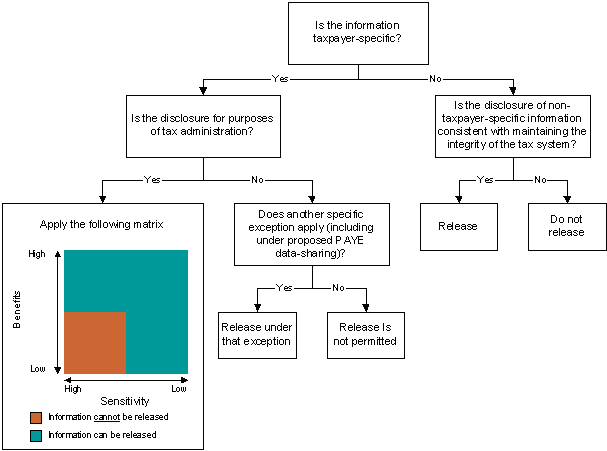

9.23 The process outlined in Diagram 1 demonstrates how Inland Revenue could apply the new secrecy rules.

Diagram 1: Proposed secrecy rules process

9.24 Below are some examples of how the proposed rules would work in practice.

Circumstances when information may be disclosed

(a) Providing a public explanation of an Inland Revenue administrative decision that involves a taxpayer

An example of when Inland Revenue might not be able to disclose information under the current rules is when a high-profile tax investigation has been incorrectly reported in the media, and public comment on limited relevant aspects by Inland Revenue on the case would protect public perceptions of the integrity of the tax system.

In the majority of tax investigation cases, Inland Revenue should not provide any public comment. This is because an important element of protecting the integrity of the tax system is a taxpayer’s right to have his or her individual affairs kept confidential. However, in some circumstances, the need to protect taxpayer perceptions of the integrity of the tax system might outweigh these confidentiality considerations. This is particularly so when the taxpayer has already commented publicly about the matter. Under the current rules, it is not clear if disclosure could be made. The proposed rules would allow Inland Revenue to provide limited, relevant public comment when protection of taxpayer perceptions of the integrity of the tax system outweigh confidentiality considerations.

Under the new rule it would be clear that Inland Revenue could release information in this situation.

(b) Releasing the fact that a taxpayer has a tax debt to a credit reporter

Disclosing the fact that a taxpayer has an outstanding tax debt to a credit reporter would be a possible strategy to improve taxpayer compliance. The underlying assumption is that it would encourage taxpayers to pay their tax debt to avoid their credit rating being affected. Although in certain circumstances this disclosure may be an appropriate strategy to improve taxpayer compliance, and therefore the integrity of the tax system, it is arguably not sufficiently necessary to administer the Inland Revenue Acts.

If there is good reason to believe that this type of disclosure would be an effective compliance tool in certain circumstances, under the proposed rules disclosure is likely to be a purpose that is related to the administration of the tax system. The disclosure should be made only if it is consistent with protecting the integrity of the tax system. As noted above, taxpayers’ rights to have their individual affairs kept confidential is important. Other components of the integrity of the tax system, such as taxpayer perceptions of the integrity of the tax system, and the responsibilities of taxpayers to comply with the law, must be considered. Advising a credit bureau that a taxpayer has a tax debt is likely to enhance these components, as other taxpayers would have confidence that the tax system encourages taxpayers to comply with the law. When balancing these different components, it may be appropriate to make a disclosure only in limited circumstances, such as when the debt amount is significant, overdue and not the subject of a dispute.

Under the proposed rule, it would be clear that Inland Revenue could release information in this situation. Before any release of information, the taxpayer concerned would be notified and given the opportunity to pay any arrears or raise any concerns.

(c) Answering phone queries from a family member of a deaf or non-English speaking taxpayer

It is not clear if the current rules permit Inland Revenue to answer phone queries made on behalf of a deaf or non-English speaking taxpayer from a relative or friend.

This is because it is not clear that disclosing information to the taxpayer’s relative or friend would meet the current test of being “reasonably necessary”, given that the taxpayer could make enquiries in writing. While a specific exception allows Inland Revenue to release information to a taxpayer, his or her agent or their legal representative, a friend or family member will usually not fall under this category (a taxpayer’s agent or legal representative generally has associated responsibilities such as filing or fiduciary obligations).

Under the proposed rules, it would be clear that Inland Revenue would be able to answer such queries when the taxpayer has authorised the relative or friend to ring Inland Revenue on their behalf. The purpose of the disclosure is related to the administration of the tax system. When the taxpayer has authorised the relative or friend, this disclosure would be consistent with protecting the integrity of the tax system and promoting compliance.

Under the proposed rule it would be clear that Inland Revenue could release information in this situation.

Circumstances when information would not be disclosed

(d) Employer wants to know whether employee has a second job

A taxpayer’s employer asks Inland Revenue whether a taxpayer has a second job. The employer suspects the taxpayer has a second job, which is in contravention of the taxpayer’s employment agreement. The information is related to a specific taxpayer and the disclosure is not for a purpose that is related to the administration of the tax system. No other specific exceptions apply.

Inland Revenue should not release information in this situation.

(e) GST refund thresholds

A person asks Inland Revenue at what threshold GST refunds are sent automatically. This information could potentially be used to defraud the tax system. Although this information is non-taxpayer specific, its release is likely to harm the integrity of the tax system.

Inland Revenue should not release information in this situation.

Improving legislative navigability of rules

9.25 The Government considers that the large number of specific legislative exceptions to the secrecy rules should be reorganised so that it is clear which exceptions are examples of disclosures that are related to tax administration purposes, and which are disclosures that are unrelated (or not primarily related) to the administration of the tax system. This would improve legislative navigability.

Operational guidelines

9.26 The proposal would allow Inland Revenue more flexibility to administer the tax system based on an assessment of risks, benefits and costs. This means the proposed rules would require more judgement and consideration than the current rules. It will be important that the proposed rules are applied consistently by Inland Revenue to different situations. The proposed option is that Inland Revenue should develop operational guidelines, in the form of a standard practice statement, to explain how Inland Revenue would exercise its discretion and how the proposed rules would be administered in different situations.

9.27 The standard practice statement would categorise disclosures according to the type of information and the recipient of the disclosure. It would outline the process for disclosure and the level at which different types of disclosures would be signed off.

9.28 The standard practice statement would be developed in consultation with the Privacy Commissioner, and professional bodies such as the New Zealand Law Society and the New Zealand Institute of Chartered Accountants.

9.29 In addition, the proposed legislative provisions should not take effect until the standard practice statement has been published.

Questions for submitters

Do you think tax information should be shared, more broadly, if it would mean improved services and less hassle?

In what circumstances should Inland Revenue release taxpayer information for tax administration purposes?

Do you agree that information should be released in the scenarios outlined in paragraph 9.24? Are there other scenarios when Inland Revenue could release taxpayer information?

The proposed test for releasing information for tax administration purposes would require higher benefits of disclosure to be demonstrated before releasing sensitive taxpayer information. The benefits must be to the integrity of the tax system, the promotion of voluntary taxpayer compliance, and administrative efficiency). Do you agree with these criteria? Are there other criteria that should be considered?

Should taxpayer consent be a factor in whether information is disclosed?