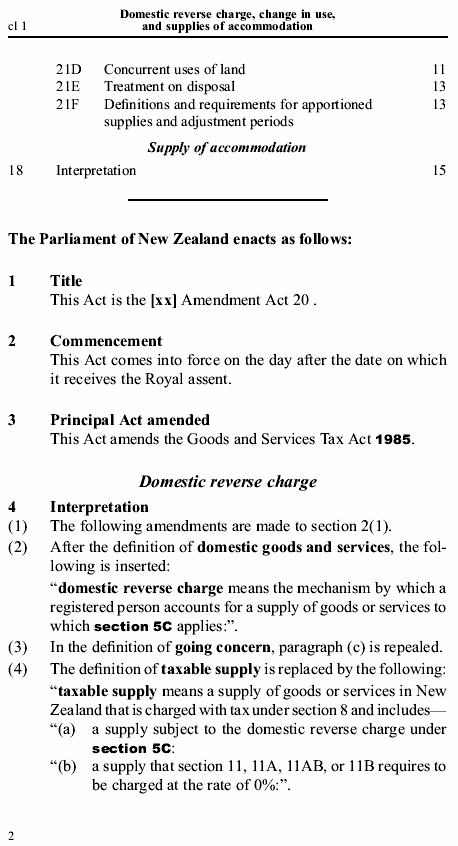

cl 4(2) - A definition of “domestic reverse charge” is introduced.

cl 4(4) - An amendment to the “taxable supplies” definition ensures that a domestic reverse charge supply is a “taxable supply” for GST purposes.

Tax Policy

|

|

|

cl 4(2) - A definition of “domestic reverse charge” is introduced. cl 4(4) - An amendment to the “taxable supplies” definition ensures that a domestic reverse charge supply is a “taxable supply” for GST purposes. |

|

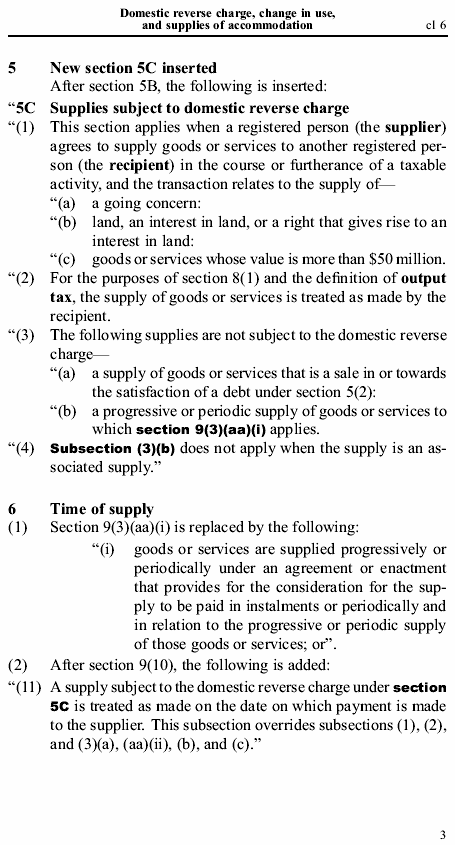

cl 5 - 5C(1) - The three types of transaction that are subject to the domestic reverse charge are going concerns, land interest and goods or services valued higher than $50m. cl 5 - 5C(2) - Affected supplies are treated as being made by the recipient for the purposes of the “output tax” definition and the imposition of tax section. cl 5 - C(3) - Specific exclusions apply for sales in satisfaction of debt and progressive or periodic supplies (unless these progressive supplies are between associates). cl 6(1) - The rules related to progressively or periodically supplied goods are expanded to also cover progressively or periodically supplied services. For the domestic reverse charge, this is relevant to supplies of services exceeding $50 million. cl 6(2) - The time of supply for domestic reverse charge transactions will be the date on which payment is made. |

|

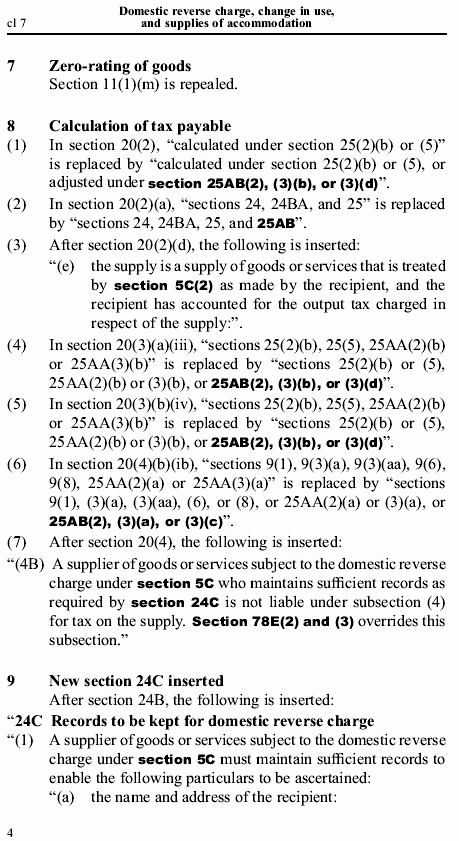

cl 7 - The existing zero-rating of going concern supplies is repealed, as these supplies will now be subject to the domestic reverse charge. cl 8(3) - A recipient can claim input tax on a domestic reverse charge supply, provided output tax in respect of that supply is or has been accounted for. cl 8(4), 8(5), 8(6) - Updated cross-references are required to the “calculation of tax payable” section to incorporate the changes in this draft into the registered person’s calculation. cl 8(7) - The supplier is not also liable for output tax, provided sufficient records are maintained. cl 9 - There are specific record-keeping requirements for both the supplier and the recipient of a domestic reverse charge supply. |

|

cl 10 - (25AB(1)) - There are separate rules for debit/credit notes related to domestic reverse charge supplies.

The supplier must still provide a debit/credit note, and the recipient must account for the variation in output and input tax. However, the recipient’s adjustment will result in a net zero position for GST (i.e. changes to output tax will be balanced by changes to input tax). |

|

cl 10 - (25AB(4)) - In the debit/credit note, the supplier must provide certain information. cl 11 - A previously unregistered person will be deemed to be registered if they represent that they are registered and receive a domestic reverse charge supply. Such a person will be liable to pay output tax on the domestic reverse charge supply. cl 12 - Where a supply has mistakenly been treated as a domestic reverse charge supply, and the output tax has been accounted for by the recipient, the supplier is not liable for the output tax. |

|

cl 12 - (78E(1)(a)) - If the recipient has not accounted for the output tax, the recipient is responsible for it if the supplier has complied with its record keeping requirements. cl 12 - (78E(2)) - If the required records have not been kept by the supplier, the supplier will be responsible for the output tax as if they were the recipient. cl 13 - (84C) - The domestic reverse charge rules will not apply to transactions that occur before the new rules come into force. |

|

cl 14(3), 14(4), 14(5) - New definitions are necessary for the apportionment rules. These definitions are largely set out in full in clause 18 (draft section 21F). cl 15 - The definition of input tax is being amended to remove the current principal purpose test, as this will be superceded by the apportionment rules. |

|

cl 16(2) - A deduction for input tax is only available to the extent that the goods or services are used for making taxable supplies, unless a de minimis threshold in relation to exempt supplies is met. cl 16(2) - (3D) - The threshold is that exempt supplies must not be more than the lower of $90,000 or 5% of consideration received for all supplies. cl 16(2) - (3F) - A taxable person must, at the time of acquisition, estimate the percentage for which goods or services will be used in making taxable supplies. They are then allowed an input tax deduction for this percentage. |

|

cl 16(2) - (3I) - Non-profit organisations will continue to have the same treatment for claiming of input tax as at present. cl 16(3) - Where an adjustment is made at a later date, the adjustment must be accounted for in the relevant taxable period. cl 17 - (21(1)) - If the estimated taxable use on acquisition is incorrect, an adjustment is required on an annual basis. This does not apply to goods or services with a value of less than $1,000 or where the variation from the initial estimate is less than 5%. cl 17 - (21(2)(c)) - This 5% “change in use” de minimis can only be used once. cl 17 - (21(4)) - If there is an adjustment, it must be accounted for on the last day of the adjustment period cl 17 - (21A) - At the end of each adjustment period, a registered person must work out the percentage for which a good or service has been used in making taxable supplies during that period. |

|

cl 17 - (21B) - This percentage use is then compared with the percentage use for the previous period, or, on the first adjustment date, with the estimated use at the time of acquisition. cl 17 - (21C) - Where the de minimis rules do not apply and there is a change in use, adjustment is necessary. The registered person is either required to pay further tax (in the case of a negative adjustment) or is entitled to further input tax (in the case of a positive adjustment). |

|

cl 17 - (21D) - Special rules apply to the concurrent use of land for both taxable and non-taxable supplies. A formula sets out what percentage of the land can be treated as being used for taxable supplies. The formula compares the taxable use with the non-taxable use by comparing the value of the non-taxable supply (the actual or deemed rental income) with the total consideration (which is the rental income plus the value of the land itself). cl 17 - (21D(5)) - A further formula must be used where the property has, for whole months, been used solely for non-taxable supplies. This formula reduces the taxable use by discounting any month for which the property has only been used for non-taxable purposes. |

|

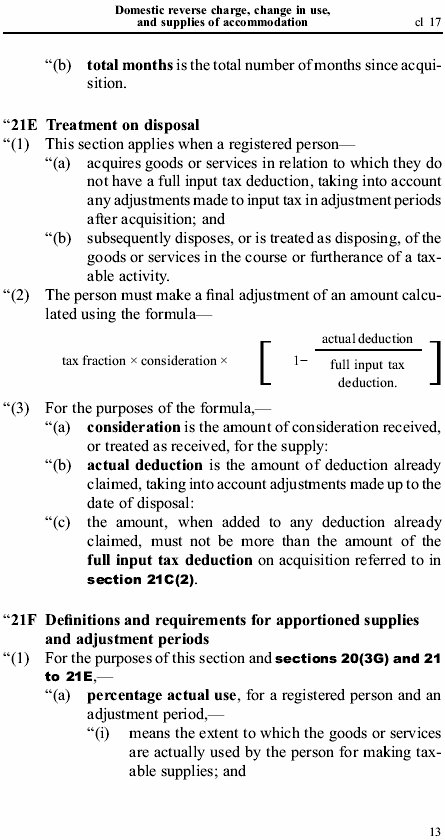

cl 17 - (21E) - When an apportioned asset is disposed of, a final wash-up calculation is performed. The effect of this is that the registered person may get further input tax credits up to a maximum of the full deduction that would have been available on the original acquisition. The deduction available will reflect the taxable use of the good or service over the period of ownership. cl 17 - (21F) - Definitions of “percentage actual use”, “percentage intended use”, “percentage difference” and “adjustment period” are used throughout the apportionment rules. |

|

cl 17 - (21F(3)) - A registered person who acquired goods or services that are subject to adjustments can choose one of two methods for making the adjustments: either the estimated use for depreciation purposes or an alternative based on the value of the good or service in question. The method chosen will set the number of adjustments required. |

|

cl 17 - (21F(3)(b)) - The exception is land, for which ongoing adjustments are required for the period for which the land is held. cl 17 - (21F(5)) - Once a method for determining the number of adjustments has been elected, it cannot be changed. cl 17 - (21F(6)) - A final adjustment must be carried out on disposal even if annual adjustments are no longer necessary. cl 18 - The definitions of “dwelling” and “commercial dwelling” are being amended to clarify the boundary between taxable and exempt accommodation. cl 18(2) - The definition of “commercial dwelling” includes a serviced apartment managed by a third party. The definition also includes premises that are not a “dwelling”. |

|

cl 18(3) - The definition of a “dwelling” refers to premises that are occupied as a principal place of residence and to which the occupant has an exclusive right of possession. |