Chapter 4 - The impact of income splitting on families

4.1 This chapter looks at the implications of income splitting in terms of who would benefit financially, and how effective marginal tax rates would change. It assumes 50/50 income splitting.

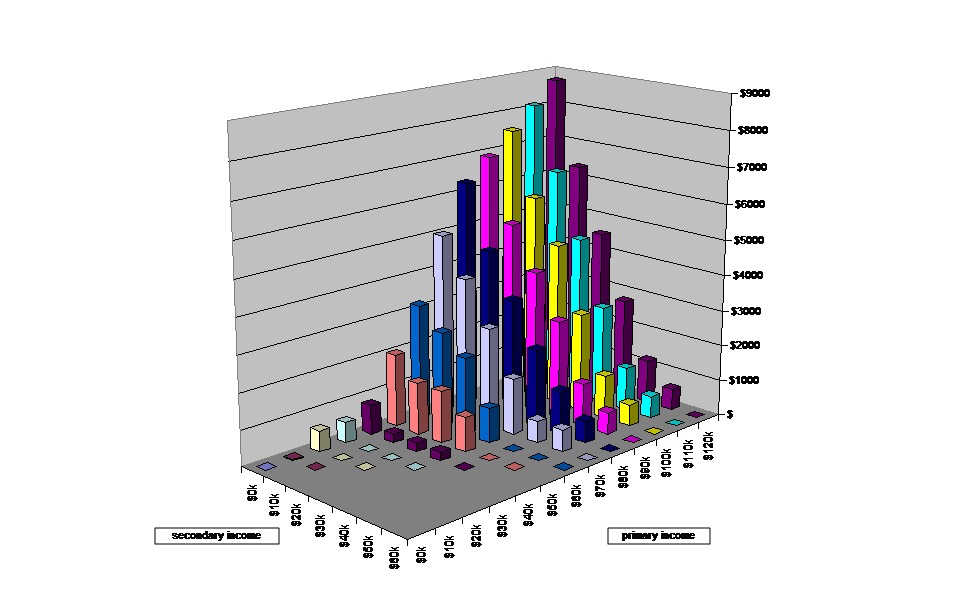

4.2 Figure 1 shows the reduction in tax paid (the “tax benefit”) for different combinations of primary and secondary earner incomes. For any level of primary earner income, the tax benefit from income splitting increases as the secondary earner’s income falls, with the maximum tax benefit going to couples in which the secondary earner is not earning any income.

4.3 Figure 1 shows that, for every level of secondary earner income, the tax benefit increases as the primary earner’s income increases. It reaches its maximum when the primary earner earns $120,000. Beyond this level the couple gains no additional benefit as all additional income will be taxed at the top marginal tax rate.

4.4 When both partners earn the same amount of income, or if the secondary earner earns $60,000 or more, there is no tax benefit from income splitting. In neither case can the partners move some income from a higher marginal tax rate to a lower one. Notably, families with a secondary earner who receives up to around $30,000 can still gain a significant tax benefit from income splitting.

4.5 Figure 1 is reproduced in table form in the Annex (Table A). This shows the exact dollar tax benefit going to each primary/secondary earner combination. The exact benefit is dependant on statutory tax rates and would alter if tax rates were to change. However, the same pattern would result, with the tax benefit increasing as primary income increases, and as secondary income decreases.

Figure 1: Gain per couple under income splitting

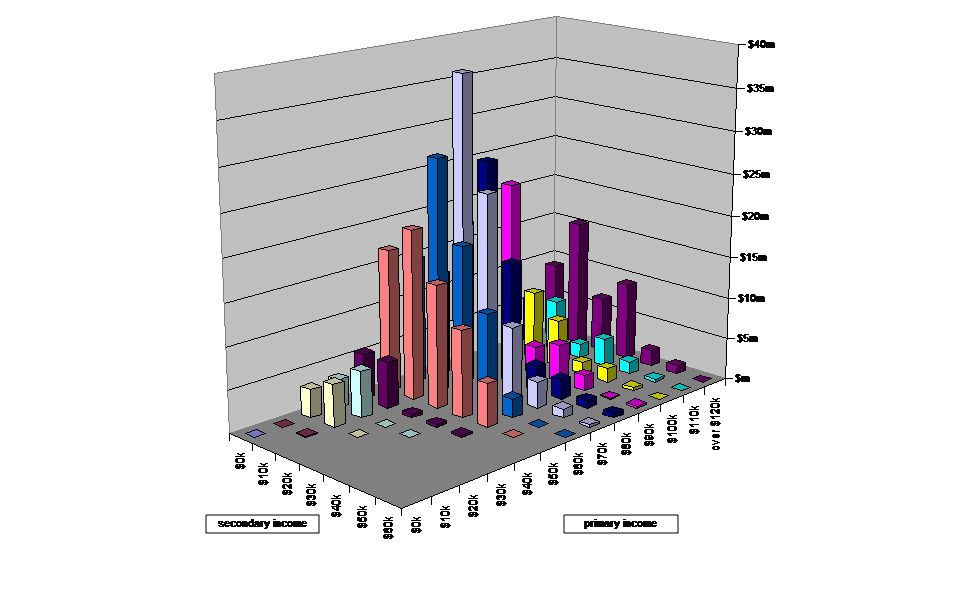

4.6 Figure 2 uses the current distribution, according to primary and secondary earner income, of families with children aged 18 and under in New Zealand to show how much tax benefit in aggregate would go to families with different combinations of primary and secondary earner incomes. The distribution is reproduced in Table B in the annex and is based on Inland Revenue sample data.

4.7 As illustrated in Figure 1, the greatest tax benefit from income splitting would go to a couple where the primary earner earns $120,000 or more and the secondary earner receives no income. Figure 2 shows that, because there are relatively few couples in this position, only a relatively small amount of the total tax benefit from income splitting goes to these couples.

4.8 The largest aggregate tax benefit would go to families in which one partner earns around $60,000 to $80,000 and the other earns less than $20,000.

4.9 Families in which a secondary earner receives up to around $30,000 would still receive a significant amount of the aggregate tax benefit from income splitting.

4.10 Figure 2 is reproduced in table form in the Annex (Table C). This shows the exact aggregate tax benefit going to each primary/secondary earner combination. Again, the exact benefit is dependant on statutory tax rates, but also on any changes to the income distribution.

Figure 2: Distrubution of tax benefits from income splitting

4.11 Not only would income splitting provide tax reductions to families with various combinations of primary and secondary earnings, it would also alter the effective marginal tax rates (EMTRs) faced by both primary and secondary earners. (As used in this discussion document, the term “effective marginal tax rate” means the proportion of an extra dollar of income that is lost as a result of taxation, benefit abatements and other income-related obligations such as ACC levies and child support payments.)

4.12 Table 1 shows the percentage point changes in primary earners’ EMTRs for different combinations of primary and secondary income. Table 2 shows the effect on secondary earners’ EMTRs.

4.13 Table 1 shows that primary earner EMTRs will decrease for a large number of combinations of primary and secondary income. For couples in which the primary earner has income between around $40,000 and $70,000 and the secondary earner earns less than $30,000 there tends to be a significant fall in the primary earner’s EMTR. The largest drop is 18 percentage points for couples in which the primary earner earns around $60,000 to $70,000 and the secondary earner receives around $10,000 or less.

4.14 Table 2 shows that secondary earner EMTRs would increase for a large number of combinations of primary and secondary income. When the primary earner has income of $80,000 or more, EMTRs would increase substantially for all secondary earners with less than $60,000 of income. The largest increase would be 24 percentage points when the primary earner earns around $120,000 or more, and the secondary earner receives less than $9,500.

| Secondary earner income | ||||||||

| $0k | $10k | $20k | $30k | $40k | $50k | $60k | ||

| Primary earner income | $0k | 0% | ||||||

| $10k | 6% | 0% | ||||||

| $20k | 0% | 0% | 0% | |||||

| $30k | 0% | 0% | 0% | 0% | ||||

| $40k | 12% | 12% | 12% | 12% | 0% | |||

| $50k | 12% | 12% | 12% | 0% | 0% | 0% | ||

| $60k | 18% | 18% | 6% | 6% | 6% | 6% | 0% | |

| $70k | 18% | 6% | 6% | 6% | 6% | 0% | 0% | |

| $80k | 6% | 6% | 6% | 6% | 0% | 0% | 0% | |

| $90k | 6% | 6% | 6% | 0% | 0% | 0% | 0% | |

| $100k | 6% | 6% | 0% | 0% | 0% | 0% | 0% | |

| $110k | 6% | 0% | 0% | 0% | 0% | 0% | 0% | |

| $120k | 0% | 0% | 0% | 0% | 0% | 0% | 0% | |

| Secondary earner income | ||||||||

| $0k | $10k | $20k | $30k | $40k | $50k | $60k | ||

Primary earner income |

$0k | 0% | ||||||

| $10k | 0% | 0% | ||||||

| $20k | 6% | 0% | 0% | |||||

| $30k | 6% | 0% | 0% | 0% | ||||

| $40k | 6% | 0% | 0% | 0% | 0% | |||

| $50k | 6% | 0% | 0% | 12% | 0% | 0% | ||

| $60k | 6% | 0% | 12% | 12% | 0% | 0% | 0% | |

| $70k | 6% | 12% | 12% | 12% | 0% | 6% | 0% | |

| $80k | 18% | 12% | 12% | 12% | 6% | 6% | 0% | |

| $90k | 18% | 12% | 12% | 18% | 6% | 6% | 0% | |

| $100k | 18% | 12% | 18% | 18% | 6% | 6% | 0% | |

| $110k | 18% | 18% | 18% | 18% | 6% | 6% | 0% | |

| $120k | 24% | 18% | 18% | 18% | 6% | 6% | 0% | |

4.15 Table 3 shows the number of taxpayers that would face these varying EMTR changes, given the current income distribution. Of all primary earners who would benefit from income splitting, 56 percent would not have any change to their EMTR, while four percent would have their EMTR fall by the maximum of 18 percentage points.

4.16 For secondary earners that benefit from income splitting, 52 percent would not face an increase in their EMTR. Five percent would face an increase of 18 percentage points, while one percent would face a 24 percentage point increase.

4.17 The average percentage point decrease in EMTRs for primary earners is 4.56, while the average increase in secondary earner EMTRs is 4.28 percentage points.

| Primary earners | Secondary earners | |||||

| change | number | percentage | change | number | percentage | |

| 0 | 236,250 | 56% | 0 | 221,900 | 52% | |

| -6 | 70,525 | 17% | 6 | 129,850 | 31% | |

| -12 | 101,150 | 24% | 12 | 48,300 | 11% | |

| -18 | 16,625 | 4% | 18 | 21,875 | 5% | |

| 24 | 2,625 | 1% | ||||