Chapter 2 - The Government’s economic vision

2.1 The Government’s economic vision is for a tax system that supports and strengthens economic growth by:

- improving incentives to work, save and invest;

- improving the fairness, coherence and integrity of the tax system by reducing opportunities to avoid tax (and unduly accessing social assistance); and

- promoting a tax system that supports New Zealand’s competitiveness globally and in a sustainable manner.

2.2 Surveys suggest the key regulatory burden most businesses face is tax compliance. However, increased government investment in infrastructure, education, skills and business assistance is funded by tax.

2.3 The Government began the reform of the tax system in Budget 2010, by introducing a package of tax policy measures to rebalance the tax system. This discussion document focuses on the underlying tax administration and processes that interact with taxpayers.

2.4 The Government has also identified better, smarter, public services as one of its priorities. This includes taking a whole of government approach in which the focus is on a better connected public service. From Inland Revenue’s perspective, the Government sees this challenge as being one of providing a service to taxpayers at a level expected of an efficient government department. Further, this vision means a system whereby Inland Revenue’s information can be leveraged as a government-wide resource, making interactions easier and eliminating the duplication of information and activities across different government agencies. Privacy concerns would need to be considered as part of any proposed changes in this area.

2.5 A tax administration that supports the Government’s economic vision should deliver:

-

Benefits to taxpayers, including:

- certainty so individuals know their obligations and entitlements;

- timely interactions with Inland Revenue; and

- low compliance costs.

-

Benefits to the Government:

- value for money; and

- trust and integrity.

2.6 In the past, significant effort has gone into reducing compliance costs – for example, by simplifying forms and changing thresholds. The next step is to enhance taxpayer interactions with Inland Revenue through greater use of technology that integrates tax with normal commercial activities. This will allow taxpayers to resolve uncertainty online, without having to wait for an answer from Inland Revenue.

2.7 Reform will also help to ensure the Government receives the revenue it needs, and at the lowest administrative cost.

2.8 However, reform is not just a challenge for the tax administration. The current system works because of the support of individuals, businesses, employers, tax agents, payroll firms, financial institutions and software developers, among others. Improving the system by introducing new technology will require the support of those affected by the problems with the current system.

Problems with current tax administration

2.9 The Government is concerned the administration of the tax system (including the costs of collection and administration by companies, individuals and Inland Revenue) is showing stress. This is mainly due to the additional requirements that social policy initiatives, such as KiwiSaver, are putting on businesses and Inland Revenue. Businesses sometimes have the feeling they work for Inland Revenue because of the amount of time they have to spend doing their taxes rather than running their business. Businesses and individuals also find current tax processes confusing and time-consuming.

2.10 The Government considers the tax administration system needs to change if it is to keep supporting New Zealand into the future.

2.11 A number of general problems and weaknesses with the system have been identified:

- Lack of certainty: The current tax system cannot provide the sort of certainty the Government wants taxpayers to have, mainly because of the large number of predominantly paper-based processes involved. One source of taxpayer dissatisfaction is the inability to directly manage or control straightforward tax interactions. Another is the time it takes to resolve tax technical questions, which is caused by the pressures the current system imposes.

- Slow response times: The public sector has been directed to seek ways to provide better, faster access to government services largely within existing resources. Despite significant improvements to Inland Revenue customer services, the volume of tax returns and contacts is increasing so Inland Revenue’s service delivery standards are under pressure.

- Value for money: The expanded products and services Inland Revenue administers as a result of its increasing role in social policy delivery have added considerably to pressures on Inland Revenue, and have markedly increased taxpayers’ expectations of service.

- Trust and integrity: Inland Revenue’s aging systems mean there may be pressure on one of the core strengths of New Zealand’s tax system, which is the trust people have in the integrity of New Zealand’s tax system. Once lost it may be hard to regain.

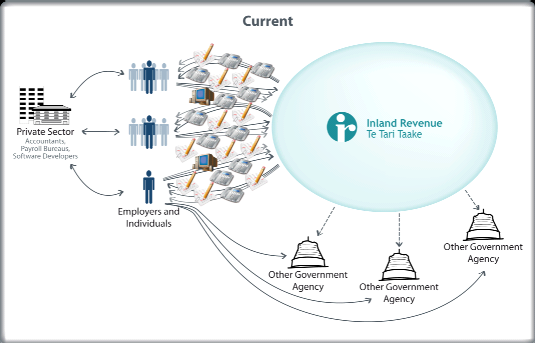

2.12 The chart below is a not an unreasonable representation of the current system.