Chapter 5 - Reporting Income on a Branch-Equivalent Basis

5.1 Overview

5.2 Non-Resident Companies

5.3 Non-Resident Trusts

5.4 Election to Report Income on Branch-Equivalent Basis

5.5 Changing from Branch-Equivalent to Comparative-Value Basis

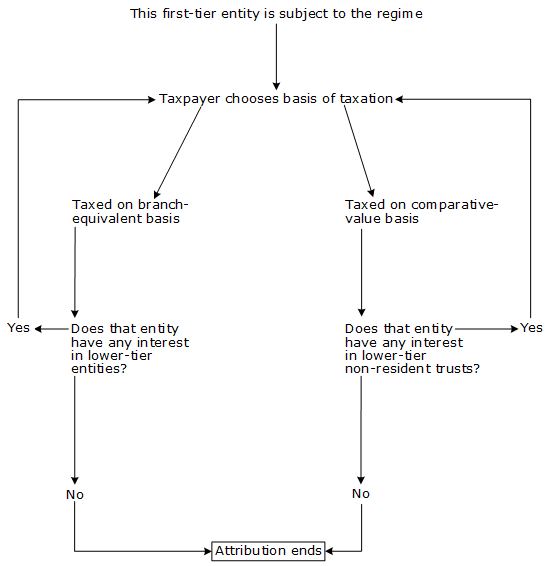

Appendix 5.1 Schematic Outline of Income Attribution Rules

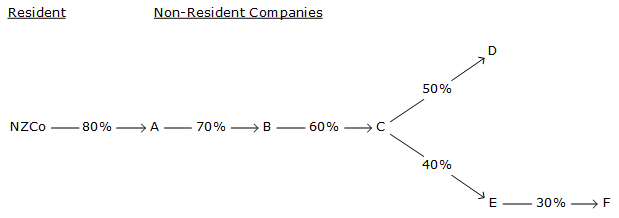

Appendix 5.2 Example of Attribution Rules in Operation

5.1 Overview

New Zealand residents who elect to have the income they derive through a non-resident company or trust taxed on a branch-equivalent basis will be taxed on their percentage interest in the entity at the end of the entity's accounting year multiplied by the income of the entity. The branch-equivalent basis operates in almost the same manner as the present treatment of foreign branches. It commences with a calculation of the non-resident entity's income as measured by New Zealand tax rules. The New Zealand resident's percentage interest in such income is then included in the resident's assessable income. A non-resident company's losses attributed to a New Zealand taxpayer may be offset only against the taxpayer's branch-equivalent or comparative-value income from other non-resident companies. Losses attributable to a settlor's interest in a non-resident trust must be carried forward to be offset against future income from the settlor's interest in that trust.

The tax liability resulting from the taxation of branch-equivalent basis income is reduced by the taxpayer's percentage interest in foreign taxes paid by the non-resident entity deriving the income. Where distributions to New Zealand residents from the non-resident entity are taxable in New Zealand, relief for previous New Zealand taxes paid is provided by permitting such distributions to be deducted from branch-equivalent income to the extent of the branch-equivalent income reported in the year of distribution. The New Zealand tax liability will be reduced by any foreign withholding taxes levied on the distributed income. Branch-equivalent income will be reported in New Zealand dollars using a close-of-trading spot exchange rate on the last day of the relevant accounting year of the non-resident entity.

5.2 Non-Resident Companies

5.2.1 Measurement of Branch-Equivalent Basis Income

New Zealand taxpayers reporting income from a non-resident company on a branch-equivalent basis will include in assessable income their percentage in the company's income at the end of the company's accounting year. This applies to non-resident companies in which a New Zealand taxpayer has a direct or an indirect interest. The income of each such company will be calculated according to New Zealand tax rules with one exception. Where dividends are paid by a non-resident company whose income is being reported by the taxpayer on a comparative-value basis to another non-resident company, they shall be included in the assessable income of the recipient company. It is necessary to include the latter dividends in the net income of the recipient company because their payment will reduce the market value of the taxpayer's interest in the dividend-paying company (for an illustration of this point, see Appendix 5.2 where the income of Company E is reported on a comparative-value basis).

When computing his or her share of branch-equivalent income, a taxpayer may deduct dividends received (gross of foreign withholding taxes) from the non-resident company. Such dividends are deductible against the income of the non-resident company in the accounting year in which they are paid, to the extent of the branch-equivalent income earned in that year. This ensures that income from which dividends are paid is not subject to New Zealand tax twice. Should the deduction of dividends result in a branch-equivalent loss being computed, such a loss may be offset against branch-equivalent or comparative-value income earned through other non-resident companies, whether in a current or future income year of a taxpayer.

5.2.2 Calculating a Taxpayer's Percentage Interest in the Income of a Non-Resident Company

The portion of a non-resident company's income included in the income of a resident New Zealand taxpayer will be the amount of such income multiplied by the taxpayer's percentage interest in the non-resident company at the end of company's accounting year (see section 4.2.1 for a description of how to calculate a percentage interest in a company). Similarly, where a taxpayer elects to report on a branch-equivalent basis the income of a non-resident company in which he or she has an indirect interest, the portion of that company's income to be included in the taxpayer's income is the company's income multiplied by the taxpayer's percentage interest in the company. In this situation, the taxpayer's percentage interest will be determined by multiplying the taxpayer's percentage interest in the first-tier non-resident company by that company's percentage interest in the lower-tier non-resident entity, and so on.

There is an exception to the income allocation rules, however, where a taxpayer can establish that 100 percent of the income of a non-resident company is included in the income of New Zealand taxpayers. (It should be noted that tax-exempt entities are not taxpayers.) The purpose of this exception is to prevent more than 100 percent of the branch-equivalent basis income of a non-resident company being taxed where there is no prospect of avoidance or deferral. It is possible for more than 100 percent of the income of a non-resident company to be taxable under these rules because the determination of a taxpayer's percentage interest is based on the greatest of the taxpayer's entitlement, or entitlement to acquire, rights to dividends and voting rights in relation to distributions and changes to the company's constitutional rules. To qualify for the exception, any one New Zealand resident with an interest in the non-resident company must provide the Inland Revenue Department (IRD) with the following information: the branch-equivalent basis income of the non-resident company, the names and IRD tax numbers of all of the resident taxpayers with interests in the company, and the allocation of 100 percent of the branch-equivalent income. If this exception applies, the resident shareholders may allocate the branch-equivalent income among themselves on any reasonable basis.

Taxpayers who acquire an interest in a non-resident company during the company's accounting year will be required to include in their assessable income their percentage interest in the pro-rata portion of the company's income attributable to the period after acquisition. Taxpayers who dispose of their interests during the company's accounting year will be required to include in their assessable income the pro-rata portion of the company's income attributable to the period before disposition. If the taxpayer lacks sufficient information to pro-rate the company's income in this way, tax will be levied on a comparative-value basis for the part-year from the beginning of the company's accounting year to the time of disposition. The valuation rules set out in chapter 6 will be used to determine the comparative-value income to be taxed.

A New Zealand resident's share of the income of a non-resident company for a particular year will be included in the resident's assessable income for his or her income year in which the non-resident company's accounting year ends. For example, if a company has a balance date of 30 September and a New Zealand resident a balance date of 31 March, the New Zealand resident will report his or her share of the non-resident company's income for the year ended 30 September on his or her return for the year ended 31 March of the following year.

A non-resident company's losses attributed to a New Zealand taxpayer may be used to offset the taxpayer's branch-equivalent or comparative-value income from other non-resident companies. Where the taxpayer is a company within a group of companies (as defined in section 191 of the Income Tax Act), these losses may be transferred to other companies in the group for offset against comparative-value or branch-equivalent income.

5.2.3 Credit for Foreign Taxes

A taxpayer's tax liability arising from income reported on a branch-equivalent basis will be reduced by his or her percentage interest in the foreign taxes paid by the non-resident company deriving the income. A taxpayer's percentage interest in foreign taxes paid by a non-resident company will be the foreign taxes paid by the company multiplied by the taxpayer's percentage interest in the company. This calculation is subject to the exception described in section 5.2.2 where 100 percent of the income of a non-resident company is included in the income of New Zealand taxpayers. If a taxpayer's percentage interest in the branch-equivalent income of a non-resident company is reduced pursuant to that exception, then the taxpayer's percentage interest of the foreign taxes paid by the company must be reduced correspondingly.

The conditions and limitations that apply to foreign tax credits in Part VIII of the Income Tax Act will be amended to ensure that they are appropriate for these measures. Foreign tax credits will be limited to the amount of New Zealand tax payable on the income of each non-resident entity. Foreign tax credits will also be limited to the amount of New Zealand tax which would have been payable on the income sourced in each jurisdiction. Carry-back and carry-forward for foreign taxes that cannot be used in the current year will be allowed to the extent permitted under current law to deal with timing differences between foreign and New Zealand tax law. Foreign taxes which will qualify for the foreign tax credit regime are income and company taxes which are of substantially the same nature as New Zealand income tax whether levied by the federal, state or provincial government in any foreign jurisdiction on the income of the non-resident entity. A credit will also be permitted for New Zealand taxes paid by a non-resident company on New Zealand-source income. Foreign withholding taxes levied on distributed income will also be creditable.

Taxes paid by non-resident companies in which a New Zealand resident has an indirect interest will also be creditable. The same formula used to determine a taxpayer's percentage interest in an entity's income will be used to calculate the taxpayer's percentage interest in the foreign taxes paid by the entity.

The operation of the rules for calculating a taxpayer's entitlement to foreign taxes paid by non-resident companies is illustrated in Appendix 5.2.

5.3 Non-Resident Trusts

As explained in section 4.3, a resident settlor will be assessed on income attributable to his or her interest in a non-resident trust. The branch-equivalent reporting system applies to settlors with interests in non-resident trusts in much the same manner as it applies to resident shareholders with interests in non-resident companies.

5.3.1 Measurement of Branch-Equivalent Basis Income

On the branch-equivalent basis, the income of a non-resident trust must be measured in accordance with New Zealand tax rules, in the same way as the income of a non-resident company (see section 5.2.1). Where, however, a non-resident trust receives dividends from a non-resident company whose income is reported on a branch-equivalent basis by the resident settlor of the trust, such dividends will be excluded from the trust's income. Where a non-resident trust receives dividends from a non-resident company whose income is reported on a comparative-value basis by the resident settlor of the trust, the dividends will be included in the trust's income in accordance with New Zealand law.

Trustee income of a non-resident trust will be defined as the net assessable income of the trust, computed in accordance with New Zealand tax law as modified above, less distributions to the extent of the branch-equivalent income reported in the year of distribution, and less amounts that have vested indefeasibly in beneficiaries (except beneficiaries which are non-resident trusts and companies). Under current law, trustee income excludes only income that is also derived by a beneficiary entitled, or deemed to be entitled, in possession to the receipt thereof. That definition will be amended in relation to non-resident trusts to make it clear that income in which a beneficiary has an indefeasibly vested interest will be deducted from the net assessable trustee income, whether or not the beneficiary is entitled to enforce immediate payment of the income. Whether trustee income vests indefeasibly in a beneficiary will be determined in accordance with New Zealand law. For example, if, under foreign law, income is deemed to vest in the registrar of trusts or some other government official until it is distributed by trustees, the income will nevertheless be considered trustee income for New Zealand income tax purposes.

5.3.2 Calculating a Taxpayer's Percentage Interest in the Income of a Non-Resident Trust

Resident settlors will include in their assessable income the portion of the trustee income of a non-resident trust equal to the trustee income multiplied by their percentage interest in the trust. The percentage interest of a resident settlor in a non-resident trust will be calculated as the percentage that the market value of the property contributed to the trust by the settlor, determined at the time of the contribution, is of the market value of the trust's net assets, also determined at the time of the settlor's contribution. Once the interest is established, it will remain constant until another contribution is made to the trust. Thus, for example, if A and B each contribute $100 to a trust each will have a 50 percent interest in the trust. If the trust assets double in value from $200 to $400, at which time C contributes $400 to the trust, A and B will each have a 25 percent interest in the trust while C will have a 50 percent interest in the trust. The recalculation of settlors' respective interests in a trust will be made only at the end of a trust's accounting year and will apply to attribute income to settlors for the next trust accounting year.

Where a non-resident trust in which a New Zealand taxpayer has an interest contributes property to another non-resident trust, the taxpayer's percentage interest in the second trust will be determined by multiplying his or her percentage interest in the first trust by that trust's percentage interest in the other non-resident trust, and so on. Resident settlors will be taxed on their share of the income of each non-resident trust separately from their other New Zealand income. This is consistent with the way trustee income is taxed in the hands of New Zealand resident trustees.

Trust losses attributable to a settlor's interest in a non-resident trust must be carried forward to be offset against future income from the settlor's interest in that trust. Since beneficiaries will never have an interest in trust losses, the entire amount of a loss will, in effect, be treated as a trustee loss. Without a carry-forward rule, the attribution system would be open to abuse, since trustees could ensure that beneficiaries had indefeasibly vested interests in any trust income while passing losses on to the settlor for tax purposes.

5.3.3 Credit for Foreign and New Zealand Taxes

If a non-resident trustee provides a resident settlor with information about foreign taxes paid on trustee income (or New Zealand taxes on New Zealand-source income), the settlor will be entitled to claim a tax credit equal to the taxes paid on trustee income multiplied by the settlor's percentage interest in the trust. The calculation and attribution of tax credits available to resident settlors who report income attributed to their interests in non-resident trusts on a branch-equivalent basis is made by reference to the same rules applicable to shareholders in non-resident companies who report income on a branch-equivalent basis.

5.4 Election to Report on Branch-Equivalent Basis

Taxpayers who qualify to report income from a non-resident entity on a branch-equivalent basis must file an election with the IRD office to which they send their annual tax returns. A copy will be sent by IRD to the special IRD tax unit. A separate election must be made in respect of each non-resident entity which the taxpayer wishes to report on a branch-equivalent basis. Thus, the taxpayer may choose to report the income of one non-resident entity on a branch-equivalent basis and another on a comparative-value basis.

The taxpayer will be required to inform the Commissioner of Inland Revenue of the accounting year used by the non-resident entity. Any subsequent change in the entity's balance date must be communicated to the Commissioner and approved by him as a basis for continuing to use the branch-equivalent method. If the Commissioner does not give his consent, the taxpayer will be required to report income from the entity using the comparative-value basis. The mechanics of changing the basis of reporting income are described in section 5.5.

Elections to use the branch-equivalent basis reporting system filed before 1 April 1988 will be effective from 1 April 1988. Elections filed after 1 April 1988 will be effective from the first accounting year of the non-resident entity commencing after the date on which the election is filed.

Branch-equivalent taxpayers must be able to provide the Commissioner with information similar to that which taxpayers reporting on an actual branch basis are required to provide. The Inland Revenue Department will make available details of the information required for filing and auditing purposes. A special requirement for taxpayers reporting income on a branch-equivalent basis will be that they must be able to provide the Commissioner, on request, with a copy of the financial accounts of the non-resident company or trust and a copy of its foreign tax returns. Any information in a foreign language must be accompanied by an English translation (see the discussion of the disclosure requirements in chapter 8).

5.5 Changing from Branch-Equivalent to Comparative-Value Basis

Taxpayers may change the basis of reporting income from a non-resident entity if they notify the Commissioner of Inland Revenue at least one month before the beginning of the next accounting year of the entity. The change in the basis of reporting will become effective from the beginning of the next accounting year of the entity.

A taxpayer changing from branch-equivalent to comparative-value reporting will be required to compute the value of his or her interest in the entity on the date the change becomes effective (referred to as the "effective date"). The value of an interest will be computed on this date in accordance with the rules set out in chapter 6.

The value of the interest computed on the effective date will be deemed as the opening value of the interest at the beginning of the taxpayer's income year. This value will be compared with the value of the interest at the end of the taxpayer's income year for the purposes of computing income using the comparative-value basis. The taxpayer will be required to report income from the entity for the accounting year up to the effective date on a branch-equivalent basis.

Where a taxpayer has elected to report income on a branch-equivalent basis and it is not possible for whatever reason to compute branch-equivalent income up to the effective date, income from the beginning to the end of the entity's accounting year must be calculated using an imputed return method. For the purposes of applying an imputed return method, the value of the interest on the first day of the non-resident entity's accounting year will be computed as the market value of the taxpayer's interest on the last day of the entity's accounting year discounted by the annual imputed return rate on a straight-line basis. This rule will apply where taxpayers cannot compute branch-equivalent income in any accounting year of a non-resident company and where they have not given prior notice of their intention to compute income on a comparative-value basis.

Appendix 5.1 Schematic Outline of Income Attribution Rules

Appendix 5.2 Example of Attribution Rules in Operation

| Company | Income (1) | Foreign Taxes | NZCo's Interest (2) | Attributed to NZCo | |

| Income (3) | Tax Credit (4) | ||||

| ($) | ($) | (%) | ($) | ($) | |

| A | 300 | 50 | 80 | 240 | 40 |

| B | −400 | NIL | 56 | −224 (5) | NIL |

| C | 500 (6) | 100 | 34 | 170 | 34 |

| D | 600 | 200 | 17 | 102 | 31 (7) |

| E | 700 (8) | 150 | 13 | 91 | N/A (9) |

| F | N/A (10) | N/A | N/A | N/A | N/A |

(Figures rounded; amounts in New Zealand dollars)

Notes

1 A, B, C and D's income, measured according to New Zealand tax rules, is reported on a branch-equivalent basis.

2 Each interest is multiplicative, eg NZCo's interest in C = .8 x .7 x .6.

3 Income attributed to NZCo is its interest in each company's income.

4 Tax credit attributed to NZCo is its interest in foreign taxes paid.

5 Loss may be offset (or carried forward for offset) only against other branch-equivalent of comparative-value income.

6 Includes dividend received from E since E's income is reported on a comparative-value basis.

7 Foreign taxes paid by D exceed the New Zealand tax (say, 30%) on such income. Thus, the credit is limited to NZCo's interest in 30% of D's income.

8 Reported on a comparative-value basis.

9 No credit available as comparative-value income is net of foreign taxes.

10 As E's income has been reported on a comparative-value basis, F's income is ignored.