Chapter 2 - What is streaming and why have rules to prevent it?

Matters for discussion

This chapter discusses imputation streaming and the reason we have rules preventing it.

Allowing streaming would conflict with a number of the key objectives of the review, including that of keeping the company tax system as close to a fully integrated tax system as possible. At the same time, preventing streaming may also stand in the way of legitimate business transactions.

The government seeks comment on the following matters:

- Do the current anti-streaming rules create particularly difficult problems for companies or shareholders?

- What are the pros and cons of allowing streaming in limited circumstances?

2.1 Under current law there are rules to prevent the streaming of imputation credits to particular shareholders, which are discussed in Chapter 3. This chapter describes the concept of streaming in the context of our current imputation system. It explains why our rules seek to prevent streaming. It also considers whether this approach is appropriate and, in particular whether there are situations where streaming should be allowed.

What is streaming?

2.2 New Zealand-resident companies earn imputation credits from the payment of their company tax and from the imputation credits attached to dividends they receive from other New Zealand-resident companies. These credits can be attached by the company to dividends paid to its shareholders.

2.3 The value of imputation credits will not be the same for all shareholders. For some shareholders imputation credits have little or no value. New Zealand-resident shareholders that pay tax can use the credits to reduce their New Zealand tax payable. However, foreign shareholders have no New Zealand income tax against which to apply imputation credits, and tax-exempt New Zealand shareholders do not benefit from imputation credits.

2.4 This creates an incentive to direct the credits to those shareholders best able to use them, a practice commonly called dividend or imputation credit “streaming”. Rules preventing streaming support a number of the key objectives of the imputation system.

Why have rules preventing streaming?

2.5 Chapter 1 set out the government’s objectives, which include ensuring that New Zealand’s tax system remains as close to a fully integrated tax system as possible, New Zealand source-basis taxation is retained and income that has not borne company tax is subject to shareholder tax to provide a “belt and braces” approach to protecting the tax base. Abandoning any rules preventing streaming and instead allowing unlimited streaming would be inconsistent with these objectives. This is best illustrated by way of examples.

Example 1 – How unlimited streaming undermines integration principle

2.6 Consider a company owned by two shareholders, each of whom has a 50 percent shareholding. One is a domestic resident taxed at a rate of 33% and the other is a non-resident. The company earns $100 of New Zealand-source income, on which it pays $30 of tax and $100 of foreign-source income (net of any foreign taxes), on which it pays no tax in New Zealand. Any foreign tax liability for the non-resident shareholder is ignored.

2.7 Streaming is not permitted under current rules. If the company distributed all of its profits, it could pay an $85 cash dividend to both its domestic and its foreign shareholders. The New Zealand shareholder would receive $85 of dividends, together with $15 of imputation credits, and hence income of $100 on which there would be further tax of $18 to pay. This is tax of $33 minus the imputation credit of $15. The resident shareholder’s after-tax income would be $67.

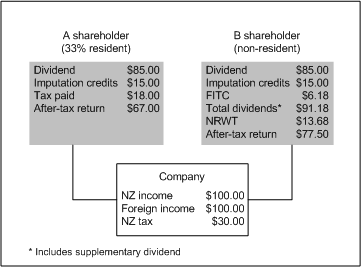

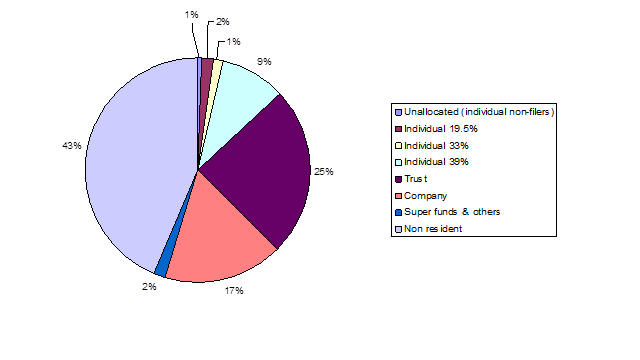

2.8 The non-resident shareholder receives $85 in cash dividends plus $15 of imputation credits, which implies a supplementary dividend and associated foreign investor tax credit (FITC credit) of $6.18. The cash plus the supplementary dividends lead to a gross dividend of $91.18, on which $13.68 of non-resident withholding tax (NRWT) is due. This leads to an after-tax dividend of $77.50. This is captured in Figure 1.

2.9 Total tax collected is $55.50. This appears an appropriate level of tax under current policy settings. The resident’s share of the domestic-source income is $50, as is her share of the foreign-source income. On distribution, all this income ends up being taxed at the shareholder’s rate of 33%, resulting in $33 of tax. The non-resident’s share of domestic-source income is taxed at 30%, resulting in $15 of tax, and, on final distribution, there is an NRWT deduction of 15%, or $7.50, on his share of foreign-source income that flows through New Zealand. The total tax of $55.50 is the sum of these amounts ($33 plus $15 plus $7.50). These calculations are shown in Figure 1.

Figure 1. After-tax return for Example 1 – without streaming

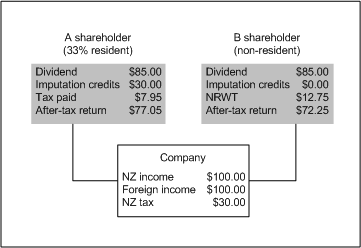

Figure 2. After-tax returns for Example 1 – with streaming

2.10 If dividend streaming were allowed it could be used to shelter the foreign income of domestic residents from tax and to shelter domestic-source income from tax, as is shown in Figure 2. Assuming that both shareholders in the figure continue to receive a cash dividend of $85, the domestic resident now has gross income of $115 ($85 plus an imputation credit of $30).[1] Extra tax on this is $7.95, leading to after-tax income of $77.05.

2.11 The non-resident shareholder now receives a cash dividend of $85, with no imputation credits, on which 15 percent NRWT is levied, amounting to $12.75. The after-tax return is $72.25. In this example, tax paid by the resident has fallen by $10.05 ($18 minus $7.95), while taxes in respect of the non-resident’s dividend have increased by $5.25 ($12.75 minus $7.50).

2.12 If streaming is allowed, New Zealand obtains less tax than would be the case if both shareholders invested in a single company with half of the foreign and half of the domestic earnings of the company that they jointly own. We end up taxing shareholders on less than their shares of the income. Thus streaming would be counter to the integration principle.[2]

2.13 The anti-streaming provisions also guard against artificial incentives for sales of shares or mergers to achieve a tax-efficient ownership structure. To illustrate this point, suppose once more that there were two companies, each with half the foreign and half the domestic income of the company described above. Assume that one company is owned by a resident and the other by a non-resident. Allowing streaming would create an artificial incentive for these firms to merge so that imputation credits could be streamed to the resident shareholder, who is best able to use them.

2.14 The rules preventing streaming also act as a barrier to the undermining of the integration principle or source-basis taxation in a number of other ways.

2.15 For example, abandoning our anti-streaming provisions (such as the share lending and imputation continuity provisions discussed in Chapter 3) could also open up scope for source-basis taxation to be undermined. This is illustrated in Example 2.

Example 2 – How unlimited streaming undermines source-basis taxation

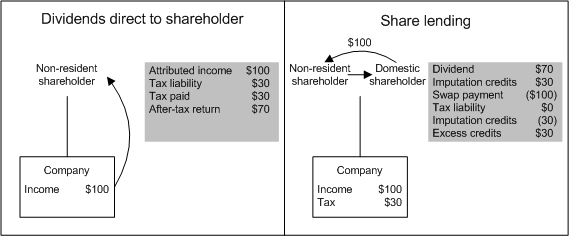

2.16 Suppose that a company that is 100 percent owned by a non-resident shareholder earns $100 profit and pays $30 tax. If these profits are distributed to the non-resident shareholder then the shareholder will make an after-tax return of $70. New Zealand has imposed source-basis taxation, as intended.

2.17 However, to take an extreme possibility, suppose instead that before distribution the shares are sold temporarily to a 33% shareholder, with an arrangement to receive a $100 cash payment (equal to the cash dividend plus a share of the imputation credits). The non-resident would make an after-tax return of $100. In this case source-basis taxation would be completely undermined. As a tax deduction is likely to be available for making the payment, the 33% shareholder would receive excess imputation credits of $30, which could be used against its tax liability on other New Zealand income. This would equate to a $30 reduction in New Zealand tax collected. These calculations are shown in Figure 3.

Figure 3. After-tax returns for Example 2

2.18 In this extreme example, the taxpayer acquiring the shares just breaks even. The cash dividend of $70 and the $30 of excess imputation credits just compensate for the $100 cost of the swap payment. In practice, the benefits of this arrangement are likely to be shared between the two parties.

2.19 The transaction raises policy concerns because the taxation of the dividend income in the hands of the domestic shareholder is sheltered by the swap payment. Therefore the purchaser obtains access to the imputation credit without receiving any net tax liability on the underlying income.

2.20 In practice, both the returning share transfer rules and the imputation continuity rules discussed in Chapter 3 guard against this possibility. They are necessary to protect source-basis taxation.

2.21 Example 3 provides a further illustration of the way in which eliminating anti-streaming provisions would be inconsistent with the objective of keeping the tax system as close to a fully integrated tax system as possible.

Example 3 – How unlimited streaming undermines integration objective

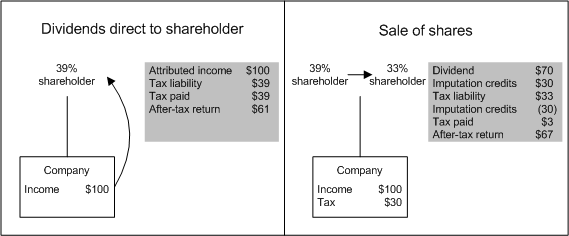

2.22 Suppose that a company were owned by an individual taxed at a 39% marginal rate. The company earns $100 and pays tax of $30. If the dividend were distributed to its shareholder, there would be a further $9 of tax to pay, leaving an after-tax dividend of $61. This is illustrated in the left-hand panel of Figure 4.

Figure 4. After-tax returns for Example 3

2.23 However, if there were no continuity provisions or other safeguards, the company might be sold to a shareholder on a 33% tax rate (possibly a trust). In this case, the dividends could be distributed to the new shareholder and taxed at 33%, which is less than the tax rate of the shareholder who owned the company at the time the profit was earned. This would be inconsistent with the integration objective of ensuring that, as far as possible, income is taxed as income of the shareholders who own the company at the time the profits are being earned.

2.24 New Zealand’s continuity provisions, which are described in Chapter 3, may guard against this sort of possibility. They generally ensure that before any such sale takes place, profits are distributed to the original shareholder, either as a dividend or through a bonus issue, so that the profits end up being taxed at the marginal rate of the original owner (although not, of course, necessarily at the marginal rate that applied in the year the income was earned).

2.25 It is an open question, however, as to how concerned we should be if shares are sold to one person to another on a different tax rate when there is only a minor difference in their rates. These concerns obviously become larger the greater the difference in tax rates or, as discussed in Chapter 4, if imputation credits can be refunded.

What would the cost be if there were no anti-streaming provisions?

2.26 First, consider the potential costs arising from undermining source-basis taxation, as shown in Example 1.

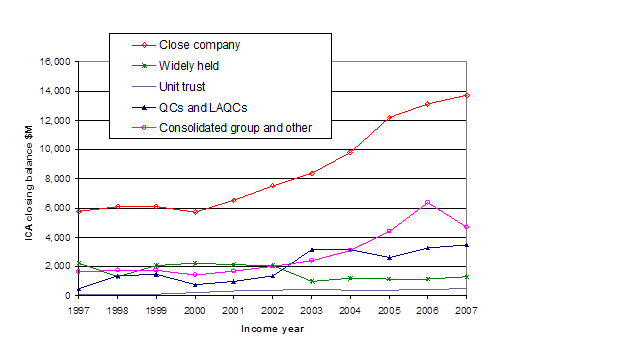

2.27 Figure 5 shows imputation credits claimed in 2006. Approximately 43 percent of these were claimed by non-resident shareholders.

Figure 5. Imputation credits claimed in 2006 income year

2.28 It is clear that if unlimited streaming were allowed and this effectively allowed domestic company tax to be refunded to non-resident shareholders, the cost could be very substantial indeed. Company tax for 2008-09 is forecast to be $7.5 billion, and 43 percent of this would be of the order of $3.2 billion.

2.29 This is a very rough costing. The 43 percent figure does not necessarily reflect the proportion of foreign ownership of New Zealand companies because different companies will have different distribution rates. Also, there is the possibility for double counting as dividends are passed between related companies. Finally, there is considerable volatility in this ratio. For example, in 2005 only 36 percent of imputation credits were claimed by non-residents.

2.30 Whether or not all of this would be at risk is an open question. However, loss of any significant part of $3.2 billion could not be contemplated by the government.

2.31 Costs of allowing streaming could also arise in the case of a company owned by a New Zealand resident. Suppose, for example, that our imputation continuity provisions (discussed in Chapter 3) were repealed and there were no replacement safeguards. That would allow the type of arrangement considered in Example 3. While there is a theoretical risk of income that should be taxed at a marginal rate of 39% being diverted to companies owned by those on a marginal rate of 12.5%, it is unlikely to be a major problem in practice. The larger concern could be diversion of income from those on a marginal rate of 39% to those, including trusts, taxed at a marginal rate of 33% percent or perhaps to widely held savings vehicles taxed at 30%.

2.32 At present, those on the top marginal tax rate are declaring $1,872 million in imputed dividends. If all of these were diverted to taxpayers on a 33% rate, the cost would be $112 million. It is also possible that income would be diverted to taxpayers on lower rates. If instead the income were all diverted to taxpayers on a 30% rate, the cost would be $169 million.

2.33 In practice, only a fraction of this amount is likely to be at risk because the kind of diversion shown in Example 3 would apply only to companies owned and controlled by a small group of shareholders. It would seem to be much more difficult to achieve diversion in the case of a more widely held company, although individual shareholders in the company could sell their shares before receiving a dividend without the company losing credits.

2.34 As well as any ongoing costs, there could potentially be an important one-off cost from allowing unlimited streaming. Figure 6 shows imputation credit account balances for various types of companies in New Zealand. By far the largest number of excess credits are held by close companies. These are companies with five or fewer shareholders, which can of course include very large private companies. The explanation for this is likely to relate in part to the fact that if dividends are distributed to shareholders rather than being retained in the company, they will be taxed in the shareholders’ hands at 39%. Removing anti-streaming provisions would create opportunities for this income to be passed to new shareholders on lower tax rates.

Figure 6. Who has excess imputation credits?

Do current rules preventing streaming get in the way of valid commercial transactions?

2.35 Chapter 3 discusses a number of rules that are aimed at preventing dividend streaming. An important question is whether or not these anti-streaming rules get in the way of valid commercial transactions.

2.36 Before examining the question, it is worth briefly discussing the imputation system itself. Some have argued that imputation can stand in the way of firms expanding overseas. This is because domestic profits are taxed once, whereas foreign profits may be taxed twice: first when earned abroad by a foreign tax authority, and second when distributed as non-imputed dividends to domestic shareholders. Foreign profits would be double taxed under some other tax systems as well, including New Zealand’s former classical company tax system.

2.37 It is clear that relative to New Zealand’s former classical company tax system, there is a greater incentive to earn taxable domestic income under full imputation. Incentives to earn income in forms that are taxable in New Zealand help to make our company tax base more robust. They also tend to boost New Zealand’s capital stock, which will add to growth and productivity.

2.38 However, the fact that the full imputation system increases incentives for domestic investment does not mean that it discourages offshore investment more than a classical company tax system does (for a given company tax rate). Shareholders will invest in companies that invest abroad if the after-tax returns are likely to exceed the opportunity cost of capital. Under both a classical company tax system and New Zealand’s full imputation system, foreign-source income can be taxed both by the foreign revenue authority when the income is earned and in New Zealand when ultimately distributed to shareholders.

2.39 There may, however, be some more complex instances where the imputation system could be argued to impede internationalisation. This leads to a difficult conundrum for the government because addressing this issue would open up the concerns with streaming that were discussed earlier.

Example 4 – Bias against domestic company taking on foreign equity to invest abroad

2.40 Consider, for example, Company 1, which is owned solely by residents and is earning domestic-source income. Also suppose that this company is currently fully distributing its profits as dividends and that it wishes to continue to do so. Such a company can be discouraged from issuing shares to foreigners to invest abroad in ways that would not happen if the investment took place through a separate company. This is illustrated in Example 4.

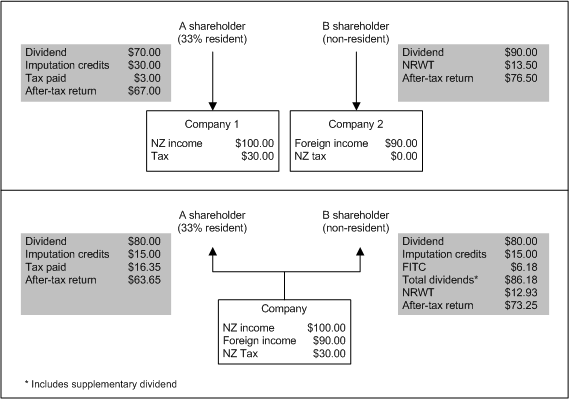

2.41 Suppose that Company 1 is initially owned by a New Zealand-resident shareholder taxed at a rate of 33%. It earns $100 of income on which it pays $30 of tax. It has a 100 percent distribution policy so it distributes its $70 of after-tax income as a dividend. The shareholder pays further tax of $3 and receives after-tax income of $67. This is illustrated in the left-hand side of the top panel of Figure 7.

2.42 Also suppose that a non-resident is willing to invest an amount, say $1,000, to a New Zealand firm (Company 2) with a technological innovation that allows the company to earn $90 abroad net of any foreign taxes. This income can then be paid as a dividend to the foreign shareholder. Under the proposed active income exemption that is currently before Parliament, Company 2 would pay no further tax in New Zealand, assuming the income is “active”. This income can then be distributed as a dividend on which $13.50 of NRWT is paid, leaving the non-residents with $76.50 net of New Zealand taxes. For simplicity, we assume that the non-resident is not taxed on this income and cares only about the return net of New Zealand tax.

2.43 The imputation system can disadvantage the New Zealand company drawing on foreign capital to expand into offshore markets. Suppose, for example, that rather than these investments being undertaken by two separate companies, Company 1 acquires the foreign capital and starts earning both domestic and foreign-source income. Also suppose that it continues to want to fully distribute its profits. This case is illustrated in the bottom panel of Figure 7. The company is now earning $100 of domestic income, on which it pays $30 of tax and $90 of foreign-source income net of any foreign taxes. It pays no New Zealand tax on its foreign-source income. It could now pay a dividend of $80 to both its domestic shareholder and its foreign shareholder, assuming equal numbers of shares are held by both parties. However, this will be less attractive to both shareholders than if the investment were to be undertaken by separate companies.

2.44 Under the single company scenario, the domestic shareholder would receive an $80 dividend together with $15 of imputation credits, on which it would need to pay $16.35 in further tax. This would leave it with an after-tax return of $63.65, which is less than the initial after-tax return of $67. At the same time, the foreign shareholder would receive $80 of dividends and $15 of imputation credits, leading to a FITC credit of $6.18 and a gross dividend of $86.18. NRWT of $12.93 would be payable, leaving an after-tax return of $73.25, which would be unattractive from the foreign shareholder’s point of view as well. Thus an investment that would be attractive if taken through separate companies can become unattractive if undertaken through a single firm. Figure 7 shows the after-tax return under both scenarios.

Figure 7. After-tax returns for Example 4

2.45 There are clearly some margins of adjustment that this example has ignored. For instance, one possibility might be for Company 1 to reduce its dividend yield when it takes on foreign shareholders to invest abroad.

2.46 Clearly, one possible way of removing this bias would be to allow foreign-source income to be streamed to foreign shareholders and domestic-source income to domestic shareholders. In this case, Company 1 could take on additional foreign capital to invest abroad without this diminishing its ability to pay fully imputed dividends to its domestic residents. It is very easy for taxpayers to convert domestic passive income into foreign passive income, and there may be concerns about biases discouraging firms from acquiring foreign equity to earn passive income abroad. This might possibly provide grounds for allowing only foreign active income to be streamed to foreign residents. At least in principle, however, a case could be made for allowing domestic income to be streamed to domestic residents and, perhaps, foreign active income to be streamed to foreign residents.

2.47 There are, however, a number of balancing considerations.

2.48 First, it is clear that there is a conflict between allowing such streaming and the government’s objective of keeping the imputation system as close to a fully integrated system as possible.

2.49 In principle, all shareholders own a fraction of a company’s underlying assets and have, in effect, borne a share of the corporate tax. Integration would mean that credits should, in principle, be distributed to all shareholders on a pro rata basis. This is not compatible with streaming, as was illustrated in Example 1.

2.50 Second, as noted, an important constraint on considering any possible streaming options is that the options should not create scope for source-basis taxation to be undermined. Before the government could contemplate allowing this form of dividend streaming it would need to be assured that it could do so without undermining source-basis taxation.

2.51 Third, allowing streaming would also create other biases. As was examined when discussing Example 1, allowing streaming would provide artificial incentives for mergers or sales of shares to create a tax-efficient ownership structure. Would these efficiency costs be greater than any efficiency benefits from allowing such streaming?

2.52 Fourth, an important feature of the New Zealand imputation scheme is the way in which it taxes dividends to domestic taxpaying shareholders when these dividends are not out of profits that have borne domestic tax. This creates incentives, all else equal, for firms to pay tax in New Zealand. This helps ensure the integrity of the New Zealand company tax system. A potential concern with any system of dividend streaming is that it may weaken these incentives.

2.53 Working through the pros and cons of allowing this form of dividend streaming is a complex issue. The government has yet to make a firm decision on this issue but there is clearly a big hurdle that needs to be overcome before contemplating any change in this area. The government would need to be convinced that the current rules were causing particularly difficult problems and that any rule change could be reasonably contained to the identified problem. It would also need to be convinced that the benefits of allowing streaming would outweigh the costs. It is interested, however, in receiving submissions on this issue and especially on whether or not it would be possible to introduce some form of dividend streaming without compromising the government’s other objectives.

Impact on capital markets

2.54 A number of other, more limited dividend streaming proposals have been made for certain foreign-owned companies operating in New Zealand as ways of developing capital markets.

2.55 Market participants have raised concerns about the lack of depth in the New Zealand market. In particular, it has been argued that the acquisition of New Zealand companies by foreign investors means that New Zealand investors can now access only certain key sectors of the market by investing through foreign (mainly Australian) companies. It is clear that New Zealand’s imputation system does provide incentives for New Zealand residents to invest at home, since imputation credits are provided for domestic but not foreign taxes. However, that is arguably attractive from a national welfare perspective because domestic taxes form part of the national return on the investment as they contribute to the government’s ability to finance a wide range of public services. Capital invested in New Zealand will add to labour productivity and growth.

2.56 Limited dividend streaming might be one way of increasing the attractiveness of investment in foreign companies, but a case would need to be made as to why this would be in the best interest of New Zealand as a whole. A more attractive option still would be to allow mutual recognition of imputation credits between Australia and New Zealand. This option is being explored with Australia. It would appear to be an attractive way of expanding the set of companies that New Zealanders can invest in and receive imputation credits.

2.57 A number of parties have expressed concerns about the size of New Zealand’s share market. On the surface, New Zealand’s full imputation system, by making it more attractive for New Zealanders to invest at home, would appear likely to increase the size of the New Zealand share market. Even so, the government is particularly interested to hear of any features of the imputation system that might be inefficiently restricting the development of New Zealand’s capital markets. This is an issue that might be considered by the government’s recently announced Capital Market Development Task Force.

2.58 The government is not closing the door on limited dividend streaming proposals and is interested in receiving submissions on the issue. Before any moves in this direction were contemplated, however, it would be necessary to ensure that any such changes would not advantage foreign-owned firms relative to domestic-owned firms. To do so could create incentives for New Zealand companies to move their head offices overseas and then conduct their domestic operations through a subsidiary of the foreign parent.

2.59 It is also recognised that allowing any form of dividend streaming may or may not be acceptable to Australia if the two countries were to agree on a system of mutual recognition of imputation credits. Therefore it may not be possible to decide if this sort of reform is feasible until we decide on whether or not to pursue mutual recognition. Even if mutual recognition were not to proceed, any move to allow limited streaming would need to be discussed with Australia under the existing trans-Tasman imputation arrangements.

1 The examples here abstract from a number of potential company and securities law issues. This particular example assumes that streaming imputation credits within a single class of shareholder is acceptable under company law as well as tax law.

2 In this simple example, if streaming were allowed the foreign shareholder ends up being worse off. However, the company might make both shareholders better off than they are in Figure 1 by issuing two classes of shares, one of which pays a slightly higher cash dividend than the other.